ArcelorMittal Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ArcelorMittal Bundle

ArcelorMittal operates in a highly competitive steel industry, facing significant pressure from powerful buyers and intense rivalry among existing players. Understanding these dynamics is crucial for navigating its market landscape.

The complete report reveals the real forces shaping ArcelorMittal’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

ArcelorMittal's raw material integration, particularly its ownership of iron ore and coal mines, significantly curtails the bargaining power of external suppliers for these vital inputs. This vertical integration ensures a more stable and cost-effective supply chain, directly impacting the leverage suppliers can exert.

In 2024, ArcelorMittal's self-sufficiency in iron ore production saw a notable increase, reinforcing its ability to dictate terms rather than being dictated to by suppliers. This internal control over raw material sourcing is a key factor in mitigating supplier power.

ArcelorMittal's steel production is inherently energy-intensive, meaning energy costs represent a significant portion of its operational expenses. For instance, in 2023, energy costs were a major factor impacting the profitability of steelmakers globally, with natural gas prices in Europe experiencing considerable volatility. This reliance makes ArcelorMittal vulnerable to the bargaining power of energy suppliers, particularly those in regions with less stable energy markets.

The increasing global focus on decarbonization and sustainable steelmaking introduces new energy considerations. As ArcelorMittal invests in greener technologies, such as electric arc furnaces powered by renewable energy, new dependencies on specialized energy providers and the associated costs emerge, potentially shifting the bargaining power dynamics.

Suppliers providing highly specialized equipment, advanced technologies, and critical intellectual property for ArcelorMittal's modern steelmaking operations wield moderate bargaining power. These niche providers offer unique solutions that are indispensable for enhancing operational efficiency, ensuring consistent product quality, and driving crucial decarbonization initiatives. The cost and complexity involved in switching these specialized suppliers can be substantial, reinforcing their influence.

Labor and Human Capital

The bargaining power of labor and human capital is a key factor for ArcelorMittal. In 2024, the availability and cost of skilled workers, especially in heavily unionized areas where ArcelorMittal operates, can significantly influence labor costs. This concentration of skilled labor in certain regions grants employees considerable leverage during negotiations.

Labor negotiations and the potential for strikes pose a direct threat to ArcelorMittal's operations. Disruptions in production can lead to increased operational costs and impact delivery schedules. For example, in 2023, several European steel plants experienced labor disputes that caused temporary shutdowns, highlighting this vulnerability.

Maintaining a highly skilled workforce is paramount for ArcelorMittal to ensure consistent productivity and to effectively implement new technologies. The company's investment in training and development programs is crucial for mitigating the bargaining power of labor by fostering a stable and adaptable workforce.

- Skilled Labor Availability: Regions with a high concentration of experienced steelworkers can exert greater bargaining power.

- Unionization Impact: Strong union presence in key operating locations can amplify labor's negotiating strength.

- Operational Disruption Risk: Potential for strikes or work stoppages directly affects production output and costs.

- Technological Adoption: A skilled workforce is essential for integrating and benefiting from advanced manufacturing processes.

Environmental Compliance & Carbon Inputs

The growing emphasis on environmental compliance and decarbonization significantly bolsters the bargaining power of suppliers in these specialized areas. As ArcelorMittal and the broader steel industry invest heavily in reducing their carbon footprint, the demand for environmental compliance services, carbon capture technologies, and future green hydrogen solutions escalates.

ArcelorMittal's stated ambition to achieve net-zero operational emissions by 2050, with interim targets, directly translates into a heightened dependence on these key suppliers. For instance, their 2023 sustainability report highlighted significant investments in projects aimed at reducing CO2 emissions, underscoring the critical role these external partners play in their strategic objectives. This reliance grants these suppliers greater leverage in negotiations.

- Increased Demand: As sustainability targets become more stringent, the need for specialized environmental solutions grows, empowering suppliers.

- Technological Dependence: ArcelorMittal's reliance on advanced carbon capture and potentially green hydrogen technologies places significant power in the hands of the providers of these innovations.

