ArcelorMittal Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ArcelorMittal Bundle

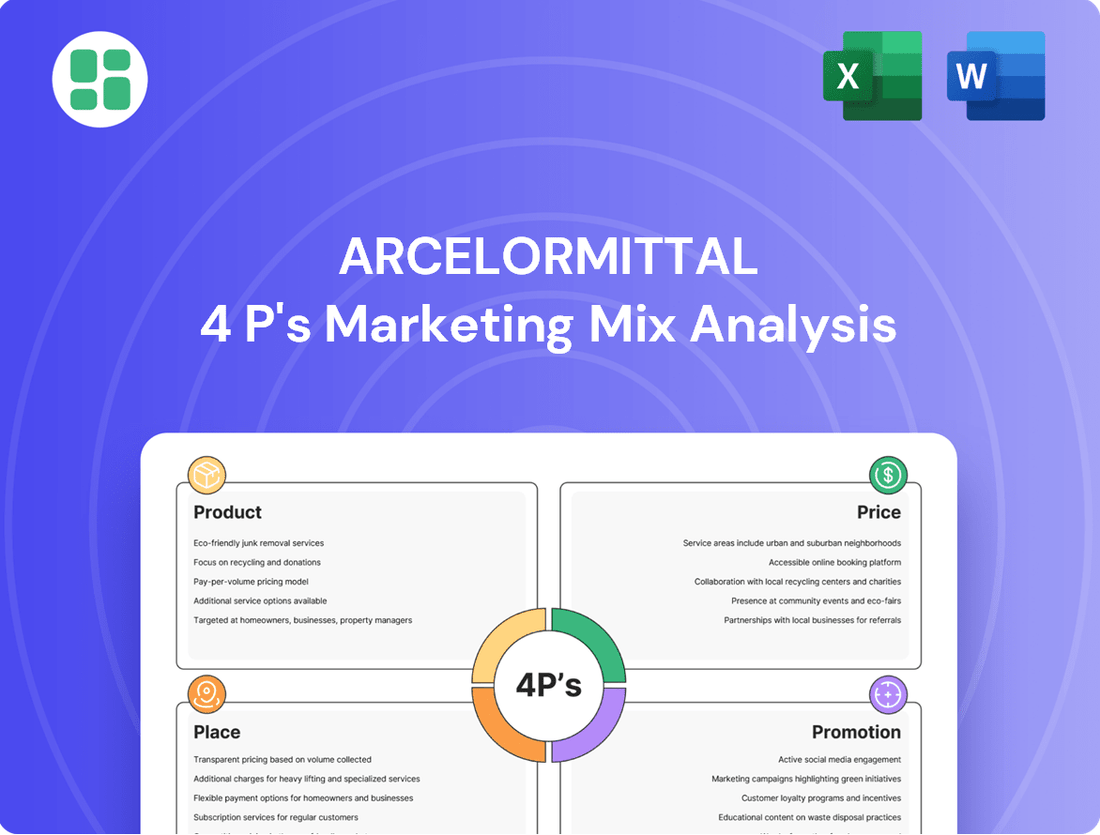

ArcelorMittal's marketing success hinges on a sophisticated interplay of its 4Ps. Discover how their diverse product portfolio, strategic pricing, extensive global distribution, and targeted promotional efforts create a powerful market presence.

Unlock the full potential of ArcelorMittal's marketing strategy by delving into the complete 4Ps analysis. This comprehensive report offers actionable insights into their product development, pricing tactics, place in the market, and promotional campaigns, providing a blueprint for strategic success.

Go beyond the surface and gain a deep understanding of ArcelorMittal's marketing prowess. Our full 4Ps analysis breaks down their product innovation, pricing models, distribution networks, and promotional channels, empowering you with strategic knowledge.

Product

ArcelorMittal's diverse steel portfolio is a cornerstone of its market strategy, encompassing flat products, long products, and tubes. This extensive range serves critical sectors like automotive, construction, and infrastructure, demonstrating the company's broad industrial reach.

The company's commitment to innovation is evident in its continuous investment in research and development. For example, ArcelorMittal's 2024 R&D efforts focus on advanced high-strength steels for lighter vehicles, a key driver in the automotive sector's push for fuel efficiency and reduced emissions.

ArcelorMittal’s integrated raw material sourcing is a cornerstone of its strategy. As a significant global mining entity, the company directly operates iron ore and coal mines across various continents, ensuring a consistent and reliable flow of essential inputs for its vast steelmaking operations. This vertical integration is not just about supply; it's a critical factor in managing production costs and maintaining stringent quality standards, directly benefiting their diverse customer base.

