arGEN-X Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

arGEN-X Bundle

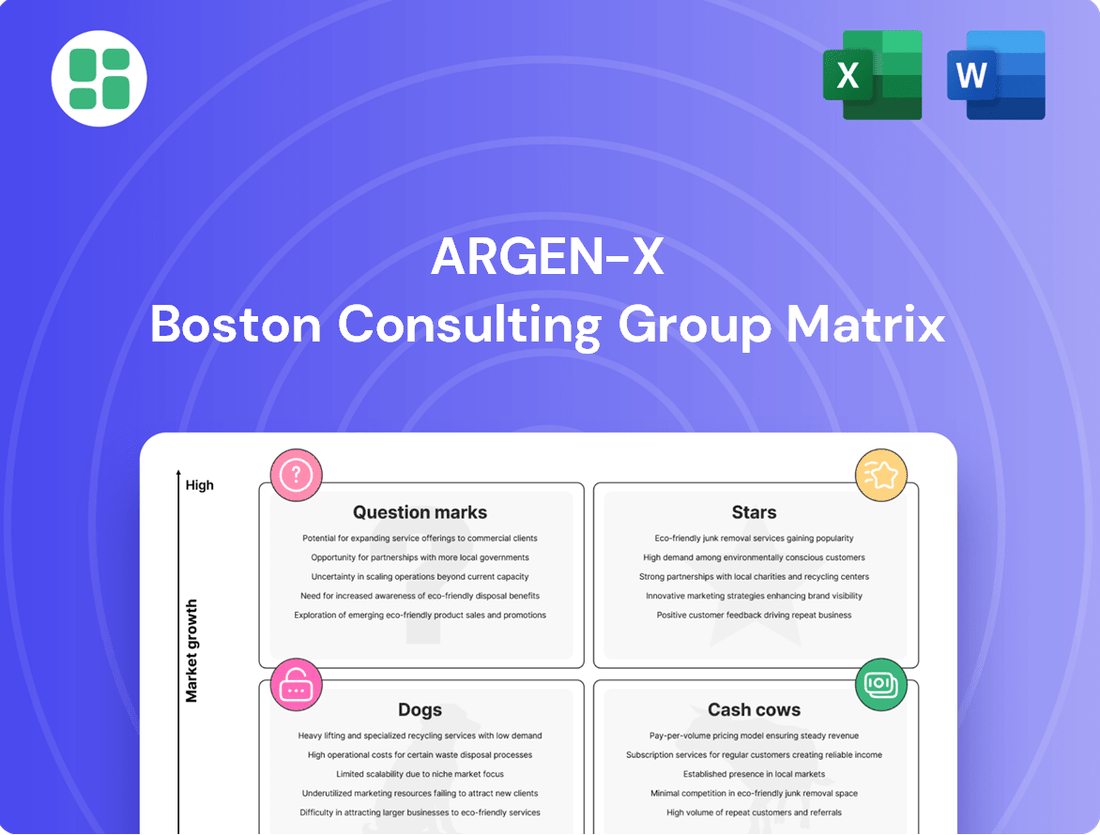

The arGEN-X BCG Matrix offers a powerful framework to understand its product portfolio's strategic positioning. By categorizing products into Stars, Cash Cows, Dogs, and Question Marks, arGEN-X can make informed decisions about resource allocation and future investments. This preview highlights the essential components of this analysis, but to truly unlock arGEN-X's strategic potential, you need the complete picture.

Dive deeper into arGEN-X's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Vyvgart, argenx's leading product, shows robust performance in generalized myasthenia gravis (gMG). Its market penetration remains high, reflecting strong adoption by patients and physicians.

In 2024, Vyvgart achieved global net product sales of $2.2 billion. The first quarter of 2025 saw sales reach $790 million, indicating sustained growth and a significant market share in the gMG treatment landscape.

