Applied Industrial Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Applied Industrial Technologies Bundle

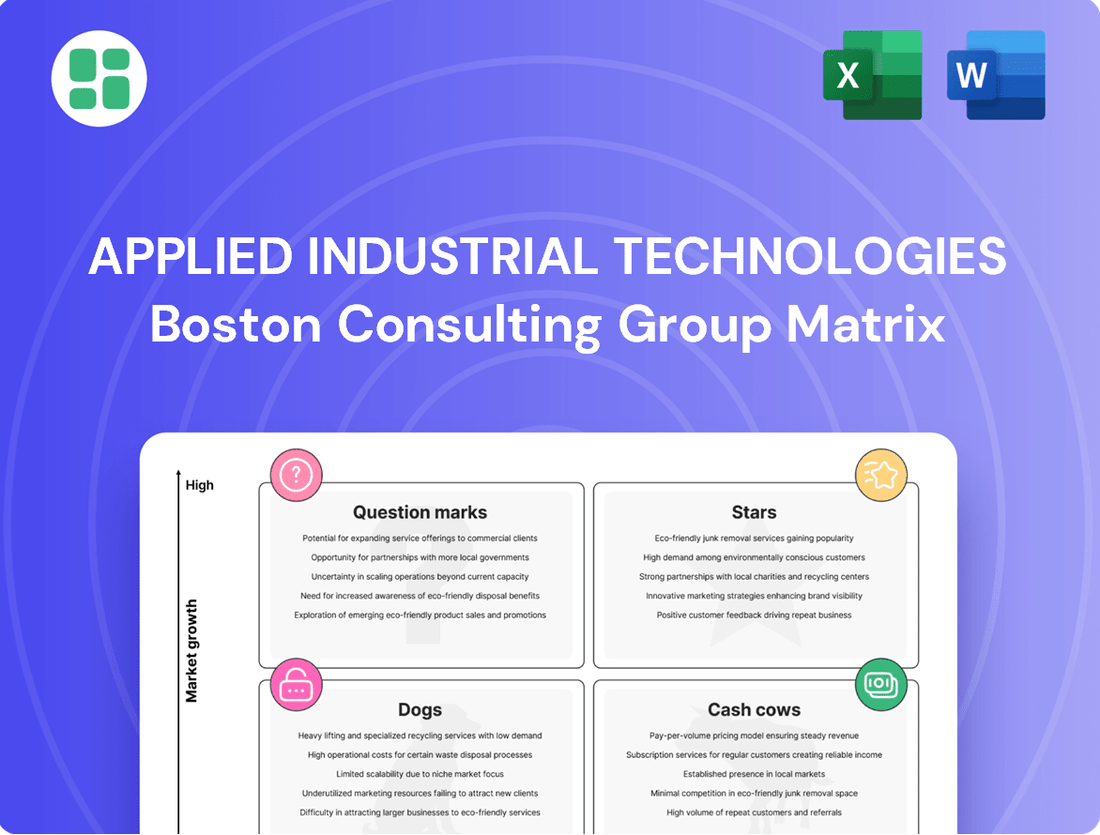

Curious about Applied Industrial Technologies' market standing? Our BCG Matrix preview offers a glimpse into their product portfolio's potential, categorizing them as Stars, Cash Cows, Dogs, or Question Marks. Don't settle for a partial view; unlock the full strategic advantage.

Purchase the complete Applied Industrial Technologies BCG Matrix to gain a comprehensive understanding of their product performance and market share. This detailed report provides the actionable insights you need to make informed investment decisions and optimize your business strategy.

Don't miss out on the opportunity to leverage expert analysis. The full BCG Matrix for Applied Industrial Technologies is your key to identifying growth opportunities and mitigating risks, ensuring your business stays ahead of the curve.

Stars

Applied Industrial Technologies is making substantial moves in automation, acquiring IRIS Factory Automation and Grupo Kopar to bolster its offerings. These strategic acquisitions are designed to expand its automation platform significantly.

The company is seeing encouraging order trends in its automation segment, particularly in technology and process markets. This positive momentum indicates strong growth potential for the near future.

Applied Industrial Technologies views automation as a critical engine for growth and improved earnings through fiscal 2025 and beyond. This strategic focus highlights the company's commitment to this high-potential area.

