Applied Industrial Technologies SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Applied Industrial Technologies Bundle

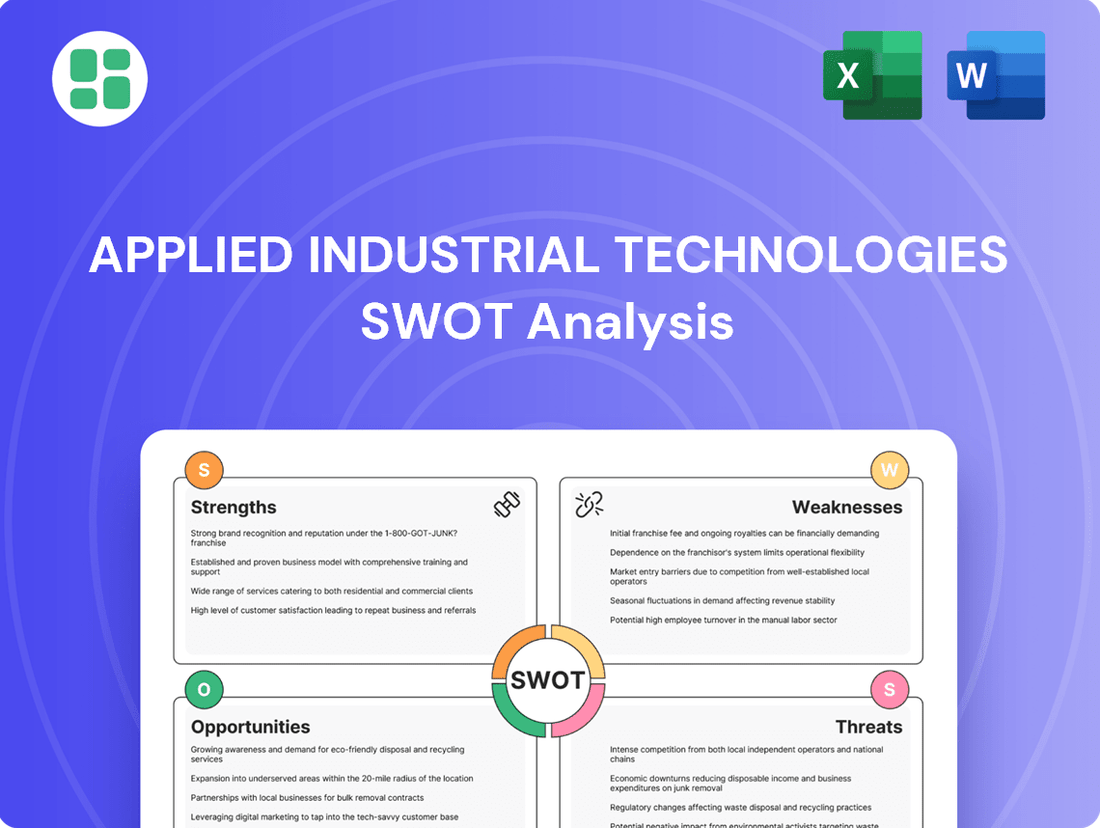

Applied Industrial Technologies leverages its extensive distribution network and strong customer relationships as key strengths, while facing potential threats from economic downturns and increasing competition. Understanding these dynamics is crucial for any stakeholder looking to navigate the industrial supply landscape.

Want the full story behind Applied Industrial Technologies' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Applied Industrial Technologies boasts a diverse product portfolio encompassing industrial motion, power, control, and flow technologies. This extensive range, including bearings, power transmission, fluid power, and automation solutions, allows the company to serve a broad spectrum of industries and customer requirements. For instance, in fiscal year 2023, their sales reached $4.5 billion, reflecting the breadth of their offerings.

Beyond its product breadth, the company distinguishes itself through valuable services such as engineering, design, and technical support. These value-added offerings enable Applied Industrial Technologies to provide integrated solutions, helping clients enhance operational efficiency and performance. This focus on comprehensive support contributed to their significant market presence.

