Arcus Biosciences Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arcus Biosciences Bundle

Arcus Biosciences' marketing strategy is a masterclass in navigating the complex biotech landscape. Our analysis delves into their innovative product pipeline, strategic pricing models, targeted distribution channels, and impactful promotional campaigns.

Discover how Arcus Biosciences leverages its cutting-edge biologics and immunotherapy treatments to capture market share and drive patient access. This comprehensive report unpacks their approach to each of the 4Ps.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for Arcus Biosciences. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Arcus Biosciences' innovative cancer immunotherapies represent their core product offering. These therapies, encompassing both small molecule drugs and biologics, are engineered to activate the patient's own immune system against cancer. The company's strategy centers on developing therapies that are either the first of their kind or offer superior efficacy compared to existing treatments, targeting established biological pathways to enhance patient results.

A key aspect of Arcus' product strategy is their emphasis on combination immunotherapies. They believe that by layering different therapeutic approaches, they can achieve more potent and durable anti-cancer responses. This approach is supported by clinical data suggesting synergistic effects when combining immunomodulatory agents, aiming for improved efficacy in challenging cancer types.

As of their latest reports in early 2025, Arcus Biosciences has advanced several promising candidates into clinical trials. For instance, their ARC-7, a combination of anti-TIGIT, anti-PD-1, and anti-CD73 antibodies, has shown encouraging results in non-small cell lung cancer (NSCLC) patients. Furthermore, their small molecule inhibitor, etrumadenant (ARC19499), targeting the adenosine pathway, is being evaluated in various solid tumors, often in combination with their other assets.

Arcus Biosciences showcases a strong clinical pipeline with multiple investigational drugs targeting prevalent cancers like lung, colorectal, pancreatic, and ccRCC. Key assets include casdatifan, domvanalimab, zimberelimab, and quemliclustat, each at different stages of development.

The company is actively advancing these programs, with several Phase 3 trials underway or slated to commence in 2025, underscoring a commitment to bringing new therapies to patients facing significant unmet medical needs.

Arcus Biosciences centers its strategy on creating smart, biology-backed combination therapies. This involves carefully pairing molecules from their own pipeline, like domvanalimab with zimberelimab. They also explore combining their assets with established treatments, such as casdatifan alongside cabozantinib or volrustomig.

This focus on synergistic drug combinations, encapsulated in their 'Combining to Cure' philosophy, is a significant differentiator for Arcus. It's designed to tackle serious medical conditions where current treatments fall short, aiming for better patient outcomes.

Addressing High Unmet Needs

Arcus Biosciences is strategically targeting disease areas with substantial unmet medical needs, aiming to make a significant impact on patient care. This focus includes challenging conditions like advanced or metastatic clear cell renal cell carcinoma, upper gastrointestinal cancers, and pancreatic cancer, where current treatment options are often limited.

The company's product development pipeline is designed to address these gaps by offering therapies that have the potential for improved efficacy and better safety profiles than the current standards of care. This approach is crucial for patients facing aggressive diseases with few alternatives.

For instance, in the realm of renal cell carcinoma, the market for second-line treatments alone was estimated to be over $2 billion in 2024, highlighting the significant demand for novel therapies. Similarly, pancreatic cancer, with a 5-year survival rate often below 10%, represents a critical area where new treatment modalities are urgently needed.

- Focus on High Unmet Need: Arcus targets cancers like advanced renal cell carcinoma, upper GI cancers, and pancreatic cancer, where treatment options are often limited.

- Improved Efficacy and Safety: The company's therapies are developed to offer better outcomes and tolerability compared to existing treatments.

- Large Patient Populations: These disease areas represent significant patient numbers, indicating a broad potential market for successful therapies.

- Market Opportunity: The demand for improved treatments in these oncology segments is substantial, with markets for specific indications valued in the billions of dollars.

Orphan Drug Designations and Potential for Best-in-Class

Arcus Biosciences is actively pursuing Orphan Drug Designation for quemliclustat in pancreatic cancer. This designation is crucial as it acknowledges the unmet need for novel treatments in rare and aggressive diseases, potentially offering market exclusivity and incentives. This strategic move underscores Arcus's commitment to addressing significant patient populations with limited therapeutic options.

