Arcosa Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arcosa Bundle

Uncover Arcosa's strategic product positioning with a glimpse into its BCG Matrix. See which of their offerings are market leaders and which require a closer look. Purchase the full BCG Matrix to gain a comprehensive understanding of their portfolio, enabling you to make informed investment and development decisions.

Stars

Arcosa's wind tower business is a star in its BCG matrix, thriving in the high-growth renewable energy sector. The global push for clean power fuels significant demand for wind turbines, and Arcosa is well-positioned to capitalize on this trend.

In 2024, Arcosa's wind tower segment saw impressive growth, with volumes increasing and Adjusted Segment EBITDA rising substantially. This surge is attributed to robust market demand and the successful expansion of their manufacturing capabilities, including new production facilities coming online.

With a strong backlog of orders and a leading market presence, Arcosa's wind tower division demonstrates a clear trajectory for continued expansion. This segment's performance underscores its status as a high-potential, high-growth area for the company.

Arcosa's Engineered Structures segment, specifically its Utility Structures business, is a star performer. This segment thrives on strong demand for electrical transmission and distribution infrastructure, driven by critical grid hardening efforts and steady population increases. In 2024, Arcosa highlighted robust organic growth and notable margin enhancements within this division, underscoring its market strength.

The company's substantial backlog for utility structures is a clear indicator of sustained market leadership and future revenue visibility. Arcosa's continued strategic investments in this area solidify its high market share within a consistently expanding market. This focus ensures the business remains a key contributor to Arcosa's overall success.

Arcosa's strategic acquisitions, like the purchase of Stavola, have significantly boosted its aggregates business. This expansion has placed Arcosa in key metropolitan areas with strong demand, particularly from burgeoning sectors such as AI data centers and advanced manufacturing. These moves are designed to capture market share in areas experiencing rapid growth.

While the aggregates market is generally mature, Arcosa's focused expansion into these high-demand regions represents a strategic push into high-growth segments. The company is actively increasing its market presence in these areas, aiming to capitalize on the ongoing development and infrastructure needs. This strategic positioning is crucial for future revenue streams.

Looking ahead, Arcosa anticipates substantial volume growth and sustained pricing strength within its expanded aggregates operations. This positive outlook is supported by the company's strategic investments and its ability to serve critical growth industries. Arcosa is solidifying its position as a star performer in this segment.

Advanced Manufacturing for Infrastructure

Arcosa is strategically positioning itself in advanced manufacturing for infrastructure, a move underscored by its proactive engagement with production tax credits. This forward-thinking approach allows Arcosa to tap into burgeoning sectors of infrastructure development that demand specialized, high-quality components. By embracing these advanced capabilities, the company is not just meeting current demands but also building a strong foundation for future growth in critical infrastructure projects.

The company's commitment to advanced manufacturing directly supports its ability to address the evolving needs of the infrastructure market. This includes areas like renewable energy components and specialized transportation solutions. Arcosa's investments in these technologies are designed to boost efficiency and product innovation, thereby strengthening its competitive edge.

- Production Tax Credit Utilization: Arcosa's focus on leveraging production tax credits signifies a direct investment in and commitment to advanced manufacturing processes.

- Market Specialization: This advanced manufacturing capability enables Arcosa to target and excel in high-growth, specialized product segments within the broader infrastructure market.

- Competitive Advantage: Investments in advanced manufacturing enhance Arcosa's operational efficiency and product quality, creating a distinct competitive advantage.

- Future-Oriented Solutions: The company's pursuit of these technologies positions it to be a key player in developing and supplying solutions for the next generation of infrastructure needs.

Integrated Solutions for Energy Transition

Arcosa is actively broadening its scope beyond traditional wind towers to embrace the wider energy transition. Acquisitions, such as Ameron Pole Products, are key to this strategy, introducing new product lines that bolster Arcosa's presence in high-growth sectors. This expansion is strategically positioned to meet increasing infrastructure and energy demands, particularly on the West Coast.

The integration of these new offerings allows Arcosa to capitalize on emerging opportunities within the dynamic energy landscape. For instance, Ameron Pole Products provides essential components for renewable energy projects and grid modernization. This diversification is crucial for Arcosa's long-term growth trajectory.

- Diversified Product Portfolio: Arcosa's expansion includes products for renewable energy infrastructure, grid modernization, and transportation.