Applied Industrial Technologies boasts a robust market position, serving both original equipment manufacturers (OEMs) and maintenance, repair, and operations (MRO) customers. This dual focus across a wide array of industries, from manufacturing to mining, creates a diversified and stable revenue base, insulating the company from sector-specific downturns.

As one of the largest global distributors of fluid power equipment, Applied Industrial Technologies commands a significant market share. This leadership, coupled with its extensive customer network, provides a strong competitive advantage and contributes to its resilience. For instance, in fiscal year 2023, the company reported record revenues of $4.2 billion, underscoring its broad reach and market penetration.

Applied Industrial Technologies boasts a history of robust financial results, marked by steady growth in earnings per share (EPS) and earnings before interest, taxes, depreciation, and amortization (EBITDA). This consistent performance is further underscored by expanding profit margins and substantial free cash flow generation, providing a solid foundation for the company's operations and strategic initiatives.

In fiscal year 2024, the company reached new benchmarks, achieving record levels for both gross and EBITDA margins. Furthermore, it generated a record amount of free cash flow, a testament to its effective financial management and operational efficiency. This strong cash generation capability offers significant flexibility for reinvestment in growth opportunities and for returning value to shareholders.

Strategic Acquisitions and Automation Focus

Applied Industrial Technologies excels through a consistent strategy of growth via strategic acquisitions. This approach has been instrumental in broadening its product portfolio and extending its market presence. For instance, the late 2024 and early 2025 acquisitions of Hydradyne and Grupo Kopar significantly bolstered its fluid power and automation segments, especially in the expanding Mexican market.

These strategic moves are not just about expansion; they are accretive to earnings, meaning they are expected to increase the company's profitability. This aligns perfectly with the increasing market demand for sophisticated automation solutions, positioning Applied Industrial Technologies to capitalize on future industry trends.

- Strategic Acquisitions: Proven track record of integrating bolt-on and mid-size acquisitions to expand product offerings and market reach.

- Automation Focus: Recent acquisitions like Hydradyne and Grupo Kopar (late 2024/early 2025) strengthen fluid power and automation capabilities.

- Geographic Expansion: Acquisitions enhance presence in key growth regions, such as Mexico, reflecting a targeted market strategy.

- Accretive Growth: Acquired businesses are expected to contribute positively to earnings, demonstrating a focus on profitable expansion.

Commitment to Digital Transformation and Technical Expertise

Applied Industrial Technologies' commitment to digital transformation is a significant strength. The company is actively enhancing its digital channels, including its website, and adopting technologies like Electronic Data Interchange (EDI). This strategic investment is paying off, with digital channel growth outperforming overall sales, indicating a successful shift towards more efficient and modern customer interactions. For instance, in fiscal year 2023, the company reported that its e-commerce sales saw double-digit growth, a key indicator of its digital strategy's effectiveness.

Furthermore, the company boasts a technically-oriented associate team, comprising engineers and specialists. This deep technical expertise is a crucial differentiator, enabling Applied Industrial Technologies to provide complex technical solutions and expert support that customers value. This human capital, combined with digital tools, positions the company to effectively address evolving customer needs for both convenience and sophisticated, tailored solutions in the industrial sector.

Key aspects of this strength include:

- Digital Channel Investment: Enhancements to website and adoption of technologies like EDI are driving growth exceeding overall sales.

- Technical Expertise: A team of engineers and specialists provides a competitive edge in delivering complex solutions.

- Customer Demand Alignment: Focus on digital capabilities and technical support meets modern customer expectations for convenience and advanced solutions.

Applied Industrial Technologies possesses a broad and diversified product range, covering industrial motion, power, control, and flow technologies. This extensive offering, which includes vital components like bearings, power transmission systems, and automation solutions, allows the company to cater to a wide array of industries and customer needs. In fiscal year 2023, their sales reached $4.5 billion, a clear indicator of the extensive market reach of their diverse product lines.