The company's HIF-2α inhibitor, casdatifan, is demonstrating promising data that suggests its potential as a best-in-class therapy for clear cell renal cell carcinoma. Further development is planned across various clinical settings, indicating a strong belief in its therapeutic profile. This positions casdatifan as a key asset in Arcus's pipeline, targeting a significant oncology indication.

- Orphan Drug Designation: Quemliclustat for pancreatic cancer

- Potential Best-in-Class: Casdatifan for clear cell renal cell carcinoma

- Market Incentives: Orphan status offers benefits like extended market exclusivity

- Pipeline Focus: Addressing unmet needs in oncology

Arcus Biosciences' product strategy centers on innovative cancer immunotherapies, including small molecule drugs and biologics designed to harness the patient's immune system. Their focus on combination therapies, such as pairing domvanalimab with zimberelimab, aims for enhanced anti-cancer efficacy.

Key pipeline assets like casdatifan and quemliclustat are targeting significant unmet needs in cancers such as renal cell carcinoma and pancreatic cancer, respectively. By early 2025, several candidates were in clinical trials, with Phase 3 trials planned for 2025, indicating a robust development path.

The company is actively seeking market advantages, including Orphan Drug Designation for quemliclustat, which could provide extended market exclusivity. Casdatifan is positioned as a potential best-in-class therapy for clear cell renal cell carcinoma, a market segment with substantial commercial potential.

| Product Candidate | Target Indication | Development Stage (Early 2025) | Key Combination Partner(s) |

| Casdatifan | Clear Cell Renal Cell Carcinoma | Clinical Trials | N/A (potential best-in-class) |

| Domvanalimab | Various Solid Tumors | Clinical Trials | Zimberelimab, Etrumadenant |

| Zimberelimab | Various Solid Tumors | Clinical Trials | Domvanalimab, Etrumadenant |

| Quemliclustat | Pancreatic Cancer | Clinical Trials (seeking Orphan Drug Designation) | N/A |

| Etrumadenant (ARC19499) | Various Solid Tumors | Clinical Trials | Domvanalimab, Zimberelimab |

What is included in the product

This analysis delves into Arcus Biosciences' marketing mix, examining their innovative product pipeline, pricing strategies for novel cancer therapies, distribution channels for specialized treatments, and promotional efforts targeting healthcare professionals and patients.

Provides a clear, concise overview of Arcus Biosciences' 4Ps marketing strategy, simplifying complex data for quick understanding and decision-making.

Acts as a readily accessible tool to articulate Arcus Biosciences' product, price, place, and promotion strategies, effectively addressing the pain point of marketing complexity.

Place

Arcus Biosciences' strategic clinical trial sites represent its 'place' in the market, acting as the physical locations where its investigational therapies are tested. This global network is fundamental for patient recruitment and gathering essential data, driving the advancement of its pipeline. As of early 2024, Arcus is actively conducting trials across numerous sites in the United States, Europe, and Asia, reflecting a broad geographical reach to access diverse patient populations and key opinion leaders.

Arcus Biosciences actively cultivates global partnerships to broaden its market access and development capabilities. Collaborations with industry giants such as Gilead Sciences, Taiho Pharmaceutical, and AstraZeneca are central to this strategy, facilitating extensive clinical trials and potential commercialization across diverse international markets.

These alliances are crucial for Arcus to navigate regulatory landscapes and distribution networks in regions like Japan and other Asian territories, ensuring their innovative therapies can reach a wider patient population. For instance, the collaboration with Gilead for the development of magrolimab has already demonstrated the power of these partnerships in advancing oncology treatments on a global scale.

Arcus Biosciences prioritizes direct engagement with the oncology community, fostering relationships with key opinion leaders (KOLs), physicians, and leading research institutions. This collaboration is crucial for shaping the design of their clinical trials, ensuring they accurately address patient needs and generate valuable data. For instance, their ongoing Phase 3 trials for etrumab and domvanalimab, like ARC-7, actively incorporate feedback from these key stakeholders.

Regulatory Pathways and Market Access Planning

Arcus Biosciences, while still in clinical development for its promising oncology treatments, is proactively engaging with regulatory bodies like the U.S. Food and Drug Administration (FDA). Discussions around registrational paths for key programs, such as their anti-TIGIT antibody domvanalimab, are crucial for future market entry. For instance, in early 2024, Arcus announced positive topline results from its Phase 2 study of domvanalimab in combination with zimberelimab and chemotherapy in first-line metastatic non-small cell lung cancer (NSCLC), a step toward potential regulatory submissions.