Applied Industrial Technologies' Advanced Fluid Power Solutions segment is a key player, bolstered by the late 2024 acquisition of Hydradyne, LLC. This strategic move significantly strengthens Applied's existing leadership in fluid power distribution by integrating Hydradyne's advanced service capabilities and a robust product portfolio.

The acquisition is designed to capitalize on complementary technical expertise and drive innovation in engineered solutions. These solutions cater to both established and developing end markets, positioning Applied for enhanced market penetration and technological advancement in fluid power applications.

Applied Industrial Technologies anticipates that this integration will be a significant driver of future growth and operational momentum. The company expects the combined strengths to translate into tangible benefits and expanded market reach within the fluid power sector.

Applied Industrial Technologies' digital sales channels, particularly Applied.com and EDI, are experiencing robust growth, outpacing the company's overall sales trajectory in fiscal 2024. This surge signifies a strong market adoption and increasing customer reliance on these platforms for their industrial supply needs.

With fiscal 2024 seeing digital channels grow faster than the company's total sales, this segment is clearly a high-growth area for Applied. The company's commitment to ongoing investments and planned digital upgrades for fiscal 2025 underscores its strategy to further capitalize on these expanding opportunities and enhance market penetration.

Solutions for Technology and Data Center Verticals

Applied Industrial Technologies is seeing significant growth in its technology sector, particularly in semiconductors and the equipment used for their manufacturing. This surge is driven by the increasing demand for advanced electronics and the ongoing need for sophisticated fabrication processes.

The company is also well-positioned to capitalize on the expansion of data center infrastructure. Applied provides essential flow control and robotics solutions that are critical for server cooling systems and the efficient handling of materials within these facilities. These are key areas for technological advancement and operational efficiency.

These markets represent high-growth opportunities for Applied Industrial Technologies. The company is actively enhancing its presence and expertise in these areas, aligning its strategy with the trajectory of these dynamic industries. For instance, the global data center market was valued at approximately $276.5 billion in 2023 and is projected to grow substantially in the coming years.

- Semiconductor Equipment Demand: Applied is experiencing a rebound in demand for fabrication equipment, a critical component of the semiconductor supply chain.

- Data Center Infrastructure Growth: The company's solutions support the expanding needs of data centers, focusing on areas like server cooling and material handling.

- Strategic Market Focus: Applied is increasing its exposure and capabilities in these high-growth technology and data center markets.

Strategic Acquisitions for Growth

Applied Industrial Technologies' growth strategy is significantly bolstered by its approach to strategic acquisitions. This isn't just about buying companies; it's about integrating them to drive earnings per share (EPS) and expand market reach.

These acquisitions are often categorized as bolt-on or mid-size, fitting neatly into Applied's existing operations or expanding into adjacent, high-growth sectors. For example, the 2023 acquisition of Hydradyne, a fluid power distributor, was a key move. This was followed by the acquisition of IRIS Factory Automation and Grupo Kopar, further diversifying their portfolio and strengthening their presence in automation solutions. These moves are not speculative; they are calculated steps to enhance their competitive standing.

The impact of these acquisitions is felt quickly. Companies like Hydradyne immediately begin contributing to Applied's overall sales figures. More importantly, they are expected to be accretive to earnings, meaning they are projected to increase the company's profitability from the outset. This focus on immediate and future financial benefit underscores the strategic nature of Applied's M&A activity.

- Strategic Acquisitions Drive Growth: Applied Industrial Technologies actively pursues bolt-on and mid-size acquisitions as a core growth strategy.

- Key Acquisitions in 2023: Notable acquisitions include Hydradyne, IRIS Factory Automation, and Grupo Kopar, expanding into high-growth areas.

- EPS Accretion: Acquired businesses are expected to contribute to sales and be accretive to earnings, enhancing profitability.

- Market Share Expansion: These strategic moves are designed to expand market share and strengthen Applied's competitive position.

Applied Industrial Technologies' technology sector, particularly in semiconductors and related manufacturing equipment, is a significant growth area. The company also benefits from the expansion of data centers, providing essential flow control and robotics for cooling and material handling. These markets are experiencing robust demand, with the global data center market valued at approximately $276.5 billion in 2023 and projected for continued substantial growth.

