Arcosa PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arcosa Bundle

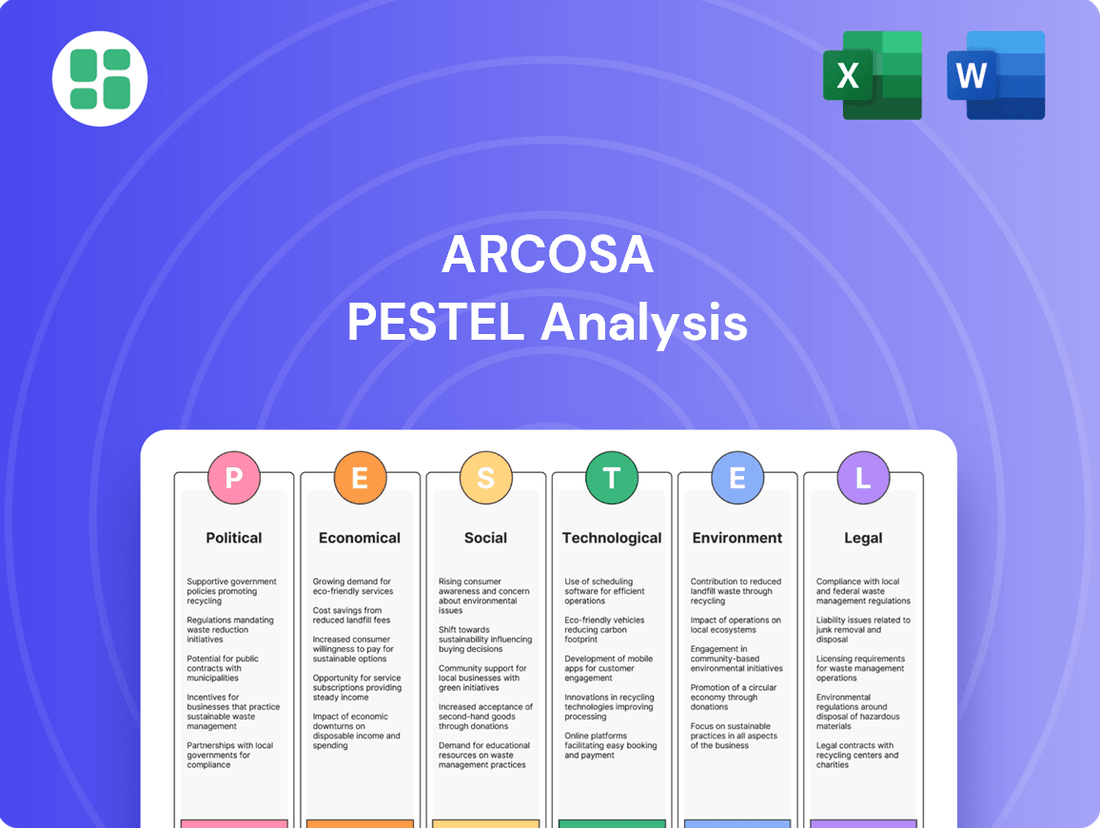

Unlock the strategic advantages Arcosa holds by understanding the external forces at play. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors shaping its trajectory. Equip yourself with this essential intelligence to refine your own market approach and identify untapped opportunities. Purchase the full analysis now for actionable insights.

Political factors

The Bipartisan Infrastructure Law (BIL) remains a key catalyst for Arcosa's business, injecting significant federal capital into transportation, energy, and water infrastructure. This ongoing investment translates directly into increased demand for the products and services Arcosa provides.

The Biden-Harris administration has earmarked $62 billion for infrastructure programs in Fiscal Year 2025. This substantial allocation directly benefits sectors like construction and transportation, which are core markets for Arcosa, ensuring a steady flow of project opportunities.

Political momentum is building around sustainable construction. The U.S. Environmental Protection Agency (EPA) is developing a label program for construction materials with low embodied carbon, a move directly influenced by the federal Buy Clean Task Force and the Inflation Reduction Act.

This focus on promoting greener products in federal purchasing signals a significant shift. Arcosa's commitment to environmentally sound materials positions it favorably to capitalize on these evolving standards, potentially unlocking new avenues for growth and market share in 2024 and beyond.

Changes in international trade policies, including tariffs on essential materials like steel, directly impact Arcosa's production costs and the reliability of its supply chains. For instance, a sudden tariff increase on steel, a key component in Arcosa's infrastructure products, could significantly raise its cost of goods sold.

