ArcelorMittal PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ArcelorMittal Bundle

ArcelorMittal operates within a dynamic global environment, significantly influenced by political shifts, economic fluctuations, and technological advancements. Understanding these external forces is crucial for any stakeholder looking to grasp the company's strategic positioning and future trajectory.

Our comprehensive PESTLE analysis delves deep into these critical factors, offering you an unparalleled view of the opportunities and challenges ArcelorMittal faces. Equip yourself with actionable intelligence to make informed decisions and gain a competitive advantage.

Don't get left behind. Purchase the full ArcelorMittal PESTLE analysis now and unlock the insights needed to navigate the complexities of the steel industry and beyond.

Political factors

Government policies, particularly trade protectionism through tariffs and import quotas, directly shape ArcelorMittal's operational environment. For instance, the United States' Section 232 tariffs on steel imports, initially implemented in 2018 and subject to ongoing review and adjustments through 2024, have significantly impacted global steel trade flows and pricing, forcing companies like ArcelorMittal to adapt sourcing and sales strategies across different markets.

Governments globally are increasingly mandating decarbonization, with many offering substantial subsidies to encourage the adoption of green steel production methods. For instance, the European Union's Innovation Fund has allocated billions of euros to support industrial decarbonization projects, including those in the steel sector.

ArcelorMittal's strategic investments in technologies like hydrogen-based direct reduction and carbon capture utilization and storage (CCUS) are directly shaped by the predictability and attractiveness of these government incentives. The company's 2023 report highlighted that the pace of its transition to low-carbon steelmaking is contingent on the availability and structure of such state aid.

Uncertainty or delays in policy implementation, such as the finalization of carbon pricing mechanisms or the disbursement of green subsidies, can significantly slow down ArcelorMittal's progress towards its ambitious decarbonization targets, potentially impacting its competitive positioning in the evolving market.

ArcelorMittal's extensive global operations, spanning 16 countries as of early 2024, expose it directly to geopolitical instability. Conflicts can significantly disrupt its intricate supply chains, impacting the consistent flow of vital raw materials like iron ore and coal. For instance, the ongoing conflict in Eastern Europe has had ripple effects on energy prices and trade routes, indirectly influencing ArcelorMittal's operational costs and market access in affected regions.

The availability and cost of raw materials are particularly sensitive to regional political climates. Unforeseen political shifts or escalating tensions can lead to export restrictions or increased tariffs, directly affecting ArcelorMittal's ability to source essential inputs at competitive prices. This necessitates a proactive strategy to diversify sourcing and maintain robust relationships with suppliers across various geopolitical landscapes.

Furthermore, steel demand is closely tied to economic activity, which is heavily influenced by political stability. Regions experiencing conflict or significant political uncertainty often see a contraction in construction and infrastructure projects, key drivers of steel consumption. ArcelorMittal must therefore carefully monitor and adapt its production and sales strategies to mitigate the impact of these demand fluctuations in volatile areas.

Regulatory Environment and Compliance

ArcelorMittal navigates a multifaceted regulatory landscape, with compliance in industrial, environmental, and labor laws being paramount across its global operations. Failure to adhere to these diverse requirements, including stringent mining permits and operational standards, can jeopardize its licenses and incur significant financial penalties.

The company's commitment to sustainability is increasingly shaped by evolving environmental regulations. For instance, the European Union's Green Deal and its associated carbon pricing mechanisms, like the Emissions Trading System (ETS), directly impact ArcelorMittal's production costs and strategic investments in decarbonization technologies. In 2023, the company announced significant investments in green steel initiatives, underscoring the financial implications of these regulatory pressures.

- Environmental Regulations: ArcelorMittal must comply with varying emissions standards and waste management protocols globally, impacting operational expenditures and capital allocation for compliance.

- Labor Laws: Adherence to diverse national labor laws, including worker safety regulations and collective bargaining agreements, is essential for maintaining stable operations and employee relations.

- Trade and Tariffs: International trade policies and tariffs, such as those imposed by the US on steel imports, directly affect ArcelorMittal's market access and profitability in key regions.

- Mining and Resource Management: Compliance with regulations governing mining permits, land use, and resource extraction is fundamental to securing and maintaining access to raw materials.

International Trade Agreements

Changes in international trade agreements and the rise of new trade blocs directly impact ArcelorMittal's global operations. For instance, the European Union's continued focus on trade liberalization, alongside the potential for new agreements with countries like the UK post-Brexit, shapes market access for steel products. Conversely, protectionist measures, such as tariffs imposed by countries like the United States, can significantly alter import/export dynamics, affecting ArcelorMittal's competitive positioning. The company must remain agile, adapting its sales strategies to navigate these evolving trade landscapes.

The World Trade Organization (WTO) data highlights the ongoing adjustments in global trade policies. In 2023, the total value of world merchandise trade was projected to grow by 0.8%, a slowdown from previous years, reflecting the complex trade environment. ArcelorMittal, as a major global steel producer, is particularly sensitive to these shifts, as tariffs and quotas can directly influence the cost and volume of its international sales. For example, the EU's safeguard measures on steel imports, which were extended in 2023, continue to affect trade flows and pricing for ArcelorMittal's European operations.

