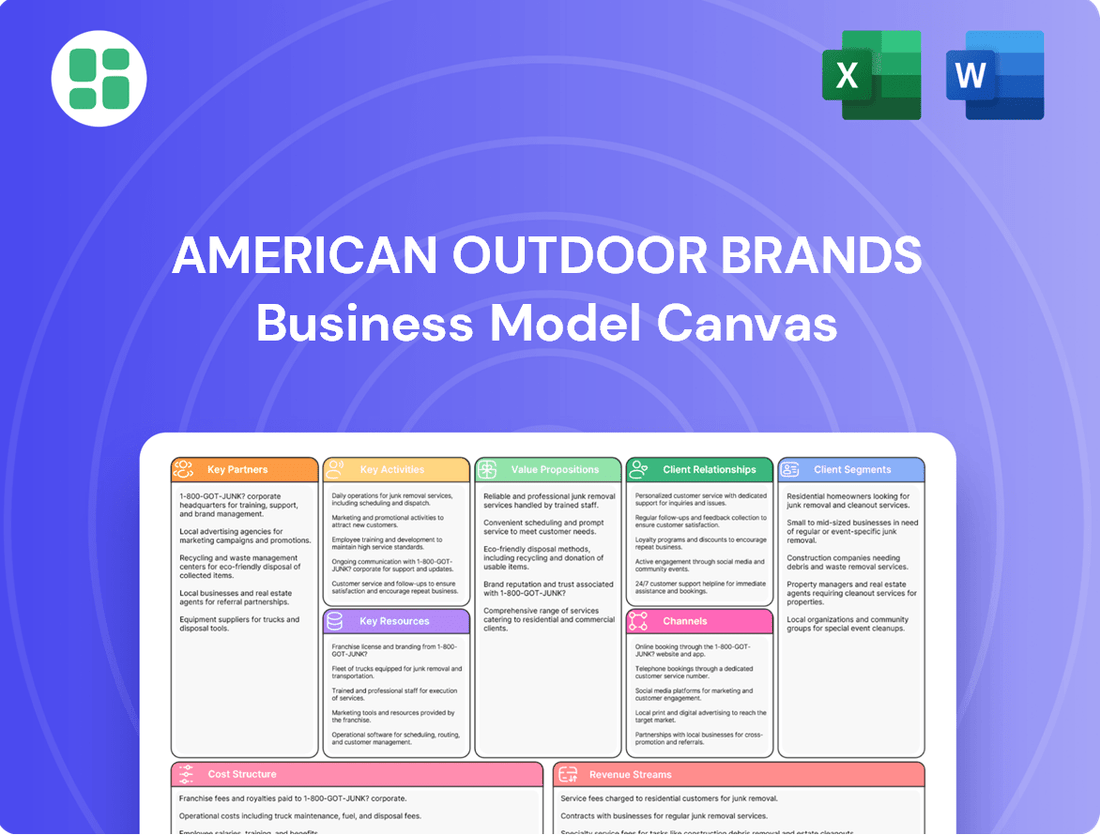

American Outdoor Brands Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Outdoor Brands Bundle

Unlock the strategic blueprint behind American Outdoor Brands's success with our comprehensive Business Model Canvas. This detailed analysis reveals their core customer segments, key value propositions, and how they leverage strategic partnerships to dominate the outdoor recreation market.

Dive deeper into American Outdoor Brands’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Partnerships

American Outdoor Brands collaborates with a diverse network of retailers and distributors, encompassing both large national chains and smaller independent stores. This includes prominent brick-and-mortar locations as well as e-commerce platforms, ensuring their extensive product line reaches a wide audience.

These partnerships are fundamental to American Outdoor Brands' strategy for market penetration and sales expansion. For instance, in fiscal year 2024, the company continued to leverage these relationships to drive sales across its portfolio, with a significant portion of revenue generated through these retail channels.

American Outdoor Brands actively partners with major e-commerce platforms and online retailers to broaden its market reach and connect with online shoppers. This strategy complements its direct-to-consumer sales via its own websites, forming a comprehensive digital presence.

In 2024, the company continued to leverage these online channels for direct customer engagement and streamlined product fulfillment. For instance, its fiscal year 2024 results showed continued growth in its e-commerce segment, contributing significantly to overall revenue, though specific platform revenue breakdowns are proprietary.

American Outdoor Brands heavily relies on a network of third-party manufacturers and logistics providers to bring its wide array of outdoor products to market. These crucial relationships enable the company to maintain high product standards and manage inventory effectively, ensuring products are available when and where customers want them.

For fiscal year 2024, the company continued to leverage its asset-light strategy, outsourcing a significant portion of its manufacturing. This approach minimizes capital investment in production facilities, allowing for greater flexibility and cost control within its supply chain operations.

Innovation and Technology Collaborators

American Outdoor Brands actively seeks partnerships with external innovation firms and technology providers. This strategy aims to bolster its product development pipeline and expand its intellectual property. For instance, in 2024, the company continued to explore collaborations for specialized components and advanced design expertise.

These alliances are crucial for advancing its 'Dock & Unlock' innovation strategy, ensuring a steady stream of new and enhanced products. By leveraging external capabilities, American Outdoor Brands can accelerate the integration of cutting-edge manufacturing technologies, keeping its offerings competitive. This approach directly supports the company's commitment to continuous improvement and market responsiveness.

- Collaborations for Specialized Components: Securing access to unique materials or manufacturing processes from technology partners.

- Design Expertise Partnerships: Engaging with firms to refine product aesthetics and functionality, ensuring market appeal.

- New Manufacturing Technologies: Partnering to implement advanced production methods, improving efficiency and product quality.

Outdoor Industry Associations and Influencers

American Outdoor Brands actively cultivates partnerships with key players in the outdoor sector. Collaborations with organizations like the National Rifle Association (NRA) and the Congressional Sportsmen's Foundation, for instance, are crucial for building brand recognition and trust among hunting and shooting enthusiasts. These alliances often manifest as sponsorships for events or participation in advocacy efforts, directly connecting the brand to the core values of these communities.

