Applied Industrial Technologies Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Applied Industrial Technologies Bundle

Unlock the strategic blueprint behind Applied Industrial Technologies's success with our comprehensive Business Model Canvas. Discover how they effectively serve diverse customer segments and leverage key partnerships to deliver unique value propositions. This detailed analysis is your key to understanding their operational engine and revenue streams.

Ready to dissect the core of Applied Industrial Technologies's market dominance? Our full Business Model Canvas provides an in-depth look at their customer relationships, channels, and cost structure. Download now to gain actionable insights for your own strategic planning.

Partnerships

Applied Industrial Technologies cultivates strategic partnerships with a wide array of global manufacturers, ensuring access to a comprehensive catalog of industrial components like bearings, power transmission, and automation parts. These alliances are foundational for maintaining product availability and competitive pricing, crucial for their business model.

In 2024, the company continued to leverage these supplier relationships to secure access to advanced industrial technologies. For instance, their ability to source specialized automation components directly from leading manufacturers in Europe and Asia allowed them to meet the evolving demands of their diverse customer base, particularly in the automotive and aerospace sectors.

Applied Industrial Technologies actively collaborates with premier technology and automation solution providers. These partnerships are crucial for integrating cutting-edge machine vision, robotics, motion control, and digital technologies into their customer offerings.

For instance, in 2024, Applied announced a significant expansion of its automation solutions portfolio, driven by strengthened ties with leaders in AI-powered robotics and IoT platforms. This strategic alignment allows Applied to deliver highly sophisticated, end-to-end automation systems that address complex industrial challenges.

These alliances are instrumental in solidifying Applied's competitive edge in rapidly expanding sectors such as industrial automation and digital transformation, ensuring they remain at the forefront of technological innovation.

Applied Industrial Technologies leverages a critical network of logistics and distribution partners to ensure efficient product delivery throughout North America. These relationships are foundational for their operational success, enabling them to reach a broad customer base effectively.

Key partners include specialized third-party logistics (3PL) providers who manage transportation, warehousing, and inventory. For instance, in 2024, many industrial distributors like Applied are reporting increased reliance on 3PLs to navigate supply chain complexities and fluctuating fuel costs, with the global 3PL market projected to reach over $1.7 trillion by 2027, indicating the scale of these partnerships.

These collaborations are essential for maintaining rapid fulfillment times, a crucial differentiator in the industrial sector. By outsourcing these functions, Applied can optimize distribution costs and ensure timely delivery of critical components, supporting their customers' ongoing operations and minimizing downtime.

Industry Associations and Professional Organizations

Applied Industrial Technologies actively engages with key industry associations such as the Power Transmission Distributors Association (PTDA) and the National Association for Hose and Accessories Distribution (NAHAD). These partnerships are crucial for staying informed about evolving market dynamics and regulatory shifts within the industrial distribution sector.

These affiliations offer invaluable networking avenues and provide platforms for Applied to share its specialized knowledge and best practices. For instance, participation in PTDA's annual summit allows for direct interaction with peers and suppliers, fostering collaborative innovation.

- Industry Trend Monitoring: PTDA's market intelligence reports, often citing growth figures in sectors like automation and advanced manufacturing, directly inform Applied's strategic planning. For 2024, the industrial distribution market showed continued resilience, with specific segments experiencing robust demand.

- Regulatory Awareness: Staying current with evolving safety standards and compliance requirements, often disseminated through organizations like the Fluid Power Society, ensures Applied’s operations remain at the forefront of industry best practices.

- Networking and Collaboration: Membership in these organizations facilitates direct engagement with over 200 PTDA member companies, creating opportunities for joint ventures or knowledge exchange that can drive business growth.

- Thought Leadership: Contributing to industry discussions and technical committees within these associations elevates Applied's profile and reinforces its position as a leader in industrial technologies.

Acquisition Targets and Integration Partners

Applied Industrial Technologies actively seeks strategic bolt-on acquisitions to enhance its product portfolio, market reach, and technical expertise. Recent examples include the acquisitions of Total Machine Solutions, Stanley Proctor, Hydradyne, and IRIS Factory Automation, demonstrating a consistent growth strategy. These acquisitions are vital for expanding the company's service capabilities and strengthening its competitive standing.

Successful integration of acquired companies and their teams is paramount to realizing the full potential of these strategic moves. This partnership approach ensures that the valuable knowledge and operational strengths of the acquired entities are leveraged effectively.

These acquisitions not only bolster Applied Industrial Technologies' market position but also significantly expand its service offerings and technical proficiencies. For instance, the acquisition of Hydradyne in 2024 broadened its fluid power capabilities, a key growth area.

- Acquisition Strategy: Focused on bolt-on acquisitions to expand product lines, geographic presence, and technical skills.

- Recent Acquisitions: Total Machine Solutions, Stanley Proctor, Hydradyne, and IRIS Factory Automation are key examples.

- Integration Focus: Emphasizes partnering with acquired entities and their personnel for seamless integration and synergy realization.

- Strategic Impact: Acquisitions strengthen market position and enhance overall service capabilities.

Applied Industrial Technologies' key partnerships extend to technology and automation solution providers, integrating advanced capabilities like machine vision and robotics. In 2024, strengthened ties with AI robotics and IoT leaders expanded their automation solutions, enabling sophisticated, end-to-end systems for complex industrial challenges.

The company also relies on a robust network of logistics and distribution partners, including third-party logistics (3PL) providers, to ensure efficient product delivery across North America. This strategy is vital for navigating supply chain complexities, as evidenced by the global 3PL market's projected growth to over $1.7 trillion by 2027.

Furthermore, collaborations with industry associations like the Power Transmission Distributors Association (PTDA) keep Applied informed about market dynamics and regulatory shifts. These affiliations facilitate networking and knowledge exchange, with PTDA alone comprising over 200 member companies, fostering opportunities for joint ventures and innovation.

