Applied Industrial Technologies Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Applied Industrial Technologies Bundle

Applied Industrial Technologies operates in an industry characterized by moderate buyer power and significant threats from substitutes, as customers can often source components and services from multiple providers. While supplier power is somewhat limited due to the industry's fragmentation, the threat of new entrants is a persistent concern, requiring continuous innovation and cost management.

The complete report reveals the real forces shaping Applied Industrial Technologies’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Applied Industrial Technologies is significantly shaped by supplier concentration for specialized industrial components. For instance, if there are only a handful of manufacturers producing critical, highly differentiated parts such as advanced robotics components or specialized sensors, these suppliers hold considerable leverage. This can translate into higher input costs for Applied Industrial Technologies, impacting its profitability and pricing strategies. In 2023, the industrial automation market, a key area for Applied, saw continued consolidation, with major players acquiring smaller specialized firms, potentially increasing supplier concentration for certain technologies.

The costs and complexities Applied Industrial Technologies faces when switching suppliers significantly influence supplier power. If Applied needs to invest heavily in re-engineering processes or re-qualifying components from a new supplier, it creates a dependency on current vendors. This reliance strengthens the bargaining position of those suppliers.

For instance, if a critical component requires extensive testing and certification to meet Applied's stringent quality standards, the expense and time involved in such a transition can be prohibitive. This makes it more advantageous for Applied to maintain existing supplier relationships, even if pricing is not at its absolute lowest.

Conversely, if the parts and processes are largely standardized and readily interchangeable between suppliers, Applied benefits from greater flexibility. This allows for more competitive sourcing and reduces the leverage any single supplier holds over the company.

Suppliers can threaten Applied Industrial Technologies by integrating forward into distribution, meaning they could start selling directly to original equipment manufacturers (OEMs) or maintenance, repair, and operations (MRO) customers themselves. This bypasses Applied's role as a distributor, directly increasing the supplier's bargaining power.

If a significant supplier chooses to go direct, it could directly impact Applied's market share and profitability. This scenario might force Applied to accept less favorable terms, such as lower margins or stricter payment conditions, simply to ensure continued access to essential products.

Importance of Applied as a Customer

Applied Industrial Technologies' significance as a customer directly influences its bargaining power with suppliers. If Applied represents a substantial portion of a supplier's overall sales, that supplier is likely to offer more competitive pricing and favorable terms to secure Applied's continued business. For instance, if a key component supplier derives over 15% of its annual revenue from Applied, it has a strong incentive to maintain a positive relationship.

Conversely, if Applied is a minor customer for a particular supplier, its leverage is considerably reduced. In such scenarios, suppliers may be less inclined to negotiate on price or offer customized solutions, as losing Applied's business would have a negligible impact on their own financial performance.

- Customer Dependence: Suppliers with a high percentage of revenue tied to Applied Industrial Technologies are more susceptible to Applied's demands.

- Supplier Concentration: If Applied sources from a few key suppliers for critical components, its bargaining power increases due to the potential disruption of withholding business.

- Switching Costs for Applied: The ease or difficulty for Applied to switch suppliers also shapes this dynamic; high switching costs empower suppliers.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences the bargaining power of suppliers for Applied Industrial Technologies. If Applied can easily find comparable products or technologies from different manufacturers, suppliers have less leverage to impose unfavorable terms or price increases. This is because the competition among suppliers for Applied's business intensifies.

For instance, in 2024, the market for industrial automation components saw a surge in new entrants offering compatible alternatives to established suppliers. This increased competition directly weakened the pricing power of incumbent suppliers. Applied's ability to switch between these options means suppliers must remain competitive to retain Applied's business.

- Increased competition from alternative suppliers reduces supplier leverage.

- Applied's ability to source substitutes diminishes suppliers' power to dictate terms.

- In 2024, new entrants in industrial automation provided more viable alternatives, impacting supplier pricing power.