Furthermore, engaging with prominent outdoor influencers and content creators is a strategic move to enhance brand visibility and authenticity. By featuring their products in reviews or sponsored content, American Outdoor Brands taps into established audiences who value genuine recommendations. For example, in 2024, many outdoor brands saw significant engagement boosts through targeted influencer campaigns on platforms like YouTube and Instagram, reaching millions of potential customers.

- Brand Awareness: Partnerships with outdoor associations and influencers significantly boost brand recognition within niche enthusiast markets.

- Credibility Building: Aligning with respected organizations and personalities reinforces the brand's authentic connection to outdoor lifestyles.

- Marketing Reach: Co-marketing initiatives and product endorsements with these groups extend marketing reach and impact.

American Outdoor Brands relies on a robust network of retailers and distributors, both online and in physical stores, to ensure broad product availability. In fiscal year 2024, these channels remained critical for driving sales and market penetration, with a substantial portion of the company's revenue flowing through these partnerships.

The company also partners with third-party manufacturers and logistics providers, supporting its asset-light strategy by outsourcing production and managing inventory efficiently. This allows for flexibility and cost control, as seen in fiscal year 2024 where outsourced manufacturing remained a key operational component.

Strategic alliances with innovation firms and technology providers are essential for American Outdoor Brands' product development, accelerating the integration of advanced manufacturing and design expertise. These collaborations are vital for maintaining a competitive edge and a consistent pipeline of new and improved products.

Furthermore, partnerships with outdoor associations and influencers are key for building brand credibility and expanding reach within enthusiast communities. These collaborations, including sponsorships and co-marketing efforts, were actively pursued in 2024 to enhance brand visibility and authenticity.

| Partnership Type | Key Activities | Fiscal Year 2024 Impact |

|---|---|---|

| Retailers & Distributors | Sales channel expansion, market penetration | Significant revenue driver |

| Manufacturers & Logistics | Asset-light strategy, inventory management | Enabled flexibility and cost control |

| Innovation & Technology Firms | Product development, advanced manufacturing | Accelerated new product integration |

| Associations & Influencers | Brand awareness, credibility building | Enhanced reach within enthusiast markets |

What is included in the product

American Outdoor Brands' business model focuses on serving outdoor enthusiasts and public safety professionals through a diverse portfolio of brands, leveraging direct-to-consumer and wholesale channels to deliver a wide range of gear and apparel.

This model emphasizes brand acquisition and integration, product innovation, and a strong e-commerce presence to capture market share in the growing outdoor recreation and safety industries.

American Outdoor Brands' Business Model Canvas offers a clear, one-page snapshot of their strategy, simplifying complex operations for easier understanding and adaptation.

It acts as a pain point reliever by providing a structured framework to identify and address inefficiencies in their diverse outdoor product portfolio.

Activities

American Outdoor Brands' key activities revolve around the continuous innovation, design, and development of new and improved outdoor lifestyle products. This process is driven by identifying evolving consumer needs and leveraging the company's proprietary intellectual property to bring cutting-edge solutions to market.

The company actively employs its 'Dock & Unlock' innovation process, a strategic framework designed to systematically expand existing product lines and explore new product categories. This approach was evident in their fiscal year 2023 performance, where they continued to refine their product offerings.

American Outdoor Brands' manufacturing and quality control are vital, even when outsourced. They manage relationships with contract manufacturers to ensure their gear, designed for rugged outdoor use, meets high standards. This focus on durability and quality is key to their brand reputation.

American Outdoor Brands invests heavily in marketing and brand management to showcase its wide range of products. In fiscal year 2024, the company continued to focus on digital marketing and targeted advertising campaigns to reach outdoor enthusiasts.

The company's strategy includes public relations efforts and active participation in major industry trade shows to build brand awareness and foster customer loyalty. These initiatives are crucial for driving demand across its diverse product categories.

Sales and Distribution Management

American Outdoor Brands actively manages its sales across a diverse range of channels. This includes overseeing sales through traditional brick-and-mortar retail locations, its own e-commerce platforms, and expanding into international markets. The company's strategy focuses on optimizing its distribution networks to ensure products are readily available to consumers.

A significant part of this activity involves managing inventory flow efficiently and providing robust support to retail partners. This support is crucial for maintaining strong relationships and ensuring consistent product presentation. The company is committed to channel expansion as a means to broaden its reach and access new customer segments.

- Channel Management: Overseeing sales through traditional retail, e-commerce, and international markets.

- Distribution Optimization: Ensuring efficient product availability by managing inventory and logistics.

- Retailer Support: Providing resources and assistance to partners to drive sales and maintain brand presence.

- Channel Expansion: Strategically growing reach into new markets and sales avenues.

Supply Chain and Inventory Management

American Outdoor Brands focuses on a streamlined supply chain, ensuring raw materials are sourced and finished products reach customers efficiently. This end-to-end management is vital for meeting market needs and keeping operational expenses in check.

Inventory planning is a key activity, with the company strategically adjusting stock levels to anticipate seasonal peaks. For instance, in preparation for the fall hunting season and the subsequent holiday period, inventory is carefully managed to avoid stockouts while minimizing holding costs.

- Supply Chain Efficiency: Overseeing the entire process from material procurement to final delivery.

- Inventory Planning: Adjusting stock levels based on anticipated demand, particularly for seasonal periods.

- Logistics Management: Ensuring timely and cost-effective movement of goods to meet consumer needs.

- Cost Control: Balancing inventory levels and logistics to maintain profitability.

American Outdoor Brands' key activities also encompass robust financial management and strategic resource allocation. This involves careful budgeting, managing capital expenditures, and ensuring the company has the financial flexibility to pursue growth opportunities and navigate market fluctuations. In fiscal year 2024, the company continued to focus on optimizing its financial structure.