- Trade Blocs: The expansion or alteration of trade blocs, such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), can open new markets or intensify competition for ArcelorMittal.

- Tariffs and Quotas: Imposition of tariffs, like those seen on steel imports into the US, directly increases costs for consumers and can lead to retaliatory measures, impacting ArcelorMittal's export volumes.

- Market Access: New trade agreements can improve ArcelorMittal's access to key markets, potentially boosting sales volumes and revenue, but also requiring adherence to new regulatory standards.

- Competitiveness: Changes in trade rules influence the landed cost of steel, affecting ArcelorMittal's ability to compete with producers from countries with different trade policies.

Government policies, especially those concerning trade protectionism like tariffs and import quotas, significantly influence ArcelorMittal's operational landscape. For instance, the United States' Section 232 tariffs on steel imports, reviewed and adjusted through 2024, have reshaped global steel trade flows and pricing, compelling ArcelorMittal to modify its sourcing and sales strategies across various markets.

Governments are increasingly pushing for decarbonization, offering substantial subsidies to promote green steel production. The European Union's Innovation Fund, for example, has allocated billions of euros to support industrial decarbonization, including projects in the steel sector, directly impacting ArcelorMittal's investment decisions in low-carbon technologies.

ArcelorMittal's global presence, operating in 16 countries as of early 2024, makes it susceptible to geopolitical instability. Conflicts can disrupt its supply chains for crucial raw materials like iron ore and coal, as seen with the impact of the Eastern European conflict on energy prices and trade routes affecting operational costs.

The company also navigates a complex regulatory environment, adhering to industrial, environmental, and labor laws globally. Failure to comply with these diverse requirements, including mining permits and operational standards, can lead to license revocation and substantial financial penalties, as highlighted by the financial implications of the EU's Green Deal and carbon pricing mechanisms on its 2023 investments.

| Factor | Impact on ArcelorMittal | Example/Data Point (2023-2024) |

| Trade Policies | Affects market access, pricing, and import/export volumes. | US Section 232 tariffs continue to influence global steel trade; EU safeguard measures extended in 2023. |

| Decarbonization Subsidies | Drives investment in green steel technologies. | EU Innovation Fund allocating billions; ArcelorMittal's green steel investments contingent on state aid availability. |

| Geopolitical Instability | Disrupts supply chains and impacts raw material costs. | Eastern European conflict affecting energy prices and trade routes. |

| Environmental Regulations | Increases operational costs and directs capital allocation. | EU Green Deal and ETS impacting production costs; ArcelorMittal investing in green initiatives. |

