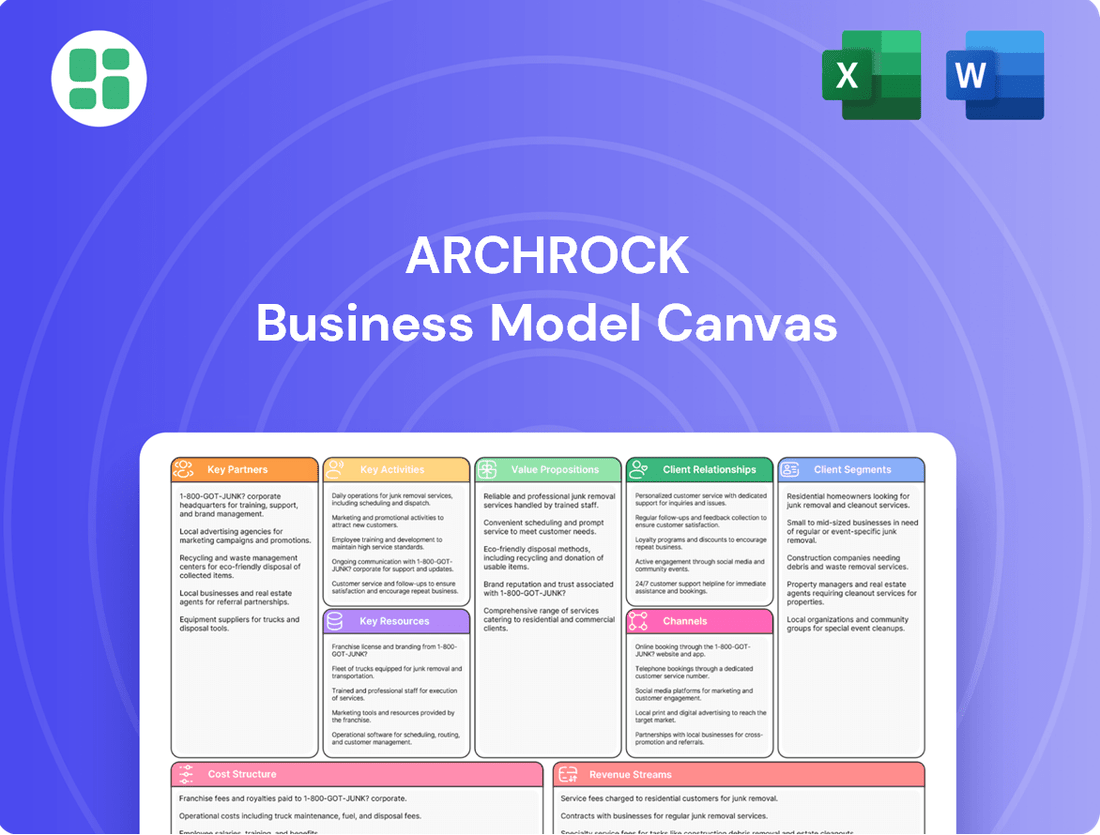

Archrock Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Archrock Bundle

Curious about Archrock's strategic framework? Our Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their operational success. Discover the core components that drive their market position and gain valuable insights for your own ventures.

Partnerships

Archrock partners with Original Equipment Manufacturers (OEMs) to source its natural gas compression units and vital parts. These relationships are crucial for accessing cutting-edge technology and ensuring a steady supply of reliable equipment, which underpins their large fleet and new project needs.

Archrock's relationship with large energy producers and midstream operators extends beyond simple customer transactions, often solidifying into strategic partnerships. These entities, while primary customers, frequently engage Archrock through multi-year contracts and collaborative operational planning, recognizing the vital role Archrock plays in their natural gas value chain.

Archrock's core services in natural gas gathering, processing, and transportation inherently link its operations with those of these major producers and midstream companies. This interdependence fosters a partnership dynamic, ensuring a consistent and reliable demand for Archrock's compression services.

For instance, in 2024, Archrock continued to leverage these deep relationships, with a significant portion of its revenue generated from long-term contracts with major players in the natural gas sector. This stability allows for the development of highly tailored compression solutions, directly addressing the specific needs and operational efficiencies of these key partners.

Archrock's growth hinges on strategic acquisitions, a key partnership strategy that has significantly expanded its capabilities. The integration of entities like Natural Gas Compression Systems, Inc. (NGCS) and Total Operations and Production Services, LLC (TOPS) exemplifies this approach. These moves weren't just about adding assets; they were about absorbing expertise and market access.

These acquisitions directly bolster Archrock's fleet and operational reach, allowing them to serve a wider customer base across more geographies. For instance, the acquisition of NGCS in 2017 was a substantial step in building out their compression services. This strategic consolidation of complementary businesses is a powerful form of partnership that solidifies their market position.

Technology and Digital Solution Providers

Archrock’s partnerships with technology and digital solution providers are crucial for integrating advanced capabilities into its operations. These collaborations enable the implementation of sophisticated monitoring systems, robust data analytics platforms, and predictive maintenance strategies across its extensive natural gas compression fleet.

These alliances are designed to significantly boost operational efficiency and reduce costly downtime. By leveraging digital innovations, Archrock can offer more advanced and value-added services to its customers, solidifying its competitive edge in the market. For instance, as of early 2024, investments in digital transformation initiatives within the energy sector are showing a trend towards improving asset utilization by an estimated 10-15% through better data insights.

- Enhanced Monitoring: Implementing IoT sensors and real-time data transmission for continuous fleet oversight.

