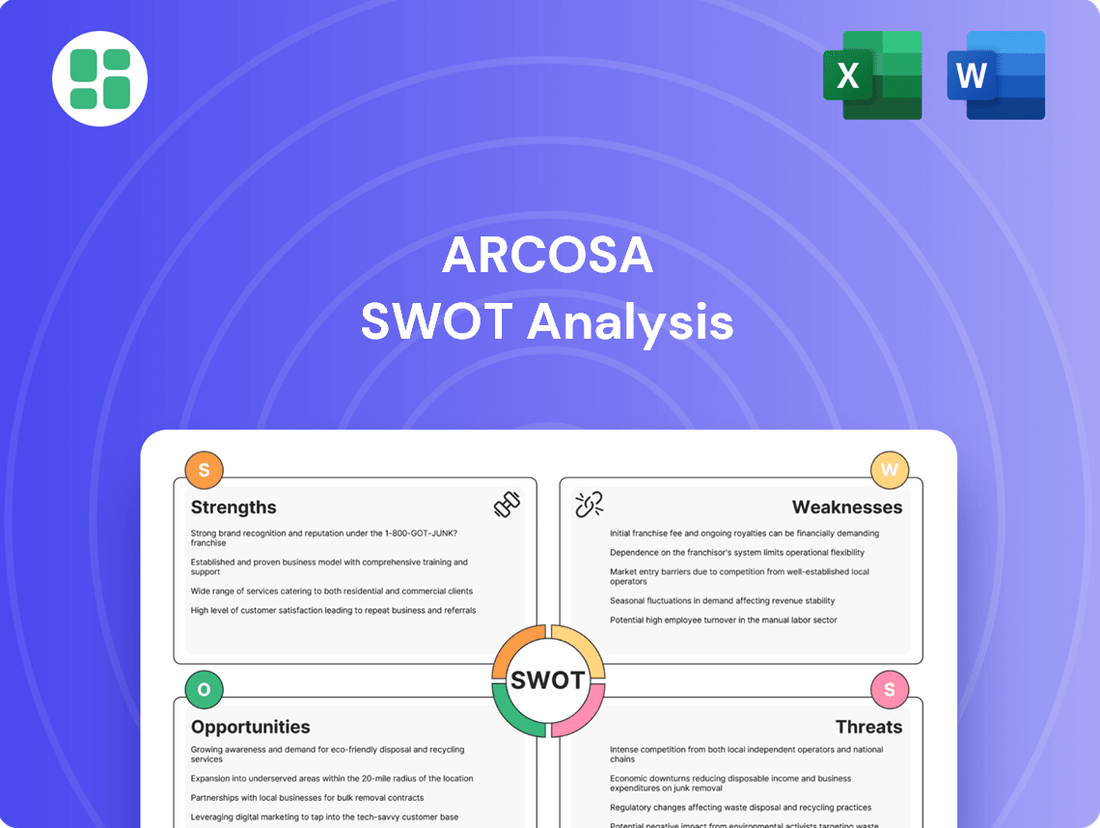

Arcosa SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arcosa Bundle

Arcosa's diverse portfolio, spanning infrastructure, energy, and transportation, presents a robust foundation for growth, yet navigating supply chain complexities and economic shifts remains a key challenge.

Want the full story behind Arcosa's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Arcosa's strength lies in its diversified portfolio, spanning Construction Products, Engineered Structures, and Transportation Products. This strategic spread across essential infrastructure markets, including energy, water, and transportation, shields the company from downturns in any single sector.

For instance, in the first quarter of 2024, Arcosa reported a robust 12% increase in revenue, driven by strong performance across its segments, particularly Engineered Structures which saw a 19% uplift. This broad market exposure allows Arcosa to capitalize on varied infrastructure spending trends throughout North America.

Arcosa's strategic acquisitions are a key strength, notably the Stavola acquisition in October 2024 and Ameron Pole Products earlier in 2024. These moves have demonstrably broadened Arcosa's aggregates presence and solidified its market standing.