The bargaining power of suppliers for Applied Industrial Technologies is influenced by the concentration of suppliers for specialized industrial components. If only a few manufacturers produce critical, highly differentiated parts, these suppliers gain leverage, potentially increasing input costs for Applied. For example, the industrial automation market, a key sector for Applied, experienced consolidation in 2023, which could increase supplier concentration for certain technologies.

High switching costs for Applied Industrial Technologies empower suppliers. If transitioning to a new supplier requires significant re-engineering or re-qualification of components, Applied becomes dependent on existing vendors, strengthening their bargaining position. Conversely, readily interchangeable parts reduce supplier leverage.

Suppliers can increase their power by integrating forward into distribution, selling directly to customers and bypassing Applied. This directly impacts Applied's market share and can force less favorable terms. Applied's significance as a customer also plays a role; if Applied represents a substantial portion of a supplier's revenue, the supplier is incentivized to offer competitive terms.

The availability of substitute inputs significantly impacts supplier power. If Applied can easily source comparable products from multiple manufacturers, suppliers have less leverage to dictate terms or raise prices. In 2024, new entrants in industrial automation provided more alternatives, weakening the pricing power of established suppliers.

| Factor | Impact on Supplier Power | Example/Data Point |

| Supplier Concentration | Increases Power | Consolidation in industrial automation market (2023) may increase concentration for specialized components. |

| Switching Costs for Applied | Increases Power | High costs for re-engineering or re-qualifying components create supplier dependency. |

| Forward Integration by Suppliers | Increases Power | Suppliers selling directly to customers bypasses Applied, enhancing their leverage. |

| Customer Dependence (Applied's Size) | Decreases Power (if Applied is large) | Suppliers deriving over 15% of revenue from Applied have incentives to offer favorable terms. |

| Availability of Substitutes | Decreases Power | New entrants in industrial automation (2024) offered alternatives, weakening incumbent pricing power. |