- Strategic Acquisitions: The acquisition of Ameron Pole Products, for example, enhances Arcosa's geographic reach and product capabilities.

- Alignment with Market Trends: Arcosa is positioning itself to benefit from the increasing global investment in clean energy and infrastructure upgrades.

- Revenue Growth Potential: These integrated solutions are expected to drive significant revenue growth as the energy transition accelerates.

Arcosa's wind tower business is a star, capitalizing on the high-growth renewable energy sector. The global shift towards clean power creates substantial demand for wind turbines, a trend Arcosa is well-positioned to leverage. In 2024, this segment experienced significant volume increases and a notable rise in Adjusted Segment EBITDA, driven by strong market demand and expanded manufacturing capacity.

Arcosa's utility structures, a key part of its Engineered Structures segment, also shines as a star. This area benefits from robust demand for electrical transmission and distribution infrastructure, essential for grid hardening and population growth. The company reported strong organic growth and improved margins in this division for 2024, reflecting its market leadership.

The company's strategic acquisitions and focused expansion in aggregates, particularly in high-demand metropolitan areas serving sectors like AI data centers, position this business as a star. While the broader aggregates market is mature, Arcosa's targeted growth in these key regions is driving significant revenue potential. The company anticipates substantial volume growth and sustained pricing power in its expanded aggregates operations for 2024 and beyond.

Arcosa's advanced manufacturing capabilities, especially its proactive use of production tax credits, further solidify its star status. This focus allows Arcosa to serve specialized, high-growth infrastructure segments, enhancing operational efficiency and product quality. The company is actively broadening its product lines through strategic acquisitions, such as Ameron Pole Products, to capture opportunities in the energy transition and grid modernization, reinforcing its position as a star performer.

| Segment | BCG Category | 2024 Performance Highlights | Key Drivers |

| Wind Towers | Star | Significant volume growth, increased Adjusted Segment EBITDA | Strong renewable energy demand, expanded manufacturing capacity |

| Utility Structures | Star | Robust organic growth, notable margin enhancements | Grid hardening, population growth, strong backlog |

| Aggregates (Strategic Expansion) | Star | Anticipated substantial volume growth, sustained pricing strength | Targeted expansion in high-demand areas, AI data centers, advanced manufacturing |

| Advanced Manufacturing & Diversified Products | Star | Leveraging production tax credits, new product lines from acquisitions | Energy transition, grid modernization, specialized infrastructure needs |

