Archrock PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Archrock Bundle

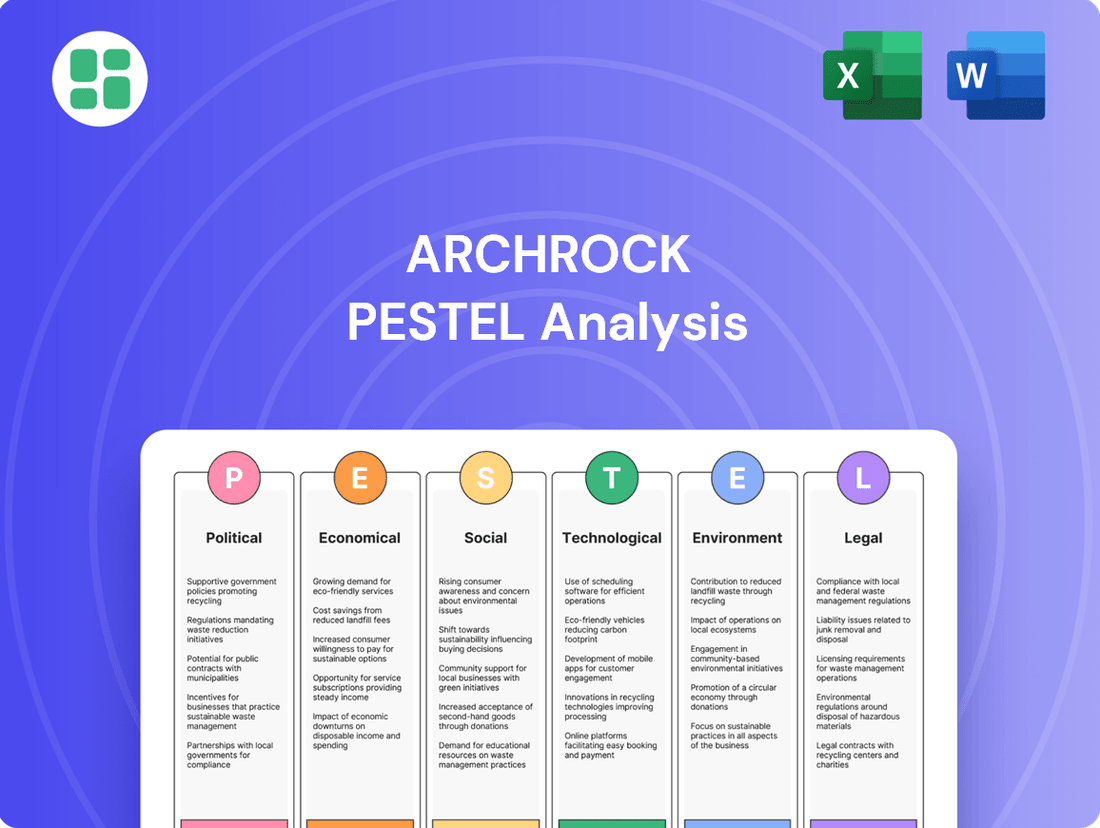

Navigate the complex external forces shaping Archrock's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities. Equip yourself with critical insights to inform your strategy and investment decisions. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Government energy policies significantly shape the natural gas compression sector. Policies favoring fossil fuel production, such as tax credits for drilling or infrastructure development, directly boost demand for Archrock's services. Conversely, a strong push towards renewables without commensurate support for natural gas infrastructure could present headwinds.

In 2024, the US government has continued to support natural gas production through various legislative measures, aiming to ensure energy security and affordability. For instance, the Inflation Reduction Act, enacted in 2022, while primarily focused on renewables, also includes provisions that indirectly benefit natural gas infrastructure by promoting its role in grid stability during the transition. Archrock's business is therefore sensitive to these evolving policy landscapes, with potential shifts in administration or legislative priorities in 2025 posing both opportunities and risks.

Geopolitical stability significantly influences the energy sector, particularly natural gas markets. Disruptions in major producing or consuming regions can lead to price volatility and affect global supply chains. For instance, ongoing geopolitical tensions in Eastern Europe continue to reshape energy flows, driving demand for alternative suppliers like the United States.

U.S. natural gas exports are a critical component of global energy security and a key driver for domestic production. In 2023, U.S. LNG exports reached record levels, exceeding 11.9 billion cubic feet per day on average, according to the U.S. Energy Information Administration. Trade policies, such as tariffs or sanctions, can directly impact the competitiveness of U.S. natural gas abroad, influencing demand for compression services needed to liquefy and transport the gas.

Changes in international trade relations can create both opportunities and risks for Archrock. Favorable trade agreements and growing global demand for cleaner energy sources like natural gas present opportunities for increased infrastructure investment. Conversely, protectionist policies or trade disputes could dampen export growth, potentially slowing the expansion of natural gas infrastructure and impacting Archrock's service demand.

Archrock's operations are significantly shaped by the regulatory landscape, particularly concerning environmental and safety standards. Political agendas often drive changes in these regulations, such as stricter methane emission controls, which can directly increase operational costs and necessitate investment in new technologies. For instance, the EPA's proposed methane regulations could require substantial capital expenditures for compliance.