The drug's proven efficacy and favorable safety profile solidify its position as a preferred therapy, contributing to its ongoing revenue expansion within this critical therapeutic area.

The FDA approval of Vyvgart Hytrulo in a subcutaneous prefilled syringe in April 2025 for generalized myasthenia gravis (gMG) and chronic inflammatory demyelinating polyneuropathy (CIDP) is a major boost for arGEN-X. This innovation allows for self-injection, making treatment more accessible and convenient for patients.

This enhanced administration method is poised to expand Vyvgart Hytrulo's patient base and capture a larger market share. By simplifying the treatment process, arGEN-X anticipates improved patient adherence and earlier intervention in the disease course.

The subcutaneous pre-filled syringe is a critical strategic focus for arGEN-X in 2025. This move is designed to position Vyvgart Hytrulo as a first-line treatment option, further solidifying its position in the market.

Vyvgart Hytrulo's FDA approval for Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) in 2024 represents a significant breakthrough, being the first new treatment option in decades for this debilitating condition. This approval unlocks a substantial new market, with early patient uptake and positive clinical reception indicating strong growth prospects.

The drug's rapid adoption in the CIDP space, evidenced by robust patient acquisition and favorable physician feedback, positions it as a high-potential product. This success in a previously underserved market segment highlights Vyvgart's strategic expansion and its potential to capture significant market share.

Global Expansion of Vyvgart

Argenx is making significant strides in the global expansion of Vyvgart, a key driver of its growth. The drug has secured approvals in more than 30 countries for generalized myasthenia gravis (gMG), and the company is actively working to introduce it for other indications like chronic inflammatory demyelinating polyneuropathy (CIDP) and primary immune thrombocytopenia (ITP) in new territories.

This international rollout is central to argenx's strategy to address significant unmet medical needs worldwide. The company's established commercial infrastructure is successfully fueling sales momentum, particularly in regions such as Europe, the Middle East, and Africa. For example, in the first quarter of 2024, argenx reported total revenue of €373.9 million, with Vyvgart sales contributing substantially to this figure, demonstrating strong market adoption.

- Vyvgart approvals: Over 30 countries for gMG.

- Geographic focus: Expansion into new regions for CIDP and ITP.

- Commercial performance: Strong sales momentum in Europe, Middle East, and Africa.

- Financial impact: Vyvgart is a significant contributor to argenx's revenue growth.

Efgartigimod's Broad Pipeline Potential

Efgartigimod's extensive pipeline, targeting over 15 severe autoimmune diseases, positions it as a significant growth driver. Phase 3 trials are underway for myositis, thyroid eye disease (TED), and Sjogren's disease, underscoring its broad therapeutic reach.

This "pipeline-in-a-product" strategy allows efgartigimod to address multiple high-value autoimmune markets, potentially capturing substantial market share. Positive Phase 2 data in myositis and Sjogren's disease further validate its broad applicability and therapeutic promise.

- Pipeline Expansion: Efgartigimod is being investigated in over 15 autoimmune diseases.

- Key Phase 3 Trials: Current focus includes myositis, thyroid eye disease (TED), and Sjogren's disease.

- Market Potential: Demonstrates potential to capture significant share in multiple autoimmune markets.

- Positive Early Data: Phase 2 results in myositis and Sjogren's disease support broad therapeutic utility.

Stars in the arGEN-X BCG matrix represent high-growth, high-market-share products. Vyvgart, with its strong performance in generalized myasthenia gravis (gMG) and expanding indications like CIDP, clearly fits this category. Its robust sales figures and ongoing global expansion solidify its position as arGEN-X's flagship product and a key driver of future growth.

Vyvgart's success is underscored by its significant revenue generation, with global net product sales reaching $2.2 billion in 2024 and $790 million in Q1 2025. The recent FDA approval of Vyvgart Hytrulo in a subcutaneous pre-filled syringe for gMG and CIDP further enhances its market potential by improving patient convenience and accessibility.