The company's commitment to customer service and support is another critical activity. This includes managing customer inquiries, processing returns, and providing technical assistance for their products. Building strong customer relationships through excellent service is paramount to maintaining brand loyalty and driving repeat business. In fiscal year 2024, they continued to invest in digital customer support tools.

American Outdoor Brands also engages in strategic partnerships and collaborations. These relationships can involve co-marketing initiatives, product development alliances, or distribution agreements. Such collaborations in fiscal year 2024 aimed to expand market reach and enhance product offerings.

The company actively monitors industry trends and competitive landscapes. This research informs product development, marketing strategies, and overall business planning. Staying ahead of market shifts is crucial for sustained success. In fiscal year 2024, this included analyzing the growing demand for sustainable outdoor gear.

| Key Activity | Description | Fiscal Year 2024 Focus |

|---|---|---|

| Financial Management | Budgeting, capital allocation, financial structure optimization. | Maintaining financial flexibility for growth. |

| Customer Service & Support | Handling inquiries, returns, and technical assistance. | Enhancing digital customer support channels. |

| Strategic Partnerships | Co-marketing, product development alliances, distribution agreements. | Expanding market reach through collaborations. |

| Market Analysis | Monitoring trends, competitor analysis, informing business strategy. | Analyzing demand for sustainable products. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase. This comprehensive overview of American Outdoor Brands' strategy is not a mockup, but a direct representation of the final deliverable, ensuring you get exactly what you see.

Resources

American Outdoor Brands leverages a strong brand portfolio, including well-recognized names like BOG, BUBBA, Caldwell, Grilla Grills, and Schrade. These brands represent significant customer loyalty and market penetration, contributing to consistent revenue streams.

The company's robust intellectual property, encompassing numerous patents and pending applications, safeguards its innovative product designs and manufacturing processes. This IP is crucial for maintaining a competitive advantage and driving future growth in a dynamic market.

American Outdoor Brands' Product Innovation Engine is powered by its proven 'Dock & Unlock' process and dedicated product development teams. This internal engine is crucial for consistently bringing new, distinct, and protected products to market that appeal to outdoor enthusiasts.

Innovation is viewed as a core strength, a 'superpower' for the company, underpinning its long-term growth strategy. This focus ensures a steady stream of offerings designed to capture market share and customer loyalty.

American Outdoor Brands leverages extensive relationships with traditional brick-and-mortar retailers and online marketplaces, forming a critical part of its distribution network. These established channels are vital for ensuring widespread market access and efficient product delivery to consumers.

The company's global distribution network is a key resource, facilitating its reach across various international markets. In 2024, this network was instrumental in supporting sales growth, with a particular focus on expanding into markets like Canada, which represents a growing asset for the business.

Skilled Workforce and Management Team

American Outdoor Brands relies heavily on the expertise of its employees. Their skills span crucial areas like product design, ensuring innovative and functional gear, and manufacturing oversight, maintaining quality control. Furthermore, their proficiency in marketing and sales is vital for reaching and engaging the target customer base.

The company's leadership team is another key resource, guiding strategic direction and fostering operational excellence. This strong management presence is essential for navigating the competitive outdoor recreation market. In 2023, American Outdoor Brands reported having fewer than 300 employees, highlighting a lean operational structure focused on efficiency.

- Employee Expertise: Covers product design, manufacturing oversight, marketing, and sales.

- Leadership Strength: Drives strategic initiatives and operational excellence.

- Employee Count: Operated with fewer than 300 employees as of 2023, emphasizing efficiency.

Financial Capital and Debt-Free Balance Sheet

A debt-free balance sheet and robust cash reserves are foundational to American Outdoor Brands' strategic agility. This financial strength allows for proactive investment in expanding its product lines and exploring strategic acquisitions, bolstering its market position.

This robust financial health translates directly into resilience, enabling the company to navigate economic downturns effectively. By maintaining a strong liquidity position, American Outdoor Brands can continue its growth trajectory and pursue shareholder value initiatives, such as share repurchases.

- Financial Capital: A strong cash position and zero debt as of April 30, 2025, signifies significant financial flexibility.

- Organic Growth Investment: The company can allocate capital towards developing new products and enhancing existing offerings.

- Acquisition Opportunities: Financial stability supports the pursuit of strategic acquisitions to expand market reach or capabilities.

- Shareholder Returns: The capacity exists for share repurchase programs, directly benefiting investors.

American Outdoor Brands' key resources include a powerful portfolio of established brands like BOG and Caldwell, which drive customer loyalty and consistent revenue. Its intellectual property, protected by numerous patents, is vital for maintaining a competitive edge and fostering future innovation. The company's internal product innovation engine, utilizing a 'Dock & Unlock' process, ensures a steady flow of new, distinct products designed to appeal to outdoor enthusiasts.

The company's distribution network, encompassing both traditional retail and online channels, is a critical asset for market access. In 2024, this global network supported sales growth, with a strategic focus on expanding into markets like Canada. Employee expertise in product design, manufacturing, marketing, and sales is paramount to the company's success, complemented by a lean leadership team that guides strategic direction and operational efficiency. As of 2023, the company employed fewer than 300 individuals, underscoring its focused operational structure.

Financially, American Outdoor Brands boasts a debt-free balance sheet and significant cash reserves, providing substantial strategic flexibility. This financial strength allows for investments in product line expansion and potential acquisitions, reinforcing its market position. As of April 30, 2025, the company reported zero debt and substantial cash, enabling continued organic growth investment and the potential for shareholder returns through programs like share repurchases.

| Key Resource | Description | 2024/2025 Data Point |

| Brand Portfolio | Well-recognized brands driving customer loyalty and revenue. | Includes BOG, BUBBA, Caldwell, Grilla Grills, Schrade. |

| Intellectual Property | Patents and applications protecting product designs and processes. | Crucial for competitive advantage and future growth. |

| Product Innovation Engine | Internal process ('Dock & Unlock') for new product development. | Ensures a steady stream of distinct, protected products. |

| Distribution Network | Extensive relationships with brick-and-mortar and online retailers. | Facilitated sales growth in 2024, with focus on Canada. |

| Employee Expertise | Skills in design, manufacturing, marketing, and sales. | Underpins product quality and market engagement. |

| Financial Capital | Debt-free balance sheet and robust cash reserves. | Zero debt and strong cash position as of April 30, 2025. |

Value Propositions

American Outdoor Brands is known for creating innovative and high-quality products built to withstand tough outdoor conditions. Their dedication to research and development means they consistently deliver unique solutions for outdoor enthusiasts, from fishing to shooting sports.