The enforcement priorities of regulatory bodies like the EPA and state-level agencies also play a crucial role. Differences in federal versus state regulations, for example, can create complex compliance requirements and varying cost structures across Archrock's service territories. This necessitates a dynamic approach to compliance and strategic planning to navigate these diverse mandates effectively.

Political Stability and Investment Climate

The United States generally offers a stable political environment, which is crucial for attracting long-term capital investments in energy infrastructure like Archrock's natural gas processing and transportation services. This stability fosters confidence among investors, encouraging the deployment of capital necessary for expanding operations and undertaking new projects.

However, political certainty can fluctuate, particularly around election cycles and during periods of intense policy debate concerning energy and climate. For instance, debates around carbon emissions and the future role of natural gas could introduce uncertainty, potentially impacting the pace of new investment in Archrock's midstream assets. The 2024 US presidential election and subsequent policy shifts will be closely watched by the energy sector.

Despite potential short-term volatility, the U.S. market remains highly attractive for energy infrastructure investment due to its vast natural gas reserves and established regulatory framework. Archrock benefits from this inherent attractiveness, as demonstrated by continued demand for its services, even amidst evolving political discourse. The Energy Information Administration (EIA) projects that natural gas will remain a significant part of the US energy mix through 2050, supporting ongoing infrastructure needs.

- Political Stability: The U.S. generally provides a stable political backdrop conducive to infrastructure investment.

- Election Cycle Impact: Upcoming elections in 2024 could introduce policy uncertainty affecting long-term capital allocation in the energy sector.

- Policy Debates: Ongoing discussions on climate policy and the role of natural gas directly influence investment sentiment and project viability.

- Market Attractiveness: The U.S. energy market's size and resource availability continue to make it a prime location for infrastructure development, with natural gas projected to be a key energy source for decades.

Lobbying and Industry Influence

The natural gas industry, including companies like Archrock, actively participates in lobbying to shape energy policy. Industry associations such as the American Gas Association (AGA) and the Interstate Natural Gas Association of America (INGAA) represent collective interests, advocating for favorable regulations and investments in natural gas infrastructure. These groups engage with lawmakers and regulatory bodies to influence legislation related to pipeline safety, environmental standards, and market access for natural gas. For instance, in 2023, the AGA reported spending approximately $2.5 million on federal lobbying efforts, aiming to promote natural gas as a reliable and cleaner energy source.

Corporate advocacy also plays a significant role. Archrock, through its own government relations activities and contributions to industry groups, works to ensure its business interests are considered in policy decisions. This influence can help to mitigate potential risks from adverse regulations, such as stricter emissions standards or policies that favor renewable energy sources over natural gas. By promoting the benefits of natural gas compression services and the role of natural gas in the energy transition, these efforts can foster a more supportive operating environment.

- Industry associations like the AGA and INGAA actively lobby on behalf of natural gas companies.

- In 2023, the American Gas Association reported spending around $2.5 million on federal lobbying.

- Lobbying efforts aim to influence legislation concerning pipeline safety, environmental regulations, and market access.

- Corporate advocacy, including Archrock's, seeks to mitigate adverse policies and promote favorable conditions for natural gas services.

Government energy policies are a primary driver for Archrock's business, with legislative actions in 2024 continuing to shape the natural gas sector. The Inflation Reduction Act, while emphasizing renewables, also supports natural gas infrastructure for grid stability, impacting Archrock's demand. Upcoming policy shifts in 2025, influenced by election outcomes, could present both opportunities and challenges for infrastructure investment.

Geopolitical events significantly impact global energy markets, influencing U.S. natural gas exports and, consequently, demand for Archrock's compression services. Record U.S. LNG exports in 2023, averaging over 11.9 billion cubic feet per day, highlight the importance of international trade policies and global energy security concerns. Trade disputes or favorable agreements directly affect the competitiveness of U.S. gas exports.

Regulatory frameworks, particularly environmental standards, are critical for Archrock. Proposed EPA methane regulations could necessitate significant capital expenditures for compliance, potentially increasing operational costs. The differing federal and state regulatory approaches create complex compliance landscapes that Archrock must navigate.

The U.S. political environment generally offers stability for energy infrastructure investment, fostering investor confidence. However, election cycles and policy debates around climate change can introduce short-term uncertainty, impacting the pace of new projects. Despite this, the EIA projects natural gas to remain a key part of the U.S. energy mix through 2050, supporting ongoing infrastructure needs.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Archrock across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A clear, actionable summary of Archrock's PESTLE factors, enabling proactive strategy adjustments and mitigating potential market disruptions.

Economic factors

U.S. natural gas demand is projected to rise, driven by robust LNG exports and increasing industrial use. The Energy Information Administration (EIA) forecasts that dry natural gas production will reach 103.5 billion cubic feet per day (Bcf/d) in 2024, a slight increase from 2023, indicating sustained supply to meet this growing demand. This upward trend in consumption directly translates to higher volumes of natural gas requiring compression services, which is Archrock's core business.