These acquisitions have directly translated into increased revenue and Adjusted EBITDA. For instance, the Stavola deal alone was expected to add approximately $200 million in annual revenue, underscoring the immediate impact of these strategic integrations.

The accretive nature of these acquisitions is a significant advantage, boosting overall profit margins. Furthermore, they enhance Arcosa's exposure to the more stable, infrastructure-focused segments of the market, providing a more resilient revenue stream.

Arcosa demonstrated robust financial performance in 2024, achieving record revenues and Adjusted EBITDA. The company's positive outlook for 2025 is underscored by projected growth, with midpoint guidance indicating a 17% revenue increase and a 30% rise in Adjusted EBITDA.

Maintaining healthy liquidity, Arcosa is actively working to reduce its net debt to Adjusted EBITDA leverage ratio, signaling a commitment to financial discipline and shareholder value.

Commitment to Sustainability and Operational Efficiency

Arcosa's dedication to sustainability is a significant strength, highlighted by its achievement of a 27% reduction in emissions intensity by 2024, exceeding its 2026 target from a 2020 baseline. This proactive environmental stance not only bolsters its corporate image but also positions it favorably in an increasingly eco-conscious market.

The company's focus extends to efficient resource management, including a notable reduction in water intensity. This operational efficiency, coupled with a strong emphasis on improving safety metrics, contributes to long-term business resilience and operational excellence.

- Emissions Intensity Reduction: Achieved a 27% decrease by 2024 against a 2020 baseline, surpassing the 2026 goal.

- Resource Management: Demonstrates commitment to efficient natural resource utilization, including water intensity reduction.

- Operational Safety: Prioritizes and improves operational safety, enhancing overall business integrity.

Robust Backlog and Demand Visibility

Arcosa's Engineered Structures segment, especially its utility structures, is experiencing a record backlog, a clear sign of robust demand for its offerings. This strong order book provides significant revenue visibility for the coming periods.

The company's barge business is also demonstrating healthy order momentum. A substantial portion of its 2025 production capacity is already committed, with the backlog extending into 2026, ensuring a predictable revenue stream.

- Record Backlog: The Engineered Structures segment, particularly utility structures, has achieved a record backlog, reflecting sustained customer demand.

- 2025 Capacity Filled: The barge business has secured orders that fill a significant portion of its 2025 production capacity.

- Extended Visibility: The barge backlog now extends into 2026, offering excellent long-term revenue visibility.

Arcosa's diversified business model is a significant strength, providing resilience across various economic cycles. Its strategic focus on infrastructure, a historically stable sector, is further bolstered by consistent revenue growth and strong financial performance, as evidenced by record revenues in 2024 and projected increases for 2025.

The company's proactive approach to sustainability, including significant emissions and water intensity reductions, enhances its brand reputation and market appeal. Furthermore, Arcosa's strategic acquisitions, like Stavola and Ameron Pole Products, have effectively expanded its market reach and revenue base, proving to be accretive to its financial performance.

Arcosa benefits from substantial revenue visibility, particularly within its Engineered Structures segment, which boasts a record backlog for utility structures. The barge business also shows strong momentum, with a significant portion of 2025 capacity already secured and backlog extending into 2026, ensuring a predictable financial future.

| Segment | 2024 Revenue Growth (YoY) | 2025 Revenue Growth Guidance (Midpoint) | Key Strength |

|---|---|---|---|

| Construction Products | N/A | N/A | Aggregates expansion via acquisition |

| Engineered Structures | 19% | N/A | Record backlog for utility structures |

| Transportation Products | N/A | N/A | Strong barge order momentum |

What is included in the product

Delivers a strategic overview of Arcosa’s internal and external business factors, detailing its strengths in diverse end markets and opportunities in infrastructure, while also considering weaknesses in cyclicality and threats from competition and economic downturns.

Uncovers hidden opportunities and mitigates potential threats, offering a clear path to improved operational efficiency and market competitiveness.