What is included in the product

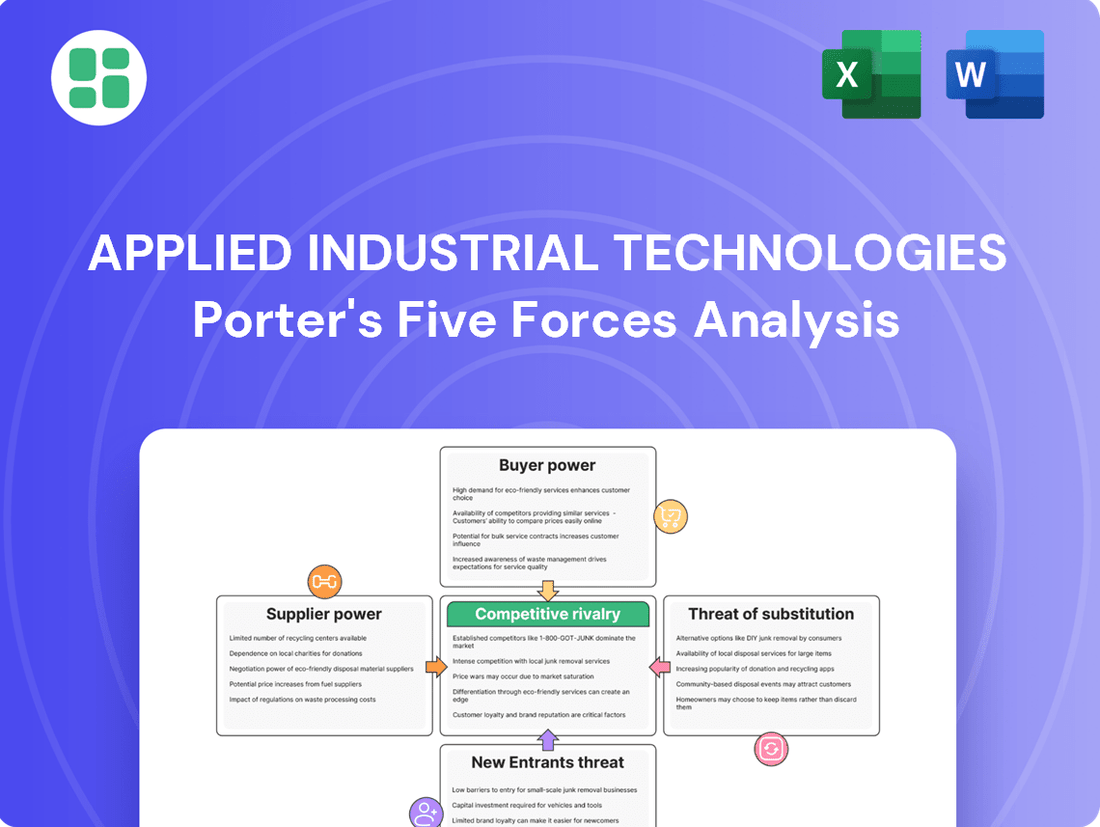

This analysis dissects the competitive forces impacting Applied Industrial Technologies, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industrial distribution sector.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces.

Gain actionable insights into market dynamics to proactively address potential disruptions and strengthen your strategic position.

Customers Bargaining Power

The bargaining power of Applied Industrial Technologies' customers, primarily Original Equipment Manufacturers (OEMs) and Maintenance, Repair, and Operations (MRO) providers, is significantly influenced by their concentration and the sheer volume of their orders. Customers that represent a substantial portion of Applied's revenue, or those who consolidate their purchasing across multiple suppliers, wield considerable leverage. For instance, a major OEM requiring large quantities of specialized components can negotiate for more favorable pricing, expedited delivery schedules, and tailored service agreements.

In 2024, the industrial sector saw continued consolidation among key players, meaning a few large customers could represent a disproportionately large share of Applied Industrial Technologies' sales. This concentration amplifies their ability to dictate terms. Conversely, a broad and diverse customer base, where no single entity accounts for a significant percentage of sales, inherently dilutes the bargaining power of any individual customer.

Customer switching costs significantly influence their bargaining power. If Original Equipment Manufacturers (OEMs) and Maintenance, Repair, and Operations (MRO) clients can easily and cheaply switch to alternative industrial distributors or procure components directly from manufacturers, their leverage increases considerably.

Applied Industrial Technologies strives to mitigate this by offering value-added services, such as specialized engineering support and inventory management solutions. These services are designed to raise the cost or difficulty for customers to switch away, thereby enhancing customer retention and loyalty.

The availability of numerous alternative distributors and the increasing ability for customers to source products directly from manufacturers or through online marketplaces significantly bolsters customer bargaining power. This competitive landscape compels Applied Industrial Technologies to consistently offer competitive pricing, superior service, and reliable product availability to retain its clientele.

Customers' Price Sensitivity and Information Access

Customers in the industrial sector, especially Maintenance, Repair, and Operations (MRO) buyers, are acutely sensitive to price. This is driven by the constant pressure to reduce their own operational costs. For instance, a 2024 study indicated that over 60% of industrial buyers prioritize price as a primary decision factor when sourcing MRO supplies.

The digital age has dramatically amplified this price sensitivity. With readily available online platforms, customers can effortlessly compare pricing, product specifications, and supplier reviews. This transparency empowers them to negotiate more effectively, directly impacting Applied Industrial Technologies' pricing power and potentially squeezing profit margins. In 2024, the average industrial buyer spent an estimated 25% more time researching prices online compared to just two years prior.

- Increased Price Sensitivity: Industrial customers, particularly MROs, face significant cost pressures, making them highly responsive to price changes.

- Enhanced Information Access: Online resources allow customers to easily compare prices and product details across multiple suppliers.

- Negotiating Power: Greater transparency empowers customers to negotiate more favorable terms, exerting downward pressure on Applied's pricing.

- Margin Erosion: The combination of price sensitivity and information access can lead to reduced profit margins for suppliers like Applied.

Threat of Backward Integration by Customers

The threat of customers integrating backward, meaning they start manufacturing the components they currently buy or establish their own distribution channels, directly enhances their bargaining power. This can force suppliers like Applied Industrial Technologies to be more competitive on price and service.

