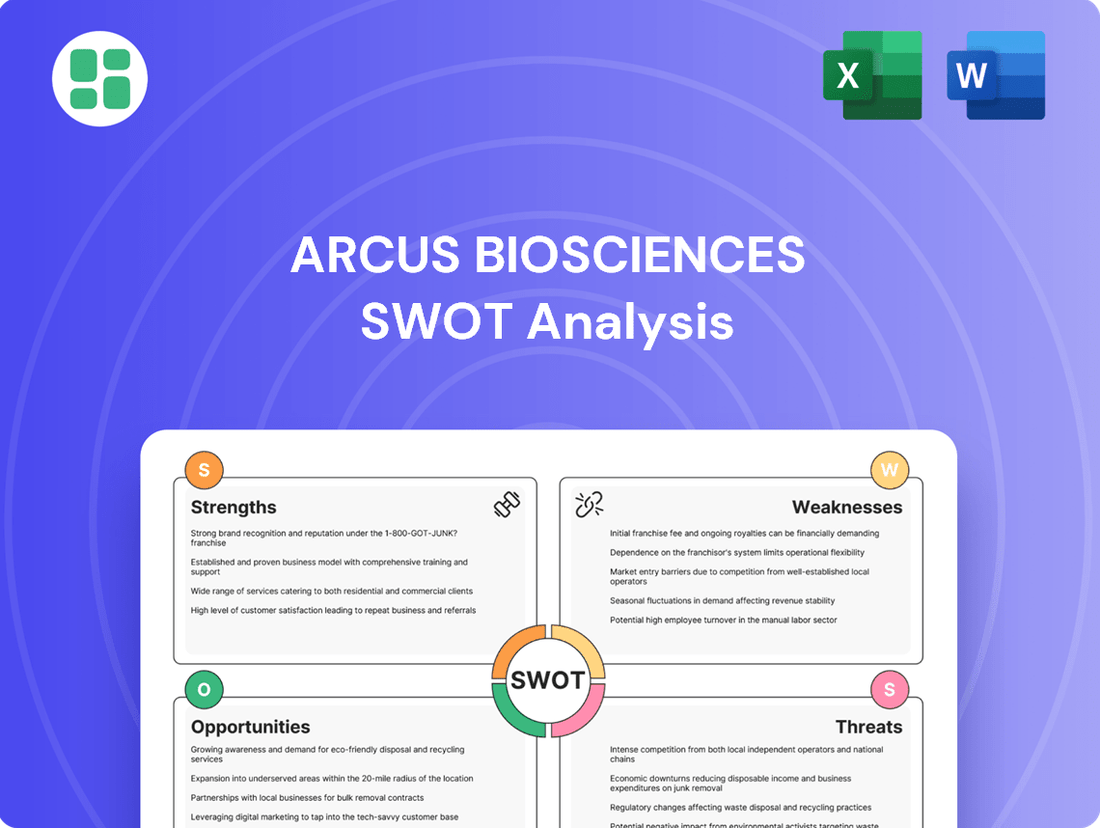

Arcus Biosciences SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arcus Biosciences Bundle

Arcus Biosciences boasts a compelling pipeline and strong scientific foundation, but navigating the competitive oncology landscape presents significant challenges. Understanding their unique strengths, potential weaknesses, market opportunities, and threats is crucial for strategic decision-making.

Want the full story behind Arcus Biosciences' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Arcus Biosciences possesses a strong and varied clinical-stage pipeline, encompassing both small molecule drugs and biologics. This multifaceted approach allows them to address cancer through multiple mechanisms, potentially increasing their market reach and mitigating risks associated with a single therapeutic class. As of early 2024, Arcus has multiple candidates in various stages of clinical development, including their ARC-7, an anti-TIGIT antibody, which has shown promising results in combination therapy trials for non-small cell lung cancer.

Arcus Biosciences leverages powerful strategic collaborations, particularly with Gilead Sciences and AstraZeneca. These partnerships are a significant strength, injecting substantial funding and shared development expertise into Arcus's pipeline.