What is included in the product

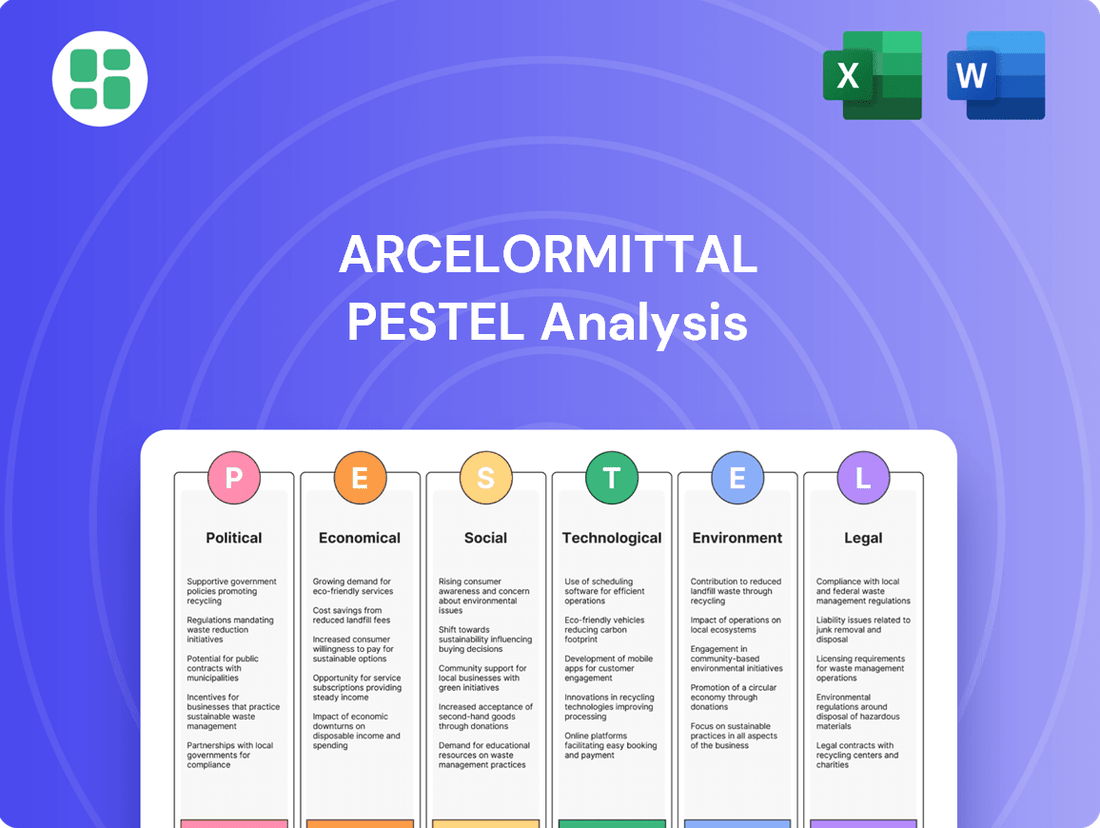

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing ArcelorMittal, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable recommendations for strategic decision-making, enabling proactive navigation of global market dynamics and competitive landscapes.

A concise PESTLE analysis for ArcelorMittal, highlighting key external factors, serves as a pain point reliever by providing clarity and focus for strategic decision-making.

This analysis streamlines complex external environments into actionable insights, enabling ArcelorMittal to proactively address risks and capitalize on opportunities.

Economic factors

Global steel demand is a crucial economic factor for ArcelorMittal, directly tied to growth in vital industries such as automotive, construction, and infrastructure development. For instance, the automotive sector, a significant steel consumer, saw global light vehicle production projected to increase by 2.1% in 2024 and a further 2.5% in 2025, according to S&P Global Mobility data as of late 2024.

ArcelorMittal's financial performance is inherently linked to the cyclical patterns of the steel market. Analysts anticipate a modest recovery in global steel demand outside of China for 2025, with projections suggesting a growth of around 1% to 2% for these regions, supported by infrastructure spending and a gradual improvement in manufacturing activity.

ArcelorMittal's profitability is significantly influenced by the fluctuating costs of essential raw materials like iron ore and coal. For instance, iron ore prices saw considerable swings in late 2023 and early 2024, impacting production expenses.

Effective management of this raw material cost volatility is paramount. ArcelorMittal employs strategies such as securing long-term supply contracts and diversifying its mining assets to mitigate these price swings and protect its profit margins.

Energy costs, especially for electricity and natural gas, are a substantial part of steelmaking expenses for ArcelorMittal. In 2024, fluctuating natural gas prices in Europe, a key market for ArcelorMittal, have added considerable pressure, with some regions seeing prices rise significantly compared to 2023 lows.

ArcelorMittal's global operations are directly impacted by the volatility of energy markets and evolving regional energy policies. For instance, the company's competitiveness in energy-intensive processes is challenged when energy prices spike, as was observed in late 2023 and early 2024 across several of its European facilities.

Currency Exchange Rate Fluctuations

As a global steel and mining giant, ArcelorMittal's financial health is significantly influenced by currency exchange rate shifts. When the company reports earnings, the value of revenues and expenses generated in foreign currencies can change dramatically due to these fluctuations.

For example, if the US dollar strengthens against the Euro, ArcelorMittal's Euro-denominated profits would translate into fewer dollars, impacting its reported financial performance. This exposure affects not only revenue but also the cost of raw materials and the value of assets and liabilities held in various currencies.

- Impact on Revenue: A stronger home currency can reduce the value of foreign sales when converted back, potentially lowering reported revenue.

- Cost of Goods Sold: Conversely, a weaker home currency can increase the cost of imported raw materials, raising production expenses.

- Asset Valuation: Fluctuations impact the reported value of overseas subsidiaries and investments.

- 2024/2025 Outlook: Analysts are closely monitoring the Euro/USD exchange rate, which has seen volatility, with the Euro trading around 1.08 USD as of mid-2024, presenting ongoing challenges and opportunities for ArcelorMittal's international operations.

Inflation and Interest Rates

Rising inflation can significantly impact ArcelorMittal's operational expenses. For instance, the Producer Price Index (PPI) for manufactured goods in the US saw a notable increase in early 2024, impacting the cost of raw materials and components. This upward pressure on input costs directly squeezes profit margins for steel producers by increasing the cost of labor and essential materials.

Higher interest rates, a common response to inflation, also present challenges. For a capital-intensive business like steel manufacturing, increased borrowing costs can make financing large-scale projects, such as new plant constructions or technological upgrades, more expensive. This directly affects investment decisions and the viability of long-term growth strategies.

- Inflationary pressures: Increased costs for energy, raw materials, and logistics in 2024 and early 2025 are expected to continue impacting ArcelorMittal’s cost base.

- Interest rate sensitivity: ArcelorMittal’s substantial debt load means that rising global interest rates, such as the sustained higher rates in major economies through 2024, increase its financing expenses.

- Impact on demand: Higher interest rates can also cool demand for steel in key sectors like automotive and construction, indirectly affecting ArcelorMittal's sales volumes.

