Arcosa Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arcosa Bundle

Unlock the full strategic blueprint behind Arcosa's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Arcosa actively pursues strategic acquisitions to bolster its market presence and product offerings. A prime example is the acquisition of Stavola Holding Corporation's construction materials business in October 2024, following the earlier acquisition of Ameron Pole Products in April 2024.

These strategic moves significantly enhance Arcosa's footprint in vital metropolitan regions and fortify its Construction Products and Engineered Structures segments. The company's growth trajectory is intrinsically linked to its ability to identify and successfully integrate businesses that align with and enhance its existing infrastructure-focused portfolio.

Arcosa relies heavily on its raw material suppliers, especially for steel, a key component in its Engineered Structures division. In 2024, Arcosa's commitment to sourcing steel and other essential materials underscores the critical nature of these partnerships for uninterrupted production. Strong supplier relationships are vital for managing costs and ensuring the availability of materials needed for infrastructure projects.

Arcosa’s collaboration with government agencies and its alignment with national infrastructure programs represent a crucial partnership. This is particularly evident in its Engineered Structures segment, where initiatives like the Inflation Reduction Act (IRA) have directly stimulated demand. The IRA's incentives for renewable energy and grid modernization, for instance, have led to a notable increase in orders for wind towers.

Logistics and Transportation Providers

Arcosa relies heavily on a robust network of logistics and transportation providers to move its substantial and often uniquely sized products throughout North America. These partnerships are fundamental to Arcosa's ability to reach its widespread customer base with construction materials, engineered structures, and transportation components.

Key partners include specialized trucking firms capable of handling heavy haulage, major rail operators for long-distance freight, and marine transport services for barge shipments. The efficiency and cost-effectiveness of these transportation channels directly influence Arcosa's overall operational expenses and its capacity to meet customer delivery timelines.

- Trucking Companies: Essential for last-mile delivery and reaching locations not serviced by rail or barge.

- Rail Operators: Crucial for transporting large volumes of raw materials and finished goods across longer distances.

- Marine Transport: Utilized for cost-effective movement of extremely large or heavy items, particularly along waterways.

Technology and Equipment Providers

Arcosa relies on key partnerships with technology and equipment providers to ensure its manufacturing facilities remain cutting-edge and to integrate advanced production methods. These collaborations are vital for sourcing specialized machinery used in aggregates production, steel fabrication, and barge construction, directly impacting operational efficiency and product quality.

These relationships allow Arcosa to benefit from technological innovations and equipment upgrades, which are essential for minimizing downtime and staying competitive. For instance, in 2024, Arcosa continued to invest in modernizing its production lines, leveraging supplier expertise to implement more efficient processes.

- Equipment Modernization: Partnerships ensure access to state-of-the-art machinery for aggregates, steel fabrication, and barge manufacturing.

- Efficiency Gains: Collaborations with tech providers enable the adoption of advanced production techniques, boosting output and reducing costs.

- Reduced Downtime: Upgraded equipment and technological support from partners help minimize operational interruptions.

- Quality Improvement: Access to the latest equipment directly contributes to enhanced product quality across Arcosa's diverse segments.

Arcosa's strategic partnerships are crucial for its operational success and expansion. The company's acquisition strategy, including the 2024 additions of Stavola Holding Corporation's construction materials business and Ameron Pole Products, highlights its reliance on integrating complementary businesses. These partnerships directly bolster Arcosa's market position and product portfolio.

Strong relationships with raw material suppliers, particularly for steel, are fundamental to Arcosa's production capabilities. In 2024, Arcosa's continued focus on securing these essential materials underscores the critical nature of supplier partnerships for cost management and consistent output. Furthermore, collaborations with government entities and alignment with infrastructure initiatives, such as those spurred by the Inflation Reduction Act, drive demand for Arcosa's engineered structures.

Arcosa also depends on a robust logistics network, including trucking, rail, and marine transport, to deliver its products efficiently across North America. These partnerships are vital for managing operational expenses and meeting customer delivery schedules. Additionally, collaborations with technology and equipment providers ensure Arcosa's manufacturing facilities remain competitive through modernization and the adoption of advanced production methods.

| Key Partnership Area | 2024 Impact/Focus | Strategic Importance |

|---|---|---|

| Acquisitions | Stavola Holding Corp. (Oct 2024), Ameron Pole Products (Apr 2024) | Market expansion, product enhancement |

| Raw Material Suppliers | Steel sourcing critical for production | Cost management, material availability |

| Government Agencies/Infrastructure Programs | IRA stimulus for wind towers | Demand generation, market growth |

| Logistics & Transportation | Trucking, Rail, Marine | Efficient delivery, cost control |

| Technology & Equipment Providers | Production line modernization | Operational efficiency, product quality |

What is included in the product

A detailed breakdown of Arcosa's operations, outlining its diverse customer segments, key revenue streams, and essential partnerships. This model highlights Arcosa's strategic approach to infrastructure solutions and its commitment to delivering value across various markets.

The Arcosa Business Model Canvas streamlines complex strategies, offering a clear, single-page snapshot that alleviates the pain of information overload.

It acts as a powerful tool to quickly identify and articulate key business drivers, relieving the burden of extensive documentation and analysis.

Activities

Arcosa's manufacturing and production is the engine driving its diverse infrastructure product offerings. This core activity spans its Construction Products, Engineered Structures, and Transportation Products segments, encompassing everything from essential aggregates and specialty materials to complex utility structures, wind towers, traffic structures, and barges.

In 2024, Arcosa continued to emphasize operational excellence and efficiency within its manufacturing footprint to effectively meet robust demand across these critical infrastructure sectors. The company's commitment to streamlined production processes is key to its ability to deliver on large-scale projects and maintain its competitive edge.

Arcosa's commitment to portfolio optimization is a core activity, exemplified by its strategic acquisitions and divestitures. In 2024, the company continued this approach, integrating businesses like Ameron Pole Products to bolster its offerings in the utility and infrastructure sectors.