While a broad product portfolio makes this less likely across the board, large original equipment manufacturers (OEMs) might explore backward integration for specific, high-volume, or strategically critical components. For instance, if a major OEM relies heavily on a particular type of sensor or specialized part distributed by Applied, they might evaluate the cost and feasibility of producing it in-house.

- Customer Integration Risk: Large customers may consider manufacturing critical components themselves to gain control and reduce costs.

- Impact on Distributors: This threat compels distributors like Applied Industrial Technologies to offer more attractive pricing, enhanced technical support, and reliable supply chains to retain business.

- OEM Considerations: For high-volume, essential parts, OEMs might assess the viability of in-house production versus relying on external suppliers, influencing their negotiation leverage.

Applied Industrial Technologies' customers, particularly large Original Equipment Manufacturers (OEMs) and Maintenance, Repair, and Operations (MRO) providers, possess significant bargaining power. This stems from their concentrated purchasing power, price sensitivity, and the increasing ease of switching suppliers or even integrating backward. In 2024, the trend of industrial customer consolidation meant fewer, larger buyers could wield more influence over pricing and terms.

The ease with which customers can compare prices online and the availability of alternative suppliers in 2024 meant that Applied Industrial Technologies had to remain highly competitive. A significant portion of industrial buyers, over 60% in a 2024 survey, prioritized price for MRO supplies, directly impacting Applied's pricing flexibility.

Customer switching costs remain a key factor; if clients can easily find alternative distributors or source directly, their leverage grows. Applied counters this by offering value-added services, aiming to increase the cost or complexity of switching. The threat of backward integration, where large customers might produce components in-house, further pressures distributors to maintain competitive offerings.

| Factor | Impact on Applied Industrial Technologies | 2024 Relevance |

|---|---|---|

| Customer Concentration | Increases leverage for large buyers | Continued industry consolidation amplified this |

| Price Sensitivity | Drives down pricing, potentially squeezing margins | Over 60% of MRO buyers prioritized price in 2024 |

| Switching Costs | Low switching costs empower customers | Digital platforms lower information costs for buyers |

| Backward Integration Threat | Pressures suppliers to offer better terms | Large OEMs may evaluate in-house production for key components |

Preview the Actual Deliverable

Applied Industrial Technologies Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Applied Industrial Technologies, detailing the competitive landscape and strategic implications. The document you see here is the exact, fully formatted report you'll receive immediately upon purchase, offering actionable insights into industry rivalry, buyer and supplier power, threat of new entrants, and substitute products. You're looking at the actual document; once your purchase is complete, you’ll gain instant access to this detailed analysis, ready for your strategic planning needs.

Rivalry Among Competitors

The industrial distribution landscape is quite crowded, featuring a wide array of competitors. You'll find major national distributors alongside smaller, more regional or niche players, all competing for business. This variety of companies means rivalry is naturally high, as everyone is trying to capture a piece of the market across different product lines and customer types.

Applied Industrial Technologies, in particular, navigates this competitive environment by facing off against both broad-line distributors who offer a bit of everything, and specialized distributors who focus on specific product categories or industries. This dual competitive pressure means Applied must be sharp and adaptable in its strategies to stand out and succeed.

The industrial motion, power, control, and flow technology solutions market's growth rate is a key factor in how intense competition is. When the market is growing slowly or has matured, companies tend to battle harder for the same customers. This often results in price cuts and more aggressive advertising campaigns to capture market share.

Conversely, a faster-growing market can ease some of this competitive strain. With more opportunities available, companies may find it less necessary to engage in fierce competition for every sale. For instance, the global industrial automation market, a significant segment of this industry, was projected to grow at a compound annual growth rate (CAGR) of around 7.5% from 2023 to 2030, indicating a generally healthy growth environment that can temper extreme rivalry.