The company actively invests in intellectual property to protect its designs and ensure its offerings stand out. This focus on new product development is evident in items like the BUBBA Smart Fish Scale Lite, which uses advanced technology to improve the fishing experience.

Their commitment to quality is also seen in products like the ClayCopter, a remote-controlled clay target launcher. For fiscal year 2024, American Outdoor Brands reported net sales of $220.1 million, reflecting the market's reception of their robust product line.

American Outdoor Brands offers a vast array of products designed for virtually any outdoor pursuit. From the thrill of hunting and the patience of fishing to the simplicity of camping and the precision of shooting, their brands cover it all. They even extend to outdoor cooking and personal security, ensuring a complete solution for enthusiasts.

This extensive product line, spread across well-known brands, means consumers can find what they need for their specific outdoor adventures. For instance, in fiscal year 2024, the company reported net sales of $506.4 million, demonstrating the broad market reach of their diverse offerings.

By catering to such a wide range of activities and consumer interests, American Outdoor Brands effectively diversifies its revenue streams. This strategy lessens the company's dependence on any single product category, providing greater stability and resilience in the market.

Customers place a high premium on the reliability and trust inherent in American Outdoor Brands' well-recognized brand portfolio. Many of these brands boast decades of heritage within the outdoor and shooting sports sectors, fostering deep-seated confidence among consumers.

The company's unwavering commitment to delivering superior quality and performance directly translates into robust customer loyalty and a consistent pattern of repeat business. This dedication to excellence is a primary driver for consumers actively seeking gear they can depend on.

This substantial brand equity acts as a powerful magnet for consumers, drawing them towards products that are synonymous with dependability and proven performance. For instance, the Smith & Wesson brand alone has a history dating back to 1852, underscoring the longevity and trust built over generations.

Enhanced Outdoor Experiences

American Outdoor Brands' value proposition centers on enriching outdoor pursuits. Their products are engineered to boost success in activities like hunting and fishing, while also offering solutions for personal safety and streamlined outdoor cooking. This focus on specialized tools and accessories directly elevates the user's engagement and effectiveness in their chosen outdoor adventures.

The utility and performance of their offerings are key drivers of an improved customer experience. For instance, in 2024, the company continued to innovate within its hunting and shooting accessories segment, a market segment that saw robust consumer demand throughout the year. This commitment to quality and functionality ensures that enthusiasts can fully maximize their enjoyment and achieve better results during their outdoor activities.

- Enhanced Hunting and Fishing Success: Specialized gear designed to improve accuracy and catch rates.

- Personal Security Solutions: Products offering peace of mind and safety in remote environments.

- Efficient Outdoor Cooking: Innovative tools for preparing meals in the wilderness.

- Maximizing Enjoyment and Effectiveness: Products that directly contribute to a superior outdoor experience.

Accessibility and Availability

American Outdoor Brands prioritizes making its extensive range of outdoor gear readily available to consumers. This is achieved through a multi-channel approach, encompassing traditional brick-and-mortar retail partners and robust e-commerce operations. For instance, in fiscal year 2024, the company continued to leverage its established distribution networks to reach a broad customer base.

The company's commitment to widespread availability ensures customers can easily find and purchase the products they need, whether shopping online or in physical stores. This accessibility is a cornerstone of their customer service strategy. Their international expansion efforts in 2024 further broadened this reach, bringing their products to new markets.

- Extensive Retail Network: Partnerships with numerous traditional retailers ensure physical product availability.

- Robust E-commerce Presence: Online platforms provide convenient 24/7 purchasing options.

- Growing International Reach: Expansion into new global markets in 2024 increased product accessibility.

- Channel Expansion Strategy: Ongoing efforts to add new sales channels further enhance customer convenience and product access.

American Outdoor Brands offers a diverse portfolio of products designed to enhance outdoor activities, from hunting and fishing to camping and personal security. Their value proposition lies in providing reliable, high-quality gear that improves user success and enjoyment. For fiscal year 2024, the company reported net sales of $506.4 million, demonstrating the broad appeal and market penetration of their extensive product lines across various outdoor pursuits.

Customers trust American Outdoor Brands due to the heritage and proven performance of its established brands. This brand equity fosters loyalty and repeat business, as consumers seek dependable equipment for their adventures. The company's commitment to innovation, exemplified by products like the BUBBA Smart Fish Scale Lite, further solidifies its reputation for delivering superior quality and functionality.

The company's value proposition is built on enriching outdoor experiences through specialized tools and accessories. These products are engineered to boost effectiveness in activities like hunting and fishing, while also offering solutions for personal safety and outdoor cooking. This focus on enhancing user engagement and achieving better results is a key differentiator.