This strategic reshaping also involves shedding less profitable or more volatile segments. The divestiture of the steel components business in prior years, for instance, was a deliberate move to reduce cyclicality and sharpen focus on higher-growth areas, a strategy that continues to inform Arcosa's operational blueprint.

Arcosa's supply chain management is a complex operation, involving the procurement of diverse raw materials like aggregates, steel, and specialized components. This ensures production continuity for its varied product lines, ranging from transportation components to energy infrastructure. Effective inventory control and logistics coordination are paramount to meeting customer delivery schedules and managing operational costs efficiently.

In 2023, Arcosa reported a significant portion of its revenue, $1.9 billion, was derived from its Construction Products segment, highlighting the substantial volume of materials and finished goods that flow through its supply chain. The company's ability to manage these inbound and outbound logistics directly impacts its cost structure and ability to capitalize on market opportunities.

Research and Development for Product Innovation

Arcosa actively pursues enhancements and new product development, particularly focusing on sustainable materials like recycled aggregates and sophisticated engineered structures. This commitment to innovation keeps their product portfolio competitive and aligned with current infrastructure demands, including environmentally conscious options.

The company's efforts in research and development are geared towards meeting evolving industry standards and addressing the specific requirements of contemporary infrastructure projects. This includes a strong emphasis on developing solutions that contribute to sustainability within the construction sector.

- Continuous Improvement: Arcosa invests in refining existing products and processes to boost efficiency and performance.

- Sustainable Materials: Development focuses on incorporating recycled content and environmentally friendly materials into their offerings.

- Engineered Solutions: The company innovates in advanced structural designs and engineered products to meet complex project needs.

- Market Responsiveness: R&D efforts are driven by market trends and customer feedback to ensure product relevance and demand.

Sales, Marketing, and Customer Relationship Management

Arcosa's sales and marketing efforts are crucial for driving demand for its diverse infrastructure products, from wind towers to traffic control equipment. The company focuses on building strong relationships with its varied customer segments, which include government entities, utilities, and private sector developers. This customer-centric approach aims to secure repeat business and cultivate lasting partnerships.

In 2024, Arcosa continued to emphasize its commitment to quality and service, leveraging its established reputation to win new contracts. This dedication to customer satisfaction is a cornerstone of their strategy, ensuring they remain a preferred supplier in competitive markets. Their proactive engagement helps them understand evolving customer needs and tailor solutions accordingly.

- Sales & Marketing Focus: Promoting infrastructure products and solutions across diverse customer bases.

- Customer Relationship Management: Ensuring satisfaction, securing new orders, and fostering long-term partnerships.

- Reputation Building: Leveraging decades of experience to highlight quality and service.

- 2024 Performance Indicator: Continued success in securing contracts through strong customer engagement.

Arcosa's manufacturing and production is the engine driving its diverse infrastructure product offerings, spanning construction products, engineered structures, and transportation products. In 2024, Arcosa continued to emphasize operational excellence and efficiency within its manufacturing footprint to effectively meet robust demand across these critical infrastructure sectors.

Arcosa's commitment to portfolio optimization is a core activity, exemplified by its strategic acquisitions and divestitures, such as integrating Ameron Pole Products in 2024 to bolster its offerings. This strategic reshaping also involves shedding less profitable segments to sharpen focus on higher-growth areas.

Arcosa's supply chain management involves procuring diverse raw materials like aggregates and steel, ensuring production continuity for its varied product lines. Effective inventory control and logistics coordination are paramount to meeting customer delivery schedules and managing operational costs efficiently, with $1.9 billion in revenue from Construction Products in 2023 highlighting the substantial flow.

Arcosa actively pursues enhancements and new product development, particularly focusing on sustainable materials like recycled aggregates and sophisticated engineered structures, keeping their product portfolio competitive and aligned with current infrastructure demands.

Arcosa's sales and marketing efforts are crucial for driving demand across its diverse infrastructure products, focusing on building strong relationships with varied customer segments like government entities and utilities to secure repeat business and foster lasting partnerships.

| Key Activity | Description | 2023/2024 Data/Focus |

|---|---|---|

| Manufacturing & Production | Producing infrastructure products across segments. | Operational excellence and efficiency in 2024 to meet demand. |

| Portfolio Optimization | Strategic acquisitions and divestitures. | Acquisition of Ameron Pole Products in 2024. |

| Supply Chain Management | Procurement, inventory control, and logistics. | Managing inbound/outbound logistics for $1.9 billion Construction Products revenue (2023). |

| Enhancements & New Product Development | Focus on sustainable materials and engineered solutions. | Innovation in advanced structural designs and recycled aggregates. |

| Sales & Marketing | Driving demand and building customer relationships. | Securing contracts through quality and service in 2024; customer engagement. |

