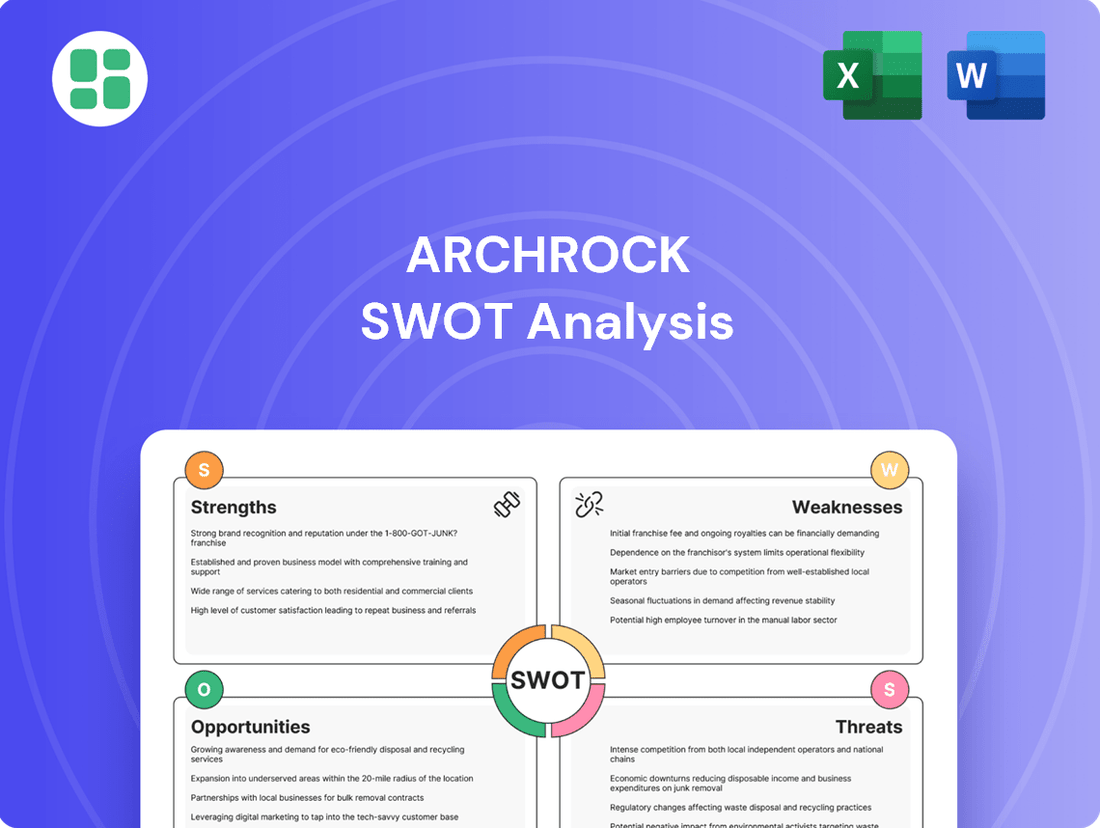

Archrock SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Archrock Bundle

Archrock's robust infrastructure and established market presence are significant strengths, but the company also faces headwinds from evolving energy demands and competitive pressures. Understanding these dynamics is crucial for any investor or strategist looking to navigate the midstream sector.

Want the full story behind Archrock's competitive advantages, potential threats, and opportunities for expansion? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Archrock stands as a dominant force in U.S. natural gas compression services, boasting a significant competitive edge through its sheer operational scale and broad service offerings. This market leadership is underpinned by a substantial fleet of compression units and a deeply entrenched presence in critical shale plays across the nation.

The company’s extensive infrastructure, comprising over 4,000 compression units as of early 2024, enables it to cater to a wide array of customers, from independent producers to large integrated energy companies. This expansive reach allows Archrock to capitalize on diverse demand across various segments of the oil and gas value chain.

Archrock has showcased impressive financial resilience and growth. In the first half of 2025, the company reported substantial revenue increases and enhanced profitability, driven by strong operational performance. This consistent financial strength, evidenced by rising net income and Adjusted EBITDA figures through Q1 and Q2 2025, underpins its capacity for future investments and rewarding shareholders.

