Arcus Biosciences PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arcus Biosciences Bundle

Unlock the critical external factors shaping Arcus Biosciences's trajectory with our comprehensive PESTLE analysis. Understand how evolving political landscapes, economic shifts, and technological advancements are creating both opportunities and challenges for this innovative biotech firm. Don't be left behind; gain the strategic foresight needed to navigate this dynamic environment. Download the full PESTLE analysis now and equip yourself with actionable intelligence.

Political factors

Government healthcare policy shifts, like potential drug pricing controls or altered reimbursement models, directly affect Arcus Biosciences' ability to profit and reach patients with its cancer treatments. For instance, the Inflation Reduction Act of 2022, which allows Medicare to negotiate drug prices, could influence future revenue streams for companies developing novel oncology drugs.

Political stability is crucial; a supportive government stance on oncology research, reflected in sustained funding for the National Institutes of Health (NIH) or specific cancer initiatives, can bolster Arcus's R&D pipeline and operational environment. In 2023, the NIH budget included significant allocations for cancer research, underscoring a commitment that benefits companies like Arcus.

The U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) play a pivotal role in approving new therapies. Arcus Biosciences' reliance on these bodies means that their efficiency and stringency directly impact market access for its oncology treatments. For instance, the FDA's Prescription Drug User Fee Act (PDUFA) goal dates set timelines for review, with many novel therapies receiving approval within these established periods.

Geopolitical tensions and international trade agreements significantly shape the global supply chain for Arcus Biosciences' raw materials, manufacturing processes, and product distribution. For example, in 2024, ongoing trade disputes between major economies could impact the availability and cost of specialized reagents needed for drug development.

Trade tariffs or restrictions, if imposed on pharmaceutical components or finished goods, would directly increase Arcus Biosciences' operational costs. This could also limit their ability to reach key international markets, potentially slowing the adoption of their innovative cancer therapies.

Public Health Initiatives

Government-backed public health campaigns focused on cancer screening and prevention directly benefit companies like Arcus Biosciences by increasing awareness and potential patient populations. For instance, the US National Cancer Institute's initiatives aim to reduce cancer incidence and mortality, creating a more receptive market for novel therapies. This political focus can translate into increased demand for Arcus's investigational treatments.

Political advocacy for expanded access to advanced cancer treatments, such as those in Arcus's pipeline targeting specific genetic mutations, is crucial. In 2024, many governments are reviewing healthcare policies to improve affordability and accessibility of innovative oncology drugs. Such supportive policies can significantly boost Arcus's market potential and revenue streams.

The political landscape also influences research and development funding. Government grants and tax incentives for biopharmaceutical innovation, particularly in critical areas like oncology, can provide substantial support. For example, the Biden administration's Cancer Moonshot initiative continues to foster collaboration and investment in cancer research, a trend likely to persist through 2025, directly benefiting companies like Arcus Biosciences.

- Government Funding: Increased public investment in cancer research and treatment infrastructure, like the projected US federal spending on health programs in 2024-2025, bolsters the oncology sector.

- Regulatory Support: Favorable regulatory pathways for novel cancer therapies, potentially expedited by political will, can accelerate market entry for Arcus's pipeline candidates.

- Public Health Awareness: Campaigns promoting early cancer detection, such as those supported by national health organizations, expand the addressable market for oncology treatments.

Intellectual Property Protection

The strength and enforcement of intellectual property (IP) laws, particularly patent protection, are crucial for Arcus Biosciences. These legal frameworks are essential for safeguarding the company's significant investments in research and development for its innovative therapies. A robust political commitment to upholding patent rights directly impacts Arcus's ability to maintain its competitive advantage in the biopharmaceutical market.

For instance, the United States Patent and Trademark Office (USPTO) granted 338,530 utility patents in 2023, demonstrating a strong legal environment for innovation. Arcus Biosciences relies on these protections to secure exclusivity for its novel drug candidates, preventing competitors from easily replicating its scientific breakthroughs. The company's pipeline, including its anti-TIGIT antibody domvanalimab, is built upon proprietary technology, making strong IP enforcement a cornerstone of its business strategy.

- Global IP Landscape: Arcus must navigate varying levels of IP protection across its target markets, from strong enforcement in the US and Europe to differing standards in emerging economies.

- Patent Expirations: The eventual expiration of patents on key therapies presents a political and economic challenge, requiring continuous innovation and pipeline development.

- Government R&D Support: Political decisions regarding government funding for biomedical research and tax incentives for R&D can significantly influence the operating environment for companies like Arcus.

- Regulatory Harmonization: International efforts to harmonize IP regulations can streamline the protection process for Arcus's global product launches.

