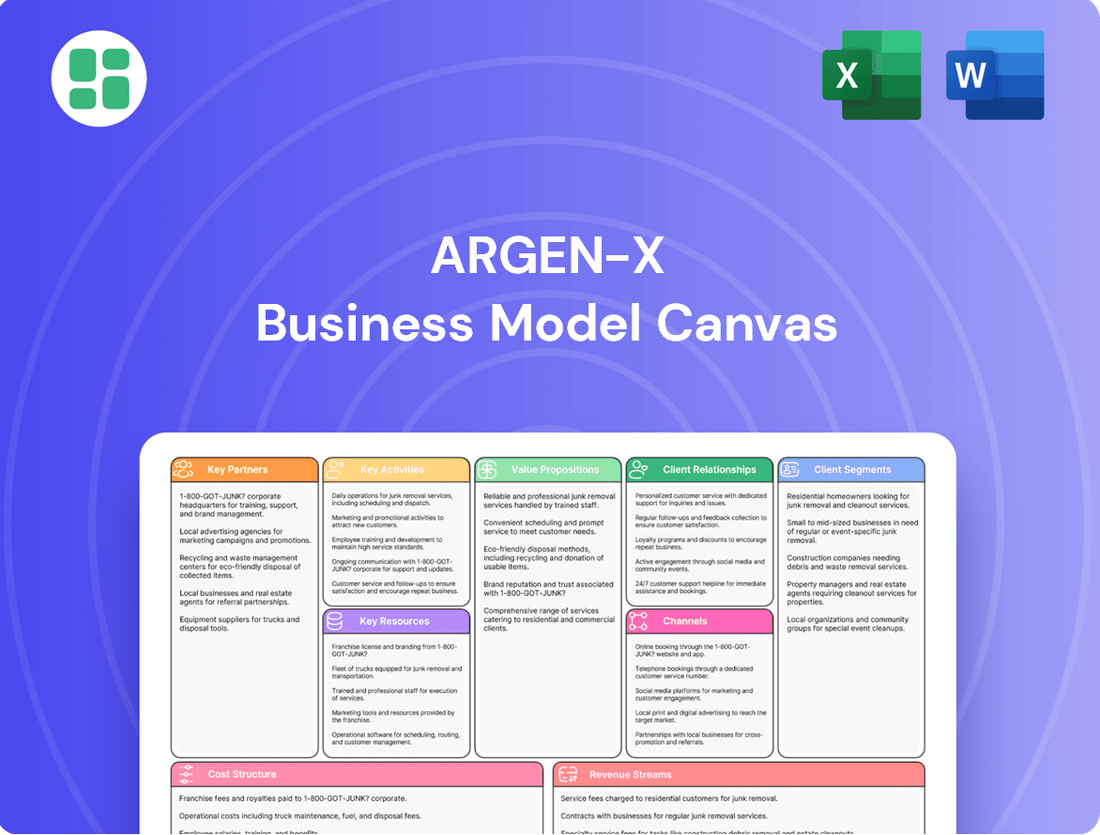

arGEN-X Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

arGEN-X Bundle

Discover the core components of arGEN-X's innovative business model with our comprehensive Business Model Canvas. This detailed breakdown reveals their unique value proposition, customer relationships, and revenue streams, offering a clear roadmap to their success. Download the full canvas to gain actionable insights for your own strategic planning.

Partnerships

argenx forms vital partnerships with other pharmaceutical giants to bolster its development and commercialization efforts. These alliances, including significant collaborations with Janssen Pharmaceuticals and Pfizer, are instrumental in co-developing antibody-based treatments and capitalizing on shared expertise.

These strategic alliances allow argenx to expedite its pipeline progress and extend its reach to a wider patient base. For instance, the collaboration with Janssen on daratumumab, a blockbuster multiple myeloma therapy, has been a cornerstone of argenx's growth, demonstrating the power of such strategic ties.

Argenx actively fosters key partnerships with esteemed academic institutions, including the University of Utrecht and Leiden University Medical Center. These collaborations are instrumental in pushing the boundaries of immunology research and pioneering new antibody technologies.

By engaging with leading academic minds, argenx ensures it stays ahead in scientific innovation, effectively translating cutting-edge discoveries into promising therapeutic candidates, reinforcing its commitment to advancing patient care.

Argenx leverages licensing agreements to bolster its innovation pipeline. A prime example is their collaboration with Genmab A/S, granting access to advanced antibody discovery platforms. This partnership, alongside agreements like the one with AbbVie for global rights to specific assets, is crucial for argenx.

These strategic alliances are instrumental in enhancing argenx's proprietary SIMPLE Antibody™ Platform. By integrating external technologies and therapeutic candidates, argenx diversifies its product pipeline and strengthens its intellectual property portfolio, a key driver for future growth.

Contract Manufacturing Organizations (CMOs)

Argenx relies heavily on Contract Manufacturing Organizations (CMOs) for the large-scale production of its innovative antibody therapies. Key partners like Lonza Group AG, Samsung Biologics, and WuXi Biologics are instrumental in ensuring the consistent and high-quality manufacturing required for both clinical development and commercial supply.

These strategic alliances provide Argenx with the necessary manufacturing capacity and expertise to meet the growing global demand for its products. For instance, Samsung Biologics, a leading CMO, has been a critical partner in manufacturing Argenx's flagship therapy, Vyvgart (efgartigimod alfa-fcab). In 2023, Samsung Biologics reported significant growth in its biologics contract manufacturing business, underscoring the importance of such partnerships.

- Lonza Group AG: A global leader in custom development and manufacturing of pharmaceuticals and biotechnology.

- Samsung Biologics: Provides end-to-end contract development and manufacturing services with a strong focus on biologics.

- WuXi Biologics: Offers a comprehensive suite of R&D and manufacturing services for biologics and small molecules.