While Arcosa's 2025 projections suggest a minimal direct effect from tariffs, continuous vigilance regarding these trade agreements is paramount. These governmental actions can alter the price dynamics between imported and domestically sourced materials, necessitating adjustments in Arcosa's purchasing approaches.

Political Stability and Project Approvals

Arcosa's business, particularly its infrastructure segments like wind towers and energy transition products, is significantly influenced by political stability. A stable political environment generally translates to more predictable infrastructure spending and smoother project approvals. Conversely, political uncertainty can lead to project delays or cancellations, directly impacting Arcosa's order pipeline. For instance, the Bipartisan Infrastructure Law in the US, enacted in 2021, has been a key driver for infrastructure projects, with significant federal funding allocated through 2026, potentially boosting demand for Arcosa's offerings.

Governmental efficiency in project approvals and permitting is crucial for Arcosa. Lengthy bureaucratic processes or legislative gridlock can stall the commencement of major construction initiatives, thereby delaying the procurement of essential components like wind towers or utility structures. This sensitivity requires Arcosa to remain agile and responsive to shifts in regulatory environments and government policy. The average time for federal environmental reviews, a key permitting step, can range from months to years, highlighting the potential impact of these processes.

- Infrastructure Spending Sensitivity: Arcosa's order volume is directly tied to the pace of government-backed and private infrastructure development, which is heavily influenced by political stability.

- Regulatory Hurdles: Delays in permitting and legislative actions can slow down project initiation, impacting the timing and volume of Arcosa's product orders.

- Policy Impact: Government policies and funding allocations, such as the US Infrastructure Investment and Jobs Act (IIJA) with its multi-year funding commitments, can significantly boost or dampen demand for Arcosa's manufactured components.

Government Incentives for Renewable Energy

Government policies and incentives designed to accelerate renewable energy infrastructure, particularly wind power, directly benefit Arcosa's Engineered Structures segment. These initiatives create a more favorable market for wind turbine components.

Arcosa's strategic investment and ongoing expansion at its New Mexico wind tower manufacturing facility underscore its commitment to capitalizing on the increasing demand within the renewable energy sector. This demand is significantly influenced by federal and state-level renewable energy mandates and available tax credits.

- Federal Tax Credits: The Inflation Reduction Act of 2022 extended and enhanced production tax credits (PTCs) and investment tax credits (ITCs) for renewable energy projects, providing a strong financial impetus for wind farm development through 2032.

- State Mandates: Numerous states have implemented Renewable Portfolio Standards (RPS) requiring utilities to source a growing percentage of their electricity from renewable sources, driving consistent demand for wind energy infrastructure. For example, California aims for 100% clean electricity by 2045, and Texas has a goal of 10 GW of renewable energy by 2025.

- Infrastructure Investment: Government focus on modernizing the grid and investing in energy infrastructure, as seen in various federal proposals, indirectly supports the deployment of renewable energy sources like wind, which Arcosa supplies.

Governmental support for infrastructure, particularly through the Bipartisan Infrastructure Law, continues to be a significant tailwind for Arcosa. Fiscal Year 2025 allocations of $62 billion toward infrastructure programs directly translate into increased demand for Arcosa's products, especially in construction and transportation sectors.

The push for sustainable construction, evidenced by the EPA's developing low-embodied carbon label program, positions Arcosa favorably given its commitment to environmentally sound materials, potentially opening new market opportunities.

Arcosa's wind tower segment is heavily influenced by government incentives for renewable energy. The Inflation Reduction Act's extended tax credits for renewables through 2032, coupled with state-level Renewable Portfolio Standards, create a robust demand environment for wind energy infrastructure.

Political stability is paramount, as uncertainty can lead to project delays and impact Arcosa's order pipeline, while efficient government permitting processes are crucial for timely project commencement.

What is included in the product

This Arcosa PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company, providing a comprehensive understanding of its operating landscape.

Provides a concise version of Arcosa's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors.

Economic factors

Fluctuations in interest rates directly affect how much it costs to finance construction projects, which in turn influences demand in both housing and business construction. Higher rates in 2023 and early 2024 have indeed tempered some private sector investment.

However, projections for 2025 suggest a potential easing of monetary policy, with gradual interest rate decreases anticipated. This shift could significantly lower borrowing costs, making it more attractive for developers to initiate new projects and boosting demand for Arcosa's offerings.

