Archrock Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Archrock Bundle

Archrock's competitive landscape is shaped by powerful forces, including the bargaining power of its customers and the threat of substitute services. Understanding these dynamics is crucial for strategic planning and identifying potential risks and opportunities.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Archrock’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for Archrock is significantly influenced by supplier concentration and specialization. For instance, a limited number of manufacturers producing critical components like large natural gas engines or specialized compressor parts can exert considerable influence. If Archrock relies on a few dominant suppliers, these entities can dictate higher prices or less favorable contract terms, impacting Archrock's operational costs.

Archrock's dependence on specific Original Equipment Manufacturers (OEMs) for essential equipment and replacement parts further amplifies this supplier power. In 2023, Archrock's capital expenditures for new compression units and upgrades amounted to approximately $700 million, highlighting the substantial investment in supplier-provided capital goods. A concentrated supplier base in these areas means fewer alternatives, giving those suppliers greater leverage in negotiations.

Switching costs for Archrock can significantly influence supplier bargaining power. If Archrock faces substantial expenses related to retooling, retraining, or re-certifying equipment and personnel when changing suppliers, its ability to negotiate favorable terms with existing suppliers is diminished. This is especially relevant for specialized or proprietary components where alternatives may be scarce or require extensive integration efforts.

Suppliers providing highly differentiated or proprietary technologies, like sophisticated compression control systems, hold significant leverage. Archrock's reliance on such unique inputs, which are difficult to substitute, allows these suppliers to dictate higher prices. Innovations in compressor design directly contribute to this input uniqueness.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Archrock's natural gas compression services market significantly bolsters their bargaining power. If equipment manufacturers, particularly those providing specialized components, also offer their own service contracts, they directly enter into competition with Archrock.

This forward integration capability means suppliers can capture the entire value chain, from manufacturing to ongoing service, potentially leveraging their existing customer relationships and technical expertise. For instance, a major compressor manufacturer with a robust service division could offer bundled packages that undercut Archrock's standalone service offerings.

- Supplier Forward Integration: Suppliers moving into Archrock's service market enhances their leverage.

- Competitive Landscape Shift: Equipment suppliers offering services directly challenge Archrock's core business.

- Value Chain Control: Suppliers integrating forward gain control over both product and service revenue streams.

Importance of Archrock to the Supplier's Business

The significance of Archrock's business to a supplier's overall revenue directly influences that supplier's bargaining power. If Archrock represents a substantial portion of a supplier's sales, the supplier is likely to be more accommodating with pricing and terms to retain this key client.

Conversely, if Archrock's purchases constitute a minor fraction of a supplier's total business, the supplier holds greater leverage. This dynamic is frequently shaped by the relative scale and market share of both Archrock and its individual suppliers.

For instance, in 2024, Archrock's substantial demand for natural gas compression services means that for many specialized equipment manufacturers or service providers, Archrock is a critical revenue stream. This dependence can temper a supplier's ability to dictate unfavorable terms.

- Archrock's Revenue Contribution: A supplier's reliance on Archrock for a significant percentage of its income grants Archrock more negotiation leverage.

- Supplier Market Share: If Archrock sources from suppliers with limited market reach, those suppliers have less power.

- Customer Concentration: For suppliers heavily concentrated on Archrock, maintaining the relationship often means offering competitive pricing.

The bargaining power of suppliers for Archrock is influenced by the concentration of specialized equipment manufacturers. For example, a limited number of companies producing critical components like large natural gas engines can exert considerable influence if Archrock relies heavily on them. In 2023, Archrock's capital expenditures for new compression units and upgrades were approximately $700 million, underscoring the importance of these supplier relationships.

Archrock's dependence on specific Original Equipment Manufacturers (OEMs) for essential equipment and replacement parts further amplifies supplier power. If Archrock faces substantial costs when switching suppliers, such as retooling or retraining, its negotiation leverage with existing suppliers is reduced. This is particularly true for proprietary components where alternatives are scarce.

