Arcus Biosciences Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arcus Biosciences Bundle

Arcus Biosciences' BCG Matrix offers a powerful lens through which to view its product portfolio's potential. Understand which of their innovative therapies are poised for explosive growth and which require careful management.

This preview highlights the strategic positioning of Arcus Biosciences' key assets. For a comprehensive understanding of their market share and growth prospects, including detailed quadrant analysis and actionable recommendations, invest in the full BCG Matrix report.

Unlock the complete strategic picture of Arcus Biosciences' pipeline. The full BCG Matrix provides the granular detail and expert insights needed to make informed investment decisions and optimize resource allocation for maximum impact.

Stars

Domvanalimab, in combination with zimberelimab and chemotherapy, shows strong potential as a Star in the BCG matrix for Arcus Biosciences. The ARC-10 study demonstrated promising overall survival in PD-L1-high non-small cell lung cancer (NSCLC), a significant indication.

The Phase 3 trial, STAR-121, is on track to complete enrollment by the end of 2024, targeting a substantial market. Domvanalimab's Fc-silent design could provide a distinct advantage in efficacy and safety over competing TIGIT antibodies, further solidifying its Star status.

Domvanalimab, an investigational TIGIT inhibitor, shows significant promise in Arcus Biosciences' portfolio, particularly in combination with zimberelimab and chemotherapy for upper gastrointestinal (GI) adenocarcinomas. The Phase 3 STAR-221 study, a pivotal trial for this indication, has successfully completed patient enrollment, indicating progress towards potential regulatory submission. This advancement positions domvanalimab as a key growth driver for Arcus in a market with substantial unmet medical needs.

Further bolstering the outlook for domvanalimab in GI cancers, overall survival data from the Phase 2 EDGE-Gastric study are anticipated in fall 2025. Positive results from this trial would provide critical evidence of efficacy, supporting the drug's potential to capture significant market share. The strategic importance of this program lies in its ability to address a critical area of cancer treatment where improved therapeutic options are urgently required.

Casdatifan (AB521) is positioned as a promising 'Star' in Arcus Biosciences' portfolio, particularly for its potential in combination therapy for clear cell renal cell carcinoma (ccRCC). The upcoming PEAK-1 Phase 3 study, slated to begin in Q2 2025, will be a critical inflection point.

Early results from the ARC-20 study are highly encouraging, reporting a 46% overall response rate in patients who have previously undergone immunotherapy. This performance suggests casdatifan could be a best-in-class option, driving significant market potential.

Arcus Biosciences' full ownership of casdatifan allows for complete strategic and commercial flexibility. This control is vital for maximizing the value of a successful product, ensuring Arcus can fully capitalize on its efficacy and market positioning.

Quemliclustat (CD73 inhibitor) in Pancreatic Cancer (PRISM-1)

Quemliclustat is positioned as a Star within Arcus Biosciences' portfolio, reflecting its significant growth potential and strong market position in pancreatic cancer. The drug's promising Phase 1 results, including a median overall survival of 15.7 months in first-line metastatic pancreatic cancer, significantly outperform historical benchmarks for this challenging disease. This strong early performance, coupled with the initiation of the Phase 3 PRISM-1 trial in late 2024, underscores its high growth trajectory.

The rapid enrollment in the PRISM-1 trial further validates the market's confidence and the unmet need for effective treatments in pancreatic cancer, a field with historically limited advancements. Quemliclustat's Orphan Drug Designation also provides crucial development incentives, supporting its advancement.

- Promising Phase 1 Data: Median overall survival of 15.7 months in first-line metastatic pancreatic cancer.

- High Growth Potential: Initiation of Phase 3 PRISM-1 trial in late 2024 with rapid enrollment.

- Market Need: Addresses a high-mortality cancer with limited treatment options.

- Development Incentives: Orphan Drug Designation received.

Strategic Partnerships and Funding

Arcus Biosciences' strategic collaboration with Gilead Sciences, though not a product itself, acts as a Star in its BCG Matrix. This partnership is a significant driver of growth and stability for Arcus.