Global Commercialization Partners

Argenx actively cultivates global commercialization partners to broaden its market footprint. A prime example is the collaboration with Zai Lab, specifically targeting the significant China market. This strategic alliance ensures effective market access and distribution channels in regions where argenx might not maintain its own extensive commercial infrastructure.

These partnerships are crucial for expanding patient access to argenx’s innovative therapies, both currently approved and those in development. By leveraging the expertise and established networks of regional partners, argenx can accelerate the availability of its treatments globally.

- Zai Lab Partnership: Focuses on commercializing argenx products in China, a key growth market.

- Market Access: Facilitates entry into territories without direct argenx presence, enhancing global reach.

- Distribution Network: Utilizes partners' established networks to ensure efficient product delivery.

- Patient Reach: Aims to make approved and pipeline treatments accessible to a wider patient population worldwide.

Argenx's key partnerships extend to contract manufacturing organizations (CMOs) like Lonza, Samsung Biologics, and WuXi Biologics, ensuring robust production of its antibody therapies. These collaborations are vital for scaling up manufacturing to meet global demand, as exemplified by Samsung Biologics' role in producing Vyvgart. Furthermore, strategic commercialization alliances, such as the one with Zai Lab for the Chinese market, are critical for expanding patient access to argenx's innovative treatments worldwide.

| Partner Type | Key Partners | Strategic Importance |

|---|---|---|

| Pharmaceutical Giants | Janssen, Pfizer | Co-development, commercialization, market access |

| Academic Institutions | Utrecht University, LUMC | Immunology research, new antibody technologies |

| Licensing/Technology | Genmab A/S, AbbVie | Pipeline enhancement, platform expansion |

| Contract Manufacturing | Lonza, Samsung Biologics, WuXi Biologics | Large-scale production, quality assurance |

| Commercialization | Zai Lab | Market penetration, distribution networks |

What is included in the product

A detailed arGEN-X Business Model Canvas outlining their antibody-based therapeutics strategy, covering customer segments, value propositions, and key partnerships.

This model highlights arGEN-X's focus on innovative drug development and commercialization, supported by a robust understanding of patient needs and market opportunities.

The arGEN-X Business Model Canvas provides a structured framework to pinpoint and address critical challenges in drug development, offering a clear path to overcoming obstacles.

It simplifies complex strategies, allowing for rapid identification of key value drivers and potential roadblocks in bringing innovative therapies to market.

Activities

Argenx's core activity revolves around the intensive research and development of novel antibody therapies, leveraging its proprietary SIMPLE Antibody™ Platform. This encompasses identifying new targets, meticulously designing and engineering antibodies, and carrying out thorough preclinical studies to validate their potential.

The company makes substantial R&D investments, a key driver for expanding and advancing its pipeline of precision therapies aimed at addressing challenging autoimmune diseases. For instance, in 2023, argenx reported R&D expenses of €1.1 billion, underscoring its commitment to innovation.

A core activity for argenx involves conducting extensive clinical trials. This includes pivotal registrational studies and early-stage proof-of-concept trials for its flagship drug, efgartigimod, as well as other promising candidates in its pipeline.

The company's ambition is to see efgartigimod approved across 15 distinct autoimmune disease indications by the year 2025. Furthermore, argenx is actively progressing other molecules, such as empasiprubart and ARGX-119, through various stages of clinical development, demonstrating a robust commitment to pipeline expansion.

This diligent and multi-faceted clinical development strategy is absolutely essential for obtaining the necessary regulatory approvals and broadening the therapeutic reach of its innovative treatments.

argenx is aggressively pursuing global commercialization for its key therapies, notably VYVGART and VYVGART SC. This entails significant investment in building robust sales and marketing teams worldwide, alongside securing necessary regulatory approvals in new territories to ensure broad patient access.

The company's strategic focus is on expanding market share within its primary indications, such as generalized myasthenia gravis (gMG) and chronic inflammatory demyelinating polyneuropathy (CIDP). This expansion is critical for maximizing the reach of their innovative treatments and solidifying their position in the rare disease landscape.

In 2024, argenx continued to drive this expansion, with VYVGART achieving significant commercial traction in established markets and progress made towards launches in additional countries. The company reported substantial revenue growth driven by these commercialization efforts, underscoring the success of their market access strategies.

Immunology Innovation Program (IIP)

Argen-X consistently invests in its Immunology Innovation Program (IIP) to foster sustainable pipeline growth. This program is dedicated to transforming immunology advancements into a leading collection of novel antibody-based therapies.

The IIP plays a crucial role in identifying new candidates for the company's pipeline and investigating cutting-edge next-generation treatments. This strategic focus ensures a robust and ongoing influx of innovative medical solutions.

- Pipeline Growth: The IIP is central to Argen-X's strategy for expanding its drug development pipeline.

- Translational Science: It bridges the gap between fundamental immunology research and the creation of tangible therapeutic candidates.

- Next-Generation Therapies: The program actively explores and develops advanced treatment modalities beyond current offerings.

- Candidate Nomination: A key output of the IIP is the regular nomination of promising new drug candidates for further development.

Regulatory Filings and Approvals

A core activity for arGEN-X is meticulously preparing and submitting extensive regulatory filings to health authorities across the globe to gain approval for its innovative antibody therapies. This encompasses applications for both new therapeutic uses and novel product forms, such as the recently developed VYVGART SC prefilled syringe.

Successfully navigating these complex regulatory landscapes is absolutely crucial for arGEN-X to effectively bring its groundbreaking new treatments to patients who desperately need them.

For instance, in 2024, arGEN-X continued its focus on regulatory submissions, building on the momentum of earlier approvals. The company's commitment to expanding access to its therapies means a significant portion of its resources are dedicated to these critical filings.

- Global Regulatory Submissions: arGEN-X actively submits applications to major health authorities like the FDA (US), EMA (Europe), and PMDA (Japan) for its lead therapies.