Suppliers who provide highly differentiated or proprietary technologies, like advanced compression control systems, hold significant leverage. Archrock's reliance on these unique inputs, which are difficult to substitute, allows these suppliers to command higher prices. Innovations in compressor design directly contribute to this uniqueness.

| Factor | Impact on Archrock | Example/Data Point |

|---|---|---|

| Supplier Concentration | High if few suppliers for critical components | Reliance on specific OEMs for large natural gas engines |

| Switching Costs | Increases supplier power if high | Costs associated with retooling for new equipment suppliers |

| Product Differentiation | High for proprietary technologies | Advanced compression control systems |

What is included in the product

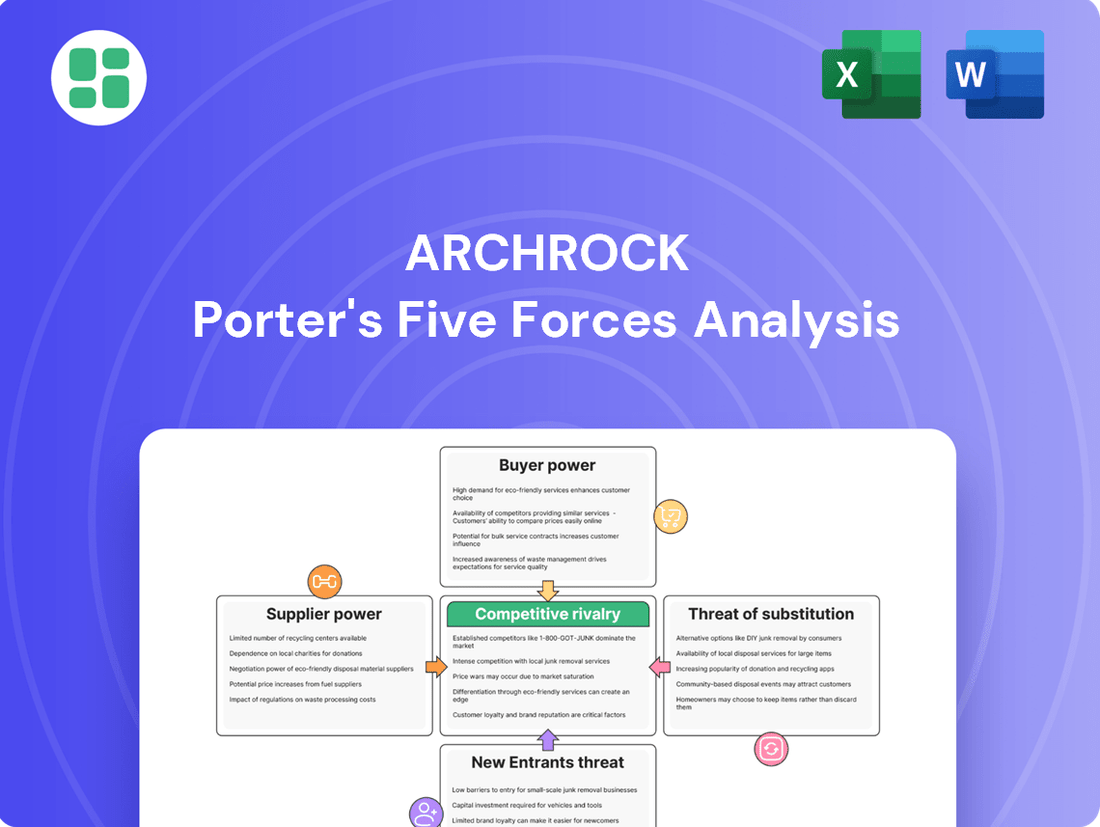

This analysis unpacks the competitive forces shaping Archrock's industry, examining rivalry, new entrants, buyer power, supplier leverage, and the threat of substitutes.

Instantly identify and address competitive threats with a visual breakdown of industry rivalry, buyer power, supplier power, new entrants, and substitutes.

Customers Bargaining Power

Archrock's customer base, largely composed of oil and gas producers, exhibits varying degrees of concentration. When a few major clients represent a substantial portion of Archrock's revenue, these large customers gain significant leverage. This concentrated power allows them to negotiate more favorable pricing and service agreements, potentially impacting Archrock's profitability.

The sheer volume of compression services a single customer utilizes directly influences their bargaining strength. For instance, if a major exploration and production company requires extensive compression capacity, their substantial commitment gives them more sway in discussions with Archrock. In 2023, Archrock's top ten customers represented approximately 50% of its revenue, highlighting the importance of managing relationships with these key accounts.

