Applied Industrial Technologies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Applied Industrial Technologies Bundle

Navigate the complex external forces shaping Applied Industrial Technologies with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, technological advancements, environmental concerns, and legal frameworks are impacting the company's operations and future growth. Gain a critical edge by leveraging these expert insights to refine your own market strategy.

Ready to make informed decisions about Applied Industrial Technologies? Our PESTLE analysis offers a deep dive into the political, economic, social, technological, environmental, and legal factors influencing its trajectory. Equip yourself with actionable intelligence to identify opportunities and mitigate risks.

Unlock the strategic advantages hidden within Applied Industrial Technologies's operating environment. Our meticulously researched PESTLE analysis provides a clear roadmap of the external trends that matter most. Download the full report to gain the clarity needed for impactful business planning and investment decisions.

Political factors

Government industrial policies, such as those fostering domestic manufacturing and infrastructure development, directly influence the market for Applied Industrial Technologies. For instance, the US CHIPS and Science Act, with its significant funding allocations, aims to bolster semiconductor manufacturing, potentially increasing demand for advanced automation and control systems that the company provides. Similarly, infrastructure spending initiatives, like those outlined in the Bipartisan Infrastructure Law, can drive demand for industrial technologies in sectors such as energy, transportation, and utilities.

Changes in international trade policies and tariffs directly impact Applied Industrial Technologies' operational costs and supply chain stability. For instance, the U.S. imposed tariffs on steel and aluminum in 2018, which increased raw material costs for many manufacturers, potentially affecting companies like Applied Industrial Technologies that rely on these inputs.

Geopolitical tensions and a rise in protectionist measures globally can create significant disruptions. The ongoing trade disputes, such as those between major economic blocs, have led to uncertainty and can hinder the smooth flow of essential components and finished goods, ultimately impacting delivery times and pricing strategies for industrial technology providers.

Monitoring these evolving trade dynamics is crucial for Applied Industrial Technologies. For example, the World Trade Organization (WTO) reported a slowdown in global trade growth in 2023, highlighting the sensitivity of industrial sectors to these policy shifts. Proactive risk management and supply chain diversification are key to maintaining competitive pricing and operational resilience in this environment.

Geopolitical instability, exemplified by the ongoing Russia-Ukraine conflict and escalating tensions in the Red Sea, significantly disrupts global supply chains. These events directly impact transportation routes, leading to increased shipping costs, with freight rates on key East-West routes seeing substantial spikes in late 2023 and early 2024. For Applied Industrial Technologies, this necessitates a robust and adaptable supply chain to ensure dependable product delivery amidst such volatile conditions.

Regulatory Pressure and Compliance

Increased regulatory pressures, especially in Europe concerning supply chain diligence and sustainability, are significantly influencing how industrial distributors like Applied Industrial Technologies operate. New legislation, such as the EU's Corporate Sustainability Due Diligence Directive (CSDDD) and Germany's Supply Chain Act (LkSG), now requires businesses to actively identify and mitigate human rights and environmental risks embedded within their supply chains.

Applied Industrial Technologies must navigate these evolving compliance requirements to prevent penalties and secure continued market access. Failure to adhere could lead to substantial fines; for instance, violations of Germany's Supply Chain Act can result in fines of up to €8 million or 2% of average annual global revenue. This underscores the critical need for robust compliance frameworks.

- EU CSDDD: Mandates due diligence on human rights and environmental impacts across value chains.

- German LkSG: Requires companies to establish internal reporting mechanisms for supply chain risks.

- Compliance Costs: Estimated to increase for businesses as they invest in new tracking and reporting systems.

Political Stability in Key Markets

The political stability of regions where Applied Industrial Technologies operates and sources materials is paramount. For instance, upcoming federal elections in Germany in late 2025 could lead to shifts in fiscal policy or environmental regulations that ripple through industrial supply chains, impacting manufacturing costs and availability of components. A predictable political landscape is crucial for maintaining operational continuity and encouraging long-term investment.

Political stability directly influences investor confidence and the ease of doing business. Countries with stable governance structures tend to attract more foreign direct investment, which can benefit companies like Applied Industrial Technologies through enhanced market access and capital availability. Conversely, political uncertainty can deter investment and disrupt established trade relationships.

Key considerations include:

- Government Stability: The likelihood of significant policy changes due to shifts in political power. For example, a change in government in a major manufacturing hub could alter trade agreements or labor laws.

- Regulatory Environment: The consistency and predictability of regulations affecting industrial production, environmental standards, and worker safety.

- Geopolitical Relations: The impact of international relations and trade policies between countries where Applied Industrial Technologies has operations or suppliers.

Government industrial policies, such as the US CHIPS and Science Act, directly boost demand for advanced automation and control systems by funding domestic manufacturing. Infrastructure spending initiatives, like the Bipartisan Infrastructure Law, also drive demand for industrial technologies in key sectors.

Trade policies and geopolitical tensions significantly impact Applied Industrial Technologies' costs and supply chain. For instance, global trade growth slowed in 2023, and geopolitical instability, like the Red Sea crisis, has increased shipping costs, with key routes seeing substantial spikes in late 2023 and early 2024.

Regulatory pressures, such as the EU's Corporate Sustainability Due Diligence Directive, require companies to mitigate supply chain risks, with potential fines for non-compliance, like up to €8 million under Germany's Supply Chain Act.