For instance, a 1% decrease in the benchmark interest rate could reduce the annual interest payment on a $10 million construction loan by $100,000, freeing up capital for more development. This is a crucial factor for Arcosa, a supplier to the construction sector.

Construction inflation remains a significant hurdle, with the Producer Price Index for construction materials showing a notable increase. For instance, lumber prices, a key component for many projects, experienced volatility throughout 2024, impacting overall project budgets. This rise in material and labor costs directly affects Arcosa's customers, potentially leading to budget overruns and extended timelines.

Arcosa has effectively navigated these inflationary headwinds by implementing robust pricing strategies. This proactive approach allows the company to mitigate the impact of rising material and labor expenses, ensuring project viability for its clients. The company's ability to manage these cost pressures is a testament to its operational efficiency and market foresight.

The United States' Gross Domestic Product (GDP) is anticipated to grow by 2.1% in 2025, according to the Congressional Budget Office's January 2024 projections. This economic expansion directly fuels demand for infrastructure and construction projects.

Increased public sector investment, such as the Infrastructure Investment and Jobs Act, is expected to drive construction activity. This trend is projected to continue through 2025 and 2026, creating a robust market for construction materials.

This favorable economic climate, characterized by steady GDP growth and heightened infrastructure spending, provides a strong foundation for Arcosa's projected revenue and EBITDA growth in the coming years.

Labor Costs and Availability

The construction sector, a key market for Arcosa, grapples with a persistent shortage of skilled workers. This scarcity directly translates into increased labor costs, with average hourly wages for construction laborers rising. For instance, by April 2024, the average hourly wage for construction laborers in the US had seen a notable increase compared to previous years, impacting project budgets. This dynamic can also lead to project delays, potentially hindering Arcosa's customers' ability to initiate new projects, thereby dampening demand for Arcosa's products.

Rising wages are a significant component of overall construction expenses, directly affecting the profitability and feasibility of projects for Arcosa's clientele. This trend is exacerbated by factors such as an aging workforce and insufficient new entrants into skilled trades. The implications for Arcosa include potential shifts in customer spending patterns and project pipelines.

- Skilled Labor Shortage: A critical issue impacting construction project timelines and budgets.

- Wage Inflation: Directly contributes to higher project costs for Arcosa's customers.

- Project Delays: Can reduce demand for Arcosa's materials and equipment.

- Impact on Demand: Customer capacity to undertake new projects is directly influenced by labor availability and cost.

Supply Chain Disruptions and Logistics Costs

Ongoing global supply chain disruptions and volatile energy prices continue to significantly impact the construction materials sector, driving up production and transportation costs for companies like Arcosa. These persistent issues can create unpredictable material availability and elevate logistics expenses, directly affecting Arcosa's operational efficiency and profitability.

The elevated cost of shipping, often tied to fuel prices, presents a substantial challenge. For instance, the Cass Freight Index, a key indicator of freight spending, showed a notable increase in expenditures throughout 2024, reflecting the sustained pressure on logistics. This means Arcosa faces higher bills for moving its products, a cost that can be difficult to fully pass on to customers in a competitive market.

- Increased Freight Costs: Volatile fuel prices continue to exert upward pressure on transportation expenses, a critical factor for Arcosa's material delivery.

- Material Availability Uncertainty: Global disruptions can lead to delays and shortages of key raw materials, impacting Arcosa's production schedules.

- Logistics Cost Management: Arcosa's ability to effectively manage its supply chain and logistics is paramount to mitigating these financial and operational risks.

The economic outlook for 2025 presents a mixed but generally positive landscape for Arcosa. Anticipated GDP growth of 2.1% in the US, as projected by the Congressional Budget Office, coupled with continued infrastructure spending from initiatives like the Infrastructure Investment and Jobs Act, signals robust demand for construction materials and services.

However, persistent construction inflation, evidenced by rising Producer Price Index for materials and volatile lumber prices in 2024, remains a key challenge. This, along with a shortage of skilled labor driving up wages, directly impacts project costs for Arcosa's customers, potentially affecting project initiation and timelines.

Interest rate movements are also critical. While higher rates in 2023-2024 may have slowed some investment, projections for a gradual easing in 2025 could lower borrowing costs, stimulating new construction projects and benefiting Arcosa.