What You See Is What You Get

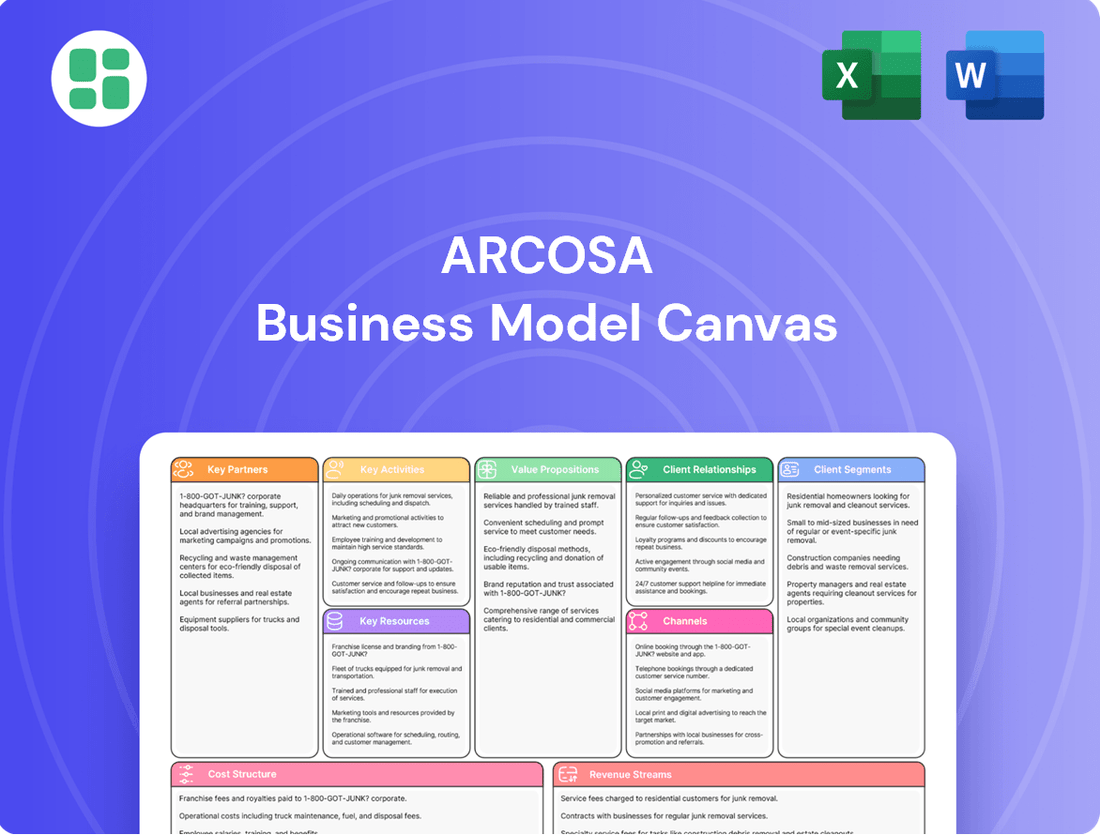

Business Model Canvas

The Arcosa Business Model Canvas preview you're viewing is an exact representation of the final deliverable. When you complete your purchase, you will receive this same comprehensive document, ready for immediate use and customization. This ensures you know precisely what you're acquiring, with no discrepancies between the preview and the purchased product.

Resources

Arcosa's manufacturing prowess is built upon a robust foundation of physical assets. The company operates a significant network of facilities across North America, encompassing quarries for essential aggregates, asphalt plants for paving materials, and specialized factories dedicated to producing steel structures and barges. This extensive footprint is crucial for its operational capacity and ability to meet the demands of large-scale infrastructure development.

These strategically located facilities are complemented by substantial investments in state-of-the-art equipment. This advanced machinery is not just about having the tools; it's about ensuring efficiency, quality, and the capacity to handle complex projects. For instance, Arcosa's steel fabrication plants utilize advanced welding and cutting technologies, enabling them to produce intricate components for bridges and other critical infrastructure.

In 2023, Arcosa reported capital expenditures of $220.4 million, a significant portion of which was directed towards enhancing and expanding its manufacturing capabilities and equipment. This ongoing investment underscores the company's commitment to maintaining a competitive edge through modern, efficient production assets that are vital for delivering on its infrastructure-focused business model.

Arcosa's highly skilled workforce, including engineers and manufacturing specialists, is a cornerstone of its operations. Their technical proficiency in complex production processes is vital for delivering quality products.

Management expertise is equally crucial, guiding strategic growth initiatives and market navigation. This leadership ensures Arcosa can effectively execute its business plan and adapt to industry changes.

In 2024, Arcosa continued to invest in its human capital, recognizing that skilled labor and adept management are key differentiators in its competitive markets, particularly within the infrastructure and energy sectors.

Arcosa's extensive product portfolio, featuring established brands in construction aggregates, utility structures, wind towers, and barges, is a cornerstone of its business model. This diversity allows Arcosa to serve a wide array of infrastructure needs, from building roads to supporting renewable energy projects.

This broad range of products, including leading brands, grants Arcosa a distinct competitive edge. It enables the company to offer integrated solutions across different infrastructure sectors and solidify its market leadership in specialized niches, such as wind towers where it is a significant player.

For instance, in 2023, Arcosa's Wind segment generated $1.1 billion in revenue, highlighting the strength of its wind tower business. Similarly, its Construction Products segment reported $1.5 billion in revenue for the same year, underscoring the importance of its aggregates and related materials.

Strategic Locations and Distribution Network

Arcosa's strategic placement of its aggregates operations, such as those situated near the bustling New York-New Jersey metropolitan area, is a critical resource. This proximity to major construction markets significantly reduces outbound freight costs for high-volume materials, a key advantage in the competitive construction supply chain.

The company's extensive distribution network further amplifies the value of these strategic locations. It ensures efficient and timely delivery of essential construction products, directly impacting Arcosa's ability to serve its customer base effectively and maintain strong market presence.

- Strategic Proximity: Arcosa's aggregates facilities are often located close to high-demand urban centers, minimizing transportation expenses for bulk construction materials.

- Efficient Distribution: A well-established network allows for prompt delivery, crucial for project timelines in the construction industry.

- Cost Advantage: Reduced freight costs due to strategic locations translate into a competitive pricing advantage for Arcosa's products.

- Market Access: Proximity to major metropolitan areas provides direct access to a large and consistent customer base for aggregates and other construction materials.

Strong Financial Capital and Liquidity

Arcosa's robust financial capital is a cornerstone of its business model. This includes strong cash flow generation from its diverse operations, providing a consistent internal funding source. For instance, in the first quarter of 2024, Arcosa reported cash provided by operating activities of $196.5 million, a significant increase from the previous year, demonstrating its operational efficiency.

Access to credit facilities and the ability to raise debt are also critical. Arcosa maintains substantial borrowing capacity, which it has utilized effectively. In 2023, the company issued senior unsecured notes, raising $400 million, further bolstering its financial flexibility to pursue growth opportunities and manage its capital structure.