The company is also meticulously planning for market access, reimbursement, and specialized distribution networks essential for oncology therapeutics. This involves strategic collaborations with partners like Gilead, who are co-developing several of Arcus’s pipeline candidates. These partnerships are vital for navigating the complex landscape of pricing, payer negotiations, and ensuring that approved therapies reach the patients who need them efficiently.

- Regulatory Engagement: Arcus is actively discussing registrational pathways with the FDA for its lead programs, aiming for timely submissions.

- Market Access Strategy: Planning includes reimbursement strategies and establishing specialized distribution channels for oncology drugs.

- Partnership Leverage: Collaborations, particularly with Gilead, are instrumental in navigating market access and distribution challenges.

- Data-Driven Approach: Clinical trial data, such as the positive Phase 2 results for domvanalimab in NSCLC announced in early 2024, underpins regulatory discussions and market access planning.

Headquarters and Research Facilities

Arcus Biosciences strategically anchors its operations from its corporate headquarters in Hayward, California. This location is not just an administrative center but also the nexus for its crucial research and development activities, driving the company's innovation pipeline.

The Hayward facility is central to Arcus's scientific endeavors, housing the teams responsible for drug discovery, preclinical studies, and the early stages of clinical development. This concentration of talent and resources in Northern California fosters collaboration and accelerates the pace of scientific advancement.

As of early 2024, Arcus Biosciences continued to invest significantly in its R&D infrastructure, with employee numbers reflecting a strong focus on scientific personnel. While specific facility investment figures are proprietary, the company's ongoing clinical trial progress and pipeline expansion underscore the importance of its Hayward-based research capabilities.

- Hayward, California: Primary corporate and R&D hub.

- Innovation Engine: Centralizes drug discovery and development.

- Strategic Location: Facilitates access to biotech talent and partnerships.

- Investment Focus: R&D infrastructure is key to pipeline advancement.

Arcus Biosciences' "Place" is multifaceted, encompassing its global clinical trial network, strategic partnerships for market access, and its core R&D hub in Hayward, California. This integrated approach ensures its investigational therapies are tested in diverse patient populations and positioned for future commercialization.

| Aspect | Description | Key Data/Examples (as of early 2024) |

|---|---|---|

| Clinical Trial Sites | Global network for patient recruitment and data gathering. | Active trials in the United States, Europe, and Asia. |

| Strategic Partnerships | Collaborations to broaden market access and development capabilities. | Gilead Sciences, Taiho Pharmaceutical, AstraZeneca. |

| R&D Hub | Corporate headquarters and center for scientific endeavors. | Hayward, California; focus on drug discovery and early development. |

| Regulatory Engagement | Proactive discussions for market entry. | Discussions with FDA on registrational paths for domvanalimab. |