The company also distinguishes itself with valuable services such as engineering, design, and technical support, enabling them to deliver integrated solutions that boost client efficiency. Furthermore, their strong market position as a distributor for both OEMs and MRO customers, across sectors from manufacturing to mining, creates a stable revenue base. Their leadership in fluid power equipment distribution, evidenced by record revenues of $4.2 billion in fiscal year 2023, further solidifies their competitive advantage.

Strategic acquisitions have been a cornerstone of Applied Industrial Technologies' growth, consistently broadening their product portfolio and market presence. Recent acquisitions, such as Hydradyne and Grupo Kopar in late 2024 and early 2025, significantly strengthened their fluid power and automation segments, particularly in the growing Mexican market. These moves are accretive to earnings, aligning with the increasing demand for sophisticated automation solutions.

The company's commitment to digital transformation is a significant strength, with digital channels outperforming overall sales growth. Investments in their website and technologies like Electronic Data Interchange (EDI) are key drivers, with e-commerce sales showing double-digit growth in fiscal year 2023. This, combined with a technically skilled associate team, allows them to provide complex solutions and expert support, meeting evolving customer demands for both convenience and advanced, tailored services.

What is included in the product

Delivers a strategic overview of Applied Industrial Technologies’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and leverage competitive advantages, mitigating risks by proactively addressing weaknesses.

Weaknesses

Applied Industrial Technologies' reliance on the industrial sector makes it susceptible to economic downturns. For instance, their fiscal 2025 first-quarter organic daily sales declined, signaling a slowdown in industrial demand. This vulnerability stems from the cyclical nature of industrial production and investment, which can be significantly impacted by economic uncertainty and interest rate environments.

Despite Applied Industrial Technologies' overall sales growth, largely fueled by strategic acquisitions, a closer look reveals a concerning trend of organic daily sales declines in its core Service Center and Engineered Solutions segments. This dip in performance from existing operations highlights headwinds in the current economic climate.

The Engineered Solutions segment, particularly its fluid power operations, has been more significantly impacted. This decline is attributed to widespread inventory destocking by customers and a general slowdown in original equipment manufacturer (OEM) production, directly affecting demand for Applied's specialized components and services.

The industrial distribution market is highly competitive and fragmented, featuring a wide array of participants from global giants like W.W. Grainger and Fastenal to niche, specialized suppliers. Applied Industrial Technologies navigates this challenging environment, constantly pressured to defend its market position and profitability against this diverse competitive set.

This intense competition often constrains pricing flexibility for Applied Industrial Technologies, compelling the company to consistently invest in enhancing its service offerings and technological capabilities to stay ahead. For instance, in 2023, the industrial distribution sector saw significant consolidation, yet remained populated by over 10,000 firms in the US alone, highlighting the ongoing fragmentation.

Supply Chain and Inflationary Headwinds

Applied Industrial Technologies' operations are vulnerable to supply chain disruptions and persistent inflation, which can directly impact its cost of goods sold and overall operating expenses. For instance, in their fiscal year 2023, the company noted that while they managed gross margins effectively, the persistent inflationary environment presented ongoing challenges. This can lead to margin compression, particularly if sales growth is not robust enough to offset rising input costs.

These external pressures necessitate diligent management of their supply chain and strict cost control measures. The company’s ability to navigate these headwinds is crucial for maintaining profitability. For example, in Q1 2024, reports indicated that increased freight costs and component shortages continued to be factors influencing operational efficiency across the industrial sector.

- Supply Chain Vulnerability: Disruptions in the availability of critical components and raw materials can hinder production and delivery schedules.

- Inflationary Impact: Rising costs for labor, energy, and materials directly affect the company's cost of goods sold and operating expenses.

- Margin Pressure: While Applied Industrial Technologies has historically shown strong gross margins, these external factors can exert downward pressure, especially during periods of slower revenue growth.

- Mitigation Strategies: Effective supply chain management and cost-containment initiatives are essential to buffer against these economic challenges.