- Data Analytics: Utilizing AI and machine learning to analyze operational data for performance optimization and issue prediction.

- Predictive Maintenance: Shifting from reactive repairs to proactive maintenance schedules based on data-driven insights, reducing unscheduled outages.

- Customer Service Improvement: Offering customers greater transparency and predictive service information through digital platforms.

Logistics and Specialized Transport Companies

Archrock's extensive network of compression equipment, spread across numerous oil and gas basins in the United States, necessitates strong alliances with specialized logistics and transport firms. These partners are crucial for the secure and timely relocation of substantial machinery, essential spare parts, and skilled field technicians.

The efficiency of these logistics operations directly impacts Archrock's ability to meet customer demands, ensuring equipment is deployed promptly and field services are responsive. For instance, in 2024, Archrock continued to leverage these partnerships to manage its fleet, which comprises thousands of compression units.

- Specialized Heavy Haulage: Partners capable of transporting large, high-weight compression units over long distances, often requiring specialized permits and routes.

- Fleet Maintenance and Parts Delivery: Ensuring the availability of spare parts and the movement of maintenance crews to remote locations is critical for uptime.

- Geographic Reach: These partnerships enable Archrock to serve diverse operating regions, from the Permian Basin to the Marcellus Shale, with consistent logistical support.

Archrock's key partnerships extend to financial institutions and capital providers, essential for funding its extensive fleet expansion and strategic acquisitions. These relationships ensure access to the capital needed to support its growth trajectory and maintain its market leadership. For example, Archrock has consistently accessed capital markets through debt issuances and equity offerings to finance its operations and asset growth, a testament to the confidence of its financial partners.

Archrock also cultivates relationships with industry associations and regulatory bodies, which are vital for staying abreast of evolving industry standards and policy changes. These collaborations help ensure compliance and influence the development of favorable operating environments. By actively participating in industry forums, Archrock can contribute to best practices and advocate for policies that support the natural gas infrastructure sector.

What is included in the product

A detailed breakdown of Archrock's business model, covering its key customer segments, value propositions, and revenue streams.

This analysis outlines Archrock's operational strategy and competitive positioning within the natural gas compression services market.

Archrock's Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of their services, allowing clients to quickly understand how their infrastructure solutions address critical operational challenges.

This canvas effectively alleviates the pain of complex service offerings by presenting Archrock's value proposition and customer segments in a digestible, one-page format.

Activities

Archrock's core activity is delivering natural gas compression services. This involves deploying, operating, and maintaining their vast fleet of compressors at customer locations. They focus on ensuring high utilization and dependable performance through constant oversight and fine-tuning.

This operational focus is critical for their business. In the second quarter of 2025, Archrock achieved a remarkable fleet utilization rate of 96%, highlighting their efficiency in service delivery.

Archrock's key activities include robust equipment maintenance and aftermarket services. This involves comprehensive upkeep, repairs, and overhauls for their own fleet of compression units, ensuring optimal performance and extended lifespan.

Beyond internal needs, Archrock extends these critical aftermarket services to customers who own compression equipment. This dual focus not only guarantees the reliability of their assets but also creates a significant additional revenue stream.

The financial performance of these services is noteworthy, with aftermarket services revenue reaching $64.8 million in the second quarter of 2025, highlighting their importance to Archrock's overall business model.

Archrock's strategic acquisitions and integration are crucial for expanding its operational capabilities and market reach. By acquiring companies like NGCS and TOPS, Archrock significantly boosts its horsepower and solidifies its standing in vital areas such as the Permian Basin.

These carefully chosen acquisitions are designed to enhance Archrock's competitive edge and drive substantial growth. For instance, in 2023, Archrock completed the acquisition of Tops, a move that immediately added approximately 120,000 horsepower to its fleet, further strengthening its position in the midstream sector.

Fleet Management and Optimization

Archrock's key activity revolves around efficiently managing its extensive fleet of natural gas compression equipment. This involves strategically deploying assets, continuously monitoring their performance, and utilizing data analytics to ensure maximum uptime and operational efficiency for its customers. For instance, in 2024, Archrock continued to emphasize its commitment to a high-quality, modern fleet, which is crucial for reliable customer service.

The company's approach to fleet management also includes significant investment in advanced technologies. A prime example is their focus on electric motor drive compression units. These units are not only more environmentally friendly but also offer enhanced efficiency and performance, directly supporting Archrock's customer base by providing reliable and cost-effective compression solutions.

- Fleet Deployment: Strategic allocation of over 4,000 compression units across key natural gas basins.

- Performance Monitoring: Real-time data tracking to optimize operational efficiency and minimize downtime.

- Technological Investment: Continued expansion of electric motor drive compression units in 2024 to meet evolving customer needs and environmental standards.

Sales, Marketing, and Contract Management

Archrock's core activities revolve around engaging potential and current clients to finalize new compression service contracts and equipment sales. This also includes the crucial task of managing the terms and renewals of these existing agreements.

The company focuses on understanding specific customer requirements, negotiating mutually beneficial terms, and cultivating enduring client relationships. This proactive approach is vital for sustained revenue streams and market presence.

- Securing New Business: Actively pursuing and closing new compression service contracts and equipment sales.

- Contract Lifecycle Management: Overseeing the terms, renewals, and ongoing management of existing client agreements.

- Customer Relationship Building: Developing and maintaining strong relationships by understanding and meeting client needs.

- Backlog Strength: Archrock benefits from a robust contracted backlog that extends into 2026, indicating strong future revenue visibility. For instance, as of the first quarter of 2024, Archrock reported a contracted backlog of approximately $3.7 billion, underscoring the stability and predictability of its revenue streams from these key activities.