- New Indication Filings: The company pursues approvals for its existing treatments in new disease areas, broadening their therapeutic reach.

- Formulation Advancements: Submissions for improved drug delivery systems, such as the VYVGART SC prefilled syringe, are a key part of their strategy.

- Post-Approval Commitments: arGEN-X also manages filings related to post-marketing studies and lifecycle management activities.

Argenx's key activities are centered on the sophisticated research and development of antibody-based treatments, the rigorous execution of clinical trials to validate these therapies, and the strategic global commercialization of its approved products. The company also actively manages regulatory submissions and invests in its Immunology Innovation Program to ensure a continuous pipeline of novel treatments.

These core functions are designed to bring innovative therapies for severe autoimmune diseases from discovery to patients. For example, the company's significant R&D investment, reaching €1.1 billion in 2023, fuels its pipeline growth and clinical trial execution. Commercialization efforts in 2024 saw VYVGART achieve substantial revenue growth, demonstrating successful market penetration.

The company's commitment to advancing its pipeline is evident in the progression of molecules like empasiprubart and ARGX-119 through clinical development. Furthermore, argenx's goal to have efgartigimod approved across 15 autoimmune disease indications by 2025 highlights the scale of its clinical development activities.

| Key Activity | Description | 2023 Data/Focus | 2024 Focus |

|---|---|---|---|

| Research & Development | Developing novel antibody therapies using proprietary platforms. | €1.1 billion in R&D expenses. | Continued pipeline advancement and new candidate identification. |

| Clinical Trials | Conducting trials for efgartigimod and other pipeline candidates. | Progress across multiple trial phases. | Advancing registrational studies and proof-of-concept trials. |

| Commercialization | Global launch and market expansion of approved therapies. | Significant revenue growth driven by VYVGART sales. | Expanding market share and entering new territories. |

| Regulatory Affairs | Preparing and submitting global regulatory filings. | Focus on new indications and formulations (e.g., VYVGART SC). | Continued submissions for expanded access and new approvals. |

Full Document Unlocks After Purchase

Business Model Canvas

The arGEN-X Business Model Canvas preview you are viewing is the identical document you will receive upon purchase. This means you're getting a direct, unedited snapshot of the final deliverable, ensuring full transparency and no surprises. Once your order is complete, you'll gain immediate access to this exact, comprehensive Business Model Canvas, ready for your strategic planning and analysis.

Resources

The SIMPLE Antibody™ Platform is the core of arGEN-X's innovation, driving the discovery and development of unique antibody therapies. This technological asset allows for the creation of highly precise and potent therapeutic candidates, forming the bedrock of their competitive edge in immunology.

Argenx boasts an extensive pipeline of antibody therapeutics, featuring promising candidates like efgartigimod, empasiprubart, and ARGX-119. This diverse portfolio is strategically designed to address multiple severe autoimmune diseases, signaling substantial future value and growth opportunities for the company.

The company’s commitment to a broad and deep pipeline is crucial for tackling unmet medical needs across various conditions. This focus ensures argenx can maintain a significant market presence and continue to innovate in the biopharmaceutical sector for years to come.

arGEN-X's success hinges on its exceptional team of scientists, researchers, and commercial experts. This highly skilled workforce is the engine behind their innovative drug discovery and development processes.

In 2024, the company continued to invest in attracting and retaining top talent, recognizing that their human capital is a critical differentiator in the competitive biopharmaceutical landscape. The expertise of these individuals is paramount for navigating complex clinical trials and ensuring successful product launches.

Intellectual Property Portfolio

argenx’s intellectual property portfolio is a cornerstone of its business model, featuring patents that shield its proprietary SIMPLE Antibody™ Platform and its pipeline of therapeutic candidates. This robust IP protection is vital for securing market exclusivity against rivals, ensuring argenx can recoup its substantial research and development investments. For instance, as of early 2024, argenx held a significant number of granted patents and pending applications globally, covering various aspects of its antibody engineering technology and specific drug candidates.

This strategic safeguarding of innovation directly supports argenx’s long-term profitability and its ongoing commitment to advancing novel treatments. The exclusivity granted by these patents allows the company to operate without immediate competitive pressure, fostering an environment where continued investment in research and development is sustainable. This focus on IP is critical for maintaining a competitive edge in the rapidly evolving biopharmaceutical landscape.

Key aspects of argenx's intellectual property strategy include:

- Broad Patent Coverage: Patents extend to the core SIMPLE Antibody™ Platform technology, enabling the creation of differentiated antibody-based therapies.

- Therapeutic Candidate Protection: argenx secures patents for each novel drug candidate, covering composition of matter, manufacturing processes, and methods of use.

- Global IP Footprint: The company actively pursues patent protection in key pharmaceutical markets worldwide to maximize market exclusivity.

- Strategic IP Management: Ongoing management and enforcement of the IP portfolio are crucial for defending market position and supporting licensing opportunities.

Financial Capital and Funding

Financial capital is arGEN-X's bedrock, fueling its innovative journey from research to market. This substantial capital is primarily generated through the successful sales of its groundbreaking products, strategic equity financing rounds, and valuable collaborations with global partners.

As of December 31, 2024, arGEN-X reported a robust financial position, holding approximately $3.4 billion in cash, cash equivalents, and current financial assets. This significant liquidity is crucial for covering the substantial costs associated with extensive research and development, rigorous clinical trials, and the complex process of global commercialization.

- Product Sales: Revenue streams from approved therapies are a primary source of financial capital.

- Equity Financing: Access to capital markets through stock offerings provides substantial funding.

- Strategic Partnerships: Collaborations with other pharmaceutical companies can bring in upfront payments and milestone revenues.

- Financial Strength: The $3.4 billion in liquid assets as of year-end 2024 underpins arGEN-X's ability to execute its long-term growth strategy.