Global demand for liquefied natural gas (LNG) continues to be a significant factor, with the U.S. playing a key role as a major exporter. In 2023, U.S. LNG exports averaged 11.8 Bcf/d, a record high, and are expected to continue growing. This expansion in international markets necessitates more natural gas processing and transportation, directly benefiting companies like Archrock that provide essential compression infrastructure.

Electricity generation remains a substantial consumer of natural gas, especially as it replaces coal in power plants for environmental reasons. The EIA anticipates that natural gas will continue to be the largest source of electricity generation in the U.S. through at least 2050. This sustained demand from the power sector ensures a consistent need for efficient natural gas infrastructure, including compression services.

Commodity price volatility, particularly for natural gas, significantly impacts Archrock's business. Fluctuations in natural gas prices directly affect the revenue and profitability of Archrock's customers, who are primarily exploration and production (E&P) companies. When natural gas prices are low, E&P companies may reduce drilling and production activities, leading to decreased demand for Archrock's compression services. Conversely, sustained high prices can incentivize increased production, boosting demand.

Sustained low natural gas prices, such as those seen periodically in the US market, can depress exploration and production (E&P) activity. For instance, if natural gas prices fall below a certain breakeven point for producers, they may curtail or halt new drilling projects. This directly reduces the need for compression services, which are essential for moving natural gas from wells to market. Archrock's business model relies on these E&P activities, making it sensitive to such downturns.

Price volatility also influences customer capital expenditure (CapEx) decisions and Archrock's contract terms. When natural gas prices are highly unpredictable, E&P companies may become more cautious with their investments, potentially delaying or scaling back projects that require significant upfront capital, including the leasing of compression equipment. This uncertainty can lead to shorter-term contracts or more flexible pricing structures for Archrock, impacting revenue predictability.

Inflationary pressures directly impact Archrock's operating costs, particularly for essential materials like steel and specialized labor required for maintaining and expanding its natural gas compression infrastructure. For instance, the Producer Price Index (PPI) for industrial machinery, a key input for compression equipment, saw an increase of 4.5% year-over-year as of Q1 2024, escalating maintenance expenses and the cost of new units.

Changes in interest rates significantly affect Archrock's capital expenditure plans and debt servicing. With the Federal Reserve maintaining a target federal funds rate between 5.25% and 5.50% through early 2024, the cost of borrowing for new equipment financing and potential acquisitions has risen. This higher cost of capital can reduce the profitability of new projects and increase the burden of servicing existing debt, impacting free cash flow.

Economic Growth and Industrial Activity

The United States economy is a crucial driver for Archrock, a company deeply intertwined with energy consumption. Broad economic growth directly correlates with industrial activity, especially in energy-intensive sectors like manufacturing and chemicals. As the overall economic health of the U.S. improves, so does energy demand, which in turn fuels the need for natural gas infrastructure. This creates a positive feedback loop for Archrock, as increased industrial output often translates to higher utilization rates for their midstream assets and opens doors for expansion.

For instance, the U.S. Gross Domestic Product (GDP) experienced a robust growth of 2.5% in 2023, signaling a healthy economic environment. This expansion generally supports higher industrial production, which is a key consumer of natural gas. Archrock's business model thrives on this demand, as greater industrial activity means more natural gas needs to be transported and processed through their facilities.

- U.S. GDP Growth: The U.S. economy grew by an annualized rate of 2.5% in 2023, indicating a strong economic foundation.

- Industrial Production: Industrial production in the U.S. saw a modest increase, reflecting sustained demand from various sectors.

- Energy Consumption Trends: Natural gas consumption remains a critical component of the U.S. energy mix, supporting infrastructure investments.

- Archrock's Role: Archrock's extensive network of natural gas processing and transportation assets is essential for meeting this industrial demand.

Capital Investment in Energy Infrastructure

Significant capital is flowing into natural gas infrastructure, particularly pipelines, processing plants, and LNG terminals. This investment directly fuels demand for Archrock's essential compression services, which are critical for moving and processing natural gas. For instance, the U.S. Energy Information Administration (EIA) reported that capital expenditures for natural gas pipelines and storage in the U.S. were projected to reach approximately $20 billion in 2024, a notable increase from previous years.

Recent trends show a robust appetite for expanding natural gas midstream assets. This aligns perfectly with Archrock's strategic focus on providing compression solutions for these growing infrastructure needs. The company's ability to deploy and maintain compression fleets positions it to capitalize on this sustained infrastructure spending.

- Increased Investment: Capital expenditures on U.S. natural gas pipelines and storage are estimated to be around $20 billion in 2024.

- Demand Driver: Expansion in pipelines, processing, and LNG terminals directly increases the need for compression services.

- Strategic Alignment: Archrock's core business of providing compression services is well-positioned to benefit from this infrastructure build-out.

- Growth Areas: Archrock's strategic growth is directly supported by the ongoing investment in natural gas infrastructure development.

The U.S. economy's growth, evidenced by a 2.5% GDP increase in 2023, directly fuels industrial activity and energy demand. This heightened demand for natural gas, especially from energy-intensive sectors, necessitates robust midstream infrastructure, which Archrock's compression services support. Consequently, Archrock is well-positioned to benefit from sustained economic expansion and its impact on energy consumption.

