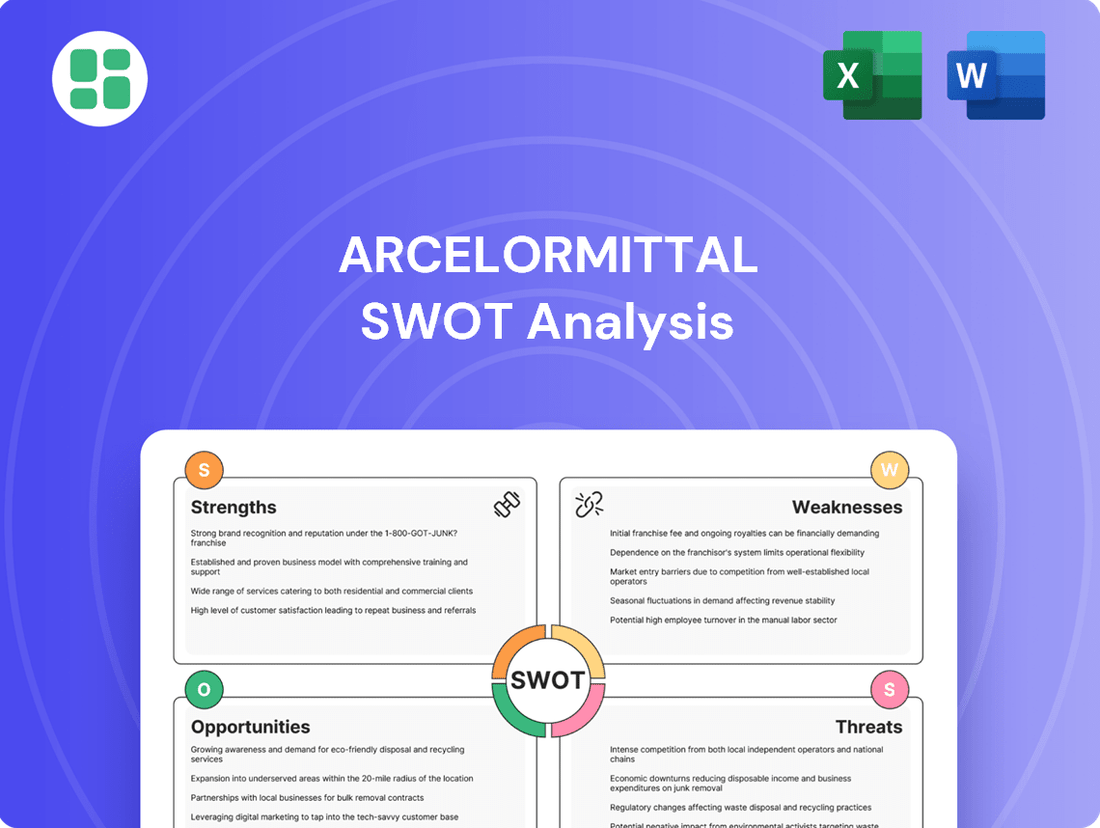

ArcelorMittal SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ArcelorMittal Bundle

ArcelorMittal's market leadership is undeniable, but understanding the nuances of its competitive landscape and operational challenges is crucial for any investor or strategist. Our comprehensive SWOT analysis delves deep into these factors, revealing critical strengths, potential weaknesses, emerging opportunities, and significant threats.

Want the full story behind ArcelorMittal's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

ArcelorMittal's position as the world's largest steel producer is a significant strength, underpinned by operations in 60 countries and primary steelmaking in 15. This vast global footprint, with strongholds in Europe and the Americas and expanding influence in Asia, enables the company to serve varied market demands and buffer against localized economic challenges.

The company's integrated business model, spanning from iron ore mining to finished steel products, further solidifies its market leadership. In 2024, ArcelorMittal reported revenues of $62.4 billion, with crude steel production reaching 57.9 million metric tonnes and iron ore output at 42.4 million tonnes, demonstrating immense operational scale and control over its value chain.

ArcelorMittal's integrated steel and mining business model is a core strength, providing a significant competitive edge. This model ensures a consistent and cost-effective supply of essential raw materials like iron ore and coal, directly from its own mining operations. This vertical integration is crucial for managing supply chain disruptions and mitigating the impact of raw material price volatility, contributing to more stable financial performance.