Political stability is crucial for investor confidence and operational continuity, as policy shifts from upcoming elections, such as in Germany in late 2025, can alter trade agreements and manufacturing costs.

| Policy/Event | Impact on Applied Industrial Technologies | Example Data/Year |

|---|---|---|

| US CHIPS and Science Act | Increased demand for automation and control systems | Significant funding allocations (2022) |

| Bipartisan Infrastructure Law | Drives demand in energy, transportation, utilities | Infrastructure spending initiatives (2021) |

| Global Trade Growth Slowdown | Sensitivity of industrial sectors to policy shifts | WTO reported slowdown in 2023 |

| Red Sea Crisis | Increased shipping costs, supply chain disruption | Freight rates spiked late 2023/early 2024 |

| EU CSDDD / German LkSG | Increased compliance costs, risk mitigation requirements | Fines up to €8 million for LkSG violations |

| German Federal Elections | Potential policy shifts affecting manufacturing costs | Upcoming late 2025 |

What is included in the product

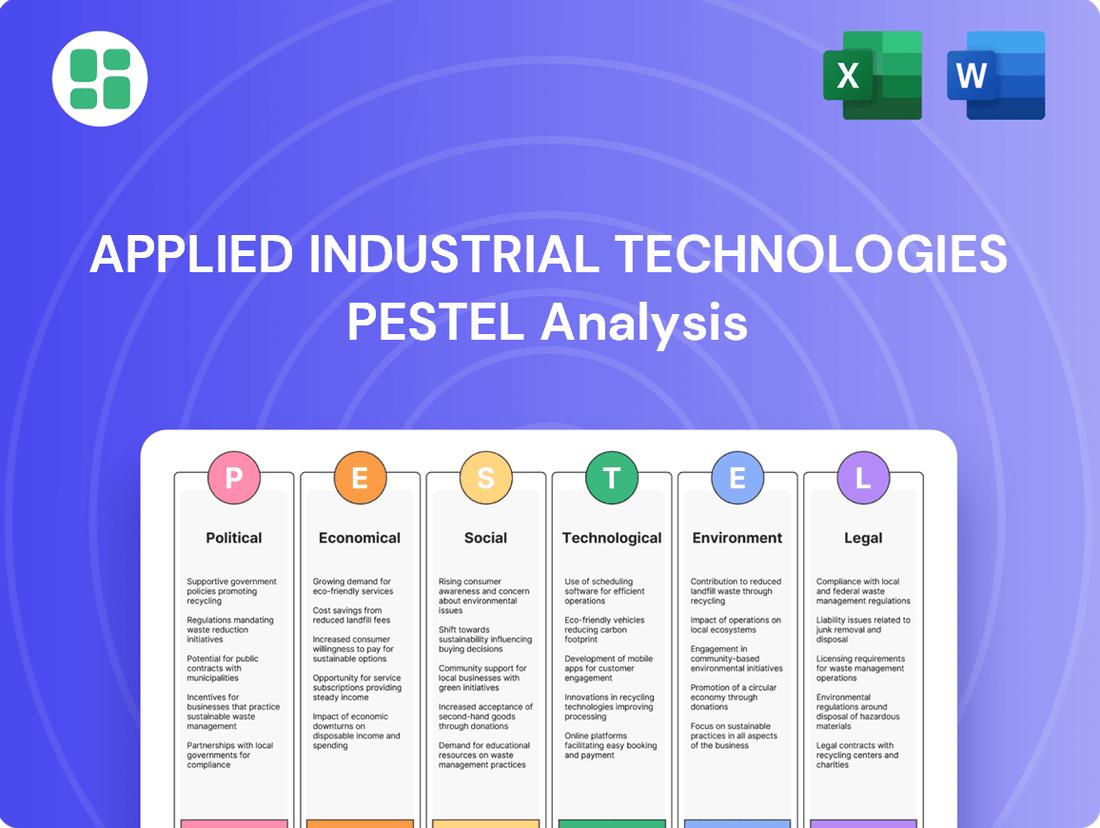

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Applied Industrial Technologies, providing a comprehensive overview of the external landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering clear insights into external factors impacting Applied Industrial Technologies.

Helps support discussions on external risk and market positioning during planning sessions by highlighting key Political, Economic, Social, Technological, Legal, and Environmental influences.

Economic factors

The performance of industrial production and manufacturing is a key indicator for Applied Industrial Technologies. A robust manufacturing sector typically translates to higher demand for the company's automation solutions and industrial components. For instance, the U.S. manufacturing sector experienced a contraction in industrial production during parts of 2024, with the Federal Reserve's index of industrial production showing a decline in output in certain months due to elevated interest rates and softening consumer demand.

However, the outlook for 2025 suggests a potential rebound. Analysts and economic forecasts, including those from organizations like the Institute for Supply Management (ISM), are anticipating an expansion in manufacturing activity in 2025, projecting growth in new orders and production levels. This projected recovery is expected to stimulate greater investment in factory upgrades and automation, directly benefiting companies like Applied Industrial Technologies.