This financial strength directly supports Arcosa's strategic initiatives. It enables the company to fund strategic acquisitions, invest in organic growth projects across its segments, manage its existing debt obligations prudently, and maintain the operational flexibility needed to navigate market dynamics and pursue long-term expansion plans.

- Cash Flow Generation: $196.5 million in cash provided by operating activities in Q1 2024.

- Debt Issuance: $400 million in senior unsecured notes issued in 2023.

- Strategic Funding: Ability to finance acquisitions and organic growth projects.

- Operational Flexibility: Capacity to manage debt and maintain liquidity for expansion.

Arcosa's key resources include its extensive physical manufacturing assets, such as quarries and fabrication plants, supported by significant investments in advanced equipment. This is complemented by a highly skilled workforce and experienced management team. The company's diverse product portfolio, featuring strong brands in construction, utilities, and energy, provides a competitive advantage. Furthermore, Arcosa benefits from strategically located operations, particularly for aggregates, which minimize freight costs and enhance market access, all underpinned by robust financial capital and access to credit facilities.

Key financial highlights for Arcosa demonstrate its operational strength and strategic financial management.

| Metric | 2023 Data | Q1 2024 Data |

|---|---|---|

| Capital Expenditures | $220.4 million | N/A (Annual) |

| Wind Segment Revenue | $1.1 billion | N/A (Annual) |

| Construction Products Revenue | $1.5 billion | N/A (Annual) |

| Cash Provided by Operating Activities | N/A (Annual) | $196.5 million |

| Debt Issuance (Senior Unsecured Notes) | $400 million | N/A (Annual) |

Value Propositions

Arcosa provides a full suite of infrastructure solutions, serving the construction, energy, and transportation sectors. They supply vital products such as aggregates, engineered structures, and barges, streamlining the customer's procurement process.

This integrated model ensures a consistent supply and high quality for a wide array of infrastructure needs, from building roads to developing renewable energy sites. For instance, in 2023, Arcosa's Construction Products segment generated $1.5 billion in revenue, highlighting their significant market presence.

Arcosa has built a strong reputation for delivering products that are both reliable and of high quality. This isn't just talk; it's backed by a long history of dependable service and operational excellence. For instance, in 2023, Arcosa's commitment to quality was evident in its robust performance across various segments, contributing to its overall revenue growth.

Their focus on quality means that the materials and structures Arcosa provides consistently meet rigorous industry standards. This dedication ensures that infrastructure projects benefit from durable and safe components, crucial for long-term investments. The company's emphasis on quality control and engineering expertise directly translates into products that customers can trust for critical applications.

Arcosa's strategic geographic presence is a cornerstone of its value proposition, particularly for its construction materials segment. By establishing operations in high-growth regions and major metropolitan areas, the company ensures efficient and cost-effective service delivery to its customer base. This proximity is critical for bulk materials like aggregates, where transportation costs can significantly impact project budgets.

This localized footprint directly translates to reduced logistics complexities and more reliable, timely delivery, which is paramount for construction and infrastructure projects. For instance, Arcosa's extensive network of aggregate facilities across the Sun Belt states, a region experiencing significant population and infrastructure growth, allows them to capitalize on demand and minimize lead times for contractors. In 2023, Arcosa reported that over half of its revenue came from construction materials, highlighting the importance of this accessible market positioning.

Support for Sustainable Infrastructure Development

Arcosa actively supports sustainable infrastructure development by providing essential components for renewable energy projects and environmentally conscious construction. Their offerings include recycled aggregates, a key material for reducing reliance on virgin resources. Furthermore, Arcosa manufactures wind towers and structures vital for grid modernization and hardening, directly contributing to cleaner energy transmission and resilience.

This focus on sustainability resonates strongly with market demands. For instance, the renewable energy sector, particularly wind power, saw significant investment in 2024, with global installations continuing to expand. Arcosa’s products enable these crucial projects, offering customers value through compliance with environmental regulations and the growing preference for green building materials.

- Recycled Aggregates: Arcosa's use of recycled materials in its products diverts waste from landfills and conserves natural resources.

- Wind Energy Components: The company's production of wind towers supports the growth of renewable energy, a critical sector for decarbonization efforts.

- Grid Hardening Structures: Arcosa provides essential infrastructure for strengthening electrical grids, enhancing reliability and supporting the integration of renewable sources.

- Environmental Responsibility: By offering sustainable solutions, Arcosa helps its customers meet their own environmental, social, and governance (ESG) goals.

Optimized Portfolio for Reduced Cyclicality

Arcosa actively optimizes its business portfolio through strategic acquisitions and divestitures, creating a more diversified and less cyclical operational structure. This approach is designed to offer customers enhanced stability in supply chains and pricing, thereby mitigating the impact of volatile market swings and bolstering long-term value creation.

This strategic portfolio management directly translates into a value proposition of reduced cyclicality for Arcosa's customers. By balancing exposure across different market segments and economic cycles, the company aims to provide a more consistent and predictable business environment.

- Diversified Revenue Streams: Arcosa's portfolio includes segments like Construction Products, Energy, and Transportation, which often experience different economic cycles, smoothing overall performance.

- Strategic Acquisitions: For instance, Arcosa's acquisition of Overhead Solutions in 2021 expanded its presence in the utility infrastructure market, a sector often less sensitive to broad economic downturns compared to some construction segments.

- Divestitures for Focus: The divestiture of its legacy steel fabrication business in prior years allowed Arcosa to concentrate on its core, higher-growth, and less cyclical segments.

- Customer Benefit: This optimization provides customers with greater assurance of supply and more stable pricing, even during periods of economic uncertainty, fostering stronger, longer-term relationships.

Arcosa's integrated approach streamlines procurement for customers by offering a comprehensive suite of infrastructure solutions across construction, energy, and transportation. This ensures a reliable supply of vital products like aggregates, engineered structures, and barges, simplifying the customer's supply chain. In 2023, Arcosa's Construction Products segment alone generated $1.5 billion in revenue, underscoring their significant market reach and the value of their broad product offering.