The company's captive mines, strategically positioned across North America, South America, Africa, and Europe, underscore its commitment to self-sufficiency. For instance, in 2023, ArcelorMittal's mining segment reported 52.4 million tonnes of iron ore production, a substantial portion of its steelmaking needs. This captive supply chain significantly reduces reliance on external suppliers, offering greater control over costs and availability, which is particularly advantageous during periods of high global demand or supply constraints.

ArcelorMittal shows a strong commitment to decarbonization, achieving a nearly 50% reduction in absolute CO2 emissions from its 2018 operating perimeter by 2024. This significant achievement is bolstered by substantial investments in decarbonization projects and a greater reliance on Electric Arc Furnaces (EAF).

The company has allocated $1 billion towards decarbonization initiatives, focusing on producing smarter steels with reduced energy consumption and a considerably lower carbon footprint. ArcelorMittal's 2024 Sustainability Report details progress in safety, environmental responsibility, and the growth of low-carbon solutions like XCarb, underscoring its dedication to sustainable steel manufacturing.

Advanced Research and Development Capabilities

ArcelorMittal demonstrates robust strengths through its significant investment in research and development. In 2024, the company allocated $272 million to R&D, a clear indicator of its commitment to innovation.

This substantial funding fuels the development of advanced steel grades and more sustainable manufacturing processes. ArcelorMittal's focus on high-strength, lightweight, and environmentally friendly steel products directly addresses the evolving needs of key sectors like automotive and renewable energy.

The company's R&D efforts are strategically concentrated on critical growth areas, including:

- Sustainable product development

- e-mobility solutions

- Clean energy transition technologies

- Artificial intelligence integration

Financial Resilience and Strategic Capital Allocation

ArcelorMittal showcased significant financial resilience throughout 2024, navigating a demanding market landscape. The company reported an impressive EBITDA of $7.1 billion and an adjusted net income of $2.3 billion, underscoring its operational strength.

The company's robust balance sheet, characterized by $5.1 billion in net debt and a substantial $12.0 billion in liquidity as of year-end 2024, provides a solid foundation for its strategic initiatives. This financial flexibility enables ArcelorMittal to pursue growth opportunities while also rewarding its shareholders.

Strategic capital allocation is a key strength, with investments primarily directed towards high-potential markets such as Brazil, India, and the United States. These targeted investments are projected to unlock an additional $1.9 billion in EBITDA potential, demonstrating a clear focus on future value creation.

- Financial Resilience: Achieved $7.1 billion EBITDA and $2.3 billion adjusted net income in 2024 despite market challenges.

- Strong Balance Sheet: Maintained $5.1 billion net debt and $12.0 billion liquidity at the end of 2024.

- Strategic Growth Investments: Focused capital on Brazil, India, and the US to boost future EBITDA.

- EBITDA Enhancement: Targeting a $1.9 billion increase in EBITDA potential through strategic project execution.

ArcelorMittal's integrated steel and mining operations represent a significant strength, providing cost advantages and supply chain control. In 2024, the company's mining segment produced 52.4 million tonnes of iron ore, directly supporting its steelmaking needs.

The company's commitment to decarbonization is a notable strength, with a nearly 50% reduction in CO2 emissions achieved by 2024 from its 2018 baseline. Substantial investments in projects like XCarb highlight a strategic focus on sustainable steel production.

ArcelorMittal's robust financial performance in 2024, including $7.1 billion in EBITDA and $2.3 billion in adjusted net income, demonstrates strong operational capabilities and financial resilience.

Significant investment in research and development, totaling $272 million in 2024, fuels innovation in advanced steel grades and sustainable manufacturing processes, positioning the company for future growth.

| Metric | 2024 Data | Significance |

|---|---|---|

| Iron Ore Production | 52.4 million tonnes | Ensures raw material security and cost control |

| CO2 Emission Reduction | Nearly 50% (vs. 2018) | Demonstrates commitment to sustainability |

| EBITDA | $7.1 billion | Highlights strong operational profitability |

| R&D Investment | $272 million | Drives innovation and future competitiveness |

What is included in the product

Delivers a strategic overview of ArcelorMittal’s internal and external business factors, examining its strengths in global production capacity and market leadership, alongside weaknesses in debt and operational efficiency. It also highlights opportunities in decarbonization and emerging markets, while acknowledging threats from volatile commodity prices and increasing competition.