High inflation and elevated interest rates, reaching 5.4% for the Federal Reserve's target rate in early 2024, have significantly constrained business investment and consumer spending, directly impacting the manufacturing sector. This environment has made manufacturers cautious about committing capital to new equipment or expanding capacity, resulting in diminished demand for industrial products. For instance, durable goods orders saw a slight contraction in late 2023, reflecting this hesitancy.

Manufacturers have been hesitant to invest in new equipment or capacity, leading to lower demand for industrial products. This cautious approach is a direct consequence of the increased cost of borrowing and the uncertainty surrounding future economic conditions.

A potential reduction in interest rates, with some economists forecasting a move by the Federal Reserve in mid-to-late 2025, could reignite investment and stimulate demand. This shift would likely lead to more favorable financing conditions, encouraging manufacturers to upgrade their operations and boosting sales for companies like Applied Industrial Technologies.

Global supply chains are still feeling the effects of various disruptions. Geopolitical tensions, like ongoing conflicts, and labor actions, such as port strikes, continue to create uncertainty. Furthermore, extreme weather events linked to climate change are increasingly impacting transportation routes and raw material availability, driving up operational expenses for companies like Applied Industrial Technologies.

These disruptions translate directly into higher costs. For instance, companies may face increased spending on expedited freight to meet delivery deadlines or pay more for essential raw materials due to scarcity. In 2024, the cost of ocean freight, while down from pandemic peaks, remained volatile. The Drewry World Container Index, a benchmark for shipping costs, saw fluctuations, with some routes experiencing significant price increases due to capacity constraints and port congestion in key regions.

To counter these financial pressures, building more resilient supply chains is becoming a critical strategy. This involves diversifying suppliers, increasing inventory levels for key components, and investing in technology for better supply chain visibility. For Applied Industrial Technologies, this means finding ways to absorb or pass on these increased costs, potentially through price adjustments or by optimizing logistics to reduce reliance on costly expedited services.

Capital Expenditure Trends

Applied Industrial Technologies' revenue is closely tied to the capital expenditure (CapEx) decisions of original equipment manufacturers (OEMs) and maintenance, repair, and operations (MRO) customers. When these businesses feel confident about the future, they are more likely to invest in new machinery, upgrade existing systems, and maintain their facilities, all of which drive demand for Applied's products and services.

Economic headwinds in 2024, including persistent inflation and elevated interest rates, have made many companies hesitant to commit to large capital projects. This caution has led to a slowdown in CapEx spending across various industrial sectors. For instance, a survey of CFOs in early 2024 indicated a general pullback on discretionary spending, including significant equipment purchases.

However, projections for 2025 suggest a potential rebound. As interest rates are anticipated to stabilize or even decrease, and economic growth shows signs of picking up, businesses may regain the confidence needed to release pent-up CapEx demand. This anticipated improvement in the economic climate could significantly boost Applied Industrial Technologies' sales pipeline as customers look to modernize and expand their operations.

- CapEx Sensitivity: Applied Industrial Technologies' performance directly correlates with customer willingness to invest in new equipment and upgrades.

- 2024 Slowdown: Economic uncertainties and high interest rates in 2024 have tempered capital expenditure across industries.

- 2025 Outlook: A more favorable economic outlook for 2025, potentially with lower interest rates, is expected to reignite investment in industrial solutions.

- Sales Opportunity: Renewed CapEx in 2025 is projected to create increased sales opportunities for Applied Industrial Technologies.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for Applied Industrial Technologies, particularly due to its global reach. Changes in the value of currencies can directly affect the reported financial performance of companies with international operations or those that source materials from abroad. For Applied Industrial Technologies, this means that the cost of imported components or the revenue generated from overseas sales can be amplified or diminished by currency movements.

The company's fiscal 2025 third-quarter earnings report highlighted this impact, noting a negative effect from foreign currency translation. This suggests that the strengthening of the U.S. dollar, for instance, relative to currencies in countries where Applied Industrial Technologies operates or sells, would reduce the translated value of foreign earnings when reported in U.S. dollars. This can create a headwind for revenue growth and profitability, even if underlying business operations remain strong.

Effective management of currency exposure is therefore crucial for Applied Industrial Technologies to maintain predictable revenue streams and stable profitability. Strategies such as hedging, diversifying currency exposure, or invoicing in a stable currency can help mitigate the adverse effects of currency volatility. This proactive approach is essential for financial planning and investor confidence in an increasingly interconnected global economy.

- Impact on International Sales: A stronger USD can make Applied Industrial Technologies' products more expensive for foreign buyers, potentially reducing sales volume.

- Cost of Goods Sold: If the company imports raw materials or components, a weaker USD increases the cost of these inputs, squeezing profit margins.

- Reported Earnings Volatility: As seen in Q3 fiscal 2025, currency translation can cause swings in reported earnings, making it harder to assess underlying operational performance.

- Strategic Sourcing and Pricing: Managing currency risk may involve adjusting sourcing strategies or pricing models in different geographic markets to absorb or pass on exchange rate impacts.

Economic factors significantly shape the industrial technology landscape. While 2024 saw manufacturing production dip due to high interest rates, forecasts for 2025 anticipate a rebound, potentially boosting demand for automation and industrial components. For instance, the Federal Reserve's industrial production index showed contractions in certain months of 2024, but projections from organizations like the ISM point to growth in 2025.