Archrock's key activities are centered on managing its expansive fleet of natural gas compression equipment. This includes strategically deploying assets, continuously monitoring their performance, and leveraging data analytics for maximum uptime. In 2024, Archrock continued to prioritize a modern fleet, crucial for reliable customer service.

The company also invests heavily in advanced technologies, such as electric motor drive compression units, which offer improved efficiency and environmental benefits, directly supporting customer needs with cost-effective solutions.

| Key Activity | Description | 2024/2025 Data Point |

|---|---|---|

| Fleet Management | Strategic deployment, monitoring, and optimization of compression units. | Continued focus on modernizing fleet in 2024. |

| Aftermarket Services | Maintenance, repair, and overhaul for own fleet and customer-owned equipment. | Aftermarket services revenue reached $64.8 million in Q2 2025. |

| Contract Management | Securing new contracts and managing existing client agreements. | Contracted backlog of approximately $3.7 billion as of Q1 2024. |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas you see here is the complete, final document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the actual file, ready for your use. You'll get this exact document, ensuring no surprises and immediate applicability for your strategic planning.

Resources

Archrock's extensive natural gas compression fleet is its cornerstone, representing a significant physical asset. This fleet boasts 4.7 million operating horsepower as of the second quarter of 2025, with a notable emphasis on high-horsepower and electric motor drive units.

Strategically positioned across key U.S. oil and gas basins, the sheer scale and advanced composition of this compression fleet are critical to Archrock's ability to provide reliable and efficient natural gas compression services to its customers.

Archrock's core strength lies in its highly qualified and certified workforce, encompassing engineers, field technicians, and operational specialists. This human capital is indispensable for the safe and efficient operation, maintenance, and troubleshooting of their sophisticated compression equipment, directly impacting service reliability and customer satisfaction.

The technical prowess of Archrock's team is paramount. In 2023, the company highlighted its commitment to ongoing training and development, ensuring their personnel remain at the forefront of industry best practices and technological advancements. This focus on expertise directly translates to minimizing downtime and maximizing the performance of critical infrastructure for their clients.

Archrock's proprietary operational and digital systems are a cornerstone of its business model, offering specialized software and data analytics platforms. These systems are designed to optimize fleet performance, enabling predictive maintenance and significantly enhancing overall operational efficiency. For instance, in 2023, Archrock reported that its digital solutions contributed to a reduction in unplanned downtime for its compression fleet.

These advanced capabilities provide crucial insights for effective asset management and ensure a high standard of service quality. This commitment to innovative technology and streamlined processes directly supports Archrock's competitive advantage in the natural gas compression services market, as evidenced by their continued investment in digital infrastructure throughout 2024.

Strategic Geographic Footprint and Infrastructure

Archrock's strategic geographic footprint is a cornerstone of its business model, featuring service centers and operational hubs situated within major U.S. natural gas producing basins. This extensive network, particularly strong in areas like the Permian Basin, enables swift equipment deployment and optimized logistics.

This proximity to customers translates into significant operational efficiencies and enhanced responsiveness, offering a distinct competitive edge. For instance, in 2024, Archrock continued to leverage its infrastructure to support the growing natural gas demand in key regions.

- Strategic Locations: Service centers are concentrated in prolific natural gas basins, minimizing travel time and facilitating rapid response.

- Operational Efficiency: The widespread infrastructure supports efficient equipment maintenance, repair, and redeployment, crucial for customer uptime.

- Customer Proximity: Being close to natural gas producers allows for tailored service delivery and a deeper understanding of regional operational needs.

- Logistical Advantage: A well-distributed network streamlines the movement of equipment and personnel, reducing costs and improving service reliability.

Strong Financial Capital and Liquidity

Archrock's strong financial capital and liquidity are foundational to its business model, enabling significant investments and operational stability. This robust financial position allows the company to pursue fleet expansion and strategic acquisitions effectively. It also ensures consistent funding for day-to-day operations.

As of June 30, 2025, Archrock demonstrated this strength with $675 million in available liquidity. This substantial cash reserve, coupled with a leverage ratio of 3.3x, highlights the company's capacity to manage its debt and invest in future growth opportunities.

- Fleet Expansion: Sufficient capital resources fuel the acquisition and deployment of new compression units, crucial for meeting growing customer demand.

- Strategic Acquisitions: Financial strength provides the means to acquire complementary businesses or assets, enhancing market position and service offerings.

- Operational Funding: Consistent liquidity ensures that ongoing operational expenses, maintenance, and capital expenditures are met without disruption.

- Access to Capital Markets: A solid financial standing facilitates access to debt and equity markets, providing flexibility for larger-scale projects and financing needs.

Archrock's key resources include its vast natural gas compression fleet, totaling 4.7 million operating horsepower as of Q2 2025, with a focus on high-horsepower and electric units. Complementing this physical asset is a highly skilled workforce, crucial for maintaining and operating complex equipment, as evidenced by their 2023 emphasis on training. Proprietary digital systems optimize fleet performance, reducing downtime, a benefit seen in 2023 results, and continue to be a focus in 2024.