Customer Relationships

Arcosa cultivates enduring relationships with key clients, including major contractors, government agencies, and large industrial players. This strategy centers on consistent communication and a deep understanding of their changing requirements, leading to customized solutions and fostering loyalty in essential infrastructure markets.

In 2024, Arcosa's commitment to these long-term partnerships is evident in its sustained revenue streams. For instance, their significant presence in the transportation infrastructure sector, a key area for large contractors and government projects, continues to drive substantial business, underscoring the value of these established relationships.

Arcosa's commitment to customer success is evident in its dedicated sales and technical support. This team offers invaluable expertise, guiding customers through product selection, application, and seamless project execution.

This hands-on approach ensures clients receive tailored solutions that precisely meet their infrastructure requirements, fostering strong, long-term relationships and boosting overall customer satisfaction.

Arcosa's focus on responsive service and reliable supply is a cornerstone of its customer relationships, particularly vital for infrastructure projects with tight deadlines. This commitment ensures customers receive essential components when needed, preventing costly delays.

Efficient order fulfillment and timely delivery are paramount. For instance, in 2024, Arcosa's manufacturing facilities worked to optimize production schedules to meet the surging demand for critical infrastructure components, demonstrating their dedication to keeping projects on track.

Proactive communication about product availability and logistics further solidifies these relationships. By keeping clients informed, Arcosa helps them manage their supply chains effectively, minimizing potential disruptions and fostering trust.

Direct Engagement with Key Accounts

Arcosa’s direct engagement with its largest and most strategic accounts is crucial for navigating complex needs and securing substantial contracts. This approach allows for the development of tailored solutions, fostering deep collaborative relationships, especially for major infrastructure projects.

- Dedicated Account Teams Arcosa likely assigns dedicated teams to manage key accounts, ensuring a deep understanding of customer operations and future needs.

- Customized Solutions Direct interaction enables the creation of bespoke product and service offerings that precisely match the intricate requirements of major clients.

- Long-Term Partnerships This high-touch model cultivates enduring partnerships, vital for the consistent delivery of large-scale infrastructure components.

- Strategic Contract Negotiation Direct engagement facilitates more effective negotiation of significant, long-term contracts, often involving multi-year commitments and substantial value.

Feedback Integration for Continuous Improvement

Arcosa views customer feedback as a vital engine for ongoing enhancement across its product and service portfolio. This proactive approach ensures that Arcosa remains attuned to market needs, driving innovation and operational excellence.

By systematically gathering and incorporating customer insights, Arcosa can refine its offerings, streamline operations, and guarantee that its solutions consistently deliver value and meet evolving client expectations. This commitment to listening fuels adaptability and reinforces customer loyalty.

- Customer Feedback Channels: Arcosa actively utilizes multiple avenues, including direct client consultations, post-project surveys, and industry-specific forums, to gather comprehensive feedback.

- Integration Process: Insights are channeled into dedicated product development and operational review teams, ensuring that customer input directly influences strategic decisions and service adjustments.

- Impact on Innovation: In 2024, feedback from infrastructure clients led to the development of a new, more durable component for its wind towers, a direct result of addressing performance concerns raised by users in demanding environments.

- Service Enhancement: Arcosa's commitment to customer satisfaction is reflected in its continuous efforts to improve project delivery timelines and communication protocols, often informed by client feedback on efficiency and transparency.

Arcosa fosters strong customer relationships through dedicated account teams and customized solutions, particularly for its large infrastructure clients. This high-touch approach ensures a deep understanding of client needs, leading to long-term partnerships and effective negotiation of significant contracts.

Customer feedback is actively sought and integrated, driving product innovation and service enhancements. For instance, in 2024, client input directly influenced the development of a more durable wind tower component, showcasing Arcosa's responsiveness to market demands.

The company's commitment to responsive service and reliable supply, exemplified by optimized production schedules in 2024 to meet surging demand for infrastructure components, prevents costly project delays and builds trust.

Arcosa's direct engagement with its most strategic accounts allows for tailored solutions and collaborative relationships, crucial for securing substantial contracts in major infrastructure projects.

| Customer Relationship Aspect | Description | 2024 Impact/Example |

|---|---|---|

| Dedicated Account Management | Personalized support and deep understanding of client operations | Ensured seamless project execution for major transportation infrastructure projects |

| Customized Solutions | Bespoke products and services tailored to specific client needs | Development of specialized components for unique government infrastructure bids |

| Long-Term Partnerships | Cultivating enduring relationships for consistent business | Sustained revenue from repeat business in critical infrastructure sectors |

| Customer Feedback Integration | Utilizing client input for product and service improvement | Led to the enhancement of wind tower components based on performance feedback |

Channels

Arcosa's direct sales force is a critical component for reaching its core customers, which include major construction firms, utility companies, and government entities. This approach is vital for handling the intricate needs of infrastructure projects.

This direct engagement facilitates deep product expertise and the negotiation of complex contracts, fostering the essential personalized relationships required in the infrastructure sector. For instance, Arcosa's 2024 revenue from infrastructure-related segments underscores the importance of this direct sales strategy.

Arcosa's official website is a key digital touchpoint, offering a broad overview of its diverse business segments and product lines. This channel provides essential corporate news and updates, keeping stakeholders informed about the company's ongoing operations and strategic direction.

The dedicated investor relations portal is a crucial resource for the financially-literate audience. It hosts vital documents like annual reports, quarterly earnings releases, and investor presentations, ensuring transparency and accessibility to financial performance data. For instance, in its fiscal year 2023 report, Arcosa detailed its revenue streams across its segments, providing investors with the granular data needed for valuation and strategic assessment.