What is included in the product

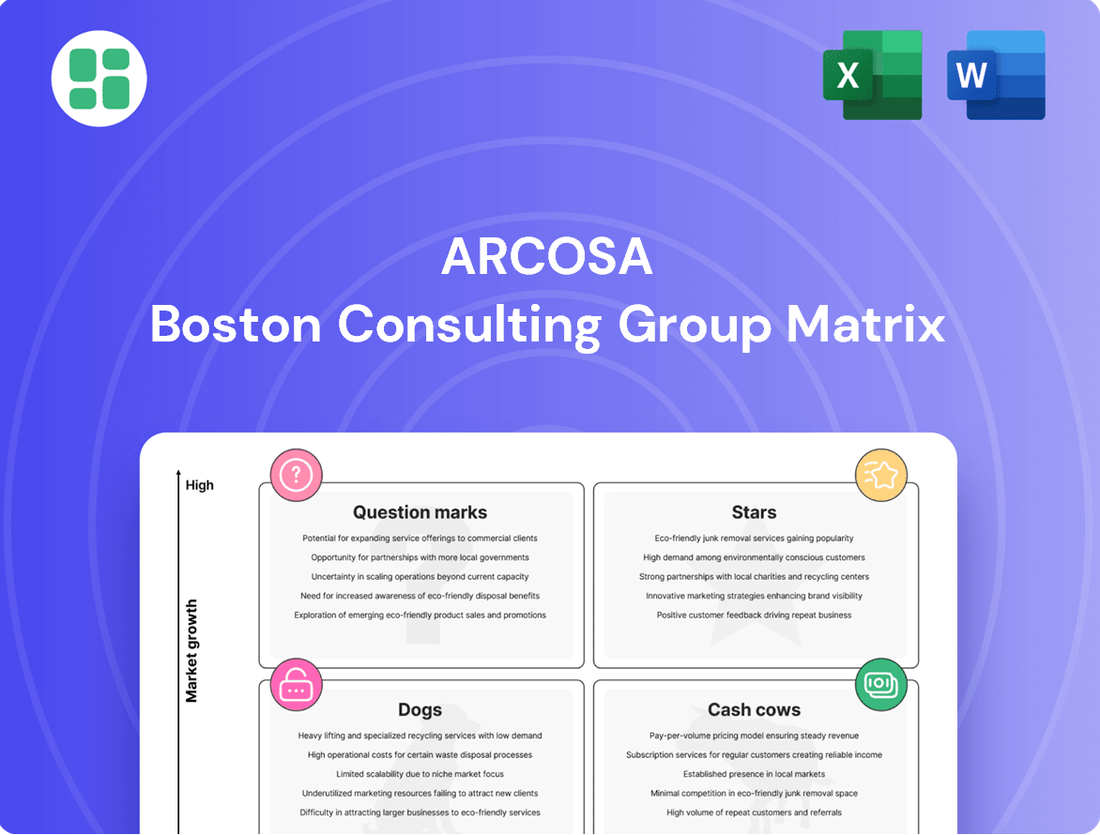

The Arcosa BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, and Dogs.

It highlights which units Arcosa should invest in, hold, or divest based on their market share and growth potential.

Arcosa BCG Matrix: A clear visual guide to strategic resource allocation, simplifying complex portfolio decisions.

Cash Cows

Arcosa's core aggregates business, a cornerstone of its Construction Products segment, operates within a mature yet consistently demanding market. This segment benefits from stable demand driven by essential infrastructure upkeep and general construction activities. In 2024, Arcosa reported that its Construction Products segment, which includes aggregates, saw revenue growth, underscoring the resilience of this mature business.

Despite occasional impacts from weather patterns affecting volume, the aggregates division reliably produces substantial cash flow and maintains robust profit margins. This financial strength is largely attributed to Arcosa's adeptness in implementing effective pricing strategies that offset cost pressures and ensure profitability. The business's established market position and the fundamental nature of its products solidify its role as a dependable cash generator for Arcosa.

The inland barge business, a key component of Arcosa's Transportation Products segment, is showing strong signs of recovery. This sector is experiencing significant pent-up demand for fleet replacements, as much of the existing fleet is aging.

Arcosa's inland barge operations are currently benefiting from a robust backlog that extends well into 2026. This provides a predictable stream of revenue and consistent cash flow, solidifying its role as a reliable cash cow for the company.

In 2024, the demand for new barges remained strong, driven by infrastructure investments and the need to modernize aging fleets. Arcosa's Transportation Products segment, which includes inland barges, reported substantial order backlogs, indicating sustained business activity.

Arcosa's established concrete products, such as precast and reinforced concrete, represent its cash cows. These mature offerings cater to fundamental construction requirements with demand that is both steady and predictable. For instance, in the first quarter of 2024, Arcosa reported that its Construction Products segment, which includes these established concrete lines, generated $199.6 million in revenue, demonstrating their consistent contribution to the company's financial stability.

These mature product lines typically require minimal aggressive investment in marketing and distribution. This allows Arcosa to enjoy high profit margins and generate consistent cash flow, reinforcing their status as cash cows. This reliable income stream provides a stable foundation for the Construction Products segment, supporting other growth initiatives within the company.

Traffic Structures

Within Arcosa's Engineered Structures segment, traffic structures represent a classic Cash Cow. These products are crucial for state Departments of Transportation and highway contractors, fulfilling ongoing needs for road and bridge infrastructure.

This sub-segment operates in a mature, competitive market but benefits from stable demand. The consistent revenue and predictable cash flow generated here require minimal reinvestment for growth, a hallmark of a strong Cash Cow.

- Stable Demand: Driven by continuous infrastructure maintenance and upgrades across the United States.

- Predictable Cash Flow: Arcosa reported that its Engineered Structures segment, which includes traffic structures, generated approximately $585 million in revenue for the fiscal year 2023, showcasing its consistent contribution.

- Low Growth Investment: The mature nature of the market means significant capital expenditure for expansion is not typically required.

- Market Position: Arcosa is a leading manufacturer of highway products, including traffic structures, indicating a solid competitive standing.