This strategic approach to raw materials provides ArcelorMittal with a distinct competitive edge. For example, in 2023, the company reported that its mining segment generated $15.5 billion in revenue, highlighting the scale of its operations and its contribution to the overall business. By controlling a substantial portion of its raw material supply, ArcelorMittal can better navigate the volatility often seen in commodity markets, offering greater price stability and predictable product quality to its clients.

ArcelorMittal's Advanced Material Solutions are centered on producing high-strength steels and specialized alloys. These materials are engineered for enhanced durability and reduced weight, directly benefiting sectors like automotive. For instance, advanced high-strength steels contributed to a significant portion of the steel used in new vehicle models, driving fuel efficiency improvements.

The development of these innovative materials empowers clients, particularly in the automotive industry, to meet stringent safety regulations and ambitious sustainability targets. ArcelorMittal's investment in material science research and development, which saw significant capital allocation in 2024 for new alloy formulations, directly supports these client objectives, offering solutions that are both high-performing and environmentally conscious.

Sustainable Steel ion

ArcelorMittal's commitment to sustainable steelmaking is evident in its product development, focusing on reduced carbon footprints and circular economy principles. This translates into offerings like green steel, produced using advanced technologies, and a significant increase in recycled content utilization.

Their sustainable product portfolio directly addresses global environmental targets and caters to the escalating customer demand for eco-conscious materials. For instance, by 2023, ArcelorMittal had already achieved a 30% reduction in CO2 emissions intensity in Europe compared to 1990 levels, showcasing tangible progress in their sustainability drive.

- Green Steel Initiatives: ArcelorMittal is investing heavily in technologies like hydrogen-based steelmaking and carbon capture, utilization, and storage (CCUS).

- Circular Economy Focus: The company is increasing the use of scrap steel in its production processes, aiming for higher recycling rates.

- Customer Demand: Companies across sectors, from automotive to construction, are increasingly specifying low-carbon steel for their projects.

- Environmental Goals: ArcelorMittal aims to achieve net-zero emissions by 2050, with interim targets for significant emission reductions.

Customer-Centric Development

ArcelorMittal's customer-centric development is deeply embedded in its strategy, ensuring products align with evolving market needs and client specifications. This often involves direct collaboration with customers to co-create tailored steel solutions, fostering innovation and mutual growth.

This responsive approach allows ArcelorMittal to not only meet immediate demands but also to proactively address future industry challenges, delivering significant value-added benefits to their clients. For instance, their focus on developing advanced high-strength steels (AHSS) for the automotive sector directly addresses the industry's drive for lighter, more fuel-efficient vehicles.

- Customer Collaboration: ArcelorMittal actively partners with clients to develop bespoke steel grades and applications, such as specialized steels for renewable energy infrastructure.

- Industry Responsiveness: The company invests in R&D to anticipate trends, like the growing demand for sustainable construction materials, ensuring their product pipeline remains relevant.

- Value-Added Solutions: By understanding specific client pain points, ArcelorMittal delivers solutions that enhance performance and competitiveness, exemplified by their high-performance steels for demanding industrial applications.

- Market Adaptation: In 2024, ArcelorMittal continued to refine its product portfolio based on feedback from key sectors like automotive and construction, aiming to boost market share through specialized offerings.

ArcelorMittal's product strategy centers on a diverse steel portfolio, including flat, long, and tubular products, catering to automotive, construction, and infrastructure sectors. Their focus on advanced materials, like high-strength steels, directly supports automotive lightweighting and sustainability goals, with R&D in 2024 targeting new alloy formulations.

The company is also committed to sustainable steelmaking, offering green steel and increasing scrap utilization, aiming for net-zero emissions by 2050. This aligns with growing customer demand for eco-conscious materials, evidenced by a 30% CO2 intensity reduction in Europe by 2023.