Global supply chain disruptions and elevated freight costs, exemplified by increased spending on freight in 2024, continue to pressure Arcosa's operational efficiency and profitability by increasing production and logistics expenses.

| Economic Factor | 2024 Trend/Observation | 2025 Projection/Impact |

|---|---|---|

| US GDP Growth | Moderate growth | Projected 2.1% (CBO Jan 2024) - Fuels demand |

| Interest Rates | Elevated, impacting financing costs | Potential easing - Lower borrowing costs, increased investment |

| Construction Inflation | Significant increases in material and labor costs | Continued pressure, impacting project budgets |

| Skilled Labor | Persistent shortage, rising wages | Increased project costs and potential delays |

| Supply Chain & Freight | Disruptions and volatile energy prices | Increased logistics and production costs |

Preview the Actual Deliverable

Arcosa PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Arcosa PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a deep understanding of the external forces shaping Arcosa's strategic landscape.

Sociological factors

The construction sector, a key market for Arcosa, grapples with persistent workforce demographics and skill shortages. An aging workforce, with many experienced professionals nearing retirement, coupled with a declining influx of younger talent into skilled trades, presents a significant challenge. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a need for over 500,000 additional skilled tradespeople annually over the next decade to meet demand.

This demographic shift compels industries like construction to ramp up investments in training and upskilling initiatives. These labor challenges can directly affect Arcosa's customer base, potentially hindering their ability to complete projects on time and at scale. Consequently, this could indirectly dampen the demand for Arcosa's manufactured components and services as project pipelines face execution hurdles.

Public sentiment regarding infrastructure development plays a crucial role in the success of projects Arcosa supports. Positive societal attitudes, often fueled by the perceived economic benefits and modernization, can streamline approvals and foster community cooperation. For instance, a 2024 survey indicated that 65% of Americans believe increased government spending on infrastructure is a high priority, a trend beneficial for Arcosa's business.

Societal expectations are increasingly pushing companies to focus on employee safety and actively engage with their local communities. Arcosa has demonstrated a commitment to this, as evidenced by a notable decrease in its Total Recordable Incident Rate (TRIR). For instance, their 2023 safety report indicated a TRIR of 0.52, a significant improvement from previous years, reflecting proactive safety measures.

This dedication to both a secure working environment and positive community involvement directly bolsters Arcosa's public image and strengthens its relationships with various stakeholders, including employees, customers, and investors. Such efforts contribute to a more sustainable and socially responsible business model.

Consumer Demand for Sustainable Infrastructure

Public awareness regarding environmental impact is significantly shaping consumer demand for infrastructure. This societal shift is driving a preference for construction methods and materials that minimize ecological footprints, influencing the entire value chain from design to material sourcing.

This growing demand for sustainability is directly impacting the infrastructure sector. For instance, by 2024, a significant portion of new construction projects are incorporating green building standards, reflecting a clear market preference for environmentally conscious solutions. Arcosa's strategic emphasis on sustainable products, such as its wind energy components, directly addresses this evolving market need.

- Growing Demand: Surveys in late 2023 indicated over 70% of consumers are willing to pay more for sustainable products and services, a trend extending to public works and infrastructure projects.

- Policy Influence: This consumer sentiment translates into pressure on governments and corporations to adopt stricter environmental regulations and invest in green infrastructure.

- Arcosa's Alignment: Arcosa's product portfolio, including components for renewable energy generation, positions it favorably to capitalize on this increasing demand for sustainable infrastructure development.

Urbanization and Population Growth

Sociological trends like urbanization and population growth are foundational drivers for infrastructure development, directly benefiting Arcosa. As more people flock to cities, the need for robust transportation, reliable utilities, and commercial spaces escalates, creating a consistent, long-term demand for Arcosa's diverse product range.

The United Nations projects that by 2050, 68% of the world's population will live in urban areas, a significant increase from 56% in 2021. This demographic shift necessitates substantial investment in infrastructure, including bridges, tunnels, and utility systems, all areas where Arcosa has established expertise and product lines.

- Urban Population Growth: The global urban population is expected to reach 6.7 billion by 2050, up from 4.4 billion in 2021, fueling infrastructure demand.

- Infrastructure Investment Needs: The American Society of Civil Engineers' 2021 report card estimated a $2.59 trillion infrastructure investment gap in the U.S. alone over the next decade.

- Arcosa's Market Position: Arcosa's diverse portfolio, including engineered products and construction services, aligns directly with the needs generated by these urban expansion and modernization trends.