The costs and complexities an oil and gas company faces when switching from Archrock to a different compression service provider directly impact customer bargaining power. If switching involves significant investment in new equipment, extensive retraining, or potential disruptions to ongoing operations, customers have less leverage.

For example, if a customer needs to integrate entirely new compression units or reconfigure their existing infrastructure to accommodate a new provider, these high switching costs effectively diminish their ability to demand lower prices or better terms from Archrock. This inertia benefits Archrock by locking in existing business.

Conversely, if Archrock's services, or components of them, are modular and easily interchangeable, the switching costs for customers are reduced. This ease of transition would then empower customers, giving them more leverage to negotiate favorable contracts or seek out competitive offers, potentially impacting Archrock's pricing power.

Customers' ability to handle natural gas compression themselves or easily switch to other providers significantly boosts their negotiating strength. If a customer possesses their own compression equipment or has many other service providers to choose from, they can push Archrock for better prices and contract conditions. Archrock's broad suite of services is designed to lessen this customer leverage.

Price Sensitivity of Customers

Archrock's customers, particularly those in the natural gas sector, exhibit significant price sensitivity. This sensitivity is directly linked to the volatile nature of natural gas prices and broader economic conditions within the energy industry. When natural gas prices decline, customers are more likely to scrutinize their operating costs, including compression services, seeking ways to improve their own profitability. This can lead them to negotiate harder for lower rates, thereby increasing their bargaining power.

For instance, during periods of depressed natural gas prices, such as those seen in early 2024, the demand for cost-effective solutions becomes paramount for producers. Archrock's ability to offer competitive pricing becomes a critical factor in retaining these customers. The company's revenue is therefore influenced by its capacity to manage costs and maintain pricing that aligns with market expectations, especially when competitors might offer similar services at a lower price point.

- Price Sensitivity Drivers: Fluctuations in natural gas prices and overall energy sector economic health directly impact customer willingness to pay for compression services.

- Impact on Negotiation: Lower natural gas prices empower customers to demand reduced compression service fees to safeguard their margins.

- Competitive Landscape: Archrock must remain competitive on pricing, especially when alternative service providers exist, to counter customer bargaining power.

Information Availability and Transparency

Customers who can easily compare Archrock's pricing and service quality against competitors are in a stronger position to negotiate. This increased transparency, fueled by readily available industry data and competitive intelligence, allows clients to make informed choices and push for more favorable terms.

For instance, in the energy infrastructure sector where Archrock operates, readily accessible data on compressor station utilization rates and contract terms from various providers can significantly shift bargaining power. In 2024, reports indicated that transparency in energy service contracts is increasing, with clients actively seeking detailed performance metrics and cost breakdowns before committing to long-term agreements.

- Informed Negotiation: Customers armed with data on market pricing and service benchmarks can effectively challenge Archrock's proposals.

- Demand for Value: Increased transparency directly correlates with customer demands for better pricing and superior service quality.

- Competitive Benchmarking: Access to competitor analysis allows customers to understand the prevailing market rates and service standards.

Archrock's customers, primarily oil and gas producers, possess significant bargaining power due to factors like customer concentration and price sensitivity. When a few large clients account for a substantial portion of revenue, they can negotiate better terms. For example, Archrock's top ten customers represented about 50% of its revenue in 2023, underscoring their influence.

The ease with which customers can switch providers also plays a crucial role. High switching costs, involving new equipment or operational disruptions, reduce customer leverage. Conversely, modular services or readily available alternatives empower customers to demand lower prices, especially during periods of low natural gas prices, as seen in early 2024. Increased market transparency in 2024 further equips customers to benchmark services and negotiate more effectively.

| Key Customer Bargaining Power Factors | Impact on Archrock | Relevant Data/Context |

| Customer Concentration | High leverage for large clients | Top 10 customers = ~50% of revenue (2023) |

| Switching Costs | Low switching costs increase power | Modular services reduce inertia |

| Price Sensitivity | Heightened during low commodity prices | Early 2024 saw increased cost scrutiny |

| Market Transparency | Enables better negotiation | Increased data availability in 2024 |

Full Version Awaits

Archrock Porter's Five Forces Analysis

This preview showcases the complete Archrock Porter's Five Forces Analysis, exactly as you will receive it upon purchase. You're viewing the professionally researched and formatted document, providing a comprehensive overview of the competitive landscape. This means you get immediate access to the full, ready-to-use analysis without any alterations or placeholders.