- Strategic Importance: Suppliers crucial for meeting decarbonization goals gain leverage due to their indispensable role in ArcelorMittal's long-term strategy and regulatory compliance.

- Future Market Growth: The burgeoning market for green technologies suggests that suppliers in this space will continue to see their bargaining power increase.

ArcelorMittal's vertical integration into iron ore and coal mining significantly reduces its reliance on external suppliers for these critical raw materials. This self-sufficiency, reinforced by increased internal production in 2024, grants ArcelorMittal considerable leverage over any remaining third-party suppliers. However, the company remains exposed to the bargaining power of energy suppliers due to its energy-intensive operations, with European natural gas price volatility in 2023 underscoring this vulnerability.

Suppliers of specialized technology and intellectual property for advanced steelmaking and decarbonization initiatives hold moderate bargaining power due to the unique nature of their offerings and the high switching costs. Similarly, skilled labor, particularly in unionized regions, can exert significant influence on ArcelorMittal's operational costs and stability, as evidenced by labor disputes causing temporary shutdowns in 2023.

The increasing demand for environmental compliance and green technologies, essential for ArcelorMittal's net-zero ambitions by 2050, significantly enhances the bargaining power of suppliers in these niche sectors. The company's 2023 sustainability report highlighted substantial investments in emission-reduction projects, confirming its dependence on these specialized providers.

| Supplier Category | Impact on ArcelorMittal | 2023/2024 Data/Trends | Bargaining Power Level |

|---|---|---|---|

| Iron Ore & Coal | Reduced reliance due to vertical integration | Increased self-sufficiency in 2024 | Low |

| Energy (e.g., Natural Gas) | High dependence, significant cost factor | European natural gas price volatility in 2023 | High |

| Specialized Technology & IP | Indispensable for efficiency and decarbonization | High switching costs for unique solutions | Moderate |

| Skilled Labor | Crucial for operations and technological adoption | Labor disputes caused shutdowns in 2023; union influence | Moderate to High |

| Environmental & Green Tech | Essential for net-zero targets | Significant investment in emission reduction projects (2023) | Moderate to High |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to ArcelorMittal's global steel and mining operations.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's five forces impacting ArcelorMittal.

Customers Bargaining Power

ArcelorMittal's customers, particularly in sectors like automotive and construction, often buy steel in massive quantities. For instance, major automotive manufacturers can account for substantial portions of a steel producer's output, giving them considerable leverage.

The concentration of these large buyers means that a relatively small number of customers can represent a significant portion of ArcelorMittal's revenue. This concentration amplifies their bargaining power, allowing them to demand better pricing and more favorable contract terms due to the sheer volume of their orders.

For standardized steel products, customers have significant bargaining power. This is because switching costs are low, and they can easily find alternative suppliers globally. For instance, in 2024, the global steel market saw continued price volatility, allowing buyers to leverage competitive offers.

ArcelorMittal counters this by concentrating on high-value, customized steel solutions. Products like advanced high-strength steels for the automotive sector, which require specific engineering and performance characteristics, lock in customers and reduce their ability to switch easily. This differentiation strategy is crucial in mitigating customer leverage.

In the cyclical steel industry, customers often exhibit significant price sensitivity. This is especially true when the market faces oversupply or economic slowdowns. For instance, in 2024, global steel prices saw considerable volatility, directly impacting purchasing decisions for many buyers.

This price sensitivity empowers customers, particularly as they navigate economic uncertainties. The expectation of continued price influences from global economic trends in the coming periods further strengthens their bargaining position as they actively seek more cost-effective solutions.

Backward Integration Threat

The threat of backward integration by large customers, while infrequent due to its significant capital demands, can empower them in negotiations. For instance, major automotive manufacturers, who are substantial steel consumers, could theoretically produce their own steel, thereby reducing their reliance on suppliers like ArcelorMittal.