Global economic growth directly fuels ArcelorMittal's demand, with projections for 2024 and 2025 indicating a mixed but generally positive trend in key steel-consuming sectors. For instance, the automotive sector, a major steel user, is expected to see global light vehicle production grow by 2.1% in 2024 and 2.5% in 2025, according to S&P Global Mobility data updated in late 2024. This growth underpins the company's sales volumes.

ArcelorMittal's profitability is sensitive to raw material costs, with iron ore and coking coal prices experiencing significant fluctuations. For example, iron ore prices saw considerable swings in late 2023 and early 2024, directly impacting production expenses and the company's cost of goods sold. Managing these input costs through strategic sourcing and asset diversification is critical for maintaining margins.

Energy costs represent a substantial operational expense for ArcelorMittal, particularly in its European operations. Natural gas prices in Europe, a key market, have shown volatility through 2024, with some regions experiencing price increases compared to 2023 lows, directly affecting the company's energy-intensive manufacturing processes and overall competitiveness.

Currency exchange rates significantly impact ArcelorMittal's consolidated financial results. The Euro's value against the US dollar, for example, affects the translation of foreign revenues and expenses; as of mid-2024, the Euro traded around 1.08 USD, presenting ongoing challenges and opportunities for its international business.

| Economic Factor | 2024/2025 Outlook/Data | Impact on ArcelorMittal |

|---|---|---|

| Global Steel Demand | Projected 2.1% (2024) & 2.5% (2025) growth in global light vehicle production. Modest recovery (1-2%) in steel demand outside China. | Directly influences sales volumes and revenue. |

| Raw Material Costs | Volatile iron ore and coal prices observed in late 2023/early 2024. | Affects cost of goods sold and profit margins. |

| Energy Costs | Fluctuating natural gas prices in Europe through 2024. | Impacts operational expenses and competitiveness in energy-intensive processes. |

| Currency Exchange Rates | Euro around 1.08 USD as of mid-2024. | Affects translation of foreign revenues, expenses, and asset valuations. |

Preview Before You Purchase

ArcelorMittal PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive ArcelorMittal PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the global steel and mining giant. Understand the intricate landscape shaping ArcelorMittal's operations and strategic decisions.

Sociological factors

ArcelorMittal places immense importance on the health and safety of its global workforce, a critical aspect given the high-risk nature of steel production and mining. The company actively pursues continuous improvement in its safety procedures, aiming to create a secure working environment for all employees.

In 2023, ArcelorMittal reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.86, a slight increase from 0.80 in 2022, underscoring the ongoing commitment to reducing workplace incidents. The company invested $373 million in health and safety initiatives throughout 2023, reflecting a dedication to robust safety measures and employee well-being.

ArcelorMittal's operational stability hinges on effective labor relations, with ongoing negotiations with unions critical for smooth production. The company reported approximately 120,000 employees globally as of December 31, 2023, highlighting the scale of its workforce management.

Developing and retaining a skilled workforce is a significant challenge, especially as ArcelorMittal invests in advanced steelmaking technologies and sustainable production methods. This requires continuous training and upskilling initiatives to meet the evolving demands of the industry.

ArcelorMittal's social license to operate hinges on robust community engagement, particularly concerning environmental stewardship and local economic benefits. In 2024, the company continued its focus on dialogue with communities surrounding its mining and steelmaking facilities, addressing issues like water management and emissions, crucial for maintaining operational continuity.

Providing tangible local benefits, such as employment and infrastructure development, is a key pillar of this engagement. For instance, ArcelorMittal's operations in South Africa have historically been a significant source of employment, with efforts in 2024 aimed at enhancing local procurement and skills development to further embed the company within the community fabric.

Consumer Preferences for Sustainable Products

Societal expectations are increasingly steering purchasing decisions towards environmentally responsible products, a trend that directly impacts heavy industries like steel manufacturing. This growing demand for sustainability, particularly for low-carbon steel, is a significant sociological factor influencing ArcelorMittal's market position and strategic direction.

ArcelorMittal's proactive engagement in developing green steel solutions, such as its XCarb™ offerings, and its pursuit of ResponsibleSteel™ certification directly addresses these evolving consumer and industry preferences. This strategic alignment is crucial for maintaining market relevance and attracting environmentally conscious clients and investors.

- Growing Demand: Surveys indicate a significant portion of consumers are willing to pay more for sustainable products. For instance, a 2024 report by Accenture found that 72% of consumers are actively trying to reduce their environmental impact through their purchases.

- Industry Shift: Major automotive manufacturers, key customers for steel, are setting ambitious decarbonization targets, creating a pull for low-carbon steel. For example, Stellantis aims for 100% of its European sales to be electric vehicles by 2030, which necessitates greener supply chains.

- Certification Value: ResponsibleSteel™ certification provides a tangible benchmark for sustainability, enhancing brand reputation and market access. Companies achieving this certification often report improved stakeholder relations and a competitive edge.