Capital investment in U.S. natural gas infrastructure is substantial, with projected expenditures of approximately $20 billion for pipelines and storage in 2024. This significant outlay for expanding pipelines, processing plants, and LNG terminals directly translates to an increased need for Archrock's core compression services. The company's strategic focus on providing these essential solutions aligns perfectly with this infrastructure build-out, indicating strong growth potential.

Inflationary pressures, such as a 4.5% year-over-year increase in the PPI for industrial machinery as of Q1 2024, are raising Archrock's operating costs. Similarly, elevated interest rates, with the federal funds rate between 5.25% and 5.50% through early 2024, increase the cost of capital for new equipment and debt servicing. These economic factors directly impact Archrock's profitability and financial planning.

Natural gas price volatility remains a key economic consideration, directly influencing the profitability and operational decisions of Archrock's customers, the E&P companies. Sustained low prices can depress production, reducing demand for compression services, while high volatility can lead to more cautious customer capital expenditure and shorter contract terms for Archrock, affecting revenue predictability.

| Economic Factor | 2023 Data/Trend | 2024 Projection/Trend | Impact on Archrock |

|---|---|---|---|

| U.S. GDP Growth | 2.5% annualized growth | Expected continued growth | Increased industrial demand for natural gas, supporting Archrock's services |

| Capital Expenditures (Pipelines & Storage) | Significant investment | Projected ~$20 billion | Directly drives demand for Archrock's compression services |

| Inflation (PPI for Industrial Machinery) | 4.5% year-over-year (Q1 2024) | Continued inflationary pressures | Increases Archrock's operating and equipment costs |

| Interest Rates (Federal Funds Rate) | 5.25%-5.50% (through early 2024) | Expected to remain elevated | Increases cost of capital for Archrock's investments and debt servicing |

Preview the Actual Deliverable

Archrock PESTLE Analysis

The preview you see here is the exact Archrock PESTLE Analysis document you’ll receive after purchase. It's fully formatted and ready to use, providing a comprehensive overview of the external factors impacting Archrock. You'll gain immediate access to this professionally structured analysis upon completing your transaction.

Sociological factors

Public perception of natural gas is increasingly complex, with growing awareness of climate change influencing attitudes. While seen by some as a cleaner alternative to coal, concerns about methane emissions and the long-term viability of fossil fuels persist.

Evolving public opinion, amplified by environmental advocacy groups and media coverage, directly translates into heightened regulatory scrutiny and can affect investment appeal. For instance, a 2024 survey indicated that over 60% of respondents in key markets expressed concern about the environmental impact of natural gas infrastructure.

Archrock must actively engage in transparent communication, highlighting its role in facilitating the transition to lower-carbon energy sources and emphasizing emission reduction technologies within its operations to navigate these shifting societal views and maintain community acceptance for its infrastructure projects.

The oil and gas sector, including midstream services like Archrock, faces a significant demographic challenge with an aging workforce. Many experienced professionals are nearing retirement, creating a knowledge gap and potential operational strain. For instance, the U.S. Bureau of Labor Statistics projected that the median age for oil and gas extraction workers was around 40 years old in recent years, highlighting a mature workforce.

This demographic shift directly impacts Archrock's ability to maintain and expand its operations. A shortage of skilled technicians and engineers, particularly those with expertise in natural gas compression, can lead to project delays and increased labor costs. Finding and retaining qualified personnel is crucial for ensuring the reliability and efficiency of Archrock's extensive infrastructure.

To counter these challenges, Archrock, like many in the industry, likely focuses on robust talent retention and development programs. This could involve competitive compensation, continuous training, and creating attractive career paths to draw in and keep new talent in a highly competitive labor market. Investing in apprenticeships and partnerships with educational institutions can also help build a future pipeline of skilled workers.

Societal expectations and the natural gas industry place a significant emphasis on health and safety. Archrock's dedication to stringent safety protocols directly influences its public image, operational smoothness, and its capacity to attract and keep skilled workers. For instance, the Pipeline and Hazardous Materials Safety Administration (PHMSA) reported that in 2023, there were 176 incidents in the natural gas transmission and distribution systems, with a focus on preventing such occurrences.

Community Engagement and Social License to Operate

Maintaining strong community relations and securing a social license to operate are paramount for natural gas infrastructure companies like Archrock. Positive engagement helps navigate regulatory hurdles and ensures smoother project execution.

Archrock's commitment to addressing local concerns, such as environmental stewardship and minimizing operational disruptions, directly influences project approvals and long-term operational viability. Proactive communication builds trust and fosters collaboration.

Corporate Social Responsibility (CSR) initiatives play a vital role in demonstrating Archrock's dedication to community well-being and sustainable practices. These efforts can range from local employment opportunities to environmental conservation programs.

- Community Support: In 2023, Archrock reported contributing to community development through various initiatives, although specific dollar amounts for local engagement are often embedded within broader operational expenses.

- Environmental Initiatives: The company's focus on reducing methane emissions, a key environmental concern for communities, aligns with broader industry efforts to improve sustainability.

