ArcelorMittal Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ArcelorMittal Bundle

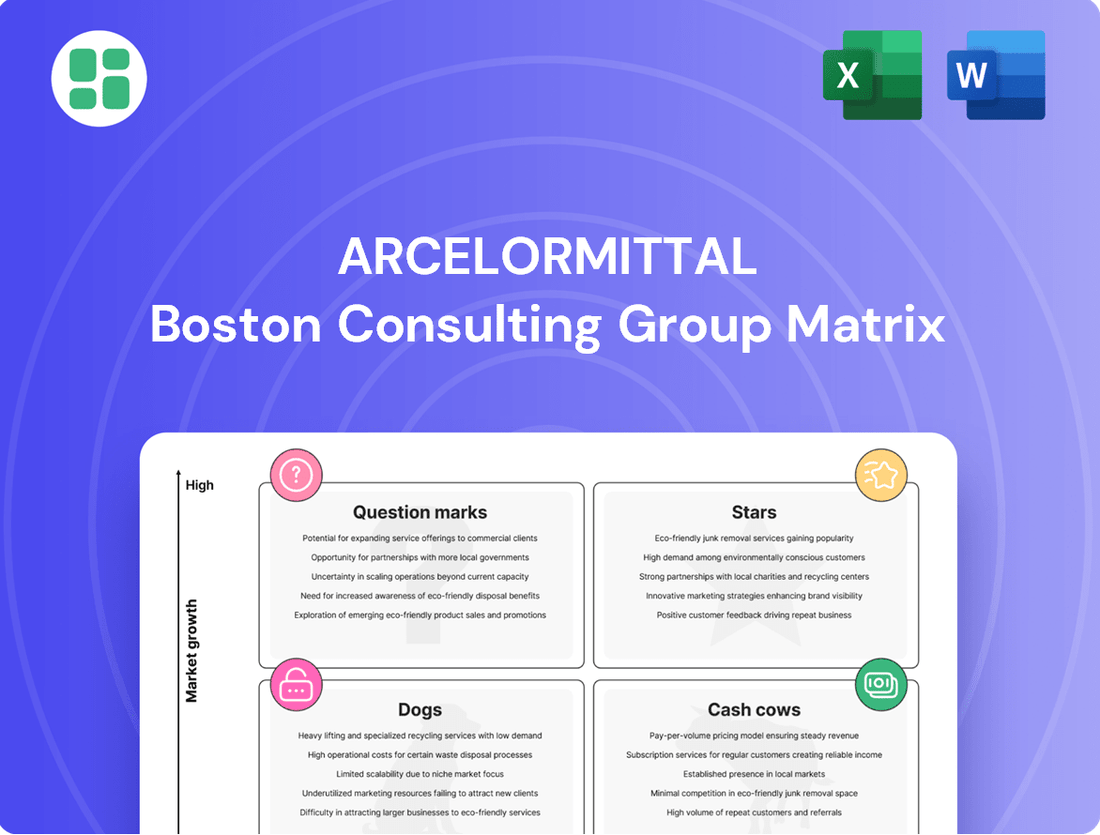

ArcelorMittal's BCG Matrix highlights its diverse product portfolio, categorizing them into Stars, Cash Cows, Dogs, and Question Marks. Understanding these classifications is crucial for strategic resource allocation and future growth.

This preview offers a glimpse into ArcelorMittal's market position. Purchase the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for this global steel giant.

Stars

ArcelorMittal is a dominant player in the automotive steel market, a sector booming due to the increasing need for lighter, more robust materials, especially for electric vehicles. Their significant investment and leadership in Advanced High-Strength Steels (AHSS) positions them squarely in a rapidly expanding, high-value niche.

The automotive industry's push for enhanced fuel efficiency and safety standards directly fuels demand for AHSS. For instance, in 2024, the global automotive steel market was projected to reach over $200 billion, with AHSS representing a substantial and growing portion of that figure, driven by stringent regulatory requirements and consumer preferences for safer, more efficient vehicles.