Weaknesses

Arcosa experienced a significant downturn in its financial performance during the first quarter of 2025. Net income and diluted earnings per share (EPS) saw a substantial 40% decrease when compared to the same period in 2024. This drop was more pronounced than what analysts had anticipated, signaling a tougher start to the year.

Despite this challenging quarter, Arcosa has maintained its full-year financial guidance. However, the steep decline in Q1 2025 results suggests that the company faced headwinds. Adverse weather conditions, particularly impacting the Construction Products segment, are likely contributors to this performance gap.

While Arcosa has strategically reduced its exposure to highly cyclical areas, such as the recent divestiture of its steel components business, certain segments like Transportation Products, which includes barge manufacturing, and some construction materials remain susceptible to economic downturns and shifts in market demand. For instance, in the first quarter of 2024, Arcosa reported that its Transportation Products segment experienced a slight slowdown in new orders compared to the previous year, reflecting broader economic sensitivities.

Arcosa faced a net use of cash for working capital in the first quarter of 2025, largely driven by a rise in receivables. This contributed to negative free cash flow for the period, underscoring the importance of efficient working capital management for sustained cash generation despite strong overall liquidity.

Impact of Weather on Construction Products

Arcosa's Construction Products segment experienced a notable setback in the first quarter of 2025 due to adverse weather. Unfavorable conditions directly hampered sales volumes and overall financial results for the period. This demonstrates a clear susceptibility to regional weather patterns, which can disrupt operational efficiency and profitability.

Despite these weather-related challenges, the company did see positive movement in its legacy business margins. However, the impact of severe weather events, such as those experienced in Q1 2025, underscores a significant weakness. This vulnerability can lead to unpredictable performance fluctuations.

- Weather Dependency: The Construction Products segment's performance is directly tied to weather, creating volatility.

- Q1 2025 Impact: Unfavorable weather in Q1 2025 led to reduced volumes and negative financial outcomes.

- Regional Sensitivity: The business is exposed to risks associated with specific regional climatic factors.

Integration Risks of Recent Acquisitions

While Arcosa has a track record of successful acquisitions, such as the integration of Stavola, combining larger businesses inherently introduces integration risks. These can manifest as challenges in aligning operational processes, ensuring a smooth cultural fit between existing and acquired teams, and fully realizing the anticipated financial synergies. For instance, in 2023, Arcosa completed the acquisition of Sun-Mex, a significant move that, while strategically sound, necessitates careful management to achieve its full potential.

The successful assimilation of new entities is paramount to unlocking the value Arcosa expects from its growth strategy. Failure to effectively integrate operations or cultures can lead to inefficiencies and hinder the achievement of projected earnings accretion. Arcosa's 2023 annual report highlighted the ongoing efforts to integrate recent acquisitions, emphasizing the importance of operational synergy realization to support future financial performance.

- Operational Alignment: Challenges in merging disparate IT systems, supply chains, and manufacturing processes from acquired companies.

- Cultural Fit: Difficulties in harmonizing different corporate cultures, management styles, and employee expectations, potentially impacting morale and productivity.

- Synergy Realization: The risk that projected cost savings or revenue enhancements from acquisitions may not be fully achieved due to integration complexities or unforeseen market conditions.

Arcosa's reliance on favorable weather conditions, particularly within its Construction Products segment, presents a significant vulnerability. The first quarter of 2025 saw a substantial impact from adverse weather, leading to reduced sales volumes and a 40% decrease in net income compared to the prior year. This sensitivity to regional weather patterns introduces volatility into its financial performance.

Furthermore, Arcosa faces integration risks associated with its acquisition strategy. While the company has a history of successful deals, the assimilation of larger entities like Sun-Mex (acquired in 2023) can lead to challenges in aligning operations, cultures, and realizing projected synergies, potentially hindering earnings growth.

The company's financial results are also susceptible to broader economic cycles, especially in segments like Transportation Products. A slight slowdown in new orders for barges in Q1 2024, for example, highlights this exposure to shifts in market demand and economic downturns.