Societal expectations for safety and community engagement are paramount, with Arcosa demonstrating a strong commitment. Their 2023 Total Recordable Incident Rate (TRIR) of 0.52 highlights a proactive approach to workplace safety, a key sociological factor influencing corporate reputation and stakeholder trust.

The increasing demand for sustainable infrastructure, driven by public awareness, directly benefits Arcosa. A late 2023 survey revealed over 70% of consumers are willing to pay more for sustainable options, a sentiment that translates into policy and investment in green projects, aligning with Arcosa's renewable energy component offerings.

Urbanization trends, with the global urban population projected to reach 6.7 billion by 2050, create a sustained need for infrastructure. This demographic shift necessitates significant investment in transportation and utilities, areas where Arcosa's diverse product lines are well-positioned to meet demand, as underscored by the estimated $2.59 trillion U.S. infrastructure investment gap.

| Sociological Factor | Trend | Impact on Arcosa | Supporting Data |

| Workforce Demographics | Aging workforce, skill shortages | Potential project delays for customers, impacting demand | U.S. BLS projected need for 500,000+ skilled tradespeople annually (2024) |

| Public Sentiment on Infrastructure | High priority for government spending | Increased project pipelines for Arcosa's customers | 65% of Americans prioritize infrastructure spending (2024 survey) |

| Environmental Awareness | Demand for sustainable solutions | Growth opportunities for Arcosa's green products | 70%+ consumers willing to pay more for sustainable products (late 2023) |

| Urbanization and Population Growth | Increasing urban populations | Sustained demand for infrastructure development | Global urban population to reach 6.7 billion by 2050 (UN projection) |

Technological factors

The construction materials sector is increasingly embracing automation and digitalization, leading to significant efficiency gains and a reduced need for manual labor. Arcosa can capitalize on this trend by integrating advanced manufacturing technologies into its operations to boost productivity, streamline resource allocation, and elevate product quality. For instance, in 2024, the global industrial automation market was projected to reach over $300 billion, highlighting the widespread adoption of these transformative technologies.

Continuous innovation in material science is a significant technological factor for Arcosa. The development of new construction materials with enhanced properties, like increased durability or better environmental performance, directly impacts the company's product offerings and competitive edge. For instance, advancements in lightweight yet strong composites could reduce transportation costs and improve structural integrity in Arcosa's wind tower segments.

Arcosa's investment in research and development for advanced materials is crucial for staying ahead. This allows them to introduce more competitive and sustainable solutions, aligning with growing market demands for eco-friendly infrastructure and stricter regulatory requirements. In 2023, the construction industry saw a notable increase in demand for sustainable building materials, with the global green building materials market projected to reach over $400 billion by 2027, underscoring the importance of Arcosa’s R&D focus.

Arcosa's adoption of data analytics is a significant technological factor for boosting operational efficiency. By analyzing production data, Arcosa can fine-tune manufacturing schedules, reducing downtime and waste. For instance, in 2023, Arcosa reported a 7% increase in its manufacturing segment revenue, partly driven by process improvements that data analytics can further refine.

Inventory management and supply chain logistics also benefit immensely from data-driven insights. Arcosa can use predictive analytics to forecast demand more accurately, ensuring optimal stock levels and minimizing carrying costs. This strategic use of data is crucial for managing its diverse product lines, from wind towers to rail components, contributing to smoother operations and cost reductions.

Building Information Modeling (BIM) Adoption

The escalating adoption of Building Information Modeling (BIM) by design and construction professionals is a significant technological driver. BIM streamlines project workflows, from initial design through to execution, fostering a greater need for precisely manufactured components. This trend directly benefits Arcosa, as it increases demand for their engineered structures and construction products that can be seamlessly integrated into digital project models.

The integration of BIM is reshaping the construction industry, with projections indicating continued growth. For instance, the global BIM market was valued at approximately $7.5 billion in 2023 and is anticipated to reach over $25 billion by 2030, demonstrating a compound annual growth rate (CAGR) of around 18%. This expansion signifies a substantial shift towards digitalized construction processes.

- BIM Adoption Growth: The global BIM market is projected to grow significantly, indicating a strong industry-wide shift.

- Demand for Precision: BIM necessitates standardized, high-quality manufactured components for digital integration.

- Arcosa's Alignment: Arcosa's production of engineered structures and construction products aligns well with this growing demand for precision and digital compatibility.