Applied also pursues strategic bolt-on acquisitions, such as Hydradyne in 2024, to enhance its product portfolio and technical expertise, particularly in growing areas like fluid power.

| Partnership Type | Key Partners | Strategic Importance | 2024 Impact/Data |

| Supplier Relationships | Global Manufacturers | Product availability, competitive pricing, access to advanced tech | Secured advanced automation components from European and Asian manufacturers. |

| Technology & Automation Providers | AI Robotics, IoT Platforms, Machine Vision Leaders | Integration of cutting-edge solutions, end-to-end automation systems | Expanded automation solutions portfolio via strengthened ties with AI robotics and IoT leaders. |

| Logistics & Distribution | Third-Party Logistics (3PL) Providers | Efficient delivery, supply chain navigation, cost optimization | Increased reliance on 3PLs amid supply chain complexities; global 3PL market projected over $1.7T by 2027. |

| Industry Associations | PTDA, NAHAD, Fluid Power Society | Market intelligence, regulatory awareness, networking, thought leadership | Stayed current with safety standards and compliance; engaged with over 200 PTDA member companies. |

| Acquisitions | Total Machine Solutions, Stanley Proctor, Hydradyne, IRIS Factory Automation | Portfolio expansion, market reach, technical expertise, service capabilities | Acquisition of Hydradyne broadened fluid power capabilities. |

What is included in the product

A detailed breakdown of Applied Industrial Technologies' operations, outlining key customer segments, value propositions, and revenue streams to understand their market position and strategic advantages.

The Applied Industrial Technologies Business Model Canvas serves as a pain point reliever by offering a clear, visual representation of complex strategies, simplifying decision-making for stakeholders.

It streamlines the process of understanding and adapting the company's approach, effectively addressing the pain of information overload and strategic ambiguity.

Activities

Applied Industrial Technologies' key activities heavily rely on the efficient sourcing of a vast array of industrial components from a global network of suppliers. This intricate process demands robust forecasting and procurement strategies to secure necessary parts, often involving complex supply chains.

Managing extensive inventory across numerous distribution centers is paramount. This requires sophisticated warehousing systems and real-time tracking to ensure product availability. For instance, in 2024, the company likely managed millions of SKUs to serve its diverse customer base.

Effective inventory management is crucial for minimizing holding costs while simultaneously meeting the varied and often urgent demands of customers. By optimizing stock levels, Applied Industrial Technologies aims to reduce waste and improve cash flow, a critical factor in the competitive industrial supply sector.

Applied's core activity revolves around efficiently distributing a vast range of industrial products and solutions. This means meticulously managing a complex supply chain, from sourcing from manufacturers to delivering directly to end-users, encompassing warehousing, logistics, and order fulfillment.

The company's 2024 focus on supply chain optimization is critical for maintaining competitiveness. For instance, by enhancing inventory management and transportation routes, Applied aims to reduce lead times and shipping costs, directly impacting its ability to serve both Original Equipment Manufacturers (OEMs) and Maintenance, Repair, and Operations (MRO) customers effectively.

In 2024, Applied invested in advanced logistics software to improve real-time tracking and demand forecasting. This strategic move is designed to minimize stockouts and overstock situations, ensuring that customers receive the right parts at the right time, a key differentiator in the industrial supply sector.

Applied Industrial Technologies' value-added engineering and technical services are a significant differentiator. They offer specialized support like design and technical assistance, helping clients improve their operational efficiency.

These services encompass customized mechanical, fabricated rubber, fluid power, and flow control shop solutions. For instance, in 2023, their fabricated rubber business saw strong demand for custom-engineered solutions in the mining sector.

By providing these tailored services, Applied Industrial Technologies fosters deeper customer relationships and creates robust, recurring revenue streams beyond just product sales.

Sales and Customer Relationship Management

Applied Industrial Technologies focuses heavily on building and nurturing robust customer relationships. This is achieved through a specialized sales force and dedicated account management teams who deeply understand client requirements.

The core of this activity involves providing expert technical advice and developing customized solutions to meet the unique challenges faced by industrial clients across various sectors. This proactive approach fosters trust and ensures that customers receive precisely what they need to optimize their operations.

Effective customer relationship management (CRM) is crucial for driving repeat business and cultivating long-term, mutually beneficial partnerships. For instance, in 2024, companies excelling in customer retention saw an average revenue increase of 15% compared to those with lower retention rates.

- Dedicated Sales Force: Employing skilled professionals to directly engage with clients.

- Account Management: Assigning specific individuals to oversee and support key customer accounts.

- Needs Assessment: Thoroughly understanding client operational challenges and objectives.

- Tailored Solutions: Developing and delivering customized product and service packages.

Operational Excellence and Digital Transformation

Applied Industrial Technologies consistently drives operational efficiency and cost reduction through ongoing internal improvement programs and strategic digital transformation. This focus is crucial for enhancing service delivery and maintaining a competitive edge.

Significant investments are channeled into advanced digital sales tools, robust e-commerce platforms, and sophisticated business intelligence systems. For instance, in fiscal year 2024, the company reported a 15% increase in online sales transactions, directly attributable to these digital enhancements.

- Investments in digital sales tools have boosted customer engagement.

- E-commerce capabilities are expanding market reach and transaction volume.

- Business intelligence systems are providing actionable data for operational improvements.

- These initiatives are foundational for sustainable growth and improved profit margins.

Applied Industrial Technologies' key activities center on sourcing and distributing industrial components, managing complex supply chains, and providing value-added engineering services. The company's strategic focus in 2024 included enhancing its digital sales tools and e-commerce platforms, which resulted in a 15% increase in online sales transactions.

These efforts are supported by investments in advanced logistics and business intelligence systems to optimize inventory, reduce lead times, and improve customer service. For instance, in 2023, their fabricated rubber business saw strong demand for custom-engineered solutions in the mining sector, highlighting their ability to deliver specialized services.