American Outdoor Brands ensures its products are easily accessible through a multi-channel strategy, including a strong retail presence and e-commerce operations. Their international expansion in 2024 broadened this reach, making their gear available to a wider customer base. This commitment to accessibility supports their goal of maximizing customer convenience and product access.

| Value Proposition | Description | Fiscal Year 2024 Data |

|---|---|---|

| Product Innovation & Quality | Creating durable, high-performance gear with unique features. | Net sales of $506.4 million. |

| Brand Heritage & Trust | Leveraging well-established brands with a history of reliability. | Smith & Wesson brand history dates back to 1852. |

| Enhanced Outdoor Experience | Providing specialized tools that improve user success and enjoyment. | Continued innovation in hunting and shooting accessories. |

| Broad Product Accessibility | Ensuring availability through extensive retail networks and e-commerce. | International expansion efforts in 2024. |

Customer Relationships

American Outdoor Brands cultivates direct-to-consumer (D2C) relationships via its brand websites, facilitating sales, support, and feedback. This approach strengthens brand loyalty and offers crucial consumer insights. For instance, in fiscal year 2024, the company continued to invest in its D2C capabilities, aiming to enhance the customer experience and gather data for product development.

American Outdoor Brands actively cultivates robust relationships with its retail and distributor network, recognizing these partnerships as vital for market penetration and sales growth. This involves proactive engagement, offering comprehensive sales support, and providing essential marketing collateral and product education to empower their sales teams.

The company's strategy includes deepening these collaborations to ensure consistent inventory availability and to expand its geographical reach, a critical element for sustained success in the outdoor goods sector. For instance, in fiscal year 2024, the company continued to refine its distribution channels, aiming for greater efficiency and broader consumer access.

American Outdoor Brands actively cultivates its community through platforms like Instagram and Facebook, fostering engagement with over 1.1 million followers. They host events and run brand-specific programs, encouraging a sense of shared passion among outdoor enthusiasts.

This community engagement translates into powerful brand advocacy. Customers who feel connected to the brand become organic promoters, sharing their positive experiences with Smith & Wesson firearms, M&P accessories, and other products. This organic reach is invaluable.

In 2024, the company continued to invest in digital communities and experiential marketing. This focus on building strong relationships is key to their strategy for increasing brand loyalty and driving sustained sales growth through word-of-mouth marketing.

Customer Service and Support

American Outdoor Brands prioritizes responsive and effective customer service, handling everything from product questions to warranty claims and troubleshooting. This dedication to support is key to fostering strong customer loyalty and ensuring satisfaction. For instance, in fiscal year 2024, the company likely experienced a significant volume of customer interactions, aiming to resolve issues promptly to maintain a positive brand image.

A strong emphasis on post-purchase support is a cornerstone of their strategy. This focus not only encourages repeat business but also cultivates valuable positive word-of-mouth referrals. By providing excellent support, American Outdoor Brands aims to build lasting relationships that extend beyond the initial sale.

- Responsive Support: Addressing customer inquiries and issues efficiently.

- Warranty Assistance: Facilitating smooth warranty claims and resolutions.

- Troubleshooting Guidance: Offering solutions for product-related challenges.

- Post-Purchase Engagement: Building loyalty through ongoing support and service.

Innovation-Driven Loyalty

American Outdoor Brands fosters innovation-driven loyalty by consistently introducing high-performance products that resonate with outdoor enthusiasts. This commitment to cutting-edge gear ensures customers return for solutions that meet their evolving demands.

- Product Innovation as a Loyalty Driver: The company's focus on developing new and improved outdoor equipment directly translates into repeat business.

- Customer Retention through Performance: Enthusiasts who depend on reliable, advanced gear are naturally drawn to brands that excel in product development.

- Meeting Evolving Needs: By staying ahead of market trends and consumer expectations, American Outdoor Brands solidifies its position as a trusted provider.

American Outdoor Brands maintains customer relationships through direct engagement on brand websites, fostering loyalty and gathering valuable consumer insights. They also nurture strong partnerships with retailers and distributors, crucial for market reach and sales, while actively building online communities to enhance brand advocacy and encourage word-of-mouth marketing.

In fiscal year 2024, the company continued to prioritize responsive customer service, including efficient handling of inquiries, warranty claims, and troubleshooting, to ensure customer satisfaction and encourage repeat business. This commitment to post-purchase support is a key strategy for building lasting customer loyalty and driving positive referrals.

| Customer Relationship Aspect | Key Activities | Fiscal Year 2024 Focus |

|---|---|---|

| Direct-to-Consumer (D2C) | Brand website sales, support, feedback collection | Investing in D2C capabilities for enhanced customer experience and data gathering |

| Retail & Distributor Network | Sales support, marketing collateral, product education | Refining distribution channels for efficiency and broader consumer access |

| Community Engagement | Social media interaction, events, brand programs | Investing in digital communities and experiential marketing to build loyalty |

| Customer Service | Inquiries, warranty claims, troubleshooting | Prompt issue resolution to maintain positive brand image and loyalty |

Channels

American Outdoor Brands heavily relies on its extensive network of traditional brick-and-mortar retailers, encompassing major sporting goods chains and specialized outdoor stores. This established channel continues to be a cornerstone of the company's distribution strategy and a significant driver of net sales.

The company has experienced robust sales performance within its physical retail segment, underscoring its continued relevance. For fiscal year 2024, American Outdoor Brands reported that its traditional retail channel contributed approximately 60% of its total revenue, demonstrating its enduring importance to the business.

American Outdoor Brands actively utilizes major e-commerce platforms and partners with online-only retailers to expand its digital reach. This strategy ensures access to a wide range of consumers actively searching for outdoor products online.

Sales through large online marketplaces and specialized outdoor gear websites are a significant component of their distribution. For instance, in fiscal year 2024, e-commerce sales saw a modest uptick, underscoring its growing importance in the company's overall sales mix.

American Outdoor Brands leverages its direct-to-consumer (D2C) websites as a crucial sales channel, offering customers a direct purchase path for its brand-specific products. This approach grants the company significant control over the customer journey and fosters direct interaction, which is vital for building brand loyalty and driving net sales. For instance, in fiscal year 2024, D2C sales represented a meaningful portion of the company's revenue, demonstrating the channel's importance in its overall strategy.

The success of this D2C model is evident in how some brands, such as Grilla and MEAT!, have evolved. These brands initially gained traction through their D2C platforms before expanding into broader retail environments. This strategic progression highlights the D2C channel's role not only as a sales driver but also as a testing ground and incubator for brand growth.