Rivalry Among Competitors

The natural gas compression services market is characterized by a notable number of competitors, including significant players like USA Compression Partners and Kodiak Gas Services. This presence of multiple key entities directly fuels competitive rivalry.

The diversity among these competitors, in terms of their operational scale, strategic objectives, and geographic footprint, further intensifies the competitive landscape. Archrock, while a leader, navigates this environment against a backdrop of robust rivals.

A slower growth rate in the natural gas compression services sector, which saw a projected 3.5% CAGR from 2023 to 2028 according to Mordor Intelligence, naturally fuels more intense competition. When the pie isn't expanding rapidly, companies like Archrock must fight harder for every slice of existing business, leading to increased price pressure and a focus on market share acquisition.

However, the broader natural gas market presents a more optimistic picture, with the U.S. Energy Information Administration forecasting a 2.9% increase in total U.S. natural gas consumption for 2024. This robust demand, particularly from liquefied natural gas (LNG) exports and its role in power generation, can act as a buffer against intense rivalry by ensuring a larger overall market for compression services, potentially easing competitive strains.

Archrock's ability to differentiate its natural gas compression solutions is a key factor in managing competitive rivalry. By offering advanced technology, superior maintenance, and specialized services, Archrock can move beyond purely price-based competition. This differentiation strategy allows them to command premium pricing and foster greater customer loyalty.

Archrock's strategic focus on high-horsepower and advanced technology assets directly supports this differentiation. In 2023, Archrock reported that approximately 80% of its fleet consisted of high-horsepower units, demonstrating a commitment to technologically superior equipment that can offer greater efficiency and performance for customers.

Exit Barriers

Archrock faces significant competitive rivalry due to high exit barriers. The company's substantial investments in compression fleets and specialized infrastructure represent fixed assets that are difficult and costly to divest. This often compels even unprofitable firms to remain operational to recoup their capital expenditures, thereby exacerbating market overcapacity and intensifying price competition.

These high exit barriers can lead to prolonged periods of intense rivalry. For instance, if a competitor is unable to sell off its assets easily, it may continue to operate at reduced margins to cover its operating costs, putting downward pressure on industry profitability. This dynamic can make it challenging for well-performing companies like Archrock to gain significant market share or improve margins.

- High Capital Intensity: Archrock's business relies on owning and maintaining a large fleet of natural gas compression units, a significant capital investment.

- Specialized Infrastructure: The infrastructure required for natural gas compression is highly specialized, limiting alternative uses and making it difficult to repurpose or sell quickly.

- Operational Continuity: Companies may prioritize continued operation, even at low profitability, to avoid substantial write-downs on their fixed assets.

- Market Overcapacity: The inability to exit the market easily can lead to an oversupply of compression services, suppressing pricing power for all players.

Capacity Utilization and Overcapacity

Periods of overcapacity in the natural gas compression market often trigger intense price competition as firms strive to maintain operational efficiency. This can significantly erode profit margins for all players involved.

Archrock's recent performance highlights a more positive scenario. For instance, in the first quarter of 2024, Archrock reported a fleet utilization rate of approximately 89.8%, a figure that suggests a healthy demand for their services and a more balanced market. This high utilization rate helps to mitigate the pressure of aggressive pricing tactics.

- High Fleet Utilization: Archrock's fleet utilization rate hovered around 89.8% in Q1 2024, indicating strong demand and a favorable supply-demand dynamic.

- Reduced Pricing Pressure: When utilization is high, companies are less compelled to engage in price wars to secure business, thus supporting profitability.

- Market Balance: A balanced market, characterized by high utilization, generally leads to less intense rivalry among compression service providers.