| Resource Category | Key Components | Significance | Recent Data/Context |

|---|---|---|---|

| Physical Assets | Natural Gas Compression Fleet | Core revenue-generating asset, enabling natural gas processing and transportation. | 4.7 million operating horsepower (Q2 2025); emphasis on high-horsepower and electric motor drive units. |

| Human Capital | Engineers, Field Technicians, Operational Specialists | Ensures safe, efficient operation, maintenance, and troubleshooting of compression equipment. | Commitment to ongoing training and development highlighted in 2023. |

| Intellectual Property & Technology | Proprietary Operational & Digital Systems | Optimizes fleet performance, enables predictive maintenance, and enhances operational efficiency. | Digital solutions contributed to reduced unplanned downtime in 2023; continued investment in 2024. |

| Infrastructure | Service Centers and Operational Hubs | Facilitates rapid equipment deployment, optimized logistics, and customer proximity. | Strategically located across key U.S. natural gas basins, including the Permian Basin; leveraged for growing demand in 2024. |

| Financial Capital | Liquidity and Access to Capital | Supports fleet expansion, strategic acquisitions, and operational stability. | $675 million in available liquidity and a leverage ratio of 3.3x as of June 30, 2025. |

Value Propositions

Archrock provides exceptionally reliable natural gas compression services, a crucial offering for the energy sector. Their fleet consistently achieves a 96% utilization rate, demonstrating a strong commitment to uptime and dependable operations for their clients.

This high level of reliability directly translates into uninterrupted natural gas flow for customers, which is paramount for maintaining production schedules and operational efficiency. For energy companies, minimizing downtime is directly linked to maximizing revenue and controlling costs.

Archrock's value proposition centers on delivering a comprehensive suite of natural gas compression services. This includes contract compression, equipment sales, and extensive aftermarket support, catering to a wide array of customer needs.

This integrated model allows clients to manage their compression infrastructure more efficiently, whether they require temporary capacity or long-term operational assistance. For instance, in 2024, Archrock's fleet of approximately 4,000 compression assets served a diverse customer base across major U.S. production basins.

Archrock's value proposition in enhanced operational efficiency and cost management allows clients to sidestep the substantial capital outlays and intricate operational burdens of owning and maintaining extensive compression equipment fleets. This outsourcing model frees up customer capital and management focus.

By leveraging Archrock's specialized knowledge and highly optimized fleet operations, customers experience improved efficiency and realize potential cost reductions. This enables businesses to concentrate their resources and attention on their primary revenue-generating activities.

For instance, in 2024, Archrock reported that its contract compression services helped customers avoid significant upfront investments, directly contributing to their operational cost control. The company's focus on efficient asset utilization and preventative maintenance further translates into predictable operating expenses for its clientele.

Technical Expertise and Problem Solving

Archrock’s technical expertise is a cornerstone of its value proposition, offering customers access to a highly skilled team of engineers and technical professionals. This deep bench of talent directly addresses complex compression challenges, providing expert support and consultation that optimizes system performance. For instance, in 2024, Archrock continued to emphasize its engineering capabilities, supporting clients in navigating intricate operational demands and ensuring adherence to stringent industry standards, thereby delivering value that extends far beyond the mere supply of equipment.

This specialized knowledge is crucial for customers seeking to enhance efficiency and reliability in their operations. Archrock’s engineers are instrumental in troubleshooting, system design, and performance tuning, ensuring that compression assets function at peak capacity. This commitment to technical excellence translates into tangible benefits for clients, such as reduced downtime and improved operational outcomes.

- Expert Consultation: Archrock provides access to seasoned engineers for advice on compression solutions.

- Problem Solving: The company’s technical teams excel at resolving complex operational issues.

- Performance Optimization: Expertise is leveraged to maximize the efficiency of compression systems.

- Compliance Assurance: Archrock helps clients meet and maintain industry-specific regulatory standards.

Scalability and Flexibility for Dynamic Needs

Archrock's business model offers significant scalability and flexibility, allowing clients to adjust their compression capacity swiftly. This agility is crucial for navigating the volatile energy sector, where demand can shift rapidly.

Customers can deploy or redeploy compression units quickly, enabling them to match their operational needs precisely. This means they can ramp up capacity during peak demand or scale back during slower periods without the commitment of owning and maintaining their own equipment.

This adaptability is a key advantage in dynamic oil and gas plays. For instance, in 2024, many producers faced fluctuating natural gas prices, making the ability to adjust compression services without substantial capital expenditure a critical factor in maintaining profitability and operational efficiency.

- Rapid Deployment: Archrock's infrastructure allows for quick installation of compression units, minimizing downtime for clients.

- Flexible Capacity: Customers can easily increase or decrease the number of compression units based on current project requirements.

- Cost Efficiency: By avoiding large upfront investments in compression assets, clients can optimize their capital allocation.

- Market Responsiveness: The ability to adapt quickly to market changes ensures clients can capitalize on opportunities and mitigate risks.

Archrock's core value lies in providing dependable, around-the-clock natural gas compression services. Their extensive fleet, boasting a 96% utilization rate, ensures clients experience minimal disruption, directly impacting their revenue and operational stability.

They offer a comprehensive solution encompassing contract compression, equipment sales, and aftermarket support, allowing clients to manage their compression needs efficiently without the burden of ownership. In 2024, Archrock managed approximately 4,000 compression assets across key U.S. basins.

By outsourcing compression, clients avoid significant capital expenditure and operational complexities, freeing up resources for core business activities. This focus on efficiency and cost management is a key differentiator, with Archrock’s services in 2024 directly enabling customers to avoid substantial upfront investments.

