Archrock Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Archrock Bundle

Curious about Archrock's product portfolio performance? This glimpse into their BCG Matrix reveals the potential for growth and income generation.

Uncover the strategic implications of their Stars, Cash Cows, Dogs, and Question Marks by purchasing the full BCG Matrix report. Gain actionable insights to optimize resource allocation and drive future success.

Stars

Archrock's Permian Basin contract compression segment is a star performer, reflecting the company's substantial investment and operational expansion in this critical U.S. energy hub. The company has notably increased its operating horsepower in the Permian, a region that consistently drives U.S. natural gas supply growth, solidifying compression services here as a leading segment for Archrock.

The strategic acquisition of TOPS significantly bolstered Archrock's capabilities and footprint within the Permian. This move positioned Archrock to capitalize on the ongoing production increases in the basin, with Permian operations representing a substantial portion of Archrock's overall business, contributing significantly to its revenue and growth trajectory.

Archrock is making significant strides in electric motor drive (EMD) compression, a move that directly supports the industry's push for reduced emissions and improved operational efficiency. This strategic expansion positions them well for the future of energy infrastructure.

The acquisition of TOPS was a pivotal moment, substantially boosting Archrock's EMD horsepower capacity. This move solidified their standing as a key player in the market for these environmentally conscious and highly sought-after compression solutions.

EMD technology is crucial for facilitating a cleaner energy transition, catering to a growing demand from customers who prioritize sustainable and eco-friendly operations. Archrock's investment in this area reflects a clear understanding of evolving market needs and regulatory landscapes.

Archrock's strategic emphasis on high-horsepower midstream solutions positions it strongly within the energy sector. The company is directing its growth capital towards compression units vital for natural gas gathering, processing, and transmission, a segment experiencing robust demand. This focus is driven by the increasing need for natural gas in LNG exports and power generation, signaling a healthy market outlook.

The demand for Archrock's services is further underscored by its strong backlog for 2025, with bookings extending into 2026. This sustained order flow highlights the critical role of its midstream compression assets in supporting the energy infrastructure. For instance, Archrock reported that its contract compression fleet utilization averaged 93.7% in the first quarter of 2024, demonstrating high operational efficiency and market demand for its services.

Digitalization and Automation Technologies

Archrock is actively investing in digitalization and automation to streamline its operations. This strategic move is designed to unlock significant cost efficiencies and elevate the quality of its service delivery. For instance, in 2024, Archrock has earmarked substantial capital for technology upgrades, aiming to improve operational uptime by an estimated 5% through predictive maintenance enabled by automation.

These advancements in digital transformation are not just about internal improvements; they also bolster Archrock's environmental stewardship. By optimizing engine performance and reducing idle times through automated controls, the company is working towards lowering its carbon footprint. This focus aligns with increasing market demand for sustainable energy infrastructure solutions.

- Digitalization Investment: Archrock is channeling capital into upgrading its operating platform for enhanced efficiency and service.

- Cost Efficiencies: Automation is projected to drive down operational expenditures by optimizing resource allocation and predictive maintenance.

- Service Enhancement: Digitized processes and smart technology are key to improving the reliability and responsiveness of Archrock's compression services.

- Market Leadership: By embracing operational intelligence, Archrock aims to solidify its position as a leader in technologically advanced compression solutions.

Methane Reduction and Carbon Capture Solutions

Archrock is making significant strides in methane reduction and carbon capture, positioning itself within the high-growth environmental services sector. The company has secured a minority investment in a carbon capture firm, signaling a strategic move into this burgeoning market. This initiative, coupled with their own patent-pending methane capture technology, directly addresses pressing environmental concerns and aligns with the global push for decarbonization.

These developing offerings represent Archrock's commitment to sustainable energy solutions. The market for environmental services within the energy sector is experiencing rapid expansion, driven by regulatory pressures and increasing corporate sustainability goals. For instance, the global carbon capture market was valued at approximately $3.5 billion in 2023 and is projected to grow significantly in the coming years.

- Methane Monitoring and Capture: Archrock is actively developing and commercializing technologies to detect and reduce methane emissions.