This robust financial backing is evident in Arcus's balance sheet, which reported $1.0 billion in cash, cash equivalents, and marketable securities as of March 31, 2025. This healthy liquidity provides ample runway to support operations through critical initial pivotal trial readouts.

Beyond financial advantages, these collaborations serve as a strong validation of Arcus's scientific platform and significantly broaden its capabilities for conducting global clinical trials and future commercialization efforts.

Arcus Biosciences is making substantial headway with its late-stage clinical trials, a key strength. The company has several promising candidates, including domvanalimab, quemliclustat, and casdatifan, currently in Phase 3 development, moving them closer to potential regulatory approval.

The commencement of pivotal trials like PRISM-1 for pancreatic cancer and PEAK-1 for renal cell carcinoma highlights Arcus's progress. These late-stage studies are crucial steps towards bringing new treatments to market and addressing significant unmet medical needs.

Successfully navigating these advanced clinical stages positions Arcus to potentially generate product revenue sooner. This advancement is vital for the company's financial growth and its ability to impact a broad range of patients.

Promising Clinical Data and Best-in-Class Potential

Arcus Biosciences is demonstrating significant strengths through its recent clinical trial results. For instance, casdatifan in clear cell renal cell carcinoma (ccRCC) has shown promising efficacy and a favorable safety profile. Some analyses even suggest it could be best-in-class when compared to existing treatments.

Furthermore, quemliclustat has presented encouraging data in pancreatic cancer studies, notably showing improved overall survival rates that surpass historical benchmarks. These positive outcomes are vital for attracting continued investment and potential partnerships, which are essential steps toward gaining regulatory approval.

- Casdatifan's ccRCC data: Early results indicate strong efficacy and a manageable safety profile, positioning it as a potential best-in-class therapy.

- Quemliclustat's pancreatic cancer results: Demonstrated improved overall survival, outperforming historical benchmarks.

- Impact of positive data: Crucial for securing further investment, fostering strategic partnerships, and advancing towards regulatory approval.

Experienced Leadership and Scientific Expertise

Arcus Biosciences benefits from a leadership team and scientific advisory board possessing significant experience in immunology and translational medicine. This deep well of expertise is paramount for guiding the intricate drug development pathway, making crucial pipeline choices, and driving innovation within the competitive oncology sector. Their strategic emphasis on biology-informed combination therapies aims to deliver novel or superior treatments.

Arcus Biosciences' strengths are anchored in its robust, diverse clinical pipeline and strategic collaborations. The company's financial health, with $1.0 billion in cash as of March 31, 2025, provides substantial runway for late-stage development.

Key clinical advancements include Phase 3 trials for domvanalimab, quemliclustat, and casdatifan, bringing them closer to market. Promising data for casdatifan in ccRCC and quemliclustat in pancreatic cancer further bolster its position, suggesting potential best-in-class therapies.

The experienced leadership team and scientific advisory board are critical assets, guiding the company's biology-informed approach to combination therapies in oncology.

| Pipeline Candidate | Indication | Development Stage | Key Data Highlight |

|---|---|---|---|

| Domvanalimab | Non-Small Cell Lung Cancer | Phase 3 | Combination therapy promise |

| Quemliclustat | Pancreatic Cancer | Phase 3 | Improved overall survival vs. benchmarks |

| Casdatifan | Clear Cell Renal Cell Carcinoma | Phase 3 | Potential best-in-class efficacy and safety |

What is included in the product

Delivers a strategic overview of Arcus Biosciences’s internal and external business factors, highlighting its innovative pipeline and potential market growth while acknowledging clinical and regulatory risks.

Offers a clear view of Arcus Biosciences' competitive landscape, highlighting opportunities to leverage strengths and mitigate weaknesses for strategic advantage.

Weaknesses

Arcus Biosciences, as a clinical-stage biopharmaceutical company, faces a significant weakness in its heavy reliance on the success of its ongoing and future clinical trials. This dependency means that any negative outcomes, such as trial failures or unexpected side effects, could severely derail its development pipeline and financial prospects.

For instance, delays in trials or poor patient enrollment can directly impact the company's ability to advance its drug candidates, potentially affecting its stock price. The inherent risk in drug development is substantial; even promising early-stage data doesn't guarantee a drug's ultimate approval and market success.