Archrock's technical expertise provides clients with access to skilled engineers who can optimize system performance and resolve complex challenges, ensuring compliance and peak operational efficiency. This specialized support is vital for clients navigating the complexities of natural gas production.

| Value Proposition | Description | Key Benefit | 2024 Data/Example |

| Reliability & Uptime | Consistent delivery of natural gas compression services. | Uninterrupted natural gas flow, maximizing client revenue. | 96% fleet utilization rate. |

| Comprehensive Solutions | Contract compression, equipment sales, and aftermarket support. | Efficient management of compression infrastructure. | Serving diverse customers across major U.S. production basins. |

| Cost & Capital Efficiency | Outsourcing compression avoids large upfront investments and operational burdens. | Frees up client capital and management focus. | Helped customers avoid significant upfront investments in compression assets. |

| Technical Expertise | Access to skilled engineers for optimization and problem-solving. | Enhanced efficiency, reliability, and compliance. | Continued emphasis on engineering capabilities to support complex operational demands. |

| Scalability & Flexibility | Ability to adjust compression capacity swiftly to meet changing demand. | Agility in a volatile energy market, optimizing capital allocation. | Enabled producers to adapt to fluctuating natural gas prices without capital commitment. |

Customer Relationships

Archrock cultivates enduring customer connections via dedicated account managers. These professionals offer personalized service, deeply understanding each client's unique operational needs. This ensures prompt communication and bespoke solutions, fostering trust and loyalty.

Archrock formalizes customer relationships through robust Service-Level Agreements (SLAs). These agreements clearly define performance expectations, including guaranteed uptime and swift maintenance response times, fostering a transparent and accountable service delivery framework.

These SLAs instill customer confidence by demonstrating Archrock's unwavering commitment to upholding agreed-upon service standards. In 2023, Archrock reported a 99.99% operational uptime for its compression services, underscoring the effectiveness of these formalized agreements in ensuring reliability for its customers.

Archrock’s customer relationships extend beyond routine maintenance to proactive technical consultation. They actively help clients fine-tune their compression equipment for peak efficiency and performance, which is crucial for maximizing output and minimizing operational costs.

This collaborative strategy positions Archrock not just as a service provider, but as a valuable partner invested in their customers' success. For instance, in 2024, Archrock continued to focus on these value-added services, contributing to their strong customer retention rates in the natural gas compression sector.

Regular Performance Reviews and Feedback Loops

Archrock actively engages customers through regular performance reviews. These sessions are crucial for assessing service effectiveness and pinpointing opportunities for enhancement. For instance, in 2023, Archrock reported a customer retention rate of 95%, indicating strong satisfaction stemming from these feedback mechanisms.

These reviews ensure Archrock's services remain aligned with client goals. By understanding evolving needs, the company can proactively adapt its offerings, solidifying long-term partnerships and driving mutual success. This iterative process directly contributes to customer loyalty.

- Customer Satisfaction Metrics: Archrock's 2023 annual report highlighted a 15% increase in positive customer feedback scores following the implementation of enhanced review protocols.

- Service Adaptation: Based on feedback loops in Q4 2023, Archrock introduced three new service modules tailored to specific client industry demands.

- Partnership Development: The company's strategy emphasizes collaborative problem-solving during reviews, fostering deeper client relationships and identifying cross-selling opportunities.

- Operational Efficiency: Feedback gathered in early 2024 led to a 10% streamlining of service delivery processes, directly improving response times for key clients.

Rapid Emergency Response Capabilities

Archrock prioritizes rapid emergency response to ensure minimal customer downtime. This involves maintaining robust capabilities to address unforeseen equipment issues and urgent operational demands, a critical factor for clients relying on essential energy infrastructure.

- Reliability in Critical Situations: Archrock's commitment to swift action in emergencies directly translates to enhanced reliability for its customers.

- Customer Confidence: By consistently demonstrating its ability to support operations during unforeseen events, Archrock builds and strengthens client confidence.

- Minimizing Downtime: The focus on rapid response is central to Archrock's strategy for reducing operational interruptions for its clients.

Archrock's customer relationships are built on a foundation of dedicated account management and clearly defined service-level agreements (SLAs). These elements ensure personalized service, operational transparency, and a commitment to reliability, as evidenced by their 99.99% operational uptime in 2023. Proactive technical consultation further solidifies these partnerships, with value-added services contributing to strong customer retention in 2024.

Regular performance reviews and a focus on rapid emergency response are integral to maintaining high customer satisfaction and trust. Archrock's 95% customer retention rate in 2023 reflects the success of these relationship-building strategies, which include adapting services based on client feedback and ensuring operational efficiency.

| Relationship Aspect | Key Action | Impact/Data Point |

|---|---|---|

| Account Management | Dedicated professionals offering personalized service | Deep understanding of client needs, fostering trust |

| Service Agreements | Robust Service-Level Agreements (SLAs) | 99.99% operational uptime in 2023; clear performance expectations |

| Value-Added Services | Proactive technical consultation | Helps clients optimize equipment efficiency; strong customer retention in 2024 |

| Feedback & Adaptation | Regular performance reviews and service adaptation | 95% customer retention in 2023; 15% increase in positive feedback scores (2023) |

| Emergency Response | Rapid response to unforeseen issues | Minimizes customer downtime, enhances reliability |

Channels

Archrock's direct sales force is the backbone of its customer acquisition strategy, focusing on building relationships with large oil and gas producers and midstream operators. This direct engagement facilitates the creation of tailored solutions and the negotiation of substantial, multi-year service agreements, which are crucial for securing high-value contracts.

In 2024, Archrock continued to leverage this direct channel, which is instrumental in understanding the complex operational needs of its key clients. This approach allows for a deeper dive into customer requirements, leading to the development of customized compression solutions that drive significant revenue. The company's ability to secure long-term contracts through these dedicated teams underscores the effectiveness of this business development model.