- Efficiency Gains: BIM adoption leads to improved project efficiency and reduced rework, benefiting companies like Arcosa that supply essential building materials.

Renewable Energy Integration in Processes

Technological leaps in renewable energy and sophisticated energy management systems are enabling manufacturers like Arcosa to significantly cut down on their energy use and environmental impact. These advancements are crucial for operational efficiency and achieving sustainability targets.

Arcosa has actively pursued energy management, focusing on optimizing its energy sources. This strategic approach not only aligns with its environmental commitments but also presents a clear opportunity to lower ongoing operational expenses.

- Renewable Energy Adoption: Arcosa's commitment to integrating renewable energy sources, such as solar and wind, into its manufacturing processes can lead to substantial reductions in electricity costs. For instance, companies in similar industrial sectors have reported savings of 10-20% on energy bills after implementing renewable energy solutions.

- Energy Efficiency Gains: Advanced energy management systems allow for real-time monitoring and control of energy consumption across Arcosa's facilities. This granular oversight can identify and eliminate energy waste, potentially improving overall energy efficiency by 5-15% in the short to medium term.

- Carbon Footprint Reduction: By shifting towards cleaner energy sources, Arcosa directly addresses its carbon footprint. This is increasingly important as regulatory pressures and investor expectations for environmental, social, and governance (ESG) performance continue to rise.

- Cost Savings Potential: The combined effect of reduced energy consumption and the utilization of lower-cost renewable energy can translate into significant operational cost savings for Arcosa. These savings can then be reinvested into further technological upgrades or other strategic initiatives.

The construction sector's increasing embrace of automation and digitalization is driving efficiency and reducing manual labor needs. Arcosa can leverage advanced manufacturing technologies to boost productivity and product quality, mirroring the global industrial automation market's projected growth beyond $300 billion in 2024.

Legal factors

Arcosa navigates a landscape of increasingly stringent environmental regulations, especially concerning greenhouse gas emissions and waste disposal within its manufacturing operations. For instance, the U.S. Environmental Protection Agency's (EPA) initiatives, such as the C-MORE program, are establishing new standards for low embodied carbon materials, which could translate into future compliance obligations for Arcosa.

These evolving standards, particularly those impacting the embodied carbon of construction materials and manufacturing processes, require Arcosa to invest in cleaner technologies and sustainable practices. Failure to adapt could impact its ability to secure contracts or meet customer demands for environmentally responsible products.

Arcosa must diligently adhere to federal, state, and local labor laws, particularly those concerning worker safety and occupational health. This includes complying with regulations set forth by agencies like the Occupational Safety and Health Administration (OSHA).

The company's demonstrated commitment to safety, reflected in a notable decrease in its Total Recordable Incident Rate (TRIR), is vital for legal compliance. For instance, Arcosa reported a TRIR of 0.67 in 2023, significantly below the industry average, which helps mitigate potential fines and legal liabilities.

Maintaining a strong safety record not only ensures legal standing but also fosters a positive and productive work environment, which is essential for employee morale and operational efficiency.

Arcosa, as a manufacturer of essential infrastructure components, operates under rigorous product liability statutes and demanding industry quality benchmarks. Maintaining the robustness, dependability, and safety of its construction materials, engineered frameworks, and transport solutions is paramount to warding off legal challenges and preserving its market standing.

Failure to meet these exacting standards can result in significant financial penalties and reputational damage. For instance, in 2023, the construction industry saw a notable increase in product liability claims, with average settlements reaching millions of dollars, underscoring the critical importance of adherence to quality control and safety protocols for companies like Arcosa.

Antitrust Laws and Market Competition

Arcosa operates in highly competitive sectors, including infrastructure, energy, and transportation. Antitrust laws are crucial as they prevent monopolistic practices and ensure fair competition across these markets. For instance, the U.S. Department of Justice and the Federal Trade Commission actively monitor mergers and acquisitions to maintain market openness. In 2023, the FTC reviewed hundreds of transactions, highlighting the ongoing scrutiny of market consolidation.

Any strategic moves by Arcosa, such as acquisitions or significant market expansion, require rigorous assessment for compliance with these regulations. Failure to adhere to antitrust legislation could result in substantial fines or mandated divestitures, impacting growth strategies and profitability. For example, a proposed acquisition that significantly reduces competition in a specific product category could face regulatory challenges.

- Antitrust Oversight: Regulatory bodies like the FTC and DOJ continuously monitor market concentration.