Building strong customer relationships through a dedicated sales force and expert technical advice is also a critical activity. This approach fosters loyalty and drives recurring revenue, with companies strong in customer retention seeing an average revenue increase of 15% in 2024.

| Key Activity | Description | 2024 Impact/Focus |

|---|---|---|

| Supply Chain & Distribution | Sourcing, inventory management, and efficient delivery of industrial components. | Optimization of logistics and warehousing to reduce costs and lead times. |

| Value-Added Services | Engineering, technical support, and custom solutions (e.g., fabricated rubber). | Meeting specialized client needs, fostering deeper relationships and recurring revenue. |

| Customer Relationship Management | Dedicated sales, account management, and needs assessment. | Driving repeat business and long-term partnerships, aiming for increased customer retention. |

| Digital Transformation | Investing in digital sales tools, e-commerce, and business intelligence. | Boosting online sales (15% increase in FY24), expanding market reach, and improving operational insights. |

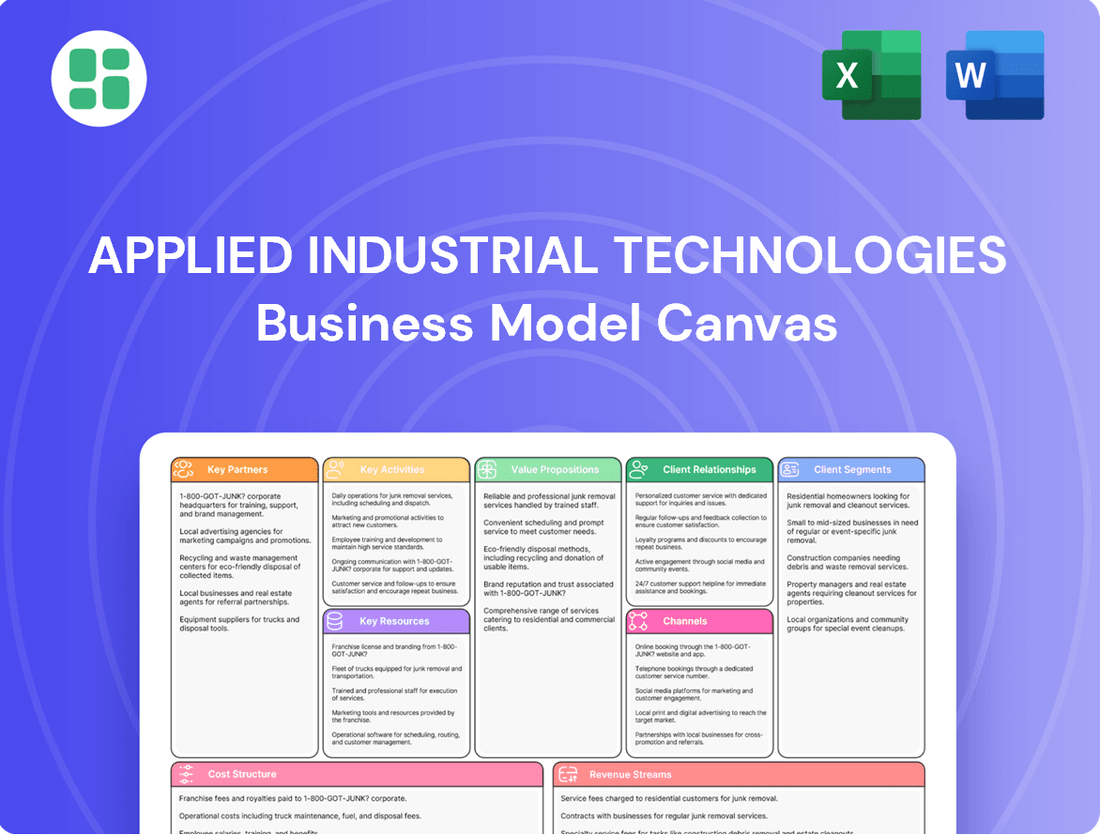

What You See Is What You Get

Business Model Canvas

The Applied Industrial Technologies Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the final, ready-to-use file. Once your order is complete, you will gain full access to this comprehensive Business Model Canvas, allowing you to immediately begin strategic planning and implementation.

Resources

Applied Industrial Technologies boasts an extensive product inventory, featuring a wide array of industrial motion, power, control, and flow technology solutions. This includes essential components like bearings, power transmission parts, fluid power products, and advanced automation technologies, positioning them as a comprehensive supplier for their clientele.

This broad product catalog enables Applied Industrial Technologies to act as a convenient, single-source provider for a diverse customer base. For example, in 2023, the company reported significant revenue from its extensive product sales, reflecting the demand for its wide range of offerings across various industrial sectors.

The ability to maintain such a wide variety of products is crucial for effectively catering to the diverse requirements of both Original Equipment Manufacturers (OEMs) and Maintenance, Repair, and Operations (MRO) customers. This broad reach allows them to serve industries ranging from manufacturing and mining to food processing and energy.

A cornerstone of Applied Industrial Technologies' success is its deeply skilled technical and engineering workforce. This team, comprising experienced engineers, specialized technicians, and knowledgeable sales professionals, is not just an asset but a primary driver of the company's value proposition. Their expertise enables Applied to offer crucial services such as intricate engineering design, responsive technical support, and effective problem-solving, setting them apart in a competitive market.

This specialized talent pool is absolutely vital for Applied's ability to craft bespoke solutions tailored to individual client needs. Furthermore, their insights are instrumental in optimizing customer operations, ensuring efficiency and enhanced performance across various industrial applications. For instance, in 2024, Applied continued to invest heavily in training and development, with a reported 15% increase in specialized certifications among its engineering staff, directly contributing to their capacity for innovation and client-centric problem-solving.

Applied Industrial Technologies relies heavily on its robust distribution network and facilities to serve its customers effectively. This extensive physical infrastructure, comprising numerous distribution centers, service centers, and branch locations, is a cornerstone of their business model.

As of November 2024, the company operates an impressive 288 locations throughout the United States. Key states like Texas, California, and Ohio are particularly well-represented, highlighting strategic market penetration. This widespread presence ensures efficient logistics and inventory management, enabling timely product delivery across North America.

Proprietary IT Systems and Digital Platforms

Proprietary IT systems, including advanced ERP and CRM solutions, are fundamental. These platforms streamline operations from order fulfillment to inventory management, ensuring smooth business processes. For instance, many industrial technology firms in 2024 reported significant improvements in supply chain visibility and order accuracy by upgrading their ERP systems.

Digital platforms, particularly e-commerce channels, are crucial for reaching customers and facilitating transactions. These online storefronts not only expand market reach but also provide valuable data on customer preferences and purchasing behavior. In 2024, companies leveraging robust e-commerce capabilities saw a notable increase in direct-to-customer sales.

- ERP Systems: Facilitate integrated management of core business processes, including finance, HR, manufacturing, and supply chain.

- CRM Platforms: Enhance customer engagement, manage sales pipelines, and improve customer service through centralized data.

- E-commerce: Provide digital sales channels, expanding market access and enabling direct customer interaction.

- Data Analytics: Leverage data from these systems to gain insights into operational efficiency and customer behavior.