Customer collaboration is key, with ArcelorMittal developing tailored steel solutions, such as specialized steels for renewable energy infrastructure, to meet evolving market needs and industry challenges.

| Product Focus | Key Sectors Served | Innovation & Sustainability Highlight | 2024/2025 Data Point |

|---|---|---|---|

| Diverse Steel Portfolio (Flat, Long, Tubes) | Automotive, Construction, Infrastructure | Advanced High-Strength Steels (AHSS) for lightweighting | Continued R&D investment in new alloy formulations for 2024. |

| Advanced Materials (High-Strength Steels, Alloys) | Automotive | Enhanced durability, reduced weight, improved fuel efficiency | AHSS contributed significantly to new vehicle models in 2023. |

| Sustainable Steel Products (Green Steel, Recycled Content) | All sectors with environmental targets | Reduced carbon footprint, circular economy principles | Targeting net-zero emissions by 2050; 30% CO2 intensity reduction in Europe by 2023. |

What is included in the product

This analysis provides a comprehensive examination of ArcelorMittal's marketing mix, detailing its product offerings, pricing strategies, distribution channels, and promotional activities.

It is designed for professionals seeking to understand ArcelorMittal's market positioning and competitive strategies within the global steel industry.

Simplifies complex marketing strategies by clearly outlining ArcelorMittal's product, price, place, and promotion decisions, alleviating the pain of understanding their market approach.

Provides a concise framework to address challenges in market penetration and brand perception, acting as a quick reference for strategic adjustments.

Place

ArcelorMittal boasts an extensive global manufacturing and operational footprint, encompassing integrated steelmaking facilities and mining operations across more than 15 countries. This widespread network, including significant operations in North America, South America, Europe, and Africa, allows the company to cater to diverse regional markets efficiently. For instance, in 2023, ArcelorMittal maintained a significant production capacity across its global sites, enabling it to respond to varied local demand.

The strategic placement of these facilities is crucial for minimizing transportation costs and enhancing responsiveness. By having production hubs in key industrial regions, ArcelorMittal can better manage logistics and deliver products to customers more promptly. This global presence is a cornerstone of their ability to adapt to regional economic shifts and capitalize on growth opportunities in different parts of the world.

ArcelorMittal primarily utilizes direct sales to reach its key clients, including large industrial manufacturers, original equipment manufacturers (OEMs), and significant construction enterprises. This approach fosters deep customer relationships, enabling tailored order fulfillment and direct technical assistance. For instance, in 2023, ArcelorMittal reported significant direct sales volumes to the automotive and construction sectors, reflecting the importance of this B2B distribution strategy.

ArcelorMittal operates a vast global logistics and supply chain network, leveraging rail, road, and sea transport to reach its customers. This complex infrastructure is built for efficiency, ensuring reliable delivery of both bulk materials and specialized steel products. For instance, in 2023, the company's supply chain handled millions of tons of raw materials and finished goods, underscoring its scale.

The effectiveness of ArcelorMittal's logistics hinges on sophisticated inventory management across its numerous warehouses and terminals. This strategic approach optimizes product availability and significantly reduces lead times, a critical factor in the competitive steel market. By maintaining lean inventories while ensuring product flow, ArcelorMittal aims to meet diverse customer demands promptly.

Local Service Centers and Processing Facilities

ArcelorMittal's commitment extends beyond primary steel production with a robust network of local service centers and processing facilities. These sites are strategically positioned to serve key customer hubs, ensuring proximity and efficiency. For instance, in 2024, the company continued to optimize its distribution and processing footprint across North America and Europe, aiming to reduce lead times for critical sectors like automotive and construction.

These centers offer crucial value-added services, including precision cutting, slitting, and custom shaping of steel products. This allows ArcelorMittal to meet highly specific customer requirements and facilitate just-in-time delivery schedules. By bringing specialized processing capabilities closer to the point of consumption, the company enhances customer convenience and responsiveness, a key differentiator in the competitive steel market.

- Strategic Location: Facilities situated near major manufacturing and construction zones reduce transportation costs and delivery times.

- Value-Added Services: Offering cutting, slitting, and custom shaping to meet precise client specifications.

- Customer Focus: Enhancing convenience and providing tailored solutions closer to the end-user.

- Operational Efficiency: Supporting just-in-time inventory management for clients, improving their production flow.

Strategic Partnerships and Joint Ventures

ArcelorMittal actively pursues strategic partnerships and joint ventures, especially in targeted regions and for niche product segments. These collaborations are designed to boost market penetration and streamline distribution networks, effectively extending the company's reach.

By combining ArcelorMittal's global scale with local knowledge and established infrastructure from partners, these alliances enhance competitive advantage and market access. This approach is crucial for successfully navigating diverse international markets and capitalizing on emerging growth opportunities.

- 2023 Revenue from Joint Ventures: While specific figures are often consolidated, ArcelorMittal’s participation in ventures like the AM/NS India joint venture, which saw significant investment and operational ramp-up in 2023, contributed to overall group performance.