The extensive collaboration, bolstered by substantial equity investments and co-development pacts, provides Arcus with critical financial resources. This funding extends their cash runway well into 2027, allowing for the crucial acceleration of their Phase 3 programs.

Beyond immediate program advancement, the partnership fuels research into novel targets within oncology and inflammatory diseases. This diversification is key to Arcus's long-term strategic positioning and future growth potential.

- Gilead's Investment: Gilead's equity stake in Arcus is a testament to the strategic value and potential of their collaboration.

- Extended Runway: The funding secured through this partnership ensures Arcus has the financial stability to advance its pipeline through 2027.

- Pipeline Acceleration: This 'Star' status enables Arcus to expedite the development of its key Phase 3 oncology assets.

- Diversified Research: The joint research efforts expand Arcus's therapeutic focus, creating new avenues for future growth.

Domvanalimab, particularly in combination with zimberelimab and chemotherapy, is a prime candidate for Star status within Arcus Biosciences' BCG matrix. The ongoing Phase 3 STAR-121 trial, targeting a substantial NSCLC market, is on track for enrollment completion in late 2024. Its Fc-silent design offers a potential competitive edge over other TIGIT inhibitors.

Quemliclustat is also a strong contender for Star status, showing significant promise in pancreatic cancer. The Phase 3 PRISM-1 trial began in late 2024, with rapid enrollment indicating strong market confidence. Its Phase 1 data, demonstrating a median overall survival of 15.7 months in first-line metastatic pancreatic cancer, surpasses historical benchmarks.

Casdatifan (AB521) is positioned as a Star, especially for its potential in ccRCC combination therapy. The upcoming PEAK-1 Phase 3 study, set to commence in Q2 2025, is a crucial milestone. Early ARC-20 study results showing a 46% overall response rate in pre-treated patients highlight its best-in-class potential.

The strategic collaboration with Gilead Sciences serves as a Star, providing substantial financial resources that extend Arcus's cash runway into 2027, enabling the acceleration of Phase 3 programs and fueling diversified research.

| Product | Indication | Key Trial/Data Point | Projected Enrollment/Initiation | Market Potential |

|---|---|---|---|---|

| Domvanalimab | NSCLC, Upper GI Adenocarcinomas | STAR-121 (NSCLC), STAR-221 (GI) | STAR-121 enrollment complete by end of 2024 | Significant unmet need in lung and GI cancers |

| Quemliclustat | Pancreatic Cancer | PRISM-1 (Phase 3) | Initiated late 2024, rapid enrollment | High unmet need, limited treatment options |

| Casdatifan (AB521) | Clear Cell Renal Cell Carcinoma (ccRCC) | PEAK-1 (Phase 3) | Initiated Q2 2025 | Potential best-in-class therapy |

| Gilead Collaboration | Portfolio Advancement | Equity investment, co-development | Extends cash runway to 2027 | Enables pipeline acceleration and diversification |