Arcosa leverages industry trade shows and conferences to directly engage with its customer base and showcase its diverse product offerings across construction, energy, and transportation. These events are vital for building relationships and demonstrating capabilities. For instance, participation in the 2024 CONEXPO-CON/AGG, a major construction equipment trade show, provided Arcosa with a platform to highlight its latest innovations in infrastructure solutions.

These gatherings are instrumental for lead generation and market intelligence, allowing Arcosa to identify emerging customer needs and competitive shifts. In 2024, Arcosa's presence at key energy sector events like the Offshore Technology Conference (OTC) facilitated discussions with potential clients for its wind energy components, a growing segment for the company.

By actively participating in these forums, Arcosa reinforces its brand as a reliable supplier and thought leader. Networking opportunities at conferences such as the American Association of State Highway and Transportation Officials (AASHTO) Annual Meeting in 2024 were crucial for strengthening ties with government agencies and prime contractors, key decision-makers in infrastructure projects.

Acquired Distribution Networks

Arcosa leverages acquired distribution networks to rapidly expand its market reach, particularly in the construction materials sector. A prime example is the acquisition of Stavola, which brought with it established local distribution channels for aggregates. This strategy provides immediate access to new customers and geographic areas, significantly boosting market penetration and operational efficiency.

These integrated networks are crucial for Arcosa's logistical capabilities. By acquiring companies with existing distribution infrastructure, Arcosa can bypass the lengthy and costly process of building new networks from scratch. This allows for quicker delivery of products and a stronger competitive position in key markets. In 2023, Arcosa reported total revenues of $2.3 billion, with its Construction Products segment, which heavily relies on these networks, contributing significantly to this figure.

- Market Expansion: Acquired networks provide instant entry into new geographic regions and customer segments.

- Logistical Efficiency: Existing infrastructure reduces delivery times and transportation costs.

- Cost Savings: Avoids the substantial investment required to build new distribution channels.

- Competitive Advantage: Enables faster response to market demands and strengthens local presence.

Direct Delivery and Logistics Fleet

Arcosa's Direct Delivery and Logistics Fleet channel is vital for transporting bulk materials and substantial structures directly to customer project sites. This controlled approach is essential for preserving product quality and adhering to critical project schedules. For instance, Arcosa's commitment to efficient logistics was evident in its 2023 performance, where its Transportation Products segment, heavily reliant on these delivery capabilities, generated $958.2 million in revenue, underscoring the importance of this channel.

This direct delivery model offers Arcosa a significant competitive advantage by ensuring timely and secure transportation. It allows for greater oversight of the entire delivery process, minimizing potential damage and delays that can arise with third-party logistics. The company's investment in and management of its own or partnered fleets directly impacts customer satisfaction and project success rates.

- Controlled Delivery: Arcosa manages its own or partnered fleets for direct delivery, ensuring product integrity.

- Efficiency and Timeliness: This channel is crucial for meeting project timelines for bulk materials and large structures.

- Revenue Impact: The effectiveness of this logistics channel supports revenue generation in segments like Transportation Products, which saw $958.2 million in revenue in 2023.

- Customer Satisfaction: Direct control over delivery enhances reliability and customer experience.

Arcosa utilizes a multi-faceted channel strategy to reach its diverse customer base. This includes a direct sales force for major infrastructure clients, an official website for broad corporate information, and a dedicated investor relations portal for financial stakeholders. Additionally, Arcosa actively participates in industry trade shows and conferences to engage customers and showcase its products, while also leveraging acquired distribution networks for market expansion and maintaining its own logistics fleet for direct delivery.

| Channel | Primary Purpose | Key Beneficiaries | 2024 Relevance/Example | 2023 Financial Impact (Segment Example) |

|---|---|---|---|---|

| Direct Sales Force | Engaging major construction, utility, and government clients for complex infrastructure projects. | Large infrastructure firms, government agencies, utility companies. | Negotiating contracts for large-scale projects. | Infrastructure-related segments revenue reflects direct sales importance. |

| Official Website | Providing broad overview of business segments, product lines, corporate news, and updates. | All stakeholders, including customers, investors, and potential employees. | Disseminating company strategy and operational updates. | N/A (Corporate Information) |

| Investor Relations Portal | Offering financial transparency with annual reports, earnings releases, and presentations. | Investors, financial analysts, and academic stakeholders. | Providing granular financial data for valuation. | 2023 Report detailed revenue streams across segments. |

| Trade Shows & Conferences | Direct customer engagement, product showcasing, lead generation, and market intelligence. | Customers across construction, energy, and transportation sectors. | Showcasing innovations at CONEXPO-CON/AGG 2024; discussing wind energy components at OTC 2024. | N/A (Marketing & Sales) |

| Acquired Distribution Networks | Rapid market expansion and logistical integration, especially in construction materials. | Customers in new geographic regions and segments. | Gaining established local distribution for aggregates via Stavola acquisition. | Construction Products segment relies on these networks; 2023 Total Revenue $2.3 billion. |

| Direct Delivery & Logistics Fleet | Transporting bulk materials and structures directly to project sites, ensuring quality and timeliness. | Customers requiring timely and secure delivery of large items. | Supporting timely delivery for projects; 2023 Transportation Products revenue $958.2 million. | Transportation Products segment revenue $958.2 million in 2023. |

Customer Segments

Large-scale construction companies represent a crucial customer segment for Arcosa. These are the major players involved in massive infrastructure projects like highways, bridges, and large commercial developments. Arcosa provides them with essential building blocks such as aggregates and specialty materials, ensuring the foundational needs of these ambitious undertakings are met. Their demand is often characterized by high volume requirements and an absolute need for consistent, reliable supply chains to keep massive projects on schedule.

Arcosa's utility and energy provider segment is crucial, encompassing companies focused on grid hardening, transmission, distribution, and renewable energy development. These clients are significant purchasers of Arcosa's engineered structures, including utility poles, telecommunication towers, and wind towers.