What You See Is What You Get

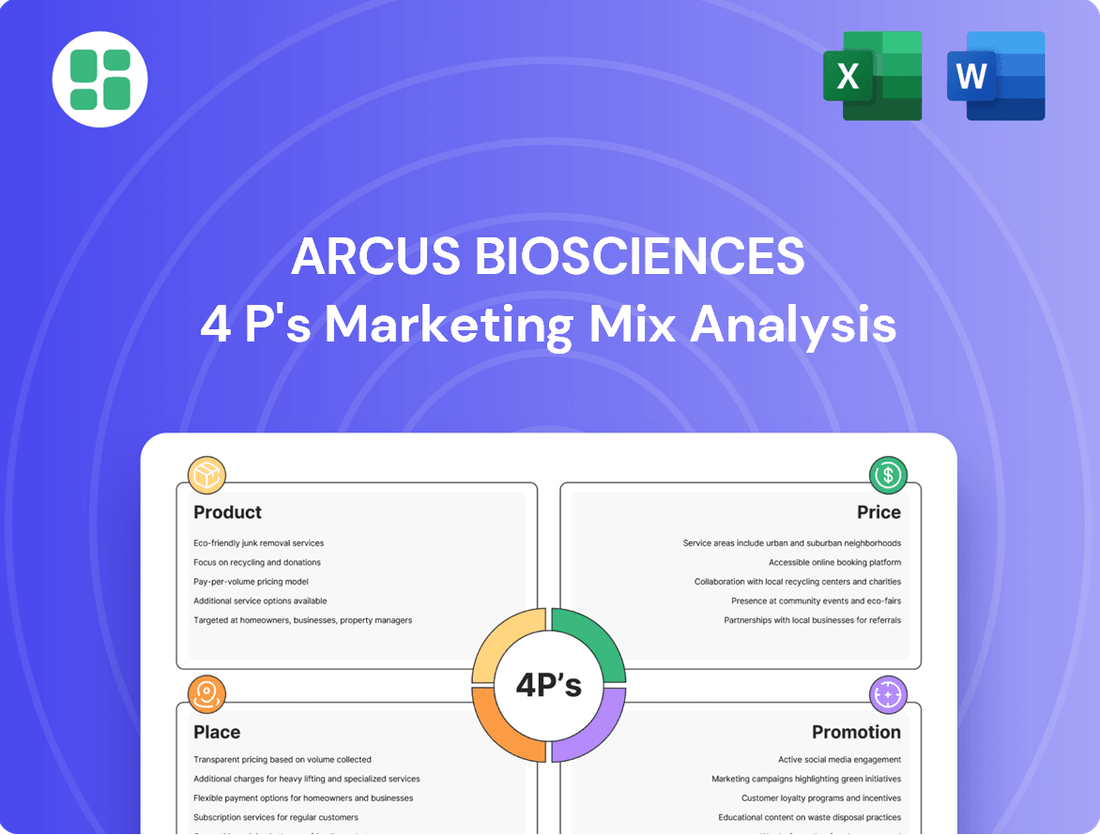

Arcus Biosciences 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises regarding Arcus Biosciences' 4P's Marketing Mix Analysis.

This is the same ready-made Marketing Mix document you'll download immediately after checkout, providing a complete overview of Arcus Biosciences' strategies.

You're viewing the exact version of the analysis you'll receive—fully complete, ready to use, and detailing Arcus Biosciences' product, price, place, and promotion.

Promotion

Arcus Biosciences emphasizes scientific presentations at key oncology conferences like ASCO and SITC, alongside peer-reviewed publications. This approach aims to inform and engage the global oncology community, including physicians, researchers, and influential opinion leaders. For instance, during 2024, Arcus presented compelling data on its investigational therapies, contributing to its scientific narrative.

Arcus Biosciences heavily invests in investor relations and financial communications to engage with a broad financial audience, from individual investors to institutional players and financial media. This proactive approach is crucial for shaping market perception and driving valuation.

The company regularly conducts earnings calls, publishes detailed financial reports, and participates in investor conferences to disseminate key information. These communications highlight pipeline advancements, financial performance, and strategic achievements, directly impacting investor sentiment.

For example, Arcus's Q1 2024 earnings call on May 7, 2024, provided updates on its clinical programs and financial position. The company reported a net loss of $115.5 million for the first quarter of 2024, alongside significant cash reserves, demonstrating its ongoing investment in research and development while maintaining financial stability.

Arcus Biosciences actively promotes its strategic partnerships with major pharmaceutical companies like Gilead, Taiho, and AstraZeneca. These collaborations serve as a significant promotional tool, leveraging the established credibility, financial strength, and extensive global networks of its partners to bolster Arcus's own market standing. For instance, the ongoing collaboration with Gilead on magrolimab, a potential first-in-class anti-CD47 antibody, highlights Arcus's ability to attract and work with industry giants, demonstrating shared expertise and accelerating the development of promising oncology treatments.

Corporate Website and Digital Presence

Arcus Biosciences leverages its corporate website as a primary digital hub, offering detailed insights into its mission, cutting-edge science, and robust pipeline of investigational therapies. This platform is crucial for disseminating official company news and updates to a wide audience, including investors, media, and healthcare professionals.

The company’s digital presence extends to strategic engagement across various platforms, ensuring consistent communication of its scientific advancements and corporate milestones. This online infrastructure is vital for fostering transparency and accessibility, allowing stakeholders to easily access critical company information.