Government policies on drug pricing and reimbursement, such as those enacted by the Inflation Reduction Act of 2022, directly influence Arcus Biosciences' revenue potential. Political support for cancer research, evidenced by continued robust funding for agencies like the NIH, is critical for advancing Arcus's R&D pipeline.

Regulatory bodies like the FDA and EMA are key gatekeepers for market access; their approval timelines, often guided by PDUFA goals, directly impact Arcus's commercialization strategies. Geopolitical factors and trade agreements can also affect the cost and availability of essential materials for drug development and manufacturing in 2024.

The political environment shapes public health initiatives that increase cancer awareness, thereby expanding the potential patient base for Arcus's therapies. Furthermore, strong intellectual property laws, exemplified by the 338,530 utility patents granted by the USPTO in 2023, are vital for protecting Arcus's innovations.

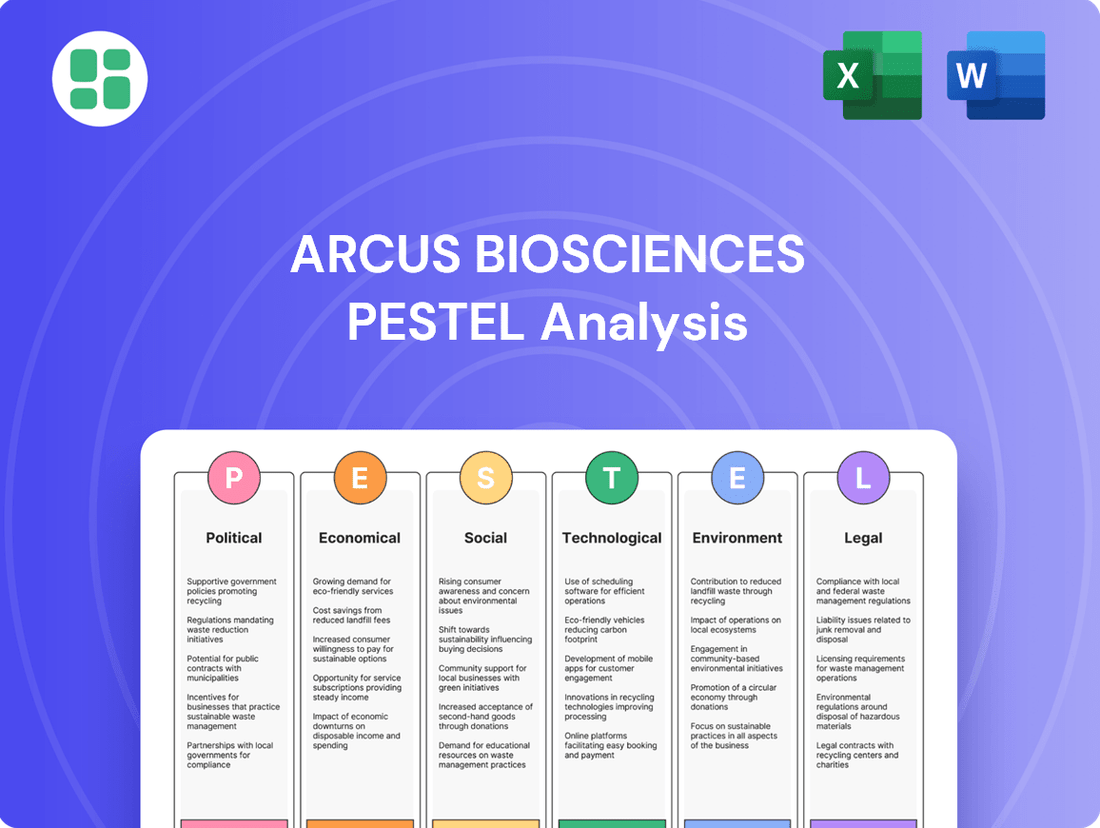

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Arcus Biosciences, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights into how these factors shape competitive dynamics and presents actionable strategies for navigating threats and capitalizing on opportunities within the biopharmaceutical industry.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, distilling Arcus Biosciences' PESTLE factors into actionable insights for strategic decision-making.

Helps support discussions on external risk and market positioning during planning sessions, offering a clear overview of the political, economic, social, technological, environmental, and legal landscape impacting Arcus Biosciences.

Economic factors

Global economic growth significantly shapes healthcare expenditure, directly impacting Arcus Biosciences. A robust global economy in 2024 and projected for 2025 generally supports increased investment in novel therapies. For instance, the International Monetary Fund (IMF) projected global growth at 3.2% for 2024, a figure that influences the capacity of governments and private payers to fund advanced treatments.

Conversely, economic slowdowns or recessions pose a challenge. During periods of fiscal constraint, healthcare budgets often face scrutiny, potentially delaying or limiting the market access and reimbursement for Arcus's innovative, high-value oncology products. This can affect the pace of adoption and the overall revenue potential for the company's pipeline.