Competitive rivalry within the natural gas compression services sector is substantial, driven by the presence of numerous key players like USA Compression Partners and Kodiak Gas Services. Archrock operates in an environment where competitors vary significantly in scale and strategy, and the market's growth rate, projected at 3.5% CAGR from 2023 to 2028, intensifies this competition.

High exit barriers, stemming from significant capital investments in specialized fleets and infrastructure, compel companies to remain operational even when unprofitable, leading to market overcapacity and price wars. Archrock's strategy of differentiating through advanced technology and high-horsepower units, with approximately 80% of its fleet in 2023 being high-horsepower, helps mitigate this pressure.

Despite intense rivalry, Archrock's high fleet utilization rate, around 89.8% in Q1 2024, indicates strong demand and a more balanced market, which in turn reduces pricing pressure and supports profitability.

| Metric | Archrock (Q1 2024) | Industry Trend (2023-2028) |

|---|---|---|

| Fleet Utilization | ~89.8% | N/A |

| High-Horsepower Fleet % | ~80% (2023) | N/A |

| Market Growth (CAGR) | N/A | ~3.5% |

SSubstitutes Threaten

The primary threat of substitutes for Archrock's natural gas compression services stems from the growing adoption of alternative energy sources. As the world increasingly transitions towards renewables like solar and wind power, the demand for natural gas, and consequently the need for its transportation and compression, could diminish. This shift is driven by environmental concerns and falling renewable energy costs.

While natural gas is often viewed as a bridge fuel in this energy transition, its long-term role is uncertain. Technological advancements in energy storage and grid modernization are making renewables more reliable and cost-competitive, potentially accelerating the displacement of natural gas. For instance, by 2023, renewable energy sources accounted for over 20% of the US electricity generation, a figure expected to climb significantly in the coming years.

Technological advancements in how natural gas is moved could eventually reduce the need for traditional compression services, posing a threat of substitutes. While not expected to completely replace existing pipeline infrastructure, innovations such as improved pipeline designs or more localized gas processing capabilities might lessen the demand for compression. For example, advancements in distributed compression units could allow for more modular and potentially less capital-intensive solutions, impacting the market for larger, centralized compression stations.

Improvements in how efficiently natural gas is used in things like industrial processes or home heating can really cut down on how much gas is needed overall. This directly affects the demand for services like compression, which are crucial for moving that gas. For instance, advancements in combined heat and power (CHP) systems, which generate both electricity and useful heat from natural gas, can significantly boost energy efficiency. In 2023, the U.S. Energy Information Administration (EIA) reported that industrial sector energy intensity, a measure of energy consumed per unit of output, continued its long-term decline, signaling more efficient operations.

Hydrogen Economy Development

The long-term development of a hydrogen economy, where hydrogen gradually replaces natural gas as a primary fuel source, poses a significant threat of substitution for Archrock's core business. While this transition is still in its early stages, it represents a fundamental shift in energy infrastructure.

Although Archrock might explore retrofitting existing natural gas compressors to handle hydrogen blending, a complete transition to a hydrogen-only economy would necessitate substantial technological adaptation and investment, potentially disrupting current operational models and revenue streams.

- Hydrogen as a Substitute Fuel: The global push for decarbonization is driving significant investment in hydrogen production and infrastructure.

- Retrofitting Potential: While some existing infrastructure may be adaptable for hydrogen blending, full conversion presents considerable technical and economic hurdles.

- Market Disruption: A widespread shift to hydrogen could diminish demand for natural gas compression services, impacting Archrock's market position.

- Investment in Alternatives: Continued growth in renewable energy sources and electric vehicle adoption also represents indirect substitution threats to the natural gas value chain.

Regulatory Shifts Favoring Alternatives

Government policies and regulations are increasingly tilting the scales in favor of alternative energy sources, potentially accelerating the shift away from natural gas. For instance, in 2024, many nations continued to implement or expand subsidies for renewable energy projects, making them more competitive. This regulatory environment can directly impact the demand for natural gas infrastructure, including the need for compression services that Archrock provides.

These shifts can lead to reduced investment in traditional natural gas infrastructure as capital flows towards cleaner alternatives. The growing emphasis on Environmental, Social, and Governance (ESG) principles by investors and corporations further amplifies this trend. By 2024, ESG considerations became a significant factor in investment decisions across the energy sector, pushing companies to divest from or reduce exposure to fossil fuels.