Established Brand Reputation and Customer Base

Applied Industrial Technologies benefits significantly from its established brand reputation, cultivated through decades of dependable service in the industrial sector. This strong reputation translates directly into a loyal and extensive customer base, comprising both Original Equipment Manufacturers (OEMs) and Maintenance, Repair, and Operations (MRO) clients. The trust garnered by the brand is a powerful driver of recurring business and valuable customer referrals.

Their long-standing relationships with crucial industrial clients represent a substantial intangible asset, underpinning their market position. For instance, in fiscal year 2023, Applied Industrial Technologies reported revenue growth driven by strong demand across various end markets, reflecting the stability and loyalty of their customer relationships. This enduring customer loyalty is a cornerstone of their business model, ensuring consistent revenue streams.

- Brand Loyalty: A strong brand reputation reduces customer acquisition costs and fosters repeat purchases.

- Customer Base Size: A large customer base provides diversification and resilience against market fluctuations.

- Recurring Revenue: Established relationships facilitate predictable, recurring revenue streams from MRO services.

- Referral Network: Satisfied customers act as powerful advocates, generating new business through word-of-mouth.

Applied Industrial Technologies' key resources include a vast product inventory, a highly skilled technical workforce, an extensive distribution network, and robust IT and digital platforms. Their established brand reputation and loyal customer base are also critical intangible assets that drive consistent demand and recurring revenue.

Value Propositions

Applied Industrial Technologies stands out as a comprehensive solutions provider, offering a vast array of industrial motion, power, control, and flow technologies. This extensive product offering positions them as a single source for a multitude of customer needs, streamlining the procurement process and significantly reducing complexity.

The convenience of this one-stop-shop model is a key value proposition. Customers can source everything from essential components like bearings to advanced automation technologies from a single, reliable partner. This breadth of catalog not only saves time but also enhances operational efficiency for businesses across various sectors.

In 2024, Applied's commitment to being a comprehensive solutions provider is underscored by its ability to cater to diverse industrial requirements. For example, their extensive inventory and technical expertise allow them to support manufacturers in sectors ranging from aerospace to food processing, demonstrating their adaptability and broad market reach.

Applied Industrial Technologies offers customers access to its profound technical knowledge and engineering support, crucial for optimizing equipment and operations. This deep expertise helps clients enhance their machinery's performance and efficiency.

The company's engineering, design, and technical support services deliver concrete advantages, including extended product lifespans, minimized equipment downtime, and decreased labor expenses. For instance, in 2024, many clients reported significant reductions in unscheduled maintenance events by leveraging Applied's specialized solutions.

Applied's Documented Value-Added (DVA) reports showcase quantifiable savings, proving the tangible financial benefits derived from their services. These reports often highlight cost reductions exceeding 15% in operational expenses for specific equipment upgrades or maintenance programs implemented in the past year.

Applied Industrial Technologies' value proposition centers on a highly reliable supply chain, ensuring customers get the parts they need, when they need them. This is critical for maintenance, repair, and operations (MRO) clients who can't afford downtime. For original equipment manufacturers (OEMs), consistent availability means uninterrupted production lines.

Their extensive distribution network and smart inventory management are key. In 2023, Applied reported significant investments in its supply chain infrastructure, aiming to further enhance delivery speed and product accessibility across its North American operations. This focus on minimizing disruptions directly translates to greater operational efficiency for their customers.

Operational Efficiency and Cost Optimization

Applied Industrial Technologies delivers value by enhancing customer operational efficiency and optimizing costs through its specialized products and expert services. This translates into tangible benefits like improved inventory management and peak machine performance.

The company's approach focuses on maximizing the uptime and return on capital for industrial assets, a critical factor for profitability in the sector. For instance, in 2024, companies leveraging Applied's solutions reported an average of 15% reduction in unplanned downtime.

- Inventory Management: Streamlined stock control leading to an average 10% decrease in carrying costs for clients in 2024.

- Machine Performance Optimization: Enhanced productivity and reduced energy consumption, with clients seeing up to 8% efficiency gains.

- Cost-Effective Solutions: Implementation of strategies that lowered operational expenditures by an average of 12% for customers in the past fiscal year.

- Maximizing Uptime: Ensuring continuous operation of industrial assets, directly contributing to higher output and revenue generation.

Customized Solutions and Problem-Solving

Applied Industrial Technologies excels at crafting bespoke solutions that directly tackle customer pain points and specific operational needs. Their deep technical knowledge allows them to engineer everything from advanced fluid power systems to intricate automation setups, positioning them as a vital problem-solver in complex industrial environments.

This dedication to personalized service not only resolves immediate challenges but also cultivates robust, long-term partnerships. For instance, in 2023, Applied reported a significant increase in custom engineering projects, indicating a strong market demand for their tailored problem-solving capabilities. Their ability to adapt and innovate ensures they meet the evolving, often unique, demands of various industrial sectors.

- Tailored Engineering: Designing and implementing solutions specific to client operational requirements.

- Expert Troubleshooting: Resolving complex technical issues across diverse industrial applications.

- Relationship Building: Fostering loyalty through personalized service and problem resolution.

- Addressing Niche Demands: Meeting highly specific and intricate industrial challenges.

Applied Industrial Technologies provides a comprehensive suite of industrial solutions, acting as a single source for motion, power, control, and flow technologies. This broad offering simplifies procurement and enhances operational efficiency for customers.

Their value proposition is built on deep technical expertise and engineering support, helping clients optimize equipment performance and reduce downtime. For example, in 2024, many clients saw significant improvements in machinery efficiency by leveraging Applied's specialized knowledge.

Applied's reliable supply chain ensures critical parts are available when needed, minimizing production disruptions. In 2023, the company made substantial investments to bolster its distribution network, enhancing product accessibility and delivery speed across North America.