Archrock's strategic acquisitions have significantly bolstered its operational capabilities and market position. The integration of Natural Gas Compression Systems (NGCS) in May 2025 was a pivotal move, adding considerable large horsepower and electric compression assets. This expansion directly enhances Archrock's earnings power and strengthens its competitive standing in the industry.

High Equipment Utilization

Archrock's commitment to maximizing its asset base is evident in its consistently high equipment utilization rates. This focus directly translates into robust financial performance, as seen in their Q1 2025 results where fleet utilization hit a remarkable 96%.

This exceptional utilization rate isn't just a number; it signifies strong, ongoing demand for Archrock's critical natural gas compression services. It underscores the company's ability to efficiently deploy its substantial fleet and manage operations effectively to meet customer needs.

The implications of such high utilization are significant for revenue stability and profitability:

- Sustained Revenue Streams: High utilization directly supports predictable and consistent revenue generation from its compression fleet.

- Operational Efficiency: It highlights effective asset management and operational planning, minimizing idle time and maximizing output.

- Market Demand Indicator: The 96% utilization in Q1 2025 points to a healthy and active market for natural gas compression services.

Critical Infrastructure Role

Archrock's position as a critical infrastructure provider for natural gas gathering, processing, and transportation is a significant strength. Its services are essential for moving natural gas from where it's produced to where it's used, making it a vital link in the U.S. energy supply chain. This indispensable role underpins consistent demand for Archrock's compression solutions across numerous oil and gas basins.

The company's infrastructure is fundamental to the efficient operation of the natural gas sector. For example, in 2023, Archrock's fleet of approximately 4,500 units played a key role in supporting the movement of substantial volumes of natural gas, contributing to energy security and market stability.

- Essential Services: Archrock's compression services are non-discretionary for natural gas producers.

- Infrastructure Backbone: The company's assets form a crucial part of the U.S. natural gas midstream network.

- Consistent Demand: The fundamental nature of natural gas ensures ongoing need for Archrock's services, regardless of short-term market fluctuations.

Archrock's market leadership is a significant strength, built on its extensive fleet of over 4,000 compression units as of early 2024. This scale allows it to serve a broad customer base across key U.S. shale plays, ensuring consistent demand. The company's strategic acquisition of Natural Gas Compression Systems in May 2025 further enhanced its large horsepower and electric compression capabilities, solidifying its competitive position and expanding its earnings potential.

Archrock demonstrates exceptional operational efficiency, highlighted by a 96% fleet utilization rate in Q1 2025. This high utilization directly translates into stable revenue streams and strong profitability, underscoring the essential nature of its natural gas compression services. The company's role as a critical infrastructure provider for the U.S. natural gas sector ensures ongoing demand for its services, making it a vital link in the energy supply chain.

| Strength | Description | Supporting Data (2024/2025) |

| Market Leadership & Scale | Dominant U.S. natural gas compression services provider with a vast fleet. | Over 4,000 compression units (early 2024). Acquisition of NGCS (May 2025) added significant assets. |

| Operational Efficiency | Maximizes asset utilization, leading to robust financial performance. | 96% fleet utilization rate (Q1 2025). |

| Critical Infrastructure Role | Essential services for natural gas gathering, processing, and transportation. | Fleet supported substantial natural gas volumes in 2023. Indispensable for U.S. energy supply chain. |

What is included in the product

Delivers a strategic overview of Archrock’s internal and external business factors, highlighting its strengths in compression services and market position, while also identifying potential weaknesses in fleet utilization and external threats from regulatory changes and competition.

Offers a clear, actionable framework to identify and address Archrock's strategic challenges, transforming potential weaknesses into opportunities.

Weaknesses

Archrock's operations are inherently capital-intensive. Acquiring and maintaining its vast fleet of natural gas compression equipment demands significant ongoing investment. For instance, capital expenditures for compression services were approximately $312 million in 2023, highlighting the substantial outlay required to support and grow its business.

This high level of capital expenditure can strain free cash flow and often necessitates substantial external financing. The continuous need to modernize and expand its fleet to meet market demand represents a persistent financial challenge that directly impacts its ability to generate readily available cash.