- Government Subsidies for Renewables: Many countries in 2024 offered enhanced tax credits and direct subsidies for solar, wind, and other renewable energy installations, making them economically more attractive than natural gas.

- Carbon Pricing Mechanisms: The expansion of carbon taxes or cap-and-trade systems in various regions in 2024 increased the operational cost of natural gas, thereby improving the relative cost-competitiveness of substitutes.

- ESG Investment Mandates: A significant portion of global assets under management in 2024 were subject to ESG mandates, leading asset managers to favor companies with lower carbon footprints and potentially reduce investments in natural gas infrastructure.

The threat of substitutes for Archrock's services is significant, primarily driven by the global energy transition towards cleaner alternatives. As renewable energy sources become more cost-effective and government policies favor decarbonization, the demand for natural gas, and consequently compression services, could decline.

Hydrogen is emerging as a key substitute fuel, potentially requiring different infrastructure and impacting the need for traditional natural gas compression. While retrofitting existing equipment is a possibility, a full transition to hydrogen presents considerable technical and economic challenges for companies like Archrock.

Increased energy efficiency in natural gas utilization and the broader adoption of renewable energy sources also serve as indirect substitutes. By 2024, investments in renewables continued to grow, and energy efficiency measures were increasingly implemented across industries, both of which can reduce the overall demand for natural gas.

| Substitute | Impact on Natural Gas Demand | 2024 Trend/Data Point |

|---|---|---|

| Renewable Energy Sources | Reduces reliance on natural gas for electricity generation | Renewables accounted for over 20% of US electricity generation in 2023, with continued growth projected for 2024. |

| Hydrogen Economy | Potential long-term replacement for natural gas as a fuel | Significant global investment in hydrogen infrastructure and production continued in 2024. |

| Energy Efficiency Improvements | Decreases the total amount of natural gas needed | US industrial sector energy intensity continued its long-term decline in 2023, signaling more efficient operations. |

Entrants Threaten

The natural gas compression sector demands significant upfront capital, with substantial investments needed for compression units, pipelines, and maintenance depots. For instance, acquiring a new, large-scale natural gas compressor can cost upwards of $1 million, and building out a competitive fleet requires hundreds of millions, if not billions, of dollars.

This high capital barrier acts as a formidable deterrent to new entrants. It's not just about buying equipment; it also involves establishing operational infrastructure and a skilled workforce, making it incredibly challenging for newcomers to compete with established players who already possess these assets and capabilities.

Established players like Archrock enjoy significant advantages from economies of scale. This means they can buy equipment and manage operations more cheaply per unit than a newcomer. For instance, Archrock’s large fleet allows for bulk purchasing of compressors and parts, driving down costs.

Furthermore, the experience curve plays a crucial role. Archrock has years of expertise in operating and maintaining complex compression equipment, leading to greater efficiency and fewer costly breakdowns. This accumulated knowledge is difficult and expensive for new entrants to replicate quickly, creating a substantial barrier.

The natural gas industry faces substantial regulatory and environmental hurdles that deter new entrants. Navigating complex permitting processes and adhering to stringent environmental standards, such as those related to methane emissions and water usage for hydraulic fracturing, requires significant investment and specialized knowledge. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to refine regulations impacting natural gas operations, increasing compliance burdens.

These compliance costs, coupled with the necessity for in-house or contracted expertise in regulatory affairs, create a formidable barrier to entry. New companies must allocate considerable resources to understand and meet these requirements, which can delay or even halt market entry. The ongoing evolution of environmental policies means that potential entrants must also factor in future regulatory changes, adding another layer of uncertainty and cost.

Access to Distribution Channels and Customer Relationships

New companies entering the midstream sector, particularly those focused on natural gas compression services like Archrock, encounter significant hurdles in establishing themselves. A primary challenge is gaining access to crucial distribution channels and cultivating trusted relationships with established oil and gas producers. These producers often have long-standing partnerships with incumbent service providers, making it difficult for new entrants to secure contracts and integrate into existing supply chains.