The company's intellectual property, particularly its SIMPLE Antibody™ Platform and a robust pipeline of drug candidates, forms a critical asset. This IP is protected by a global portfolio of patents, ensuring market exclusivity and supporting ongoing R&D investments. Financial capital, evidenced by $3.4 billion in cash and equivalents as of December 31, 2024, fuels these operations, enabling extensive research, clinical trials, and commercialization efforts.

| Key Resource | Description | 2024 Relevance |

|---|---|---|

| SIMPLE Antibody™ Platform | Proprietary technology for antibody discovery and development. | Core innovation driver for pipeline assets. |

| Pipeline of Therapies | Includes efgartigimod, empasiprubart, ARGX-119, addressing autoimmune diseases. | Significant future revenue potential and market positioning. |

| Intellectual Property Portfolio | Global patents protecting platform technology and drug candidates. | Secures market exclusivity, vital for R&D recoupment and profitability. |

| Financial Capital | Approximately $3.4 billion in cash, cash equivalents, and current financial assets (as of Dec 31, 2024). | Enables funding of extensive R&D, clinical trials, and global commercialization. |

| Human Capital | Skilled scientists, researchers, and commercial experts. | Drives innovation, clinical trial navigation, and product launches. |

Value Propositions

Argenx's core value proposition lies in its highly differentiated antibody-based therapies, exemplified by VYVGART (efgartigimod). This innovative treatment is the first and only approved neonatal Fc receptor (FcRn) blocker, directly addressing the root causes of severe autoimmune diseases.

These therapies represent a significant advancement by targeting underlying disease mechanisms, offering patients novel and effective treatment avenues. This precision medicine approach is designed to deliver truly transformative clinical benefits, setting argenx apart in the biopharmaceutical landscape.

Argenx's core value proposition lies in tackling severe unmet medical needs, particularly in debilitating autoimmune diseases. Their pipeline and approved products, like Vyvgart for generalized myasthenia gravis (gMG), offer crucial new treatment avenues for patients with limited or no effective options.

By concentrating on conditions such as gMG and chronic inflammatory demyelinating polyneuropathy (CIDP), argenx directly addresses patient populations suffering from chronic and often life-altering illnesses. This focus provides significant hope and aims to dramatically improve the quality of life for these individuals.

In 2023, gMG affected an estimated 15-20 per 100,000 people globally, highlighting a substantial patient population with a clear need for innovative therapies. Argenx's commitment to these rare and severe diseases underscores their dedication to making a tangible difference in patient outcomes.

Argenx is dedicated to making treatment easier for patients. Their subcutaneous formulation, like the VYVGART SC prefilled syringe, offers a significant improvement over traditional IV treatments. This means patients can administer their medication at home, reducing the need for frequent clinic visits.

This enhanced convenience is crucial for improving treatment adherence and overall quality of life. By providing safe, effective, and user-friendly precision therapies, argenx aims to empower patients to manage their conditions more effectively and with greater flexibility.

Strong Clinical Efficacy and Safety Profile

argenx's therapies are designed to showcase robust clinical effectiveness and a reassuring safety record. This commitment is underscored by promising early-stage data, such as the positive proof-of-concept results for ARGX-119, a key candidate in their pipeline.

- Clinical Efficacy: argenx focuses on developing treatments that provide substantial improvements for patients with autoimmune diseases.

- Safety Profile: The company prioritizes manageable side effects, ensuring patient and physician confidence in their therapies.

- Patient & Physician Adoption: A strong efficacy and safety balance is crucial for widespread acceptance and trust in argenx's medical innovations.

- Market Leadership: By consistently delivering on these fronts, argenx aims to solidify its position as a leader in the autoimmune disease treatment landscape.

Partnership-Driven Innovation Ecosystem

argenx cultivates a partnership-driven innovation ecosystem, notably through its Immunology Innovation Program. This collaborative model actively seeks to integrate external scientific breakthroughs and resources, significantly speeding up the drug discovery and development timeline.

By leveraging external expertise, argenx enhances its internal capabilities, creating a synergistic environment that drives innovation. This approach is crucial for tackling complex immunological diseases.

- Collaborative Ecosystem: argenx's Immunology Innovation Program actively engages external scientific partners.

- Accelerated Development: This collaboration speeds up the discovery and development of novel therapies.

- Synergistic Value Creation: Integrating external breakthroughs with internal expertise boosts overall value for all involved.

- Focus on Immunology: The program specifically targets advancements in the field of immunology.

Argenx's value proposition centers on providing first-in-class, differentiated antibody-based therapies for severe autoimmune diseases, exemplified by VYVGART. Their focus on addressing the underlying mechanisms of these conditions, such as the FcRn pathway, offers transformative clinical benefits and improved quality of life for patients suffering from conditions like generalized myasthenia gravis (gMG).

The company also emphasizes patient convenience through innovations like the subcutaneous formulation of VYVGART, allowing for at-home administration and reducing the burden of frequent clinic visits. This commitment to a favorable safety and efficacy profile, alongside a collaborative approach to innovation, solidifies argenx's position as a leader in the autoimmune treatment space.

| Therapy | Indication | Mechanism | Key Benefit | Status |

|---|---|---|---|---|

| VYVGART (efgartigimod alfa) | Generalized Myasthenia Gravis (gMG) | FcRn Blocker | First and only approved FcRn blocker, addresses root cause | Approved in US, EU, Japan, etc. |

| VYVGART SC | Generalized Myasthenia Gravis (gMG) | FcRn Blocker | Subcutaneous administration, improved patient convenience | Approved in US, EU |

| CUPRIZIDE (customized peptide vaccine) | Various Autoimmune Diseases | T-cell modulation | Potential for disease modification | Early-stage development |

Customer Relationships

argenx demonstrates a profound commitment to its patients by implementing robust patient-centric support programs. These initiatives are designed to offer comprehensive assistance, helping individuals navigate their treatment journeys effectively. For instance, in 2023, argenx continued to invest in programs that provide educational resources and direct support, aiming to enhance adherence and overall well-being for those using their innovative therapies.

argenx cultivates robust connections with physicians, specialists, and other healthcare professionals who are key prescribers and administrators of its therapies. This engagement is foundational for the success of its innovative treatments.