What is included in the product

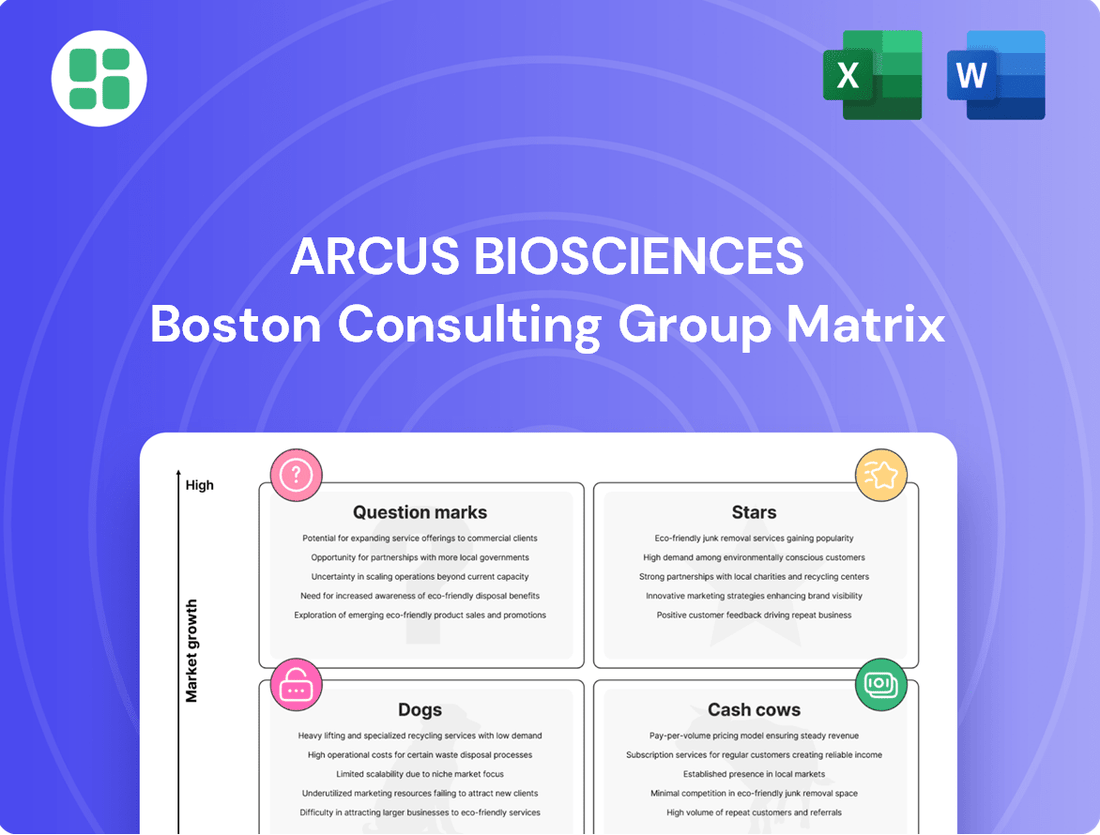

Arcus Biosciences BCG Matrix offers a strategic overview of its pipeline, categorizing assets by market growth and share.

Arcus Biosciences BCG Matrix offers a clear, visual pain point reliever by categorizing its pipeline, aiding strategic decision-making.

Cash Cows

Arcus Biosciences, as a clinical-stage biopharmaceutical company, currently lacks traditional commercialized products. This means it doesn't have the established, high-profit revenue streams that define a 'Cash Cow' in the standard BCG matrix framework. Their financial inflows are largely derived from strategic partnerships and licensing deals, not from the sale of approved therapies.

The collaboration revenue from Gilead Sciences for Arcus Biosciences functions as a cash cow, providing a consistent and predictable financial inflow. This revenue stems from upfront payments, milestone payments, and reimbursements for shared development expenses, offering a stable funding base. In 2023, Arcus reported $125 million in revenue from its Gilead collaboration, highlighting its significance as a key financial contributor.

Arcus Biosciences strategically manages its substantial research and development (R&D) expenses, a necessity for its clinical-stage operations, by actively securing partnership funding. This approach is crucial for advancing its pipeline. For instance, in 2023, Arcus reported R&D expenses of $347 million, underscoring the significant capital required for drug development.

By leveraging these partnerships, Arcus effectively finances its clinical programs, ensuring that capital is channeled into projects with the highest probability of success. This indirect capital preservation is vital as the company currently operates without product revenue, making prudent financial management paramount for sustained pipeline advancement.

Equity Investments and Strong Cash Position

Arcus Biosciences boasts a robust financial foundation, with its cash, cash equivalents, and marketable securities exceeding $1 billion as of early 2024. This substantial cash position offers significant financial stability and provides a projected runway extending into 2027, allowing the company to comfortably fund its ongoing operations and development pipeline.

This strong capital base, bolstered by equity investments and strategic collaborations, is crucial for Arcus. It enables the company to self-fund its critical Phase 3 trials without immediate pressure to generate revenue from product sales, a testament to its well-managed financial strategy.

- Cash Position: Exceeds $1 billion in cash, cash equivalents, and marketable securities.

- Runway: Projected to last into 2027, providing long-term operational capacity.

- Funding Source: Derived from equity investments and strategic agreements.

- Operational Impact: Enables funding of pivotal Phase 3 trials without immediate product sales reliance.