Even if this direct integration doesn't occur, the potential for it influences pricing and contract terms. In 2023, the automotive sector's global production reached approximately 80 million vehicles, highlighting the sheer scale of potential steel demand that could be brought in-house.

- Theoretical Threat: Large customers like automotive giants possess the financial clout to consider in-house steel production, a move that inherently strengthens their negotiating position.

- Influence on Negotiations: The mere possibility of backward integration, even if not executed, pressures steel suppliers to offer more competitive pricing and favorable terms.

- Capital Intensity: Establishing steel manufacturing capabilities requires immense investment, making widespread backward integration a rare occurrence in practice.

- Market Dynamics: The bargaining power of customers is amplified by their ability to credibly threaten to bypass traditional suppliers.

Global Demand Trends

Global demand trends significantly shape the bargaining power of customers in the steel industry. For example, a slowdown in major sectors like automotive and construction, which experienced some headwinds in 2024, tends to increase customer leverage as producers compete for fewer orders.

Conversely, robust growth in emerging markets, such as India's infrastructure boom, can bolster the bargaining power of steel suppliers. In 2024, India's construction sector continued its strong performance, driving demand for steel and potentially shifting some power towards producers in that region.

- A downturn in global construction activity in 2024 reduced demand, giving buyers more negotiating power.

- Strong automotive production growth in certain regions in 2024 supported steel prices, lessening customer bargaining power.

- The infrastructure development drive in India during 2024 created high demand, strengthening ArcelorMittal's position with customers there.

ArcelorMittal's customers, particularly large buyers in the automotive and construction sectors, wield considerable bargaining power due to high purchase volumes and low switching costs for standardized products. This leverage is amplified in 2024 by global steel price volatility, forcing ArcelorMittal to focus on value-added, customized solutions to retain customers.

| Customer Segment | Bargaining Power Drivers | Impact on ArcelorMittal | 2024 Data/Context |

|---|---|---|---|

| Automotive Manufacturers | High volume purchases, potential backward integration threat | Pressure on pricing, demand for specific grades | Global automotive production ~80 million vehicles in 2023; continued focus on lightweight, high-strength steels in 2024. |

| Construction Sector | Price sensitivity, availability of alternative suppliers | Negotiations influenced by market oversupply and economic outlook | Global construction activity experienced varied regional performance in 2024, impacting demand and pricing power. |

| Standardized Products Buyers | Low switching costs, global supplier competition | Intense price competition | Continued price volatility in the global steel market in 2024 provided buyers leverage. |

