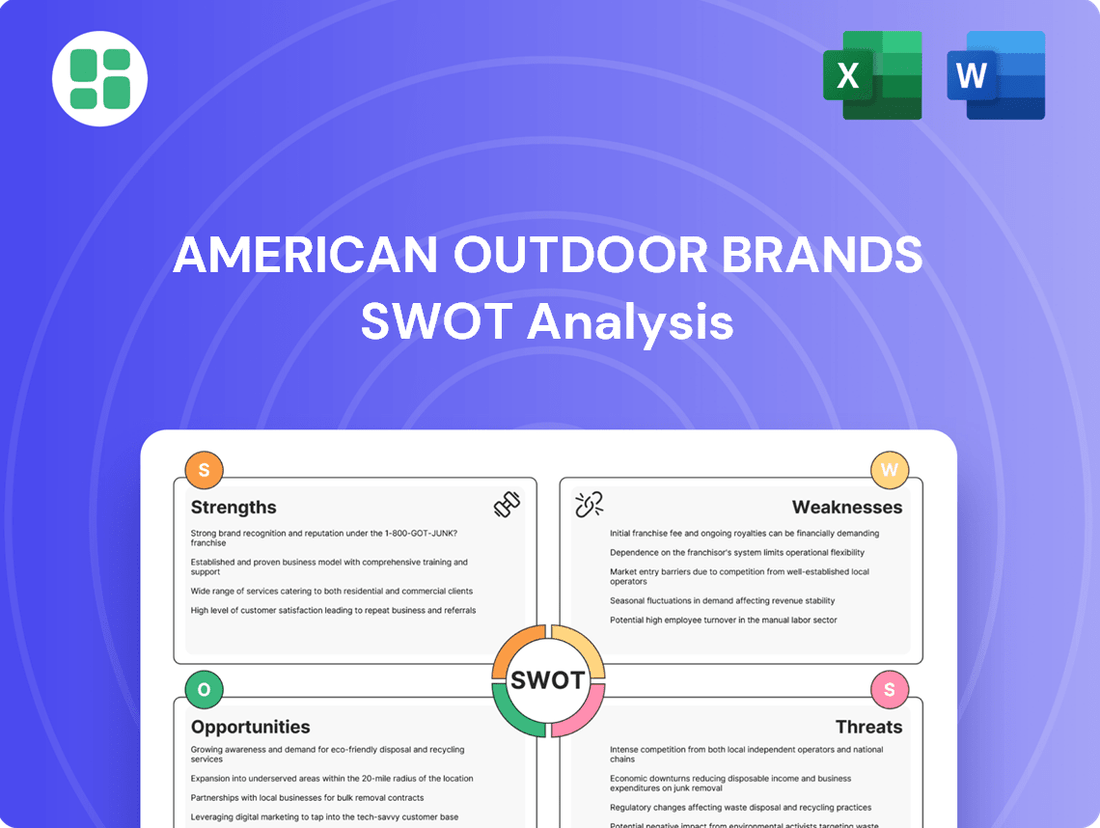

American Outdoor Brands SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Outdoor Brands Bundle

American Outdoor Brands leverages strong brand recognition and a diverse product portfolio, but faces challenges in supply chain management and evolving consumer preferences. Understanding these internal capabilities and external market forces is crucial for strategic decision-making.

Want the full story behind American Outdoor Brands' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

American Outdoor Brands' diverse product portfolio is a significant strength, encompassing hunting, fishing, camping, shooting, and personal security gear. This broad offering appeals to a wide range of outdoor enthusiasts, reducing the company's vulnerability to fluctuations in any single market segment. The company's strategy to cultivate over 20 early-stage consumer 'lifestyle' brands, including recognized names like BOG, BUBBA, Caldwell, and Grilla, further solidifies its market presence and brand recognition across various outdoor activities.

American Outdoor Brands' robust innovation strategy is a cornerstone of its growth, driven by its 'Dock & Unlock' process. This systematic approach to product development has proven highly effective, with new product introductions accounting for a significant portion of sales. In fiscal year 2024, these innovations contributed over 23% to net sales, followed by 21.5% in fiscal year 2025, demonstrating consistent success in bringing new offerings to market.

The company actively fuels this innovation by consistently launching new and improved products designed to resonate with current consumer demands and broaden market reach. Recent examples like the BUBBA Pro Series Smart Fish Scale and the Caldwell Claymore Solo highlight their commitment to staying ahead of market trends and meeting evolving customer needs through thoughtful product enhancement and development.

American Outdoor Brands boasts a robust financial position, concluding fiscal year 2024 without any debt and holding approximately $30 million in cash. This strong balance sheet provides significant financial agility, enabling strategic investments, potential acquisitions, and share buybacks.