This innovation is expected to drive increased patient adherence and capture a larger market share, positioning Vyvgart Hytrulo as a preferred first-line treatment. The drug's approval for CIDP in 2024, the first new treatment in decades, also opens up a substantial new market with promising early uptake.

ArGEN-X's strategic focus on expanding Vyvgart's approvals and market access globally, particularly in Europe, the Middle East, and Africa, reinforces its star status. The company reported €373.9 million in total revenue for Q1 2024, with Vyvgart being a major contributor, highlighting its critical role in arGEN-X's financial success.

| Product | Indication | 2024 Net Sales (USD Billions) | Q1 2025 Net Sales (USD Billions) | Key Developments |

|---|---|---|---|---|

| Vyvgart | gMG | 2.2 | 0.79 | FDA approval for subcutaneous Hytrulo (gMG & CIDP) in April 2025. Over 30 country approvals for gMG. |

| Vyvgart Hytrulo | CIDP | N/A (Launched 2024) | N/A | First new treatment for CIDP in decades. Strong early patient uptake and physician reception. |

What is included in the product

The arGEN-X BCG Matrix categorizes its business units into Stars, Cash Cows, Question Marks, and Dogs to guide strategic resource allocation.

arGEN-X BCG Matrix: a visual tool to prioritize R&D investments, alleviating the pain of resource allocation uncertainty.

Cash Cows

Vyvgart, a key product for arGEN-X, is a prime example of a cash cow within the company's portfolio. Its established presence and consistent revenue generation, particularly from its initial approval for generalized myasthenia gravis (gMG), provide a crucial and reliable cash flow.

For the full year 2024, arGEN-X reported preliminary global product net sales for Vyvgart reaching $2.2 billion. This figure underscores the drug's strong market penetration and its capacity to deliver substantial and dependable income, solidifying its role as a cash cow.

This robust financial foundation is instrumental, enabling arGEN-X to allocate significant resources towards its extensive research and development pipeline, as well as its ongoing commercial expansion efforts across various markets.

Argenx's transition to profitability marks a significant shift, with Q1 2025 earnings reaching $169 million, a stark contrast to the loss reported in Q1 2024. This turnaround is primarily fueled by the strong performance of its key product, Vyvgart.

This financial achievement indicates that Vyvgart is now a cash cow, generating sufficient revenue to not only cover its own costs but also contribute to the company's overall operational expenses and future growth initiatives.

The ability to self-fund growth provides argenx with greater financial flexibility, reducing its dependence on external capital and allowing for more strategic reinvestment in its pipeline and market expansion.

Vyvgart's substantial revenue stream acts as a vital internal engine for argenx's broad pipeline development. This financial strength enables significant investment in crucial registrational trials and early-stage proof-of-concept studies for new therapeutic areas and innovative drug candidates. This approach minimizes the need for external financing, preserving shareholder value.

High Gross Margins on Commercialized Product

Argenx's Vyvgart demonstrates exceptional profitability, a key indicator of a cash cow. The company's financial reports highlight robust gross margins, a testament to efficient manufacturing processes and the premium pricing afforded by its orphan drug designation.

This strong gross margin, often cited around 89.74% in recent financial assessments, means a substantial amount of the revenue generated by Vyvgart directly converts into gross profit. This efficiency is crucial, allowing Argenx to fund its ongoing, significant research and development expenditures while maintaining a healthy cash flow.

- High Gross Margins: Vyvgart exhibits gross margins nearing 90%, indicating strong pricing power and efficient production.

- Profitability Driver: These margins ensure a significant portion of revenue becomes gross profit, fueling cash generation.

- R&D Funding: The profitability supports Argenx's substantial investments in future research and development.

Strategic Investment in Commercial Infrastructure

argenx's investment in its commercial infrastructure for Vyvgart positions it as a strong Cash Cow within the BCG matrix. The company has successfully established a robust global sales and marketing network, crucial for supporting Vyvgart's high market share in its key therapeutic areas, particularly for generalized myasthenia gravis (gMG) and chronic inflammatory demyelinating polyneuropathy (CIDP).