ArcelorMittal's XCarb® Low-Carbon Emissions Steel Products are a key component of their business strategy, targeting the burgeoning demand for greener materials. This brand signifies a significant investment in sustainable steel production, aiming to capture market share in an environmentally conscious world.

The XCarb® line is performing exceptionally well, with sales doubling in 2024 to reach roughly 400,000 tonnes. This substantial growth underscores the market's appetite for low-carbon steel, even amidst broader policy uncertainties surrounding the green steel transition.

AMNS India's expansion is a key growth engine, with new downstream facilities specifically targeting automotive clients and their need for high-value-added steel products. This strategic move capitalizes on India's position as the fastest-growing major steel market globally.

ArcelorMittal is actively enhancing its market presence in India by focusing on premium product offerings. For instance, in 2024, AMNS India continued its investment in advanced steelmaking technologies to meet the stringent requirements of the automotive sector, aiming to capture a larger share of this high-growth segment.

Liberia Iron Ore Mining Expansion

The Liberia iron ore expansion project, targeting a 20 million tonnes (Mt) capacity ramp-up by the end of 2025, positions this asset as a significant growth driver for ArcelorMittal. This initiative is already demonstrating impressive results, with record production and shipments bolstering the Mining segment's financial performance.

This expansion is crucial for ArcelorMittal's strategy, reinforcing its commitment to a secure, integrated raw material supply chain.

- Projected Capacity: 20 Mt by end of 2025.

- Performance: Achieving record production and shipments.

- Contribution: Significantly boosting the Mining segment's results.

- Strategic Importance: Reinforces integrated raw material supply.

New Electric Arc Furnace (EAF) at AMNS Calvert, US

The new 1.5 million tonne Electric Arc Furnace (EAF) at ArcelorMittal Calvert (AMNS Calvert) in the US is a significant strategic move. This advanced facility is specifically engineered to produce exposed automotive grades, a high-growth and high-value sector within the steel market.

This investment directly supports the North American automotive industry by enabling domestic production of essential materials. It underscores ArcelorMittal's commitment to strengthening its leadership position in specialized steel markets.

- Investment in High-Growth Segment: The 1.5 Mt EAF is positioned to capture demand in the automotive sector.

- Domestic Production Capability: It enhances the US supply chain for critical automotive steel.

- Market Leadership: This facility reinforces ArcelorMittal's standing in specialized, high-value steel grades.

ArcelorMittal's automotive steel business, particularly its Advanced High-Strength Steels (AHSS), is a prime candidate for the Stars category in the BCG Matrix. This segment benefits from the automotive industry's increasing demand for lighter, safer, and more fuel-efficient materials, especially with the growth in electric vehicles.

The company's XCarb® low-carbon steel products are also performing exceptionally well, experiencing significant sales growth in 2024. This indicates strong market acceptance and positions ArcelorMittal favorably in the environmentally conscious automotive supply chain.

Furthermore, strategic investments in facilities like the 1.5 million tonne EAF at ArcelorMittal Calvert in the US, designed for high-value automotive grades, solidify its leadership in this high-growth, high-margin sector.

The expansion of AMNS India, focusing on premium automotive steel products, also contributes to this segment's star status, tapping into India's rapidly growing automotive market.

| Business Segment | Product Focus | Market Growth | ArcelorMittal's Position | BCG Category |

|---|---|---|---|---|

| Automotive Steel | Advanced High-Strength Steels (AHSS), XCarb® Low-Carbon Steel | High (driven by EV and safety regulations) | Market Leader, strong innovation pipeline | Star |

| Mining | Iron Ore (Liberia expansion) | Moderate to High (commodity dependent) | Significant capacity expansion, cost efficiency | Question Mark / Cash Cow (depending on market price) |

| Flat Steel Americas | Automotive grades (AMNS Calvert EAF) | High (North American automotive demand) | Strengthening domestic supply, specialized production | Star |

| Flat Steel Europe | Various steel products | Moderate (mature market) | Focus on decarbonization and efficiency | Cash Cow / Question Mark |

What is included in the product

The ArcelorMittal BCG Matrix offers a strategic overview of its diverse business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

A clear BCG Matrix for ArcelorMittal offers a strategic roadmap, alleviating the pain of resource allocation by highlighting growth and market share.