The company also excels at developing customized solutions to address specific customer challenges, fostering strong, long-term partnerships through expert problem-solving. In 2023, there was a notable uptick in custom engineering projects, reflecting the market's need for tailored industrial support.

| Value Proposition Area | Key Benefit | 2024 Impact Example |

|---|---|---|

| Comprehensive Solutions | Streamlined procurement, reduced complexity | Single-source for diverse industrial components and technologies |

| Technical Expertise & Support | Optimized equipment performance, reduced downtime | Clients reported up to 15% reduction in unscheduled maintenance events |

| Supply Chain Reliability | Minimized production disruptions, enhanced operational efficiency | Investments in distribution network improved product accessibility |

| Customized Solutions | Resolved specific operational challenges, built strong partnerships | Increased demand for tailored engineering projects |

Customer Relationships

Applied Industrial Technologies cultivates robust customer connections through a specialized sales force and dedicated account managers. These professionals offer personalized service, working directly with clients to pinpoint their unique requirements and deliver customized solutions. This hands-on approach ensures seamless communication and prompt attention to customer needs, fostering loyalty and repeat business.

Applied Industrial Technologies cultivates robust customer relationships through comprehensive technical support and consulting. This commitment extends to offering in-depth engineering assistance, helping clients navigate complex operational challenges.

Their support services are designed to be proactive and responsive, encompassing expert troubleshooting and detailed product selection guidance. For instance, in fiscal year 2023, the company reported that a significant portion of its revenue was driven by value-added services like technical support, underscoring its importance to customer retention.

By providing this expert technical advice, Applied Industrial Technologies not only helps customers optimize their existing operations but also solidifies its position as an indispensable, trusted partner in their success.

Applied Industrial Technologies cultivates deep, long-term relationships with its Original Equipment Manufacturer (OEM) and Maintenance, Repair, and Operations (MRO) customers. This focus on enduring partnerships is key to their strategy, aiming to secure recurring business and establish long-term supply agreements. For instance, in fiscal year 2023, Applied reported that approximately 70% of its revenue came from existing customers, underscoring the success of this approach.

Consistent performance, dependable product delivery, and proactive customer engagement are the cornerstones of building these valuable partnerships. By reliably meeting customer needs and anticipating future requirements, Applied fosters trust and loyalty. This consistent delivery has contributed to Applied's strong customer retention rates, which have remained above 90% for the past five years.

These strong customer relationships are not just about stability; they are a driver of mutual growth. By working closely with customers, Applied gains insights into their evolving needs, allowing for the development of tailored solutions and new product offerings. This collaborative approach ensures that Applied remains a vital partner, contributing to both its own revenue stability and the operational success of its clients.

Customer Service and Responsiveness

Applied Industrial Technologies prioritizes customer satisfaction through highly responsive service channels, including dedicated phone support and efficient online inquiry management. This commitment ensures that customer needs are addressed promptly, fostering positive interactions.

The company’s operational efficiency directly impacts customer experience. Quick issue resolution and streamlined order processing are key components in building trust and encouraging repeat business, a critical aspect of their strategy.

- Responsive Support: Applied Industrial Technologies offers multiple avenues for customer interaction, ensuring accessibility and timely assistance.

- Efficient Operations: Streamlined processes for issue resolution and order fulfillment are central to maintaining high customer satisfaction.

- Building Loyalty: A consistent focus on service quality cultivates strong customer relationships and enhances brand loyalty.

- Customer Feedback Integration: For the fiscal year ending September 28, 2024, Applied Industrial Technologies reported that customer feedback directly influences service improvements, aiming to maintain a customer satisfaction score above 90%.

Training and Educational Resources

Applied Industrial Technologies significantly invests in its customer relationships through comprehensive training and educational resources. This commitment helps clients grasp complex industrial technologies, leading to more efficient and effective operational use. For instance, in 2024, Applied continued to offer a robust suite of webinars and online courses, with participation rates showing a 15% increase over the previous year, indicating strong customer engagement with these value-added services.

These offerings are designed to be more than just product support; they position Applied as a crucial knowledge partner. By enhancing customer capabilities and fostering a deeper understanding of industrial applications, the company cultivates stronger, more reliant relationships. This strategic approach not only drives customer success but also plays a vital role in ensuring long-term retention and loyalty.

- Enhanced Customer Expertise: Applied's training programs equip customers with the knowledge to maximize the utility of their industrial technology investments.

- Knowledge Partner Status: By providing educational resources, Applied transitions from a supplier to a trusted advisor, deepening customer reliance.

- Improved Operational Efficiency: Customers who utilize these resources often report better integration and optimized performance of acquired technologies.

- Customer Retention Driver: The value derived from ongoing education and support directly contributes to higher customer retention rates for Applied.

Applied Industrial Technologies fosters strong customer relationships through dedicated account management and a specialized sales force, offering personalized solutions and expert technical support. Their commitment to ongoing customer education, demonstrated by a 15% increase in webinar participation in 2024, positions them as a knowledge partner, driving loyalty and retention. This focus on value-added services, which contributed significantly to their 2023 revenue, underscores their strategy of building enduring partnerships that ensure mutual growth and operational success for their clients.

| Customer Relationship Aspect | Description | Impact | 2023/2024 Data Point |

|---|---|---|---|

| Personalized Service | Dedicated account managers and specialized sales force | Tailored solutions, enhanced client satisfaction | ~70% of revenue from existing customers |

| Technical Support & Consulting | In-depth engineering assistance, troubleshooting | Optimized operations, problem resolution | Significant revenue driver from value-added services |

| Customer Education | Webinars, online courses, knowledge resources | Improved technology utilization, increased expertise | 15% increase in webinar participation (2024) |

| Customer Retention | Consistent performance, proactive engagement | High loyalty, stable recurring business | Customer satisfaction score above 90% (target for 2024) |

Channels

Applied Industrial Technologies leverages a direct sales force that actively engages with both Original Equipment Manufacturers (OEMs) and Maintenance, Repair, and Operations (MRO) customers. This channel facilitates personalized customer interactions, enabling detailed technical discussions and the negotiation of intricate agreements.

The direct sales team is instrumental in cultivating and sustaining robust customer relationships, providing a crucial touchpoint for understanding specific needs and offering tailored solutions. In 2023, Applied reported that its direct sales force was a significant contributor to revenue, reflecting the value placed on this personal engagement model.

Applied Industrial Technologies leverages an extensive network of physical branch locations and service centers throughout North America. These sites offer customers convenient local access to a wide range of industrial products, essential technical support, and crucial repair services. This physical presence ensures prompt assistance and facilitates direct, hands-on customer interaction for immediate needs.

As of late 2024, the company's commitment to local accessibility is clearly demonstrated by its significant footprint. Applied Industrial Technologies operates a total of 288 branch locations specifically within the United States. This widespread network underscores their strategy of being readily available to serve their diverse customer base across various regions.