Archrock's corporate website functions as a crucial digital storefront and information nexus, offering detailed insights into its natural gas compression services and infrastructure. This platform is designed to engage potential customers, investors, and industry partners, showcasing the company's extensive fleet and operational expertise.

In 2024, Archrock continued to leverage its digital presence to communicate its value proposition, highlighting its role in the energy transition and its commitment to reliable service delivery. The website provides access to financial reports, sustainability initiatives, and operational updates, reinforcing transparency and accessibility for all stakeholders.

Archrock actively participates in key oil and gas industry conferences and trade shows, such as the Offshore Technology Conference (OTC) and the American Petroleum Institute (API) events. These gatherings are vital for demonstrating their advanced compression solutions and fostering relationships with potential customers in the midstream sector. In 2024, Archrock's presence at these events aims to highlight their commitment to innovation and operational efficiency.

Strategic Acquisition Integration

Strategic acquisition integration is a crucial channel for Archrock, enabling rapid growth and market penetration. Recent acquisitions, such as the purchase of NGCS and TOPS, exemplify this strategy by immediately expanding Archrock's customer base and geographic footprint.

Integrating these acquired companies brings new clients and operational territories under the Archrock umbrella, providing direct access to new market segments and reinforcing its position in the midstream sector. For instance, the acquisition of NGCS in 2023 added approximately 1.5 billion cubic feet per day of natural gas processing capacity and expanded Archrock’s presence in key basins.

These integrations are not just about adding capacity; they are about synergizing operations and cross-selling services to a broader client base. This strategic channel allows Archrock to leverage its existing infrastructure and expertise more effectively across a wider operational landscape.

- Expansion of Customer Base: Acquisitions directly onboard new clients from acquired entities.

- Geographic Reach: Entry into new operational territories and basins through strategic purchases.

- Market Segment Access: Direct engagement with previously untapped customer segments and industries.

- Synergistic Opportunities: Integration allows for operational efficiencies and cross-selling of services.

Existing Customer Referrals and Reputation

Archrock's strong reputation for dependable service cultivates lasting relationships with its existing customer base, which in turn drives valuable referrals. This positive industry standing and word-of-mouth marketing are crucial, organic avenues for securing new business within the competitive energy infrastructure landscape.

In 2024, Archrock continued to benefit from this organic growth. The company reported that a significant portion of its new contract wins were influenced by existing customer relationships and positive industry feedback, underscoring the power of their established reputation.

- Reputation as a Key Driver: Archrock's commitment to reliability and customer satisfaction fosters a strong brand image.

- Referral Network: Positive experiences from existing clients translate into direct referrals, reducing customer acquisition costs.

- Industry Standing: A solid reputation in the midstream energy sector attracts new partners and clients seeking dependable service providers.

- Organic Growth: Word-of-mouth marketing and a strong industry presence are vital for sustained, cost-effective expansion.

Archrock utilizes a multi-faceted channel strategy to reach its target audience. The direct sales force is paramount for securing large, long-term contracts with major oil and gas producers. Complementing this, the corporate website serves as an essential digital hub for information dissemination and engagement with a broader stakeholder group.

Industry events are crucial for showcasing technological advancements and building relationships, while strategic acquisitions offer a rapid path to expanding customer bases and geographic reach. Finally, Archrock's strong reputation for dependable service fosters organic growth through customer referrals and positive word-of-mouth marketing.

| Channel | Description | 2024 Focus/Impact |

|---|---|---|

| Direct Sales Force | Relationship building with large producers and midstream operators. | Securing tailored solutions and multi-year service agreements. |

| Corporate Website | Digital storefront for services, financial reports, and sustainability initiatives. | Communicating value proposition and enhancing transparency. |

| Industry Events | Trade shows and conferences for showcasing solutions and networking. | Highlighting innovation and operational efficiency. |

| Strategic Acquisitions | Integrating acquired companies to expand customer base and footprint. | Expanding into new basins and customer segments. |

| Customer Referrals/Reputation | Organic growth driven by dependable service and positive industry standing. | Leveraging existing relationships for new contract wins. |

Customer Segments

Large integrated and independent oil and gas producers are Archrock's core customer base. These entities rely on Archrock's contract compression services to efficiently gather natural gas directly from wellheads, boost production volumes, and ensure the gas meets pipeline specifications for transportation. In 2024, the Permian Basin, a key focus area for Archrock, continued to be a significant driver of natural gas production, with associated gas volumes playing a crucial role.

Midstream natural gas companies, the operators of gathering systems, processing plants, and transmission pipelines, are a core customer group for Archrock. These companies depend on Archrock's compression services to ensure efficient gas movement, maintain crucial pipeline pressure, and support their processing operations. Archrock's strategic emphasis on large horsepower units directly addresses the high-volume needs of these midstream players.

Industrial end-users, particularly large facilities relying on natural gas for power generation or manufacturing processes, represent a key customer segment for Archrock. These high-demand users often require specialized on-site compression solutions to meet their specific operational needs.

For instance, power plants that use natural gas as a primary fuel source depend on reliable compression for efficient energy production. Similarly, manufacturing plants with unique energy requirements can benefit from Archrock's tailored compression services, ensuring consistent and optimized operations.

Natural Gas Utilities and Local Distribution Companies (LDCs)

Natural gas utilities and Local Distribution Companies (LDCs) represent a crucial, albeit less direct, customer segment for Archrock. These entities often need compression services to maintain or increase pressure within their extensive distribution networks, ensuring reliable gas delivery to end-users. For instance, LDCs might require compression for specific storage and withdrawal operations, particularly to manage seasonal demand fluctuations. Archrock's expertise in providing compression solutions can significantly bolster the integrity and operational efficiency of their vital gas delivery infrastructure.

