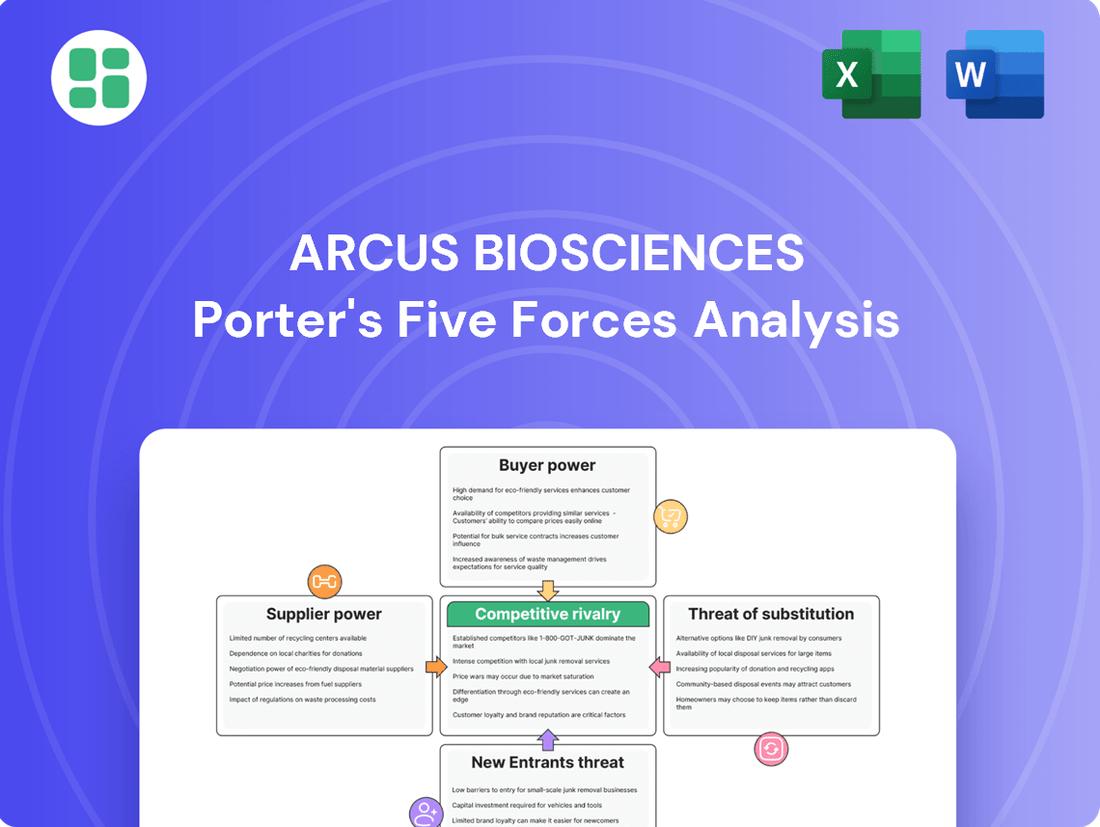

Arcus Biosciences Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arcus Biosciences Bundle

Arcus Biosciences faces intense rivalry, with significant threats from substitutes and new entrants in the competitive oncology landscape. Understanding the bargaining power of buyers and suppliers is crucial for navigating this dynamic market.

The complete report reveals the real forces shaping Arcus Biosciences’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The biopharmaceutical sector, including companies like Arcus Biosciences, depends on highly specialized raw materials, proprietary reagents, and complex biologics. The unique and often scarce nature of these essential inputs grants suppliers considerable bargaining power.

For clinical-stage biotechs, the inability to secure these critical components can lead to significant delays in research and development, directly impacting project timelines and escalating costs. For instance, a disruption in the supply of a specific cell culture medium or a crucial antibody could halt a preclinical study or delay a Phase 1 trial.