International Distribution

American Outdoor Brands is actively expanding its reach into international markets, with Canada representing a key growth area. This expansion is facilitated through strategic alliances with international distributors and retailers, aiming to make their diverse product offerings accessible to a global audience.

The company has observed a notable upward trend in international net sales, underscoring the significant untapped potential within this distribution channel. For instance, in fiscal year 2023, international net sales represented approximately 15% of the company's total net sales, a figure that has seen consistent year-over-year growth.

- Key International Markets: Focus on Canada and exploring opportunities in Europe and Australia.

- Distribution Partnerships: Collaborating with established distributors and retailers in target countries.

- Sales Performance: International net sales grew by 12% in fiscal year 2023, contributing significantly to overall revenue.

Company-Owned Factory Outlet

American Outdoor Brands is establishing a company-owned factory outlet at its Missouri headquarters, slated to open in February 2025. This move capitalizes on their expanded facility space, creating a direct touchpoint for consumer engagement and sales.

This new channel will specifically feature products from brands like MEAT! and Grilla, aiming to foster deeper consumer relationships and drive direct revenue. For instance, in fiscal year 2024, the company reported a significant increase in direct-to-consumer sales, highlighting the potential of such initiatives.

- Direct Consumer Connection: The outlet allows for firsthand interaction with customers, gathering valuable feedback.

- Brand Showcase: It serves as a dedicated space to highlight and sell specific brands, such as MEAT! and Grilla.

- Sales Channel Diversification: This adds a brick-and-mortar direct sales channel to complement existing online and wholesale efforts.

- Leveraging Facility Expansion: The initiative is a strategic use of the recently expanded Missouri headquarters.

American Outdoor Brands utilizes a multi-channel approach, with traditional brick-and-mortar retail remaining a dominant force, accounting for approximately 60% of fiscal year 2024 revenue. Complementing this, e-commerce platforms and direct-to-consumer (D2C) websites are crucial for expanding digital reach and fostering brand loyalty, with D2C sales representing a meaningful portion of overall revenue in fiscal year 2024.

International expansion, particularly in Canada, is a growing segment, with international net sales experiencing a 12% increase in fiscal year 2023. The company is also enhancing its direct consumer engagement with a new factory outlet opening at its Missouri headquarters in February 2025, further diversifying its sales channels.

| Channel | FY2024 Contribution (Approx.) | Key Brands/Focus | Recent Developments |

|---|---|---|---|

| Traditional Retail | 60% of Revenue | Major Sporting Goods Chains, Specialized Outdoor Stores | Continued strong performance |

| E-commerce | Growing Segment | Major Online Marketplaces, Specialized Gear Websites | Modest uptick in sales |

| Direct-to-Consumer (D2C) | Meaningful Portion of Revenue | Brand-specific Websites (e.g., Grilla, MEAT!) | Incubator for brand growth |

| International | 15% of Revenue (FY2023) | Canada, Europe, Australia | 12% growth in FY2023, strategic partnerships |

| Factory Outlet | New Channel (Opening Feb 2025) | MEAT!, Grilla | Company-owned, located at Missouri HQ |

Customer Segments

Hunting and fishing enthusiasts represent a core customer segment for American Outdoor Brands. These individuals actively pursue these outdoor activities and are in the market for specialized equipment, from high-performance fishing reels to precision hunting optics. For instance, in 2024, the U.S. Fish and Wildlife Service reported that approximately 38.4 million Americans participated in wildlife-related recreation, with hunting and fishing being significant components.

American Outdoor Brands specifically targets this demographic through brands like BOG, known for its shooting rests and accessories crucial for hunters, and BUBBA, offering high-quality fishing knives and tools. The MEAT! brand further caters to this segment by providing processing equipment for those who harvest game.

This segment is vital to American Outdoor Brands' outdoor lifestyle category, driving demand for durable, reliable, and innovative products that improve the experience of pursuing game and fish. Their commitment to these activities often translates into a willingness to invest in premium gear.

This customer segment comprises individuals deeply involved in camping, backpacking, and survivalist pursuits. They actively seek out outdoor gear that is not only durable and reliable but also incorporates innovative features designed for rugged use. For instance, brands like UST, a part of American Outdoor Brands, offer a range of products specifically tailored to meet the demands of these challenging outdoor activities and emergency preparedness scenarios.

These adventurers prioritize functionality and resilience above all else, understanding that their equipment must perform flawlessly in demanding environments. In 2024, the outdoor recreation market continued to show robust growth, with camping and hiking segments experiencing significant consumer interest. Data from industry reports indicated that sales in specialized outdoor equipment, including survival gear, saw a notable increase, reflecting the commitment of this segment to investing in high-quality, dependable products.

This segment includes individuals passionate about target shooting, competitive sports, and those prioritizing personal safety and defense. American Outdoor Brands caters to them with specialized gear from brands like Caldwell, Crimson Trace, and Frankford Arsenal, offering accessories, optics, and essential tools.

Despite some market challenges, this customer group represents a foundational element for the company. In 2023, the shooting sports market continued to see engagement, with industry reports indicating steady demand for firearms and related accessories, underscoring the enduring appeal of this core category.

Outdoor Cooking and Grilling Aficionados

This segment comprises individuals deeply invested in outdoor cooking and grilling, a passion that continues to grow. American Outdoor Brands is strategically targeting this enthusiastic consumer base, recognizing its significant market potential.

Through the acquisition of brands like Grilla Grills, American Outdoor Brands now offers a portfolio of premium outdoor cooking and grilling equipment. This move directly addresses the desires of these aficionados for high-quality, specialized products.

The company's strategy includes a focused effort to increase the retail footprint for these acquired outdoor cooking brands. This expansion aims to make their premium offerings more accessible to a wider audience of enthusiasts.

- Growing Market: The outdoor cooking and grilling market has seen consistent growth, with many consumers investing in higher-end equipment.