The ability of distributors to differentiate their offerings significantly influences the intensity of competitive rivalry within the industrial technologies sector. Applied Industrial Technologies, for instance, actively seeks to distinguish itself not just on product availability but through a suite of value-added services. These include crucial elements like engineering expertise, custom design solutions, and robust technical support.

By emphasizing these services, Applied aims to move beyond the commoditized nature of basic industrial components. This differentiation strategy is designed to lessen the pressure of direct price-based competition, fostering deeper, more loyal relationships with its customer base. For example, in 2024, companies prioritizing specialized support often saw higher customer retention rates compared to those solely competing on price.

Exit Barriers for Competitors

High exit barriers can indeed trap even unprofitable competitors within the industrial technologies sector, prolonging intense rivalry. For instance, specialized manufacturing equipment, often with high upfront costs and limited resale value, represents a significant sunk cost. Companies heavily invested in such assets may find it more economical to continue operating at a loss rather than abandon their investment entirely. This dynamic can directly impact established players like Applied Industrial Technologies, as these entrenched, albeit struggling, competitors can continue to exert downward pressure on pricing and market share.

The persistence of these less efficient firms can lead to a prolonged period of heightened competition. Consider the implications of long-term contracts that bind companies to supply agreements, even when market conditions become unfavorable. Similarly, substantial employee severance packages or contractual obligations can make a swift exit financially punitive. In 2024, many industrial technology firms faced headwinds from supply chain disruptions and fluctuating demand, making the decision to exit even more complex when significant exit barriers are present.

- Specialized Assets: High capital expenditure on unique machinery or production lines with limited alternative uses.

- Long-Term Contracts: Binding agreements with customers or suppliers that incur penalties for early termination.

- Employee Severance Costs: Significant financial obligations related to workforce reductions, including pensions and severance pay.

- Brand Reputation: Fear of damaging brand image through a perceived failure or market withdrawal.

Price Competition and Service Offerings

Price competition is indeed a major battleground in industrial distribution, particularly for widely available, standard components. Distributors often find themselves needing to match or beat competitor pricing to secure deals, a dynamic that can compress margins.

However, the rivalry isn't solely about the sticker price. Applied Industrial Technologies, like its peers, also competes fiercely on a spectrum of service-related factors. These include the speed and reliability of deliveries, the breadth and depth of inventory available, the technical knowledge of their sales and support staff, and the overall quality of customer service provided.

For instance, in 2024, the industrial distribution sector saw continued emphasis on logistics efficiency. Companies that could demonstrate faster order fulfillment and more reliable delivery networks often gained a competitive edge, even if their base prices were slightly higher. Applied must constantly evaluate how to offer a compelling value proposition that blends competitive pricing with these crucial service differentiators to win and keep business.

- Price Sensitivity: High for commoditized industrial parts, forcing distributors to maintain competitive pricing strategies.

- Service Differentiation: Key areas include delivery speed, inventory management, technical support, and customer relationship building.

- Balancing Act: Applied Industrial Technologies must harmonize aggressive pricing with value-added services to attract and retain a diverse customer base.

- Market Trends: In 2024, supply chain resilience and digital customer service platforms became increasingly important competitive factors beyond just price.

The competitive rivalry within the industrial technologies sector is intense, driven by a crowded market with both large national distributors and smaller niche players. Applied Industrial Technologies faces this pressure from broad-line and specialized competitors alike, requiring constant adaptation.

Market growth significantly influences rivalry; a slower market intensifies competition as firms fight for existing customers, often leading to price wars. For example, while the industrial automation market showed robust growth projected at 7.5% CAGR from 2023-2030, specific segments within industrial distribution can still experience slower growth, increasing competitive pressure.

Applied differentiates itself through value-added services like engineering expertise and technical support, moving beyond simple price competition. In 2024, firms focusing on specialized support saw better customer retention than those solely competing on price, highlighting the effectiveness of this strategy.