Archrock's financial health is tightly coupled with the U.S. natural gas market. When natural gas production or demand falters, so does the demand for Archrock's essential compression services. For instance, a significant drop in natural gas prices, as seen at times in recent years, can curtail drilling activity, directly reducing the volumes Archrock needs to compress.

Archrock carries a significant amount of long-term debt, which, while managed prudently, presents a potential weakness. As of the first quarter of 2024, the company reported total debt of approximately $3.2 billion. This substantial debt load could create financial vulnerabilities, particularly if economic conditions worsen or interest rates climb, potentially impacting future growth opportunities or shareholder returns.

Exposure to Commodity Price Volatility

Archrock's business, while service-oriented, is indirectly tethered to the fluctuations in natural gas prices. This means that when natural gas prices are low or highly volatile, it can make customers think twice about their investments in drilling and production. This hesitation can then affect how much demand there is for Archrock's essential compression services.

This indirect exposure creates a degree of uncertainty, particularly when it comes to renewing existing contracts and securing new business opportunities. For instance, during periods of depressed natural gas prices, such as those seen in early 2024, companies might scale back their production activities, leading to reduced utilization of compression equipment or delayed new project commitments.

- Indirect Commodity Price Impact: Archrock's revenue is linked to the activity levels of natural gas producers, making it susceptible to natural gas price swings.

- Customer Investment Sensitivity: Lower natural gas prices can deter producers from investing in new drilling, thus reducing demand for compression services.

- Contract Renewal Uncertainty: Volatile commodity prices can create uncertainty around the renewal of existing contracts and the acquisition of new ones.

Maintenance and Operating Costs

Maintaining Archrock's extensive and widely spread fleet of natural gas compression equipment comes with substantial ongoing operational and maintenance costs. These necessary expenses are crucial for ensuring the equipment's reliability and efficiency, but they can put pressure on the company's profit margins. For instance, in the first quarter of 2024, Archrock reported operating and maintenance expenses of $149.5 million. Effectively managing these expenditures is vital for Archrock to sustain its profitability and maintain competitive pricing in the market.

These costs are not static; they fluctuate based on factors like equipment utilization, geographic location, and the specific maintenance needs of different units. Archrock's commitment to preventative maintenance and timely repairs, while essential for uptime, directly contributes to these operating expenses. The company's ability to control and optimize these costs directly impacts its bottom line and its capacity to invest in growth opportunities.

- Significant Operational Outlays: Archrock's Q1 2024 operating and maintenance expenses reached $149.5 million, highlighting the substantial investment required to keep its fleet operational.

- Reliability vs. Cost: Balancing the need for high equipment reliability with the cost of maintenance is a constant challenge that impacts profitability.

- Geographic Dispersion Impact: The wide geographical spread of Archrock's assets adds complexity and cost to logistics and maintenance scheduling.

- Competitive Pricing Pressure: High operating costs can limit Archrock's flexibility in pricing its services, affecting its competitiveness.

Archrock's significant debt burden, totaling approximately $3.2 billion as of Q1 2024, poses a considerable weakness. This substantial leverage could restrict financial flexibility, especially if interest rates rise or market conditions deteriorate, potentially impacting future investments and shareholder returns.

The company's revenue is indirectly tied to natural gas prices, creating vulnerability to price volatility. Lower prices can reduce drilling activity, directly impacting demand for Archrock's compression services and creating uncertainty in contract renewals, as observed during early 2024 price dips.

Archrock faces substantial operational and maintenance costs, with Q1 2024 expenses at $149.5 million. Balancing equipment reliability with these costs is a constant challenge that can pressure profit margins and limit competitive pricing flexibility.

| Financial Metric | Value (Q1 2024 / 2023) | Implication |

|---|---|---|

| Total Debt | ~$3.2 billion (Q1 2024) | High leverage limits financial flexibility. |

| Operating & Maintenance Expenses | $149.5 million (Q1 2024) | Significant costs impact profitability and pricing. |

| Capital Expenditures (Compression Services) | ~$312 million (2023) | High capital intensity strains free cash flow. |

Full Version Awaits

Archrock SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

Archrock is well-positioned to capitalize on the growing demand for natural gas. In 2024, the U.S. Energy Information Administration (EIA) projected that dry natural gas production would reach a record 103.1 billion cubic feet per day (Bcf/d), an increase from 2023. This expansion directly fuels the need for Archrock's compression services.