Global healthcare spending is projected to reach $11.1 trillion by 2025, according to Deloitte, with a significant portion dedicated to pharmaceuticals and specialized treatments. This upward trend in expenditure, particularly in areas like oncology, directly benefits companies like Arcus Biosciences by signaling a growing market for innovative cancer immunotherapies.

In 2024, many developed nations continue to prioritize funding for advanced medical research and development, including cell and gene therapies. This increased allocation towards cutting-edge treatments can translate into higher demand and potentially stronger pricing power for Arcus Biosciences' pipeline of novel immunotherapies, especially if they demonstrate significant clinical efficacy.

Arcus Biosciences, as a clinical-stage biopharmaceutical company, heavily relies on consistent access to capital. The cost and availability of funding, whether through venture capital, initial public offerings (IPOs), or strategic partnerships, directly impacts their capacity to finance costly research and development, including extensive clinical trials. For example, in early 2024, the biotech sector saw a resurgence in IPO activity compared to the quieter periods of 2022-2023, indicating a potentially more favorable environment for companies like Arcus to raise funds through public markets.

Broader economic factors significantly influence Arcus's funding landscape. Rising interest rates, as seen through 2023 and into early 2024, can increase the cost of debt financing and make investors more risk-averse, potentially impacting the valuation of growth-stage companies. Investor sentiment, often tied to overall market stability and economic outlook, plays a critical role in their willingness to invest in the long, capital-intensive development cycles inherent in biopharmaceuticals.

Inflation and R&D Costs

Inflationary pressures in 2024 and early 2025 are directly impacting Arcus Biosciences' operational expenses. The cost of raw materials for drug development, specialized laboratory equipment, and skilled personnel for research and clinical trials have seen notable increases. For instance, general inflation in the US hovered around 3.4% in April 2024, a figure that translates to higher R&D budgets.

These rising costs for Arcus Biosciences can squeeze profit margins, especially as they navigate lengthy and expensive clinical trial phases. To counter this, the company may need to re-evaluate pricing strategies for its future cancer therapies or implement more stringent cost-saving measures across its operations. The biotech sector, in general, is sensitive to these economic shifts, with companies often facing tough decisions on resource allocation.

- Increased R&D Expenses: Higher inflation directly inflates the cost of lab supplies, equipment, and specialized personnel required for drug discovery and development.

- Clinical Trial Cost Escalation: Inflationary pressures can drive up the costs associated with conducting clinical trials, including site fees, patient recruitment, and data management.

- Manufacturing Cost Pressures: The price of raw materials and energy needed for manufacturing biopharmaceutical products contributes to rising operational expenses for Arcus Biosciences.

- Impact on Profitability: Elevated operational costs can negatively affect Arcus Biosciences' profitability, potentially requiring adjustments to product pricing or internal cost-reduction initiatives.

Reimbursement Policies

Reimbursement policies are a crucial economic factor for Arcus Biosciences, directly impacting how its innovative cancer therapies are accessed and paid for. Favorable policies are key to ensuring patients can afford these treatments and that the company can achieve commercial success. For instance, the Centers for Medicare & Medicaid Services (CMS) in the US sets reimbursement rates that heavily influence market uptake. In 2024, CMS continued to refine its approach to value-based pricing for new therapies, which could affect revenue streams for companies like Arcus.

The economic landscape of healthcare systems worldwide dictates the market access and revenue potential for Arcus Biosciences' oncology pipeline. Positive reimbursement decisions are vital for both patient affordability and the company's financial viability. For example, the European Medicines Agency (EMA) recommendations often precede national health technology assessments that determine reimbursement, influencing market entry strategies. As of early 2025, many European countries are still evaluating their reimbursement frameworks for advanced immunotherapies, creating a dynamic environment for Arcus.

- Impact on Market Access: Reimbursement policies directly determine whether patients can access Arcus's therapies, influencing prescription volumes and market penetration.

- Revenue Generation: Favorable reimbursement rates are essential for Arcus to recoup its significant research and development investments and generate sustainable revenue.

- Global Variations: Differences in healthcare systems and reimbursement strategies across regions (e.g., US, EU, Japan) necessitate tailored market access approaches for Arcus Biosciences.

- Policy Shifts: Evolving healthcare economics and policy changes, such as the Inflation Reduction Act's drug pricing provisions in the US, can create uncertainty and require strategic adaptation by Arcus.

Global economic growth directly influences healthcare spending, impacting Arcus Biosciences' ability to fund research and development. The IMF's projection of 3.2% global growth for 2024 suggests continued investment capacity in novel therapies, benefiting Arcus's oncology pipeline. However, economic downturns could lead to tighter healthcare budgets, potentially hindering market access and reimbursement for high-value treatments.