Preview Before You Purchase

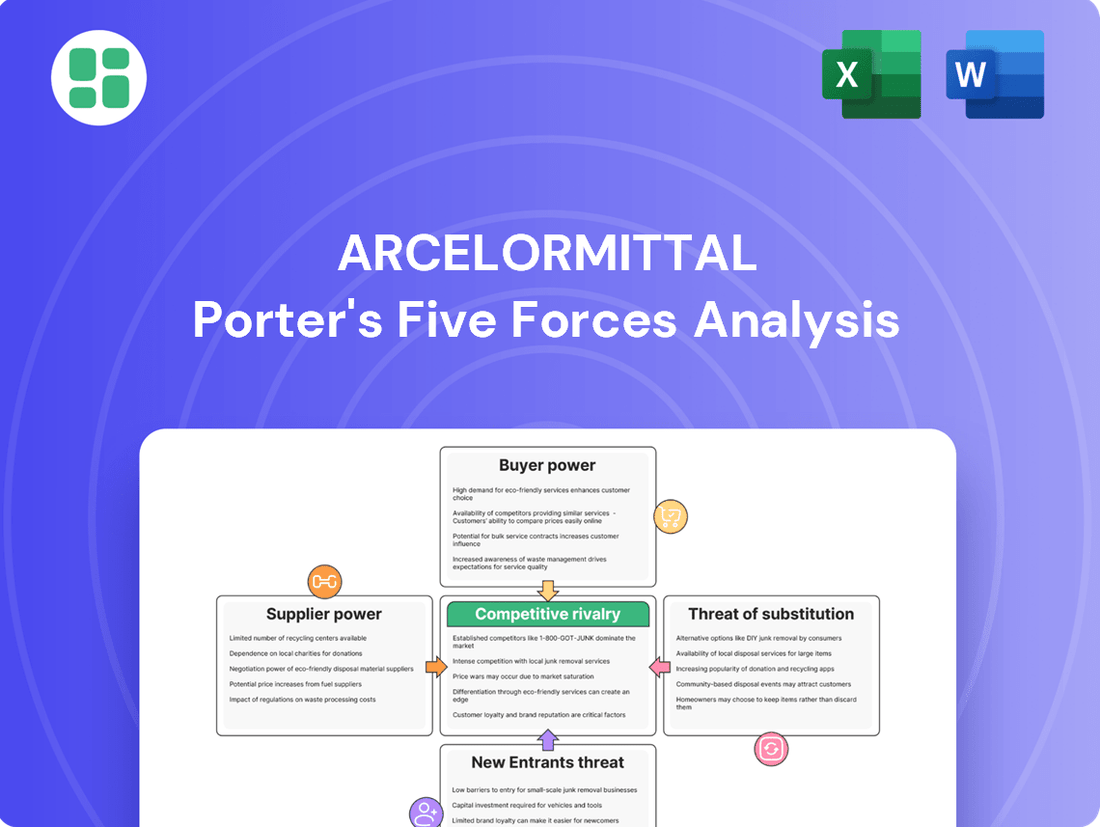

ArcelorMittal Porter's Five Forces Analysis

This preview showcases the complete ArcelorMittal Porter's Five Forces Analysis, offering an in-depth examination of the competitive landscape. The document you see here is precisely what you'll receive upon purchase, providing a professionally formatted and ready-to-use strategic tool. Gain immediate access to this detailed analysis, including insights into bargaining power of buyers and suppliers, threat of new entrants and substitutes, and the intensity of rivalry within the steel industry.

Rivalry Among Competitors

The global steel industry is intensely competitive, with ArcelorMittal operating on a vast scale alongside other major players. This global reach means competition isn't confined to local markets. A significant factor is the persistent issue of overcapacity, largely driven by production from China, which often floods the market with steel.

This oversupply, combined with the inherently high fixed costs associated with steel production, creates a challenging pricing environment. When demand dips, the pressure to sell inventory intensifies, leading to aggressive price competition. For instance, in 2023, global steel production reached approximately 1.89 billion tonnes, a slight increase from 2022, underscoring the ongoing supply dynamics.

The consequence of this overcapacity and high cost structure is a constant struggle to maintain healthy profit margins, especially during periods of economic slowdown. Companies like ArcelorMittal must constantly navigate these market pressures to remain profitable.

ArcelorMittal operates in a highly competitive global steel market. Major rivals like POSCO, Nippon Steel, and Baowu Steel Group exert significant pressure, often bolstered by strong home market positions and potential government backing. For instance, Baowu Steel, China's largest steel producer, saw its crude steel output reach approximately 130 million tonnes in 2023, highlighting its immense scale.

ArcelorMittal aims to stand out by offering specialized and high-value steel products. However, a significant portion of the steel industry still operates on a commodity basis, making it challenging to differentiate solely on product features.

This commodity nature means that competition often centers on price, operational efficiency, and the robustness of the supply chain. For instance, while ArcelorMittal might offer advanced steel grades for automotive lightweighting, many competitors can still vie for market share through cost leadership.

In 2023, the global steel market experienced price fluctuations, with benchmark hot-rolled coil prices in the US averaging around $750 per ton, highlighting the sensitivity to cost and efficiency. ArcelorMittal's efforts in product differentiation must therefore be balanced with a strong focus on cost management to remain competitive.

Trade Protectionism and Geopolitics

Trade protectionism, including tariffs and quotas, directly influences global steel prices and ArcelorMittal's market access. For instance, the US Section 232 tariffs, implemented in 2018, imposed a 25% tariff on steel imports, significantly altering trade patterns and creating a more challenging environment for international producers. This can lead to higher input costs for downstream industries and spark retaliatory measures from other nations, further complicating international trade.