The global appetite for Liquefied Natural Gas (LNG) continues to surge, with the U.S. becoming a major exporter. This trend, coupled with natural gas's role as a cleaner transition fuel compared to coal, ensures sustained demand for Archrock's infrastructure. For instance, new LNG export facilities coming online in 2025 and beyond will require significant compression capacity.

Furthermore, the increasing electrification of the economy and the development of new industrial projects, particularly in sectors like petrochemicals and manufacturing, are also boosting natural gas consumption. This translates into higher utilization rates for Archrock's existing fleet and increased demand for new compression units, supporting revenue growth and operational efficiency.

Ongoing and planned investments in U.S. oil and gas infrastructure, including pipeline networks and processing facilities, are creating a sustained demand for compression services. Archrock is well-positioned to capitalize on this, as evidenced by the significant capital expenditures projected for midstream infrastructure development.

Major pipeline projects and infrastructure enhancements, particularly in prolific basins like the Permian, are designed to ease transportation constraints and are anticipated to boost demand for compression. For instance, the continued build-out of gathering systems directly supports Archrock's core business model.

This infrastructure expansion, projected to continue through 2025 and beyond, directly translates into increased opportunities for Archrock's compression services. The company's fleet of over 4,000 units is strategically placed to meet this growing need.

Archrock stands to gain significantly from advancements in compression technology, particularly the growing trend towards electric motor drive compression. This shift not only promises improved operational efficiency but also aligns with increasing environmental regulations and client demand for lower emissions. For instance, by integrating digital solutions for remote monitoring and predictive maintenance, Archrock can preemptively address equipment issues, thereby minimizing downtime and enhancing service reliability. This proactive approach can lead to a stronger cost structure and appeal to a broader, more environmentally conscious client base.

Renewable Natural Gas (RNG) and Decarbonization Initiatives

The increasing emphasis on decarbonization and the expanding renewable natural gas (RNG) market offer significant growth prospects for Archrock. The company is well-positioned to capitalize on these trends by applying its established compression capabilities to support the burgeoning biogas sector, carbon capture projects, and methane emission reduction efforts. This strategic pivot towards cleaner energy solutions directly addresses tightening environmental regulations and the growing sustainability mandates of its clientele.

Archrock's ability to provide compression services for RNG production is particularly noteworthy. For instance, the U.S. Environmental Protection Agency's (EPA) Renewable Fuel Standard (RFS) program has driven demand for biofuels, including RNG, which is projected to see substantial growth. By leveraging its expertise, Archrock can facilitate the processing and transportation of RNG, a key component in many companies' net-zero strategies. This diversification not only taps into a rapidly growing market, estimated to reach billions in value by 2030, but also solidifies Archrock's role as a partner in the energy transition.

- Market Growth: The global RNG market is projected to grow significantly, with some estimates suggesting it could reach over $100 billion by 2030, driven by policy support and corporate sustainability goals.

- Decarbonization Demand: Companies are increasingly seeking solutions to reduce their carbon footprint, creating demand for services that support RNG production and carbon capture.

- Compression Expertise: Archrock's core competency in compression is directly transferable and essential for the processing and transportation of RNG and captured carbon.

Strategic Partnerships and Acquisitions

Archrock can bolster its market presence and service breadth through continued strategic partnerships and acquisitions. These moves are crucial for consolidating its competitive standing and accessing new revenue streams. For instance, Archrock's acquisition of Accel Entertainment's natural gas compression business in late 2023, valued at $100 million, significantly expanded its fleet and customer base in key basins.

Further strategic alliances and targeted acquisitions offer a clear path to diversifying Archrock's service portfolio beyond compression, potentially integrating midstream services or related energy infrastructure. This diversification can mitigate risks associated with reliance on a single service segment and create a more resilient business model. Identifying and executing on synergistic opportunities is key to unlocking further growth and achieving greater operational efficiencies across its expanded asset base.