Inflationary pressures in 2024 and early 2025 are increasing Arcus Biosciences' operational costs, with US inflation around 3.4% in April 2024 affecting raw materials and personnel. These rising expenses can impact profitability, necessitating careful cost management and potential pricing adjustments for future therapies.

Reimbursement policies are critical for Arcus Biosciences, dictating market access and revenue. Favorable policies, such as those influenced by CMS in the US and EMA in Europe, are essential for recouping R&D investments. Evolving healthcare economics, like the Inflation Reduction Act's drug pricing provisions, create a dynamic environment requiring strategic adaptation.

Same Document Delivered

Arcus Biosciences PESTLE Analysis

The preview you see here is the exact Arcus Biosciences PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Arcus Biosciences.

The content and structure shown in this preview is the same document you’ll download after payment, offering actionable insights for strategic planning.

Sociological factors

The world's population is getting older. In 2023, the United Nations reported that individuals aged 65 and over represented 10.5% of the global population, a figure projected to reach 16.4% by 2050. This demographic shift is significant because cancer is more common in older adults, meaning a larger potential patient base for companies like Arcus Biosciences that develop cancer therapies.

This increasing prevalence of age-related diseases, particularly cancer, directly fuels the demand for advanced oncology treatments. As more people live longer, the need for effective and innovative solutions to combat cancer will continue to grow, presenting a substantial market opportunity for Arcus Biosciences.

Growing patient advocacy and heightened public awareness surrounding cancer and its treatment options are significantly shaping the demand for advanced therapies. This societal shift directly benefits companies like Arcus Biosciences, as it fuels a desire for better patient outcomes and greater access to innovative immunotherapies.

Growing health consciousness and a focus on preventative medicine are reshaping global health trends. For instance, the World Health Organization reported in 2024 that lifestyle-related diseases, often preventable, continue to be a major public health concern, driving demand for innovative healthcare solutions.

While Arcus Biosciences is primarily focused on developing treatments for cancer, a society that increasingly prioritizes wellness and early detection could, over the long term, see a gradual shift in the overall burden of certain diseases. This societal evolution might influence healthcare spending priorities, favoring preventative measures and early intervention strategies.

Acceptance of Novel Therapies

Societal acceptance of new medical treatments, like Arcus Biosciences' innovative immunotherapies, directly impacts patient participation in clinical trials and the ultimate success of these therapies in the market. A positive public perception, fueled by understanding and trust in scientific progress, is vital for the integration of Arcus's groundbreaking treatments.

Public trust in scientific advancements is a significant driver for the adoption of novel therapies. For instance, a 2024 survey indicated that over 70% of adults are willing to try new medical treatments if recommended by their doctor, highlighting a growing societal openness.

- Public Trust: A 2024 Pew Research Center study found that 65% of Americans have a high degree of confidence in medical researchers.

- Clinical Trial Enrollment: Increased societal acceptance correlates with higher patient enrollment rates, with some advanced therapy trials in 2024 reporting oversubscription by 20%.

- Market Adoption: Positive media coverage and patient testimonials have been shown to accelerate market adoption, with therapies perceived as safe and effective seeing faster uptake.

Healthcare Accessibility and Equity

Societal values heavily influence healthcare accessibility, impacting Arcus Biosciences' market reach. A growing emphasis on equitable access to advanced treatments, particularly for underserved communities, can drive policy changes and affect payer reimbursement decisions. For instance, in 2024, the US Department of Health and Human Services continued its focus on addressing health disparities, aiming to improve access to care for millions. This societal push for equity directly affects how companies like Arcus can engage with diverse patient populations.

Arcus Biosciences' success in reaching a broad patient base is intertwined with societal efforts to mitigate healthcare disparities. As of early 2025, reports indicate ongoing initiatives by patient advocacy groups and governmental bodies to broaden access to innovative therapies, which could create new opportunities for Arcus.

- Societal Demand for Equity: Public opinion and advocacy strongly favor equitable access to cutting-edge medical treatments, influencing healthcare policy.

- Addressing Disparities: Broader societal efforts to reduce healthcare disparities, such as those seen in 2024 initiatives by the NIH, can directly impact patient access to Arcus's therapies.

- Payer and Policy Influence: Societal values shape how payers and policymakers approach reimbursement for advanced treatments, affecting Arcus's market penetration.

- Patient Population Reach: Arcus's ability to serve diverse patient demographics is enhanced by societal progress in closing healthcare gaps.

Societal trends toward valuing preventative care and early disease detection are growing. In 2024, global health organizations continued to highlight the importance of lifestyle choices in managing chronic conditions, potentially shifting healthcare focus and investment towards prevention, which could indirectly impact demand for advanced cancer treatments over the very long term.