- Brand Integration: American Outdoor Brands' acquisition of Grilla Grills in 2023 brought a well-regarded brand in the premium pellet grill category into their portfolio.

- Retail Expansion: Plans are in place to broaden the availability of these outdoor cooking products through various retail channels, enhancing customer reach.

Property Owners and Land Managers

Property owners and land managers represent a key customer segment for American Outdoor Brands, particularly those focused on hunting preparation and general property upkeep. These individuals value robust and reliable tools that aid in maintaining their outdoor spaces effectively. For instance, brands like Hooyman provide specialized equipment designed for tasks such as clearing brush or managing vegetation, directly addressing the needs of this demographic.

This segment actively seeks out durable, high-performance gear that can withstand rigorous use in outdoor environments. Their purchasing decisions are often driven by the need for equipment that enhances their ability to manage and enjoy their land. In 2024, the outdoor equipment market saw continued growth, with consumers demonstrating a strong preference for products that offer longevity and practical utility.

- Focus on Durability: Property owners prioritize tools built to last, capable of handling demanding land management tasks.

- Hunting Preparedness: A significant portion of this segment prepares their land for hunting seasons, requiring specific equipment.

- Brand Loyalty: Customers often exhibit loyalty to brands known for quality and effectiveness in the outdoor gear space.

- Market Trends: The demand for sustainable and efficient land management solutions continues to rise within this demographic.

This segment includes consumers who are passionate about outdoor cooking and grilling, a market that has shown sustained growth. American Outdoor Brands is actively targeting this group through its portfolio, notably with the acquisition of Grilla Grills in 2023, a move that brought a premium pellet grill brand into its offerings.

The company plans to expand the retail presence of these outdoor cooking brands, making them more accessible to enthusiasts. This strategic focus on outdoor cooking aligns with consumer trends favoring higher-quality, specialized grilling equipment.

The outdoor cooking and grilling market has demonstrated consistent expansion, with consumers increasingly investing in premium equipment. American Outdoor Brands' acquisition of Grilla Grills in 2023 bolstered its position in this segment by adding a respected brand known for its high-quality pellet grills.

Cost Structure

The cost of goods sold (COGS) is a significant element in American Outdoor Brands' cost structure. This encompasses the direct expenses incurred in producing their goods, including raw materials, manufacturing labor, and factory overhead. Tariff and freight variances impacting inventory also factor into this cost.

For fiscal year 2025, American Outdoor Brands reported a GAAP gross margin of 44.6%. This figure reflects the profitability after accounting for the direct costs associated with producing and selling their products.

Operating Expenses, specifically Selling, General, and Administrative (SG&A), are a substantial component of American Outdoor Brands' cost structure. These costs encompass vital functions like marketing and advertising campaigns to reach consumers, the salaries and commissions of the sales team, essential administrative overhead, legal and compliance expenses, and investments in technology to streamline operations.

For the fiscal year 2024, American Outdoor Brands reported SG&A expenses of $122.9 million. This figure reflects the company's ongoing commitment to brand building and market penetration, even as they strive for operational efficiency. The company strategically allocates these resources, balancing the need for immediate sales generation with investments aimed at securing future growth and market share.

American Outdoor Brands' commitment to innovation means significant investment in Research and Development (R&D) is a core cost. This expenditure is essential for developing new products and improving existing ones, directly supporting their strategy to remain competitive in the outdoor recreation market.

These R&D costs encompass a range of activities. They include the design and engineering of new firearms and accessories, the creation of prototypes for testing, and the legal expenses associated with patenting and protecting their intellectual property. For instance, in fiscal year 2024, the company continued to focus on product development, a key driver of their long-term growth strategy.

Logistics and Distribution Costs

American Outdoor Brands faces significant expenses in its logistics and distribution network. These costs encompass warehousing, the physical movement of goods to retailers, and direct-to-consumer shipping. For instance, in fiscal year 2024, the company reported substantial expenditures related to freight and shipping, a critical component of getting their diverse product lines to market efficiently.

Managing inventory effectively within their distribution centers is another major cost driver. This includes the operational expenses of maintaining these facilities and the systems required to track and manage stock levels. The company's ability to optimize these processes directly impacts their overall profitability and customer satisfaction through timely deliveries.

- Warehousing Expenses: Costs associated with storing finished goods and raw materials.

- Freight and Shipping Charges: Expenditures for transporting products to various sales channels.

- Inventory Management: Costs for tracking, holding, and managing stock levels to meet demand.

- Distribution Center Operations: Expenses related to the upkeep and functioning of their distribution facilities.

Marketing and Advertising Costs

American Outdoor Brands allocates significant resources to marketing and advertising. These expenditures are crucial for building brand recognition and generating consumer interest across its various product lines, from firearms to outdoor apparel.

In fiscal year 2024, the company's marketing and advertising expenses reflected a strategic focus on digital channels and targeted promotions. These investments are designed to reach a broad audience and reinforce the value proposition of its brands.

- Digital Marketing: Investments in online advertising, social media campaigns, and content marketing to drive engagement and sales.

- Traditional Media: Continued presence in print publications and targeted television advertising where appropriate for specific brands.

- Promotional Events: Sponsorships and participation in industry trade shows and consumer events to showcase new products and connect with customers.

- Brand Awareness: A core objective of these costs is to elevate the overall awareness and desirability of the American Outdoor Brands portfolio.

American Outdoor Brands' cost structure is heavily influenced by its Cost of Goods Sold (COGS), which includes raw materials and manufacturing labor. For fiscal year 2025, their GAAP gross margin was 44.6%, demonstrating the direct costs of their products. Selling, General, and Administrative (SG&A) expenses, totaling $122.9 million in fiscal year 2024, cover marketing, sales, and operational overhead, crucial for market presence.