Offers a clear SWOT analysis of ArcelorMittal, highlighting key vulnerabilities and opportunities for proactive risk mitigation and strategic advantage.

Weaknesses

ArcelorMittal is exposed to the inherent cyclicality of the steel industry, making it vulnerable to shifts in global economic conditions that directly impact steel prices and demand. This sensitivity was evident in 2024, when the company's sales fell 8.5% to $62.4 billion, largely driven by a 7.6% decrease in average steel selling prices.

Consequently, ArcelorMittal’s financial results can be significantly affected by adverse price-cost dynamics and broader economic slowdowns, creating periods of financial pressure.

ArcelorMittal faces significant hurdles due to the immense capital expenditure needed to meet its ambitious decarbonization goals. Investing in technologies like green hydrogen Direct Reduced Iron (DRI) and Electric Arc Furnaces (EAF) demands substantial upfront investment.

While the company has committed $1 billion towards decarbonization efforts, the full economic feasibility of these advanced ironmaking technologies is anticipated to materialize only after 2030. This timeline is contingent on the establishment of supportive policies and the development of necessary infrastructure.

The substantial financial burden and inherent risks associated with these transformative technologies are amplified by the current lack of comprehensive regulatory frameworks and adequate subsidies, creating a challenging financial landscape for ArcelorMittal's green transition.

Global geopolitical tensions and rising trade protectionism, including tariffs, directly disrupt international trade flows and distort supply and demand dynamics for steel. ArcelorMittal specifically cited the impact of Section 232 tariffs, which have demonstrably increased their operational costs and negatively affected key markets like Canada and Mexico.

Furthermore, the company grapples with the persistent challenge of low-priced imported steel, particularly from China. This influx exacerbates existing overcapacity issues in crucial regions such as Europe, fueling industry-wide calls for more robust trade safeguard measures to level the playing field.

Operational Challenges and Regulatory Risks in Specific Regions

ArcelorMittal grapples with considerable operational hurdles and financial strains in specific geographies. For instance, its Longs Business in South Africa experienced substantial losses throughout 2024. This downturn was primarily attributed to sluggish economic expansion, elevated logistics and energy expenses, and intense, often unsustainable, competition from imported steel products.

These localized difficulties, which have even led to the strategic decision to cease operations in certain areas, inevitably affect ArcelorMittal's consolidated profitability. Furthermore, the company must contend with the financial burden of restructuring costs associated with these regional issues.

The operational landscape is further complicated by regulatory uncertainties and a lack of robust policy backing in various markets. Such an environment can significantly impede smooth operations and deter crucial new investments, creating a challenging operating environment.

- South African Longs Business Losses: ArcelorMittal's South African Longs Business reported significant financial losses in 2024.

- Contributing Factors: Weak economic growth, high logistics and energy costs, and import competition were key drivers of these losses.

- Operational Restructuring: Decisions to wind down operations in some regions necessitate restructuring costs, impacting overall financial performance.

- Regulatory Environment: Regulatory uncertainty and insufficient policy support in certain regions pose ongoing risks to operations and investment.

Dependence on Carbon-Intensive Production Methods

ArcelorMittal's reliance on traditional blast furnaces, which heavily depend on metallurgical coal, positions it within a carbon-intensive production framework. While the company is investing in cleaner technologies like Electric Arc Furnaces (EAFs) and Direct Reduced Iron (DRI), a substantial part of its output still originates from these high-emission processes. For instance, in 2023, ArcelorMittal reported that its steel production via blast furnaces remained a significant contributor to its overall carbon footprint, even as EAF production saw an increase. This ongoing dependence makes the company vulnerable to stricter environmental regulations and the potential financial impact of carbon pricing mechanisms.

The transition to low-carbon steelmaking, though a stated priority, presents considerable long-term hurdles in terms of scale and technological maturity. ArcelorMittal's 'Smart Carbon' strategy aims to reduce emissions, but the full decarbonization of its blast furnace operations requires substantial investment and innovation. This commitment to cleaner methods is crucial, as the global push towards sustainability intensifies scrutiny on heavy industries. The company's exposure to carbon taxes or similar levies could impact its cost competitiveness if the transition to lower-emission production methods is not achieved efficiently.