- Stakeholder Dialogue: Archrock actively engages with stakeholders, including local governments and community groups, to ensure their perspectives are considered in project planning and operations.

- Regulatory Compliance: Adherence to environmental regulations and community benefit agreements is fundamental to maintaining a social license to operate, a critical factor for infrastructure projects.

Consumer Behavior and Energy Consumption Patterns

Shifting consumer preferences towards sustainability and energy efficiency can subtly impact natural gas demand. For instance, increased adoption of electric vehicles (EVs) or greater use of solar power for residential heating could reduce reliance on natural gas. In 2024, the global EV market continued its robust growth, with sales projected to reach over 17 million units, a significant increase from previous years, potentially influencing long-term energy consumption patterns.

These broader societal trends are reshaping the energy mix. As consumers and businesses prioritize lower-carbon solutions, the strategic direction for companies like Archrock, which primarily transports natural gas, may need to adapt. This could involve exploring investments in carbon capture technologies or diversifying into other energy infrastructure that aligns with evolving environmental consciousness.

Societal awareness of climate change is a key driver for these behavioral shifts. A growing segment of the population is actively seeking ways to reduce their carbon footprint, which can translate into reduced consumption of fossil fuels. For example, by mid-2025, it's anticipated that renewable energy sources will account for a larger share of electricity generation in many developed nations, a trend that could gradually diminish the role of natural gas in certain applications.

- Growing consumer demand for sustainable products and services.

- Increased adoption of energy-efficient technologies in homes and businesses.

- Rising public awareness and concern regarding climate change impacts.

- Potential for reduced natural gas demand in sectors influenced by electrification trends.

Public perception of natural gas is complex, with climate change concerns influencing attitudes, even as it's seen as a cleaner alternative to coal. Evolving public opinion, amplified by environmental groups and media, leads to increased regulatory scrutiny and can affect investment appeal. For instance, a 2024 survey showed over 60% of respondents in key markets were concerned about natural gas infrastructure's environmental impact.

Archrock faces a demographic challenge with an aging workforce, as experienced professionals near retirement, creating knowledge gaps and potential operational strain. The U.S. Bureau of Labor Statistics indicated the median age for oil and gas extraction workers was around 40 in recent years, highlighting a mature workforce that impacts the ability to maintain and expand operations due to potential shortages of skilled technicians and engineers.

Societal expectations and the natural gas industry place a significant emphasis on health and safety, with Archrock's dedication to stringent safety protocols directly influencing its public image and operational smoothness. The Pipeline and Hazardous Materials Safety Administration (PHMSA) reported 176 incidents in natural gas transmission and distribution systems in 2023, underscoring the industry's focus on preventing such occurrences.

Shifting consumer preferences toward sustainability, such as increased adoption of electric vehicles (EVs) or solar power, can subtly impact natural gas demand. The global EV market's robust growth in 2024, with sales projected to exceed 17 million units, signals a potential shift in long-term energy consumption patterns and influences the strategic direction for companies like Archrock.

Technological factors

Recent innovations in natural gas compression technology are significantly boosting efficiency and reducing emissions. This includes the development of advanced, lower-emission compressors and a notable shift towards electric-drive units, which offer greater energy efficiency and operational flexibility compared to traditional engine-driven models.

Archrock's strategic investment in and adoption of these cutting-edge compression technologies are poised to enhance its operational efficiency and environmental performance. For instance, by integrating more electric-drive compressors, Archrock can potentially lower its fuel consumption and associated carbon footprint, offering a competitive edge in an increasingly sustainability-focused market.

Digitalization and automation are revolutionizing Archrock's natural gas compression services. Remote monitoring and advanced analytics, powered by IoT sensors, allow for real-time performance tracking and predictive maintenance, significantly boosting uptime and reducing unexpected failures. For instance, by leveraging data analytics, Archrock can anticipate equipment needs, potentially slashing unplanned downtime by an estimated 15-20% in the coming years, directly impacting operational efficiency and cost reduction.

The integration of technologies like AI-driven diagnostics and automated control systems directly enhances safety by minimizing human exposure to hazardous environments and reducing the likelihood of operational errors. This technological advancement also necessitates a shift in workforce skills, with a growing demand for personnel proficient in data analysis, cybersecurity, and the operation of sophisticated automated systems, reflecting the evolving landscape of the energy sector.

The push to reduce methane emissions from natural gas infrastructure is accelerating, with significant technological advancements in detection and mitigation. Companies are developing and deploying advanced sensor networks and aerial surveillance technologies to pinpoint leaks more effectively. For instance, by 2024, many operators are expected to adopt continuous monitoring systems, a substantial increase from previous years.

Archrock is actively involved in this transition, integrating methane detection and reduction solutions into its operations. This includes the adoption of technologies that capture methane at compressor stations, thereby preventing its release into the atmosphere. These efforts are crucial for meeting increasingly stringent environmental regulations and demonstrating a commitment to sustainability.

The financial implications are also significant. Investments in methane reduction technologies are projected to grow, with the global methane detection market alone expected to reach billions by 2025. Archrock's proactive stance positions it to benefit from this trend, not only by complying with regulations but also by potentially creating new revenue streams through emissions reduction services.