The demand from this segment is propelled by ongoing energy transition initiatives and regulatory requirements. For instance, in 2024, the U.S. Department of Energy continued to emphasize investments in grid modernization and renewable energy infrastructure, directly benefiting Arcosa's product lines.

State Departments of Transportation (DOTs) and public works departments are key clients, especially for Arcosa's offerings in road and bridge construction materials and traffic structures. These entities are heavily influenced by government infrastructure spending, which saw a significant boost with initiatives like the Infrastructure Investment and Jobs Act (IIJA) in the United States.

These government agencies typically engage in competitive bid processes, meaning pricing and adherence to project specifications are paramount. Arcosa’s ability to deliver high-quality, compliant materials on time is crucial for securing contracts within this segment. For instance, in 2023, Arcosa reported that its infrastructure products segment, which serves these customers, experienced robust demand driven by these infrastructure investments.

Inland Waterway and Rail Transportation Industries

Arcosa's Inland Waterway and Rail Transportation Industries customer segment includes operators who purchase barges for the crucial movement of bulk commodities. These operators are key buyers of Arcosa's Transportation Products, ensuring the efficient flow of goods across inland waterways.

Railcar manufacturers also form a significant part of this segment. They rely on Arcosa for essential components, both for building new railcars and for the ongoing maintenance and repair operations that keep the rail network running.

- Inland Waterway Operators: These companies are central to the transport of bulk commodities like grain, coal, and chemicals.

- Railcar Manufacturers: They procure components for the production of new freight cars and for the maintenance of existing fleets.

- Market Demand: In 2024, the demand for efficient commodity transport via barges and rail remained robust, directly impacting Arcosa's sales in this segment.

Specialized Contractors and Developers

Arcosa also serves specialized contractors and developers who focus on niche infrastructure sectors. These clients often engage in projects like underground construction, where Arcosa's trench shields are critical for safety and efficiency. For instance, in 2024, the demand for underground utility work, a key area for trench shield applications, saw continued growth driven by infrastructure investment initiatives.

These specialized customers frequently require highly tailored products and solutions to meet the unique demands of their specific projects. This could involve custom-designed steel components for industrial facilities or specialized civil infrastructure equipment. Arcosa's ability to adapt and provide these bespoke offerings is a significant value proposition for this segment.

The company's expertise in engineering and manufacturing allows it to address the complex technical requirements often associated with specialized construction. This capability ensures that Arcosa can deliver reliable and effective solutions, even for the most demanding infrastructure challenges faced by these contractors and developers.

Arcosa's customer base is diverse, spanning major industries that underpin economic activity. These include large construction firms, utility and energy providers, government transportation departments, and operators within the inland waterway and rail sectors. Specialized contractors also represent a key segment, particularly those involved in underground construction.

| Customer Segment | Key Products/Services | 2024 Market Drivers |

|---|---|---|

| Large-scale Construction Companies | Aggregates, specialty materials | Infrastructure project demand, high-volume requirements |

| Utility & Energy Providers | Utility poles, telecommunication towers, wind towers | Energy transition, grid modernization investments |

| State DOTs & Public Works | Road/bridge materials, traffic structures | Government infrastructure spending (e.g., IIJA) |

| Inland Waterway & Rail | Barges, railcar components | Commodity transport demand, efficient logistics needs |

| Specialized Contractors | Trench shields, custom steel components | Underground utility work growth, niche infrastructure needs |

Cost Structure

The cost of raw materials, especially steel for engineered structures, is a major component of Arcosa's expenses. Operational costs for aggregates, including fuel and machinery upkeep, also contribute significantly. These material costs are subject to market volatility, making smart sourcing and pricing crucial for maintaining profitability.

Arcosa's manufacturing and operational expenses are significant, encompassing labor, energy, and the upkeep of its numerous facilities and machinery. For instance, in the first quarter of 2024, the company reported total operating expenses of $434.4 million, highlighting the scale of these costs.

To combat these substantial outlays, Arcosa actively pursues operational efficiencies. This includes investing in automation to streamline production processes and adopting lean manufacturing principles to minimize waste and optimize resource utilization across its varied production sites.

Arcosa's cost structure is significantly impacted by logistics and transportation. Given the often bulky nature of its products, such as wind towers and construction materials, freight charges for both inbound raw materials and outbound finished goods represent a substantial expense. For instance, in 2023, Arcosa's total operating expenses were $1.6 billion, a portion of which is directly attributable to moving materials and products across its extensive network.

Optimizing these logistics is crucial for cost control. Arcosa invests in efficient supply chain and distribution strategies to mitigate these inherent transportation expenses. This focus on network efficiency helps manage the significant outlays required to deliver its large-scale components to diverse customer locations.

Acquisition and Integration Costs

Arcosa’s growth-by-acquisition strategy means it faces substantial upfront costs. These include expenses for thoroughly vetting potential acquisition targets, the actual purchase price of the companies, and the significant effort required to merge them into Arcosa's existing operations. For instance, in 2023, Arcosa completed the acquisition of two businesses, contributing to its overall investment in strategic growth initiatives.

These integration costs aren't just a one-time hit; they often involve ongoing expenses as systems, processes, and cultures are harmonized. While these expenditures can initially weigh on the cost structure, Arcosa anticipates that the acquired businesses will ultimately boost revenue and improve profit margins, making the investment strategically sound.

- Due Diligence: Costs associated with evaluating the financial health, operational efficiency, and legal standing of potential acquisition targets.

- Purchase Prices: The capital outlay required to acquire the equity or assets of target companies.

- Integration Expenses: Costs related to merging IT systems, consolidating operations, rebranding, and retaining key personnel from acquired entities.

- Strategic Investment: These acquisition-related costs are viewed as investments aimed at expanding market share, diversifying revenue streams, and achieving economies of scale.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses are a significant and ongoing component of Arcosa's cost structure. These costs encompass essential functions like sales and marketing efforts to drive revenue, corporate overhead necessary for overall business management, and administrative functions that keep operations running smoothly.