Mature Construction Site Support Services

Arcosa's mature construction site support services, a key component of its Construction Products segment, function as classic cash cows within the BCG matrix. These services, encompassing essential materials and support for day-to-day construction operations, benefit from consistent demand that underpins reliable cash flow generation. While not experiencing rapid market growth, their necessity for ongoing projects ensures a stable, low-investment revenue stream.

The stability of these services is evident in Arcosa's financial reporting. For instance, in 2023, the Construction Products segment, where these services are housed, demonstrated robust performance. The segment's contribution to Arcosa's overall revenue highlights the enduring value of these foundational offerings.

- Consistent Demand: Essential for ongoing construction projects, ensuring a predictable revenue base.

- Reliable Cash Flow: These services generate steady income with minimal need for reinvestment.

- Low Investment Component: They represent a stable, mature part of the business, requiring limited capital expenditure.

- Segment Contribution: These cash cows significantly support the financial health of Arcosa's Construction Products segment.

Arcosa's established concrete products, like precast and reinforced concrete, are clear cash cows. These offerings serve fundamental construction needs with steady demand. In Q1 2024, Arcosa's Construction Products segment, including these lines, generated $199.6 million in revenue, highlighting their consistent financial contribution.

These mature products require minimal aggressive investment, allowing for high profit margins and consistent cash flow. This reliable income stream provides a stable foundation for Arcosa's Construction Products segment, supporting other company initiatives.

The inland barge business is also a strong cash cow, bolstered by significant pent-up demand for fleet replacements and a robust backlog extending into 2026. In 2024, demand for new barges remained strong, with Arcosa's Transportation Products segment reporting substantial order backlogs.

| Business Unit | Product/Service | BCG Category | 2024 Revenue Contribution (Approx.) | Key Characteristic |

| Construction Products | Aggregates | Cash Cow | Significant portion of segment revenue | Stable demand, strong pricing power |

| Construction Products | Established Concrete Products | Cash Cow | $199.6M (Q1 2024) | Mature, low investment, high margins |

| Transportation Products | Inland Barges | Cash Cow | Strong backlog into 2026 | Aging fleet replacement demand |

| Engineered Structures | Traffic Structures | Cash Cow | ~$585M (FY 2023 segment revenue) | Essential infrastructure, stable demand |

What You’re Viewing Is Included

Arcosa BCG Matrix

The Arcosa BCG Matrix you are previewing is the definitive document you will receive upon purchase, offering a complete strategic overview without any watermarks or demo content. This comprehensive report is meticulously designed for immediate professional application, ensuring you get the fully formatted, analysis-ready file you expect. Upon purchase, this exact BCG Matrix will be delivered to you, ready for integration into your strategic planning, client presentations, or internal discussions. What you see is the actual, professionally crafted Arcosa BCG Matrix document that will be yours to download and utilize instantly, empowering your decision-making processes.

Dogs

Arcosa's divestiture of its steel components business in August 2024 clearly marks this segment as a 'Dog' within its BCG Matrix. This business was characterized by its cyclical nature and a dilutive effect on Arcosa's broader profit margins.

The steel components segment operated in a market with limited growth prospects and required substantial capital investment, yet it failed to deliver commensurate returns. Divesting this underperforming asset was a strategic decision to enhance Arcosa's overall portfolio focus and boost profitability.

Arcosa's recent divestiture of a single-location, subscale asphalt and paving business exemplifies a classic 'Dog' in the BCG Matrix. This unit was operating at a modest loss, indicating low market share in a potentially stagnant or unprofitable niche.

Divesting such operations is a strategic move to bolster Arcosa's overall financial health and operational efficiency. For instance, in 2023, Arcosa reported total revenues of $2.2 billion, and shedding underperforming assets like this paving business allows for a sharper focus on more lucrative segments.

Arcosa's decision to exit its small, underperforming natural aggregates operation in West Texas clearly positions this segment as a 'Dog' within its portfolio. This strategic move, involving the redeployment of equipment, signals a recognition of low market share or profitability in that specific regional market.

By divesting this operation, Arcosa is actively working to eliminate potential cash traps. This aligns with a broader strategy of reallocating capital and resources towards ventures with higher growth potential and better returns, as seen in their overall portfolio management approach.