Demographic Shifts and Urbanization

Global demographic shifts, particularly the ongoing trend of urbanization, directly impact ArcelorMittal's long-term demand for steel. As more people move to cities, the need for new housing, transportation networks, and public infrastructure escalates, all of which are major consumers of steel products. For instance, the United Nations projects that by 2050, 68% of the world's population will live in urban areas, a significant increase from today's figures.

ArcelorMittal must strategically align its production and supply chains to meet the specific demands of these expanding urban centers. This involves not only increasing output but also potentially tailoring product offerings to suit the types of construction prevalent in different urban environments. The company's ability to adapt to these evolving needs will be crucial for sustained growth.

- Urbanization Rate: The global urban population is projected to reach 68% by 2050, up from 56% in 2021, according to the UN.

- Infrastructure Investment: Developing nations, where much of this urbanization is occurring, are expected to see significant investment in infrastructure, requiring vast amounts of steel.

- Steel Consumption in Construction: Steel is a primary material in roughly 75% of all construction projects globally.

- Emerging Market Growth: ArcelorMittal's strategic focus on emerging markets, which are experiencing rapid urbanization, is key to capitalizing on these demographic trends.

Societal expectations are increasingly steering purchasing decisions towards environmentally responsible products, a trend that directly impacts heavy industries like steel manufacturing. This growing demand for sustainability, particularly for low-carbon steel, is a significant sociological factor influencing ArcelorMittal's market position and strategic direction.

ArcelorMittal's proactive engagement in developing green steel solutions, such as its XCarb™ offerings, and its pursuit of ResponsibleSteel™ certification directly addresses these evolving consumer and industry preferences. This strategic alignment is crucial for maintaining market relevance and attracting environmentally conscious clients and investors.

Global demographic shifts, particularly the ongoing trend of urbanization, directly impact ArcelorMittal's long-term demand for steel. As more people move to cities, the need for new housing, transportation networks, and public infrastructure escalates, all of which are major consumers of steel products. For instance, the United Nations projects that by 2050, 68% of the world's population will live in urban areas, a significant increase from today's figures.

ArcelorMittal must strategically align its production and supply chains to meet the specific demands of these expanding urban centers. This involves not only increasing output but also potentially tailoring product offerings to suit the types of construction prevalent in different urban environments. The company's ability to adapt to these evolving needs will be crucial for sustained growth.

| Sociological Factor | Impact on ArcelorMittal | Supporting Data/Trend |

|---|---|---|

| Consumer Demand for Sustainability | Drives need for low-carbon steel and green production methods. | 72% of consumers actively trying to reduce environmental impact (Accenture, 2024). |

| Urbanization Trends | Increases demand for steel in construction and infrastructure. | Global urban population projected to reach 68% by 2050 (UN). |

| Industry Decarbonization Targets | Creates demand for greener supply chains from key customers. | Stellantis aims for 100% European EV sales by 2030. |

Technological factors

ArcelorMittal is channeling significant investment into pioneering decarbonization technologies, with a strong focus on hydrogen-based direct reduced iron (DRI) coupled with electric arc furnaces (EAF) and carbon capture, utilization, and storage (CCUS). These innovations are fundamental to the company's ambitious net-zero emissions goals.

In 2023, ArcelorMittal reported a capital expenditure of $3.7 billion, with a substantial portion allocated to decarbonization projects. The company aims to reduce its CO2 intensity by 25% by 2030 compared to 2018 levels, a target heavily reliant on the successful deployment of these advanced technologies.

ArcelorMittal is heavily investing in digitalization and automation to streamline its vast operations. This includes implementing AI for sophisticated production scheduling, which aims to reduce waste and improve output, and employing predictive maintenance technologies to anticipate equipment failures, thereby minimizing costly downtime. For instance, in 2023, the company highlighted its progress in digital transformation initiatives across its mining and steelmaking segments, targeting significant efficiency gains.

ArcelorMittal's commitment to advanced materials is crucial for its future. The company is heavily investing in steel products designed for e-mobility, such as lightweight alloys for electric vehicles, and materials for climate infrastructure, like high-strength steel for wind turbines and renewable energy projects. This focus directly addresses the growing demand in these rapidly expanding sectors.

In 2024, ArcelorMittal reported significant progress in its advanced steel offerings. For instance, their Usibor® and Ductibor® grades are increasingly specified by automotive manufacturers for their enhanced safety and weight reduction capabilities, critical for EV battery casings and structural components. This innovation pipeline is key to ArcelorMittal maintaining its leadership in high-performance steel solutions.

Resource Efficiency and Circular Economy

Technological advancements are pivotal for ArcelorMittal's pursuit of resource efficiency and circular economy principles. Innovations in areas like advanced process controls and material science allow for optimized raw material consumption, directly impacting cost and environmental footprint. For instance, the company is investing in technologies to enhance scrap sorting and processing, aiming to increase the proportion of recycled content in its steel products. This focus is crucial as global demand for sustainable materials continues to rise, pushing industries towards closed-loop systems.