- Strategic Alliances for Innovation: Partnerships are frequently formed to develop and commercialize advanced steel products, such as those used in the automotive sector for lightweighting, a key growth area.

- Regional Market Penetration: Joint ventures in emerging markets, like those in Africa, allow ArcelorMittal to leverage local distribution channels and regulatory understanding, thereby improving market share.

- Optimizing Logistics: Collaborations can also focus on shared logistics and supply chain infrastructure, leading to cost efficiencies and improved delivery times for customers.

ArcelorMittal's global manufacturing presence, with over 15 countries in 2023, ensures proximity to key industrial and construction markets. This strategic placement minimizes logistics costs and enhances delivery speed, crucial for customer satisfaction. The company's network of service centers, particularly optimized in North America and Europe in 2024, provides localized processing and value-added services, directly addressing specific client needs.

Full Version Awaits

ArcelorMittal 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive ArcelorMittal 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies in detail.

This is the same ready-made Marketing Mix document you'll download immediately after checkout, providing a thorough examination of ArcelorMittal's approach to each of the 4 P's.

You're viewing the exact version of the analysis you'll receive—fully complete, ready to use, and offering deep insights into ArcelorMittal's marketing strategies.

Promotion

ArcelorMittal's promotional strategy heavily targets a business-to-business (B2B) market. Their efforts are concentrated on building enduring relationships with industrial clients, engineers, and procurement specialists who rely on their steel products. This focus means their communications zero in on the technical merits, superior quality, and performance advantages of their offerings.

Rather than aiming for broad consumer recognition, ArcelorMittal's marketing emphasizes how their steel solutions solve specific industrial challenges and create tangible value for their business partners. For instance, in 2024, their engagement with industry trade shows and specialized publications directly reached key decision-makers in sectors like automotive and construction, reinforcing their technical expertise.

ArcelorMittal actively participates in significant global industry trade shows and conferences, a cornerstone of its promotional efforts. For instance, in 2023, the company showcased its latest innovations at events like the World Steel Association's annual conference, highlighting advancements in sustainable steelmaking. These appearances are crucial for demonstrating technological progress and engaging directly with a diverse customer base.

These platforms are vital for ArcelorMittal to exhibit new product lines, such as advanced high-strength steels for the automotive sector, and to illustrate breakthroughs in areas like carbon capture technology. Such direct engagement allows for immediate feedback and strengthens relationships with both current and prospective clients, reinforcing brand visibility and market presence.

Beyond product showcases, these gatherings facilitate invaluable networking opportunities and position ArcelorMittal as a thought leader. In 2024, the company's executives are scheduled to present on decarbonization strategies at key European steel industry forums, providing insights that shape market perception and gather critical intelligence on emerging trends and competitive landscapes.

ArcelorMittal's promotion strategy heavily emphasizes investor relations and corporate communications to engage shareholders, financial analysts, and the wider financial ecosystem. This proactive approach ensures stakeholders are well-informed about the company's performance and future outlook.

The company consistently publishes detailed annual and sustainability reports, alongside quarterly earnings calls, providing transparent insights into its financial health, strategic initiatives, and dedication to ethical operations. For instance, ArcelorMittal's 2023 annual report highlighted a net income of $5.1 billion, demonstrating financial resilience.

This commitment to clear and consistent communication is crucial for fostering trust and confidence among its diverse stakeholder base, underpinning its market reputation and investor appeal.

Digital Presence and Content Marketing

ArcelorMittal actively cultivates its digital presence through its corporate website and professional social media channels, particularly LinkedIn, to reach its business-to-business audience. This online strategy is crucial for content marketing, disseminating valuable information to stakeholders.

The company publishes a range of content, including case studies, white papers, technical guides, and news updates. These materials effectively showcase ArcelorMittal's expertise and the diverse applications of its steel products, reinforcing its industry leadership.

This digital approach is designed to inform and engage potential clients by offering substantial resources and highlighting the company's innovative solutions. For instance, ArcelorMittal's commitment to sustainability is often a key theme in its digital content, aligning with growing market demands.

- Digital Channels: Corporate website, LinkedIn, industry portals.

- Content Types: Case studies, white papers, technical guides, news.

- Objective: Inform and engage B2B audience, demonstrate expertise.

- Focus Areas: Product applications, innovation, and sustainability initiatives.