- Website as a central information repository: Arcus Biosciences’ corporate website provides a comprehensive overview of its scientific approach, clinical pipeline, and corporate governance.

- Investor and media relations: The digital presence facilitates direct communication channels for investors and media, offering timely access to press releases, financial reports, and investor presentations.

- Accessibility of pipeline data: Key information regarding Arcus's investigational programs, including targets and development stages, is readily available online for informed decision-making.

Public Relations and Media Engagement

Arcus Biosciences actively manages its public relations and media engagement to highlight crucial advancements. This includes announcing key milestones like orphan drug designations, the commencement of clinical trials, and the release of significant data from their investigational therapies. For example, in late 2023 and early 2024, Arcus has been focused on advancing its portfolio, including its Fc-enhanced antibody platform, with ongoing clinical studies that generate media interest.

These strategic communications efforts are designed to elevate both public and industry awareness regarding Arcus's novel approaches to cancer treatment and their potential to make a meaningful impact. By consistently engaging with media outlets, Arcus ensures its scientific progress and the potential benefits of its therapies are communicated effectively to a broad audience, including investors, healthcare professionals, and patient advocacy groups.

The company's media outreach often centers on:

- Announcements of regulatory milestones: Such as receiving orphan drug designations from the FDA or EMA, which signifies a therapy's potential to treat rare diseases.

- Clinical trial updates: Including the initiation of new trials, enrollment progress, and the presentation of interim or final data readouts, which are critical for assessing therapeutic efficacy.

- Scientific presentations: Highlighting data at major medical conferences, generating buzz and validating their research in front of key opinion leaders and the scientific community.

Arcus Biosciences' promotional strategy is multifaceted, focusing on scientific validation, investor communication, and strategic partnerships. The company actively disseminates data through peer-reviewed publications and presentations at major oncology conferences, reinforcing its scientific credibility within the medical community.

Financial communications, including earnings calls and investor conferences, are central to shaping market perception and attracting investment, as demonstrated by their Q1 2024 earnings call where they reported a net loss of $115.5 million but highlighted substantial cash reserves. Strategic collaborations, particularly with industry leaders like Gilead, serve as powerful endorsements, leveraging partner networks to amplify Arcus's market presence and accelerate drug development.

The corporate website acts as a primary information hub, detailing the company's pipeline and scientific approach, while proactive public relations efforts, including announcements of regulatory milestones and clinical trial updates, maintain visibility and stakeholder engagement.

| Promotional Activity | Key Channels | 2024/2025 Focus |

| Scientific Dissemination | Oncology Conferences (ASCO, SITC), Peer-Reviewed Publications | Presenting data on investigational therapies, reinforcing scientific narrative. |

| Investor Relations | Earnings Calls, Investor Conferences, Financial Reports | Communicating pipeline progress, financial performance, and strategic achievements. |

| Partnership Amplification | Co-promotion, Joint Presentations | Leveraging collaborations with Gilead, Taiho, AstraZeneca to enhance market standing. |

| Digital Presence | Corporate Website, Social Media | Providing comprehensive pipeline data, corporate news, and accessibility. |

| Public Relations | Press Releases, Media Outreach | Announcing regulatory milestones, clinical trial updates, and scientific advancements. |

Price

Future pricing for Arcus Biosciences' specialized oncology therapies, once they reach commercialization, will likely reflect the significant investment in research and development, estimated to be in the billions for novel cancer treatments. Given the complexity of oncology and the potential for these immunotherapies to offer substantial improvements in patient outcomes, including extended survival, prices are expected to be in the high six figures or even seven figures per patient annually, aligning with current benchmarks for advanced cancer care.

Arcus Biosciences' future pricing will likely hinge on the demonstrated value of its therapies, especially if they offer superior efficacy or novel mechanisms compared to current options. This means considering not just clinical results but also how treatments improve patients' lives and impact overall healthcare costs.

For instance, if Arcus's lead oncology candidates, like AB248 in Phase 2 for non-small cell lung cancer, show significant improvements over existing standards of care, pricing could be set at a premium reflecting this enhanced value. The market's willingness to pay will be directly tied to the quantifiable benefits delivered to patients and payers.