High exit barriers, such as specialized machinery and contractual obligations, can keep less efficient competitors in the market, prolonging intense rivalry and price pressure, especially when market conditions are challenging, as many firms experienced in 2024.

| Competitive Factor | Applied Industrial Technologies' Approach | 2024 Market Insight |

|---|---|---|

| Price Competition | Must balance competitive pricing with service offerings. | High for commoditized parts, impacting margins. |

| Service Differentiation | Emphasizes delivery speed, inventory, technical knowledge, and customer service. | Logistics efficiency and digital service platforms gained importance. |

| Market Growth Impact | Slower growth markets increase rivalry. | Industrial automation market growth tempered extreme competition in that segment. |

| Exit Barriers | Can prolong rivalry by keeping inefficient firms active. | Supply chain issues and demand fluctuations in 2024 complicated exit decisions. |

SSubstitutes Threaten

The threat of substitutes for Applied Industrial Technologies is significant, stemming from alternative technologies and entirely different solutions that can meet customer needs. For example, advancements in additive manufacturing, commonly known as 3D printing, are increasingly capable of producing components that were once exclusively made through traditional manufacturing processes. This shift could reduce the reliance on physical distribution networks for certain parts, impacting the company's traditional business model.

Large Original Equipment Manufacturers (OEMs) are increasingly exploring in-house maintenance, repair, and operations (MRO) or even manufacturing select components. This trend directly substitutes the need for external distribution services, impacting companies like Applied Industrial Technologies. For instance, a significant portion of MRO spending, which was historically outsourced, is now being brought in-house by major players seeking cost efficiencies.

This do-it-yourself (DIY) approach acts as a potent substitute, particularly for less intricate or highly standardized parts and services that Applied Industrial Technologies offers. In 2024, many large industrial clients reported an increase in their internal capabilities for certain repair and component fabrication, aiming to reduce lead times and gain greater control over their supply chain.

The growing prevalence of digital platforms and direct-to-consumer sales by manufacturers presents a substantial threat of substitutes for traditional distributors like Applied Industrial Technologies. These online channels allow manufacturers to reach end-users directly, potentially offering competitive pricing and more streamlined purchasing experiences.

This shift bypasses the established distribution network, directly impacting Applied's role and revenue streams. For instance, in the industrial sector, many manufacturers are investing heavily in their own e-commerce capabilities, aiming to capture a larger share of the market and build direct relationships with their customer base.

Performance-Based Contracting and Servitization

A significant emerging threat comes from customers shifting towards performance-based contracting and servitization. In this model, clients pay for the guaranteed outcome or operational uptime of equipment instead of buying individual components. This fundamentally alters the business model from selling products to delivering services.

This trend directly impacts companies like Applied Industrial Technologies by potentially decreasing the demand for discrete industrial components. Instead of purchasing pumps, motors, or bearings outright, customers might opt for a service agreement that includes maintenance, replacement, and guaranteed performance. For instance, a manufacturing plant might contract for guaranteed uptime on its assembly line, with the service provider responsible for all component upkeep and replacement.

- Servitization Growth: The global servitization market is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) of over 10% in the coming years, indicating a substantial shift in customer preferences.

- Reduced Component Sales: As more customers adopt servitization, the direct sales volume of individual industrial parts, a core business for distributors, could see a decline.

- Shift to Service Revenue: Companies that successfully transition to servitization models see a higher proportion of their revenue derived from recurring service contracts, which can be more stable but requires different operational capabilities.

- Focus on Total Cost of Ownership: Customers are increasingly focused on the total cost of ownership and operational efficiency, making performance-based contracts attractive as they align supplier incentives with customer success.

Evolution of Product Lifecycles and Maintenance Needs

The threat of substitutes in Applied Industrial Technologies is evolving due to shifts in product lifecycles and maintenance strategies. As components become more durable, the need for frequent replacement parts diminishes, directly impacting MRO (Maintenance, Repair, and Operations) suppliers. For example, advancements in materials science and engineering are leading to longer-lasting industrial equipment, potentially reducing the demand for spare parts by 5-10% over the next five years.