Non-Core, Legacy Operations

Arcosa's strategy focuses on optimizing its portfolio, which includes divesting non-core and underperforming businesses. These legacy operations, often found in mature or declining sectors, align with the 'Dog' category in the BCG matrix. They typically exhibit low market share and low market growth, not fitting Arcosa's long-term strategic direction and making them potential divestiture candidates.

These segments generally contribute minimally to overall revenue and profitability, and their operational complexity can detract from resources needed for core growth areas. For instance, Arcosa has previously divested businesses that no longer fit its strategic focus, such as its Engineered Structures segment in 2022.

- Low Market Share: These operations typically hold a small percentage of their respective markets.

- Low Market Growth: The sub-markets they operate in are often stagnant or declining.

- Strategic Misalignment: They do not align with Arcosa's future growth initiatives and portfolio optimization goals.

- Divestiture Potential: Arcosa actively considers divesting these underperforming or non-core assets to streamline operations and enhance focus.

General Railcar Manufacturing (beyond barges)

Arcosa's involvement in general railcar manufacturing, outside of its inland barge segment, faces headwinds. The overall US railcar manufacturing market has experienced a contraction, with market size and new car deliveries declining in both 2024 and 2025. This trend suggests a low-growth or even declining industry landscape.

If Arcosa held a minimal market share within this shrinking sector, its general railcar manufacturing operations would likely be classified as a 'Dog' in the BCG matrix. This classification stems from the combination of a weak competitive position in a slow-moving or contracting market.

- Market Decline: The US railcar manufacturing market saw a decrease in activity in 2024 and is projected to continue this trend through 2025.

- Low Growth Potential: The overall industry is characterized by limited expansion prospects, making it difficult to gain significant traction.

- Competitive Positioning: A low market share within this declining segment would place Arcosa's railcar business in a disadvantageous position.

- BCG Classification: Such a scenario would align with the characteristics of a 'Dog' in the BCG matrix, indicating a business unit with low market share in a low-growth industry.

Arcosa's divestiture of its steel components business in August 2024 clearly marks this segment as a 'Dog' within its BCG Matrix. This business was characterized by its cyclical nature and a dilutive effect on Arcosa's broader profit margins.

The steel components segment operated in a market with limited growth prospects and required substantial capital investment, yet it failed to deliver commensurate returns. Divesting this underperforming asset was a strategic decision to enhance Arcosa's overall portfolio focus and boost profitability.

Arcosa's recent divestiture of a single-location, subscale asphalt and paving business exemplifies a classic 'Dog' in the BCG Matrix. This unit was operating at a modest loss, indicating low market share in a potentially stagnant or unprofitable niche.

Divesting such operations is a strategic move to bolster Arcosa's overall financial health and operational efficiency. For instance, in 2023, Arcosa reported total revenues of $2.2 billion, and shedding underperforming assets like this paving business allows for a sharper focus on more lucrative segments.

Question Marks

The acquisition of Ameron Pole Products in April 2024 marks a strategic move by Arcosa into the burgeoning utility structures and energy transition sectors. This integration, however, necessitates substantial upfront investment for operational alignment and expansion into new territories like the West Coast.

Arcosa's performance in this segment hinges on effectively integrating Ameron's operations and strategically allocating capital to capitalize on its market potential, aiming to elevate it from a question mark to a star within the BCG framework.

Arcosa's strategic investment in new greenfield aggregates sites, exemplified by its Texas operations, directly addresses robust demand driven by significant construction projects. These new ventures enter growing markets with inherently low initial market share as they commence operations.

These nascent operations are classified as question marks, necessitating substantial capital infusion to achieve market penetration and establish dominance. The objective is to transform these sites into future stars or cash cows within Arcosa's portfolio.

In 2024, Arcosa reported approximately $2.1 billion in total revenue, with its Construction Products segment, which includes aggregates, contributing significantly. This highlights the company's ongoing commitment to expanding its footprint in key growth areas like Texas.

Arcosa's expansion of specialty plaster operations in Oklahoma signifies a strategic move into a potentially high-growth segment of the construction materials market. This venture, while aiming for a promising niche, begins with a modest market share, necessitating substantial investment in marketing and operations to build significant customer adoption and market presence.