In 2024, the demand for natural gas by LDCs remained robust, driven by residential, commercial, and industrial consumption. Archrock's ability to offer flexible and reliable compression assets allows LDCs to optimize their operations, especially during peak demand periods. This support is critical for maintaining service quality and meeting regulatory requirements related to gas pressure and delivery. The company's fleet of contract compression units is well-positioned to serve the ongoing needs of this segment.

- Infrastructure Support: Archrock provides compression to maintain pressure in LDC distribution systems, ensuring consistent gas flow.

- Storage and Withdrawal: Compression is vital for LDCs managing natural gas storage facilities, optimizing injection and withdrawal rates.

- Operational Efficiency: Archrock's services enhance the reliability and efficiency of LDC gas delivery networks.

- Market Demand: The consistent demand from LDCs for natural gas underscores the need for dependable compression solutions.

Companies Requiring Electric Motor Drive Compression

Archrock focuses on energy companies that need electric motor drive compression, driven by a growing industry emphasis on reducing emissions and improving operational reliability. This segment actively seeks out more environmentally sound and efficient compression technologies.

These customers are often looking to upgrade their existing infrastructure to meet stricter environmental regulations and improve overall efficiency. For instance, in 2024, the demand for cleaner energy solutions has accelerated, pushing many operators to invest in electric-powered equipment.

- Environmental Compliance: Companies facing increasing pressure to reduce greenhouse gas emissions are prioritizing electric compression over traditional combustion engines.

- Operational Efficiency: Electric drives offer higher efficiency and lower maintenance requirements, leading to reduced operating costs for these customers.

- Reliability and Uptime: The inherent reliability of electric motors translates to fewer unplanned outages, a critical factor for customers in the energy sector.

- Technological Advancement: This segment represents forward-thinking energy companies willing to adopt advanced technologies for competitive advantage and sustainability.

Archrock's customer base primarily consists of large oil and gas producers, both integrated and independent, who utilize contract compression for gas gathering and processing. Midstream companies, crucial for pipeline operations, also form a core segment, relying on Archrock for maintaining gas pressure and facilitating efficient movement. Industrial users, such as power plants and manufacturing facilities with high energy demands, represent another key group seeking specialized, on-site compression solutions.

Natural gas utilities and Local Distribution Companies (LDCs) are important, though less direct, customers. They employ compression to manage pressure within their distribution networks and for storage operations, ensuring reliable delivery to end-users. In 2024, robust demand from LDCs for residential, commercial, and industrial consumption highlighted the ongoing need for Archrock's services to optimize operations during peak periods.

Furthermore, Archrock targets energy companies prioritizing electric motor drive compression. This segment is driven by a strong industry push towards emission reduction and enhanced operational reliability, with many seeking to upgrade infrastructure to meet stricter environmental regulations and improve efficiency. The demand for cleaner energy solutions in 2024 accelerated this trend, leading to increased investment in electric-powered equipment.

| Customer Segment | Key Needs | 2024 Relevance |

| Large Oil & Gas Producers | Wellhead gathering, production boost, pipeline specs | Permian Basin production significant driver |

| Midstream Companies | Pipeline pressure, efficient gas movement, processing support | High horsepower units for high-volume needs |

| Industrial End-Users | On-site compression for power generation, manufacturing | Reliable energy for power plants, optimized manufacturing |

| Natural Gas Utilities/LDCs | Distribution network pressure, storage operations | Robust demand from consumption, optimizing peak periods |

| Electric Motor Drive Seekers | Emission reduction, operational reliability, efficiency | Accelerated demand for cleaner solutions in 2024 |

Cost Structure

The most substantial cost for Archrock revolves around capital expenditures for new natural gas compression units, coupled with the depreciation of its existing fleet. This represents a consistent outlay to both sustain and grow its operational horsepower.

Archrock is projecting a minimum of $250 million in growth capital expenditures for 2026, highlighting the ongoing investment required to expand its fleet and meet market demand.

Operations and maintenance expenses are a significant component of Archrock's cost structure, encompassing the daily running, upkeep, and major servicing of its extensive compression fleet. These costs directly reflect the intensive, mechanical demands of the equipment, which often operates continuously in the field.

Key expenditures within this category include the procurement of replacement parts, specialized repair services, and the wages for skilled field service technicians. For instance, in the first quarter of 2024, Archrock reported that its total operating expenses, which include O&M, were $504 million, highlighting the substantial investment required to keep its assets in optimal working condition.

Archrock's personnel costs are a significant component of its expenses, encompassing salaries, wages, benefits, and training for its extensive workforce. This includes highly skilled technicians and engineers essential for maintaining and operating their natural gas compression infrastructure, as well as administrative staff supporting these operations.

In 2024, Archrock's total employee compensation and benefits expenses were a substantial outlay, reflecting the critical role human capital plays in delivering their compression services and ensuring the reliability of their extensive asset base. For instance, their commitment to developing this skilled workforce through ongoing training directly impacts their service quality and operational efficiency.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses represent the overhead costs crucial for Archrock's operations. These include vital functions like corporate management, sales and marketing efforts, essential administrative support, and the underlying information technology infrastructure that keeps everything running smoothly. These costs are fundamental to supporting the company's overall business functions and driving its strategic growth initiatives forward.