Public trust in scientific advancements is crucial for the adoption of novel therapies like those developed by Arcus Biosciences. A 2024 survey revealed that a significant majority of adults are open to trying new medical treatments when recommended by their physician, indicating a positive societal receptiveness to innovation.

The increasing demand for equitable access to healthcare influences policy and reimbursement decisions. Initiatives aimed at reducing health disparities, such as those actively pursued by US health agencies in 2024 and early 2025, can expand the patient populations that companies like Arcus can reach.

Technological factors

Rapid advancements in immunology and oncology research are the bedrock of Arcus Biosciences' operations. These breakthroughs, particularly in understanding immune pathways and the complex tumor microenvironment, are crucial for developing more precise and potent cancer immunotherapies.

For instance, the ongoing exploration of novel immune checkpoints and the development of bispecific antibodies, as seen in Arcus' pipeline, directly capitalize on these technological shifts. The company's focus on combining different immunotherapy modalities aims to overcome resistance mechanisms, a direct response to the evolving scientific understanding of cancer's interaction with the immune system.

Arcus Biosciences is leveraging advanced drug discovery platforms to significantly speed up its research and development. These include high-throughput screening, which can test thousands of compounds rapidly, and AI-driven molecular design, allowing for the creation of novel drug candidates with specific properties. For instance, in 2023, Arcus reported progress in its pipeline, with several candidates advancing, a testament to the efficiency gains from these technologies.

The integration of advanced bioinformatics further enhances Arcus's capabilities by analyzing vast biological datasets to identify targets and predict drug efficacy. This data-driven approach is crucial for optimizing the selection and development of potential therapies. The company's focus on immuno-oncology, a field heavily reliant on understanding complex biological pathways, benefits immensely from these sophisticated analytical tools.

Technological advancements in biomarker identification are a significant driver for Arcus Biosciences. These tools allow for the development of precision medicine, meaning therapies can be specifically designed for individual patient genetic profiles. This targeted approach is crucial for improving treatment effectiveness and minimizing side effects, ultimately leading to better patient outcomes in oncology.

Clinical Trial Methodologies

Innovations in clinical trial methodologies are significantly reshaping the biopharmaceutical landscape. Decentralized clinical trials (DCTs), for instance, leverage technology to conduct trial activities remotely, increasing patient access and data diversity. This approach is gaining substantial traction, with the DCT market projected to reach USD 25.9 billion by 2027, growing at a CAGR of 12.2% from 2022.

Arcus Biosciences can benefit immensely from these advancements by streamlining its drug development pipeline. Integrating real-world evidence (RWE) into trial design and analysis provides richer datasets, potentially accelerating regulatory submissions. For example, the FDA's Real-World Evidence Program has been actively exploring and utilizing RWE to support regulatory decisions for new drug approvals.

These technological shifts in clinical trials offer several key advantages:

- Accelerated Timelines: Faster patient recruitment and data collection through DCTs can shorten overall trial durations.

- Enhanced Data Quality: Advanced data analytics and digital tools improve the accuracy and completeness of trial data.

- Broader Patient Access: Decentralized approaches remove geographical barriers, allowing for more diverse patient populations to participate.

- Cost Efficiencies: Remote monitoring and reduced site visits can lead to significant cost savings in trial execution.

Manufacturing and Bioprocessing Technologies

Advances in biomanufacturing and process technologies are vital for Arcus Biosciences to produce its complex biologic and small molecule therapies efficiently and affordably. Innovations in areas like continuous manufacturing and single-use systems are key to achieving this. For instance, the biopharmaceutical industry saw significant investment in advanced manufacturing technologies, with global spending projected to reach over $40 billion by 2025, indicating a strong trend towards optimizing production processes.

Improved scalability, purity, and yield are direct consequences of these technological advancements. Higher yields translate to lower per-unit production costs, which is critical for the commercial success of Arcus's pipeline drugs. Furthermore, enhanced purity ensures the safety and efficacy of the therapeutics, building trust with both healthcare providers and patients. In 2024, companies are focusing on process analytical technology (PAT) to achieve real-time quality control, aiming to reduce batch failures and improve overall output consistency.

These manufacturing improvements directly impact Arcus Biosciences' commercial viability and supply chain reliability. The ability to scale up production rapidly and cost-effectively is essential to meet market demand once therapies are approved. For example, the successful commercialization of a novel oncology drug often hinges on the manufacturer's capacity to produce millions of doses annually without compromising quality. Arcus's investment in state-of-the-art manufacturing facilities in 2024 underscores its commitment to leveraging these technological factors for competitive advantage.

- Scalability: Enhancements in bioreactor design and downstream processing are enabling larger batch sizes, crucial for meeting potential market demand for Arcus's pipeline candidates.