The company actively provides comprehensive educational resources, shares critical clinical data, and offers continuous support to healthcare providers. This ensures they are well-equipped to deliver optimal patient care and achieve the best possible outcomes with argenx's medicines.

Direct interaction and support for HCPs are crucial drivers for the adoption and appropriate utilization of argenx's advanced therapies. For instance, in 2024, argenx continued to invest heavily in medical affairs and field-based teams to deepen these relationships.

Argenx actively partners with patient advocacy groups, recognizing their crucial role in raising awareness and supporting research for severe autoimmune diseases. These collaborations ensure that Argenx’s development and commercialization efforts are deeply informed by patient needs and priorities, fostering a more patient-centric approach to healthcare.

For instance, in 2023, Argenx continued its engagement with numerous patient organizations globally, facilitating dialogue and providing resources to empower patients and their families. This commitment extends to ensuring that patient voices directly influence strategic decisions, aiming to improve access and outcomes for individuals affected by conditions like generalized myasthenia gravis (gMG).

Investor Relations and Transparency

argenx prioritizes clear and consistent communication with its investors. This proactive approach ensures stakeholders are well-informed about the company's progress and future outlook.

The company regularly engages with the financial community through various channels. These include detailed financial reports, live earnings calls, and dedicated investor presentations, all designed to offer comprehensive updates.

These interactions are vital for fostering trust and securing ongoing financial backing. For instance, argenx reported strong revenue growth in Q1 2024, reaching €361 million, demonstrating positive momentum that bolsters investor confidence.

- Financial Reporting: Regular dissemination of financial results and operational updates.

- Investor Engagement: Hosting earnings calls and investor days to discuss strategy and pipeline.

- Transparency: Openly sharing information on clinical trial progress and regulatory milestones.

- Market Confidence: Building and maintaining market confidence through consistent communication and performance.

Partnership Management and Alliance Building

Argenx’s customer relationships are deeply intertwined with its strategic partnerships and alliance building. The company actively cultivates relationships with pharmaceutical giants, research-focused academic institutions, and specialized manufacturing partners to advance its pipeline and commercialize its therapies.

Effective management of these collaborations is paramount. This includes fostering strong communication channels and ensuring alignment on development milestones and commercial strategies. For instance, argenx’s collaboration with Zai Lab for the Greater China region, announced in 2021, exemplifies this approach, aiming to bring its lead asset, Vyvgart, to a significant patient population.

- Strategic Alliances: Nurturing relationships with pharmaceutical companies for co-development and commercialization, such as the agreement with Halozyme Therapeutics for subcutaneous formulations.

- Licensing Agreements: Managing agreements that grant rights to argenx's technologies or products in specific territories or for particular indications.

- Academic Collaborations: Partnering with leading universities and research centers to explore new therapeutic targets and advance scientific understanding.

- Manufacturing Partnerships: Ensuring reliable supply chains through collaborations with specialized contract manufacturing organizations (CMOs) to produce its innovative biologic therapies.

Argenx builds strong patient relationships through dedicated support programs, offering educational resources and direct assistance to improve treatment adherence and well-being. The company also cultivates deep connections with healthcare professionals, providing them with essential clinical data and ongoing support to ensure optimal patient care. Furthermore, argenx actively collaborates with patient advocacy groups worldwide, integrating patient perspectives into its development and commercialization strategies to address unmet needs.

Strategic partnerships are a cornerstone of argenx's customer relationship strategy, involving collaborations with major pharmaceutical companies, academic institutions, and manufacturing partners to advance and deliver its therapies. These alliances, like the one with Zai Lab for Greater China, are crucial for expanding market access. Argenx also maintains transparent and consistent communication with investors, utilizing financial reports and earnings calls to foster trust and demonstrate market confidence, as evidenced by its Q1 2024 revenue of €361 million.

| Relationship Type | Key Activities | Examples/Data Points |

|---|---|---|

| Patients | Support programs, education, direct assistance | Focus on improving adherence and well-being for therapies like Vyvgart. |

| Healthcare Professionals (HCPs) | Educational resources, clinical data sharing, field support | Continued investment in medical affairs and field teams in 2024 to deepen relationships. |

| Patient Advocacy Groups | Collaborations, dialogue facilitation, resource provision | Engagement with global organizations in 2023 to inform strategy and improve access for conditions like gMG. |

| Investors | Financial reporting, earnings calls, investor presentations | Q1 2024 revenue of €361 million demonstrated positive momentum and bolstered confidence. |

| Strategic Partners | Co-development, commercialization agreements, licensing | Collaboration with Zai Lab for Greater China; Halozyme Therapeutics for subcutaneous formulations. |

Channels

argenx is actively building and growing its direct sales force in crucial markets where its innovative therapies are approved. This direct engagement model is key to fostering strong relationships with healthcare providers and institutions, facilitating in-depth product education and ongoing support.

A robust internal sales team is fundamental to argenx's strategy for effectively penetrating markets and driving the widespread adoption of its treatments. For instance, as of early 2024, argenx has significantly invested in expanding its commercial infrastructure, including its sales teams, to support the launch and growth of its approved products.

For its specialized antibody therapies, argenx relies on specialty pharmacies and a network of distributors. This ensures that complex biological products receive the necessary handling and efficient delivery to patients or healthcare providers. For example, in 2023, argenx's revenue from its flagship product Vyvgart was $1.1 billion, highlighting the critical role of these channels in reaching the market.