In 2024, Archrock experienced an increase in its SG&A expenses. This rise was primarily attributed to higher incentive compensation payouts. For instance, Archrock reported that its SG&A expenses for the full year 2024 were approximately $310 million, an increase from $285 million in 2023.

- Corporate Management: Costs associated with executive leadership and strategic decision-making.

- Sales and Marketing: Expenses incurred to promote Archrock's services and acquire new customers.

- Administrative Support: Costs for human resources, finance, legal, and other back-office functions.

- Information Technology: Investments in systems and infrastructure to support business operations.

Debt Service and Financing Costs

Archrock's capital-intensive nature means debt service and financing costs are a major expense. As of June 30, 2025, the company carried $2.6 billion in long-term debt, necessitating substantial interest payments. Effectively managing these financing obligations is paramount for maintaining the company's financial stability and profitability.

- Long-Term Debt: $2.6 billion as of June 30, 2025.

- Interest Expense: Significant portion of operating costs due to debt servicing.

- Financial Health: Direct impact on profitability and cash flow.

- Cost Management: Crucial for maintaining competitive pricing and investor confidence.

Archrock's cost structure is dominated by capital expenditures for new compression units and depreciation of its existing fleet, representing significant ongoing investment. Operations and maintenance, including parts and skilled labor, are critical for keeping its mechanical assets running. Personnel costs, covering a broad range of skilled and administrative staff, are also a substantial outlay, directly impacting service delivery and operational efficiency.

Selling, General, and Administrative (SG&A) expenses, covering management, sales, and IT, are essential overheads. In 2024, SG&A reached approximately $310 million, up from $285 million in 2023, largely due to higher incentive compensation. Debt servicing is another major cost, with $2.6 billion in long-term debt as of June 30, 2025, requiring significant interest payments.

| Cost Category | 2024/2025 Data Point | Significance |

| Capital Expenditures (Growth) | Projected minimum $250 million for 2026 | Sustaining and expanding operational capacity |

| Operations & Maintenance (Q1 2024) | Total Operating Expenses: $504 million | Ensuring asset reliability and performance |

| SG&A Expenses | Approx. $310 million (2024) | Supporting business functions and growth initiatives |

| Long-Term Debt (June 30, 2025) | $2.6 billion | Impacts profitability through interest payments |

Revenue Streams

Contract compression services represent Archrock's core revenue driver, stemming from agreements to provide essential natural gas compression for customers. This revenue is largely recurring, calculated based on factors like horsepower deployed and contract terms. For instance, in the second quarter of 2025, this segment brought in a significant $318.3 million.

Aftermarket services represent a crucial revenue stream for Archrock, focusing on maintenance, repair, and parts sales for their owned compression equipment. This segment offers ongoing support to their contract compression customers, ensuring operational efficiency and longevity of the assets. In Q2 2025, this vital service generated $64.8 million in revenue.

Archrock generates income through the direct sale of new and used natural gas compression equipment. This revenue stream, while not their main business, serves customers who wish to purchase and own their compression assets outright.

Sale of Non-Strategic Assets

Archrock can generate revenue by selling assets that no longer align with its core business strategy or are underperforming. This allows the company to reallocate capital towards more profitable ventures and improve overall efficiency.

A recent example of this strategy in action occurred in the second quarter of 2025, when Archrock successfully divested 155 compressors to Flowco for a sum of $71.0 million. This transaction highlights the company's ability to monetize non-core assets effectively.

- Asset Monetization: Archrock generates income by selling compression and other equipment that is not central to its primary operations.

- Strategic Divestitures: This revenue stream involves the disposal of assets deemed inefficient or no longer strategically important.

- Capital Reallocation: Proceeds from these sales can be reinvested in core business growth or other strategic initiatives.

- Q2 2025 Transaction: Archrock sold 155 compressors to Flowco for $71.0 million, demonstrating a concrete instance of this revenue generation method.

Performance-Based Contract Incentives

Archrock's revenue streams can include performance-based contract incentives, where they earn extra income by hitting specific operational goals. For example, exceeding uptime guarantees or achieving efficiency improvements can trigger these bonuses.

This structure directly links Archrock's financial success to the success of their customers. In 2024, such performance incentives are becoming increasingly important as clients demand more tangible value and operational excellence from their service providers.

- Performance Incentives: Additional revenue tied to exceeding operational targets like uptime.

- Customer Alignment: Financial rewards directly correlate with customer success and satisfaction.

- Value-Driven Contracts: Reflects a shift towards contracts where service providers are rewarded for demonstrable results.

Archrock's revenue is primarily driven by contract compression services, generating $318.3 million in Q2 2025. Complementing this are aftermarket services, which brought in $64.8 million in the same quarter, encompassing maintenance and repair. The company also generates income from equipment sales, both new and used, and through strategic asset divestitures, such as the $71.0 million sale of 155 compressors to Flowco in Q2 2025.

| Revenue Stream | Q2 2025 Revenue (Millions USD) | Description |

|---|---|---|

| Contract Compression Services | 318.3 | Core business providing natural gas compression under contract. |

| Aftermarket Services | 64.8 | Maintenance, repair, and parts for compression equipment. |

| Equipment Sales | N/A* | Direct sale of new and used compression assets. |

| Asset Divestitures | 71.0 | Sale of non-core or underperforming assets (e.g., 155 compressors to Flowco). |

*Specific revenue figures for equipment sales were not provided in the source data for Q2 2025.

Business Model Canvas Data Sources

The Archrock Business Model Canvas is constructed using a blend of financial disclosures, industry-specific market research, and internal operational data. These sources provide a robust foundation for understanding Archrock's strategic positioning and revenue generation.