- Strategic Investment: A minority investment in a carbon capture company diversifies Archrock's environmental solutions portfolio.

- Emerging Market Focus: These initiatives target the high-growth potential of environmental services within the energy industry.

- Decarbonization Alignment: Archrock's efforts directly support global decarbonization strategies and address critical environmental issues.

Archrock's Permian Basin contract compression segment stands out as a star, driven by substantial investments and expansion in this key U.S. energy region. The company's increased operating horsepower in the Permian, a hub for natural gas supply growth, solidifies its compression services in this area as a top-tier performer.

The acquisition of TOPS significantly enhanced Archrock's Permian presence and capabilities, allowing it to capitalize on rising production. Permian operations now represent a substantial part of Archrock's business, contributing significantly to revenue and growth.

Archrock's focus on electric motor drive (EMD) compression is a strategic move towards reduced emissions and improved efficiency, positioning it well for the future of energy infrastructure. The acquisition of TOPS further boosted its EMD horsepower capacity, cementing its role in providing these environmentally conscious solutions.

Archrock's commitment to high-horsepower midstream solutions, particularly for natural gas gathering, processing, and transmission, is a key growth driver. This focus is supported by robust demand for natural gas in LNG exports and power generation, indicating a strong market outlook.

The company's strong backlog for 2025, extending into 2026, highlights the sustained demand for its midstream compression assets. In the first quarter of 2024, Archrock's contract compression fleet utilization averaged 93.7%, demonstrating high operational efficiency and market demand.

Archrock is actively investing in digitalization and automation to boost efficiency and service quality, with substantial capital earmarked for technology upgrades in 2024. These advancements aim to improve operational uptime by an estimated 5% through predictive maintenance.

These digital transformations also enhance Archrock's environmental stewardship by optimizing engine performance and reducing idle times, aligning with market demand for sustainable energy infrastructure.

Archrock's strategic expansion into methane reduction and carbon capture, including a minority investment in a carbon capture firm and its own patent-pending methane capture technology, targets the high-growth environmental services sector. The global carbon capture market was valued at approximately $3.5 billion in 2023, indicating significant potential.

| Segment | Key Driver | 2024 Highlight | Market Outlook |

|---|---|---|---|

| Permian Basin Compression | High natural gas production growth | Increased operating horsepower, TOPS acquisition | Strong demand driven by U.S. supply growth |

| Electric Motor Drive (EMD) Compression | Demand for emissions reduction | Boosted EMD horsepower via TOPS acquisition | Growing customer preference for sustainable solutions |

| High-Horsepower Midstream | LNG exports and power generation demand | Focus on compression for gathering, processing, transmission | Robust market outlook for natural gas infrastructure |

| Environmental Services | Decarbonization efforts and regulatory pressure | Investment in carbon capture, methane capture technology | Rapidly expanding market driven by sustainability goals |