Alternative Energy Integration and Infrastructure Adaptability

Technological advancements in alternative energy, like hydrogen blending and carbon capture, utilization, and storage (CCUS), present both challenges and opportunities for natural gas infrastructure. These developments could necessitate significant adaptation of existing pipelines and compression equipment to handle new energy mediums or captured gases.

Archrock's core competency in compression technology positions it to potentially pivot towards new applications. For instance, their equipment could be reconfigured or adapted for the transportation of CO2 or for facilitating the introduction of hydrogen into existing natural gas networks. This adaptability is crucial for maintaining asset relevance in a shifting energy landscape.

The demand for hydrogen as a clean energy source is projected to grow significantly. By 2030, the global hydrogen market is expected to reach over $250 billion, with a substantial portion dedicated to green hydrogen production and infrastructure. Archrock's ability to integrate its compression solutions into hydrogen transport and blending projects will be key to capitalizing on this burgeoning market.

- Hydrogen Blending: Research indicates that natural gas pipelines can safely accommodate up to 20% hydrogen blend without major modifications, creating an immediate market for specialized compression.

- CCUS Infrastructure: The development of CCUS facilities requires robust CO2 transportation networks, a service where adapted Archrock compression could play a vital role.

- Equipment Retrofitting: Archrock's existing fleet of compressors offers a substantial base for retrofitting, potentially reducing the capital expenditure required for new energy integration projects.

- Market Diversification: By embracing these technological shifts, Archrock can diversify its revenue streams beyond traditional natural gas compression, enhancing long-term financial resilience.

Cybersecurity in Industrial Operations

Cybersecurity is paramount for critical energy infrastructure, including Archrock's natural gas compression systems. The increasing sophistication of cyber threats necessitates robust defenses to ensure operational reliability and service continuity.

Archrock implements a multi-layered approach to cybersecurity, safeguarding both its operational technology (OT) and information technology (IT) systems. This includes advanced threat detection, regular vulnerability assessments, and employee training, aligning with industry best practices to mitigate risks.

The financial implications of cyber incidents can be substantial, impacting business continuity and potentially leading to significant financial losses. For instance, the average cost of a data breach in the energy sector reached $5.19 million in 2023, highlighting the critical need for proactive cybersecurity measures.

- Enhanced OT Security: Implementing network segmentation and intrusion detection systems specifically for industrial control systems.

- IT System Protection: Utilizing firewalls, encryption, and access controls for corporate and data management systems.

- Incident Response Planning: Developing and regularly testing comprehensive plans to address and recover from cyber incidents swiftly.

- Supply Chain Risk Management: Vetting third-party vendors to ensure their cybersecurity practices meet Archrock's standards.

Technological advancements are driving efficiency and sustainability in natural gas compression, with a notable shift towards electric-drive units and improved methane leak detection. Archrock's investment in these areas, such as integrating IoT sensors for predictive maintenance, is expected to reduce unplanned downtime by 15-20%.

Legal factors

Archrock operates within a legal framework heavily influenced by environmental regulations, particularly concerning methane emissions from natural gas infrastructure. The U.S. Environmental Protection Agency's (EPA) proposed rules, like NSPS OOOOb and OOOOc, aim to significantly reduce methane leaks from oil and natural gas facilities, directly impacting Archrock's compressor station operations.

Compliance with these evolving federal and state methane regulations necessitates substantial investment in leak detection and repair (LDAR) programs and the adoption of advanced abatement technologies. For instance, the EPA's proposed standards could require retrofitting existing equipment and implementing more stringent monitoring protocols, potentially increasing operational costs for Archrock and its customers. Delays or changes in compliance deadlines, as seen with some proposed rules, can create uncertainty for long-term capital planning and technology deployment strategies.

Archrock operates within a stringent legal framework governing health and safety in the natural gas sector. This includes adhering to Occupational Safety and Health Administration (OSHA) regulations, which mandate safe working conditions, proper equipment usage, and comprehensive employee training. For instance, OSHA's Process Safety Management (PSM) standard is critical for facilities handling highly hazardous chemicals, including natural gas.

Compliance with these regulations is paramount. Archrock's commitment is demonstrated through rigorous training programs for its employees on hazard recognition and mitigation, regular maintenance schedules for all operational equipment, and robust incident reporting and investigation procedures. Failure to comply can result in significant fines, operational shutdowns, and severe reputational damage, underscoring the importance of a proactive safety culture.

A strong safety record is not just a legal obligation but a business imperative. In 2023, the U.S. Bureau of Labor Statistics reported an injury and illness rate of 2.7 cases per 100 full-time workers in the oil and gas extraction sector. Archrock's dedication to exceeding these industry benchmarks helps ensure operational continuity and employee well-being, directly impacting its financial performance and stakeholder trust.

Archrock's contract compression and aftermarket service agreements are governed by intricate contract law, detailing terms for equipment leasing, maintenance, and performance standards. These agreements typically include clauses on payment schedules, equipment specifications, warranty periods, and liability limitations, with dispute resolution often involving arbitration or mediation to maintain customer relationships and revenue stability.