- Compliance in M&A: Arcosa must ensure all acquisitions comply with competition laws to avoid penalties.

- Market Impact: Strategic actions are evaluated for their potential to create monopolies or unfair advantages.

- Regulatory Scrutiny: The increasing focus on antitrust enforcement in 2024-2025 necessitates proactive compliance measures.

Permitting and Zoning Laws for Construction

Arcosa's construction projects, and by extension the demand for its materials, are heavily influenced by a patchwork of permitting and zoning laws. These regulations vary significantly by municipality and state, impacting everything from site selection to project completion timelines. For instance, a delay in obtaining a critical building permit in a major metropolitan area could stall a large infrastructure project, directly reducing the need for Arcosa's steel or concrete products in that region.

The efficiency and complexity of these legal frameworks directly correlate with market activity. In 2024, some states continued to grapple with permitting backlogs, particularly in areas experiencing rapid growth. Conversely, regions that have streamlined their approval processes often see a more robust construction sector. For example, states that have implemented online permitting portals and standardized review periods tend to attract more development, creating a more consistent demand for construction materials.

The legal landscape also dictates the types of construction that are feasible and the materials that can be used. Zoning laws might restrict the height of buildings, the types of businesses allowed in certain areas, or mandate specific construction methods. These factors indirectly shape the product mix required by the construction industry, influencing Arcosa's product development and sales strategies.

- Varying Permitting Timelines: Average construction permit processing times can range from a few weeks to over a year depending on the jurisdiction, impacting project start dates.

- Zoning Impact on Development: Local zoning ordinances in 2024 continued to dictate land use, influencing the scale and type of construction projects, and thus material demand.

- Regulatory Compliance Costs: Adherence to evolving building codes and environmental regulations adds costs to construction, potentially affecting project viability and material choices.

- Interstate Legal Differences: Significant legal variations exist between states regarding construction permits and zoning, creating a complex operating environment for national suppliers like Arcosa.

Arcosa must navigate a complex web of legal and regulatory requirements, including environmental standards, labor laws, and product liability statutes. Compliance with these mandates is crucial for operational continuity and mitigating financial risks. For instance, adherence to OSHA regulations, evidenced by Arcosa's 2023 TRIR of 0.67, helps avoid penalties. Furthermore, stringent product liability laws necessitate maintaining high quality in construction materials and engineered products, as product liability claims in the construction sector averaged millions of dollars in settlements in 2023.

Antitrust laws play a significant role, with bodies like the FTC and DOJ scrutinizing market concentration, as seen in the hundreds of transactions reviewed by the FTC in 2023. Arcosa's strategic decisions, particularly mergers and acquisitions, must align with these regulations to prevent substantial fines or mandated divestitures. Additionally, varying state and local permitting and zoning laws can significantly impact project timelines and material demand, with some states in 2024 experiencing permitting backlogs that affect the construction sector's pace.

| Legal Area | Key Considerations for Arcosa | 2023/2024 Data/Trends |

|---|---|---|

| Environmental Regulations | Compliance with emission standards (e.g., EPA's C-MORE program) and waste disposal. | Increasing focus on embodied carbon in materials. |

| Labor Laws | Adherence to OSHA standards for worker safety. | Arcosa's 2023 TRIR was 0.67, below industry average. |

| Product Liability | Ensuring quality and safety of infrastructure components. | Product liability claims in construction saw increased settlements in 2023. |

| Antitrust Laws | Compliance with fair competition regulations, especially during M&A. | FTC reviewed hundreds of transactions in 2023; ongoing scrutiny of market consolidation. |

| Permitting & Zoning | Navigating varying municipal and state laws for construction projects. | Permitting backlogs noted in some states in 2024, affecting project timelines. |

Environmental factors

Climate change is a significant environmental factor for Arcosa, as it directly impacts the demand for resilient infrastructure. The growing frequency and intensity of extreme weather events, such as hurricanes and heavy rainfall, require construction materials and engineered solutions that can withstand these environmental stresses. This trend is projected to continue, with the National Oceanic and Atmospheric Administration (NOAA) reporting that the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023 alone, underscoring the need for more robust infrastructure.

Concerns over the depletion of vital natural resources, like aggregates and essential raw materials, are increasingly driving the construction sector towards more sustainable sourcing methods and the integration of recycled content. This trend directly impacts companies like Arcosa, which operates within industries reliant on these materials.