What is included in the product

This BCG Matrix analysis categorizes Applied Industrial Technologies' business units into Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic recommendations on investment, holding, or divestment for each unit.

The Applied Industrial Technologies BCG Matrix offers a clear, one-page overview, simplifying complex business unit performance for strategic decision-making.

Cash Cows

Bearings and standard power transmission components are a cornerstone of Applied Industrial Technologies' portfolio, firmly positioned as Cash Cows within the BCG Matrix. This segment operates in a mature market, characterized by consistent demand for essential maintenance, repair, and operations (MRO) across a broad industrial base.

Applied Industrial Technologies commands a substantial and stable market share in this category. For instance, in 2024, the industrial bearings market alone was valued at approximately $25 billion globally, with power transmission components adding significantly to this figure. These products are critical for the ongoing functionality of machinery, ensuring predictable revenue streams.

Applied Industrial Technologies' General MRO Service Center Operations function as a classic Cash Cow within its BCG Matrix. This segment offers a diverse range of maintenance, repair, and operations supplies, creating a predictable and consistent revenue flow. The company's strong technical standing and the perpetual need for 'break-fix' solutions solidify its position as a steady cash generator.

Despite some fluctuations in organic sales growth, the MRO segment benefits from a wide customer reach and a well-established distribution infrastructure, ensuring continued profitability. For instance, Applied Industrial Technologies reported that its service center segment generated approximately $1.3 billion in revenue for fiscal year 2023, highlighting its significant contribution to the company's overall financial health.

Applied Industrial Technologies' established fluid power distribution business is a classic cash cow, holding a substantial market share in a mature industry. This segment consistently generates strong, reliable cash flow, essential for funding growth initiatives and other business units.

Serving a broad customer base with fundamental fluid power components and services, this division benefits from consistent demand. For instance, in fiscal year 2023, Applied generated $4.1 billion in revenue, with fluid power being a significant contributor, underscoring its stability.

The strategic acquisition of Hydradyne in 2022 significantly bolstered Applied's position in the fluid power market, further cementing its leadership and enhancing its cash-generating capabilities within this established segment.

Core Industrial Distribution Network and Infrastructure

Applied Industrial Technologies' extensive distribution network, boasting over 590 locations, acts as a significant cash cow. This vast infrastructure is crucial for efficiently delivering a broad range of Maintenance, Repair, and Operations (MRO) and Original Equipment Manufacturer (OEM) products and services.

The company's deep-rooted relationships with its MRO and OEM customer base, facilitated by this widespread presence, contribute to stable and predictable sales. This consistent demand allows the distribution network to generate strong cash flows from its diverse product offerings.

This established network represents a formidable competitive advantage, particularly in a market characterized by fragmentation. It enables Applied Industrial Technologies to effectively serve a wide geographic area and a large customer base, solidifying its position.

- Over 590 distribution locations

- Strong MRO and OEM customer relationships

- Consistent sales and cash generation

- Key competitive advantage in a fragmented market

Flow Control Solutions for Critical Infrastructure

Flow control solutions, representing about 15% of Applied Industrial Technologies' overall business, are vital for numerous industrial processes and critical infrastructure. This segment is a consistent profit contributor, benefiting from recurring maintenance, repair, and operations (MRO) activities and stable demand within essential sectors.

The steady demand profile for these solutions makes them a reliable cash generator for the company. In 2024, Applied Industrial Technologies reported that its Flow Control segment generated substantial revenue, underscoring its role as a cash cow.

- Segment Contribution: Flow control solutions account for approximately 15% of Applied Industrial Technologies' total revenue.

- Profitability Driver: This segment offers higher margins due to recurring MRO activity and consistent demand.

- Market Stability: Essential industries ensure a steady demand for flow control solutions, making it a reliable cash generator.

- 2024 Performance: The Flow Control segment demonstrated robust financial performance in 2024, reinforcing its cash cow status.

Applied Industrial Technologies' bearings and standard power transmission components are firmly established as Cash Cows. This segment benefits from consistent demand in mature markets, ensuring predictable revenue streams for the company.

The company's strong market share in these essential industrial supplies, valued in the billions globally, reinforces their status as reliable cash generators. For instance, the global industrial bearings market alone was projected to reach around $25 billion in 2024, with power transmission components adding further to this substantial market.