While argenx continues to invest in expanding Vyvgart's indications, the foundational commercial organization for gMG and CIDP is now mature and efficient. This allows the company to maintain and grow its market presence without requiring substantial new capital outlays for these established uses. For instance, in 2024, argenx reported significant revenue growth driven by Vyvgart's performance, underscoring the effectiveness of this established commercial engine.

- Established Global Commercial Organization: argenx has built a robust infrastructure to support Vyvgart's market penetration.

- High Market Share: Vyvgart commands a significant share in its therapeutic segments.

- Efficient Market Maintenance: The core infrastructure for gMG and CIDP is well-developed, enabling cost-effective market operations.

- Leveraging Existing Resources: Maximizing returns from Vyvgart's established indications with controlled spending.

Vyvgart's strong financial performance, highlighted by $2.2 billion in preliminary global product net sales for 2024, firmly establishes it as argenx's cash cow. This product generates substantial and consistent revenue, enabling the company to fund its ambitious research and development pipeline. The drug's high gross margins, often around 89.74%, demonstrate efficient operations and pricing power, directly contributing to argenx's profitability.

| Product | 2024 Preliminary Global Net Sales | Gross Margin (Approx.) | BCG Category |

| Vyvgart | $2.2 billion | ~89.74% | Cash Cow |

Delivered as Shown

arGEN-X BCG Matrix

The arGEN-X BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks or demo content will be present in the final version, ensuring you get a professional and ready-to-use strategic tool. The insights and analysis presented here are exactly what you will unlock for immediate application in your business planning. This comprehensive BCG Matrix report is designed to provide clear strategic direction and is delivered directly to you, ready for implementation.

Dogs

In 2025, arGEN-X made the strategic decision to discontinue the development of efgartigimod for bullous pemphigoid (BP). This move suggests the program may not have met arGEN-X's internal benchmarks for clinical efficacy, market opportunity, or competitive positioning.

This discontinuation aligns with typical biotech pipeline management, where companies reallocate resources from programs that fail to demonstrate sufficient promise. For instance, arGEN-X's 2024 financial reports would likely show the R&D investment in efgartigimod for BP being redirected to more promising candidates within their portfolio.

Within argenx's extensive Immunology Innovation Program (IIP), many early-stage research ideas and preclinical candidates are constantly being assessed. A substantial number of these will naturally not meet the scientific or strategic criteria needed to move forward to Investigational New Drug (IND) applications.

These represent 'dogs' because resources were allocated, but they didn't result in viable product candidates. Often, these programs remain private unless a specific initiative is officially discontinued after a public announcement.

While argenx's core strategy targets significant autoimmune conditions, certain niche indications, even with a sound biological basis, might present challenges. These could include exceptionally small patient pools or substantial hurdles in gaining market approval and reimbursement. For instance, a rare autoimmune subtype affecting only a few hundred patients globally would likely fall into this category.

Investing in such indications would typically result in a low market share and a disproportionately high investment compared to the potential return. This makes them 'dogs' within the BCG matrix framework, meaning they are not actively developed beyond initial feasibility studies. This strategic decision helps argenx avoid diverting valuable resources from more promising commercial ventures.

Ineffective or Suboptimal Platform Applications

Even with argenx's advanced SIMPLE Antibody™ Platform, not every antibody candidate hits the mark. Some may fall short in potency, selectivity, or how the body handles them, making them unsuitable for specific targets. These less-than-ideal molecules, though born from a promising platform, are set aside and don't move into clinical trials.

This situation is common in drug development. It highlights the reality that many potential drugs don't make it through the rigorous process. For instance, in 2024, the pharmaceutical industry continued to see high attrition rates in early-stage drug discovery, with many promising leads failing to demonstrate sufficient efficacy or safety in preclinical studies.