Geopolitical tensions also play a crucial role, creating uncertainty and potentially disrupting supply chains. Conflicts or strained international relations can lead to sanctions, export restrictions, or shifts in demand, forcing companies like ArcelorMittal to diversify their production bases and sourcing strategies to ensure operational resilience. The ongoing geopolitical landscape in Eastern Europe, for example, has had a notable impact on energy costs and raw material availability for steel producers.

- Trade Barriers Impact: US Section 232 tariffs on steel imports averaged 25%, impacting global trade flows.

- Regional Imbalances: Protectionist measures can create price disparities between regions, favoring domestic producers.

- Supply Chain Adaptation: Companies must adjust production and sourcing to navigate geopolitical risks and trade disruptions.

- Market Access Challenges: Tariffs and trade disputes can limit ArcelorMittal's ability to export to key markets.

Decarbonization Race

The steel industry is in the midst of a profound shift towards sustainability, often referred to as the decarbonization race. This means companies are pouring significant resources into developing and implementing technologies that reduce carbon emissions in steel production. For instance, ArcelorMittal is investing billions in projects like direct reduction of iron (DRI) plants powered by green hydrogen, aiming for substantial emissions cuts by 2030.

This intense focus on green steel introduces a fresh competitive dynamic. Companies are vying not only on price and quality but also on their environmental credentials. The ability to offer steel with a lower carbon footprint is becoming a key differentiator, driven by increasingly stringent environmental regulations and growing customer demand for sustainable materials. This is pushing innovation and accelerating the adoption of new, cleaner production methods across the sector.

- Industry Transformation: The steel sector is actively transitioning to low-carbon production methods.

- Key Investments: Major players are allocating substantial capital towards green steel technologies.

- Competitive Edge: Sustainability is emerging as a critical factor in market competition.

- Regulatory & Customer Drivers: Environmental regulations and customer preferences are fueling the race to decarbonize.

Competitive rivalry within the steel sector is fierce, characterized by global overcapacity, primarily from China, which pressures pricing. High fixed costs amplify this, forcing companies to compete aggressively on price and efficiency. For example, in 2023, global steel production neared 1.89 billion tonnes, illustrating the sheer volume in play.

ArcelorMittal faces formidable competitors like POSCO and Nippon Steel, with Baowu Steel Group, China's largest producer, outputting around 130 million tonnes in 2023. Differentiation through specialized products is a strategy, but the industry's commodity nature means price and operational efficiency often dictate market share.

Trade protectionism, such as the US Section 232 tariffs at 25%, significantly alters market access and pricing. Geopolitical instability further complicates operations, necessitating supply chain resilience. The industry's push towards decarbonization, with companies like ArcelorMittal investing heavily in green hydrogen DRI, introduces sustainability as a new competitive battleground.

| Key Competitor | Approx. 2023 Crude Steel Output (Million Tonnes) | Key Differentiator/Strategy |

|---|---|---|

| Baowu Steel Group | ~130 | Scale, Home Market Dominance |

| POSCO | Data Unavailable | Technological Innovation, High-Value Products |

| Nippon Steel | Data Unavailable | Advanced Materials, Global Presence |

| ArcelorMittal | Data Unavailable | Product Specialization, Sustainability Investments |

SSubstitutes Threaten

In the automotive industry, the threat of substitutes for steel is growing. For instance, aluminum is increasingly favored for lightweighting vehicles to boost fuel efficiency and accommodate electric vehicle battery systems. By 2024, the global automotive aluminum market was projected to reach over $110 billion, showcasing this shift.

Similarly, advanced composites are gaining traction, offering superior strength-to-weight ratios. These materials are crucial for EV development, directly challenging steel's traditional role. This trend is driven by stringent emissions regulations and consumer demand for greener transportation solutions.