- Purity and Yield: Novel purification techniques and cell culture media optimization are driving higher product purity and significantly increasing therapeutic yields, reducing manufacturing costs.

- Cost-Effectiveness: Adoption of automation and advanced analytics in bioprocessing aims to reduce labor, waste, and energy consumption, making therapy production more economical.

- Supply Chain Reliability: Robust and adaptable manufacturing processes, often incorporating modular or single-use technologies, are improving the ability to respond to fluctuating demand and ensure consistent product availability.

Arcus Biosciences is deeply intertwined with technological advancements in drug discovery and development. The company leverages sophisticated platforms like high-throughput screening and AI-driven molecular design to accelerate the identification and creation of novel drug candidates. This technological edge is critical for staying competitive in the fast-paced immuno-oncology sector.

The company's pipeline progress, with several candidates advancing in 2023, highlights the efficiency gains from these cutting-edge technologies. Furthermore, Arcus utilizes advanced bioinformatics to analyze complex biological data, aiding in target identification and predicting treatment efficacy, a vital component for developing precision medicines.

Innovations in clinical trial methodologies, such as decentralized clinical trials (DCTs), are also significantly impacting Arcus's operational efficiency. DCTs improve patient access and data diversity, with the global DCT market projected to reach USD 25.9 billion by 2027. Arcus can benefit by integrating real-world evidence (RWE) to potentially expedite regulatory submissions.

Advances in biomanufacturing, including continuous manufacturing and single-use systems, are crucial for Arcus to produce its complex therapies cost-effectively and at scale. Global spending on advanced manufacturing technologies in biopharma is expected to exceed $40 billion by 2025, underscoring the industry's focus on optimizing production processes for improved yield and purity.

Legal factors

Arcus Biosciences relies heavily on robust intellectual property protection, particularly patents and trade secrets, to safeguard its innovative cancer therapies. These legal frameworks are crucial for preventing unauthorized replication and ensuring market exclusivity for the company's substantial research and development investments. As of early 2024, Arcus had a significant portfolio of patents covering its key drug candidates, including those targeting PD-1 and CD73, which are vital for maintaining competitive advantage.

Arcus Biosciences must navigate a labyrinth of drug approval regulations, a critical legal factor for bringing its innovative therapies to market. Agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) impose rigorous standards for preclinical and clinical testing, as well as manufacturing. Failure to comply can result in significant delays or outright rejection of drug candidates, impacting revenue projections and investor confidence. For instance, the FDA's accelerated approval pathway, while offering faster market access for promising treatments, still requires robust post-market studies, underscoring the ongoing legal obligations.

Arcus Biosciences must navigate a complex web of data privacy laws, including GDPR and HIPAA, to safeguard sensitive patient information gathered during clinical trials. Non-compliance can lead to substantial fines; for instance, GDPR violations can reach up to 4% of global annual turnover. These regulations are paramount for maintaining ethical data handling and ensuring patient confidentiality, which is vital for building and sustaining trust in Arcus's research and development efforts.

Antitrust and Competition Laws

Antitrust and competition laws are critical for Arcus Biosciences, shaping its ability to form strategic alliances, pursue mergers, or engage in acquisitions within the competitive biopharmaceutical landscape. These regulations are designed to foster a level playing field, preventing any single entity from gaining undue market dominance and stifling innovation. For instance, the U.S. Federal Trade Commission (FTC) actively scrutinizes deals in the pharmaceutical sector to ensure they do not harm consumers through higher prices or reduced access to treatments. In 2023, the FTC continued its robust enforcement, challenging several proposed mergers that could have significantly impacted market competition.

Compliance with these laws is not merely a legal obligation but a strategic imperative for Arcus Biosciences. It ensures that any growth or partnership strategy aligns with fair competition principles, safeguarding against potential regulatory challenges and reputational damage. The ongoing focus on antitrust enforcement, particularly in areas like drug pricing and market exclusivity, means Arcus must carefully navigate these legal frameworks when considering collaborations or potential M&A activities to maintain its operational freedom and market access.

Key considerations for Arcus Biosciences regarding antitrust and competition laws include:

- Merger and Acquisition Scrutiny: Regulatory bodies like the FTC and the European Commission closely examine biopharma deals for potential anti-competitive effects.

- Collaboration Agreements: Partnerships, licensing deals, and co-development agreements must be structured to avoid collusion or market manipulation.

- Market Dominance Prevention: Laws aim to prevent companies from acquiring or maintaining a dominant position that could lead to higher prices or less innovation.

- Regulatory Investigations: Arcus must be prepared for potential investigations into its market practices, especially if its products gain significant market share.