- Suboptimal Candidates: Antibodies failing to meet stringent potency and selectivity criteria.

- Shelved Assets: Molecules that do not progress beyond the discovery phase due to pharmacokinetic limitations.

- Iterative Process: The reality of drug discovery involves numerous failures before a successful candidate emerges.

- Industry Attrition: High failure rates in early-stage drug development are a persistent challenge across the pharmaceutical sector.

Competitive Landscape Limitations in Certain Areas

In specific therapeutic arenas, deeply entrenched existing treatments or rapidly emerging rivals can create formidable obstacles to capturing significant market share, even for a drug demonstrating some level of effectiveness. For instance, if arGEN-X were to consider a market segment already dominated by blockbuster drugs with established patient loyalty and extensive physician familiarity, the path to substantial market penetration would be exceedingly difficult.

Should arGEN-X identify an environment where its product is likely to be a minor player in a saturated or stagnant market, it might strategically choose to halt further investment. This approach effectively categorizes such potential indications as 'dogs' within the BCG framework. This decision is crucial for maintaining focus and allocating resources to areas where a distinct competitive advantage can be cultivated and leveraged for greater success.

- Market Saturation: Consider the autoimmune disease space, where multiple established therapies exist for conditions like myasthenia gravis.

- Competitive Intensity: For example, if a new indication for one of arGEN-X's drugs faces competition from several drugs with long-standing efficacy data and strong payer coverage, it could be classified as a dog.

- Resource Allocation: In 2024, pharmaceutical companies are increasingly scrutinizing R&D pipelines, prioritizing assets with clear differentiation and high market potential.

- Strategic Divestment: Companies may choose to out-license or abandon indications where achieving a leading market position is improbable, optimizing their portfolio for growth.

Dogs in arGEN-X's portfolio represent research avenues or potential indications that consume resources but offer low prospects for market share or profitability. These are often early-stage projects that fail to meet rigorous development criteria or face insurmountable market challenges. For instance, a niche autoimmune indication with a tiny patient population and limited unmet need would likely be classified as a dog.

The discontinuation of efgartigimod for bullous pemphigoid in 2025 exemplifies this, indicating the program didn't meet arGEN-X's benchmarks for success. Such decisions are crucial for efficient resource allocation, allowing the company to focus on more promising candidates. In 2024, the biotech industry saw continued scrutiny of R&D pipelines, with companies actively pruning underperforming assets.

These 'dogs' can emerge from various stages, including preclinical candidates with unfavorable pharmacokinetic profiles or market segments saturated with established competitors. For arGEN-X, this means setting aside molecules that, despite being derived from their advanced platform, don't demonstrate the necessary potency or selectivity for clinical success.

The strategic decision to halt investment in these areas is vital for maintaining a competitive edge. By avoiding diversion of capital into low-return ventures, arGEN-X can concentrate its efforts on areas where it has a clear advantage and a higher probability of market success, a common practice in the pharmaceutical sector during 2024.

Question Marks

Empasiprubart, a C2 inhibitor, is currently in Phase 2 development for conditions like multifocal motor neuropathy (MMN), delayed graft function, and dermatomyositis. While it has demonstrated promising proof-of-concept in MMN, it has no current market share and demands substantial funding for further clinical development.

The drug's potential across several autoimmune diseases places it firmly in the Question Mark category of the BCG matrix. Its future trajectory hinges on successful late-stage trials, with the potential to transition into a Star product if it achieves market approval and significant sales.

ARGX-119, a promising muscle-specific kinase (MuSK) agonist, is currently navigating the early stages of clinical development. Phase 1b/2a studies are underway for congenital myasthenic syndrome (CMS) and amyotrophic lateral sclerosis (ALS), addressing significant unmet needs in rare neuromuscular diseases.