The construction sector also presents viable alternatives to steel. Concrete, wood, and engineered timber are commonly used for various structural applications, offering different cost and performance profiles. The global engineered wood market, for example, was valued at over $12 billion in 2023, indicating a strong demand for these steel substitutes.

The threat of substitutes for steel, a key product for ArcelorMittal, is largely determined by the cost-performance trade-offs. While materials like advanced composites or high-strength plastics can offer benefits such as lighter weight or enhanced corrosion resistance, their higher price points often restrict their use to niche or premium applications. For instance, the automotive industry, a significant consumer of steel, is exploring aluminum and carbon fiber for weight reduction, but the cost differential remains a substantial barrier for mass-market vehicles.

Ongoing advancements in materials science are significantly improving the performance and lowering the cost of substitute materials, directly challenging steel's market position. For instance, the development of advanced composites and high-strength plastics is making them increasingly viable alternatives in sectors like automotive and construction, where steel has traditionally dominated. This continuous innovation means that even as ArcelorMittal invests in efficiency, the threat from these evolving substitutes remains a potent force.

Recycling and Circular Economy Trends

The growing emphasis on sustainability and the circular economy presents a nuanced threat to traditional steel production. While steel is inherently recyclable, the increasing demand for recycled content and reduced carbon footprints could favor alternative materials or production methods that more easily meet these evolving environmental standards. For instance, in 2024, the global market for green steel, produced with significantly lower emissions, is projected to see substantial growth, potentially diverting demand from conventional steel.

This trend pressures companies like ArcelorMittal to accelerate their own decarbonization efforts and invest in technologies that enhance the circularity of steel.

- Growing demand for recycled content in construction and automotive sectors.

- Increased investment in alternative materials with lower embodied carbon.

- Policy shifts favoring circular economy principles and sustainable sourcing.

Niche vs. Mass Market Adoption

While substitutes like advanced composites and high-strength plastics pose a threat, it's primarily within niche, high-value sectors such as aerospace and premium automotive manufacturing. For instance, carbon fiber composites, while offering superior strength-to-weight ratios, still carry a significant cost premium, limiting their widespread adoption in mass-market applications.

In contrast, for ArcelorMittal's core mass-market segments like general construction and heavy machinery, steel maintains a robust competitive advantage. Its established cost-effectiveness, inherent strength, and the extensive global infrastructure for its production and processing significantly dampen the threat of substitution in these high-volume areas. For example, in 2024, the global construction market, a major consumer of steel, continued to see steady demand, underscoring steel's continued relevance.

The threat of substitutes is therefore bifurcated: substantial in specialized, performance-driven niches, but considerably less so in the broad, cost-sensitive industrial and construction markets where ArcelorMittal primarily operates. This distinction is crucial for understanding the overall competitive landscape.

Key considerations regarding substitutes include:

- Niche Threat: Advanced materials like composites and specialized alloys are gaining traction in aerospace and high-performance automotive, where weight reduction and extreme durability justify higher costs.

- Mass Market Resilience: Steel's cost-effectiveness and widespread availability remain dominant factors in construction, infrastructure, and general manufacturing, limiting substitute penetration.

- Cost Differential: The price gap between steel and many advanced substitutes remains a significant barrier to mass-market adoption, especially in price-sensitive industries.

- Infrastructure Dependence: The existing global infrastructure for steel production, processing, and recycling reinforces its position against newer, less established material supply chains.

While advanced materials like composites and specialized alloys are making inroads in niche sectors such as aerospace and premium automotive due to their superior strength-to-weight ratios, their higher cost remains a significant barrier for mass-market adoption. Steel's cost-effectiveness and established infrastructure continue to provide a strong defense against widespread substitution in core industries like construction and general manufacturing.

The threat of substitutes for steel, a primary product for ArcelorMittal, is largely dictated by the cost-performance balance and the specific application's demands. In sectors where cost is a primary driver, such as general construction or infrastructure projects, steel's affordability and robust performance characteristics make it highly resilient to substitution. For instance, the global construction market, a major steel consumer, continued to show steady demand in 2024, highlighting steel's ongoing relevance in these high-volume areas.