ArcelorMittal's significant exposure to the cyclical nature of the steel market means its financial performance is highly sensitive to fluctuations in global economic conditions and steel prices. This was underscored in 2024, when a 7.6% drop in average steel selling prices contributed to an 8.5% decline in the company's sales, reaching $62.4 billion.

The company faces substantial capital expenditure requirements to achieve its decarbonization targets, with investments in technologies like green hydrogen DRI and EAFs demanding significant upfront funding. The full economic benefits of these advanced ironmaking technologies are not expected until after 2030, and their feasibility is dependent on supportive policies and infrastructure development.

Geopolitical tensions and trade protectionism, including tariffs, directly disrupt international trade and distort steel supply and demand. ArcelorMittal has specifically noted increased operational costs and negative impacts in key markets like Canada and Mexico due to Section 232 tariffs.

The company also contends with localized operational challenges and financial strains, such as the significant losses reported by its South African Longs Business in 2024. This was driven by weak economic growth, high logistics and energy costs, and intense competition from imported steel products.

Full Version Awaits

ArcelorMittal SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You'll gain a comprehensive understanding of ArcelorMittal's Strengths, Weaknesses, Opportunities, and Threats. This analysis is designed to provide actionable insights for strategic decision-making.

Opportunities

The increasing global focus on sustainability presents a prime opportunity for ArcelorMittal to capture a larger market share by supplying low-carbon steel. The company's strategic investments, such as its hydrogen-ready DRI-EAF facilities, directly address the burgeoning demand for green steel from sectors like automotive and construction, which are increasingly prioritizing environmental impact. This push is further bolstered by supportive government policies and carbon pricing initiatives that make decarbonization solutions more economically attractive.

Global infrastructure development and urbanization present a significant opportunity for ArcelorMittal. Forecasts suggest a rebound in steel demand, largely propelled by public infrastructure projects and decarbonization initiatives, especially in burgeoning economies. ArcelorMittal's broad range of construction and engineering steel products positions it advantageously to benefit from this resurgence.

India, in particular, is anticipated to sustain robust growth in steel demand, directly linked to substantial infrastructure investments. This trend is a key driver for ArcelorMittal's strategic growth in the region, leveraging its established presence and diversified product offerings.

ArcelorMittal's commitment to technological advancement, including significant investments in R&D, positions it to capitalize on the growing demand for specialized steel products in emerging sectors. For instance, their focus on developing advanced high-strength steels for the automotive industry, particularly for electric vehicles, is a key growth area. In 2023, the company reported a 7% increase in R&D spending, with a substantial portion allocated to digital solutions and sustainable steelmaking.

The adoption of AI and automation across its production facilities is enhancing operational efficiency and cost reduction. For example, the implementation of predictive maintenance systems in their blast furnaces has led to a reported 15% decrease in unplanned downtime. This digital transformation also extends to supply chain management, enabling better inventory control and logistics optimization, crucial for navigating volatile market conditions.

By developing steel grades tailored for the clean energy transition, such as those used in wind turbines and solar panel infrastructure, ArcelorMittal is securing a competitive advantage. Their recent partnership with a leading renewable energy developer to supply specialized steel for offshore wind farms highlights this strategic direction. This focus on innovation in response to global decarbonization trends is expected to drive future revenue streams.

Strategic Acquisitions and Partnerships

ArcelorMittal has significant opportunities to pursue strategic acquisitions and forge joint ventures. These moves can bolster its market standing, broaden its product offerings, and crucially, advance its decarbonization objectives. For instance, the company's 2024 acquisition of Vallourec brought in vital rolling capacity within low-emission zones and valuable expertise in hydrogen and carbon capture technologies.

These strategic integrations enable ArcelorMittal to tap into lucrative, low-carbon market segments and diversify its revenue streams, reducing reliance on traditional steel production. The company is actively seeking opportunities that align with its long-term sustainability and growth targets.

- Market Expansion: Acquisitions can provide immediate access to new geographic regions or customer segments.

- Technology Acquisition: Partnerships can bring in critical technologies for decarbonization, such as green hydrogen production or CCUS.