Arcus Biosciences' reliance on Contract Research Organizations (CROs) for its global clinical trials, particularly in oncology, highlights the significant bargaining power these suppliers can wield. The specialized expertise and infrastructure required for complex trials mean that a select group of leading CROs can dictate terms, impacting Arcus's development costs and timelines.

The market for high-quality oncology CRO services is concentrated, with a few major players dominating. For instance, in 2024, the global CRO market was valued at approximately $60 billion, with a substantial portion dedicated to oncology. This concentration means Arcus has fewer alternatives for specialized trial management, amplifying the CROs' leverage.

Developing and scaling up the production of novel cancer therapies, like those Arcus Biosciences is working on, demands highly specialized and compliant manufacturing facilities. Since Arcus is still in the clinical stage, it's probable they depend on contract manufacturing organizations (CMOs) or other partners for producing their drug substances and final products.

The scarcity of these specialized facilities, especially for intricate biologics, gives these suppliers considerable leverage. This power translates into their ability to influence pricing and dictate production schedules, impacting Arcus's ability to bring its therapies to market efficiently.

Scientific Talent and Expertise

The biopharmaceutical industry, particularly in advanced areas like immuno-oncology, relies heavily on a specialized workforce. This includes research scientists, clinical development specialists, and regulatory affairs professionals, all of whom are in high demand.

The intense global competition for this niche talent pool significantly enhances the bargaining power of individual experts and specialized recruitment agencies. For companies like Arcus Biosciences, securing and keeping top-tier scientific talent is paramount for driving innovation and advancing their drug development pipeline.

In 2024, the demand for experienced professionals in biotech, especially those with expertise in AI-driven drug discovery and gene editing, remained exceptionally strong. For instance, reports indicated salary increases of 10-15% for senior research scientists in specialized fields compared to 2023, reflecting the competitive landscape.

- High Demand for Specialized Skills: Immuno-oncology and related fields require scientists with advanced degrees and specific research experience.

- Global Competition for Talent: Companies worldwide vie for the same limited pool of highly qualified individuals.

- Impact on Innovation: Arcus's ability to attract and retain leading scientific minds directly influences its capacity for groundbreaking research and pipeline development.

Intellectual Property and Licensing

Intellectual property and licensing play a crucial role in the bargaining power of suppliers for Arcus Biosciences. Key technologies, research tools, or early-stage drug candidates are often licensed from universities, research institutions, or other biotech firms. The proprietary nature of these intellectual properties grants the licensors significant leverage in dictating the terms of their use.

Arcus's capacity to integrate these innovations into its drug development pipeline is directly impacted by the bargaining power of these intellectual property holders. For instance, in 2024, the valuation of early-stage biotech intellectual property continued to be a significant factor in deal-making, with licensing agreements often involving substantial upfront payments, milestone payments, and royalties, reflecting the suppliers' strong negotiating position.

- Proprietary technologies and research tools are often licensed from external entities.

- Licensors leverage the unique nature of their intellectual property to set favorable terms.

- Arcus's pipeline development is contingent on securing access to these critical innovations.

- The 2024 market demonstrated robust demand for early-stage biotech IP, strengthening supplier bargaining power.

Arcus Biosciences faces significant bargaining power from suppliers of specialized raw materials, as these inputs are often unique and scarce, directly impacting R&D timelines and costs. The concentration within the Contract Research Organization (CRO) market, particularly for oncology trials, further amplifies this leverage, with a few major players dictating terms. Similarly, the scarcity of specialized manufacturing facilities for complex biologics and the intense competition for highly skilled scientific talent in immuno-oncology strengthen suppliers' negotiating positions.

| Supplier Type | Key Factor | Impact on Arcus | 2024 Data/Trend |

|---|---|---|---|

| Specialized Raw Materials | Uniqueness & Scarcity | R&D delays, cost escalation | High demand for novel reagents |

| Contract Research Organizations (CROs) | Market Concentration & Expertise | Control over trial costs & timelines | Global CRO market ~$60B, oncology focus |

| Contract Manufacturing Organizations (CMOs) | Facility Scarcity & Compliance | Pricing and production schedule influence | Increasing demand for biologics manufacturing |

| Specialized Talent | High Demand & Competition | Talent acquisition/retention costs | 10-15% salary increases for senior scientists |

| Intellectual Property (IP) Licensors | Proprietary Nature | Licensing terms, upfront/milestone payments | Robust demand for early-stage biotech IP |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Arcus Biosciences' innovative oncology pipeline and its position within the biopharmaceutical industry.