What is included in the product

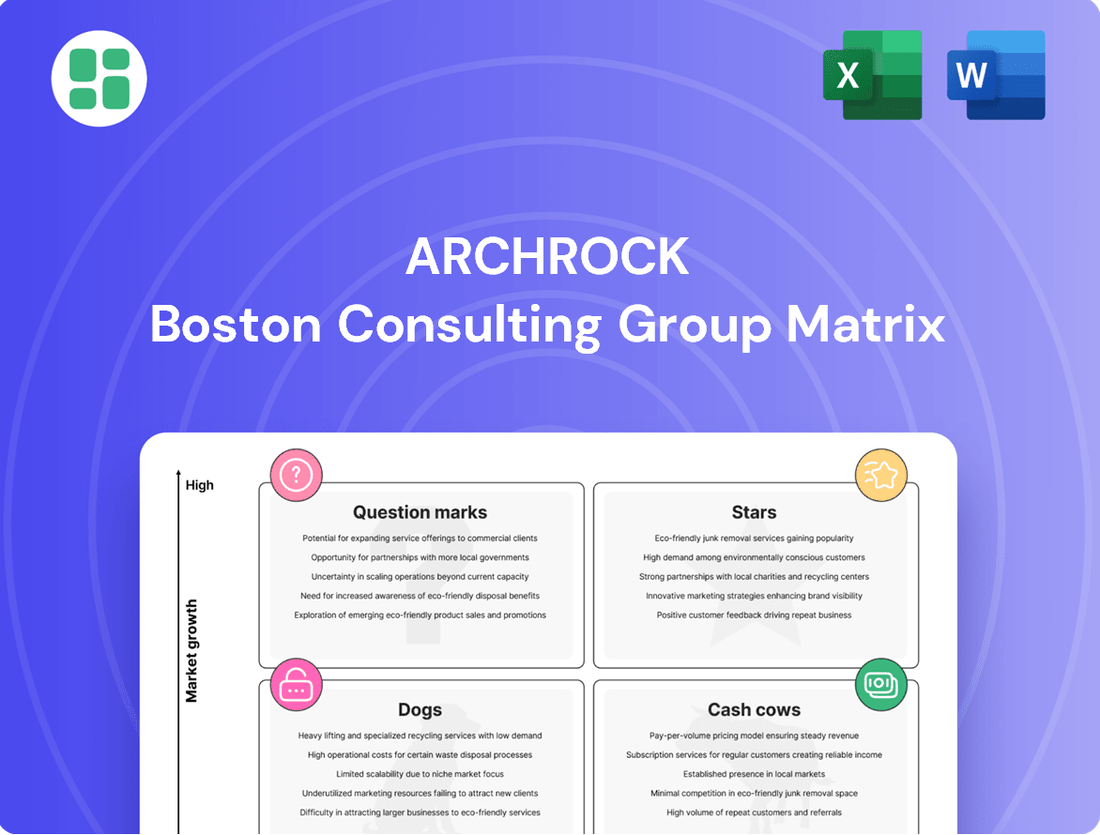

Archrock's BCG Matrix offers a strategic framework to analyze its business units, guiding investment decisions based on market growth and share.

Archrock's BCG Matrix provides a clear, actionable framework to identify and address underperforming business units, alleviating the pain of strategic uncertainty.

Cash Cows

Archrock's core contract compression services in mature natural gas basins are its established cash cows. These operations generate a stable and predictable revenue stream, underpinned by multi-year contracts with creditworthy customers. This reliability is crucial for consistent cash flow generation.

The company's fleet utilization rates highlight the strong demand for these essential services. In Q1 and Q2 of 2025, Archrock achieved a robust 96% fleet utilization for its contract compression services. This high utilization signifies efficient operations and a strong market position in these established basins.

Archrock's comprehensive aftermarket services are a true cash cow, generating consistent, high-margin revenue from its vast installed base of compression equipment. This segment is built on essential services like maintenance, repairs, and parts sales, all critical for keeping customer operations running smoothly and efficiently. For instance, in Q1 2024, Archrock reported that its aftermarket services segment contributed significantly to its overall financial performance, demonstrating its reliability as a revenue driver.

Archrock's standard reciprocating compressor fleet represents a classic Cash Cow in the BCG matrix. These machines are workhorses in the natural gas industry, excelling in situations requiring high pressure and on-again, off-again gas movement. Their widespread deployment across the United States ensures a steady stream of revenue for Archrock.

The reliability and cost-effectiveness of reciprocating compressors have cemented their position in the market, even with the advent of newer technologies. Archrock's substantial fleet benefits from this mature technology's established demand, generating predictable income from their extensive use in well-understood applications.

Long-Term Customer Contracts

Archrock's business model thrives on long-term, fee-based contracts with major exploration and production (E&P) and midstream energy companies. These agreements are the bedrock of their stable and predictable cash flows, offering a shield against the often-turbulent short-term commodity price swings.

The company boasts high contract renewal rates, a testament to its strong relationships with blue-chip customers operating within critical energy infrastructure. This customer loyalty and the essential nature of their services underscore the consistent cash-generating stability of Archrock's operations.

- Stable Revenue: Long-term contracts provide predictable revenue streams, reducing reliance on fluctuating energy prices.

- Customer Loyalty: High renewal rates with major energy players indicate strong customer satisfaction and essential service provision.

- Predictable Cash Flows: Fee-based structures ensure consistent cash generation, a key characteristic of cash cows.