However, in performance-critical applications, particularly within the automotive industry's push for lightweighting and electric vehicle integration, substitutes like aluminum and advanced composites are gaining traction. The global automotive aluminum market was projected to exceed $110 billion in 2024, illustrating the growing preference for lighter materials to enhance fuel efficiency and accommodate battery systems, directly challenging steel's traditional dominance.

The ongoing advancements in materials science are continuously improving the viability of substitutes. For example, the development of high-strength plastics and engineered timber, with the latter seeing a global market valued at over $12 billion in 2023, presents alternative options in construction. This evolving landscape necessitates that ArcelorMittal remains vigilant and adaptive to these material innovations.

| Material Substitute | Key Sectors | Primary Advantages | Cost Comparison to Steel | Market Penetration Trend (2024) |

|---|---|---|---|---|

| Aluminum | Automotive, Aerospace | Lightweight, Corrosion Resistance | Higher | Increasing |

| Advanced Composites (e.g., Carbon Fiber) | Aerospace, High-Performance Automotive | Superior Strength-to-Weight Ratio | Significantly Higher | Niche Growth |

| Engineered Timber | Construction | Sustainability, Aesthetics | Comparable to some steel grades | Moderate Growth |

| Concrete | Construction | Cost-Effectiveness, Durability | Lower (for certain applications) | Stable Dominance |

Entrants Threaten

The steel industry demands immense capital, with integrated steelmaking facilities costing billions to construct. For instance, building a new greenfield steel plant in 2024 could easily require upwards of $5 billion, encompassing blast furnaces, rolling mills, and extensive infrastructure. This substantial financial hurdle significantly deters potential new entrants, creating a strong barrier to entry.

ArcelorMittal, as an established steel titan, enjoys substantial economies of scale. This means they can produce steel at a lower cost per ton due to their massive production volumes, bulk purchasing power for raw materials, and efficient distribution networks. For instance, in 2023, ArcelorMittal reported crude steel production of 58.8 million tonnes, a scale that new entrants would find incredibly difficult and expensive to replicate quickly.

New companies entering the steel market face a steep uphill battle to match these cost efficiencies. Without the years of accumulated operational experience and the sheer volume of output that ArcelorMittal commands, any new entrant would likely operate at a higher per-unit cost. This cost disadvantage makes it challenging for them to compete on price with established players, thereby limiting the threat of new entrants.

The steel industry faces significant regulatory and environmental hurdles that act as a strong deterrent to new entrants. For instance, in 2024, the European Union's Carbon Border Adjustment Mechanism (CBAM) continues to impose costs on imported steel based on its carbon content, requiring new players to invest heavily in low-carbon production technologies from the outset.

Navigating stringent environmental permits and compliance with evolving decarbonization mandates, such as those aimed at reducing greenhouse gas emissions, presents substantial capital expenditure and operational complexity. These requirements mean that a new steel producer would need to commit billions in upfront investment to meet modern environmental standards, a barrier that ArcelorMittal, as an established player, has already begun to address.

Access to Raw Materials and Distribution Channels

ArcelorMittal's established position creates significant hurdles for new entrants seeking access to essential raw materials. Established players often leverage long-term contracts and even captive mines for key inputs like iron ore and coal. This secures a stable supply and provides considerable cost advantages, making it difficult for newcomers to compete on input costs.

Newcomers would struggle to secure reliable and cost-effective access to these critical raw materials, often facing higher spot market prices or limited availability. Furthermore, building the necessary extensive distribution networks and cultivating strong customer relationships, which ArcelorMittal already possesses, represents another substantial barrier.

- Securing Raw Materials: New entrants face challenges in accessing iron ore and coal, with established players often holding long-term contracts or captive mines.

- Cost Disadvantage: Without such arrangements, new entrants are likely to face higher input costs compared to established competitors like ArcelorMittal.