Applied Industrial Technologies' General MRO Service Center Operations and its extensive fluid power distribution business also exemplify Cash Cow characteristics. These divisions leverage established customer relationships and broad distribution networks, contributing significantly to the company's overall financial stability and cash flow generation.

The company's strategic acquisitions, like Hydradyne, have further solidified its market position in these mature segments, enhancing their ability to generate consistent returns. In fiscal year 2023, Applied Industrial Technologies reported total revenues of $4.1 billion, with these established segments playing a crucial role in that performance.

| Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Approx.) |

|---|---|---|---|

| Bearings & Standard Power Transmission | Cash Cow | Mature market, consistent demand, high market share | Significant portion of total revenue |

| General MRO Service Centers | Cash Cow | Predictable revenue, strong technical standing, broad customer reach | ~$1.3 billion |

| Fluid Power Distribution | Cash Cow | Established market, strong cash flow, strategic acquisitions | Significant portion of total revenue |

What You’re Viewing Is Included

Applied Industrial Technologies BCG Matrix

The preview of the Applied Industrial Technologies BCG Matrix you are currently viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive report, designed for strategic insight, contains no watermarks or demo content, ensuring you get immediate access to actionable market analysis. You can confidently expect the final, professionally crafted BCG Matrix to be ready for your business planning and competitive strategy development right after your transaction. This preview accurately represents the quality and detail of the complete report, enabling you to make an informed decision before acquiring it.

Dogs

Certain legacy product lines within Applied Industrial Technologies, such as older hydraulic systems or less efficient conveyor components, are likely in the Dogs category. These products have been largely superseded by newer, more advanced technologies, leading to declining demand and market relevance.

These legacy offerings typically exhibit low sales volumes and a shrinking market share, offering minimal growth prospects for the company. For instance, sales of older-generation industrial motors might have seen a year-over-year decline of 5-10% by mid-2024, reflecting this trend.

Applied Industrial Technologies would strategically minimize further investment in these areas, focusing resources on more promising growth segments. The company may consider a phased exit or divestment strategy for these underperforming product lines to reallocate capital effectively.

Applied Industrial Technologies may offer products or services in niche industrial sectors that are either very fragmented or experiencing decline. These areas often see Applied with a limited grip on the market and not much of a competitive edge. For instance, in 2024, the company might still serve certain legacy equipment maintenance needs in industries like older manufacturing plants, where competition is fierce and margins are thin.

These types of offerings can demand a significant amount of resources and attention, yet they yield minimal returns. This situation can tie up valuable capital and personnel that could otherwise be directed towards more promising or strategically important ventures. For example, supporting a very specific, low-volume spare part for an obsolete industrial machine might consume engineering time without contributing meaningfully to growth objectives.

Such offerings might also diverge from Applied's core strategy, which often emphasizes technical expertise and expansion into high-growth markets. If these niche areas don't align with the company's forward-looking vision or its strengths in advanced solutions, they represent a potential drain on resources and a missed opportunity for more impactful investments. Imagine a scenario where a small segment of their business focuses on manual calibration services for outdated scientific instruments, a task that requires specialized labor but offers little scalability or technological advancement.

While Applied Industrial Technologies' Service Center segment generally operates as a Cash Cow, certain individual regional centers might be experiencing challenges. These underperforming locations, particularly those situated in severely depressed local industrial economies, could exhibit characteristics of a Question Mark.

For instance, a specific regional center might hold a low market share within its particular micro-market and face difficulties in achieving organic growth. This situation necessitates a careful evaluation for potential restructuring or even divestiture to optimize the company's overall portfolio.

Outdated Inventory from Slow-Moving Categories

Outdated inventory in slow-moving categories represents a significant drag on Applied Industrial Technologies' financial health. This includes components or supplies that are no longer in demand due to technological advancements or changing customer needs. For instance, in 2024, many industrial distributors reported increased write-downs on older electrical components as automation systems rapidly evolved.

This type of inventory ties up valuable working capital, preventing its deployment into more profitable ventures. Carrying costs, such as warehousing, insurance, and potential obsolescence reserves, further erode margins. Companies like Applied Industrial Technologies must actively manage these 'cash traps' to maintain operational efficiency.