Instantly visualize competitive intensity with a dynamic, interactive Porter's Five Forces model, allowing Arcus Biosciences to pinpoint and address strategic threats with agility.

Customers Bargaining Power

Healthcare payers, including private insurers and government programs like Medicare, wield significant bargaining power as they ultimately control patient access to therapies. The Inflation Reduction Act in the U.S., for example, enacted in 2022, has intensified scrutiny on drug pricing, directly impacting how much companies can charge for their treatments.

This legislative pressure translates into substantial leverage for these large-scale buyers, enabling them to engage in price negotiations and implement formulary restrictions. Their focus on cost-effectiveness means that new treatments must demonstrate clear value to gain widespread adoption.

The availability of numerous therapeutic alternatives significantly impacts the bargaining power of customers in the oncology market. Patients and healthcare providers can choose from traditional treatments like chemotherapy and radiation, alongside a rapidly expanding range of targeted therapies and immunotherapies offered by competitors.

If Arcus Biosciences' treatments don't demonstrate a clear clinical superiority or are priced uncompetitively against existing or new options, customers possess the leverage to switch. This ability to switch therapies directly enhances customer bargaining power.

For instance, in 2024, the oncology market saw continued growth in the immunotherapy segment, with numerous companies launching new agents and expanding indications for existing ones. This competitive landscape means Arcus Biosciences must clearly differentiate its offerings and aim for best-in-class status to mitigate customer power.

High out-of-pocket costs for prescription drugs, especially advanced cancer treatments, can make patients more sensitive to pricing. In 2024, many patients faced substantial co-pays, sometimes thousands of dollars per month, for innovative therapies. This financial strain can amplify patient and advocacy group pressure for more accessible pricing structures.

Physician and Hospital Formularies

Physician and hospital formularies represent a significant lever for the bargaining power of customers in the pharmaceutical industry. These preferred drug lists, maintained by hospitals and integrated healthcare systems, directly influence prescribing habits by prioritizing certain treatments. For Arcus Biosciences, securing a spot on these formularies is paramount for market access.

Hospitals and health networks leverage their purchasing power to negotiate favorable terms, often prioritizing drugs based on a combination of factors. These include:

- Cost-effectiveness: Demonstrating superior value compared to alternatives.

- Clinical outcomes: Evidence of superior efficacy and patient benefit.

- Administrative ease: Simplicity in prescribing and administration.

Arcus Biosciences must navigate these powerful institutional buyers, understanding that gaining preferred formulary status requires demonstrating not just clinical merit but also economic value. The negotiation process with these large healthcare networks can be intense, impacting market penetration and revenue generation.

Clinical Efficacy and Safety Data

The strength of a drug's clinical efficacy and safety profile is a crucial, albeit indirect, factor influencing customer bargaining power. If Arcus Biosciences' investigational therapies, such as their anti-TIGIT antibody domvanalimab, show compelling results in late-stage trials, it bolsters their value proposition. For instance, positive Phase 3 data for domvanalimab in combination with zimaveltimab for non-small cell lung cancer could significantly reduce price sensitivity among payers and providers.

Superior outcomes and manageable side effects directly translate to a stronger market position. Arcus's focus on immuno-oncology, aiming to overcome resistance to existing therapies, means that demonstrating clear patient benefit is paramount. For example, if their combination therapies achieve higher response rates or improved progression-free survival compared to standard of care, this data becomes a powerful negotiating tool.

- Clinical Efficacy: Demonstrated superior outcomes in trials strengthen pricing power.