- Distribution Network: Building a comprehensive distribution network and establishing customer loyalty requires significant time and investment, posing a barrier to entry.

- Market Access: Gaining access to established markets and customer bases is difficult for new companies, as key relationships are already held by incumbents.

Brand Loyalty and Customer Relationships

In sectors like automotive and construction, where reliability and established trust are paramount, ArcelorMittal benefits from deeply entrenched brand loyalty. This loyalty, built over years of consistent performance and strong customer relationships, acts as a significant barrier to new entrants. Buyers often face high switching costs, not just in terms of financial outlay but also in the perceived risk of engaging with an unproven supplier.

ArcelorMittal's extensive history and proven track record in delivering quality steel products foster a sense of security among its clientele. This makes it challenging for newcomers to displace established players, as trust and long-term partnerships are highly valued. For instance, in the automotive industry, a supplier's ability to meet stringent quality standards and provide consistent supply chains is critical, and ArcelorMittal has cultivated this reputation.

The threat of new entrants is therefore mitigated by ArcelorMittal's strong brand equity and the inertia created by existing customer commitments. New companies entering the steel market would need to invest heavily in building similar levels of trust and demonstrating comparable reliability to even begin competing effectively. This often requires substantial time and resources, making rapid market penetration by new firms less likely.

Consider these factors contributing to brand loyalty:

- Established Reputation: ArcelorMittal's long-standing presence in the global steel market has solidified its brand as a reliable and high-quality provider.

- Deep Customer Relationships: The company has cultivated enduring partnerships with key players across various industries, fostering loyalty through consistent service and collaboration.

- High Switching Costs: For many customers, particularly in demanding sectors like automotive and construction, changing suppliers involves significant re-qualification processes, potential production disruptions, and the risk of compromising product integrity.

- Perceived Reliability: ArcelorMittal's consistent delivery and adherence to stringent quality standards reduce the perceived risk for buyers, making them hesitant to switch to less proven alternatives.

The steel industry presents formidable barriers to entry, significantly limiting the threat of new competitors for ArcelorMittal. The sheer capital required to establish new, large-scale steel production facilities is immense, with costs for a greenfield plant in 2024 easily exceeding $5 billion. This financial burden, coupled with the need to achieve economies of scale comparable to ArcelorMittal's 2023 production of 58.8 million tonnes of crude steel, makes it exceptionally difficult for newcomers to compete on cost.

Furthermore, regulatory and environmental compliance, such as the EU's 2024 Carbon Border Adjustment Mechanism (CBAM), adds substantial upfront investment and operational complexity for any new entrant. ArcelorMittal's established access to raw materials through long-term contracts and captive mines, alongside its robust distribution networks and deep customer relationships built on brand loyalty, further solidifies its market position and deters potential new entrants.

| Barrier Type | Description | Impact on New Entrants | Example Data/Fact |

|---|---|---|---|

| Capital Requirements | High cost of building new steel plants. | Significant financial hurdle. | Greenfield plant cost in 2024: ~$5 billion+. |

| Economies of Scale | Lower per-unit costs due to large production volumes. | New entrants face higher production costs. | ArcelorMittal's 2023 crude steel production: 58.8 million tonnes. |

| Regulatory & Environmental | Compliance with emissions standards and carbon pricing. | Requires substantial investment in new technologies. | EU CBAM in 2024 imposes costs based on carbon content. |

| Raw Material Access | Securing iron ore and coal at competitive prices. | New entrants may face higher input costs. | Established players often have long-term contracts or captive mines. |

| Brand Loyalty & Switching Costs | Customer trust and established relationships. | Difficult for new players to gain market share. | Automotive sector prioritizes reliability and proven suppliers. |

Porter's Five Forces Analysis Data Sources

Our ArcelorMittal Porter's Five Forces analysis is built upon a robust foundation of data, drawing from the company's annual reports, investor presentations, and SEC filings. We supplement this with insights from reputable industry research firms and global steel market intelligence reports to provide a comprehensive view of the competitive landscape.