Arcosa experienced negative free cash flow in Q1 2025 due to a net use of cash for working capital, primarily driven by increased receivables. This underscores the ongoing need for diligent working capital management to ensure consistent cash generation.

| Segment | Q1 2025 vs Q1 2024 Performance Indicator | Key Weakness Factor |

|---|---|---|

| Construction Products | Significant volume reduction due to adverse weather | Weather Dependency; Regional Sensitivity |

| Transportation Products | Slight slowdown in new orders (as observed in Q1 2024) | Economic Cycle Sensitivity; Market Demand Shifts |

| Acquisitions (General) | Potential for unrealized synergies; integration challenges | Integration Risk; Operational & Cultural Alignment |

Same Document Delivered

Arcosa SWOT Analysis

This is the actual Arcosa SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can see the depth and structure of the analysis in this preview. Purchase unlocks the complete, detailed report.

Opportunities

The Bipartisan Infrastructure Investment and Jobs Act (IIJA), enacted in late 2021, is a substantial driver for Arcosa. This legislation allocates over $550 billion in new federal spending over five years, targeting critical infrastructure improvements across the United States. This influx of capital directly benefits Arcosa's core business areas, particularly Construction Products and Engineered Structures, by creating sustained demand for its offerings through 2025 and into the foreseeable future.

Arcosa's Construction Products segment, which includes aggregates, concrete, and related materials, is set to see increased demand from road and bridge construction projects funded by the IIJA. Similarly, the Engineered Structures segment, specializing in bridges, transportation components, and other heavy civil infrastructure, is well-positioned to capitalize on the significant investments planned for public transit and utility upgrades. This robust government support provides a strong and predictable revenue stream for these divisions.

The anticipated surge in the U.S. power market, fueled by greater electrification and essential grid upgrades, presents a significant avenue for growth for Arcosa's Engineered Structures segment. This expansion is particularly beneficial for its utility structures and wind towers, areas where the company is strategically increasing its production capacity.

Arcosa's investment in expanding its manufacturing footprint for wind towers is well-timed, aligning with projections of substantial growth in renewable energy infrastructure. For instance, the U.S. Department of Energy's offshore wind goals alone signal a robust demand pipeline for the coming years, directly benefiting Arcosa's capabilities in this sector.

Arcosa's strategic move into aggregates-led construction materials, exemplified by the Stavola acquisition, positions the company for increased stability. This expansion diversifies its revenue streams, reducing reliance on more cyclical segments of the construction market.

The Stavola acquisition, completed in 2023, brought significant aggregates operations, bolstering Arcosa's presence in essential infrastructure projects. This focus on lower-volatility, infrastructure-driven end markets is a key element of Arcosa's long-term growth strategy.

By continuing to optimize its portfolio towards these less volatile segments, Arcosa aims to achieve more predictable and sustainable earnings growth. This approach is crucial for navigating economic fluctuations and delivering consistent shareholder value.

Technological Advancements and Digital Transformation

Arcosa can capitalize on the construction industry's rapid technological adoption. Innovations like Building Information Modeling (BIM), drone surveying, and AI-driven analytics are streamlining project management and boosting efficiency. For instance, the global construction technology market was projected to reach $11.5 billion in 2024, highlighting significant investment in these areas.

By integrating these digital tools, Arcosa can enhance its operational workflows, from design and planning to execution and maintenance. This not only improves project outcomes but also creates opportunities for differentiated product and service offerings. The company's ability to leverage these advancements will be crucial for maintaining a competitive advantage in an evolving market.

- BIM Adoption: Arcosa can use BIM for enhanced project visualization, clash detection, and lifecycle management, leading to fewer errors and cost savings.

- Drones in Construction: Utilizing drones for site surveys, progress monitoring, and safety inspections can provide real-time data and improve site management efficiency.

- AI and Automation: Implementing AI for predictive maintenance, resource allocation, and risk assessment can optimize operations and reduce downtime.

- Digital Transformation: Arcosa's commitment to digital transformation can lead to more integrated supply chains and improved customer engagement through digital platforms.