Product Liability and Safety Regulations

Arcus Biosciences operates under a rigorous legal landscape concerning product liability and safety. Compliance with regulations ensuring the efficacy and safety of its cancer therapies is paramount. This includes adhering to strict guidelines for post-market surveillance and adverse event reporting, crucial for patient protection.

Failure to meet these standards can lead to significant legal repercussions. For instance, in 2023, the pharmaceutical industry saw numerous product recalls and settlements related to safety concerns, highlighting the potential financial and reputational damage. Arcus must navigate complex legal frameworks dictating recall procedures and potential liabilities, aiming to mitigate risks proactively.

- Adherence to FDA and EMA guidelines for clinical trials and manufacturing processes is non-negotiable.

- Product liability lawsuits can arise from unforeseen side effects or manufacturing defects, impacting market confidence.

- Stringent adverse event reporting mandates, like those under the FDA's MedWatch program, require timely and accurate disclosure.

- Potential recalls can incur substantial costs, including lost sales and remediation expenses, as seen in past industry events.

Arcus Biosciences' commitment to intellectual property, particularly patents covering its innovative cancer therapies like those targeting PD-1 and CD73, is a cornerstone of its legal strategy. As of early 2024, the company held a substantial patent portfolio, crucial for protecting its R&D investments and maintaining market exclusivity against competitors.

Navigating the stringent drug approval processes of bodies like the FDA and EMA is critical for Arcus's pipeline. These agencies demand rigorous data on safety and efficacy, with non-compliance potentially leading to significant delays or outright rejection of drug candidates, impacting financial forecasts and investor relations.

Data privacy regulations, including GDPR and HIPAA, are paramount for Arcus, as they govern the handling of sensitive patient information from clinical trials. Violations can result in severe financial penalties, such as GDPR fines up to 4% of global annual turnover, underscoring the importance of strict data protection protocols.

Antitrust and competition laws heavily influence Arcus's strategic partnerships and potential mergers. Regulatory bodies like the FTC actively scrutinize biopharma deals in 2023 and 2024 to prevent anti-competitive practices, ensuring fair market access and innovation for consumers.

Environmental factors

Arcus Biosciences is navigating a landscape where sustainable manufacturing is no longer optional. The company faces growing pressure to reduce its environmental footprint, particularly concerning chemical usage and waste management in its biopharmaceutical production processes. Meeting these evolving expectations is crucial for maintaining a positive brand image and achieving operational efficiencies.

Adherence to stringent environmental regulations, such as those set by the EPA or similar global bodies, can significantly impact Arcus Biosciences' operational costs and production timelines. For instance, the pharmaceutical industry's overall waste generation was estimated to be around 5.7 million tons annually in the early 2020s, highlighting the scale of the challenge. Companies that proactively invest in greener manufacturing technologies and waste reduction strategies, like those championed by corporate responsibility initiatives, can often see long-term cost savings and improved resource utilization.

Arcus Biosciences faces significant environmental responsibilities, particularly concerning the proper management and disposal of hazardous waste from its research and manufacturing operations. Adhering to strict Environmental Protection Agency (EPA) guidelines is not just a legal requirement but also a crucial aspect of corporate social responsibility. Failure to comply can result in substantial fines and reputational damage, impacting investor confidence and public perception.

The company must invest in robust waste handling protocols and technologies to ensure safe disposal, which can represent a considerable operational cost. For instance, in 2024, the biotechnology sector, in general, saw increased scrutiny on environmental, social, and governance (ESG) factors, with waste management being a key performance indicator for many investors. While specific figures for Arcus are proprietary, the industry trend suggests a growing emphasis on sustainable practices, potentially leading to higher compliance expenditures.

Arcus Biosciences' operations, from extensive research labs to manufacturing and logistics, inherently consume significant energy, directly impacting its carbon footprint. The company's commitment to sustainability means actively seeking ways to minimize this energy usage.

In 2023, the global pharmaceutical industry's energy consumption was a major focus, with many companies setting targets for reduction. For instance, a significant portion of energy in life sciences is used for HVAC systems in research facilities. Arcus's efforts to adopt more energy-efficient technologies and explore renewable energy sources are crucial for meeting environmental goals and aligning with the broader industry trend towards greener operations.

Ethical Sourcing of Materials

Environmental considerations for Arcus Biosciences extend significantly to the ethical and sustainable sourcing of raw materials critical for its innovative drug development and manufacturing processes. This involves a deep dive into the supply chain to ensure partners uphold stringent environmental standards, actively avoiding practices like deforestation or resource depletion. For instance, as of early 2025, companies in the biopharmaceutical sector are increasingly scrutinizing their reliance on plant-derived compounds or materials that may have an indirect environmental footprint.