- Safety Profile: Manageable side effects reduce payer and provider pushback.

- Value Proposition: Enhanced efficacy and safety increase willingness to pay.

- Market Acceptance: Positive Phase 3 results are critical for adoption and negotiation leverage.

The bargaining power of customers in the pharmaceutical sector, particularly for innovative treatments like those developed by Arcus Biosciences, is substantial. Payers, including government programs and private insurers, wield significant influence due to their role in approving and reimbursing therapies, a dynamic amplified by legislation like the Inflation Reduction Act of 2022 which targets drug pricing. This power is further cemented by the availability of numerous alternative treatments, forcing companies to demonstrate clear clinical and economic advantages to secure market access and favorable pricing.

In 2024, the competitive oncology landscape, especially within immunotherapy, continues to intensify with new drug launches and expanded indications. Arcus Biosciences must therefore prove its therapies offer best-in-class efficacy and value to counter the leverage held by large healthcare systems and patient groups sensitive to high out-of-pocket costs, which in 2024 often reached thousands of dollars monthly for advanced treatments.

Physician and hospital formularies act as critical gatekeepers, directly influencing prescribing patterns. Gaining placement on these preferred drug lists requires Arcus Biosciences to present compelling data on cost-effectiveness, superior clinical outcomes, and ease of administration, as these institutions leverage their purchasing power for negotiation. Positive Phase 3 data, such as for Arcus's domvanalimab, is crucial for strengthening its negotiating position against these powerful customer segments.

| Customer Segment | Key Bargaining Levers | Impact on Arcus Biosciences |

|---|---|---|

| Payers (Insurers, Government) | Reimbursement decisions, Formulary placement, Price negotiations (IRA impact) | Limits market access and pricing flexibility; necessitates strong value demonstration. |

| Healthcare Providers (Hospitals, Health Systems) | Formulary inclusion, Purchasing power, Preference for cost-effectiveness and clinical outcomes | Influences prescribing habits; requires competitive pricing and proven efficacy. |

| Patients & Advocacy Groups | Sensitivity to out-of-pocket costs, Pressure for affordability | Amplifies demand for accessible pricing; can influence payer decisions. |

Preview Before You Purchase

Arcus Biosciences Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces Analysis of Arcus Biosciences details the competitive landscape, including the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitute products. This in-depth examination will equip you with critical insights into Arcus Biosciences' strategic positioning and potential challenges within the biopharmaceutical industry.

Rivalry Among Competitors

The oncology landscape is incredibly crowded, with both large pharmaceutical companies and nimble biotech firms actively developing new treatments. This intense competition means Arcus Biosciences is up against a significant number of players all aiming to capture a piece of the growing cancer immunotherapy market. For instance, in 2024, the global oncology drug market was valued at over $200 billion, highlighting the immense opportunity and the fierce battle for dominance.

Players in this space are developing a wide array of therapies, from established immune checkpoint inhibitors to cutting-edge CAR-T cell therapies and novel bispecific antibodies. Arcus Biosciences’ own pipeline of immuno-oncology assets directly confronts those of competitors who may have similar mechanisms of action or target overlapping patient populations. This means Arcus must constantly innovate and demonstrate clear clinical and commercial advantages.

The oncology sector, especially immunotherapy, is a hotbed of rapid scientific progress and ongoing pipeline expansion. Competitors are heavily invested in research, growing their clinical trial portfolios, and pushing for faster drug approvals.

To stay ahead, Arcus Biosciences needs to consistently innovate and prove that its experimental drugs, such as casdatifan and domvanalimab, offer distinct clinical advantages. For instance, in 2023, the global oncology market was valued at over $200 billion, with significant investments flowing into R&D for novel therapies.

The landscape of cancer immunotherapy is marked by extensive strategic collaborations and partnerships. Companies frequently team up to speed up the development of new treatments, broaden their market presence, and distribute the substantial risks and costs involved. Arcus Biosciences, for instance, has formed significant alliances with major players like Gilead and AstraZeneca, underscoring the vital role these partnerships play in the competitive arena.