Arcus Biosciences faces a significant hurdle with its substantial operating losses, a common but critical challenge for early-stage biotech companies. For the first quarter of 2025, the company reported a net loss of $112 million. This follows a net loss of $94 million in the fourth quarter of 2024, underscoring a consistent pattern of high expenditure.

These considerable losses are largely driven by aggressive investment in research and development (R&D). While essential for innovation in the pharmaceutical sector, these R&D costs represent a substantial burn rate that necessitates continuous capital infusions to sustain operations and advance its pipeline through clinical trials.

Looking ahead, Arcus anticipates 2025 to mark a peak year for development expenses. This projection signals that the financial intensity of its current development stage is likely to continue, requiring careful financial management and strategic fundraising efforts to navigate this period of significant investment.

The immuno-oncology field is incredibly crowded, with giants like Merck, Bristol Myers Squibb, and Roche, alongside many other biotech companies, all vying for a piece of the market. Arcus's therapies must demonstrate clear advantages over these established players and emerging competitors.

This intense competition means Arcus faces significant hurdles in gaining market share, even if their treatments prove effective. Potential pricing pressures and the need for substantial marketing efforts to differentiate their offerings are considerable challenges.

Regulatory Hurdles and Market Access Challenges

Navigating the complex and often lengthy process of obtaining regulatory approvals from bodies like the FDA presents a significant hurdle for Arcus Biosciences. Even with promising clinical data, the path to market is not guaranteed, and subsequent market access can be further complicated by reimbursement policies and pricing negotiations with payers.

These challenges are underscored by Arcus's recent strategic decision to halt the Phase 3 study for etrumadenant in third-line metastatic colorectal cancer (mCRC), despite positive earlier results. This move highlights the difficult choices companies face when balancing development timelines, resource allocation, and the inherent uncertainties in regulatory pathways.

- Regulatory Uncertainty: The success of drug development hinges on unpredictable regulatory review processes, impacting timelines and investment.

- Market Access Barriers: Gaining approval is only the first step; securing favorable reimbursement and pricing is critical for commercial viability.

- Strategic Prioritization: Decisions like halting a Phase 3 study reflect the need to manage resources effectively in the face of regulatory and market access complexities.

Dependence on Key Pipeline Assets

Arcus Biosciences' reliance on a few crucial pipeline assets, such as domvanalimab, quemliclustat, and casdatifan, presents a significant vulnerability. The company's market valuation and future growth trajectory are heavily influenced by the clinical and regulatory success of these lead candidates. Any setbacks in these pivotal programs, including trial failures or unexpected side effects, could disproportionately damage investor sentiment and the company's overall financial standing, even with other earlier-stage assets.

This concentration risk means that the failure of a single key drug could have a domino effect on Arcus's development pipeline and financial health. For instance, if domvanalimab, a potential blockbuster in immuno-oncology, were to face significant clinical hurdles in its late-stage trials, it would cast a long shadow over the company's projected revenues and market position. This dependence highlights the critical need for successful outcomes in these specific programs to sustain investor confidence and fund further research and development.

- Pipeline Concentration: Arcus's future hinges significantly on the success of a limited number of key pipeline assets, notably domvanalimab, quemliclustat, and casdatifan.

- Clinical Trial Risk: Any adverse events or failures in the late-stage clinical trials for these lead candidates could severely impact the company's valuation and future prospects.

- Investor Confidence: Setbacks in pivotal programs can erode investor confidence, potentially affecting the company's ability to secure future funding and partnerships.

Arcus Biosciences faces the weakness of substantial operating losses, a common characteristic of early-stage biotechs. For the first quarter of 2025, the company reported a net loss of $112 million, following a $94 million loss in Q4 2024. These losses are driven by significant R&D investments, leading to a high burn rate that requires continuous capital infusion.

The company's pipeline is also concentrated, with heavy reliance on a few key assets like domvanalimab and quemliclustat. Any failure or significant delay in these pivotal programs could disproportionately impact Arcus's valuation and future prospects, making it vulnerable to specific clinical trial outcomes.