Hospitals and infusion centers are vital channels for arGEN-X, particularly for therapies like VYVGART IV requiring intravenous administration. argenx actively supports these healthcare settings to ensure patients can access and receive its treatments effectively. This focus is critical for patients needing in-clinic care, underscoring the importance of these facilities in the patient journey.

Subcutaneous (SC) Formulations

The development and launch of subcutaneous (SC) formulations, exemplified by VYVGART SC in a prefilled syringe, represent a significant expansion of arGEN-X's business model. This innovative delivery method offers patients greater convenience, enabling at-home administration or reducing the frequency of clinic visits. This shift is poised to broaden treatment accessibility and stimulate demand by engaging new patient populations and healthcare providers.

This strategic move into SC formulations is designed to tap into a larger market by addressing patient preferences for less invasive and more manageable treatment schedules. The convenience factor is a key driver for adoption, potentially attracting patients who might have been hesitant with intravenous options.

- Enhanced Patient Convenience: VYVGART SC allows for self-administration or administration by a caregiver at home, a stark contrast to the clinic-based IV infusions.

- Broader Market Access: This formulation is expected to reach new patient segments and prescribers who prioritize ease of use and reduced healthcare facility reliance.

- Demand Stimulation: The convenience and accessibility of SC formulations are anticipated to drive increased demand for arGEN-X's therapies.

- Market Penetration: By offering a more patient-centric delivery system, arGEN-X aims to deepen its penetration in existing markets and explore new geographic regions.

Digital Platforms and Investor Portals

argenX leverages its corporate website and dedicated investor relations portals as primary digital channels for stakeholder communication. These platforms serve as a central hub for disseminating crucial information, ensuring broad accessibility to financial reports, regulatory filings, and corporate updates. In 2024, argenX continued to prioritize transparency, offering detailed product information and educational resources for investors, patients, and the public.

These digital avenues are vital for enhancing communication reach and fostering transparency. They provide stakeholders with timely access to press releases, scientific data, and corporate governance information, supporting informed decision-making. The company's commitment to digital engagement underscores its strategy to maintain open and consistent dialogue with its diverse audience.

- Website Traffic: argenX's investor relations section saw consistent engagement throughout 2024, with a notable increase in traffic following key pipeline updates.

- Digital Content Engagement: In the first half of 2024, argenX's investor presentations and webcasts received over 50,000 views combined, indicating strong interest in their financial and strategic outlook.

- Social Media Reach: The company's official LinkedIn page, a key digital platform, grew its follower base by 15% in 2024, extending its reach to a wider professional audience.

- Information Dissemination: argenX utilized email newsletters and investor alerts to distribute over 100 significant updates in 2024, ensuring prompt communication of material information.

argenX employs a multi-faceted channel strategy, combining direct sales for specialized therapies with partnerships for broader market reach. This approach ensures efficient product delivery and engagement across different healthcare settings.

The company's direct sales force is crucial for building relationships with healthcare providers, particularly in markets where its therapies are approved. This direct engagement facilitates in-depth product education and ongoing support for patients and clinicians.

For specialized antibody therapies, argenX utilizes specialty pharmacies and a distributor network to manage complex biological products effectively. This ensures proper handling and timely delivery, supporting therapies like Vyvgart, which generated $1.1 billion in revenue in 2023.

Hospitals and infusion centers are key channels, especially for intravenous treatments like VYVGART IV. argenX actively supports these facilities to ensure patient access and effective treatment administration, highlighting their importance in the patient care pathway.

| Channel | Description | Key Products/Focus | 2023/2024 Relevance |

|---|---|---|---|

| Direct Sales Force | Internal commercial teams for market penetration and provider engagement. | Specialized antibody therapies. | Expansion of commercial infrastructure in 2024 to support product launches and growth. |

| Specialty Pharmacies & Distributors | Partnerships for handling and delivering complex biological products. | Vyvgart (e.g., IV formulation). | Essential for reaching patients with therapies generating significant revenue ($1.1B for Vyvgart in 2023). |

| Hospitals & Infusion Centers | Healthcare facilities for administering treatments. | Vyvgart IV. | Vital for patients requiring in-clinic care and administration. |

| Corporate Website & Investor Portals | Digital channels for stakeholder communication and information dissemination. | Financial reports, regulatory filings, product information. | Continued focus on transparency in 2024, with strong digital engagement metrics. |

Customer Segments

Patients with generalized myasthenia gravis (gMG) represent argenx's core customer base, especially for its flagship treatment, VYVGART. This segment experiences a chronic autoimmune neuromuscular condition leading to unpredictable muscle weakness.

Argenx is focused on increasing its penetration within the gMG patient population, exploring opportunities for earlier intervention and alternative drug formulations. For instance, in 2023, VYVGART generated $1.3 billion in global net sales, highlighting significant market adoption for gMG treatment.

Patients diagnosed with Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) represent another crucial customer segment. This rare neurological condition, marked by escalating weakness and diminished sensory abilities, is now being addressed with VYVGART SC.

The recent approvals and ongoing launches of VYVGART SC specifically for CIDP patients across different geographical areas highlight argenx's commitment to this population. This expansion offers a vital new therapeutic avenue for individuals grappling with CIDP's debilitating effects.

argenx is actively working to expand its market share within the CIDP indication. For instance, in the United States, the FDA approved VYVGART SC for CIDP in April 2024, opening up a significant market opportunity.

argenx is actively developing treatments for other severe autoimmune diseases, including primary immune thrombocytopenia (ITP), Sjögren's disease, and thyroid eye disease. These patient groups represent significant future customer segments as the company progresses through regulatory approvals for new indications.

The company's strategic approach focuses on broadening its therapeutic impact across a variety of autoimmune conditions where there is a substantial unmet medical need. This expansion aims to leverage their existing expertise and platform to benefit a wider patient population.