These alliances can forge powerful joint entities, thereby escalating the intensity of competition. For example, the collaboration between Arcus Biosciences and Gilead, announced in 2020 with an initial deal worth $1.2 billion, aims to co-develop and commercialize Arcus’s pipeline of novel cancer therapies, including its Fc-enhanced antibody platform.

High Stakes and Investment in R&D

Developing innovative cancer therapies is incredibly costly, with late-stage clinical trials alone demanding hundreds of millions of dollars. For instance, the average cost to bring a new cancer drug to market has been estimated to be well over $2 billion. This immense financial pressure forces companies like Arcus Biosciences to pursue aggressive commercialization strategies once their therapies gain regulatory approval, aiming to recoup these substantial investments quickly.

The high stakes involved in recouping these R&D expenditures naturally intensify competition. Companies are driven to secure dominant market positions for their approved cancer treatments, leading to fierce rivalry within specific therapeutic areas. This dynamic means that even a single successful drug can generate billions in revenue, making the race to market and market share paramount.

- Significant R&D Investment: The development of novel cancer treatments, especially those progressing through late-stage clinical trials, requires substantial financial backing, often reaching hundreds of millions of dollars per drug.

- Pressure to Recoup Costs: Upon securing regulatory approval, companies face immense pressure to generate significant revenue to offset their massive R&D expenditures, driving aggressive market strategies.

- Elevated Competitive Intensity: The substantial capital required for drug development and the potential for high returns create a highly competitive landscape where companies vie for leadership in specific cancer indications.

Market Growth and Segmentation

The global cancer immunotherapy market is projected for substantial growth, with estimates suggesting it could reach over $65 billion by 2027, up from around $30 billion in 2022. This expansion is fueled by a rising cancer incidence and a strong patient preference for innovative treatments.

While this market expansion presents lucrative opportunities, it also intensifies competition. As more players enter the space, they often employ aggressive tactics to secure market share in rapidly developing segments.

Companies are increasingly focusing on product differentiation, targeting specific cancer types or patient demographics. This strategic segmentation, however, does not diminish the overall intensity of the rivalry.

- Market Growth: Global cancer immunotherapy market expected to exceed $65 billion by 2027.

- Drivers: Increasing cancer prevalence and demand for advanced therapies.

- Competitive Impact: Growth attracts more competitors, leading to aggressive market strategies.

- Differentiation: Companies focus on specific cancer types and patient populations to stand out.

The competitive rivalry for Arcus Biosciences is exceptionally high due to the crowded oncology market, where numerous large pharmaceutical companies and smaller biotech firms are all vying for dominance in cancer immunotherapies. This intense competition is underscored by the global oncology drug market's valuation, which surpassed $200 billion in 2024, signaling immense opportunity and fierce battles for market share.

Companies are actively developing a broad spectrum of therapies, directly confronting Arcus's pipeline with similar mechanisms of action or targeting the same patient populations. This necessitates continuous innovation and a clear demonstration of clinical and commercial advantages to stand out in a field characterized by rapid scientific advancement and expanding clinical trial portfolios.

The substantial investment required for drug development, with late-stage trials costing hundreds of millions and the total cost to market exceeding $2 billion, intensifies this rivalry. Companies are driven to aggressively commercialize approved therapies to recoup these costs and secure dominant market positions, making the race to market and market share paramount.

| Key Competitor Actions | Impact on Arcus Biosciences | 2024 Market Data Context |

|---|---|---|

| Development of similar immuno-oncology therapies | Direct competition for patient populations and clinical trial enrollment | Global oncology drug market valued over $200 billion |

| Aggressive R&D investment and pipeline expansion | Pressure to accelerate development and demonstrate superior efficacy | Significant R&D spending across the industry |

| Strategic collaborations and partnerships | Formation of powerful joint entities that can outmaneuver smaller players | Alliances are crucial for navigating high development costs |

SSubstitutes Threaten

Despite significant progress in immunotherapy, traditional cancer treatments like chemotherapy, radiation, and surgery are still very much in play. These methods continue to be the go-to options for many patients and are often highly effective. For instance, in 2024, chemotherapy remained a cornerstone in treating a wide array of cancers, with global market revenue projected to reach over $180 billion.