Arcosa's strategic emphasis on utilizing recycled aggregates directly addresses this environmental imperative. By incorporating recycled materials, Arcosa contributes to a more circular economy, reducing reliance on virgin resources and mitigating the environmental impact associated with extraction. For instance, the company's commitment to sustainability is reflected in its operational practices, aiming to minimize waste and maximize resource efficiency throughout its supply chain.

Arcosa has demonstrated a strong commitment to environmental stewardship by significantly exceeding its emissions intensity reduction targets. As of 2024, the company achieved a remarkable 27% reduction in emissions intensity, surpassing its initial goal of a 10% reduction by 2026.

This proactive approach to lowering its carbon footprint is crucial for aligning with Arcosa's overarching corporate sustainability objectives. Furthermore, it directly addresses the increasing expectations from investors, customers, and regulatory bodies regarding environmental responsibility.

Waste Management and Recycling Initiatives

The construction sector is increasingly prioritizing waste reduction and recycling. Arcosa's construction products segment can actively participate by enhancing material efficiency, establishing recycling programs, and exploring products with greater recycled content, thereby supporting circular economy objectives. For instance, in 2023, the U.S. construction industry generated an estimated 600 million tons of debris, with a significant portion potentially diverted from landfills through improved practices.

Arcosa's commitment to sustainability can be demonstrated through:

- Optimizing material usage in manufacturing processes to reduce scrap.

- Implementing internal recycling programs for manufacturing byproducts.

- Researching and developing products that incorporate a higher percentage of recycled materials.

- Engaging with suppliers to promote sustainable sourcing and waste reduction throughout the supply chain.

Water Management and Conservation

Water scarcity is a growing global concern, directly impacting industries that rely on significant water resources. Arcosa, recognizing this, has made strides in managing its water footprint. In 2023, the company achieved a notable 22% reduction in water intensity compared to 2022, showcasing a tangible commitment to conservation.

These efforts are crucial not only for environmental responsibility but also for ensuring long-term operational resilience, especially as regulatory pressures and public awareness around water usage intensify. Continued focus on water efficiency will be key for Arcosa's sustainability.

- Water Intensity Improvement: Arcosa reported a 22% decrease in water intensity in 2023 versus 2022.

- Environmental Impact: Industrial water consumption poses risks to ecosystems and local water availability.

- Operational Efficiency: Effective water management can lead to cost savings and reduced operational disruptions.

- Sustainability Commitment: Ongoing conservation efforts align with broader environmental stewardship goals.

The increasing frequency of extreme weather events, driven by climate change, heightens the demand for resilient infrastructure, a core market for Arcosa. This necessitates materials and engineered solutions capable of withstanding environmental stresses, as evidenced by the 28 billion-dollar weather and climate disasters in the U.S. during 2023. Furthermore, resource depletion is pushing the construction sector toward sustainable sourcing and recycled content, directly influencing Arcosa's material reliance.

Arcosa has significantly advanced its environmental performance, achieving a 27% reduction in emissions intensity by 2024, surpassing its 2026 target of 10%. The company also reduced water intensity by 22% in 2023 compared to 2022, demonstrating a strong commitment to conservation and operational efficiency.

The construction industry's growing focus on waste reduction and recycling presents opportunities for Arcosa's construction products segment to enhance material efficiency and incorporate more recycled content, aligning with circular economy principles. The U.S. construction industry generated approximately 600 million tons of debris in 2023, highlighting the potential for waste diversion.

| Environmental Factor | Impact on Arcosa | Key Data/Trend |

|---|---|---|

| Climate Change & Extreme Weather | Increased demand for resilient infrastructure | 28 U.S. billion-dollar weather/climate disasters in 2023 |

| Natural Resource Depletion | Shift towards sustainable sourcing and recycled content | Growing industry reliance on recycled aggregates |

| Emissions Reduction | Alignment with sustainability goals and stakeholder expectations | 27% reduction in emissions intensity achieved by 2024 |

| Water Scarcity & Conservation | Focus on water efficiency for operational resilience and cost savings | 22% reduction in water intensity in 2023 vs. 2022 |

| Waste Reduction & Recycling | Opportunity for material efficiency and products with recycled content | ~600 million tons of construction debris generated in the U.S. in 2023 |

PESTLE Analysis Data Sources

Our Arcosa PESTLE Analysis is built upon a robust foundation of data, drawing from official government reports, reputable financial news outlets, and leading industry publications. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in credible and current information.