Elevated interest rates, hovering around 5.4% in early 2024, have curbed business investment and consumer spending, impacting capital expenditures. A projected rate reduction in mid-to-late 2025 could, however, stimulate investment in factory upgrades and new equipment, benefiting companies like Applied Industrial Technologies.

Global supply chain disruptions, fueled by geopolitical tensions and climate events, continue to increase operational costs for industrial firms. Fluctuations in shipping costs, as seen in the Drewry World Container Index in 2024, highlight this volatility, prompting companies to build more resilient supply chains.

Preview Before You Purchase

Applied Industrial Technologies PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Applied Industrial Technologies delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

Sociological factors

The industrial sector grapples with an aging workforce, with a significant portion of experienced skilled workers approaching retirement age. This demographic shift, coupled with a declining interest in manufacturing careers among younger generations, has created a critical shortage of qualified personnel for essential roles in production and maintenance.

This skilled labor gap directly impacts operational efficiency and growth potential for many businesses. For instance, in 2024, the U.S. manufacturing sector reported a shortage of over 800,000 workers, highlighting the severity of the issue. This scarcity drives up labor costs and can delay critical projects.

Consequently, there's a heightened demand for advanced automation technologies that can bridge these labor deficits. Applied Industrial Technologies' offerings in robotics, AI-driven systems, and automated machinery provide crucial solutions, enabling clients to maintain productivity and competitiveness despite workforce constraints.

Societal views on automation are shifting, with a notable increase in acceptance for integrating advanced technologies into daily work. This evolving attitude is crucial for companies like Applied Industrial Technologies, as it directly influences the market's readiness for their solutions.

The rise of Industry 4.0 concepts, emphasizing smart factories and human-machine collaboration, is a key driver. A 2024 report indicated that 65% of manufacturing executives believe automation will improve worker safety and efficiency, a sentiment that underpins the demand for sophisticated industrial automation.

This growing acceptance fuels the adoption of industrial IoT and robotics, core areas for Applied Industrial Technologies. Projections for the industrial IoT market alone suggest a compound annual growth rate of over 15% through 2028, highlighting a strong societal and economic push towards these technologies.

Societies worldwide are placing a greater emphasis on employee well-being, driving stricter regulations and a demand for safer industrial environments. This societal shift directly impacts companies like Applied Industrial Technologies.

The global occupational safety and health market was valued at approximately $55.8 billion in 2023 and is projected to grow, indicating a strong market for safety-enhancing solutions. For instance, the adoption of advanced sensor technology for real-time hazard detection is a key area of growth.

Applied Industrial Technologies can capitalize on this trend by providing innovative products and services that demonstrably improve workplace safety, reduce accident rates, and offer robust monitoring capabilities for their clients' operations, aligning with the growing expectation for responsible corporate citizenship.

Demand for Sustainable Practices

Growing environmental awareness is a significant sociological driver, prompting a greater demand for sustainable practices across industries. Consumers and employees alike are increasingly prioritizing companies that demonstrate genuine commitment to ecological responsibility, influencing purchasing and employment decisions. This societal shift is particularly relevant for sectors like industrial technologies, where the environmental footprint of operations and products is under scrutiny.

This demand translates into tangible market opportunities. For instance, a 2024 report indicated that over 70% of consumers consider sustainability when making purchasing decisions, and this figure is projected to rise. Businesses that proactively integrate eco-friendly solutions, such as energy-efficient machinery or waste-reduction technologies, are likely to gain a competitive edge. Applied Industrial Technologies can leverage this trend by highlighting its own sustainability initiatives and offering products that help clients achieve their environmental goals.

- Consumer Preference: A significant majority of consumers now factor sustainability into their buying choices, impacting brand loyalty and market share.

- Workforce Expectations: Employees, especially younger generations, are seeking employers with strong environmental, social, and governance (ESG) credentials.

- Regulatory Influence: While not strictly sociological, societal pressure often fuels regulatory changes that mandate or incentivize sustainable operations.

- Supply Chain Impact: Companies are increasingly scrutinizing their supply chains for environmental compliance, pushing for greener practices from their partners.

Reshoring and Regionalization of Supply Chains

The growing movement to bring manufacturing back home, known as reshoring, and to shorten supply chains to regional hubs is significantly influenced by societal factors. This trend is partly fueled by a desire for greater national security and economic stability, which resonates with public sentiment. For instance, a 2024 survey indicated that 65% of consumers believe it's important for companies to manufacture goods domestically, reflecting a societal preference for local production.

This shift has direct implications for job creation and local economic development. As companies invest in domestic facilities, there's a projected increase in manufacturing jobs. In the United States, reshoring initiatives are estimated to have created over 350,000 manufacturing jobs between 2010 and 2023, demonstrating the tangible economic benefits for communities. Applied Industrial Technologies can capitalize on this by expanding its presence in these revitalized industrial regions.

The societal demand for ethical and sustainable production also plays a role. Consumers are increasingly aware of labor practices and environmental impacts, preferring products made closer to home where oversight might be perceived as stronger. This societal pressure encourages companies to build more transparent and accountable supply chains, aligning with the values of a growing segment of the population.

- Increased Consumer Demand for Domestic Goods: Surveys in 2024 indicate a strong public preference for domestically manufactured products, with over 60% of consumers stating they actively seek out such items.