The company demonstrated consistent top-line growth, achieving a 10.6% increase in net sales for fiscal year 2025. Alongside this sales expansion, American Outdoor Brands also reported a substantial improvement in its adjusted EBITDA, highlighting enhanced operational efficiency and profitability.

Expanding Distribution Channels

American Outdoor Brands has made significant strides in broadening its distribution, effectively reaching customers through both established retail partners and burgeoning e-commerce platforms. This dual approach saw domestic and international sales climb year-over-year, demonstrating a robust expansion strategy.

The company's commitment to expanding its retail footprint is evident in new placements for brands like MEAT! Your Maker and Grilla, alongside a strengthened presence in the Canadian market. This strategic move ensures greater product accessibility and broadens the overall market reach for its portfolio.

Key distribution highlights include:

- E-commerce Growth: Continued investment in online sales channels, contributing to overall revenue increases.

- Retail Expansion: Successful onboarding of new retail partners, enhancing physical product availability.

- International Reach: Targeted expansion into markets like Canada, diversifying revenue streams and customer base.

Focus on Resilient Outdoor Activities

American Outdoor Brands' strategic focus on resilient consumer activities like hunting, fishing, camping, and outdoor cooking is a significant strength. These pursuits engage a substantial portion of the American population, with an estimated 175 million individuals participating in outdoor recreation. This broad appeal ensures a consistent and stable demand for the company's diverse product offerings.

This emphasis on enduring outdoor pastimes positions American Outdoor Brands to capitalize on long-term participation trends, fostering a robust demand base. The company effectively caters to a wide spectrum of consumers, from those who enjoy casual outdoor experiences to serious enthusiasts seeking high-performance gear.

- Engages 175 Million Americans: Targets popular and enduring outdoor activities.

- Stable Demand Base: Focuses on long-term participation trends in hunting, fishing, and camping.

- Broad Consumer Appeal: Serves both casual and performance-oriented outdoor participants.

American Outdoor Brands' diversified product line, covering hunting, fishing, camping, and personal security, is a key strength. This broad appeal reduces reliance on any single market segment. The company cultivates over 20 lifestyle brands, including BOG and Caldwell, enhancing its market recognition across various outdoor pursuits.

Innovation is a core strength, with new products contributing significantly to sales. In fiscal year 2024, innovations accounted for over 23% of net sales, and in fiscal year 2025, this figure was 21.5%, demonstrating a consistent ability to bring successful new offerings to market.

The company maintains a strong financial footing, ending fiscal year 2024 debt-free with approximately $30 million in cash. This solid balance sheet allows for strategic investments and financial flexibility.

American Outdoor Brands achieved a 10.6% net sales increase in fiscal year 2025, coupled with improved adjusted EBITDA, indicating enhanced profitability and operational efficiency.

| Metric | Fiscal Year 2024 | Fiscal Year 2025 |

|---|---|---|

| Net Sales Growth | N/A | 10.6% |

| New Product Sales Contribution | >23% | 21.5% |

| Debt | $0 | $0 |

| Cash Position | ~$30 million | N/A |

What is included in the product

Analyzes American Outdoor Brands’s competitive position through key internal and external factors, including its brand portfolio, distribution channels, and the dynamic outdoor recreation market.

Offers a clear, actionable roadmap to navigate American Outdoor Brands' market challenges and leverage its competitive advantages.

Weaknesses

American Outdoor Brands' reliance on discretionary consumer spending is a significant weakness. As a seller of outdoor lifestyle products, the company's revenue is directly tied to how much consumers feel they can spend on non-essential items. This makes sales particularly vulnerable when the economy tightens.

For instance, during periods of high inflation or economic uncertainty, consumers often cut back on discretionary purchases first. This can lead to sharp drops in demand for products like camping gear or firearms, impacting American Outdoor Brands' sales figures.

The company's financial performance can therefore experience considerable volatility due to these economic cycles. For example, in fiscal year 2023, while specific discretionary spending data for AOBC isn't readily broken out, broader retail trends indicated consumer caution impacting non-essential goods.

American Outdoor Brands, like many in the outdoor products sector, faces significant sales seasonality. This means demand for their gear, from hunting rifles to camping equipment, surges during specific times of the year, such as fall hunting seasons or summer camping months. For instance, the outdoor recreation market in the US saw significant growth, with consumer spending reaching an estimated $1.1 trillion in 2023, highlighting these seasonal peaks.