Integration Risks from Frequent Acquisitions

Applied Industrial Technologies' growth hinges on acquisitions, but this strategy introduces significant integration risks. For instance, the successful assimilation of acquired businesses, such as Hydradyne and Grupo Kopar, into existing operational frameworks and IT systems is paramount. Failure to achieve seamless integration can undermine expected synergies and negatively impact financial performance.

The company's history shows a pattern of strategic acquisitions, with over 20 acquisitions completed in the last decade. Each integration presents challenges in aligning cultures, streamlining supply chains, and harmonizing technology platforms. For example, the 2023 acquisition of Grupo Kopar, a Brazilian fluid power distributor, required significant effort to integrate its distinct market presence and operational procedures.

- Integration Complexity: Merging diverse business units, each with unique operational models and technological infrastructures, poses a substantial challenge.

- Synergy Realization: The ability to achieve cost savings and revenue enhancements from acquisitions, estimated to be around 5-7% of acquired revenue, depends heavily on effective integration.

- Operational Disruption: Poorly managed integrations can lead to temporary disruptions in service delivery or internal inefficiencies, impacting customer satisfaction and profitability.

Applied Industrial Technologies faces a significant weakness in its reliance on acquisitions for growth, which carries inherent integration risks. The company's fiscal 2025 first quarter saw continued organic sales declines in key segments, underscoring the need for robust performance from existing operations rather than solely depending on new additions.

The complexity of integrating acquired entities, such as the 2023 addition of Grupo Kopar, can lead to operational disruptions and hinder the realization of expected synergies. For instance, aligning diverse IT systems and business cultures across multiple acquisitions requires substantial management attention and resources, potentially diverting focus from core business improvements.

Furthermore, the industrial distribution market's fragmented nature, with thousands of competitors, means that even successful acquisitions must be meticulously managed to avoid being outmaneuvered by nimbler or more specialized players. This competitive pressure amplifies the risk associated with integration challenges.

Preview the Actual Deliverable

Applied Industrial Technologies SWOT Analysis

You’re previewing the actual analysis document. Buy now to access the full, detailed report on Applied Industrial Technologies' Strengths, Weaknesses, Opportunities, and Threats.

This preview reflects the real document you'll receive—professional, structured, and ready to use for strategic planning.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain comprehensive insights.

Opportunities

Applied Industrial Technologies has a prime opportunity to bolster its automation offerings, especially in areas like advanced robotics, machine vision, and Industrial Internet of Things (IIoT). The push for factory automation and smart manufacturing is accelerating, fueled by the constant drive for greater efficiency and persistent labor shortages. For instance, the global industrial automation market was projected to reach $313.4 billion by 2027, showcasing the immense potential.

The company's recent strategic moves, such as acquiring IRIS Factory Automation, and its continued internal investment in these technologies are setting the stage for significant expansion. This focus is particularly well-timed for tapping into burgeoning end markets that are increasingly reliant on sophisticated automated solutions to remain competitive.

The industrial distribution sector is seeing a lot of companies combine, which is a great chance for Applied Industrial Technologies to keep doing what it does best: buying other companies. This trend towards consolidation means there are more potential targets to help the company grow.

Applied Industrial Technologies has a strong financial position, meaning it has the money to buy more businesses. This allows them to make strategic acquisitions, both smaller ones that fit nicely into their existing operations (bolt-on) and larger ones (mid-size). These moves can broaden their product selection, enhance their technical expertise, and extend their reach into new areas.

Specifically, expanding into regions like Mexico and the wider North American market presents significant upside. By acquiring companies in these growing areas, Applied Industrial Technologies can quickly increase its market share and become more diversified, reducing reliance on any single market or product line.

The ongoing digital transformation in industrial distribution offers Applied Industrial Technologies a substantial avenue for expansion. Customers are increasingly favoring online procurement, demanding personalized experiences and rapid delivery, a trend that has accelerated significantly. For instance, in 2024, e-commerce sales for industrial products were projected to reach hundreds of billions globally, with continued double-digit growth anticipated through 2025.