- Job Creation in Manufacturing Hubs: Reshoring efforts are projected to add an estimated 100,000 new manufacturing jobs in North America by the end of 2025, boosting local economies.

- Focus on Supply Chain Transparency: Societal pressure for ethical labor and environmental standards is driving companies to regionalize, making their supply chains more visible and accountable.

- Regional Economic Development: The localization of supply chains is expected to stimulate investment in smaller cities and towns, fostering diversified regional economic growth.

Societal attitudes towards automation are increasingly positive, with a growing acceptance of technology in the workplace. This shift is driven by the perceived benefits of increased efficiency and safety, as highlighted by a 2024 report where 65% of manufacturing executives believed automation would improve worker safety and efficiency.

The emphasis on employee well-being is also a significant factor, leading to greater demand for safer industrial environments. The global occupational safety and health market, valued at approximately $55.8 billion in 2023, reflects this societal priority, creating opportunities for safety-enhancing technologies.

Environmental consciousness is another key sociological driver, with consumers and employees favoring companies with strong sustainability commitments. A 2024 report showed over 70% of consumers consider sustainability in purchasing decisions, pushing for eco-friendly industrial solutions.

The reshoring trend, influenced by a desire for economic stability and national security, also reflects societal preferences for localized production. A 2024 survey indicated that 65% of consumers believe domestic manufacturing is important, supporting regional economic development and job creation.

| Sociological Factor | 2024/2025 Data Point | Impact on Applied Industrial Technologies |

|---|---|---|

| Automation Acceptance | 65% of manufacturing execs see automation improving safety/efficiency (2024) | Increased market readiness for automation solutions |

| Employee Well-being & Safety | Global OHS market ~$55.8 billion (2023), growing | Demand for safety-enhancing technologies and monitoring systems |

| Environmental Consciousness | >70% of consumers consider sustainability (2024) | Opportunity for eco-friendly products and sustainability initiatives |

| Reshoring & Domestic Production | 65% of consumers favor domestic manufacturing (2024) | Growth potential in revitalized industrial regions, demand for localized solutions |

Technological factors

The Industrial Internet of Things (IIoT) is rapidly changing how factories and warehouses operate. By connecting machines and sensors, IIoT allows for real-time data collection, giving businesses a clear view of their entire supply chain. This leads to more efficient processes and greater automation.

Applied Industrial Technologies can capitalize on this trend by offering solutions that harness IIoT for smart manufacturing. For instance, predictive maintenance, powered by IIoT data, can prevent costly downtime. In 2024, the IIoT market was projected to reach over $110 billion globally, demonstrating significant growth potential.

The increasing integration of artificial intelligence (AI) and machine learning (ML) into industrial operations is a significant technological factor. These advancements are particularly impactful in areas like predictive maintenance and the optimization of overall operational efficiency. For Applied Industrial Technologies, this translates to enhanced value for their Maintenance, Repair, and Operations (MRO) customers.

AI-powered analytics offer the capability to forecast equipment failures before they occur, thereby minimizing costly downtime and reducing overall maintenance expenditures. This proactive approach is a key benefit that Applied Industrial Technologies can leverage to better serve its client base.

Furthermore, Applied Industrial Technologies' existing portfolio of automation technologies is well-positioned to integrate these cutting-edge AI advancements. This integration can lead to smarter, more efficient industrial processes, potentially boosting productivity by an estimated 15-20% in certain applications by 2025, according to industry forecasts.

Digitalization is fundamentally reshaping supply chain management, offering unprecedented visibility and data granularity. This enhanced insight is critical for proactive risk management in today's volatile global landscape. For instance, by 2025, it's projected that 70% of global supply chains will leverage AI and IoT for real-time tracking and predictive maintenance, a significant jump from 30% in 2022.

Key technologies like digital twins, cloud-based predictive analytics, and integrated ERP systems are at the forefront of this transformation. These tools enable businesses to model complex operations, forecast demand with greater accuracy, and streamline inventory management. Applied Industrial Technologies, by offering solutions that integrate these advanced technologies, can directly empower its customers to achieve greater operational efficiency and agility.

Additive Manufacturing (3D Printing) Evolution

Additive manufacturing, or 3D printing, is rapidly advancing beyond prototyping to become a key player in industrial-scale production. The focus is sharpening on high-speed processes, the development of novel materials, and the creation of end-use parts, moving it from a niche technology to a mainstream manufacturing solution.

This evolution offers significant advantages, including accelerated product development cycles, the ability to design and produce lighter yet stronger components, and the potential for more sustainable manufacturing through reduced waste. For companies like Applied Industrial Technologies, this presents a compelling opportunity to engage with the growing industrial 3D printing sector, perhaps by supplying specialized materials or components.

The market for industrial 3D printing is projected for substantial growth. For instance, the global additive manufacturing market was valued at approximately $15.1 billion in 2023 and is expected to reach over $60 billion by 2030, with a compound annual growth rate (CAGR) exceeding 20%. This expansion is driven by increasing adoption across various industries, including aerospace, automotive, and healthcare, all seeking the benefits of on-demand production and complex geometries.

- Market Growth: The global additive manufacturing market is anticipated to grow from an estimated $15.1 billion in 2023 to over $60 billion by 2030, indicating a significant expansion.

- Key Drivers: Increased demand for lightweight components, customization, and on-demand manufacturing are fueling the adoption of 3D printing in industrial applications.