These established treatments act as powerful substitutes, especially when newer immunotherapies aren't a good fit, are hard to get, or are too expensive for specific patients or cancer types. The decision on which treatment to pursue is highly personalized, taking into account the cancer’s specifics, its progression, and the patient’s general health.

The threat of substitutes for Arcus Biosciences' offerings is significant, particularly from other targeted therapies and small molecules. These treatments directly attack cancer cells by interfering with specific molecular pathways or genetic mutations, offering an alternative to immunotherapy for certain patient populations.

For example, the market for targeted cancer therapies is robust. In 2024, the global oncology drugs market, which includes these targeted agents, was projected to reach hundreds of billions of dollars, demonstrating substantial investment and patient adoption. Companies heavily invested in developing novel small molecule inhibitors or antibody-drug conjugates (ADCs) can present direct competition, especially if they achieve superior efficacy or safety profiles in specific cancer types where Arcus also operates.

The oncology landscape is transforming with advanced therapies like CAR T-cell, CRISPR-Cas9 gene editing, and personalized cancer vaccines. These innovations, while often related to immunotherapy, offer unique mechanisms and potent results in certain cancers, making them significant substitutes.

Should these cutting-edge treatments become more widespread and affordable, they could draw patients away from Arcus Biosciences' developing drug candidates. For instance, the global CAR T-cell therapy market was valued at approximately $2.5 billion in 2023 and is projected to grow substantially, indicating a strong competitive force.

Preventative Measures and Lifestyle Changes

Public health campaigns promoting cancer prevention, early detection, and healthier lifestyles, such as improved diet, increased exercise, and smoking cessation, can significantly lower cancer incidence. This reduction in disease prevalence indirectly acts as a substitute for advanced therapies by decreasing the overall demand for treatments.

While not a direct competitive threat, a healthier global population requiring less cancer intervention could, over the long term, impact market size for innovative oncology treatments. For instance, the World Health Organization's 2024 report highlighted a projected 77% increase in cancer cases globally by 2050, underscoring the ongoing need for therapies, but also the potential for prevention to mitigate future demand growth.

- Reduced Cancer Incidence: Lifestyle changes and preventative measures decrease the number of individuals needing cancer treatment.

- Long-Term Market Impact: A healthier population could lead to a slower growth in demand for advanced therapies over decades.

- Public Health Investment: Government and organizational investments in preventative health initiatives represent an indirect substitute for pharmaceutical solutions.

Off-Label Use and Repurposed Drugs

The threat of substitutes for Arcus Biosciences' innovative immunotherapies is relatively low but not entirely absent. While highly specialized treatments like Arcus's antibody-based therapies have few direct substitutes, the landscape can shift with the emergence of alternative treatment modalities or the repurposing of existing drugs.

In certain therapeutic areas, existing drugs approved for other conditions or older cancer therapies might be used off-label or repurposed to treat specific cancers. This can offer a more cost-effective alternative, particularly in markets facing significant pricing pressures or where access to novel, high-cost treatments is limited. For instance, while less common for cutting-edge immunotherapies, the broader oncology market has seen instances of established chemotherapy regimens being adapted for new indications, potentially impacting market share for newer agents if cost-effectiveness becomes a primary driver.

The cost factor is a significant consideration. As of early 2024, the average cost of immunotherapy treatments can range from $100,000 to over $200,000 annually per patient, depending on the specific drug and indication. This high price point makes off-label or repurposed drugs, even if less effective or with different side effect profiles, an attractive substitute for some patient populations and healthcare systems.