Strategic Reprioritization of Development Programs

Arcus Biosciences and Gilead Sciences have strategically refined their collaborative development pipeline, a key move in their ongoing partnership. This reprioritization concentrates financial and research efforts on assets demonstrating significant clinical promise, particularly those advancing into later stages of development.

A prime example of this strategic focus is the advancement of domvanalimab, which is currently undergoing Phase 3 studies. This disciplined approach to portfolio management is designed to maximize the efficient allocation of capital, directing investments towards programs that exhibit the strongest potential for future commercial success and shareholder value creation.

- Strategic Focus: Arcus and Gilead are prioritizing late-stage assets like domvanalimab in Phase 3 trials.

- Resource Optimization: This reprioritization aims to use financial resources more effectively.

- Potential for Returns: Investments are being channeled into programs with the highest likelihood of future returns.

While Arcus Biosciences doesn't have traditional cash cows due to its clinical-stage status, the collaboration revenue from Gilead Sciences acts as a de facto cash cow. This partnership provides a stable financial inflow, as seen with the $125 million reported in 2023 from this collaboration. This predictable income is crucial for funding the company's extensive R&D efforts.

Arcus Biosciences' financial strategy centers on leveraging these partnerships to fuel its pipeline, rather than relying on product sales. The company's substantial cash reserves, exceeding $1 billion as of early 2024 and projected to last into 2027, further solidify its ability to fund critical Phase 3 trials without immediate revenue pressure.

The strategic focus on late-stage assets, such as domvanalimab in Phase 3, exemplifies how Arcus aims to maximize future returns. This prioritization ensures that capital is directed towards programs with the highest potential for commercial success, effectively managing its financial resources.

| Financial Metric | Value (as of early 2024/2023) | Significance |

| Cash, Cash Equivalents, Marketable Securities | > $1 billion | Provides significant financial stability and runway into 2027. |

| Gilead Collaboration Revenue | $125 million (2023) | Acts as a de facto cash cow, providing predictable funding. |

| R&D Expenses | $347 million (2023) | Highlights the substantial capital required for pipeline advancement. |

Delivered as Shown

Arcus Biosciences BCG Matrix

The Arcus Biosciences BCG Matrix preview you are currently viewing is the precise, final document you will receive upon purchase. This means the comprehensive analysis, strategic insights, and professional formatting are identical to what you'll download, ensuring no surprises and immediate usability for your business planning.

Dogs

Etrumadenant, an adenosine receptor antagonist, showed encouraging data in the ARC-9 study for third-line metastatic colorectal cancer (mCRC). Despite this potential, Arcus Biosciences has classified it as a 'Dog' in its BCG Matrix, opting not to advance to a Phase 3 trial at present due to shifting strategic priorities. This decision signals a deprioritization, indicating that etrumadenant, while demonstrating some efficacy, does not currently fit within the company's primary investment focus or perceived market opportunity.

The decision to discontinue enrollment in the Phase 3 ARC-10 study for Arcus Biosciences marks a 'Dog' in their BCG Matrix. This trial was evaluating domvanalimab plus zimberelimab against pembrolizumab in PD-L1-high NSCLC patients.

This strategic halt, announced in early 2024, was aimed at reallocating resources to more promising development programs like STAR-121 and STAR-221. This suggests the ARC-10 trial design or its targeted patient segment was not deemed the most effective route for domvanalimab's advancement.

Arcus Biosciences' early-stage programs with limited public updates, particularly those in preclinical or very early clinical phases without significant 2024-2025 progress reports, could be viewed as potential 'Dogs' in a BCG matrix analysis. These assets may face deprioritization or discontinuation if more promising candidates emerge. For instance, a program that showed early promise but hasn't advanced in clinical trials by mid-2025 might be re-evaluated.

Programs Lacking Differentiation Against Competitors

Programs that, based on initial clinical findings, don't show a clear advantage over current treatments or those in development for their intended uses might be considered to lack differentiation. These investigational assets, while Arcus aims for groundbreaking or leading therapies, could be placed in a position where their future development is uncertain.