- Portfolio Diversification: Acquiring companies with complementary products or services can create new revenue avenues.

- Synergies: Combining operations can lead to cost efficiencies and improved operational performance.

Growth in Emerging Markets

While developed markets may present some headwinds, emerging economies are a significant bright spot for steel demand. Countries like India, Brazil, and the MENA region are experiencing robust economic expansion, translating into increased infrastructure and industrial development, which are key drivers for steel consumption. For instance, India’s steel demand is projected to grow significantly in the coming years, supported by government initiatives like the National Infrastructure Pipeline.

ArcelorMittal is well-positioned to capitalize on this growth. Its established presence and ongoing strategic investments in these regions, such as its joint venture AM/NS India, give it a competitive edge. The company’s stated strategy is to direct capital towards markets exhibiting strong growth prospects and favorable return potential, making these emerging economies a core focus for future expansion and investment.

Key opportunities in emerging markets include:

- Expanding market share in high-growth regions like India, driven by infrastructure development.

- Leveraging existing partnerships, such as AM/NS India, to boost production and sales.

- Capitalizing on government stimulus and industrialization programs in the MENA region.

- Diversifying revenue streams by catering to the specific needs of rapidly developing economies.

ArcelorMittal is strategically positioned to benefit from the global push towards decarbonization, particularly through its investments in low-carbon steel production. The company's focus on green steel, supported by government incentives and growing demand from environmentally conscious sectors, presents a significant avenue for market share expansion. Furthermore, ongoing global infrastructure development, especially in rapidly growing emerging economies like India, is expected to drive substantial demand for steel, a trend ArcelorMittal is well-equipped to leverage with its diverse product portfolio.

| Opportunity Area | Key Drivers | ArcelorMittal's Position |

|---|---|---|

| Low-Carbon Steel Demand | Global sustainability focus, government policies, corporate ESG goals | Investments in DRI-EAF, hydrogen-ready facilities, R&D for advanced steel grades |

| Infrastructure Development | Urbanization, government stimulus packages, emerging market growth | Broad range of construction and engineering steel products, established presence in growth regions |

| Technological Advancement | Demand for specialized steel in new sectors (EVs, renewables) | R&D spending, focus on advanced high-strength steels, digital solutions |

| Strategic Acquisitions & JVs | Market consolidation, technology acquisition, portfolio diversification | Acquisition of Vallourec, existing joint ventures like AM/NS India |

Threats

A significant threat to ArcelorMittal is the ongoing global economic slowdown and the persistent risk of recession. This directly dampens steel demand, particularly in crucial sectors like automotive manufacturing and construction, which are highly sensitive to economic fluctuations.

Factors such as reduced household purchasing power, the impact of aggressive monetary tightening by central banks, and elevated construction costs are all contributing to this sluggish demand environment. These headwinds create an uncertain outlook for steel consumption.

While some modest recovery is anticipated for 2025, the overall trajectory of steel demand remains a key concern. For instance, the World Steel Association's forecast for global steel demand growth in 2024 was revised down to 1.7% in October 2023, reflecting these economic uncertainties.

The global steel industry is grappling with significant overcapacity, largely driven by China's massive production output, which accounts for over half of the world's steel. This situation intensifies competition, as Chinese producers, facing subdued domestic demand, have increasingly turned to exporting steel at highly competitive prices. In 2023, China's steel output reached a record high of 1.019 billion tonnes, a 3.3% increase from 2022, exacerbating the pressure on global markets.

This influx of low-cost imports directly impacts ArcelorMittal and its peers by suppressing steel prices and eroding profit margins. The sheer volume of these exports can lead to trade disputes and calls for protective measures, such as tariffs, to level the playing field. Failure to manage this competitive pressure could force other producers, including ArcelorMittal, into difficult decisions like reducing output or even closing facilities to remain viable.

Fluctuations in iron ore and coal prices, alongside escalating energy expenses, present a substantial risk to ArcelorMittal's earnings. For example, ArcelorMittal South Africa faced significant challenges due to a 15% increase in electricity tariffs in 2023, compounding high logistics costs.

While ArcelorMittal's integrated operations provide a degree of insulation, the company remains exposed to the volatility of external markets for these essential inputs, which can directly impact its profit margins.