Cash Cows

ArcelorMittal's integrated steelmaking operations in Europe are undeniable cash cows. As the continent's largest steel producer, these facilities, including significant sites like Ghent in Belgium and Fos-sur-Mer in France, consistently churn out substantial profits. In 2023, ArcelorMittal reported an EBITDA of $10.9 billion, with European operations being a significant contributor to this robust performance.

These mature European assets benefit from decades of investment, ensuring efficiency and a wide product range catering to sectors such as automotive, construction, and packaging. Their established market position and economies of scale allow them to generate stable cash flow, even when facing the cyclical nature of the steel industry. For instance, ArcelorMittal's European crude steel production in 2023 reached approximately 33.1 million tonnes, underscoring the sheer volume and market penetration of these operations.

ArcelorMittal's established iron ore mining operations, particularly in Canada, are a cornerstone of its business, acting as a significant cash cow. These mines offer a consistent and cost-effective supply of essential raw materials, underpinning the company's integrated steel production. In 2023, ArcelorMittal's iron ore segment reported strong performance, with volumes reaching 60.4 million tonnes and an average realized price of $118 per tonne, contributing substantially to the company's financial health.

ArcelorMittal's bulk steel products, like rebar and wire rods, are firmly in the Cash Cows quadrant of the BCG matrix. These are foundational products for construction and general industry, commanding a significant market share due to the company's massive production scale and established distribution channels.

While the markets for these commodity steel items are mature and experience low growth, they are vital revenue generators. In 2024, ArcelorMittal reported a substantial portion of its revenue coming from these core steel segments, underscoring their consistent and strong cash flow generation capabilities, which help fund other strategic initiatives.

North American Steel Operations (Post-Normalization)

ArcelorMittal's North American steel operations, after normalizing, are a significant contributor to the company's earnings before interest, taxes, depreciation, and amortization (EBITDA). These operations are a consistent cash generator, benefiting from a strong market position and a broad customer base.

The segment's ability to produce a diverse range of steel products and its established market share solidify its role as a cash cow. This reliability is further enhanced by operational efficiencies and a presence in a comparatively stable market environment.

- EBITDA Contribution: ArcelorMittal's North American segment consistently delivers substantial EBITDA, reflecting its mature and profitable status.

- Market Share: The company holds a significant market share across various steel product categories in North America, ensuring stable demand.

- Diversified Customer Base: A broad customer portfolio across different industries reduces reliance on any single sector, bolstering cash flow stability.

- Operational Efficiency: Streamlined production processes and a focus on cost management enhance the profitability of these established operations.

Steel for the Packaging Sector

Steel for the packaging sector is a cornerstone of ArcelorMittal's cash cow portfolio. This segment benefits from the packaging industry's maturity and stability, ensuring a consistent demand for steel products. ArcelorMittal's significant global market share in this area translates into predictable revenue streams.

The demand for steel in packaging is notably less volatile than in more cyclical industrial markets. This steadiness allows for efficient production planning and reliable cash generation. For instance, in 2024, the global packaging market was projected to reach over $1 trillion, with steel packaging holding a substantial share, underscoring its importance.

- Stable Market: The packaging industry offers a mature and predictable demand for steel.

- High Market Share: ArcelorMittal leverages its global leadership to maintain a strong position.

- Consistent Revenue: The sector's lower cyclicality ensures steady cash flow.

- Operational Efficiency: Predictable demand supports efficient production processes.