By bolstering its digital infrastructure, including robust e-commerce capabilities, seamless EDI integration, and sophisticated data analytics, Applied Industrial Technologies can significantly elevate customer satisfaction and operational efficiency. This strategic investment allows the company to tap into the burgeoning online market, capture new revenue streams, and solidify its competitive position in an evolving landscape.

Increased Demand for MRO and Technical Services

Applied Industrial Technologies' MRO-focused Service Center segment is poised to capitalize on sustained demand for maintenance, repair, and operational continuity. This is particularly true as businesses increasingly prioritize optimizing asset performance and extending the useful life of their equipment.

The growing emphasis on specialized services, technical support, and predictive maintenance solutions presents a significant opportunity. Applied's established expertise in these critical areas enables it to forge stronger customer relationships and cultivate a predictable stream of recurring revenue.

- Growing Need for Operational Continuity: Businesses across sectors are investing in upkeep to ensure uninterrupted operations, driving demand for MRO services.

- Asset Optimization Focus: Companies are seeking to maximize the efficiency and lifespan of their existing machinery, boosting the appeal of technical support and repair services.

- Recurring Revenue Potential: Applied's service offerings, including maintenance contracts and technical support, contribute to a stable and predictable revenue base.

- Data-Driven Maintenance: The increasing adoption of predictive maintenance technologies, leveraging data analytics, further enhances the value proposition of Applied's technical services.

Reshoring and Infrastructure Development

The trend of reshoring manufacturing back to North America, coupled with substantial investments in infrastructure, presents a significant growth avenue. Projects focused on energy grids, data centers, and transportation networks are projected to boost demand for industrial goods and services. Applied Industrial Technologies, with its established foothold in the North American industrial landscape, is strategically positioned to benefit from these macro trends. This includes increased sales of essential machinery, equipment, and associated supplies.

Several key factors underscore this opportunity:

- Reshoring Momentum: Companies are increasingly bringing production closer to home, driven by supply chain resilience and geopolitical considerations. For instance, the US Department of Commerce reported a significant increase in manufacturing reshoring announcements in 2023.

- Infrastructure Spending: Government initiatives and private sector investments are fueling large-scale infrastructure development. The Bipartisan Infrastructure Law in the United States alone allocates hundreds of billions of dollars to modernize infrastructure, directly impacting demand for industrial technologies.

- Applied Industrial Technologies' Position: The company's extensive distribution network and expertise in industrial automation and maintenance make it a prime partner for businesses involved in these expanding sectors.

Applied Industrial Technologies is well-positioned to capitalize on the growing demand for industrial automation and digital transformation. The company's strategic acquisitions and investments in advanced technologies like robotics and IIoT align with the accelerating push for smart manufacturing and increased efficiency, a trend expected to drive significant market growth through 2025.

Threats

A significant threat for Applied Industrial Technologies is the ongoing risk of economic slowdowns or recessions. Such downturns directly curb industrial production and dampen capital expenditure by their customer base.

Evidence from recent economic data, such as the International Monetary Fund's (IMF) revised global growth forecast for 2024 to 3.2% (down from 3.3% in January 2024), highlights this persistent uncertainty. This cautious spending environment, influenced by elevated interest rates and geopolitical instability, could lead to decreased demand for the company's offerings, thereby affecting its sales and overall profitability.

The industrial technology sector is a hotbed of innovation, with advancements in automation, the Internet of Things (IoT), and artificial intelligence (AI) constantly reshaping the landscape. Applied Industrial Technologies is making strides by investing in these critical areas, but the pace of change presents a significant threat.

There's a real risk that more nimble, specialized competitors or entirely new market entrants could introduce disruptive technologies at a faster rate. If Applied Industrial Technologies cannot match this speed or effectively integrate these cutting-edge solutions, its competitive edge could diminish.

For instance, a report from McKinsey in late 2024 highlighted that companies failing to adopt AI-driven predictive maintenance solutions risk seeing their operational efficiency lag by as much as 15-20% compared to early adopters. This highlights the potential market share erosion if integration isn't swift.