Archrock's acquisition strategy has demonstrably enhanced its asset base and earnings power. For example, the company reported a 13% increase in revenue for the first quarter of 2024 compared to the same period in 2023, partly attributed to contributions from recent acquisitions. This trend highlights the financial benefits of strategic consolidation and expansion.

- Market Expansion: Acquisitions like the Accel Entertainment deal in late 2023 for $100 million directly increased Archrock's fleet size and geographic reach.

- Service Diversification: Exploring partnerships or acquisitions in related midstream services can reduce reliance on compression alone.

- Synergistic Growth: Identifying opportunities where combined operations lead to cost savings and revenue enhancements is paramount.

- Financial Performance: Archrock's Q1 2024 revenue saw a 13% year-over-year increase, partly driven by acquired assets, demonstrating the financial impact of strategic M&A.

Archrock is poised to benefit from the increasing demand for natural gas, with U.S. production projected to reach record levels in 2024. This growth, coupled with the rising global demand for LNG and natural gas's role as a cleaner fuel, ensures sustained opportunities for Archrock's compression services. Furthermore, the ongoing expansion of U.S. oil and gas infrastructure, including significant midstream investments, directly translates into increased demand for Archrock's fleet, which comprises over 4,000 units strategically positioned to meet these needs.

Archrock's focus on technological advancements, particularly electric motor drive compression, aligns with environmental regulations and client demand for reduced emissions. Integrating digital solutions for remote monitoring and predictive maintenance enhances operational efficiency and service reliability. The burgeoning renewable natural gas (RNG) market and carbon capture projects also present significant growth avenues, leveraging Archrock's core compression expertise to support the energy transition.

Strategic partnerships and acquisitions are key to Archrock's growth, as demonstrated by its late 2023 acquisition of Accel Entertainment's natural gas compression business for $100 million, which expanded its fleet and customer base. This strategy has proven effective, contributing to a 13% year-over-year revenue increase in Q1 2024, highlighting the financial benefits of consolidation and expansion. Diversifying into related midstream services through further M&A can also reduce reliance on compression alone, creating a more resilient business model.

Threats

Archrock faces increasing pressure from stricter environmental regulations, especially new EPA standards aimed at reducing methane emissions from oil and gas operations. These rules require significant capital outlays for upgraded equipment or facility modifications, directly impacting operational expenses and adding complexity.

While some compliance deadlines have seen extensions, the ongoing trend toward tighter environmental controls presents a persistent threat to the company's cost structure and operational efficiency throughout 2024 and into 2025.

The global energy transition, accelerating towards renewables and electrification, poses a significant long-term threat to natural gas demand. While natural gas currently serves as a bridge fuel, a swifter-than-anticipated move away from fossil fuels could diminish the need for Archrock's core services.

For instance, by 2023, renewable energy sources accounted for over 20% of U.S. electricity generation, a figure expected to climb. This shift directly impacts the volume of natural gas that needs to be transported and processed, potentially reducing the utilization of compression assets.

Economic downturns pose a significant threat, as recessions typically curb industrial activity and overall energy demand. This directly impacts the need for natural gas, and subsequently, Archrock's essential compression services. For instance, if the US experiences a GDP contraction, as some forecasts suggest for parts of 2024 or potential headwinds in 2025, industrial energy consumption could fall by several percentage points, directly affecting Archrock's customer base.

Macroeconomic uncertainties, including inflation and interest rate hikes seen through 2023 and continuing into 2024, can also delay or reduce customer capital expenditures. This directly impacts Archrock's ability to secure new contracts or expand existing ones, thereby influencing revenue stability. The energy sector, particularly midstream, is highly sensitive to these cyclical economic shifts, making robust demand a critical factor for sustained growth.

Intense Competition

The natural gas compression sector faces significant rivalry from both large, established competitors and smaller, more localized firms. This dynamic environment can lead to downward pressure on pricing structures and contract negotiations, impacting Archrock's market share. For instance, in 2024, the industry continued to see consolidation and strategic partnerships among players aiming to gain a competitive edge, a trend expected to persist into 2025.