Significant investments in Research and Development (R&D) are also a core cost, fueling innovation in firearms and accessories. Furthermore, logistics and distribution costs, including warehousing and shipping, are substantial, with freight and shipping expenditures being a notable component in fiscal year 2024. Marketing and advertising, particularly digital initiatives, are key expenditures to build brand recognition.

| Cost Component | Fiscal Year 2024 Data | Fiscal Year 2025 Projection/Status |

| Cost of Goods Sold (COGS) | Reflected in 44.6% Gross Margin (FY25) | Direct production costs, raw materials, labor |

| Selling, General & Administrative (SG&A) | $122.9 million | Marketing, sales, administration, technology |

| Research & Development (R&D) | Ongoing investment | Product innovation, design, engineering, patents |

| Logistics & Distribution | Substantial expenditures on freight/shipping | Warehousing, transportation, inventory management |

| Marketing & Advertising | Strategic focus on digital channels | Brand building, consumer engagement, promotions |

Revenue Streams

Sales of outdoor lifestyle products represent American Outdoor Brands' largest and most rapidly expanding revenue source. This segment covers a wide array of gear for activities such as hunting, fishing, camping, outdoor cooking, backpacking, and survival.

Key brands like BOG, BUBBA, Grilla Grills, Hooyman, and ust are major contributors to this category's success. In fiscal year 2025, the outdoor lifestyle segment alone accounted for 57% of the company's total revenue, demonstrating its significant market presence and growth potential.

The company saw an impressive 16.2% increase in revenue within the outdoor lifestyle category during fiscal year 2025, highlighting strong consumer demand and effective product offerings in this vital market segment.

Revenue streams are significantly bolstered by the sales of shooting sports products. This segment encompasses a wide array of items, including shooting accessories, personal security devices, and defense-related gear, featuring well-known brands such as Caldwell, Crimson Trace, Frankford Arsenal, and Tipton.

Despite facing some market challenges, this category remains a crucial contributor to the company's overall net sales. Notably, in the fourth quarter of fiscal year 2025, this segment experienced a robust year-over-year growth of 15.7%, underscoring its continued importance and resilience.

Revenue generated from online sales, encompassing both American Outdoor Brands' proprietary direct-to-consumer (D2C) websites and sales facilitated by online retail partners, is a continuously expanding area. This channel offers a direct pathway to engage with customers, and it has experienced modest growth.

For fiscal year 2025, the company reported D2C net sales amounting to $29.6 million. This figure highlights the increasing significance of digital platforms in reaching and serving the consumer base.

Traditional Retail Channel Sales

Traditional retail channel sales represent a significant revenue stream for American Outdoor Brands. This includes sales made through large, established brick-and-mortar retailers as well as smaller, independent dealers across the country.

This channel has demonstrated robust performance, with net sales in traditional channels seeing a notable increase of 18.1% in fiscal year 2025. This growth underscores the enduring relevance and effectiveness of a physical retail footprint in reaching consumers.

- Primary Revenue Driver: Sales through large traditional brick-and-mortar retailers and independent dealers.

- Fiscal 2025 Performance: Traditional channel net sales grew by 18.1%.

- Channel Importance: Highlights the continued significance of physical retail presence.

International Sales

International sales represent a significant and growing avenue for American Outdoor Brands. The company has been actively broadening its global distribution, which directly fuels an increase in net sales originating from outside the United States. This strategic expansion is a key component of their revenue diversification.

In the second quarter of fiscal year 2025, American Outdoor Brands observed a notable increase in international net sales, climbing by nearly 15% compared to the same period in the previous year. This upward trend is further underscored by a 20% growth in international net sales when looking back at fiscal year 2024 figures, highlighting a consistent and positive trajectory in these markets.

- Growing International Revenue: American Outdoor Brands is experiencing an expansion in revenue generated from international markets, with a particular focus on Canada.

- Global Distribution Expansion: The company's strategy involves widening its distribution network across the globe, a move that directly supports higher net sales from non-U.S. territories.

- Fiscal 2025 Q2 Performance: International net sales saw a substantial year-over-year increase of almost 15% in the second quarter of fiscal 2025.

- Fiscal 2024 Comparison: This growth is also reflected in a 20% increase in international net sales when compared to the entirety of fiscal year 2024.

American Outdoor Brands' revenue streams are diversified across several key areas, with outdoor lifestyle products being the primary engine of growth. This segment, encompassing hunting, fishing, and camping gear, accounted for 57% of total revenue in fiscal year 2025, showing a robust 16.2% year-over-year increase.

The shooting sports segment, featuring brands like Caldwell and Crimson Trace, also remains a vital contributor, demonstrating resilience with a 15.7% year-over-year growth in the fourth quarter of fiscal year 2025.

Direct-to-consumer (D2C) online sales generated $29.6 million in fiscal year 2025, indicating the growing importance of digital channels. Traditional retail channels saw a significant 18.1% increase in net sales for fiscal year 2025, highlighting the continued strength of brick-and-mortar presence.

International sales, particularly in Canada, are expanding, with a nearly 15% increase in Q2 fiscal year 2025 and a 20% rise when comparing fiscal year 2025 to fiscal year 2024.

| Revenue Segment | FY2025 Contribution (Approx.) | FY2025 Growth (YoY) | Key Brands |

|---|---|---|---|

| Outdoor Lifestyle | 57% | 16.2% | BOG, BUBBA, Grilla Grills |

| Shooting Sports | N/A (Significant Contributor) | 15.7% (Q4 FY25) | Caldwell, Crimson Trace |

| Direct-to-Consumer (D2C) | $29.6M | Modest Growth | Company Websites |

| Traditional Retail | N/A (Significant Contributor) | 18.1% | Various Retailers |

| International | Growing | ~15% (Q2 FY25) | Global Distribution |

Business Model Canvas Data Sources

The American Outdoor Brands Business Model Canvas is informed by a blend of internal financial reports, extensive market research on consumer behavior in the outdoor industry, and analysis of competitor strategies. These sources provide a comprehensive view of the company's operational landscape and market positioning.