The industrial distribution landscape is rapidly shifting, with digital-first distributors and online marketplaces emerging as significant competitors. These agile players often cater to a growing customer base that prioritizes the speed, convenience, and ease of e-commerce transactions. For instance, the global industrial e-commerce market was valued at over $1.5 trillion in 2023 and is projected to continue its strong growth trajectory, indicating a clear customer preference shift.

Applied Industrial Technologies faces the challenge of keeping pace with these digitally native competitors who possess highly optimized online sales channels and sophisticated logistics networks. This trend means that companies with less developed digital infrastructures risk losing market share to rivals who can offer a more seamless and efficient customer experience. Failing to adapt to this digital evolution could impact revenue streams and customer retention.

To counter this threat, Applied Industrial Technologies must invest in and continuously enhance its digital capabilities. This includes improving its own e-commerce platforms, streamlining online ordering processes, and optimizing its digital supply chain and delivery networks. Staying competitive requires a proactive approach to digital transformation to meet evolving customer expectations and maintain a strong market position against increasingly formidable online rivals.

Supply Chain Volatility and Geopolitical Risks

Global supply chains remain a significant vulnerability for Applied Industrial Technologies. The ongoing volatility in raw material prices, coupled with persistent logistics challenges, directly impacts operational costs and product availability. For instance, the semiconductor shortage experienced through 2023 and into early 2024 continued to affect various manufacturing sectors, including those reliant on advanced industrial components.

Geopolitical tensions further exacerbate these issues. Changes in trade policies, the imposition of tariffs, and the outbreak of international conflicts create unpredictable sourcing and distribution landscapes. These disruptions can lead to increased prices for essential components or outright stockouts, directly affecting Applied Industrial Technologies' ability to meet demand and maintain stable pricing for its customers.

- Raw Material Price Fluctuations: For example, the price of copper, a key component in many industrial applications, saw significant swings in 2024 due to global demand and supply-side issues, impacting production costs.

- Logistics Bottlenecks: Container shipping costs, while stabilizing from pandemic highs, remained sensitive to port congestion and labor availability throughout 2024, affecting delivery times and expenses.

- Trade Policy Uncertainty: The ongoing review and potential adjustments of international trade agreements in 2024 and projected into 2025 create uncertainty for companies with global sourcing and sales operations.

- Geopolitical Conflicts: Regional conflicts in 2024 continued to disrupt key shipping lanes and impact the availability of certain manufactured goods, posing a direct threat to uninterrupted supply.

Labor Shortages and Talent Retention

The industrial sector, including distribution and technical services like those offered by Applied Industrial Technologies, is grappling with significant labor shortages, particularly for specialized roles such as engineers and technicians. This scarcity of skilled professionals directly impacts the company's capacity to deliver its value-added services, which are crucial for its competitive positioning.

Applied Industrial Technologies' reliance on a technically proficient workforce means that ongoing difficulties in finding and keeping qualified personnel could hinder service delivery, impede operational expansion, and ultimately erode its market advantage. For instance, in the US, manufacturing job openings averaged 860,000 per month in late 2023 and early 2024, highlighting the breadth of this challenge.

- Skilled Labor Gap: A persistent shortage of engineers and technicians directly affects Applied Industrial Technologies' ability to provide essential technical support and specialized services.

- Talent Retention Challenges: Difficulty in retaining key technical talent can disrupt operations and impact service quality, a critical differentiator for the company.

- Operational Impact: Labor shortages can limit the company's capacity to take on new projects or expand its service offerings, potentially capping revenue growth.

- Competitive Disadvantage: Competitors who can more effectively address labor needs may gain an advantage in service delivery and market reach.

Intensifying competition from digitally native distributors poses a significant threat, as they leverage efficient e-commerce platforms and streamlined logistics to capture market share. Applied Industrial Technologies must enhance its digital infrastructure to match the speed and convenience offered by these agile rivals. For example, the industrial e-commerce market's projected growth underscores this shift in customer preference, making digital adaptation crucial for maintaining relevance and customer loyalty.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Applied Industrial Technologies' official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic perspective.