Changes in contract law, such as evolving warranty regulations or new data privacy requirements impacting service reporting, could necessitate revisions to Archrock's standard clauses. For instance, stricter enforcement of force majeure clauses could impact revenue predictability if unforeseen events disrupt service delivery, underscoring the importance of meticulously crafted and legally sound agreements.

Antitrust and Competition Laws

Antitrust and competition laws significantly shape Archrock's operational landscape, particularly concerning its position in the midstream natural gas processing sector. Regulatory bodies like the Federal Trade Commission (FTC) and the Department of Justice (DOJ) scrutinize mergers and acquisitions to prevent undue market concentration. For instance, the FTC's ongoing review of consolidation within the energy infrastructure sector highlights the importance of these regulations.

These laws directly impact Archrock's growth strategies by setting boundaries on how it can expand through acquisitions. Any move that could substantially lessen competition or create a monopoly is subject to rigorous review. This regulatory oversight encourages Archrock to pursue growth avenues that foster competition rather than stifle it, potentially influencing its approach to organic expansion and partnerships.

The potential for regulatory intervention means Archrock must carefully consider the competitive implications of its business development plans. For example, if Archrock were to acquire a competitor in a key processing region, regulators would assess whether this consolidation would give Archrock excessive market power, potentially leading to higher prices or reduced service quality for its customers. This careful balancing act is crucial for maintaining compliance and ensuring sustainable market presence.

- Regulatory Scrutiny: Antitrust laws require careful monitoring of Archrock's M&A activities to prevent market monopolization.

- Fair Competition: Regulatory bodies ensure that industry consolidation, including Archrock's potential deals, does not harm fair competition.

- Growth Strategy Influence: These laws guide Archrock's expansion, encouraging strategies that maintain a competitive market.

- Market Dominance Impact: Archrock must navigate regulations that limit its ability to achieve overwhelming market dominance.

Taxation Policies and Incentives

Archrock's financial performance is directly influenced by federal and state taxation policies. The corporate income tax rate, for instance, impacts its net earnings. Property taxes on its extensive infrastructure assets also represent a significant operating expense.

Energy-specific tax incentives or disincentives can further sway profitability and capital allocation. For example, changes in tax credits or deductions related to natural gas infrastructure could encourage or discourage investment in new projects.

Recent tax legislation, such as potential adjustments to the corporate tax rate or the introduction of new environmental taxes, could materially affect Archrock's bottom line and its ability to fund future growth initiatives.

- Impact of Corporate Income Tax: Fluctuations in the federal corporate income tax rate directly alter Archrock's net profit.

- Property Tax Burden: Property taxes on its extensive network of compression and processing assets represent a considerable operational cost.

- Energy Tax Incentives: The availability or removal of tax credits for natural gas infrastructure projects can significantly influence investment decisions and capital expenditure plans.

- Legislative Changes: Anticipated shifts in tax laws, including potential carbon taxes or changes to depreciation schedules, require careful financial modeling to assess their impact on profitability and strategic planning.

Archrock's operations are subject to evolving environmental regulations, particularly those targeting methane emissions from natural gas infrastructure. The U.S. Environmental Protection Agency's (EPA) proposed rules, such as NSPS OOOOb and OOOOc, aim to curb methane leaks, directly affecting Archrock's compressor stations and requiring investments in leak detection and repair (LDAR) programs and abatement technologies.

Compliance with stringent health and safety regulations, including OSHA's Process Safety Management (PSM) standard, is critical for Archrock. The company prioritizes safe working conditions and employee training, as a strong safety record is vital for operational continuity and stakeholder trust, especially given the industry's reported injury rates.

Antitrust and competition laws, enforced by bodies like the FTC and DOJ, significantly shape Archrock's expansion strategies, particularly concerning mergers and acquisitions. These regulations ensure fair competition and prevent market monopolization, influencing Archrock's approach to growth and partnerships to avoid excessive market power.

Taxation policies, including corporate income tax and property taxes on infrastructure, directly impact Archrock's profitability and capital allocation. Energy-specific tax incentives or disincentives, such as credits for natural gas infrastructure, can further sway investment decisions and financial performance.

Environmental factors

Growing concerns over methane emissions from natural gas infrastructure are a significant environmental factor. The global effort to curb greenhouse gases, particularly methane, is intensifying, creating a market for solutions that reduce these emissions.

This heightened scrutiny directly benefits Archrock, as it drives demand for their compression services and equipment designed for lower emissions and methane reduction. For instance, in 2023, Archrock reported a 12% reduction in its fleet's greenhouse gas emissions intensity compared to 2022.

Archrock's commitment to sustainability, including its own emission reduction targets, positions it favorably within this evolving environmental landscape. The company aims to further decrease its emissions intensity by 20% by 2025 compared to a 2022 baseline.

Water usage, especially in hydraulic fracturing, is a key environmental factor impacting the natural gas industry. This process requires significant water volumes, and any scarcity or stricter regulations around its use can directly affect drilling activity. For Archrock, this means potential fluctuations in demand for its natural gas compression services, as reduced drilling activity translates to less gas needing to be processed.