ArcelorMittal's commitment to these principles is reflected in its operational strategies and investments. The company is actively exploring and implementing technologies that reduce waste generation and improve energy efficiency throughout the steelmaking lifecycle. This includes advancements in blast furnace technology and the development of new steel grades with improved recyclability. By embracing these technological shifts, ArcelorMittal is positioning itself to meet evolving market expectations and regulatory requirements for environmental performance.

- Improved Scrap Utilization: Technologies enabling better identification and processing of scrap steel are key to increasing recycled content, a core tenet of the circular economy.

- Energy Efficiency Innovations: Investments in advanced furnace designs and heat recovery systems aim to significantly lower the energy intensity of steel production.

- Digitalization of Processes: AI and IoT are being deployed to monitor and optimize material flow, predict equipment maintenance, and reduce waste in real-time.

- Development of Sustainable Steel Grades: Research into new steel alloys that are more durable and easier to recycle contributes to a more circular material flow.

Cybersecurity and Data Management

ArcelorMittal's increasing reliance on digital systems for its global operations necessitates advanced cybersecurity. The company's commitment to data management is paramount to safeguarding sensitive information and ensuring operational resilience. For instance, in 2023, global cybersecurity spending was projected to reach $215 billion, highlighting the industry-wide focus on this area.

Effective data management is crucial for ArcelorMittal to maintain the integrity and accessibility of its vast operational data, from production schedules to supply chain logistics. This digital infrastructure is key to optimizing processes and mitigating risks in a highly interconnected business environment.

- Cybersecurity Investment: Companies are significantly increasing their cybersecurity budgets to combat evolving threats.

- Data Breach Costs: The average cost of a data breach in 2023 was $4.45 million globally, underscoring the financial imperative for robust protection.

- Operational Continuity: Strong data management ensures uninterrupted production and supply chain activities for ArcelorMittal.

ArcelorMittal is heavily investing in technological advancements to achieve its decarbonization targets, focusing on hydrogen-based DRI and CCUS technologies. This strategic technological pivot is essential for meeting its 2030 CO2 intensity reduction goals, aiming for a 25% decrease from 2018 levels.

Digitalization and automation are key to ArcelorMittal's operational efficiency, with AI and predictive maintenance being implemented across its mining and steelmaking segments to minimize downtime and waste. The company's commitment to advanced materials, particularly for e-mobility and climate infrastructure, is demonstrated by the increasing adoption of specialized steel grades like Usibor® and Ductibor® in the automotive sector.

Technological innovation is also driving ArcelorMittal's circular economy initiatives, with investments in scrap sorting and processing technologies to enhance recycled content. Furthermore, robust cybersecurity measures are a priority, reflecting the industry-wide trend of increased spending on data protection to ensure operational resilience, with global cybersecurity spending projected to reach $215 billion in 2023.

Legal factors

ArcelorMittal faces rigorous environmental regulations worldwide, including those targeting CO2 emissions and air/water quality. For instance, the European Union's Emission Trading System (ETS) mandates allowances for greenhouse gas emissions, impacting steel production costs. In 2024, the EU ETS continued to drive investments in decarbonization technologies for heavy industries like steel.

Meeting these evolving standards necessitates substantial capital outlays for cleaner production methods and advanced pollution control systems. ArcelorMittal has committed billions to its decarbonization strategy, aiming to reduce its carbon emissions intensity by 25% by 2030 compared to 2018 levels, with significant portions allocated to projects like carbon capture and green hydrogen use in its facilities.

ArcelorMittal must navigate a complex web of global labor laws, covering everything from minimum wages and working hours to collective bargaining rights and workplace safety. In 2024, for instance, the company's operations in countries like South Africa faced scrutiny regarding wage negotiations with mining unions, impacting operational costs and labor relations. Ensuring compliance with these diverse regulations is crucial for maintaining a stable workforce and avoiding costly legal battles or reputational damage.

ArcelorMittal, as a dominant force in the global steel industry, faces stringent competition and anti-trust regulations across its operating regions. These laws, designed to prevent monopolies and ensure a level playing field, significantly impact its strategic decisions regarding market entry, pricing, and potential mergers or acquisitions. For instance, the European Commission has actively monitored steel markets for anti-competitive practices, and ArcelorMittal has had to comply with divestment requirements in past acquisitions to gain regulatory approval.

Mining Permits and Land Use Regulations

ArcelorMittal's mining operations are intrinsically tied to stringent legal frameworks governing permits and land use. These regulations dictate everything from initial exploration rights to the eventual rehabilitation of mined land, ensuring environmental stewardship and responsible resource extraction. Failure to comply can result in significant fines, operational shutdowns, and reputational damage.