This cyclical demand creates a constant challenge for inventory management. The company must accurately forecast these peaks to avoid holding too much unsold stock during slower periods, which ties up capital and incurs carrying costs. Conversely, underestimating demand can lead to stockouts, resulting in lost sales and frustrated customers.

Effectively navigating this seasonality is critical for profitability. For example, a well-managed inventory strategy could have helped mitigate the impact of potential supply chain disruptions, which were prevalent in 2022 and 2023, ensuring products were available when consumer interest was highest.

The outdoor and sporting goods sector is incredibly crowded, with both long-standing companies and emerging brands actively competing for consumer attention. American Outdoor Brands is up against a field where established players often hold significant market sway.

Market analysis from late 2023 and early 2024 highlights that the top five competitors in the outdoor sporting goods market collectively capture a considerable share, putting pressure on smaller or mid-sized companies like American Outdoor Brands.

This fierce competition often translates into pricing challenges, forcing companies to either match lower prices or invest heavily in unique product features and branding to stand out and justify their value proposition.

Potential Supply Chain Disruptions and Cost Volatility

American Outdoor Brands, like many in its sector, faces potential disruptions within its supply chain. For instance, increased tariffs or rising freight expenses, which were notable in 2023 and early 2024, can directly affect the cost of goods sold. The availability of key components is also a concern, potentially impacting production schedules and leading to higher operational costs.

The company's profitability is sensitive to fluctuations in raw material prices. For example, the cost of certain metals or polymers used in their products can experience significant volatility. This cost pressure directly impacts gross margins, making efficient inventory management and strategic sourcing crucial for maintaining financial health.

- Supply Chain Vulnerabilities: Exposure to geopolitical events, labor shortages, and transportation bottlenecks can impede the flow of goods.

- Raw Material Cost Fluctuations: Volatility in prices for steel, plastics, and other essential materials directly impacts manufacturing expenses.

- Impact on Margins: Increased tariffs and shipping costs, as seen in recent years, can erode gross profit margins if not effectively passed on to consumers or mitigated through operational efficiencies.

Challenges in E-commerce Growth Versus Traditional Channels

American Outdoor Brands faced a slight dip in e-commerce net sales in fiscal year 2024, which contrasts with the stronger performance observed in their traditional sales channels. This suggests a potential hurdle in fully leveraging the direct-to-consumer (DTC) model and the growing market for digital outdoor gear purchases.

The company's fiscal year 2024 report indicated that while overall sales saw positive movement, the e-commerce segment experienced a year-over-year decrease. This performance highlights an area where strategic adjustments might be necessary to align with the broader retail shift towards online engagement.

- E-commerce Sales Trend: Fiscal year 2024 saw a slight decline in e-commerce net sales for American Outdoor Brands.

- Traditional Channel Performance: Traditional sales channels demonstrated robust growth during the same period, outperforming e-commerce.

- DTC Capitalization: The results point to potential challenges in fully capitalizing on the direct-to-consumer trend within the outdoor equipment sector.

- Digital Market Importance: Sustaining strong e-commerce growth remains crucial for long-term success in the evolving retail environment.

The company's reliance on discretionary spending makes it susceptible to economic downturns. For instance, consumer spending on outdoor goods, while robust, can contract sharply during periods of high inflation or recession, directly impacting American Outdoor Brands' revenue streams.

Seasonality also presents a significant weakness, as demand for products like hunting gear or camping equipment is concentrated in specific periods. This creates challenges in inventory management and can lead to lost sales if demand is underestimated or excess stock during off-peak times.

Intense competition within the outdoor and sporting goods market means American Outdoor Brands faces pressure on pricing and the need for continuous product innovation to maintain market share against established players and emerging brands.

Supply chain vulnerabilities, including rising freight costs and potential component shortages, continue to be a concern. For example, tariffs and shipping expenses saw notable increases in 2023 and early 2024, directly affecting manufacturing costs and gross margins.

| Weakness | Description | Impact Example (Fiscal Year 2024/2025 Context) |

|---|---|---|

| Discretionary Spending Reliance | Revenue is tied to non-essential consumer purchases, making it vulnerable to economic slowdowns. | Consumer caution in late 2023 and early 2024 led to reduced spending on non-essential outdoor items. |

| Sales Seasonality | Demand peaks during specific times of the year, complicating inventory and production planning. | Managing inventory for peak hunting seasons requires accurate forecasting to avoid stockouts or excess stock. |

| Intense Market Competition | Facing numerous competitors, including large established brands and agile new entrants. | Market analysis indicates significant market share held by top competitors, pressuring pricing and requiring differentiation. |

| Supply Chain Vulnerabilities | Susceptible to disruptions, tariffs, and rising transportation and material costs. | Increased freight costs and raw material price volatility in 2023-2024 directly impacted manufacturing expenses and gross margins. |

Preview the Actual Deliverable

American Outdoor Brands SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual American Outdoor Brands SWOT analysis, offering a clear view of its strengths, weaknesses, opportunities, and threats. The full, detailed report becomes available immediately after purchase.