- Obsolescence Risk: Technological shifts in sectors like robotics and advanced manufacturing can render existing parts obsolete quickly.

- Carrying Costs: In 2024, average inventory carrying costs for industrial distributors ranged from 15% to 30% of inventory value annually.

- Capital Impairment: Slow-moving inventory represents capital that is not generating revenue, impacting return on investment.

- Management Imperative: Proactive inventory management, including regular stock reviews and targeted sales, is critical for mitigation.

Commoditized Offerings Without Value-Added Services

In segments where Applied Industrial Technologies' offerings are largely commoditized and lack distinct value-added services, profitability can be significantly challenged. These products often face intense price competition, leading to thin margins and difficulty in expanding market share. For instance, in 2024, many basic industrial components saw price erosion due to oversupply in certain markets, impacting companies that couldn't bundle them with specialized services or support.

Such commoditized offerings may at best break even, contributing minimally to the company's overall financial performance and strategic growth objectives. Applied Industrial Technologies' deliberate strategy to focus on technical solutions and integrated services is designed precisely to steer clear of these low-value traps. This approach aims to differentiate their portfolio by offering expertise and tailored solutions rather than just standard products.

The company's commitment to innovation and customer-specific solutions is a direct countermeasure against the risks associated with commoditization. For example, their investments in advanced predictive maintenance software for industrial equipment, launched in late 2023 and gaining traction through 2024, represent a move to add significant value beyond the physical product itself. This strategy aims to secure higher margins and build stronger customer loyalty.

- Market Share Erosion: Companies in commoditized markets without differentiation often see their market share decline as competitors offer similar products at lower prices.

- Low Profit Margins: Basic, undifferentiated products typically yield single-digit profit margins, making significant revenue contribution difficult.

- Strategic Focus on Value-Add: Applied Industrial Technologies prioritizes technical expertise and integrated solutions to avoid the pitfalls of pure commodity sales.

- 2024 Market Conditions: Reports from late 2024 indicated that sectors with high product standardization experienced an average profit margin contraction of 2-3% compared to the previous year.

Products categorized as Dogs within Applied Industrial Technologies represent legacy offerings or those in declining niche markets. These products, like older hydraulic systems or specific spare parts for obsolete machinery, exhibit low sales volumes and shrinking market share. By mid-2024, sales of older industrial motors, for instance, might have declined by 5-10% year-over-year, illustrating this trend.

Applied Industrial Technologies strategically minimizes investment in these areas, often considering phased exits or divestments to reallocate capital. For example, the company might still service niche maintenance needs in older manufacturing plants, but these areas are characterized by fierce competition and thin margins, yielding minimal returns and tying up valuable resources.

These "Dog" segments, such as commoditized basic industrial components, often face intense price competition, resulting in thin margins and limited growth potential. Reports from late 2024 indicated that sectors with high product standardization experienced an average profit margin contraction of 2-3% compared to the previous year, underscoring the challenges.

Applied Industrial Technologies' focus on technical expertise and integrated services is a direct strategy to avoid these low-value traps, aiming to differentiate its portfolio and secure higher margins. This proactive approach ensures resources are channeled towards more impactful investments and growth objectives.

Question Marks

Applied Industrial Technologies' strategic bolt-on acquisitions, such as IRIS Factory Automation, are introducing cutting-edge automation technologies into nascent markets. These engineered solutions are designed to penetrate highly specialized industrial niches and new geographic territories, areas where Applied's presence is currently nascent.

While these emerging segments offer substantial growth prospects, Applied's market share within these specific new domains is still in its formative stages. Consequently, significant capital investment will be necessary to achieve scalable operations and establish a dominant position.

Applied Industrial Technologies is enhancing its Internet of Things (IoT) and digital integration services, crucial for Industry 4.0. These offerings are in early adoption for many clients, presenting a high-growth opportunity.

The company's market share in these advanced digital solutions is likely still developing. This necessitates substantial investment to capture a significant portion of this burgeoning market.

Applied Industrial Technologies is strategically positioning its flow control business to capitalize on the burgeoning demand for decarbonization solutions. This focus targets a high-growth, albeit nascent, market driven by global sustainability mandates.