Furthermore, Arcus operates in a highly competitive immuno-oncology landscape populated by major pharmaceutical companies. Demonstrating clear advantages over established players and emerging competitors is a significant challenge, potentially leading to pricing pressures and increased marketing costs to gain market share.

Regulatory uncertainty and market access barriers represent another weakness. The complex approval process and subsequent negotiations for reimbursement and pricing can significantly hinder commercial viability, as exemplified by the halt of the etrumadenant Phase 3 study in mCRC.

Full Version Awaits

Arcus Biosciences SWOT Analysis

This preview reflects the real Arcus Biosciences SWOT analysis document you'll receive—professional, structured, and ready to use.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, providing a comprehensive understanding of Arcus Biosciences' strategic position.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail, allowing you to leverage its insights immediately.

Opportunities

Arcus Biosciences has a significant opportunity to broaden the reach of its existing pipeline assets by exploring new cancer indications. This strategy leverages the positive clinical data emerging from ongoing trials, potentially unlocking new patient populations and treatment paradigms.

For example, casdatifan is currently being investigated across multiple settings for renal cell carcinoma. Simultaneously, domvanalimab is undergoing evaluation in various gastrointestinal cancers and non-small cell lung cancer. These expansions are crucial for Arcus to tap into larger markets and diversify its revenue potential, especially as the oncology landscape continues to evolve with new therapeutic approaches.

Arcus Biosciences can significantly benefit from forging new strategic collaborations and licensing agreements, mirroring the success of its existing partnership with Gilead. These alliances can inject crucial funding, share the substantial costs and risks inherent in drug development, and expedite the journey of its therapies to patients worldwide.

The recent exercise of an option by Taiho Pharmaceutical for quemliclustat in the Asian market serves as a prime example of the value these deals unlock. This specific agreement is projected to generate substantial non-dilutive revenue for Arcus, demonstrating a clear path to expanding its global footprint and market penetration without issuing new stock.

Arcus Biosciences' commitment to developing novel, biology-driven combination therapies is a significant opportunity, directly addressing the shift towards more sophisticated treatment strategies in oncology. This focus taps into the growing recognition that combining different therapeutic modalities can unlock synergistic effects, potentially leading to superior patient outcomes.

The company's diverse pipeline, which includes investigational agents like domvanalimab (anti-TIGIT) and etrumab (anti-VISTA) in combination with established checkpoint inhibitors, positions it to capitalize on these evolving treatment paradigms. For instance, in their Phase 2 study for non-small cell lung cancer, the combination of domvanalimab and zimberelimab demonstrated promising objective response rates, with early data suggesting a favorable safety profile that supports further development.

Orphan Drug Designations and Expedited Pathways

Arcus Biosciences can leverage orphan drug designations to its advantage. For instance, the recent designation for quemliclustat for pancreatic cancer by the FDA in 2024 offers a significant boost. This designation typically comes with benefits like a seven-year period of market exclusivity in the U.S. upon approval, tax credits for qualified clinical trials, and waivers of certain FDA user fees, which can substantially reduce development costs.

Furthermore, pursuing expedited regulatory pathways is crucial for therapies addressing significant unmet medical needs. Arcus's focus on oncology, a field with many such needs, positions them well to benefit from programs like the FDA's Fast Track or Breakthrough Therapy designations. These pathways can allow for more frequent communication with the FDA and potentially rolling reviews, accelerating the overall development and approval process, and thus reaching patients sooner.

- Orphan Drug Designation Benefits: Quemliclustat's recent FDA designation for pancreatic cancer in 2024 grants seven years of U.S. market exclusivity, tax credits for clinical trials, and user fee waivers, potentially saving millions in development costs.

- Expedited Pathway Acceleration: Pursuing FDA Fast Track or Breakthrough Therapy designations for Arcus's oncology pipeline can shorten development timelines, allowing for earlier market entry and patient access to novel treatments.

- Market Exclusivity Value: The market exclusivity provided by orphan drug status, particularly in rare or underserved indications like certain pancreatic cancer subtypes, can be a significant commercial advantage, protecting revenue streams from generic competition.