In 2023, ArcelorMittal continued to navigate a complex web of mining legislation across its global sites. For instance, in Canada, adherence to provincial mining acts and federal environmental protection laws is paramount for its iron ore operations. Similarly, in South Africa, the Mineral and Petroleum Resources Development Act (MPRDA) sets the standard for licensing and social responsibility, impacting ArcelorMittal South Africa's activities.

- Mining Permit Acquisition: Obtaining and maintaining valid mining permits is a critical legal hurdle, often involving extensive environmental impact assessments and community consultations.

- Land Use Zoning: Regulations specify how land can be used for mining, often requiring adherence to specific zoning laws and restrictions on surface activities.

- Rehabilitation Bonds: Companies like ArcelorMittal are typically required to post financial bonds to guarantee the eventual restoration of mined areas, reflecting legal obligations for post-closure land management.

- Compliance Audits: Regular legal and environmental audits are conducted by authorities to ensure ongoing adherence to mining laws and permit conditions, with penalties for non-compliance.

International Trade Laws and Tariffs

International trade laws, particularly those concerning tariffs and import duties, are critical for ArcelorMittal. These regulations directly affect the cost of importing essential raw materials like iron ore and coking coal, as well as the competitiveness of its finished steel products in global markets. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), implemented in October 2023 and fully phased in by 2026, imposes costs on carbon-intensive imports, impacting ArcelorMittal's trade flows and necessitating adjustments to its pricing and supply chain strategies.

Changes in trade policies can swiftly alter market access and profitability. For example, the imposition of safeguard measures or anti-dumping duties by various countries can restrict ArcelorMittal's export volumes or force it to re-evaluate its production and sales strategies. In 2024, ongoing trade disputes and the potential for new tariffs, particularly between major economies, continue to create uncertainty, requiring the company to remain agile in its international operations.

- Tariff Impact: Tariffs on steel imports can increase production costs for ArcelorMittal if it relies on imported materials, while tariffs on its exports can reduce demand and profitability in those markets.

- Trade Barriers: Non-tariff barriers, such as quotas, complex customs procedures, and differing product standards, also add complexity and cost to international trade for ArcelorMittal.

- Regulatory Compliance: ArcelorMittal must navigate a complex web of international trade laws, including sanctions and export controls, to ensure compliance and avoid penalties.

- Market Access: Favorable trade agreements can open new markets and reduce costs, whereas protectionist policies can limit ArcelorMittal's global reach and competitive positioning.

ArcelorMittal's operations are heavily influenced by evolving environmental legislation, particularly concerning carbon emissions. The company is investing significantly in decarbonization technologies, aiming for a 25% reduction in carbon emission intensity by 2030 from 2018 levels, with substantial capital allocated to green hydrogen and carbon capture projects.

Labor laws worldwide dictate terms of employment, from wages to safety standards, impacting ArcelorMittal's operational costs and labor relations, as seen in wage negotiations in 2024. Navigating these diverse regulations is vital for workforce stability and avoiding legal repercussions.

Antitrust regulations are critical as ArcelorMittal operates in a concentrated global steel market, influencing decisions on market entry and acquisitions to prevent monopolies. The company must comply with competition oversight, which has previously led to divestitures to secure regulatory approval.

Mining permits, land use zoning, and post-closure rehabilitation bonds are key legal requirements for ArcelorMittal's resource extraction activities. Compliance is rigorously audited, with non-adherence leading to penalties and operational disruptions, as exemplified by Canadian and South African mining acts in 2023.

International trade laws, including tariffs and the EU's Carbon Border Adjustment Mechanism (CBAM) effective from October 2023, directly impact ArcelorMittal's material costs and export competitiveness. Trade policies and potential tariffs in 2024 necessitate strategic agility in its global supply chain and market access.

| Legal Factor | Impact on ArcelorMittal | 2024/2025 Relevance |

| Environmental Regulations | Increased compliance costs, drive for decarbonization investment | EU ETS driving green tech investment; 25% CO2 reduction target by 2030 |

| Labor Laws | Operational costs, workforce relations, potential legal disputes | Wage negotiations impacting labor relations in 2024 |

| Antitrust Regulations | Market entry, M&A strategy, potential divestitures | Ongoing oversight of steel markets for anti-competitive practices |

| Mining Legislation | Permit acquisition, land use, rehabilitation obligations | Adherence to Canadian and South African mining acts in 2023 |

| International Trade Laws | Material costs, export competitiveness, market access | CBAM impact from Oct 2023; ongoing trade disputes and tariff uncertainties in 2024 |

Environmental factors

ArcelorMittal is heavily invested in its 2050 net-zero emissions target, a commitment that places significant pressure on its operations to drastically lower its carbon footprint.

This strategic imperative necessitates substantial capital allocation towards developing and implementing low-carbon steelmaking technologies, such as hydrogen-based direct reduction and carbon capture utilization and storage (CCUS).

In 2023, ArcelorMittal reported a 14% reduction in its CO2 intensity compared to 2018 levels, underscoring the tangible progress being made in its decarbonization journey, with further investments planned to accelerate this transition.