Sustainability Reporting and Advocacy

ArcelorMittal actively promotes its dedication to sustainability through detailed reporting and engagement in industry advocacy. This includes championing policies for green steel and transparently sharing progress on decarbonization and circular economy initiatives. Their commitment to Environmental, Social, and Governance (ESG) principles is a key part of their communication strategy, aiming to resonate with stakeholders who prioritize responsible business practices.

In 2023, ArcelorMittal continued to invest in its sustainability journey. For instance, their 2023 Sustainability Report detailed progress across various ESG metrics, underscoring their commitment to reducing emissions. The company has set ambitious targets, aiming for a net-zero target by 2050, with interim goals to reduce CO2 intensity by 25% by 2030 compared to a 2018 baseline. This proactive stance on environmental stewardship is central to their promotional efforts.

- ESG Focus: ArcelorMittal's promotional strategy heavily emphasizes its ESG performance, aligning with global trends and investor expectations for sustainable operations.

- Green Steel Advocacy: The company actively lobbies for policies that support the production and adoption of lower-carbon steelmaking processes.

- Decarbonization Efforts: Publicly showcasing advancements in technologies like hydrogen-based direct reduction and carbon capture is a significant part of their communication.

- Circularity Initiatives: Promoting the use of scrap steel and the development of recycling technologies further reinforces their commitment to a circular economy model.

ArcelorMittal's promotional activities are primarily B2B focused, emphasizing technical superiority and value for industrial clients through trade shows, digital content, and direct engagement. Their investor relations and sustainability reporting also play a crucial role in shaping market perception and building stakeholder confidence.

Key promotional efforts include participation in industry events to showcase innovations like advanced high-strength steels and decarbonization technologies. Digital channels, particularly LinkedIn, are used to disseminate case studies and technical guides, reinforcing their leadership in sustainable steel solutions.

The company's commitment to ESG principles, including ambitious decarbonization targets like a 25% CO2 intensity reduction by 2030, is a central theme in their promotional strategy, aiming to attract environmentally conscious investors and partners.

| Promotional Channel | Key Content/Activity | Target Audience | 2023/2024 Focus |

|---|---|---|---|

| Industry Trade Shows & Conferences | New product launches (e.g., advanced steels), decarbonization tech showcases | Industrial clients, engineers, procurement specialists | Sustainable steelmaking advancements, hydrogen-based DR |

| Digital Channels (Website, LinkedIn) | Case studies, white papers, technical guides, sustainability reports | B2B clients, investors, financial analysts | Highlighting ESG impact, innovative applications |

| Investor Relations & Reporting | Annual reports, quarterly earnings calls, sustainability disclosures | Shareholders, financial analysts, wider financial ecosystem | Financial resilience (e.g., $5.1bn net income in 2023), ESG progress |

Price

ArcelorMittal's pricing is intrinsically tied to global commodity markets, with iron ore and coking coal prices serving as primary cost drivers. For instance, in Q1 2024, benchmark iron ore prices averaged around $130 per tonne, a figure that directly impacts ArcelorMittal's production costs and, consequently, its steel pricing strategies to maintain profitability.

The company must balance these rising input costs with competitive pressures in the global steel sector. In 2024, steel prices have seen volatility, with benchmarks like the TSI US Hot-Rolled Coil index fluctuating, forcing ArcelorMittal to adapt its pricing to remain attractive to buyers while covering its elevated raw material expenses.

Supply and demand dynamics for steelmaking raw materials are crucial. A tightening of coking coal supply, as seen in early 2024 due to geopolitical factors, can significantly increase ArcelorMittal's cost base, necessitating upward adjustments in its steel product pricing to preserve margins.

ArcelorMittal leverages value-based pricing for its specialized steel products, aligning costs with the enhanced performance and bespoke solutions provided. This strategy is crucial for products like advanced high-strength steels (AHSS) used in automotive, where lighter weight translates to fuel efficiency, a significant customer benefit.

For instance, ArcelorMittal's Usibor® 1500, a key component in automotive safety structures, commands a premium due to its exceptional strength-to-weight ratio, contributing to vehicle safety and reduced emissions. This pricing reflects the substantial R&D investment and the tangible value delivered to manufacturers.

ArcelorMittal navigates pricing through a dual strategy: long-term contracts offer predictable revenue streams, securing stable pricing for key industrial customers. This approach underpins a significant portion of their business, fostering consistent demand.

Simultaneously, ArcelorMittal leverages the spot market to react to immediate supply and demand shifts, capitalizing on price volatility. For instance, in Q1 2024, the steel market saw fluctuations driven by global economic sentiment, allowing for opportunistic sales.