Leveraging Biomarkers for Patient Selection

Arcus Biosciences' strategy to utilize translational biomarkers for patient selection and optimize dosing in clinical trials presents a substantial opportunity. This precision medicine focus aims to boost trial success rates by identifying patients most likely to respond to their therapies, thereby enhancing treatment efficacy for specific patient groups.

By pinpointing responders early, Arcus can potentially streamline clinical development, leading to reduced overall costs and faster market entry for promising treatments. For instance, in oncology, biomarker-driven patient selection has been shown to significantly improve the response rates in targeted therapies. In 2024, the precision medicine market in oncology alone was valued at over $60 billion, highlighting the immense potential of such approaches.

This strategic advantage is further amplified by the ability to tailor treatment regimens, ensuring that resources are concentrated on patient populations that will benefit most. This not only improves clinical outcomes but also strengthens the value proposition for investors and partners.

- Enhanced Trial Success Probability: Biomarker selection directly correlates with higher response rates, as seen in numerous targeted cancer therapies.

- Optimized Resource Allocation: Focusing on likely responders reduces trial failures and associated costs, a critical factor in drug development economics.

- Improved Patient Outcomes: Tailoring treatments to specific genetic or molecular profiles leads to more effective and personalized care.

- Market Differentiation: A robust biomarker strategy positions Arcus as a leader in precision medicine, attracting partnerships and investment.

Arcus Biosciences can expand its market reach by exploring new cancer indications for its existing pipeline assets, capitalizing on positive clinical data to access broader patient populations.

Strategic collaborations and licensing agreements, similar to the Gilead partnership, offer opportunities for crucial funding and risk sharing, accelerating therapy development and global reach.

The company's focus on novel combination therapies, like domvanalimab and etrumab with checkpoint inhibitors, aligns with evolving oncology treatment strategies and has shown promising results in early trials, such as the Phase 2 non-small cell lung cancer study.

Leveraging orphan drug designations, as seen with quemliclustat for pancreatic cancer in 2024, provides significant benefits including market exclusivity and reduced development costs, while expedited regulatory pathways can accelerate market entry.

Utilizing translational biomarkers for patient selection and dose optimization in clinical trials is a key opportunity, enhancing trial success rates and aligning with the growing precision medicine market, which was valued at over $60 billion in oncology alone in 2024.

Threats

The oncology landscape, especially in immunotherapies, is incredibly crowded and changes fast. Big pharma companies and newer biotech firms are all fighting for a piece of the market. This means Arcus faces stiff competition from players with deeper pockets and existing approved drugs.

In 2024, the global oncology market was valued at over $200 billion, with immunotherapies making up a significant and growing portion. Arcus's challenge is to carve out space against these well-established competitors, even if their pipeline candidates show promise.

This intense rivalry can make it harder for Arcus to secure partnerships, gain regulatory approval, and ultimately achieve commercial success for its innovative therapies. The sheer volume of new treatments entering development means market saturation is a real concern.

The path of drug development is fraught with risk, and Arcus Biosciences is no exception. Any of its current or future Phase 3 clinical trials could fail to demonstrate efficacy or reveal concerning safety issues. For instance, a significant setback in a pivotal trial for a key oncology asset could severely impact its market potential.

Such failures can trigger substantial declines in Arcus's stock price, eroding investor trust. This loss of confidence can make it harder to secure future funding, potentially forcing the company to abandon promising drug candidates altogether, thereby casting a shadow over Arcus's long-term prospects.

Regulatory agencies globally impose rigorous standards for drug approval, and Arcus Biosciences, like its peers, faces the risk of significant delays. These can stem from complex data reviews, emerging safety questions, or evolving regulatory mandates, impacting projected launch timelines and escalating development expenses. For instance, the FDA's review process for novel oncology drugs can often extend beyond initial estimates, as seen with other biotechs in 2024, potentially costing millions in extended R&D.

Patent Expiry and Intellectual Property Challenges

The biopharmaceutical sector's reliance on robust intellectual property (IP) protection presents a significant threat to Arcus Biosciences. The expiration of key patents, as seen with many established drugs entering the market, can drastically reduce a company's pricing power and market exclusivity. For Arcus, the potential invalidation of existing patents or the emergence of challenges to their IP portfolio could open the door for generic competitors, directly impacting revenue streams and profitability for their pipeline candidates.