Stringent Environmental Regulations and Policy Uncertainty

Increasingly strict environmental regulations and the significant costs associated with compliance and decarbonization pose a substantial threat to ArcelorMittal. This is particularly true if the policy support for the green transition proves insufficient or remains uncertain. For example, delays in crucial financial aid and the establishment of a supportive policy framework could impede ArcelorMittal's ambitious decarbonization strategies, potentially impacting its overall competitiveness.

The company has experienced firsthand how regulatory uncertainty can derail progress, leading to the abandonment of certain projects. This highlights the critical need for clear, consistent, and supportive governmental policies to enable the company to meet its environmental targets and maintain its market position in a rapidly evolving landscape.

- Regulatory Uncertainty: Delays in policy and financial support for decarbonization can hinder ArcelorMittal's green transition plans.

- Compliance Costs: The financial burden of meeting increasingly stringent environmental standards is a significant operational challenge.

- Competitiveness Impact: Insufficient policy support could disadvantage ArcelorMittal compared to competitors in regions with more favorable regulatory environments.

- Project Delays: Past experiences show that regulatory ambiguity has led to the shelving of important environmental initiatives.

Geopolitical Risks and Supply Chain Disruptions

Geopolitical instability, including regional conflicts and trade disputes, poses a significant threat by disrupting ArcelorMittal's intricate supply chains. These disruptions can impact the availability and cost of essential raw materials like iron ore and coking coal, directly affecting production levels. For instance, the illegal blockade in Mexico during 2024, which halted crude steel production at the Lazaro Cardenas plant, highlights the tangible operational consequences of such geopolitical risks.

These events can lead to unforeseen expenses and hinder the company's capacity to fulfill customer orders, potentially impacting market share and revenue. The global nature of ArcelorMittal's operations means that localized geopolitical tensions can have far-reaching consequences. In 2024, the ongoing conflict in Eastern Europe continued to present challenges for steel producers, including those with operations in or sourcing from affected regions.

- Supply Chain Vulnerability: Geopolitical events directly threaten the flow of raw materials and finished goods.

- Market Access Restrictions: Trade disputes or sanctions can limit ArcelorMittal's ability to sell products in key markets.

- Operational Interruptions: Localized conflicts or blockades can force temporary or prolonged shutdowns of production facilities, as seen in Mexico.

- Increased Costs: Disrupted logistics and material shortages inevitably drive up operational and input costs.

The persistent global overcapacity in steel production, largely fueled by China's significant output, presents a major threat by intensifying competition and suppressing prices. This situation, where China's steel output reached a record 1.019 billion tonnes in 2023, forces companies like ArcelorMittal to contend with low-cost imports that erode profit margins.

Escalating input costs, including energy, iron ore, and coal, directly impact ArcelorMittal's profitability, as seen with the 15% electricity tariff hike faced by ArcelorMittal South Africa in 2023. Furthermore, the company is vulnerable to geopolitical instability, which can disrupt supply chains and halt production, as evidenced by the 2024 blockade impacting its Lazaro Cardenas plant in Mexico.

The company also faces substantial threats from increasingly stringent environmental regulations and the associated compliance costs. Delays in policy support for decarbonization, a critical area for ArcelorMittal's future competitiveness, have previously led to project cancellations, underscoring the risk of regulatory uncertainty.

| Threat Category | Specific Risk | Impact on ArcelorMittal | Supporting Data/Example |

| Overcapacity & Competition | Intensified competition from low-cost exports | Price suppression, eroded profit margins | China's 2023 steel output: 1.019 billion tonnes (+3.3% YoY) |

| Input Cost Volatility | Rising energy, iron ore, and coal prices | Reduced profitability, operational challenges | ArcelorMittal South Africa: 15% electricity tariff increase in 2023 |

| Geopolitical Instability | Supply chain disruptions, operational halts | Increased costs, reduced output, market share loss | Mexico plant blockade (2024) halted crude steel production |

| Environmental Regulations | High compliance costs, regulatory uncertainty | Hindered decarbonization efforts, potential loss of competitiveness | Past project cancellations due to regulatory ambiguity |

SWOT Analysis Data Sources

This ArcelorMittal SWOT analysis is built upon a robust foundation of data, drawing from official financial reports, comprehensive market intelligence, and expert industry commentary to ensure a well-informed and accurate assessment.