- Material Innovation: The development of advanced polymers, metals, and ceramics for 3D printing is expanding the range of applications and performance capabilities.

- Industry Adoption: Sectors like aerospace and automotive are increasingly using additive manufacturing for critical end-use parts, demonstrating its maturity.

Automation and Robotics Integration

The increasing integration of automation and robotics across manufacturing and logistics is a significant technological driver. This encompasses advanced robotics, automated material handling systems, and the adoption of smart factory concepts. For Applied Industrial Technologies, a distributor of these automation solutions, this trend presents a direct growth opportunity as businesses increasingly invest in these technologies to boost productivity, lower labor expenses, and improve workplace safety.

The market for industrial robots saw substantial growth, with global sales reaching approximately 500,000 units in 2023, a notable increase from previous years. This expansion is fueled by a demand for greater efficiency and precision in production processes. Applied Industrial Technologies is well-positioned to capitalize on this, offering a range of products that support these evolving industrial needs.

- Increased adoption of collaborative robots (cobots) in assembly lines, enhancing human-robot interaction and flexibility.

- The global market for warehouse automation solutions is projected to reach over $50 billion by 2028, indicating strong demand for automated material handling.

- Smart factory initiatives are driving investment in interconnected systems and data analytics, creating a need for integrated automation components.

Technological advancements are fundamentally reshaping industrial operations, with the Industrial Internet of Things (IIoT) enabling real-time data for enhanced efficiency and automation. Artificial intelligence (AI) and machine learning (ML) are further optimizing processes, particularly in predictive maintenance, offering significant value for MRO services.

Digitalization is transforming supply chains with increased visibility, driven by technologies like digital twins and cloud analytics, with a projected 70% of global supply chains leveraging AI and IoT by 2025. Additive manufacturing (3D printing) is maturing into industrial-scale production, with the market expected to exceed $60 billion by 2030, driven by demand for customization and on-demand parts.

The integration of automation and robotics is accelerating, with global industrial robot sales reaching approximately 500,000 units in 2023. This trend, coupled with smart factory initiatives, creates substantial growth opportunities for companies supplying automation solutions.

| Technology Area | 2023/2024 Data Point | Projected 2025/2030 Data Point | Impact on Applied Industrial Technologies |

|---|---|---|---|

| IIoT Market | Projected over $110 billion (2024) | Continued strong growth | Opportunity for smart manufacturing solutions |

| AI/ML in Industry | Driving efficiency in MRO | Potential productivity boost of 15-20% (2025) | Enhanced value for customers through predictive analytics |

| Additive Manufacturing | Market valued at $15.1 billion (2023) | Projected to exceed $60 billion by 2030 | Potential to supply specialized materials and components |

| Industrial Robots | Global sales ~500,000 units (2023) | Increasing adoption across industries | Direct growth opportunity in automation solutions |

Legal factors

A growing number of global regulations are now requiring companies to meticulously examine their supply chains for human rights and environmental risks. For instance, the EU's Corporate Sustainability Due Diligence Directive (CSDDD) and Germany's Supply Chain Act (LkSG) are prime examples of this trend, compelling businesses to actively identify and mitigate potential issues. Applied Industrial Technologies, with its vast supplier network, must navigate these complex legal landscapes to prevent significant legal repercussions and safeguard its public image.

Environmental compliance and reporting standards are becoming increasingly stringent globally. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD) mandates detailed disclosure of environmental impacts, and the US Securities and Exchange Commission (SEC) is implementing climate disclosure rules. These regulations require companies like Applied Industrial Technologies to meticulously track and report their environmental footprint, including greenhouse gas emissions across Scope 1, 2, and often Scope 3.

Failure to adhere to these evolving standards can lead to significant penalties and reputational damage, impacting market access and investor confidence. As of early 2025, many companies are investing heavily in data collection and reporting systems to meet these growing demands. This focus on transparency means that robust environmental management is no longer optional but a core operational necessity for businesses operating internationally.

Product safety and liability regulations are absolutely crucial for a company like Applied Industrial Technologies that distributes industrial equipment. They need to make sure everything they sell meets tough safety standards to avoid accidents, costly recalls, and lawsuits. For instance, in 2024, product liability claims in the manufacturing sector can lead to millions in damages, underscoring the importance of compliance.

Labor Laws and Workforce Regulations

Evolving labor laws, particularly concerning worker safety and fair wages, directly influence Applied Industrial Technologies' operational costs and the economic viability of its clients' projects. For instance, in the United States, the Department of Labor's Occupational Safety and Health Administration (OSHA) continues to enforce stringent safety standards, with penalties for violations often reaching tens of thousands of dollars per incident, impacting industries that rely on industrial technologies. Compliance is paramount to sidestep costly legal battles and cultivate a stable workforce.

Labor disruptions, such as strikes or union negotiations, can significantly disrupt supply chains and project timelines for companies utilizing industrial technologies. In 2024, several key manufacturing sectors experienced labor disputes, leading to production delays and increased costs for businesses dependent on timely component delivery. Applied Industrial Technologies must navigate these potential disruptions, ensuring robust contingency plans are in place.

- Worker Safety Regulations: Compliance with OSHA standards is critical, with average penalties for serious violations in 2024 exceeding $15,000.