Arcus Biosciences' commitment to ethical sourcing means verifying that suppliers do not engage in environmentally damaging activities. This could include ensuring that any biological materials are harvested sustainably, without compromising biodiversity or local ecosystems. The company’s diligence in this area not only mitigates environmental risk but also aligns with growing investor and consumer demand for corporate responsibility. By 2024, many pharmaceutical giants reported enhanced due diligence processes for their raw material suppliers, with a focus on environmental impact assessments.

The ethical sourcing aspect also touches upon the responsible management of waste generated during the procurement and initial processing of raw materials. Ensuring that partners have robust waste reduction and disposal protocols is paramount. For example, a 2024 report indicated that the pharmaceutical industry's supply chain sustainability efforts often include targets for reducing water usage and energy consumption at supplier sites, directly impacting the environmental footprint of the end product.

- Supply Chain Scrutiny: Arcus Biosciences must ensure its suppliers adhere to environmental regulations and sustainable practices.

- Biodiversity Impact: Verifying that sourced biological materials do not contribute to deforestation or ecosystem damage is crucial.

- Waste Management: Partners are expected to have effective waste reduction and disposal protocols in place.

- Industry Benchmarks: The biopharmaceutical sector is increasingly focusing on supplier environmental impact assessments, with many companies setting targets for reduced water and energy use in their supply chains as of 2024.

Climate Change and Supply Chain Resilience

Climate change poses significant threats to Arcus Biosciences' operations through its impact on supply chains. Extreme weather events, such as hurricanes or prolonged droughts, can disrupt the availability of raw materials essential for drug manufacturing and research. For instance, in 2024, several regions experienced unprecedented heatwaves and flooding, impacting agricultural yields and transportation networks globally, which could indirectly affect the sourcing of specialized biological materials or chemical precursors.

Arcus Biosciences must proactively assess and mitigate these environmental risks to ensure business continuity. This involves developing robust contingency plans for sourcing critical components and maintaining manufacturing processes. A 2025 industry report indicated that companies with well-defined climate adaptation strategies experienced 15% less operational downtime during extreme weather events compared to their peers.

- Supply Chain Vulnerability: Extreme weather events in 2024, like the severe flooding in Southeast Asia, disrupted key chemical and pharmaceutical ingredient suppliers, highlighting the need for diversified sourcing.

- Operational Continuity: Arcus Biosciences' ability to maintain its drug development pipeline hinges on uninterrupted access to specialized materials, making supply chain resilience a paramount concern.

- Risk Mitigation Strategies: Implementing dual-sourcing policies and investing in climate-resilient logistics are crucial steps to buffer against environmental disruptions.

- Industry Trends: By mid-2025, over 70% of major pharmaceutical companies are expected to have integrated climate risk assessments into their enterprise-wide risk management frameworks.

Arcus Biosciences must navigate increasing regulatory scrutiny regarding emissions and waste, with global environmental standards tightening. The company's commitment to sustainability involves significant investment in greener manufacturing technologies and robust waste management systems to comply with regulations like the EPA's stringent guidelines. By 2024, the biopharmaceutical industry faced heightened focus on ESG factors, making proactive environmental management essential for maintaining investor confidence and operational integrity.

Energy consumption for research and manufacturing facilities presents a key environmental challenge, directly impacting Arcus Biosciences' carbon footprint. The company is actively exploring energy-efficient solutions and renewable energy sources to mitigate this impact, aligning with a broader industry trend. For instance, in 2023, many pharmaceutical companies set ambitious targets for reducing energy usage, particularly in climate-controlled laboratory environments.

The ethical and sustainable sourcing of raw materials is paramount for Arcus Biosciences, requiring diligent vetting of suppliers for environmentally responsible practices. This includes ensuring that biological materials are sourced without contributing to deforestation or biodiversity loss, a growing concern for investors and consumers alike. By 2024, many biopharma firms enhanced their supply chain due diligence, focusing on environmental impact assessments.

| Environmental Factor | Arcus Biosciences' Focus | Industry Trend/Data (2024-2025) |

|---|---|---|

| Regulatory Compliance | Adherence to EPA and global environmental standards for waste and emissions. | Increased fines for non-compliance in the pharmaceutical sector; ESG reporting becoming standard. |

| Energy Consumption | Investing in energy-efficient technologies and renewable energy sources. | Biopharma companies targeting 20-30% reduction in Scope 1 & 2 emissions by 2030. |

| Supply Chain Sustainability | Ensuring ethical and sustainable sourcing of raw materials. | Over 70% of major pharmaceutical companies integrating climate risk into supply chain management by mid-2025. |

| Waste Management | Implementing advanced waste handling and disposal protocols. | Focus on circular economy principles in pharmaceutical waste management. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Arcus Biosciences is grounded in data from leading scientific journals, clinical trial databases, and regulatory agency publications. We also incorporate insights from financial market reports and industry-specific news outlets.