Archrock's competitive advantage is significantly bolstered by its deep-seated customer relationships and its comprehensive network of assets. These established connections and infrastructure provide a substantial barrier to entry, as new competitors must invest heavily to replicate the level of trust and access that Archrock already possesses. For instance, in 2024, Archrock continued to leverage its extensive fleet of over 4,000 compression units, serving a broad base of customers across key North American basins.

- Established Trust: New entrants struggle to build the same level of credibility and reliability with major oil and gas companies that Archrock has cultivated over years of service.

- Infrastructure Access: Securing access to critical pipeline infrastructure and gathering systems, essential for efficient operations, is a major obstacle for newcomers.

- Customer Loyalty: Existing customers often exhibit loyalty to established providers like Archrock due to proven performance and integrated service offerings.

- Network Effects: Archrock's extensive network of compression assets and logistical capabilities creates a significant advantage that is costly and time-consuming for new players to match.

Proprietary Technology and Expertise

While not entirely proprietary, the specialized engineering, operational expertise, and advanced technology, such as predictive maintenance and AI integration, required for efficient natural gas compression present a significant hurdle for new entrants. Developing this in-house or acquiring the necessary capabilities is both costly and time-consuming, effectively acting as a barrier to entry. For instance, companies like Archrock invest heavily in R&D for optimizing compressor performance, a capital expenditure that new competitors must replicate.

The threat of new entrants in the natural gas compression sector is somewhat mitigated by the high capital requirements and specialized knowledge needed. However, potential new players might focus on niche markets or leverage emerging technologies to gain a foothold.

- High Capital Investment: Building or acquiring a fleet of natural gas compressors, along with the necessary infrastructure and maintenance facilities, demands substantial upfront capital. This can easily run into tens or hundreds of millions of dollars, making it difficult for smaller or less-funded entities to compete.

- Technical Expertise and Experience: Operating and maintaining complex compression equipment requires highly skilled engineers and technicians. This specialized knowledge is not easily transferable and takes years to cultivate, creating a barrier for new companies lacking this established expertise.

- Regulatory Compliance: The natural gas industry is heavily regulated, and new entrants must navigate a complex web of environmental, safety, and operational standards. Compliance requires significant investment in training, equipment, and processes, adding to the cost and complexity of market entry.

- Established Relationships: Existing players often have long-standing relationships with customers, suppliers, and regulatory bodies. These established networks can provide a competitive advantage in terms of securing contracts, accessing financing, and navigating the operational landscape.

The threat of new entrants in the natural gas compression sector is relatively low due to significant barriers. High capital expenditure, estimated in the hundreds of millions for a competitive fleet, alongside stringent regulatory compliance and the need for specialized technical expertise, deters most newcomers. Established players like Archrock benefit from economies of scale and deep-rooted customer relationships, further solidifying their market position.

In 2024, Archrock continued to demonstrate its market strength with a fleet of over 4,000 compression units, serving a diverse customer base across major North American basins. This scale allows for cost efficiencies in procurement and operations that are difficult for new entrants to match. Furthermore, the company's investment in advanced technologies and operational know-how, accumulated over years of experience, creates a substantial knowledge barrier.

The regulatory environment, with evolving standards from bodies like the EPA in 2024, adds complexity and cost for any new player attempting to enter the market. Navigating these requirements demands significant resources and specialized knowledge, which established firms already possess.

New entrants face challenges in securing essential infrastructure access and building the trust and loyalty that incumbents like Archrock have cultivated. These established networks and proven track records represent a significant hurdle for any company looking to break into the market.

| Barrier Type | Description | Estimated Impact on New Entrants |

| Capital Requirements | Acquiring a competitive fleet of compressors and infrastructure costs hundreds of millions of dollars. | Very High |

| Technical Expertise | Operating and maintaining complex equipment requires specialized, hard-to-replicate knowledge. | High |

| Regulatory Compliance | Navigating complex environmental and safety regulations incurs significant costs and delays. | High |

| Established Relationships | Building trust and securing contracts with producers is difficult due to existing loyalties. | High |

| Economies of Scale | Incumbents benefit from lower per-unit costs due to large-scale operations. | High |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Archrock leverages data from industry-specific market research reports, Archrock's own SEC filings and investor presentations, and broader energy sector financial databases to provide a comprehensive view of competitive pressures.