Regions facing water stress or implementing tougher water management policies, such as restrictions on withdrawal or discharge, can slow down or halt new natural gas projects. For instance, states like Colorado and California have implemented stringent water quality standards for fracking wastewater. Such measures can increase operational costs for producers and, by extension, influence the volume of gas Archrock handles.

The industry's commitment to responsible water practices, including recycling and reusing produced water, is becoming increasingly important. Companies are investing in technologies to minimize freshwater intake and reduce the volume of wastewater requiring disposal. Archrock's business is indirectly tied to these efforts; greater efficiency in water use by producers can lead to more stable, albeit potentially lower, volumes of gas being transported and compressed.

The expansion of natural gas infrastructure, including Archrock's facilities, inherently impacts land use and can affect local habitats and biodiversity. Pipeline construction and compressor station siting require significant land disturbance, potentially fragmenting ecosystems and impacting wildlife corridors. The permitting process for such projects often involves environmental impact assessments, and public scrutiny regarding land use can lead to delays and increased costs, as seen in various energy infrastructure projects across the US.

Archrock is committed to minimizing its environmental footprint through practices like responsible site selection and reclamation efforts following construction. While specific data on their current land use mitigation efforts for 2024/2025 is not yet widely publicized, the industry trend, driven by regulatory pressures and stakeholder expectations, is towards more sustainable development. This includes exploring advanced technologies for reduced land disturbance during pipeline maintenance and station operations.

Waste Management and Pollution Control

Natural gas compression operations, like those Archrock manages, can generate waste from lubricants and other byproducts, posing environmental challenges. Potential pollution risks to air, water, and soil necessitate careful management.

Archrock focuses on responsible waste handling and spill prevention. The company adheres to stringent pollution control standards to minimize its environmental footprint.

- Waste Reduction Initiatives: Archrock implements programs to reduce the volume of waste generated, including recycling lubricant oil and properly disposing of operational byproducts.

- Spill Prevention and Response: Robust spill prevention measures are in place, coupled with rapid response protocols, to mitigate any potential contamination of soil and water resources.

- Emissions Control: Archrock invests in technologies to control air emissions from compression units, ensuring compliance with regulatory limits and protecting air quality.

Renewable Energy Transition Impact

The global push towards renewable energy sources presents a significant long-term environmental shift that could impact natural gas demand. While natural gas is often viewed as a transitional fuel, its role in a decarbonizing economy is subject to the speed of renewable energy adoption and advancements in energy storage technologies. For instance, by 2023, renewable energy sources accounted for approximately 23% of the total electricity generation in the United States, a figure projected to grow.

The pace of this energy transition directly influences future investments in natural gas infrastructure, including pipelines and compression services, which are Archrock's core business. If the transition accelerates faster than anticipated, it could lead to a reduced need for new natural gas infrastructure and potentially impact the utilization of existing assets. Conversely, a slower transition might sustain demand for natural gas, supporting continued investment.

Archrock is navigating this evolving landscape by considering its role in a transitioning energy sector. The company has indicated an interest in diversifying its services and exploring opportunities related to lower-carbon energy solutions. This includes evaluating the potential for compression services in areas like carbon capture, utilization, and storage (CCUS) and potentially hydrogen transportation, aligning with broader environmental goals and seeking to mitigate risks associated with a declining natural gas demand.

- Renewable energy's growing share: Renewables comprised about 23% of U.S. electricity generation in 2023, with continued growth expected.

- Infrastructure investment sensitivity: The speed of renewable deployment directly affects the long-term viability and investment in natural gas infrastructure.

- Archrock's strategic adaptation: The company is exploring opportunities in CCUS and hydrogen to align with decarbonization trends.

Intensifying global efforts to reduce greenhouse gas emissions, especially methane, directly benefit Archrock by increasing demand for its low-emission compression services and equipment. The company reported a 12% reduction in its fleet's greenhouse gas emissions intensity in 2023 compared to 2022 and aims for a further 20% decrease by 2025 against a 2022 baseline.

Water scarcity and stricter regulations around its use in hydraulic fracturing can impact drilling activity and, consequently, Archrock's demand. Regions with water stress, like parts of California, face tighter water quality standards for fracking wastewater, potentially increasing producer costs and influencing gas volumes handled by Archrock.

The expansion of natural gas infrastructure, including Archrock's facilities, inherently involves land use considerations and potential impacts on local habitats. Permitting processes often require environmental impact assessments, and public scrutiny can lead to project delays and increased costs.

The growing share of renewable energy in the U.S. electricity mix, reaching approximately 23% in 2023, presents a long-term environmental shift that could affect natural gas demand and infrastructure investment. Archrock is strategically exploring opportunities in carbon capture, utilization, and storage (CCUS) and hydrogen transportation to adapt to decarbonization trends.

PESTLE Analysis Data Sources

Our Archrock PESTLE Analysis is informed by a comprehensive review of regulatory filings, industry publications, and economic forecasts. We incorporate data from government agencies, energy sector reports, and market research firms to provide a robust understanding of the macro-environment.