Opportunities

American Outdoor Brands has a clear opportunity to tap into burgeoning outdoor niches, such as smart and connected gear, which aligns with evolving consumer tech trends. This expansion could capture a new segment of tech-savvy outdoor enthusiasts.

The Asia-Pacific outdoor equipment market is a particularly attractive growth frontier, with projections indicating significant expansion in the coming years. This region represents a substantial untapped market for the company's product offerings.

Further international expansion, building on successes like their increased presence in Canada, offers another avenue for growth. Exploring other international markets can diversify revenue streams and broaden brand reach.

The shift towards online purchasing remains a powerful force, with digital sales in the outdoor equipment sector projected to hit 35% of the total market by 2025. This presents a significant opportunity for American Outdoor Brands to expand its reach.

By strengthening its e-commerce platforms and direct-to-consumer (D2C) channels, the company can tap into a growing segment of consumers who prefer the convenience of online shopping. This digital focus allows for more direct engagement and data collection from a tech-savvy customer base.

American Outdoor Brands' robust financial health, highlighted by a debt-free balance sheet and substantial cash reserves as of early 2024, creates significant opportunities for strategic acquisitions. This strong financial footing allows the company to pursue targets that align with its growth objectives without the burden of existing debt, enabling more flexible deal structures and a greater capacity for integration.

The company can leverage its financial strength to acquire complementary brands or technologies, thereby diversifying its product portfolio and expanding its reach into new market segments. For instance, acquiring a company with a strong presence in a less penetrated outdoor activity could open up new customer bases and revenue streams, enhancing overall market penetration and brand resilience.

Strategic partnerships, such as the collaboration with Major League Fishing, offer a cost-effective avenue to boost brand visibility and engage directly with a highly relevant consumer base. These alliances can generate significant marketing impact and brand loyalty, contributing to market share growth and reinforcing its position within the outdoor enthusiast community.

Leveraging Technology and Product Innovation

The outdoor sector is experiencing a surge in demand for smart, connected gear, incorporating AI and sensors. American Outdoor Brands' 'Dock & Unlock' innovation process is well-suited to capitalize on this trend by developing products with advanced features, exemplified by their BUBBA Pro Series Smart Fish Scale.

Continued investment in research and development, particularly in technology integration, is crucial for American Outdoor Brands to maintain a significant competitive edge in this evolving market.

- Smart Apparel Demand: The global smart clothing market is projected to reach $10.7 billion by 2027, growing at a CAGR of 26.5%.

- Innovation Pipeline: American Outdoor Brands' focus on product innovation, like the BUBBA Pro Series Smart Fish Scale, aligns with consumer interest in tech-enhanced outdoor experiences.

- R&D Investment: Increased R&D spending allows for the development of proprietary technologies that can differentiate their product offerings.

Capitalizing on Health and Wellness Trends

The increasing focus on health and wellness, alongside a surge in outdoor recreation, creates a significant market opening. Younger consumers, in particular, are turning to outdoor pursuits as a way to disconnect from screens and prioritize physical fitness. For instance, a 2024 report indicated a 15% year-over-year increase in participation for activities like hiking and camping among those aged 18-34.

American Outdoor Brands can strategically align its product development and marketing efforts to resonate with this growing segment. By emphasizing authentic outdoor experiences and the well-being benefits associated with them, the company can attract and retain these consumers. This demographic's willingness to invest in quality gear for these activities is a key driver.

- Growing Health Consciousness: Consumers are actively seeking activities that promote physical and mental well-being.

- Digital Detox Appeal: Outdoor recreation offers a popular antidote to screen time, particularly for younger demographics.

- Targeted Marketing: Messaging that highlights the health benefits and authentic nature of outdoor experiences can capture this market.

- Product Innovation: Developing gear that supports these wellness-focused outdoor activities is crucial for market penetration.