However, for Arcus Biosciences, whose pipeline focuses on novel mechanisms of action and combination therapies designed to overcome resistance and improve patient outcomes, the direct threat from repurposed drugs is mitigated by the unique biological targets and sophisticated approaches employed. The efficacy and safety profiles of these specialized immunotherapies are generally distinct from older or off-label treatments.

Traditional treatments like chemotherapy and radiation remain significant substitutes, especially for patients who don't respond to or can't access newer therapies. In 2024, the chemotherapy market alone was projected to exceed $180 billion, highlighting its continued dominance and accessibility.

Targeted therapies and small molecules also present a strong threat, directly attacking cancer cells through specific pathways. The global oncology drugs market, encompassing these agents, was valued in the hundreds of billions in 2024, indicating substantial competition for Arcus Biosciences.

Emerging advanced therapies such as CAR T-cell treatments, while often related to immunotherapy, offer distinct mechanisms and potent results. The CAR T-cell market, valued at approximately $2.5 billion in 2023, is rapidly expanding, posing a growing substitute threat.

| Treatment Type | 2024 Market Projection (USD Billions) | Key Characteristics |

| Chemotherapy | >180 | Established, broad applicability, cost-effective |

| Targeted Therapies/Small Molecules | Hundreds (part of broader oncology market) | Specific molecular targets, personalized approach |

| CAR T-cell Therapy | Projected significant growth from $2.5B (2023) | Genetically engineered immune cells, highly potent for specific blood cancers |

Entrants Threaten

Developing novel cancer therapies, particularly in the complex field of immunotherapies, demands substantial upfront capital. This investment covers extensive preclinical research, multi-phase clinical trials, and navigating rigorous regulatory approvals. The sheer financial commitment, often reaching billions of dollars for a single drug, acts as a significant deterrent for new companies attempting to enter this market.

Arcus Biosciences, for instance, demonstrates this by maintaining a robust cash reserve, evidenced by its reported cash and cash equivalents of approximately $642 million as of March 31, 2024. This financial strength is crucial for funding its broad pipeline of investigational cancer medicines, highlighting the capital-intensive nature of the industry and the barrier it presents to potential new competitors.

The biopharmaceutical industry, including companies like Arcus Biosciences, faces a formidable threat from new entrants due to the lengthy and complex regulatory approval process. Agencies such as the U.S. Food and Drug Administration (FDA) impose stringent requirements, making market entry a significant hurdle.

The drug development and approval pathway is notoriously protracted, often spanning a decade or more and involving multiple, expensive phases of clinical trials. This extensive timeline, coupled with the substantial financial investment and a high probability of failure at various stages, acts as a powerful deterrent for nascent companies seeking to enter the market.

The oncology biopharmaceutical sector presents a formidable barrier to new entrants due to the immense need for specialized expertise and sophisticated infrastructure. Developing novel cancer therapies requires deep scientific knowledge, extensive clinical trial experience, and advanced manufacturing capabilities. For instance, companies like Arcus Biosciences, established in 2015, have invested years and significant capital to build the necessary R&D facilities, clinical trial networks, and recruit a highly skilled workforce, a testament to the substantial upfront investment required.

Strong Intellectual Property and Patent Protection

Arcus Biosciences, like many in the biopharmaceutical sector, leverages robust intellectual property and patent protection as a significant barrier to entry. This strategy shields their innovative cancer therapies from immediate competition, demanding substantial investment and time from potential new entrants to develop non-infringing alternatives or secure necessary licenses. For instance, as of early 2024, the pharmaceutical industry continues to see companies invest heavily in R&D, with patent filings remaining a critical component of their competitive strategy.

Navigating this intricate IP landscape presents a formidable challenge. New companies must dedicate considerable resources to research and development, ensuring their products do not infringe upon existing patents held by established players like Arcus. Failure to do so can result in costly legal battles and significant delays, effectively deterring many aspiring entrants. The average cost of bringing a new drug to market, including the extensive patent protection phase, can run into billions of dollars.

This strong patent protection provides a crucial period of market exclusivity for successful drug developers. For Arcus Biosciences, this exclusivity is vital for recouping their substantial research and development investments and funding future innovation. For example, drugs that achieve market exclusivity can often command premium pricing, contributing to higher profit margins during that protected period.