- Fair Wage Mandates: Minimum wage increases in various U.S. states and cities in 2024 and projected for 2025 directly affect labor costs for both technology providers and their clients.

- Labor Relations: The potential for strikes or slowdowns in sectors like automotive manufacturing or logistics can halt production lines, impacting demand for industrial automation and machinery.

- Workforce Training and Development: Regulations often encourage or mandate investment in employee upskilling, particularly relevant for adopting advanced industrial technologies.

Data Privacy and Cybersecurity Laws

As industrial operations increasingly rely on the Industrial Internet of Things (IIoT), data privacy and cybersecurity laws are becoming paramount. Applied Industrial Technologies, by providing advanced technological solutions, must rigorously adhere to data protection regulations. This ensures the safeguarding of sensitive operational data and customer information against evolving cyber threats. For instance, the General Data Protection Regulation (GDPR) in Europe, and similar frameworks globally, impose strict requirements on data handling, with significant penalties for non-compliance. In 2024, the global cost of cybercrime was estimated to reach $10.5 trillion annually, highlighting the critical need for robust security measures.

Compliance with these evolving legal landscapes is not just a matter of avoiding fines; it's crucial for maintaining customer trust and operational integrity. Applied Industrial Technologies needs to implement comprehensive data security protocols and ensure its IIoT platforms are designed with privacy by default. Failure to do so could lead to reputational damage and loss of business. The increasing sophistication of cyberattacks means that continuous investment in cybersecurity infrastructure and employee training is essential. By 2025, the cybersecurity market is projected to exceed $300 billion, reflecting the growing demand for these protective services.

- Data Protection Compliance: Ensuring adherence to regulations like GDPR and CCPA for sensitive industrial data.

- Cybersecurity Investments: Allocating resources to protect IIoT systems and client data from breaches, with the global cybersecurity market expected to reach $315 billion by 2025.

- Reputational Risk: Mitigating the impact of data breaches on customer trust and brand image.

- Regulatory Fines: Avoiding substantial financial penalties associated with non-compliance, which can reach millions of dollars for major violations.

The legal landscape for industrial technologies is increasingly complex, with a strong emphasis on supply chain transparency and environmental accountability. Regulations like the EU's Corporate Sustainability Due Diligence Directive (CSDDD) and Germany's Supply Chain Act (LkSG) compel companies to rigorously vet their suppliers for human rights and environmental risks, impacting global operations and necessitating robust compliance frameworks.

Environmental reporting standards are also tightening, with directives like the EU's Corporate Sustainability Reporting Directive (CSRD) and upcoming SEC climate disclosure rules demanding detailed tracking and reporting of environmental impacts, including greenhouse gas emissions. Failure to comply can result in significant penalties and reputational damage, prompting substantial investments in data collection and reporting systems by early 2025.

Product safety and liability laws remain critical, with manufacturers and distributors like Applied Industrial Technologies facing substantial financial repercussions for non-compliance. In 2024, product liability claims in the manufacturing sector have demonstrated the potential for multi-million dollar damages, underscoring the necessity of strict adherence to safety standards.

Labor laws, particularly those concerning worker safety and fair wages, directly influence operational costs and project viability. For instance, OSHA penalties for serious violations in the US can exceed $15,000 per incident, emphasizing the need for compliance to avoid legal battles and ensure workforce stability. Minimum wage increases in various US states and cities throughout 2024 and projected for 2025 also directly impact labor costs.

| Legal Factor | Key Regulation/Area | Impact/Data Point (2024/2025) | Implication for Applied Industrial Technologies |

| Supply Chain Due Diligence | EU CSDDD, Germany LkSG | Mandatory risk assessment for human rights and environmental issues in supply chains. | Requires enhanced supplier vetting and monitoring processes. |

| Environmental Reporting | EU CSRD, SEC Climate Disclosure | Increased demand for detailed environmental impact reporting, including GHG emissions. | Necessitates investment in robust environmental data management systems. |

| Product Safety & Liability | Consumer Protection Laws | Potential for multi-million dollar damages from product liability claims (e.g., manufacturing sector in 2024). | Emphasizes strict adherence to safety standards and quality control. |

| Labor Laws | OSHA Standards, Minimum Wage Laws | OSHA penalties for serious violations exceeding $15,000; projected minimum wage increases impacting labor costs. | Requires diligent compliance with safety regulations and awareness of rising labor expenses. |

Environmental factors

Climate change, characterized by escalating extreme weather events, presents a substantial risk to global supply chains. These disruptions impact transportation networks, damage critical infrastructure, and reduce the availability of essential raw materials. For instance, the World Economic Forum's 2024 Global Risks Report highlighted that extreme weather events are the most likely risks to manifest in the next two years, directly impacting logistics and production.

Applied Industrial Technologies must proactively evaluate and address these climate-induced vulnerabilities within its supply chain. This assessment is crucial for maintaining uninterrupted operations and preventing significant financial repercussions. Companies are increasingly investing in supply chain resilience, with a projected global market for supply chain risk management software reaching $5.6 billion by 2027, indicating a strong industry focus on mitigating such threats.

Investors, customers, and regulators are increasingly demanding that companies embrace and report on Environmental, Social, and Governance (ESG) criteria. Applied Industrial Technologies faces pressure to showcase its dedication to sustainability, aiming to shrink its carbon footprint and implement responsible practices across its entire supply chain.