Furthermore, the rise of predictive maintenance technologies, which use sensors and data analytics to anticipate equipment failures, acts as a significant substitute. Instead of stocking a wide array of reactive spare parts, companies can increasingly rely on proactive interventions. This trend could see the market for traditional MRO parts distribution shrink as the fundamental need for reactive parts decreases, with some analysts projecting a potential 15% decline in demand for certain legacy components by 2026.

- Extended Product Lifespans: Innovations in materials and design are increasing the durability of industrial machinery, leading to fewer replacements.

- Predictive Maintenance Adoption: Advanced analytics and sensor technology allow for proactive repairs, reducing the reliance on readily available spare parts.

- Digitalization of Services: Remote diagnostics and virtual support can often resolve issues without the need for physical part replacement.

- Shift to Service-Based Models: Manufacturers are increasingly offering comprehensive service contracts that include maintenance and parts, internalizing what was once an external MRO market.

The threat of substitutes for Applied Industrial Technologies is multifaceted, encompassing technological advancements, evolving customer strategies, and shifts in product lifecycles. These substitutes directly challenge the company's traditional distribution model by offering alternative ways to meet customer needs for components and maintenance services.

Companies are increasingly adopting in-house capabilities, digital platforms, and performance-based contracts, all of which reduce reliance on external distributors. For example, in 2024, many industrial clients increased their internal repair and component fabrication capacity, aiming to streamline supply chains and reduce lead times.

Furthermore, the trend towards servitization, where customers pay for guaranteed outcomes rather than individual parts, fundamentally alters the demand for discrete components. This shift, projected for significant growth with a CAGR potentially exceeding 10%, means fewer component sales and a greater focus on recurring service revenue.

The durability of industrial equipment is also increasing, with some components seeing reduced replacement needs by 5-10% over the next five years. Coupled with the rise of predictive maintenance, which aims to anticipate failures rather than reactively replace parts, the market for traditional MRO parts distribution faces potential contraction, with some legacy components potentially seeing a 15% demand decline by 2026.

| Substitute Type | Impact on Applied Industrial Technologies | Key Drivers | 2024 Trend Example |

|---|---|---|---|

| In-house Manufacturing/MRO | Reduced demand for distributed parts and services | Cost efficiency, supply chain control | Increased internal repair capabilities by OEMs |

| Digital Platforms/Direct Sales | Bypassed distribution channels, potential price pressure | Streamlined purchasing, direct customer relationships | Manufacturer investment in e-commerce |

| Servitization/Performance Contracts | Decreased component sales, shift to service revenue | Total cost of ownership focus, guaranteed uptime | Shift from buying parts to paying for operational outcomes |

| Extended Product Lifecycles/Predictive Maintenance | Lower demand for spare parts, reduced reactive MRO needs | Durability advancements, proactive failure anticipation | Reduced need for stocking reactive spare parts |

Entrants Threaten

The industrial distribution sector, particularly for broad-line distributors like Applied Industrial Technologies, demands substantial capital for inventory, warehousing, logistics, and technology. For instance, in 2024, major industrial distributors often carry billions in inventory to meet diverse customer needs.

Newcomers confront formidable capital barriers, while established firms leverage economies of scale in purchasing, distribution, and operations. This scale advantage allows incumbents to offer more competitive pricing, creating a significant hurdle for any new entity attempting to enter the market and achieve cost parity.

New entrants face a formidable barrier in replicating Applied Industrial Technologies' deeply entrenched distribution networks and exclusive supplier agreements. These established relationships, cultivated over many years, provide preferential pricing and guaranteed product availability, making it exceedingly difficult for newcomers to compete on cost and reliability.

Applied Industrial Technologies benefits from deeply entrenched brand loyalty and robust customer relationships, particularly with its original equipment manufacturers (OEM) and maintenance, repair, and operations (MRO) clients. These relationships are built on years of trust, demonstrated technical prowess, and consistently dependable service, making it difficult for newcomers to penetrate the market.