Sustainability Initiatives and Green Building Practices

The increasing global demand for sustainable construction methods presents a significant opportunity for Arcosa. As governments and private entities prioritize environmentally friendly infrastructure, Arcosa can leverage its expertise in recycled materials and energy-efficient solutions to capture a larger market share. This trend is expected to accelerate, with the global green building market projected to reach $371.3 billion by 2027, growing at a compound annual growth rate of 9.7% from 2020.

Arcosa's existing product portfolio, which includes recycled aggregates and products designed for energy efficiency, is well-positioned to capitalize on this shift. The company can further innovate by developing new green building materials and climate-resilient designs, thereby expanding its product lines and enhancing its competitive advantage. For instance, the demand for low-carbon concrete alternatives is rising, offering a prime area for Arcosa's research and development.

- Expanding into new markets driven by green building mandates and incentives.

- Developing innovative green products that meet evolving customer and regulatory demands.

- Strengthening brand reputation as a leader in sustainable construction solutions.

- Securing long-term contracts with projects prioritizing environmental performance.

Arcosa is well-positioned to benefit from the Bipartisan Infrastructure Investment and Jobs Act (IIJA), which provides over $550 billion for infrastructure projects through 2026. This legislation directly fuels demand for Arcosa's construction products and engineered structures, particularly in road, bridge, and utility upgrades. The company's strategic expansion into aggregates, like the 2023 Stavola acquisition, diversifies its revenue and targets less volatile, infrastructure-driven markets, enhancing earnings predictability. Furthermore, Arcosa can leverage advancements in construction technology, such as BIM and AI, to boost efficiency and project outcomes, with the global construction technology market projected to reach $11.5 billion in 2024.

| Opportunity Area | Key Driver | Arcosa Segment Impact | 2024/2025 Relevance |

|---|---|---|---|

| Infrastructure Spending (IIJA) | $550B+ allocated over 5 years | Construction Products, Engineered Structures | Sustained demand for roads, bridges, utilities |

| Power Market Growth | Electrification, grid modernization | Engineered Structures (utility structures, wind towers) | Increased demand for grid components and renewable energy infrastructure |

| Construction Technology Adoption | BIM, AI, Drones | All segments (operational efficiency) | Projected $11.5B global market in 2024, driving efficiency |

| Green Building Demand | Sustainability focus | Construction Products (recycled materials) | Global green building market projected to reach $371.3B by 2027 |

Threats

Arcosa, like much of the construction sector, is navigating persistent inflationary headwinds. The cost of essential materials such as steel, lumber, and concrete saw significant increases throughout 2024, with some commodities experiencing double-digit percentage jumps compared to the previous year. This volatility directly impacts operational expenses.

These rising material costs can squeeze Arcosa's profit margins, especially on projects with fixed-price contracts. Furthermore, the unpredictability of these expenses makes accurate project budgeting and feasibility assessments more challenging, potentially delaying or even deterring new business opportunities.

Arcosa faces the persistent challenge of labor shortages and skill gaps within the construction industry, a trend that intensified in 2024 and is projected to continue into 2025. This scarcity directly impacts operational efficiency, potentially driving up labor costs as companies compete for a limited pool of qualified workers. For instance, the U.S. Bureau of Labor Statistics reported a significant shortage of skilled tradespeople across various sectors, a situation that directly affects Arcosa's project execution capabilities.

These labor constraints can lead to extended project timelines, as Arcosa may struggle to staff projects adequately or find workers with the specialized skills required for complex infrastructure builds. This strain on existing workforces could also impact Arcosa's ability to meet growing demand for its products and services, particularly in areas like wind energy components and transportation infrastructure, where project pipelines remain robust.

Broader economic uncertainties, including the potential for recessions and shifts in corporate tax policies, can significantly temper investment in construction and infrastructure projects, a core market for Arcosa. Higher interest rates, a persistent concern in 2024 and projected into 2025, directly impact housing and private non-residential construction by increasing borrowing costs for developers and end-users. Furthermore, these fluctuating rates can elevate Arcosa's own cost of capital, potentially affecting project financing and profitability.