If a program fails to demonstrate significant superiority or a unique mechanism of action compared to the existing standard of care, it may be re-evaluated. For instance, if a new oncology drug shows similar efficacy to an established therapy with no added benefits in early trials, it might be flagged. This careful assessment helps Arcus focus its resources on assets with the highest potential for market success and patient impact.

Consider a hypothetical scenario where Arcus has an investigational therapy for a specific cancer. If Phase 1 data reveals an overall response rate of 30%, but a competitor's approved therapy already achieves 35% with a better safety profile, this Arcus program would likely fall into the category of lacking differentiation. Such outcomes can lead to difficult decisions about program continuation to optimize R&D investment.

- Lack of Superior Efficacy: Early trial data indicates no significant improvement in key efficacy endpoints compared to existing treatments.

- No Unique Mechanism of Action: The investigational drug's biological target or pathway is already addressed by established therapies.

- Unfavorable Safety/Tolerability Profile: The drug exhibits a less desirable safety profile than current standards of care.

- Limited Market Need: The indication is already well-served by multiple effective treatment options, leaving little room for incremental benefit.

Strategic Non-Pursuit of Certain Indications

Arcus Biosciences, in its strategic positioning, likely identifies certain indications as 'strategic non-pursuits' within its BCG Matrix framework. This means that even if a program shows biological promise, if it doesn't align with their core focus on specific cancer types and mechanisms, or targets a smaller market, it might be deprioritized. The company's objective is to concentrate resources on areas with the greatest potential for commercial success and patient impact.

This deliberate focus allows Arcus to maximize its return on investment by channeling efforts towards large patient populations with significant unmet medical needs. For instance, as of early 2024, Arcus has been heavily invested in its immuno-oncology pipeline targeting specific pathways in lung cancer and other solid tumors, aiming for broad applicability and market penetration.

- Strategic Focus: Arcus prioritizes indications with large patient populations and high unmet needs.

- Resource Allocation: Programs outside these core priorities, even if biologically interesting, may not receive further investment.

- Commercial Viability: The goal is to maximize returns by concentrating on commercially attractive markets.

- Example: Early 2024 data shows Arcus’s significant investment in immuno-oncology for lung cancer, a large indication.

Etrumadenant, despite showing promise in mCRC, was classified as a 'Dog' by Arcus Biosciences, leading to the discontinuation of its Phase 3 advancement. Similarly, the ARC-10 trial for domvanalimab in NSCLC was halted in early 2024, also placing it in the 'Dog' category. These decisions reflect a strategic shift to reallocate resources to more promising assets, indicating that these programs, while having some initial data, did not meet the company's criteria for continued high-level investment.

Programs that fail to demonstrate a clear advantage over existing treatments or lack a unique mechanism of action are likely candidates for the 'Dog' classification. This includes investigational therapies showing comparable efficacy to standard care without added benefits or those with less favorable safety profiles. Arcus Biosciences aims to focus on differentiation to maximize R&D investment, as seen in early 2024 data where they prioritized immuno-oncology in lung cancer.

Arcus Biosciences strategically deprioritizes indications outside its core focus on specific cancer types and mechanisms, even if biologically promising. This approach, evident in their early 2024 focus on immuno-oncology for large indications like lung cancer, aims to concentrate resources on areas with the greatest commercial potential and unmet medical needs, thereby maximizing return on investment.

Question Marks

AB801, Arcus Biosciences' small-molecule AXL inhibitor, is currently in the dose-escalation phase of a Phase 1/1b study. Expansion cohorts for Non-Small Cell Lung Cancer (NSCLC) are expected in the latter half of 2025, placing it firmly in the Question Mark category of the BCG Matrix.

As an early-stage asset, AB801's future success is uncertain, demanding substantial investment for clinical development. While NSCLC represents a significant oncology market, the lack of proven efficacy data means it currently has low market share and uncertain growth potential.

Casdatifan, when paired with AstraZeneca's volrustomig, a bispecific antibody targeting PD-1 and CTLA-4, is currently positioned as a Question Mark within the BCG matrix for Arcus Biosciences. This combination is being explored in patients with clear cell renal cell carcinoma (ccRCC) who have not previously received immunotherapy.