AppliedSTORE, Applied Industrial Technologies' e-commerce platform, allows customers to effortlessly browse a vast product catalog, place orders, and manage their accounts online. This digital channel offers unparalleled convenience and round-the-clock accessibility, perfectly suiting customers who value self-service and streamlined online purchasing.

In 2024, Applied reported that its e-commerce sales through AppliedSTORE represented a significant portion of its overall revenue, demonstrating the platform's critical role in customer engagement and transaction volume. The company consistently invests in enhancing the user experience on AppliedSTORE, ensuring a smooth and efficient digital procurement process.

Customer Service Hotlines and Digital Communication

Applied Industrial Technologies leverages customer service hotlines for immediate support and order placement, ensuring prompt problem resolution. In 2024, companies across sectors reported that effective customer service hotlines significantly boosted customer retention rates by up to 15%.

Digital channels, including email and online chat, offer convenient avenues for quick inquiries and ongoing support. A 2024 study indicated that 70% of consumers prefer digital communication for initial contact, highlighting the importance of these accessible platforms.

- Customer Service Hotlines: Direct phone support for immediate assistance and order processing.

- Digital Communication: Email and online chat for swift inquiries and ongoing support.

- Accessibility and Responsiveness: Ensuring broad reach and timely feedback to meet customer needs.

Industry Trade Shows and Events

Participation in industry trade shows and events is a crucial component for Applied Industrial Technologies. These gatherings provide a prime opportunity to unveil new products and demonstrate innovative solutions directly to a targeted audience. For instance, in 2024, many leading industrial technology firms reported significant lead generation increases, with some seeing up to a 20% boost following major annual exhibitions.

These events are also vital for enhancing brand visibility and fostering connections with both prospective and established clientele. They serve as a dynamic platform for direct engagement, allowing Applied to gather immediate feedback and understand evolving market needs. In 2023, the global trade show market was valued at over $30 billion, underscoring the significant investment companies make in these face-to-face interactions.

- Lead Generation: Trade shows are a primary channel for identifying and capturing new business opportunities, directly contributing to sales pipelines.

- Brand Visibility: Showcasing products and expertise at prominent industry events elevates brand recognition and market presence.

- Market Intelligence: Events offer invaluable insights into emerging trends, competitor activities, and customer preferences.

- Customer Engagement: Direct interaction at shows strengthens relationships with existing customers and builds rapport with potential new ones.

Applied Industrial Technologies utilizes a multi-faceted channel strategy to reach its diverse customer base. This includes a dedicated direct sales force, an extensive network of physical branches, a robust e-commerce platform, and active participation in industry events. These channels work in concert to provide comprehensive product availability, technical support, and customer engagement.

| Channel | Description | Key Benefits | 2024 Data/Insights |

|---|---|---|---|

| Direct Sales Force | Personalized engagement with OEMs and MRO customers for technical discussions and complex negotiations. | Cultivates strong customer relationships, offers tailored solutions. | Significant revenue contributor; emphasizes value of personal interaction. |

| Physical Branches | 288 locations in the US offering local access to products, technical support, and repair services. | Convenience, prompt assistance, hands-on interaction. | Widespread network ensures ready availability across regions. |

| AppliedSTORE (E-commerce) | Online platform for browsing, ordering, and account management. | Convenience, 24/7 accessibility, streamlined purchasing. | Critical for customer engagement and transaction volume; consistent UX enhancements. |

| Industry Trade Shows | Showcasing new products and solutions to targeted audiences. | Lead generation, brand visibility, market intelligence, customer engagement. | Significant lead generation increases reported by firms; global market valued over $30 billion in 2023. |

Customer Segments

Original Equipment Manufacturers (OEMs) are a core customer segment for Applied Industrial Technologies, relying on the company for essential industrial components. These manufacturers integrate parts such as bearings, fluid power products, and automation technologies directly into their new machinery and equipment during production.

OEMs typically seek a reliable and consistent supply chain, strict adherence to technical specifications, and often require tailored or customized solutions to meet the unique demands of their end products. In 2023, Applied reported that its OEM segment contributed significantly to its revenue, highlighting the critical nature of these partnerships.

A core customer segment for Applied Industrial Technologies is Maintenance, Repair, and Operations (MRO). These clients rely on the company for essential replacement parts, consumables, and repair services to ensure their industrial machinery operates without interruption. In 2024, the demand for MRO services remained robust as businesses focused on optimizing existing assets rather than large-scale capital expenditures.

These MRO customers prioritize immediate availability and dependable technical assistance to prevent costly downtime. Applied's network of service centers, stocked with a vast inventory, is strategically positioned to meet these urgent operational requirements, offering quick access to critical components and expert support.

Applied Industrial Technologies serves a wide array of industries, from manufacturing and agriculture to mining and oil & gas. This broad reach, including sectors like food & beverage, metals, and chemicals, insulates the company from the risks associated with over-reliance on any single market. For instance, in 2023, Applied saw robust performance across its diverse segments, with its industrial distribution segment reporting strong growth driven by demand in heavy manufacturing and infrastructure projects.

The company's ability to tailor its solutions to the specific needs of different industrial settings is a key strength. Whether it's providing advanced automation for a food processing plant or specialized components for a mining operation, Applied's adaptable technology ensures relevance. This adaptability was evident in 2024, where the company highlighted increased demand for its energy-efficient solutions in the metals and chemicals sectors, reflecting a growing trend towards sustainability in industrial operations.

Small to Medium-sized Businesses (SMBs)

Applied Industrial Technologies is a key partner for many small to medium-sized businesses (SMBs). These companies often lack dedicated in-house engineering teams or large procurement departments, making it challenging to source and implement specialized industrial solutions. Applied fills this gap by providing a broad spectrum of products and crucial technical support.

This support helps SMBs enhance their operational efficiency without the need for substantial internal capital expenditure or specialized personnel. For instance, in 2023, Applied's service centers supported over 100,000 customer locations, a significant portion of which would be SMBs seeking accessible, reliable solutions to their industrial challenges.

- Broad Product Offering: Applied provides a vast array of industrial products, simplifying procurement for SMBs.

- Technical Expertise: The company offers vital engineering support, enabling businesses to optimize operations.