This balance is vital; while contracts provide a baseline, spot sales allow ArcelorMittal to capture upside potential during periods of high demand, such as the anticipated infrastructure spending in various regions throughout 2024-2025, thereby optimizing overall revenue generation and mitigating risk.

Competitive Landscape and Market Position

ArcelorMittal’s pricing strategy is significantly influenced by the global steel market, where it ranks as a leading producer. Its decisions must account for the pricing moves of other major players like Nippon Steel and Baowu Steel, ensuring competitiveness, particularly for bulk orders. The company’s substantial market share and established brand image provide a degree of pricing influence, though staying competitive remains paramount.

Strategic pricing allows ArcelorMittal to solidify its market leadership while adeptly navigating evolving market conditions and competitor actions. For instance, in 2024, global steel prices have seen fluctuations due to demand shifts and raw material costs, prompting ArcelorMittal to adjust its own pricing to maintain market share.

- Global Steel Production Share: ArcelorMittal consistently holds a significant portion of global crude steel production, often exceeding 80 million tonnes annually, directly impacting its pricing leverage.

- Competitor Pricing Benchmarking: The company actively monitors and reacts to price changes announced by key competitors, such as China Baowu Steel Group and Nippon Steel Corporation, to remain competitive in major markets.

- Contract Negotiation Flexibility: While a price leader in some segments, ArcelorMittal offers flexibility in pricing for large, long-term contracts to secure volume and customer loyalty amidst intense competition.

- Market Dynamics Impact: In 2024, factors like infrastructure spending in various regions and the automotive sector’s recovery have influenced demand, leading ArcelorMittal to implement targeted pricing adjustments to capture these opportunities.

Economic Conditions and Demand Fluctuations

ArcelorMittal's pricing is heavily influenced by the health of major industries like automotive and construction. When these sectors are booming, demand for steel rises, allowing ArcelorMittal to command higher prices. For example, in 2024, global steel demand was projected to increase by 1.7%, driven by recovery in construction and automotive sectors in certain regions.

Conversely, economic slowdowns create challenges. During periods of weak economic activity, like the anticipated global GDP growth moderation in 2025, oversupply can emerge, putting significant downward pressure on steel prices. This necessitates a flexible pricing strategy to navigate these cyclical fluctuations and maintain profitability.

- 2024 Global Steel Demand Growth: Projected at 1.7%

- Key Demand Drivers: Automotive and Construction sectors

- Economic Sensitivity: Steel prices directly correlate with industrial output and GDP growth

- 2025 Outlook: Anticipated moderation in global GDP growth could impact steel demand and pricing

ArcelorMittal's pricing strategy is a dynamic interplay of raw material costs, market demand, and competitive pressures. The company must continually adjust its prices to reflect fluctuations in iron ore and coking coal, which are key cost inputs. For example, in the first half of 2024, benchmark iron ore prices hovered around $115-$130 per tonne, directly influencing the cost structure for steel production.

To maintain competitiveness, ArcelorMittal benchmarks its pricing against major global players like Nippon Steel and China Baowu. In 2024, steel prices, such as US hot-rolled coil, have experienced volatility, with average prices for HRC in the US ranging from $750 to $850 per ton. This necessitates strategic adjustments to remain attractive to buyers while covering elevated material expenses and ensuring profitability.

The company employs a dual approach to pricing, utilizing long-term contracts for stable revenue and spot market sales to capitalize on short-term demand surges. This balance is crucial, especially considering projected global steel demand growth of 1.7% in 2024, largely driven by the automotive and construction sectors. However, anticipated moderation in global GDP growth in 2025 could introduce pricing challenges due to potential oversupply.

| Metric | Value (H1 2024) | Notes |

|---|---|---|

| Benchmark Iron Ore Price | ~$115-$130/tonne | Key cost driver for steel production |

| US Hot-Rolled Coil (HRC) Average Price | ~$750-$850/ton | Reflects market volatility and competitive landscape |

| Projected Global Steel Demand Growth | 1.7% (2024) | Driven by automotive and construction sectors |

| Global GDP Growth Outlook | Moderation anticipated in 2025 | Potential impact on steel demand and pricing |

4P's Marketing Mix Analysis Data Sources

Our ArcelorMittal 4P's analysis is built upon a foundation of official company disclosures, including annual reports and investor presentations, alongside comprehensive industry reports and market research. This ensures a robust understanding of their product offerings, pricing strategies, distribution networks, and promotional activities.