- Market Position: Archrock's role in critical energy infrastructure supports the longevity and stability of its contract base.

Optimized Field Services and Maintenance

Archrock's Optimized Field Services and Maintenance segment functions as a classic Cash Cow within its business portfolio. The company's extensive field services and maintenance operations are crucial for maintaining high uptime and efficiency across its compression fleet and customer equipment. This operational strength directly contributes to robust gross margins and high levels of customer satisfaction, solidifying its leading market position.

Continued investment in supporting infrastructure and processes is key to enhancing efficiency and maximizing the cash flow generated from these established assets. For instance, in 2023, Archrock reported that its contract compression segment, which heavily relies on these services, generated approximately $1.05 billion in revenue, showcasing the segment's consistent financial contribution.

- Operational Excellence: Ensures high uptime and efficiency for compression assets.

- Strong Margins: Translates operational strength into healthy gross margins.

- Customer Satisfaction: Reinforces market leadership through reliable service.

- Investment Focus: Enhances efficiency and cash flow from existing infrastructure.

Archrock's contract compression services in mature natural gas basins are its established cash cows, generating stable, predictable revenue through multi-year contracts. The company consistently achieves high fleet utilization, with 96% in Q1 and Q2 2025, underscoring strong demand and market leadership.

The aftermarket services segment is another key cash cow, providing high-margin revenue from essential maintenance and repairs on its extensive installed base. This segment's reliability was evident in Q1 2024, where it significantly contributed to overall financial performance.

Archrock's standard reciprocating compressor fleet, vital for high-pressure natural gas movement, represents a classic cash cow. Their widespread use across the U.S. ensures a steady income stream, benefiting from the technology's established demand and cost-effectiveness.

| Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Approx.) |

|---|---|---|---|

| Contract Compression Services | Cash Cow | Stable, predictable revenue from long-term contracts, high fleet utilization (96% in Q1/Q2 2025). | $1.05 billion (Contract Compression) |

| Aftermarket Services | Cash Cow | High-margin, consistent revenue from maintenance, repairs, and parts sales. | Significant contributor to overall performance (Q1 2024 data). |

| Standard Reciprocating Compressors | Cash Cow | Mature, cost-effective technology with established demand for high-pressure applications. | Core revenue driver within Contract Compression. |

Delivered as Shown

Archrock BCG Matrix

The Archrock BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises – just a professionally designed, analysis-ready report ready for your strategic planning.

Dogs

Older, less efficient compression units that don't meet today's environmental standards or operational needs are likely candidates for the 'Dogs' category in the Archrock BCG Matrix. These assets often come with increased maintenance expenses and lower usage, leading to negligible returns for the company.

Archrock's recent sale of 155 non-strategic compressors in 2024 highlights a deliberate strategy to shed these underperforming assets and enhance the overall quality of its fleet. This move is expected to streamline operations and improve capital allocation.

Providing compression services in natural gas fields that are severely declining, often termed 'Dogs' in the BCG matrix, represents a challenging market segment. These fields typically exhibit diminishing production volumes and limited future growth potential, leading to reduced demand for compression services. Archrock's strategic focus on premier, growing basins means a deliberate reduction in exposure to these less attractive, declining areas.

Non-core, low-demand equipment sales in Archrock's BCG Matrix would likely be classified as 'Dogs.' These are specialized or niche compression units where market interest is minimal, or Archrock doesn't possess a distinct competitive advantage. Such sales often yield low revenue and slim profit margins, effectively immobilizing capital without generating meaningful returns.

Archrock's strategic emphasis is on high-return growth sectors, implying a potential divestment from these underperforming sales segments. For instance, if a particular type of compressor, like older, less efficient models, only accounted for less than 1% of Archrock's total revenue in 2024, it would be a prime candidate for the 'Dog' category.

Underperforming Rental Fleet Equipment

Underperforming rental fleet equipment within Archrock's portfolio, often characterized by low utilization rates or high maintenance costs, can be categorized as 'Dogs' in a BCG Matrix analysis. These assets represent a drain on capital and resources, hindering overall fleet efficiency and profitability. For instance, if a specific type of compressor unit in Archrock's fleet saw an average utilization below 60% in 2024, while its maintenance expenditure exceeded 15% of its rental revenue, it would likely fall into this category.