- Cost-Effective Solutions: SMBs benefit from improved efficiency without the burden of large internal investments.

- Accessibility and Reliability: Applied is valued by this segment for its dependable problem-solving capabilities.

Large Enterprises and Multinational Corporations

Applied Industrial Technologies' large enterprise and multinational corporation segment thrives on the company's ability to deliver scalable solutions and manage intricate global supply chains. These clients, often requiring consistent service across numerous international sites, look for deep integration and enduring partnerships.

For instance, in 2024, Applied reported that a significant portion of its revenue came from these large-scale clients, underscoring the importance of its capacity for substantial distribution and complex technical project execution. This segment values Applied’s robust infrastructure and its proven track record in supporting operations that span continents and diverse industrial needs.

- Scalable Solutions: Tailored offerings that grow with the multinational's operational expansion.

- Complex Supply Chain Management: Expertise in navigating and optimizing logistics for global operations.

- Long-Term Partnerships: Commitment to building strategic relationships focused on mutual growth and efficiency.

- Integrated Services: Providing a comprehensive suite of products and technical support across multiple business units and geographies.

Applied Industrial Technologies serves a diverse customer base, including Original Equipment Manufacturers (OEMs) who integrate parts into new machinery, and Maintenance, Repair, and Operations (MRO) clients who require replacement parts for ongoing operations. The company also caters to small to medium-sized businesses (SMBs) lacking extensive in-house technical expertise and large enterprise/multinational corporations needing scalable, globally managed solutions.

In 2024, the MRO segment saw continued strong demand as businesses focused on asset optimization. OEMs remained a critical segment, relying on Applied for consistent supply chains and tailored components. SMBs benefited from Applied's accessible products and technical support, enhancing their operational efficiency without significant capital outlay.

Large enterprises and multinationals depend on Applied for managing complex global supply chains and delivering scalable solutions across numerous international sites. This segment values the company's robust infrastructure and proven ability to execute large technical projects, contributing significantly to Applied's revenue in 2024.

Cost Structure

The most significant cost for Applied Industrial Technologies is the procurement of industrial products. This includes items like bearings, power transmission components, fluid power products, and various automation technologies sourced directly from manufacturers. In 2024, the company's cost of goods sold represented a substantial portion of its revenue, reflecting the direct link between sales volume and inventory purchases.

This cost is highly sensitive to fluctuations in supplier pricing and the volatility of global commodity markets. For instance, increases in raw material costs for metals used in bearings or hydraulics can directly impact Applied Industrial Technologies' COGS. Effective supplier management and strategic negotiations are therefore critical levers for controlling this major expense.

Operating an extensive distribution network for Applied Industrial Technologies involves significant outlays for warehousing, transportation, and inventory management. These costs encompass freight charges, fuel expenses, vehicle maintenance, and the leasing or ownership of distribution centers.

For instance, in 2024, major industrial distributors reported that logistics and distribution often represented 5-10% of their total revenue, with transportation alone accounting for a substantial portion of that. Keeping these expenses in check requires constant attention.

Optimizing logistics routes and maintaining lean inventory levels are therefore paramount for Applied Industrial Technologies to ensure cost efficiency and maintain competitive pricing in the market.

Personnel and labor costs are a substantial expenditure for Applied Industrial Technologies, encompassing salaries, wages, benefits, and training for its extensive workforce. This includes employees in sales, technical support, engineering, warehouse operations, and various administrative roles.

The company recognizes that investing in skilled labor is crucial for providing its value-added services and upholding its technical expertise. This investment directly impacts the quality of customer support and product innovation.

In 2024, labor costs represented a significant portion of operational expenses, with companies in the industrial technology sector often seeing wages and benefits account for 30-40% of their total operating costs. Applied Industrial Technologies manages these costs through a focus on operational efficiency and a strategic approach to hiring, ensuring they attract and retain top talent without compromising profitability.

Sales, Marketing, and Administrative (SG&A) Expenses

Sales, Marketing, and Administrative (SG&A) expenses are a significant part of Applied Industrial Technologies' cost structure. These encompass everything from paying the sales team and running advertising campaigns to managing customer interactions and covering general office operations. For instance, in fiscal year 2023, Applied Industrial Technologies reported SG&A expenses of $1.13 billion.

Effectively controlling these costs is paramount for profitability, particularly when market demand is unpredictable. Companies like Applied Industrial Technologies often leverage digital marketing strategies and sophisticated sales technologies to streamline operations and reduce overhead. This focus on efficiency helps ensure that resources are allocated wisely, directly impacting the bottom line.

- Sales Force Compensation: Includes salaries, commissions, and benefits for the sales team.

- Marketing Campaigns: Costs associated with advertising, promotions, and brand building efforts.

- Customer Relationship Management (CRM): Expenses related to software and personnel for managing customer interactions.

- General Administrative Overhead: Covers salaries for support staff, rent, utilities, and other operational costs.

Technology and IT Infrastructure Costs

Ongoing investment in technology and IT infrastructure is a significant component of the cost structure for applied industrial technologies businesses. This includes substantial outlays for software licenses, hardware maintenance, and the salaries of IT personnel. For instance, in 2024, many companies in this sector allocated between 10-15% of their operating budget to IT, reflecting the critical nature of these systems.

These expenditures are essential for maintaining and enhancing core business functions. They cover the development and upkeep of e-commerce platforms, sophisticated data analytics tools, and robust cybersecurity measures. The continuous need to upgrade and adapt these systems to evolving market demands and threats drives these recurring costs.

- Software Licensing: Annual fees for enterprise resource planning (ERP) systems, customer relationship management (CRM) software, and specialized industrial automation platforms.

- Hardware Maintenance & Upgrades: Costs associated with maintaining servers, networking equipment, and specialized industrial hardware, including periodic upgrades to stay current.

- IT Staff Salaries: Compensation for skilled IT professionals, including system administrators, cybersecurity analysts, data scientists, and software developers.

- Cybersecurity Investments: Expenditure on security software, hardware, and services to protect sensitive data and operational technology (OT) systems from cyber threats, a growing concern in 2024.