While these indications represent substantial therapeutic opportunities, ARGX-119 is in its nascent stages, demanding considerable research and development investment without generating current revenue. Its position in the BCG matrix is that of a Question Mark, highlighting its potential for future growth but also its inherent risks.

Positive clinical outcomes from its ongoing trials could significantly shift ARGX-119's trajectory, potentially elevating it to Star status. For instance, arGEN-X reported in their Q1 2024 update that the Phase 1b/2a study for ARGX-119 in CMS was progressing as planned, with data expected later in 2024.

ARGX-213 represents argenx's strategic move to expand its dominance in FcRn-targeted therapies. This next-generation candidate holds significant growth potential, aiming to deliver enhanced therapeutic profiles or address previously unmet patient needs.

Currently in preclinical stages, ARGX-213 is slated for an Investigational New Drug (IND) filing by the close of 2025. This places it firmly in the Question Mark category, reflecting its high-risk, high-reward profile.

ARGX-121 (IgA) and ARGX-109 (IL-6)

ARGX-121, targeting IgA, and ARGX-109, targeting IL-6, are pioneering molecules for argenx, expanding its reach within the immune system. These represent significant growth opportunities in novel therapeutic domains.

Phase 1 trial results for ARGX-109 are anticipated in the second half of 2025, with ARGX-121 results expected in the first half of 2026. This timing places them squarely in the question mark category of the BCG matrix, demanding substantial research and development investment.

- High R&D Investment: Both ARGX-121 and ARGX-109 require considerable financial resources for their development and clinical trials.

- Uncertain Market Adoption: As first-in-class therapies, their future market success and patient uptake are not yet established.

- Potential for High Growth: If successful, these molecules could tap into significant unmet medical needs and generate substantial revenue.

- Strategic Expansion: They broaden argenx's therapeutic focus beyond its established areas, diversifying its pipeline.

Other Early-Stage Immunology Innovation Program (IIP) Candidates

ArgEN-X's Immunology Innovation Program is actively developing a portfolio of early-stage candidates, with a strategic focus on identifying and advancing novel immunology assets. The company anticipates four new Investigational New Drug (IND) filings by the close of 2025, underscoring its commitment to pipeline expansion.

These nascent molecules, such as ARGX-220, a sweeping antibody, are positioned within high-growth segments of the immunology market. However, they currently represent zero market share and necessitate significant research and development investment to reach commercialization.

- Pipeline Expansion: arGEN-X aims for four new IND filings by the end of 2025, demonstrating robust early-stage development.

- High-Growth Potential: Early-stage candidates like ARGX-220 target promising areas within immunology.

- Speculative Nature: These assets currently hold no market share and require substantial R&D funding.

- Future Growth Engine: They represent the most speculative, yet potentially impactful, drivers for arGEN-X's future growth.

Question Marks in arGEN-X's portfolio represent early-stage assets with high growth potential but also significant risk and no current market share. These products, like ARGX-119 and ARGX-213, require substantial investment in research and development to advance through clinical trials and achieve market approval. Their success is uncertain, but a positive outcome could transform them into lucrative Star products for the company.

| Product Candidate | Therapeutic Area | Development Stage | BCG Category | Key Considerations |

|---|---|---|---|---|

| Empasiprubart | Autoimmune Diseases (MMN, etc.) | Phase 2 | Question Mark | High R&D needs, promising proof-of-concept |

| ARGX-119 | Neuromuscular Diseases (CMS, ALS) | Phase 1b/2a | Question Mark | Early stage, significant unmet need, data expected 2024 |

| ARGX-213 | FcRn-targeted Therapies | Preclinical | Question Mark | IND filing by end of 2025, high-risk/high-reward |

| ARGX-109 | Immunology | Phase 1 | Question Mark | Phase 1 results expected H2 2025, potential for growth |

| ARGX-121 | Immunology | Phase 1 | Question Mark | Phase 1 results expected H1 2026, broadening therapeutic reach |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.