ArcelorMittal's vast steelmaking operations are inherently tied to the availability and cost of key natural resources, primarily iron ore and metallurgical coal. The company's 2023 annual report highlighted significant investments in upstream mining assets to secure long-term supply, a crucial strategy given global demand pressures. For instance, the company's iron ore production reached 56.4 million tonnes in Q1 2024, demonstrating its reliance on these finite resources.

Rising concerns over resource depletion necessitate a robust focus on sustainable sourcing and efficient utilization. ArcelorMittal is actively pursuing strategies to minimize waste and improve energy efficiency across its production processes, aiming to reduce its environmental footprint. Exploring alternative, lower-impact raw materials and investing in circular economy initiatives are also becoming increasingly vital for long-term operational resilience and market competitiveness.

Water usage is a significant environmental consideration for ArcelorMittal, particularly in its steelmaking and mining operations, which are inherently water-intensive. Effective water management and conservation are therefore critical for sustainable operations and regulatory compliance.

ArcelorMittal is actively working to reduce its overall water intake and enhance the treatment of water used across its global facilities. For instance, in 2023, the company reported a reduction in its freshwater withdrawal intensity compared to previous years, reflecting progress in its conservation efforts.

Waste Management and Circular Economy Initiatives

ArcelorMittal faces the considerable environmental challenge of managing industrial waste generated from its steel production and mining operations. A key focus for the company is to significantly reduce the amount of waste that ends up in landfills.

The company is actively embracing circular economy principles as a strategic approach to tackle this challenge. This involves enhancing resource efficiency by reusing and recycling materials wherever possible, thereby minimizing the environmental footprint.

In 2023, ArcelorMittal reported a reduction in its waste intensity, with a target to further decrease landfill waste. For instance, their European operations are increasingly integrating recycled materials into their production processes, contributing to a more sustainable model.

- Waste Reduction Targets: ArcelorMittal has set ambitious goals to reduce landfill waste across its global operations by a specified percentage by 2030.

- Circular Economy Investments: The company is investing in technologies and processes that facilitate the recycling of steel by-products and slag, turning waste streams into valuable resources.

- Resource Efficiency Gains: By adopting circular economy practices, ArcelorMittal aims to improve its overall resource efficiency, leading to cost savings and reduced environmental impact.

- Partnerships for Recycling: Collaboration with external partners is crucial for developing advanced recycling solutions for complex waste materials, further supporting the circular economy model.

Biodiversity and Land Use Impacts

ArcelorMittal's extensive mining and steel production operations inherently influence biodiversity and land use patterns. The company acknowledges these impacts and is committed to responsible management.

In 2023, ArcelorMittal reported progress in its biodiversity initiatives, with specific projects focused on habitat restoration at several of its key operational sites. For example, its operations in South Africa have seen dedicated efforts to reintroduce native flora and fauna in areas previously affected by mining.

- Biodiversity Risk Assessment: ArcelorMittal integrates biodiversity risk assessments into its operational planning, aiming to minimize negative impacts on ecosystems.

- Habitat Restoration Efforts: The company actively engages in projects to restore and enhance habitats surrounding its mining and steelmaking facilities.

- Environmental Management Systems: Biodiversity considerations are embedded within ArcelorMittal's overarching environmental management systems, ensuring a structured approach to conservation.

- Land Use Planning: Strategic land use planning is employed to balance operational needs with the preservation of ecological value and community land rights.

ArcelorMittal's commitment to its 2050 net-zero emissions target drives significant investment in low-carbon steelmaking technologies, with a 14% reduction in CO2 intensity achieved by 2023 compared to 2018 levels.

The company's operations are deeply intertwined with natural resources, with 56.4 million tonnes of iron ore produced in Q1 2024, emphasizing the need for sustainable sourcing and efficient utilization to mitigate depletion concerns.

Water management is critical, with ArcelorMittal reporting reduced freshwater withdrawal intensity in 2023, alongside efforts to minimize industrial waste through circular economy principles and a focus on reducing landfill waste.

Biodiversity is addressed through habitat restoration projects, as seen in South African operations, and integrated into environmental management systems and land use planning to balance operational needs with ecological preservation.

| Environmental Factor | 2023/2024 Data Point | Strategic Focus |

|---|---|---|

| Carbon Emissions | 14% CO2 intensity reduction (vs. 2018) | Net-zero 2050 target, low-carbon tech investment |

| Natural Resources | 56.4 million tonnes iron ore (Q1 2024) | Sustainable sourcing, resource efficiency |

| Water Usage | Reduced freshwater withdrawal intensity | Water conservation, enhanced treatment |

| Waste Management | Reduced waste intensity | Circular economy, waste-to-resource initiatives |

| Biodiversity | Habitat restoration projects underway | Minimizing impact, ecological preservation |

PESTLE Analysis Data Sources

Our ArcelorMittal PESTLE analysis is built on a robust foundation of data from official government publications, international financial institutions like the IMF and World Bank, and reputable industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the global steel industry.