New entrants face a significant hurdle in overcoming Applied's established customer base, which is unlikely to switch without a compelling reason, such as a dramatically superior offering or substantially lower pricing. For instance, in 2024, customer retention rates for established players in industrial distribution often exceed 90%, highlighting the stickiness of these long-term partnerships.

Regulatory Barriers and Industry Standards

While not as imposing as in heavily regulated sectors, Applied Industrial Technologies faces potential threats from new entrants due to existing regulatory barriers and industry standards. New companies must navigate certifications and adhere to quality management systems, which can be costly and time-consuming.

Compliance with these standards, such as ISO 9001, requires significant investment in processes and documentation. For instance, obtaining and maintaining such certifications can cost tens of thousands of dollars, plus ongoing audit fees. This financial and operational commitment can act as a significant deterrent for smaller, less capitalized new entrants looking to compete in the industrial distribution space.

- Regulatory Hurdles: New entrants must comply with diverse regulations specific to the types of industrial goods they distribute, impacting logistics, safety, and product handling.

- Industry Certifications: Achieving and maintaining certifications like ISO 9001 demonstrates a commitment to quality, but the process itself presents a barrier to entry, requiring substantial upfront investment and expertise.

- Specialized Knowledge: Understanding and implementing complex industry standards requires specialized technical and operational knowledge, which new firms may lack, increasing their initial learning curve and operational costs.

- Compliance Costs: The direct costs associated with meeting regulatory requirements and industry standards, including legal fees, audits, and system upgrades, can be prohibitive for emerging competitors.

Technological Expertise and Value-Added Services

The threat of new entrants into the applied industrial technologies sector is significantly mitigated by the substantial investment required in specialized technological expertise and value-added services. Applied Industrial Technologies, for instance, differentiates itself by offering comprehensive services that extend beyond mere product supply. These include intricate engineering solutions, custom design capabilities, and robust technical support, all of which demand a deep pool of highly skilled personnel and sophisticated infrastructure.

New companies entering this market would face considerable hurdles in replicating this level of integrated service and technical proficiency. The cost associated with acquiring and retaining top engineering talent, alongside the capital expenditure for advanced design and testing facilities, presents a formidable barrier. For example, a new entrant would need to invest millions in specialized software and training to match Applied's existing capabilities, a financial commitment that deters many potential competitors.

- High Cost of Skilled Labor: Acquiring and retaining engineers with expertise in areas like automation, robotics, and advanced manufacturing can cost companies upwards of $150,000 annually per engineer in 2024, excluding benefits and overhead.

- Investment in R&D and Infrastructure: Developing proprietary design software or advanced testing labs can easily run into millions of dollars, a significant upfront cost for new players.

- Established Reputation and Trust: Applied Industrial Technologies has built decades of trust with clients who rely on their consistent delivery of complex solutions, a reputation that new entrants cannot quickly establish.

- Integrated Service Model: The seamless integration of engineering, design, and support creates a holistic offering that is difficult and expensive for newcomers to replicate, requiring significant operational and strategic alignment.

The threat of new entrants for Applied Industrial Technologies is significantly lowered by high capital requirements for inventory and logistics, with major distributors holding billions in stock in 2024. Established players also benefit from economies of scale, allowing for more competitive pricing that new firms struggle to match.

Deeply entrenched distribution networks and exclusive supplier agreements provide Applied Industrial Technologies with preferential pricing and product availability, creating a substantial barrier for newcomers. Furthermore, strong brand loyalty and long-standing customer relationships, particularly with OEMs and MRO clients, make customer acquisition difficult for new entrants.

Regulatory hurdles and industry certifications, such as ISO 9001, add to the cost and complexity for new companies, requiring significant investment in processes and expertise. The need for specialized technological knowledge and value-added services, like engineering solutions and technical support, further elevates the barrier to entry, demanding substantial investment in skilled personnel and advanced infrastructure.

Porter's Five Forces Analysis Data Sources

Our Applied Industrial Technologies Porter's Five Forces analysis is built upon a foundation of diverse data sources, including company annual reports, industry-specific market research from firms like IBISWorld, and publicly available SEC filings.