ArcelorMittal's established European steel operations and its North American segment are prime examples of cash cows within its business portfolio. These mature, high-volume segments benefit from significant market share and operational efficiencies, generating consistent and substantial profits. Their contribution to the company's overall financial health is crucial, providing stable cash flow that can be reinvested in growth areas or used to weather industry downturns.

| Segment | 2023 EBITDA (USD Billion) | Key Characteristics | Market Position |

|---|---|---|---|

| European Steel Operations | (Significant contributor to total EBITDA) | Mature, high-volume, integrated facilities | Largest steel producer in Europe |

| North American Steel Operations | (Substantial contributor to total EBITDA) | Diverse product range, stable market | Strong market share across categories |

| Iron Ore Mining (Canada) | (Strong performance in 2023) | Cost-effective raw material supply | Cornerstone of integrated production |

What You See Is What You Get

ArcelorMittal BCG Matrix

The ArcelorMittal BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, meticulously prepared by industry experts, will be delivered directly to you, ready for immediate integration into your strategic planning processes. You can confidently rely on this preview as an exact representation of the high-quality, actionable insights contained within the final report you'll download.

Dogs

The announced divestment of the Zenica integrated steel plant in Bosnia suggests it's a Question Mark in ArcelorMittal's BCG Matrix. This usually means it has low market share in a high-growth industry or, more likely, is an underperforming asset with low growth prospects and limited strategic value to the core business.

Divesting such operations often targets those that are no longer competitive or don't fit future strategic plans, draining resources without generating sufficient returns. For instance, in 2023, ArcelorMittal reported a significant drop in steel production in Europe, impacting many of its integrated plants.

The Prijedor iron ore mining operation in Bosnia, much like the Zenica steel plant, is slated for divestment by ArcelorMittal. This strategic move indicates that Prijedor is categorized as a low-growth asset with a limited market share within ArcelorMittal's broader mining interests.

This classification suggests that the Prijedor operation has likely not met the company's profitability targets or its overarching strategic goals. In 2024, the global iron ore market has seen significant price volatility, with benchmarks like the Platts IODEX fluctuating considerably, impacting the economics of such operations.

ArcelorMittal's older, less efficient blast furnaces in Europe, especially those not targeted for decarbonization or conversion to electric arc furnaces (EAFs), are likely classified as Dogs in the BCG Matrix. These facilities contend with elevated operating expenses and mounting environmental regulations, while their contribution to market share in an already saturated European steel market is minimal.

These European blast furnaces are particularly vulnerable. For instance, in 2023, the European steel industry faced significant challenges, with energy costs remaining a key concern for producers. The push for sustainability and stricter emissions standards further pressures these older assets, making their continued operation economically questionable and strategically disadvantageous.

Commodity Steel Products in Highly Competitive, Stagnant Markets

Certain commodity steel products within ArcelorMittal's portfolio may find themselves in highly competitive or stagnant regional markets. These segments, especially those grappling with significant import competition, often characterize low growth and a diminished market share for the company's specific production facilities.

These particular steel product lines typically offer minimal differentiation, making them susceptible to becoming cash traps. This occurs when achieving competitive cost structures proves elusive, hindering profitability and strategic flexibility.

- Market Share & Growth: ArcelorMittal's commodity steel products in mature, competitive markets often show low market share and minimal growth prospects. For instance, in 2024, certain long-steel products in European markets faced import volumes that grew by an estimated 5-7%, pressuring domestic producers.

- Competitive Landscape: Intense competition, particularly from regions with lower production costs, limits pricing power and profitability for these commodity steel lines. The global steel market in 2024 continued to be influenced by overcapacity, with output from China remaining a significant factor impacting global prices.

- Cost Structure Sensitivity: The viability of these products hinges on achieving best-in-class cost structures. Failure to do so, especially when raw material costs fluctuate, can lead to negative cash flow. In 2023, ArcelorMittal reported that its European operations faced an average energy cost increase of approximately 15% compared to 2022, impacting the cost structure of commodity products.