By mid-2025, the landscape for biopharmaceutical patent cliffs is becoming increasingly pronounced. For instance, major blockbuster drugs that saw patent expirations in the early 2020s have experienced revenue drops exceeding 70% in the years following generic entry. Arcus must proactively manage its IP strategy to mitigate the impact of these potential challenges.

- Patent Expiration: Key patents protecting Arcus's lead drug candidates will eventually expire, allowing for generic competition.

- IP Challenges: Competitors may challenge the validity of Arcus's patents, potentially leading to their invalidation.

- Erosion of Market Exclusivity: Loss of patent protection directly translates to a loss of market exclusivity and pricing power.

- Profitability Impact: Generic competition can significantly reduce sales volume and profitability for Arcus's approved or near-approval products.

Macroeconomic and Financial Market Volatility

Broader macroeconomic factors, like persistent inflation and rising interest rates, pose a significant threat to Arcus Biosciences. These conditions can make it harder and more expensive for the company to secure the additional capital needed for its extensive clinical trials. For instance, the Federal Reserve's aggressive rate hikes throughout 2022 and 2023 have increased borrowing costs across the board, impacting companies reliant on external financing.

Investor sentiment is also highly sensitive to economic downturns and market volatility. A general downturn in the stock market, particularly within the volatile biotechnology sector, could lead to a decrease in Arcus's stock price and a less favorable valuation for its clinical-stage assets. This was evident in early 2023, where many biotech stocks experienced significant pullbacks due to economic uncertainty, even those with promising pipelines.

- Inflationary Pressures: Higher inflation can increase operating costs for Arcus, from R&D expenses to general administrative overhead, potentially squeezing margins.

- Interest Rate Hikes: Increased interest rates make debt financing more expensive, impacting Arcus's ability to fund its operations and expansion plans.

- Market Volatility: Fluctuations in broader equity markets and the biotech sector specifically can negatively affect Arcus's market capitalization and access to capital.

- Investor Sentiment: Negative macroeconomic outlooks can dampen investor appetite for riskier, clinical-stage biotech investments, potentially hindering Arcus's fundraising efforts.

The highly competitive oncology market, particularly in immunotherapies, presents a significant hurdle for Arcus Biosciences. With a global oncology market valued at over $200 billion in 2024, Arcus faces intense rivalry from well-capitalized pharmaceutical giants and agile biotech firms, many with established approved drugs.

The inherent risks in drug development mean that any failure in Arcus's pivotal Phase 3 trials could lead to substantial stock price drops and funding difficulties. Furthermore, intellectual property challenges, such as patent expirations or invalidation, threaten market exclusivity and pricing power, a concern amplified by the trend of significant revenue drops post-generic entry for blockbuster drugs.

Macroeconomic conditions, including persistent inflation and rising interest rates, increase the cost of capital for Arcus's extensive clinical trials. Market volatility, especially within the biotech sector, can negatively impact Arcus's valuation and access to necessary funding, as seen with broader biotech pullbacks in early 2023 due to economic uncertainty.

| Threat | Description | Impact | Data Point |

| Intense Competition | Crowded oncology market with established players. | Difficulty gaining market share and partnerships. | Global oncology market >$200 billion (2024). |

| Clinical Trial Failures | Risk of negative efficacy or safety data in late-stage trials. | Stock price decline, loss of investor confidence, funding challenges. | N/A (Specific trial outcomes are prospective). |

| Patent Expiration & IP Challenges | Loss of exclusivity and potential for generic competition. | Reduced pricing power and profitability. | Major drugs can see >70% revenue drop post-generic entry. |

| Macroeconomic Headwinds | Inflation, rising interest rates, market volatility. | Increased cost of capital, reduced valuation, hindered fundraising. | Fed rate hikes increased borrowing costs significantly in 2022-2023. |

SWOT Analysis Data Sources

This analysis is built on a foundation of reliable data, including Arcus Biosciences' official financial filings, comprehensive market research reports, and expert industry commentary to provide a thorough and accurate strategic assessment.