Efficiently managing SG&A is paramount for Arcosa's profitability, particularly as the company pursues market expansion and growth initiatives. For example, in 2023, Arcosa reported SG&A expenses of $305.1 million, representing a notable portion of its overall operating expenses and underscoring the importance of cost control in these areas.

- Sales and Marketing: Costs associated with promoting Arcosa's products and services to customers.

- Corporate Overhead: Expenses related to the central management and administration of the company.

- Administrative Functions: Costs incurred for day-to-day operational support and compliance.

- Impact on Profitability: Effective management of SG&A is critical for maintaining healthy profit margins, especially during periods of expansion.

Arcosa's cost structure is heavily influenced by its raw material and operational expenses, particularly for steel and aggregates, which are subject to market fluctuations. The company also incurs significant manufacturing and logistics costs due to the size of its products, as seen in its $1.6 billion in total operating expenses for 2023. Furthermore, Arcosa invests in growth through acquisitions, incurring due diligence, purchase prices, and integration costs, while managing Selling, General, and Administrative (SG&A) expenses, which totaled $305.1 million in 2023.

| Cost Category | 2023 Data (Millions USD) | Notes |

|---|---|---|

| Total Operating Expenses | $1,600 | Reflects broad operational and logistical outlays. |

| SG&A Expenses | $305.1 | Covers sales, marketing, and administrative functions. |

| Acquisition Investments | Multiple undisclosed acquisitions in 2023 | Includes due diligence, purchase prices, and integration costs. |

| Raw Material & Operational Costs | Significant component of total expenses | Includes steel, fuel, and machinery upkeep, subject to volatility. |

Revenue Streams

Revenue from Construction Products Sales comes from selling natural and recycled aggregates, specialty materials, and products that support construction sites. This stream is closely tied to overall construction spending, especially in infrastructure. For Arcosa, this segment saw strong performance, with revenues in the Construction Products segment reaching $776.6 million for the first nine months of 2024, up from $658.3 million in the same period in 2023.

Revenue from Engineered Structures Sales comes from selling essential components like utility structures, wind towers, and telecom and traffic structures. This is a significant revenue driver for Arcosa, fueled by ongoing investments in critical infrastructure.

The demand for these structures is directly linked to upgrades and expansions in energy transmission networks, the growth of renewable energy sources like wind power, and the continuous build-out of communication infrastructure. These projects often involve substantial, multi-year contracts, contributing to a stable backlog of work.

For example, Arcosa's Engineered Structures segment reported strong performance in 2024, with revenues reflecting the robust demand for wind towers and utility structures. The company's backlog in this segment remained healthy, indicating continued business for the foreseeable future.

Revenue from Transportation Products primarily stems from manufacturing and selling inland barges and marine components. This segment is directly tied to freight volumes, the need to replace older vessels, and the overall demand for efficient waterborne transport of goods.

In 2024, Arcosa's Transportation Products segment saw continued strength, reflecting robust activity in the barge market. The company's ability to deliver specialized marine equipment supports the ongoing need for reliable and cost-effective commodity shipping.

Services and Rental Income

Arcosa's revenue model extends beyond just selling products; it also includes income from services and rentals. This can involve offering support during construction projects or renting out equipment, which not only adds to the company's top line but also strengthens customer relationships.

For instance, Arcosa's rental and service offerings can contribute to recurring revenue. In 2023, Arcosa reported total revenues of $2.2 billion, indicating a robust market for their diverse offerings, which likely includes these service components.

- Services Revenue: Income generated from providing specialized support, maintenance, or operational assistance related to Arcosa's core products.

- Rental Income: Revenue earned from leasing equipment or assets to customers for a specified period.

- Customer Retention: These ancillary services can enhance customer loyalty by offering comprehensive solutions beyond initial product purchase.

- Diversification: Service and rental income streams help diversify Arcosa's overall revenue base, potentially smoothing out cyclicality in product sales.

Strategic Acquisition Contributions

Arcosa's revenue streams are significantly bolstered by the integration of strategically acquired companies. These acquisitions are not just about adding scale; they are about enhancing market presence and product offerings. For instance, the acquisitions of Stavola and Ameron have directly contributed to Arcosa's top-line growth and expanded its footprint in critical product segments and geographical areas.

- Strategic Acquisitions: Stavola and Ameron are prime examples of how acquisitions fuel Arcosa's revenue growth.

- Market Expansion: These deals immediately broaden Arcosa's market share in key product categories.

- Geographic Reach: Acquisitions also serve to extend the company's presence into new and important geographic regions.

- Revenue Growth Driver: A substantial part of Arcosa's overall revenue increase can be directly attributed to the performance of these acquired entities.

Arcosa's revenue streams are diverse, encompassing sales of construction products, engineered structures, and transportation products. These segments are driven by infrastructure spending, renewable energy development, and freight transportation demands, respectively. The company also generates income through services and rentals, further diversifying its revenue base.

Acquisitions play a crucial role in Arcosa's revenue growth strategy, with companies like Stavola and Ameron contributing significantly to market expansion and product offering enhancement. This multi-faceted approach ensures resilience and continuous top-line expansion.

| Revenue Segment | Key Drivers | 2024 (9 Months) Revenue (Millions USD) | 2023 (9 Months) Revenue (Millions USD) |

|---|---|---|---|

| Construction Products | Infrastructure spending, construction activity | $776.6 | $658.3 |

| Engineered Structures | Renewable energy, utility infrastructure, telecom | N/A | N/A |

| Transportation Products | Freight volumes, marine transport demand | N/A | N/A |

| Services & Rentals | Project support, equipment leasing | N/A | N/A |

Business Model Canvas Data Sources

The Arcosa Business Model Canvas is built upon a foundation of Arcosa's internal financial reports, market analysis of the infrastructure and construction sectors, and strategic insights from industry experts. These diverse data sources ensure each component of the canvas is informed by accurate and relevant information.