- Potential Cash Traps: Without significant investment in efficiency or a shift towards higher-value products, these segments risk becoming cash traps, draining resources without generating substantial returns. The company's strategic focus in 2024 has been on optimizing its asset portfolio, including potential divestments of underperforming commodity assets.

Non-Core Legacy Assets from Past Acquisitions

ArcelorMittal's history of growth through acquisitions means it likely holds non-core legacy assets. These might be smaller operations that no longer align with the company's primary strategic focus.

These legacy assets often operate in mature, low-growth markets where ArcelorMittal has a limited market share. Consequently, they can become a drain on resources rather than significant contributors to overall performance.

- Asset Rationalization: These assets are prime candidates for divestment or closure to streamline operations.

- Market Position: Typically found in niche, slow-growing sectors with a small competitive footprint.

- Financial Impact: May represent a drag on profitability due to underperformance and high maintenance costs.

- Strategic Fit: Their continued ownership often lacks a clear strategic advantage for ArcelorMittal's future direction.

ArcelorMittal's older, less efficient blast furnaces in Europe, particularly those not slated for modernization or conversion to electric arc furnaces, are likely classified as Dogs. These facilities face high operating costs and increasing environmental regulations, while contributing little to market share in a saturated European steel market.

These European operations are vulnerable; for instance, in 2023, energy costs remained a significant challenge for European steel producers. Stricter emissions standards further pressure these older assets, making their continued operation economically questionable.

Certain commodity steel products in mature, competitive markets, especially those facing import competition, also fall into the Dog category. These segments often exhibit low growth and a diminished market share, potentially becoming cash traps if cost structures cannot be optimized.

In 2024, ArcelorMittal has been focused on optimizing its asset portfolio, which includes divesting underperforming commodity assets. The company's 2023 financial report highlighted that European operations experienced an average energy cost increase of approximately 15% compared to 2022, impacting the profitability of these commodity lines.

| Asset/Product Category | BCG Classification | Rationale | 2023/2024 Data Point |

| Older European Blast Furnaces | Dog | Low market share, high operating costs, regulatory pressure | ~15% increase in European energy costs (2023) |

| Commodity Steel Products (Mature Markets) | Dog | Low growth, intense competition, potential cash trap | 5-7% estimated growth in import volumes for certain long-steel products in European markets (2024) |

Question Marks

ArcelorMittal's hydrogen-based DRI projects are positioned as potential stars in their future portfolio, targeting the high-growth area of green steel production. While the long-term potential is significant, these initiatives are currently in their early stages, meaning they have a low market share today.

These ambitious projects are capital-intensive and face considerable hurdles, including significant upfront investment and the need for supportive policy frameworks and affordable green hydrogen. For instance, ArcelorMittal aims to produce 1.5 million tonnes per annum of green steel in Gijon, Spain, by 2025, but such ventures require substantial cash outlay without immediate profitability.

Investments in Carbon Capture, Utilization, and Storage (CCUS) are vital for ArcelorMittal's long-term decarbonization strategy. However, these technologies are currently in an experimental phase, characterized by high costs and limited commercial application, resulting in a low market share for ArcelorMittal in this segment.

While CCUS offers significant potential for emission reduction, its economic viability is still developing. Substantial research and development, coupled with robust policy support, are necessary to make these solutions cost-effective, with widespread deployment anticipated post-2030. For instance, the International Energy Agency (IEA) reported in 2023 that global CCUS capacity was around 45 million tonnes per annum, a fraction of what’s needed for climate goals.

The planned 7.3 million tonnes per annum (Mtpa) integrated greenfield steel plant in Rajayyapeta, India, represents a significant investment in a high-growth sector. This project aligns with India's ambitious infrastructure development goals, with the steel sector projected to reach 300 Mtpa by 2030, a substantial increase from its current capacity.