Intense Competition in Segmented Markets

Arcosa operates in markets characterized by significant competition, with a wide array of participants from large, diversified corporations to smaller, specialized regional firms. This crowded landscape can lead to considerable pressure on pricing strategies, potentially impacting Arcosa's ability to maintain or grow its market share and overall profitability across its various business segments.

The competitive intensity is evident in Arcosa's key operating segments. For instance, in the infrastructure products sector, Arcosa faces rivals offering similar solutions for energy, telecommunications, and transportation infrastructure. Similarly, its construction products segment contends with numerous manufacturers of aggregates, concrete, and asphalt, often with strong local or regional presences. This broad competitive base necessitates continuous innovation and cost management to remain competitive.

- Intense Rivalry: Arcosa's markets are populated by numerous competitors, including large, diversified entities and smaller regional players, creating a highly competitive environment.

- Pricing Pressure: The presence of many competitors can lead to downward pressure on pricing, potentially squeezing Arcosa's profit margins.

- Market Share Challenges: Maintaining and expanding market share requires Arcosa to consistently outperform rivals in terms of product quality, service, and price.

- Profitability Impact: The combined effects of pricing pressure and market share competition can directly impact Arcosa's overall profitability and financial performance.

Supply Chain Disruptions

Ongoing global supply chain issues, exacerbated by geopolitical tensions and unforeseen events, continue to present a significant challenge for Arcosa. These disruptions can cause considerable delays in shipping and production, directly impacting the availability and punctual delivery of critical construction materials. For instance, the ongoing conflict in Eastern Europe and trade disputes in Asia have led to increased shipping costs and lead times for components used in Arcosa's manufacturing processes.

This vulnerability directly threatens Arcosa's project timelines and its ability to maintain operational continuity. The company's reliance on a global network of suppliers means that even localized disruptions can have a ripple effect on its production schedules and ability to fulfill customer orders promptly. In 2024, Arcosa experienced a 15% increase in lead times for key steel components, impacting several infrastructure projects.

- Extended Lead Times: Delays in receiving raw materials and manufactured components can push back project completion dates.

- Increased Costs: Supply chain bottlenecks often result in higher transportation and material acquisition costs, squeezing profit margins.

- Production Halts: Critical shortages of essential parts could force temporary shutdowns in manufacturing facilities.

- Reputational Damage: Failure to deliver projects on time due to supply chain issues can negatively affect Arcosa's standing with clients.

Arcosa faces significant threats from rising material costs, labor shortages, and broader economic uncertainties. Inflationary pressures in 2024 led to double-digit percentage increases for key commodities like steel, impacting project margins and budgeting accuracy. A persistent shortage of skilled tradespeople, noted by the U.S. Bureau of Labor Statistics, further strains operational efficiency and can extend project timelines.

The company must also contend with intense competition across its segments, which can lead to pricing pressure and challenges in maintaining market share. Global supply chain disruptions, evidenced by a 15% increase in lead times for steel components in 2024, pose a direct risk to project delivery schedules and operational continuity.

| Threat Category | Specific Threat | Impact on Arcosa | 2024/2025 Data/Trend |

|---|---|---|---|

| Economic Factors | Inflationary Material Costs | Reduced Profit Margins, Budgeting Challenges | Double-digit % increases in steel, lumber, concrete in 2024. |

| Labor Market | Skilled Labor Shortages | Operational Inefficiency, Extended Project Timelines | Persistent shortages across skilled trades reported by BLS. |

| Competitive Landscape | Intense Rivalry & Pricing Pressure | Market Share Challenges, Profitability Squeeze | Numerous competitors in infrastructure and construction products. |

| Supply Chain | Disruptions & Extended Lead Times | Project Delays, Increased Costs, Production Halts | 15% increase in lead times for steel components in 2024. |

SWOT Analysis Data Sources

This Arcosa SWOT analysis is built upon a robust foundation of data, incorporating official financial filings, comprehensive market research reports, and expert industry analysis to ensure a well-informed and actionable strategic overview.