The company's investment in specialized solutions for initiatives like carbon capture and hydrogen infrastructure signifies a commitment to capturing market share in this evolving sector. While the overall market potential is substantial, Applied's current penetration in these niche areas might be limited, necessitating significant R&D and market development efforts.

Expansion into New High-Growth Geographies with Emerging Solutions

Applied Industrial Technologies' strategic expansion into high-growth geographies, exemplified by its acquisition of Grupo Kopar in Mexico, positions it firmly within the question marks quadrant of the BCG matrix. This move targets the burgeoning demand for automation and engineered solutions in emerging markets.

These new territories present substantial growth potential, but Applied is still in the early stages of establishing its brand presence and market share for these specialized offerings. Consequently, significant ongoing investment is required to nurture these ventures and capitalize on their inherent growth prospects.

- Geographic Focus: Mexico, with a specific emphasis on automation and engineered solutions.

- Market Growth: High growth rates are anticipated in these emerging markets.

- Investment Needs: Continued investment is necessary to build brand recognition and market share.

- Strategic Rationale: To capture early market share in rapidly expanding sectors.

Customized Engineering for Nascent High-Tech Applications

Customized engineering for nascent high-tech applications represents a niche within the Applied Industrial Technologies sector, often categorized as a question mark in the BCG Matrix. These services are characterized by their highly specialized nature, tailoring solutions for emerging technologies that are not yet widely adopted. The demand is driven by companies pushing the boundaries of innovation, requiring bespoke design and engineering to bring their cutting-edge products to life.

These projects inherently carry significant risk due to the unproven nature of the technologies and markets they serve. However, they also offer substantial growth potential if the applications achieve market acceptance. For instance, the burgeoning field of quantum computing hardware development in 2024 necessitates highly specialized engineering for cryogenics and control systems, areas with immense future upside but also considerable upfront investment and technical uncertainty.

- High R&D Intensity: Companies offering these services often have substantial research and development expenditures, as demonstrated by the average R&D as a percentage of revenue for advanced materials engineering firms, which can exceed 15% in early-stage projects.

- Project-Based Revenue: Revenue streams are typically project-based rather than recurring, reflecting the bespoke nature of the work and the developmental stage of the applications.

- Strategic Partnerships: Success often hinges on forming strategic partnerships with key players in emerging technology sectors, enabling access to pilot projects and early market validation.

- Talent Acquisition: A critical factor is the ability to attract and retain highly skilled engineers and scientists with expertise in niche, advanced fields, a challenge in a competitive labor market.

Applied Industrial Technologies' engagement in nascent, high-growth markets, such as advanced automation in emerging economies or specialized components for new energy technologies, places it squarely in the question mark category of the BCG matrix. These ventures require significant investment to build market share and brand recognition.

The company's strategic acquisitions and organic growth initiatives in these areas, like the expansion into Mexico with Grupo Kopar, highlight a deliberate strategy to cultivate future revenue streams. While the growth potential is substantial, the current market penetration and profitability are still developing, necessitating continued capital allocation.

Applied Industrial Technologies' focus on Industry 4.0 digital integration and decarbonization solutions also falls into this quadrant. These are high-potential markets, but adoption rates are still maturing, demanding ongoing investment in technology and market development to secure a leading position.

The company's commitment to customized engineering for cutting-edge applications, such as those in quantum computing hardware in 2024, exemplifies the question mark profile. These projects are R&D intensive and carry inherent risks but offer significant long-term upside if the technologies gain traction.

| Initiative/Market Segment | Market Growth Potential | Current Market Share | Investment Requirement | Strategic Outlook |

|---|---|---|---|---|

| Automation in Mexico (Grupo Kopar) | High | Nascent | Significant | Build brand, scale operations |

| IoT & Digital Integration (Industry 4.0) | Very High | Developing | Substantial | Capture early adopters, expand service offerings |

| Decarbonization Solutions (Hydrogen, Carbon Capture) | High | Niche | High | Develop specialized solutions, secure early projects |

| Customized Engineering for Nascent Tech (e.g., Quantum Computing Components) | Extremely High | Minimal | Very High (R&D Intensive) | Partner with innovators, develop core competencies |

BCG Matrix Data Sources

Our Applied Industrial Technologies BCG Matrix is built on a foundation of comprehensive data, including company financial reports, market research, and industry growth forecasts.