As a new venture, this plant, while promising, will initially function as a question mark in the ArcelorMittal portfolio. It requires substantial upfront capital expenditure and a considerable ramp-up period to establish market presence and operational efficiency. For instance, similar large-scale greenfield projects can see initial capital costs running into billions of dollars.

New Non-Grain-Oriented Electrical Steel (NOES) Facility, Calvert, US

ArcelorMittal's new Non-Grain-Oriented Electrical Steel (NOES) facility in Calvert, Alabama, represents a strategic investment in the burgeoning electric vehicle (EV) market. This $0.9 billion project is positioned to capitalize on the increasing demand for specialized steel used in EV motors, a sector experiencing rapid expansion.

- Strategic Alignment: The Calvert facility directly targets the high-growth electric vehicle market, a key area for future industrial development.

- Investment Scale: A significant $0.9 billion is allocated to this new NOES facility, underscoring ArcelorMittal's commitment to this segment.

- Market Entry Timing: Production is slated to begin in the latter half of 2027, indicating a current lack of market share for this specific product line.

- Growth Potential: The facility aims to capture a share of the expanding EV market, which is projected to see substantial growth in the coming years.

Advanced Digitalization and Artificial Intelligence (AI) Integration

ArcelorMittal's commitment to advanced digitalization and AI, including investments in Industry 4.0 technologies like autonomous cranes and big data analytics, positions it for significant future operational efficiency gains. These investments, while foundational, are still in early stages of market share impact, demanding ongoing integration across its global operations.

The company's strategic focus on AI and digitalization is a key driver for potential growth, aiming to optimize processes and foster innovation in new product development. For instance, ArcelorMittal has been exploring AI for predictive maintenance in its facilities, which could reduce downtime and boost output. In 2023, the company continued to invest in digital transformation initiatives, with a portion of its capital expenditure directed towards these advanced technologies.

- Investment in AI and Digitalization: ArcelorMittal is actively investing in technologies such as autonomous cranes and big data analytics to enhance operational efficiency.

- Industry 4.0 Focus: The company's strategy aligns with Industry 4.0 principles, aiming to create smarter, more connected manufacturing processes.

- Nascent Market Share Impact: While these investments hold high growth potential, their direct impact on market share is currently developing and requires continued integration.

- Operational Efficiency and New Products: The primary goals are to achieve greater operational efficiency and to drive the development of innovative new products through these advanced capabilities.

ArcelorMittal's new integrated greenfield steel plant in India, while a significant investment in a high-growth market, represents a question mark due to its nascent stage. This project requires substantial upfront capital and a considerable ramp-up period to establish market presence and operational efficiency. Large-scale greenfield projects often involve billions in initial capital costs, and this Indian venture is no different, demanding time to build market share.

| Project | Status | Market Share Potential | Investment Stage | Key Challenges |

|---|---|---|---|---|

| Greenfield Steel Plant, India | New Venture | High (aligned with India's 300 Mtpa steel goal by 2030) | Early Stage / High Capital Expenditure | Ramp-up period, establishing market presence, operational efficiency |

| Hydrogen-based DRI Projects | Early Stage | High (green steel demand) | Early Stage / Capital Intensive | Affordable green hydrogen, supportive policies, upfront investment |

| CCUS Technologies | Experimental | Low (currently) | Development / High Costs | Economic viability, R&D, policy support, cost-effectiveness |

| NOES Facility, Alabama | New Facility | Moderate to High (EV market) | Pre-production (2027) / $0.9 billion investment | Market entry timing, capturing EV demand |

| Digitalization & AI | Integration Phase | Developing (operational efficiency) | Ongoing Investment | Full integration across global operations, demonstrating market share impact |

BCG Matrix Data Sources

Our ArcelorMittal BCG Matrix is informed by a comprehensive blend of internal financial statements, global steel market reports, and competitor performance data to provide a robust strategic overview.