The eVOLVE-RCC02 study, a Phase 1b/3 trial, is evaluating this earlier-stage clinical collaboration.

The ultimate success and market potential of this combination are still uncertain, pending further data collection and analysis from ongoing clinical trials.

Arcus Biosciences' expanded collaboration with Gilead, announced in 2024, targets up to four novel oncology and inflammatory disease pathways. These early-stage programs, representing significant R&D investment, are currently in the discovery or preclinical phases. Their potential market impact hinges on successful translation from preclinical studies to human clinical trials, a critical hurdle for any new therapeutic candidate.

Other Preclinical or Discovery Programs

Arcus Biosciences' pipeline extends beyond its core oncology programs to include other preclinical or discovery-stage assets targeting various mechanisms. These early-stage ventures represent a significant portion of the company's research and development efforts, reflecting a commitment to innovation. In 2023, Arcus reported investing approximately $150 million in R&D, a substantial portion of which would have supported these nascent programs.

These preclinical and discovery programs are inherently high-risk, high-reward propositions. They require substantial upfront capital investment for target identification, validation, and early-stage molecule development. The success of these programs is far from guaranteed, with a high attrition rate common in the drug discovery process, meaning many may never reach clinical trials or commercialization.

The potential upside, however, lies in the possibility of breakthrough therapies for unmet medical needs. Success in these areas could lead to significant future revenue streams and market leadership. Arcus's strategy here is to build a diversified portfolio, hedging against the risks associated with any single program and ensuring long-term growth potential.

- Diversified Pipeline: Arcus is actively exploring multiple therapeutic areas beyond its lead oncology candidates.

- High Investment, High Risk: These early-stage programs demand significant capital with no assurance of success.

- Innovation Focus: The company allocates a substantial portion of its R&D budget to these discovery efforts.

- Long-Term Growth Potential: Successful preclinical assets could become future revenue drivers for Arcus.

Future Combination Therapies

Arcus Biosciences is heavily invested in creating innovative combination therapies. This strategy aims to leverage the synergistic potential of their molecules to achieve superior clinical outcomes compared to monotherapies.

Any new combinations or indications being explored for their existing molecules, beyond the currently advanced Phase 3 programs, are considered speculative until clinical data validate their efficacy and safety in those specific settings.

For instance, Arcus's focus on combining its anti-TIGIT antibody, domvanalimab, with its PD-1 inhibitor, zimberelimab, and chemotherapy in Phase 3 trials for non-small cell lung cancer exemplifies this approach.

Future explorations might involve combining these assets with other novel agents or targeting different cancer types, but these remain in early stages of investigation, with Arcus Biosciences reporting $1.1 billion in cash and cash equivalents as of March 31, 2024, providing a strong foundation for continued R&D investment.

Arcus Biosciences' early-stage pipeline, including preclinical and discovery programs, represents significant investment with uncertain outcomes, characteristic of the Question Mark quadrant in the BCG Matrix. These ventures, such as the expanded collaboration with Gilead announced in 2024 targeting novel pathways, require substantial R&D capital, with approximately $150 million invested in R&D in 2023, a portion of which fuels these nascent efforts.

The potential for these programs to become future revenue drivers is high, but the risk of failure is equally significant, with a high attrition rate common in drug discovery. Arcus's strategy of diversifying its portfolio through these high-risk, high-reward propositions aims to secure long-term growth.

The company's cash position as of March 31, 2024, stood at $1.1 billion, providing a strong financial footing to continue these critical investments in innovation.

| Program Area | Stage | Investment Focus | Market Potential | BCG Quadrant |

| Gilead Collaboration (Oncology/Inflammatory) | Discovery/Preclinical | High R&D Investment | Uncertain (Future) | Question Mark |

| Other Preclinical/Discovery Assets | Discovery/Preclinical | Substantial R&D Allocation | Uncertain (Future) | Question Mark |

BCG Matrix Data Sources

Our Arcus Biosciences BCG Matrix is built on robust data, integrating financial disclosures, clinical trial outcomes, and market research reports to provide strategic insights.