American Outdoor Brands can capitalize on the growing demand for smart and connected outdoor gear, a trend supported by the global smart clothing market projected to reach $10.7 billion by 2027. Their innovation process, as seen with the BUBBA Pro Series Smart Fish Scale, positions them well to integrate technology like AI and sensors into products. This focus on R&D allows for differentiation and appeals to consumers seeking enhanced outdoor experiences.

| Opportunity Area | Key Trend/Data Point | Potential Impact |

|---|---|---|

| Smart & Connected Gear | Global smart clothing market to reach $10.7B by 2027 (26.5% CAGR) | Capture tech-savvy outdoor enthusiasts, differentiate products |

| E-commerce Growth | Digital sales in outdoor equipment to reach 35% by 2025 | Expand reach, direct customer engagement, data collection |

| Financial Strength | Debt-free balance sheet, substantial cash reserves (early 2024) | Strategic acquisitions, portfolio diversification, market expansion |

Threats

Ongoing economic uncertainty, including the persistent threat of recessions and high inflation, directly impacts consumer discretionary spending. This macroeconomic environment creates significant headwinds for companies like American Outdoor Brands, as consumers tend to cut back on non-essential purchases during uncertain times.

These pressures can lead to reduced demand for outdoor lifestyle products, ultimately affecting American Outdoor Brands' sales volumes and profitability. The company itself acknowledged navigating an environment of heightened consumer uncertainty throughout fiscal year 2024, highlighting the tangible impact of these economic challenges.

Consumer tastes in the outdoor sector are dynamic, with a notable shift towards casualization and a strong preference for sustainable products. For instance, the global sustainable apparel market is projected to reach $36.7 billion by 2030, indicating a significant consumer drive for eco-friendly options.

American Outdoor Brands must proactively adapt to these evolving preferences, including the increasing demand for brands demonstrating social and environmental responsibility. A failure to align with these expectations, such as a growing emphasis on ethical sourcing and reduced environmental impact, could erode market share and brand relevance, especially with younger demographics who prioritize these values.

The outdoor and sporting goods sector is highly competitive, with a few dominant companies holding a substantial market share. This intense rivalry often triggers price wars, which can directly impact American Outdoor Brands' profit margins and necessitate higher spending on marketing efforts to maintain visibility and market position.

The market is dynamic, with both established competitors and new entrants frequently launching innovative products. This constant influx of new offerings escalates competitive pressure, forcing companies like American Outdoor Brands to continuously adapt and invest in product development to stay relevant and competitive.

Supply Chain Disruptions and Increased Tariffs

Global supply chain disruptions continue to pose a significant risk, potentially delaying product delivery and increasing manufacturing expenses for American Outdoor Brands. For instance, the company has navigated challenges related to component availability and shipping costs, impacting its operational efficiency.

The specter of increased tariffs, particularly those stemming from evolving trade policies, presents a substantial threat to the company's cost of goods sold and overall profitability. American Outdoor Brands has explicitly mentioned tariff uncertainties as a factor influencing its financial outlook, underscoring the direct impact on its bottom line.

- Supply chain volatility: Continued global disruptions can lead to extended lead times and higher input costs.

- Tariff impact: Potential increases in import duties could erode profit margins on key product lines.

- Cost of goods sold: Both disruptions and tariffs directly inflate the expenses associated with producing goods.

Regulatory Scrutiny, Especially in Shooting Sports Category

American Outdoor Brands' significant presence in the shooting sports category makes it susceptible to heightened regulatory oversight and evolving political climates. Even with a more cautious approach to this segment, changes in firearm legislation or public opinion on related products could adversely affect its revenue streams. For instance, proposed federal legislation in 2024 aimed at restricting certain firearm accessories could directly impact sales if enacted.

The company's financial reports for the fiscal year ending February 29, 2024, indicated that while the shooting sports segment represented a smaller portion of total revenue compared to previous years, it remained a notable contributor. Any adverse regulatory changes could therefore still present a material risk.

- Increased legislative proposals targeting firearm accessories.

- Potential shifts in consumer sentiment driven by political discourse.

- Impact on specific product lines within the shooting sports division.

- Risk of fines or operational disruptions due to non-compliance with new regulations.

Intensifying competition, including price wars and rapid product innovation from both established players and new entrants, poses a significant threat to American Outdoor Brands' market share and profitability. The company must continually invest in R&D and marketing to stay relevant in this dynamic landscape.

The company faces ongoing risks from supply chain volatility and potential tariff increases, which can inflate costs and disrupt product delivery. For example, the cost of goods sold can be directly impacted by these external factors, affecting overall margins.

Evolving consumer preferences, particularly the growing demand for sustainable and ethically sourced products, require American Outdoor Brands to adapt its offerings. Failure to align with these trends could alienate key customer segments, especially younger demographics.

The company's exposure to the shooting sports market makes it vulnerable to regulatory changes and shifts in public sentiment. Proposed legislation in 2024 targeting firearm accessories highlights the potential for adverse policy shifts that could impact revenue.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research reports, and insights from industry experts to ensure a robust and accurate assessment of American Outdoor Brands.