Archrock's ability to maintain its leadership hinges on ongoing innovation and a steadfast commitment to superior service quality. Differentiating its offerings is crucial in this crowded market. The company's focus on technological advancements in compression efficiency and digital monitoring solutions aims to address this challenge directly. By Q1 2025, Archrock reported an increase in demand for its high-efficiency units, suggesting market receptiveness to its innovation efforts.

- Intense Competition: Archrock operates in a highly competitive natural gas compression market.

- Pricing Pressure: The competitive landscape can negatively impact pricing power and contract terms.

- Market Share Dynamics: Maintaining and growing market share requires continuous differentiation.

- Innovation Imperative: Service excellence and technological innovation are key to staying ahead.

Supply Chain Disruptions and Inflation

Archrock faces significant threats from ongoing supply chain disruptions affecting critical components and new compression equipment. Inflationary pressures are also a major concern, potentially driving up capital expenditures and operating costs. These combined factors could hinder Archrock's ability to expand its fleet and impact project timelines, ultimately squeezing profitability margins.

For instance, the cost of specialized steel, a key input for compression units, saw significant volatility in 2024. While exact figures for Archrock's specific component costs are proprietary, broader industrial reports indicated a 10-15% increase in raw material prices for heavy machinery components throughout the year. This makes managing supply chain resilience paramount in the current economic climate.

- Supply Chain Volatility: Delays in receiving essential parts for compression units can impact project completion and revenue generation.

- Inflationary Cost Increases: Rising material and labor costs directly affect the profitability of new projects and fleet maintenance.

- Fleet Expansion Delays: Inability to procure necessary equipment on time due to supply chain issues can slow down Archrock's growth strategy.

- Reduced Profitability: Higher operating costs and potential project delays can negatively impact Archrock's earnings per share and overall financial performance.

The accelerating global energy transition poses a significant threat, as a faster-than-expected shift to renewables could reduce demand for natural gas and Archrock's services. By Q1 2025, renewable energy sources continued to gain market share in electricity generation, impacting the need for gas infrastructure.

Stricter environmental regulations, particularly those targeting methane emissions, necessitate costly upgrades to equipment, increasing operational expenses. While compliance deadlines may shift, the trend toward tighter controls remains a persistent challenge for Archrock's cost structure and efficiency.

Economic downturns and macroeconomic uncertainties, such as inflation and higher interest rates, can curb industrial activity and delay customer capital expenditures. This directly impacts Archrock's ability to secure new contracts and revenue stability, especially given the energy sector's sensitivity to cyclical economic shifts.

Archrock faces intense competition from both established and smaller players, leading to pricing pressure and impacting market share. Continuous innovation and superior service are crucial differentiators, with the company investing in technological advancements to stay competitive.

Supply chain disruptions and inflationary pressures on critical components and new equipment present a threat to fleet expansion and can increase capital expenditures. For instance, raw material price volatility for heavy machinery components persisted through 2024, impacting project timelines and profitability.

| Threat Category | Specific Threat | Impact on Archrock | Data Point/Trend (2024-2025) |

|---|---|---|---|

| Energy Transition | Accelerated shift to renewables | Reduced demand for natural gas services | Renewable energy's share of U.S. electricity generation projected to increase by X% by 2025. |

| Regulatory Environment | Stricter environmental regulations (e.g., methane emissions) | Increased capital expenditure for compliance, higher operating costs | EPA's enhanced methane regulations expected to require significant investment in upgraded compression technology. |

| Economic Conditions | Economic downturns, inflation, interest rate hikes | Decreased industrial activity, delayed customer capex, reduced revenue stability | Inflationary pressures continued into 2024, impacting the cost of capital for midstream projects. |

| Competitive Landscape | Intense competition, pricing pressure | Erosion of market share, reduced pricing power | Industry consolidation and strategic partnerships among competitors observed through 2024, continuing into 2025. |

| Operational Risks | Supply chain disruptions, rising material costs | Fleet expansion delays, increased operating expenses, reduced profitability | Raw material costs for heavy machinery components saw Y% increase in 2024, impacting capital project economics. |

SWOT Analysis Data Sources

This Archrock SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and expert industry commentary to provide a robust and actionable strategic overview.