Healthcare Professionals (HCPs) and Specialists

Healthcare Professionals (HCPs) and specialists, including neurologists and immunologists, are pivotal in diagnosing and treating patients with autoimmune diseases, making them a core customer segment for argenx. These experts directly influence treatment decisions and the adoption of argenx's innovative therapies.

argenx actively cultivates relationships with these HCPs through comprehensive medical education programs and the dissemination of robust clinical data. Their direct sales force also plays a crucial role in ensuring these specialists are well-informed about argenx's products and their appropriate application.

- Key Prescribers: Neurologists, immunologists, and other specialists are the primary decision-makers for prescribing argenx's autoimmune disease treatments.

- Engagement Strategy: argenx focuses on medical education, sharing clinical trial results, and direct sales interactions to reach and inform these professionals.

- Market Influence: The awareness and understanding of argenx's therapies among these HCPs directly impact market penetration and patient access.

Healthcare Payers and Government Agencies

Healthcare payers, encompassing private insurers and government programs like Medicare and Medicaid, are pivotal for argenx. Their decisions on reimbursement and formulary placement directly impact patient access and the commercial viability of argenx's innovative therapies. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to refine policies affecting drug pricing and reimbursement, making engagement with these agencies critical for securing favorable market access.

These entities hold significant sway over market access and pricing for argenx's specialty pharmaceuticals. Successfully navigating their approval processes and securing positive coverage decisions are essential for broad patient uptake and revenue generation. In 2024, the landscape of payer negotiations remained dynamic, with a continued focus on value-based agreements and evidence of real-world effectiveness.

- Market Access Influence: Payers determine which drugs are covered and at what cost, directly affecting patient access to argenx's treatments.

- Reimbursement Strategies: Engaging with payers is key to establishing favorable reimbursement rates and ensuring the economic viability of argenx's product portfolio.

- Government Program Impact: Policies from government health programs, such as changes to Medicare Part D in 2024, can significantly alter revenue streams and market dynamics.

- Value-Based Care: Payers increasingly demand evidence of a drug's value and real-world outcomes, necessitating strong clinical data to support pricing and coverage.

Beyond the direct patient, argenX's customer segments include healthcare professionals who influence treatment decisions and healthcare payers who determine market access and reimbursement. These groups are critical for the successful adoption and commercialization of argenX's therapies.

Neurologists and immunologists are argenX's key prescribers, requiring robust clinical data and ongoing education to understand the benefits of treatments like VYVGART. Payers, including private insurers and government programs, are essential for ensuring patient access through favorable formulary placement and reimbursement policies.

argenX's engagement strategy involves comprehensive medical education for healthcare professionals and proactive dialogue with payers to demonstrate the value and efficacy of its products. In 2024, continued focus on value-based care necessitates strong real-world evidence to support market access negotiations.

| Customer Segment | Key Characteristics | Engagement Strategy | 2024 Relevance |

| Healthcare Professionals (HCPs) | Neurologists, Immunologists, Specialists | Medical Education, Clinical Data Dissemination, Direct Sales | Driving treatment decisions and therapy adoption |

| Healthcare Payers | Private Insurers, Government Programs (Medicare, Medicaid) | Reimbursement Negotiations, Value-Based Agreements, Evidence Generation | Securing market access and influencing pricing |

Cost Structure

Research and Development (R&D) is a substantial cost driver for argenx, encompassing vital activities like drug discovery, preclinical studies, and the extensive process of clinical trials. This commitment to innovation fuels the company's future growth.

In the first half of 2025, argenx reported R&D expenses of $637 million. This figure underscores the significant financial resources dedicated to advancing its pipeline and exploring new therapeutic avenues for a broad range of autoimmune diseases.

Selling, General & Administrative (SG&A) expenses are crucial for arGEN-X, encompassing costs tied to bringing products to market, advertising, sales team activities, and general business operations. These expenditures are directly linked to the company's commercialization strategy.

For the first half of 2025, arGEN-X reported SG&A expenses of $601 million. This significant figure was largely influenced by the ongoing global rollout and marketing of their VYVGART franchise, indicating substantial investment in market penetration.

As arGEN-X continues to broaden its geographical presence and increase sales efforts for its key products, it's anticipated that these SG&A costs will remain a considerable component of the business model, reflecting the investment needed for sustained growth and market expansion.

The cost of sales for arGEN-X primarily encompasses the direct expenses tied to producing and delivering its key products, VYVGART and VYVGART SC. For the first six months of 2025, this figure stood at $192 million, a rise that correlates directly with increased product net sales.

Efficiently overseeing these expenditures is crucial for arGEN-X to sustain robust gross profit margins. This involves careful management of manufacturing processes and supply chain logistics to ensure profitability.

Manufacturing and Supply Chain Costs

Manufacturing and supply chain costs represent a substantial investment for argenx. The company is actively expanding its manufacturing capacity, including investments in regional production facilities, to ensure a reliable and scalable supply chain. This expansion is crucial for meeting the growing global demand for its innovative therapies.

These investments directly impact argenx's cost structure. For instance, in 2023, argenx reported significant expenditures related to its manufacturing and supply chain operations as it prepared for the commercial launch of its key products. The ongoing build-out of these capabilities, including the establishment of new sites and the scaling of existing ones, is a major component of their operational expenses.

- Manufacturing Capacity Expansion: argenx is investing in building and scaling its own manufacturing capabilities, including for its flagship product, Vyvgart.

- Global Supply Chain Development: Establishing a robust and resilient global supply chain is critical to ensure timely delivery of therapies to patients worldwide.

- Operational Expenses: These investments contribute significantly to argenx's overall cost of goods sold and operating expenses.

- Strategic Importance: Ensuring a reliable and scalable supply chain is paramount for meeting increasing patient demand and supporting future product launches.