The Orphan Drug Designation for quemliclustat in pancreatic cancer is a significant factor in Arcus Biosciences' pricing strategy. This designation could grant Arcus seven years of market exclusivity post-approval, allowing for more flexible pricing and a stronger market position for this targeted therapy. For instance, the U.S. Orphan Drug Act provides incentives like tax credits, which can offset development costs and influence the ultimate price point.

Collaboration Agreements and Revenue Streams

Arcus Biosciences' financial health is substantially bolstered by its strategic collaborations, most notably with Gilead. These partnerships generate significant revenue through licensing fees, development services, and other collaborative efforts. For instance, in the first quarter of 2024, Arcus reported collaboration revenue of $92.5 million, a testament to the financial contributions from these key alliances.

These collaboration agreements are crucial for funding Arcus's extensive research and development pipeline. They also serve to mitigate the direct costs associated with commercializing new therapies, effectively sharing the financial burden and risks. This shared risk model can indirectly influence future pricing strategies by allowing for more competitive development cost absorption.

- Collaboration Revenue: Arcus reported $92.5 million in collaboration revenue in Q1 2024.

- Gilead Partnership: This revenue is primarily driven by the significant partnership with Gilead.

- R&D Funding: Collaboration revenues are vital for financing Arcus's ongoing research and development initiatives.

- Risk Mitigation: These agreements help reduce direct commercialization costs and share development risks.

Market Opportunity and Competitive Landscape

Arcus Biosciences is positioned to tap into significant market opportunities, with projected market values for its targeted cancer indications estimated between $3 billion and $10 billion. This vast potential necessitates a strategic pricing approach that remains competitive.

Future pricing will need careful consideration of the existing therapeutic landscape, including established treatments and emerging therapies from competitors. The economic environment for oncology drugs, particularly in 2024 and 2025, will also play a crucial role in determining optimal price points for Arcus's innovative treatments.

- Substantial Market Potential: Arcus's targeted cancer therapies address markets valued between $3 billion and $10 billion.

- Competitive Pricing Strategy: Pricing must account for existing treatments and new entrants in the oncology market.

- Economic Landscape Influence: The overall economic climate for cancer drugs in 2024-2025 will impact pricing decisions.

- Value Proposition: Arcus's ability to demonstrate superior efficacy and safety will be key to justifying its pricing.

Arcus Biosciences' pricing strategy will be deeply influenced by the substantial R&D investments, potentially reaching billions for novel oncology therapies. Future pricing will likely be in the high six to seven figures annually, mirroring current advanced cancer treatment benchmarks, especially if its immunotherapies demonstrate significant patient outcome improvements.

The Orphan Drug Designation for quemliclustat, granting seven years of market exclusivity in the U.S., provides Arcus with pricing flexibility and a stronger market position for this pancreatic cancer therapy. This exclusivity, coupled with potential tax credits under the Orphan Drug Act, can help offset development costs and inform the final price.

Arcus's collaborations, particularly with Gilead, are crucial financial enablers. In Q1 2024, collaboration revenue reached $92.5 million, directly funding R&D and mitigating commercialization risks, which indirectly supports competitive pricing by allowing for better absorption of development costs.

The company targets markets valued between $3 billion and $10 billion for its oncology candidates, necessitating a competitive pricing approach that considers existing treatments and emerging therapies. The economic environment for oncology drugs in 2024 and 2025 will also be a key factor in setting optimal price points.

| Factor | Impact on Pricing | Supporting Data/Context |

|---|---|---|

| R&D Investment | Higher costs justify premium pricing | Billions estimated for novel cancer treatments |

| Clinical Efficacy | Superior outcomes command higher prices | Potential for extended survival, novel mechanisms |

| Market Exclusivity (Orphan Drug) | Allows for flexible and premium pricing | 7 years for quemliclustat; potential tax credits |

| Collaboration Revenue | Funds R&D, mitigates commercialization costs | $92.5M in Q1 2024 from Gilead partnership |

| Market Size & Competition | Requires competitive positioning | Target markets $3B-$10B; influenced by economic climate (2024-2025) |

4P's Marketing Mix Analysis Data Sources

Our Arcus Biosciences 4P's Marketing Mix Analysis is grounded in comprehensive data from SEC filings, investor relations materials, and clinical trial updates. We also incorporate insights from industry publications and competitive landscape reports to ensure accuracy.