The critical factor for this Oklahoma-based specialty plaster operation, within the Arcosa BCG framework, is its current position as a Question Mark. Its future trajectory hinges on its ability to capture market share and achieve rapid growth. For instance, the U.S. construction industry, a key market for specialty plasters, saw a 1.4% increase in construction spending in 2023, reaching an estimated $1.98 trillion, according to the U.S. Census Bureau. This growth provides a favorable backdrop for Arcosa's expansion.

Emerging Energy Infrastructure Components

Arcosa's strategic alignment with the green transition means exploring emerging energy infrastructure components. These could include advanced battery storage solutions or hydrogen production and distribution equipment, representing high-growth but currently nascent markets. Entering these segments, even with smaller, specialized ventures, requires significant strategic investment to build market share effectively.

For instance, the global energy storage market, a key emerging area, was projected to reach over $100 billion by 2025, with significant growth driven by renewable energy integration. Arcosa could leverage its manufacturing expertise to develop components for these systems.

- Emerging Components: Battery energy storage systems (BESS) and hydrogen electrolyzers and storage tanks.

- Market Potential: The global BESS market is expected to grow at a CAGR of over 20% through 2030.

- Strategic Focus: Targeting niche manufacturing opportunities within these rapidly expanding sectors.

- Investment Needs: Significant capital for research, development, and scaling production capabilities.

Niche Solutions for Data Centers/AI Infrastructure

Arcosa recognizes the significant demand from AI, data centers, and manufacturing as key growth areas. Developing specialized solutions for these burgeoning, yet specific, infrastructure needs could position Arcosa as a leader. This strategy requires targeted investment to capture market share and achieve scalability.

Consider Arcosa's potential to innovate within these sectors:

- Data Center Cooling Solutions: Developing advanced, energy-efficient cooling systems tailored to the high heat loads of AI servers.

- AI-Specific Enclosures: Creating robust, modular enclosures designed for the unique power and connectivity requirements of AI hardware deployments.

- Specialized Manufacturing Components: Producing high-precision components for advanced manufacturing equipment used in semiconductor fabrication and other AI-related industries.

The global data center market is projected to reach over $300 billion by 2026, with AI workloads driving a substantial portion of this growth. Arcosa's ability to provide niche, high-performance infrastructure solutions within this expanding market could yield significant returns.

Question Marks in Arcosa's portfolio represent ventures with low market share in high-growth industries. These require significant investment to develop and capture market potential. Success in these areas, like the Ameron acquisition or new greenfield aggregates sites, is crucial for future growth.

Arcosa's strategic focus on emerging sectors such as battery energy storage systems (BESS) and hydrogen infrastructure, alongside specialized solutions for data centers and AI, places these initiatives squarely in the Question Mark category. The company's 2024 revenue of $2.1 billion underscores its overall scale, but the success of these nascent ventures will determine their future position within the BCG matrix.

The company's expansion into specialty plaster operations in Oklahoma and its exploration of components for advanced battery storage and hydrogen production exemplify its commitment to high-growth, albeit currently low-market-share, areas. These ventures are positioned as Question Marks, demanding substantial capital and strategic execution to evolve into Stars or Cash Cows.

Arcosa's strategic positioning in areas like data center infrastructure and AI-related manufacturing components highlights its forward-looking approach. These sectors, characterized by rapid growth and evolving technological demands, represent significant opportunities for Arcosa to establish a strong market presence, provided it makes the necessary strategic investments.

| Initiative | Industry Growth | Arcosa Market Share (Est.) | Investment Need | BCG Status |

| Ameron Pole Products Acquisition | Utility Structures/Energy Transition: High | Low (Post-Acquisition Integration) | High | Question Mark |

| Greenfield Aggregates Sites (e.g., Texas) | Construction: High | Low (New Operations) | High | Question Mark |

| Specialty Plaster (Oklahoma) | Construction Materials: Moderate-High | Low | Moderate-High | Question Mark |

| BESS & Hydrogen Components | Energy Storage/Hydrogen: Very High | Very Low (Nascent) | Very High | Question Mark |

| Data Center/AI Infrastructure Solutions | Technology Infrastructure: Very High | Very Low (Niche) | High | Question Mark |

BCG Matrix Data Sources

Our Arcosa BCG Matrix is constructed using a blend of proprietary market research, financial disclosures, and industry expert analysis. This combination ensures a comprehensive view of market share and growth potential.