For instance, a significant majority of institutional investors, around 85% as of early 2024, now consider ESG factors in their investment decisions, highlighting the critical nature of ESG reporting for companies like Applied Industrial Technologies.

Global concerns over dwindling natural resources are increasingly pushing industries to embrace circular economy models. This shift emphasizes waste reduction, enhanced recycling, and the adoption of sustainable materials. For instance, the World Economic Forum highlighted that adopting circular economy practices could unlock $4.5 trillion in economic value by 2030.

Applied Industrial Technologies is well-positioned to capitalize on this trend by developing and supplying products designed for longevity, ease of repair, and recyclability. This directly supports the environmental goals of its clients and the broader market, potentially leading to increased demand for its sustainable solutions.

Emissions Reduction and Energy Efficiency

Governments globally are intensifying efforts to curb carbon emissions, compelling industrial players like Applied Industrial Technologies' customers to minimize their greenhouse gas (GHG) output across all scopes. For instance, the European Union's Fit for 55 package aims for a 55% net GHG reduction by 2030 compared to 1990 levels, directly impacting manufacturing operations.

Applied Industrial Technologies is well-positioned to assist clients in meeting these stringent environmental mandates and enhancing energy efficiency. Their advanced industrial technologies, including smart sensors and optimized control systems, directly address the need for reduced energy consumption and lower emissions in industrial processes.

Key contributions include:

- Enabling Scope 1 & 2 Emission Reduction: Through energy-efficient machinery and process optimization solutions, directly cutting on-site emissions and purchased energy-related emissions.

- Facilitating Scope 3 Engagement: Providing technologies that improve supply chain efficiency and product lifecycle management, indirectly lowering emissions associated with raw materials and logistics.

- Driving Energy Savings: Implementing advanced monitoring and automation systems that have shown to reduce energy usage in manufacturing by up to 15-20% in pilot programs.

- Supporting Regulatory Compliance: Offering solutions that help companies meet evolving emissions standards and reporting requirements, such as those mandated by the EPA in the United States.

Waste Management and Pollution Control

Global environmental regulations are tightening, impacting industries significantly. Stricter rules on waste management, air quality, and water conservation are becoming the norm worldwide. For instance, the European Union's Circular Economy Action Plan, updated in 2023, aims to reduce waste generation and promote resource efficiency, with ambitious targets for recycling rates and waste reduction by 2030.

Manufacturers are now mandated to adopt best available techniques (BAT) to lessen their environmental footprint and guarantee the safe disposal of hazardous substances. This includes investing in advanced pollution control technologies and waste treatment processes. In 2024, the US Environmental Protection Agency (EPA) continued to enforce regulations like the Clean Air Act and Clean Water Act, with significant penalties for non-compliance.

Applied Industrial Technologies' client base faces direct pressure to adhere to these evolving environmental laws. Consequently, there's a growing demand for innovative solutions that facilitate effective waste management and robust pollution control. Companies are actively seeking technologies that optimize resource use, minimize emissions, and ensure compliance, driving market opportunities for providers of such services and equipment.

- Global Waste Reduction Targets: Many nations are setting ambitious waste reduction goals. For example, the UN Environment Programme reported in 2024 that over 190 countries have national waste management strategies, with many aiming for a 50% reduction in municipal solid waste by 2030.

- Air Quality Standards: In 2025, air quality standards are expected to become even more stringent in major economies, pushing industries to invest in advanced emission control systems. The World Health Organization's updated air quality guidelines in 2023 recommend lower levels for pollutants like PM2.5 and ozone.

- Water Conservation Mandates: Water scarcity is driving stricter water conservation regulations. By 2024, several regions, particularly in the Middle East and parts of North America, have implemented or are planning to implement stricter water usage permits and wastewater discharge limits.

- Hazardous Waste Disposal Costs: The cost of proper hazardous waste disposal continues to rise, incentivizing companies to minimize waste generation through process optimization and recycling. In 2024, the average cost for hazardous waste disposal in the US ranged from $500 to $2,000 per ton, depending on the waste type.

The increasing focus on environmental sustainability is reshaping industrial practices and market demands. Applied Industrial Technologies must navigate evolving regulations and capitalize on the growing need for eco-friendly solutions.

Companies are under pressure to reduce their carbon footprint, with many investors and consumers prioritizing ESG performance. For instance, by early 2024, approximately 85% of institutional investors considered ESG factors in their decisions, making sustainability a critical business imperative.

The global push towards a circular economy, emphasizing waste reduction and resource efficiency, presents significant opportunities. This shift could unlock trillions in economic value by 2030, as noted by the World Economic Forum, directly benefiting companies offering sustainable technologies.

Governments worldwide are implementing stricter environmental regulations, particularly concerning carbon emissions and waste management. For example, the EU's Fit for 55 package targets a 55% GHG reduction by 2030, directly influencing industrial operations and driving demand for emission-reducing technologies.

PESTLE Analysis Data Sources

Our PESTLE analysis for Applied Industrial Technologies is built on a robust foundation of data from leading industry associations, financial market reports, and government regulatory bodies. We meticulously gather insights on technological advancements, economic indicators, and socio-cultural trends to ensure a comprehensive view.