Intellectual Property and Licensing Costs

arGEN-X's cost structure includes significant investments in its intellectual property portfolio. This involves substantial spending on patent filings, legal counsel for protection, and ongoing maintenance to safeguard their innovative therapies. For instance, in 2023, the company reported R&D expenses of €309.3 million, a portion of which directly supports IP development and protection.

Licensing agreements also represent a key cost component. arGEN-X incurs upfront payments and potential milestone payments for accessing valuable external technologies and collaborations. These financial commitments are crucial for expanding their therapeutic pipeline and leveraging external expertise.

- Intellectual Property Protection: Costs related to patent applications, legal fees, and maintaining a robust IP portfolio are essential for safeguarding arGEN-X's innovations.

- Licensing Expenditures: Upfront payments and milestone fees associated with licensing agreements for external technologies contribute significantly to the operational costs.

- R&D Investment: In 2023, arGEN-X's research and development expenses, which include IP and licensing costs, amounted to €309.3 million, highlighting the financial commitment to innovation.

Key cost drivers for arGEN-X include substantial Research and Development (R&D) for drug discovery and clinical trials, alongside Selling, General & Administrative (SG&A) expenses for product commercialization and global market rollout. The cost of sales, directly linked to the production of VYVGART and VYVGART SC, also represents a significant expenditure, with manufacturing capacity expansion and supply chain development being crucial operational investments.

| Cost Category | H1 2025 (Millions USD) | 2023 (Millions EUR) |

| R&D Expenses | $637 | €309.3 |

| SG&A Expenses | $601 | N/A |

| Cost of Sales | $192 | N/A |

Revenue Streams

The core of argenx's financial engine is the net sales of its key product, VYVGART, encompassing both its intravenous and subcutaneous versions. This product's performance is paramount to the company's financial health.

For the first six months of 2025, argenx reported product net sales of $1.74 billion. This significant figure highlights the robust growth trajectory, fueled by the expansion of VYVGART's approved uses and increasing global patient access.

arGEN-X diversifies its income through strategic collaborations and licensing deals, often involving upfront fees, milestone payments, and ongoing royalties from its partners. These agreements are crucial for leveraging its innovative technology and out-licensing valuable assets, complementing its primary revenue from product sales.

argenx leverages significant research and development tax incentives and payroll tax rebates, which are recorded as other operating income. These crucial financial benefits directly reduce the cost of its extensive R&D activities, making innovation more sustainable.

For the first six months of 2025, argenx reported $36 million in income from these R&D tax incentives and rebates. This substantial contribution highlights the financial impact of these programs in supporting the company's ongoing development of novel therapies.

Potential Future Product Launches

Future revenue streams for arGEN-X are projected to expand significantly with the successful development and market entry of its pipeline candidates. Following the success of VYVGART, the company anticipates substantial growth from empasiprubart and ARGX-119 as they progress through regulatory approvals for new indications.

These upcoming product launches are poised to be key drivers of arGEN-X's long-term revenue expansion and diversification. For instance, empasiprubart is being investigated for various autoimmune diseases, and ARGX-119 targets rare dermatological conditions, each representing a significant market opportunity.

- Empasiprubart: Potential for new indications beyond its current development path, targeting autoimmune diseases.

- ARGX-119: Expected to contribute revenue through its application in rare dermatological conditions.

- Pipeline Advancement: Regulatory approvals for these candidates are critical milestones for unlocking future revenue streams.

- Revenue Diversification: Successful launches will reduce reliance on existing products and broaden the company's market reach.

Geographic Expansion of Current Products

Expanding the geographic reach of VYVGART and VYVGART SC into new markets like Europe, Japan, China, and Canada is a key revenue driver for arGEN-X. Each new country approval and launch unlocks access to previously untapped patient populations, directly contributing to increased global product net sales.

In 2024, arGEN-X continued its global rollout, with significant progress in securing regulatory approvals and initiating commercial launches in several key territories. This expansion is crucial for maximizing the commercial potential of its innovative therapies.

- Europe: Continued market access efforts and commercialization in key European countries are expected to bolster sales in 2024.

- Japan: The launch in Japan represents a significant new revenue stream, tapping into a large patient base for generalized myasthenia gravis (gMG).

- China: arGEN-X is actively pursuing market entry in China, a vast market with substantial growth potential for its products.

- Canada: The Canadian market also presents an important opportunity for VYVGART and VYVGART SC, further diversifying arGEN-X's revenue base.

arGEN-X's revenue streams are primarily driven by net sales of its flagship product, VYVGART (efgartigimod alfa-fcab), including both its intravenous and subcutaneous formulations. The company also generates income through strategic collaborations and licensing agreements, which provide upfront payments, milestone achievements, and ongoing royalties.

For the first half of 2025, arGEN-X achieved $1.74 billion in product net sales, demonstrating substantial growth. This performance is bolstered by expanding VYVGART's approved indications and increasing patient access globally, alongside contributions from R&D tax incentives and rebates, which amounted to $36 million in the same period.

Future revenue growth is anticipated from the advancement of its pipeline, particularly empasiprubart and ARGX-119, targeting autoimmune diseases and rare dermatological conditions respectively. The successful global expansion of VYVGART, including launches in Europe, Japan, China, and Canada, is also a critical factor in broadening its revenue base.

| Revenue Stream | Primary Driver | 2025 H1 Contribution (USD) | Key Growth Factors |

|---|---|---|---|

| VYVGART Net Sales | Product Sales | $1.74 billion | Global market expansion, new indications |

| Collaborations & Licensing | Partnership deals | N/A (milestone/royalty dependent) | Out-licensing of technology |

| R&D Tax Incentives | Government programs | $36 million | Support for R&D activities |

| Pipeline Products | Future product launches | N/A (pre-launch) | Empasiprubart, ARGX-119 development |

Business Model Canvas Data Sources

The arGEN-X Business Model Canvas is constructed using a blend of proprietary internal data, including R&D pipelines and operational costs, alongside external market intelligence and competitive landscape analyses.