Such 'Dog' assets require careful strategic consideration. Archrock's approach would involve evaluating whether these underperformers can be revitalized through refurbishment or redeployment, or if divestment is the more prudent course of action. Minimizing the presence of these low-return assets is crucial for optimizing capital allocation and enhancing the performance of the rental fleet as a whole.

- Low Utilization: Fleet segments with average utilization rates consistently below industry benchmarks or Archrock's internal targets.

- High Maintenance Costs: Equipment requiring disproportionately high repair and upkeep expenses relative to its revenue generation.

- Capital Tied Up: Assets that consume valuable capital without delivering commensurate returns, impacting cash flow.

- Strategic Review: The necessity for Archrock to analyze and potentially divest or repurpose these underperforming assets to improve fleet economics.

Legacy Services Without Modern Upgrades

Legacy services that haven't kept pace with industry technology or environmental rules, often using older, less compliant equipment, fall into this category. These areas might see demand shrink because of new regulations or customers wanting greener, more efficient options. Archrock's focus on electric drive and methane reduction shows a shift away from these older offerings.

These services could be characterized by:

- Higher operational costs due to inefficient older machinery.

- Increased exposure to environmental compliance risks and potential fines.

- Lower customer appeal compared to modern, eco-friendly alternatives.

Archrock's 'Dogs' represent older, less efficient compression units or services in declining natural gas fields. These assets often incur high maintenance costs, experience low utilization rates, and generate negligible returns, tying up valuable capital. For instance, if a specific compressor segment in Archrock's fleet had an average utilization below 60% in 2024, it would likely be a 'Dog'.

Archrock's strategic divestment of 155 non-strategic compressors in 2024 exemplifies its approach to shedding these underperformers. The company’s focus on premier, growing basins and modern, eco-friendly alternatives like electric drive further signifies a deliberate reduction in exposure to these less attractive, declining areas.

These 'Dog' assets, characterized by low demand or minimal competitive advantage, often yield low revenue and slim profit margins. Archrock's strategy involves evaluating whether to refurbish, redeploy, or divest these low-return assets to optimize fleet economics and capital allocation.

Archrock's commitment to high-return growth sectors means a strategic reduction in services tied to legacy equipment or declining fields. For example, if older, less efficient compressor models accounted for less than 1% of Archrock's total revenue in 2024, they would be prime candidates for the 'Dog' category.

| Asset Category | Characteristics | 2024 Data/Implications |

|---|---|---|

| Older Compression Units | Low efficiency, high maintenance, environmental compliance risks | Potential divestment; if maintenance exceeds 15% of rental revenue, likely a 'Dog' |

| Services in Declining Fields | Diminishing production, limited growth, reduced demand for services | Archrock reducing exposure; focus on premier, growing basins |

| Non-Core/Niche Equipment | Minimal market interest, lack of competitive advantage | Low revenue, slim profit margins; capital immobilization |

| Low Utilization Fleet Segments | Consistently below industry benchmarks or internal targets | If average utilization below 60% in 2024, classified as 'Dog' |

Question Marks

Archrock's strategic move into hydrogen and carbon capture compression, including a minority investment in a carbon capture company, positions it to tap into burgeoning energy transition markets. These ventures, while promising for long-term growth, represent nascent technologies with early commercialization, suggesting Archrock's current market share in these specific segments is likely minimal. Significant capital outlay will be crucial for establishing a dominant presence.

Archrock's expansion into new domestic or international geographic markets, where its current market share is low but the potential for natural gas infrastructure development is high, falls into the Question Mark category of the BCG Matrix. These initiatives demand significant initial capital for equipment and infrastructure, with uncertain immediate returns and no existing market leadership.

For instance, consider Archrock's potential entry into a rapidly industrializing region in Southeast Asia. In 2024, such a market might present opportunities due to increasing demand for cleaner energy sources like natural gas, but it also carries risks associated with regulatory hurdles and the need to build a customer base from scratch. The capital expenditure for establishing compressor stations and related infrastructure in a new territory could easily run into tens or hundreds of millions of dollars.