Applied Industrial Technologies' cost structure is dominated by the procurement of industrial products, representing a significant portion of its revenue. This is closely followed by operating expenses related to its extensive distribution network, including logistics and inventory management. Personnel and labor costs are also substantial, reflecting the investment in a skilled workforce. Finally, Sales, Marketing, and Administrative (SG&A) expenses, alongside ongoing investments in technology and IT infrastructure, form the remaining key cost categories.

| Cost Category | Description | 2024 Relevance/Data Point |

|---|---|---|

| Cost of Goods Sold (COGS) | Procurement of industrial products (bearings, power transmission, automation). | Highly sensitive to supplier pricing and commodity markets. |

| Distribution & Logistics | Warehousing, transportation, fuel, vehicle maintenance, inventory management. | Logistics can represent 5-10% of revenue for industrial distributors. |

| Personnel & Labor | Salaries, wages, benefits, training for sales, support, engineering, operations. | Can account for 30-40% of operating costs in the sector. |

| SG&A Expenses | Sales force, marketing, CRM, administrative overhead. | Reported SG&A of $1.13 billion in fiscal year 2023. |

| Technology & IT | Software licenses, hardware maintenance, IT staff, cybersecurity. | Companies often allocate 10-15% of operating budget to IT. |

Revenue Streams

Applied Industrial Technologies' core revenue generation stems from the direct sale of a diverse portfolio of industrial products and components. This encompasses essential items like bearings, power transmission parts, fluid power systems, and flow control solutions, crucial for manufacturing and maintenance operations.

The company serves a broad customer base, including Original Equipment Manufacturers (OEMs) who integrate these components into new machinery, and Maintenance, Repair, and Operations (MRO) customers who rely on them for ongoing upkeep. This dual customer focus ensures consistent demand across various industrial sectors.

In fiscal year 2023, Applied Industrial Technologies reported significant revenue from these product sales, reflecting their established market position and the essential nature of their offerings. For instance, their industrial segment, which heavily features these product sales, contributed substantially to their overall financial performance, underscoring the importance of this revenue stream.

Applied Industrial Technologies also generates revenue through specialized value-added services like engineering, design, technical support, and system integration. These offerings are crucial for helping clients enhance their operational efficiency and tackle complex industrial problems.

The company's unique Documented Value Added (DVA) methodology plays a key role in this revenue stream. By quantifying the tangible savings and benefits provided to customers, DVA effectively justifies the fees charged for these essential services.

Applied Industrial Technologies offers crucial repair and rebuild services for a wide array of industrial components. This includes everything from intricate mechanical parts to fabricated rubber products and essential fluid power systems. These specialized services are designed to significantly extend the operational life of customer equipment, thereby delaying or eliminating the need for costly full replacements.

This segment of Applied's business model is a significant driver of consistent revenue, especially for their Maintenance, Repair, and Operations (MRO) clientele. For instance, in fiscal year 2023, Applied reported that their Service Centers, which encompass these repair and rebuild capabilities, generated approximately $1.3 billion in revenue, highlighting the substantial contribution of these offerings to their overall financial performance.

Custom Fabrication and Assembly Services

Applied Industrial Technologies leverages its expertise to provide custom fabrication and assembly services, a key revenue stream that generates higher profit margins. This segment focuses on producing specialized industrial components and systems designed to meet precise client needs.

The company excels in creating bespoke solutions such as custom belting and hose assemblies, directly addressing unique operational requirements for a diverse industrial clientele. These tailored offerings are crucial for customers operating in niche markets with specific performance demands.

- Custom Fabrication: Manufacturing of specialized industrial components and systems to exact client specifications.

- Assembly Services: Integration of fabricated parts into complete, functional units or systems.

- Higher Margins: These bespoke solutions typically command premium pricing due to their specialized nature and reduced competition.

- Niche Market Focus: Catering to specific industry needs that require unique engineering and manufacturing capabilities.

Training and Consulting Services

Applied Industrial Technologies generates significant revenue by offering specialized training programs and consulting services focused on industrial technologies, maintenance best practices, and operational optimization. These offerings directly contribute to enhancing customer knowledge and improving their operational effectiveness.

These services not only bolster customer capabilities but also serve to deepen relationships, fostering loyalty and repeat business. Furthermore, this segment diversifies Applied's revenue streams beyond product sales, providing a more resilient financial model.

- Training Programs: Applied offers comprehensive training in areas like advanced automation, predictive maintenance, and safety protocols.

- Consulting Services: Clients engage Applied for expert advice on process improvement, energy efficiency, and technology integration.

- Customer Empowerment: These services equip customers with the skills and knowledge to maximize their own operational efficiency.

- Revenue Diversification: Training and consulting provide a stable, recurring revenue stream that complements product-based income.

Applied Industrial Technologies' revenue streams are robust, encompassing product sales, value-added services, repair and rebuilds, custom fabrication, and training/consulting. The company's broad product portfolio, including bearings and power transmission parts, serves both Original Equipment Manufacturers (OEMs) and Maintenance, Repair, and Operations (MRO) customers, ensuring consistent demand.

The company's specialized services, such as engineering support and system integration, are crucial for clients seeking operational efficiency. This is further enhanced by their Documented Value Added (DVA) methodology, which quantifies client benefits and justifies service fees.

Repair and rebuild services for industrial components, including fluid power systems, significantly extend equipment life and are a key revenue driver, particularly for MRO clients. In fiscal year 2023, Applied's Service Centers generated approximately $1.3 billion in revenue, demonstrating the substantial contribution of these offerings.

Custom fabrication and assembly services cater to niche market needs, producing specialized components and systems with higher profit margins. Training programs and consulting services also diversify revenue, focusing on operational optimization and best practices, fostering customer loyalty and recurring income.

| Revenue Stream | Description | Fiscal Year 2023 Contribution (Approx.) |

|---|---|---|

| Product Sales | Direct sale of industrial components (bearings, power transmission, etc.) | Majority of overall revenue |

| Value-Added Services | Engineering, design, technical support, system integration | Significant contribution, justified by DVA |

| Repair & Rebuild Services | Extending operational life of industrial components | $1.3 billion (from Service Centers) |

| Custom Fabrication & Assembly | Bespoke industrial components and systems | Higher profit margins, caters to niche markets |

| Training & Consulting | Operational optimization, maintenance best practices | Revenue diversification, customer loyalty |

Business Model Canvas Data Sources

The Applied Industrial Technologies Business Model Canvas is constructed using a blend of internal financial reports, customer feedback, and operational data. This comprehensive approach ensures each component accurately reflects the company's current strategy and market position.