- Patent Portfolios as Barriers: Arcus Biosciences’ extensive patent filings create significant hurdles for new biopharmaceutical companies seeking to enter the market with similar therapies.

- IP Navigation Costs: New entrants face substantial costs associated with researching existing patents, potentially requiring expensive licensing agreements or developing entirely novel approaches to avoid infringement.

- Market Exclusivity Value: Strong patent protection grants Arcus a period of market exclusivity, essential for recovering R&D expenses and funding further innovation in oncology.

- Industry R&D Investment: The biopharmaceutical industry's continued high investment in research and development, often exceeding tens of billions annually, underscores the importance of IP protection in maintaining competitive advantage.

Established Collaborations and Market Access

Established collaborations, like Arcus Biosciences' significant partnerships with Gilead and AstraZeneca, create formidable barriers for new entrants. These alliances grant Arcus preferential access to key opinion leaders and healthcare providers, streamlining market penetration and product commercialization.

New companies must invest heavily in building similar networks, a time-consuming and resource-intensive process. For instance, Arcus's deal with Gilead, announced in 2020 and valued at up to $1.2 billion, demonstrates the depth of commitment required to establish such crucial market access channels.

- Established relationships with key opinion leaders and healthcare providers are crucial for market access.

- Large pharmaceutical partnerships, such as Arcus's with Gilead and AstraZeneca, provide significant advantages.

- New entrants face the challenge of replicating these extensive networks from the ground up.

- The cost and time required to build these critical relationships deter potential competitors.

The threat of new entrants in the oncology biopharmaceutical space, where Arcus Biosciences operates, is significantly mitigated by the immense capital required for research, development, and regulatory approval. The lengthy drug development cycle, often a decade or more, coupled with a high failure rate and substantial R&D investment, acts as a powerful deterrent. For example, the average cost to bring a new drug to market can easily exceed $2 billion.

Arcus Biosciences' own financial standing, with approximately $642 million in cash and cash equivalents as of March 31, 2024, highlights the capital intensity of this industry. This financial muscle is essential for funding its pipeline and presents a barrier to smaller, less capitalized new entrants who would struggle to match such investment levels.

Furthermore, the industry is protected by strong intellectual property rights and patent portfolios, demanding significant investment and time from potential new entrants to navigate or circumvent. Arcus Biosciences, like its peers, relies on these patents to secure market exclusivity, a critical factor for recouping R&D costs. The biopharmaceutical industry's annual R&D investment, often in the tens of billions, underscores the importance of IP protection.

Established collaborations, such as Arcus's strategic partnerships with Gilead and AstraZeneca, create further barriers by providing preferential access to key opinion leaders and healthcare providers. Building similar extensive networks requires substantial time and resources, deterring new companies from entering the market.

| Barrier Type | Description | Impact on New Entrants | Example (Arcus Biosciences) |

|---|---|---|---|

| Capital Requirements | High upfront investment for R&D, clinical trials, and regulatory processes. | Deters companies with limited funding. | $642M cash reserve as of March 31, 2024, to fund pipeline. |

| Intellectual Property | Extensive patent protection and complex IP landscape. | Requires significant investment in R&D and legal navigation. | Focus on patent filings for novel cancer therapies. |

| Regulatory Hurdles | Lengthy and stringent FDA approval processes. | Extends time-to-market and increases development costs. | Multi-phase clinical trials are standard. |

| Established Networks | Strong relationships with key opinion leaders and healthcare providers. | Difficult and time-consuming for new entrants to replicate. | Partnerships with Gilead and AstraZeneca for market access. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Arcus Biosciences is built upon a foundation of comprehensive data, including SEC filings, investor presentations, and industry-specific market research reports.

We leverage insights from clinical trial data, patent filings, and scientific publications to thoroughly assess the threat of substitutes and the bargaining power of buyers and suppliers.