Investing in novel, potentially disruptive compression technologies, even those with minimal current market adoption and significant upfront costs, is a key part of Archrock's strategy. These ventures, while carrying inherent uncertainty, represent opportunities for future industry leadership and significant market share gains. Archrock's commitment to technological advancement underpins these high-risk, high-reward research and development initiatives.

Specialized RNG (Renewable Natural Gas) Compression Services

Archrock's specialized Renewable Natural Gas (RNG) compression services fall into the question mark category of the BCG matrix. This segment offers significant growth potential due to increasing demand for sustainable energy solutions, with the RNG market projected to expand considerably in the coming years. For example, the U.S. Environmental Protection Agency's Renewable Fuel Standard program incentivizes RNG production, driving investment in the sector.

While the market is expanding, Archrock's current market share in specialized RNG compression might be relatively small. This requires substantial investment to build out capacity, develop expertise, and secure contracts in this emerging niche. The high growth potential is counterbalanced by the inherent uncertainty and the need for strategic investment to establish a stronger competitive position.

- High Growth Potential: Driven by global sustainability initiatives and government incentives for renewable fuels.

- Developing Market: RNG is a newer sector compared to traditional natural gas, presenting both opportunities and challenges.

- Investment Required: Significant capital expenditure is needed to adapt existing infrastructure and develop new capabilities for RNG processing.

- Market Share Uncertainty: Archrock's position in this specific niche is still being established, necessitating strategic moves to capture market share.

Strategic Acquisitions for Future Growth

Archrock's strategic acquisitions, like the purchase of Natural Gas Compression Systems (NGCS) for $1.05 billion in 2023, are positioned as potential question marks within the BCG matrix. While these moves are designed to fuel future growth and expand market reach, their immediate impact and long-term success are still being evaluated.

These acquisitions are intended to capture emerging opportunities, but their classification as stars or question marks hinges on their ability to achieve significant market share and profitability. For instance, the NGCS acquisition aimed to bolster Archrock's midstream services and expand its compression fleet, a move expected to yield accretive results.

- NGCS Acquisition: Completed in 2023 for $1.05 billion, enhancing Archrock's compression services.

- Strategic Intent: Focus on capturing future growth in specific market segments.

- Integration & Impact: Full integration and market acceptance are key determinants of success.

- Accretive Expectations: The acquisition is projected to be accretive to earnings per share.

Archrock's ventures into emerging energy sectors like hydrogen and carbon capture compression, alongside expansion into new geographic markets, represent classic Question Marks. These areas offer high growth potential but currently have low market share for Archrock, demanding significant investment and carrying inherent uncertainty regarding future returns and competitive positioning.

The company's investment in new technologies and its strategic acquisitions, such as the $1.05 billion purchase of Natural Gas Compression Systems (NGCS) in 2023, also fall into this category. While these moves aim to capture future growth and expand market reach, their success and ability to achieve dominant market share are still unfolding, requiring substantial capital and strategic execution.

Archrock's focus on the specialized Renewable Natural Gas (RNG) compression services is another key Question Mark. The RNG market is experiencing rapid growth, driven by sustainability initiatives and regulatory support like the U.S. EPA's Renewable Fuel Standard program. However, Archrock's current market share in this niche is relatively small, necessitating significant investment to build capacity and expertise.

| Initiative | Market Growth Potential | Current Market Share (Archrock) | Investment Required | Uncertainty Level |

|---|---|---|---|---|

| Hydrogen Compression | High | Low | High | High |

| Carbon Capture Compression | High | Low | High | High |

| New Geographic Markets | Moderate to High | Low | High | Moderate to High |

| RNG Compression Services | High | Low | Moderate to High | Moderate |

| Acquisition Integration (e.g., NGCS) | Dependent on segment | N/A (focus on integration) | Ongoing (for full realization) | Moderate |

BCG Matrix Data Sources

Our Archrock BCG Matrix is informed by comprehensive data, including Archrock's financial filings, industry growth rates, and market share analysis from reputable research firms.