American Outdoor Brands Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Outdoor Brands Bundle

American Outdoor Brands faces significant competitive pressures, with the threat of new entrants and the bargaining power of buyers playing crucial roles in shaping its market landscape. Understanding these dynamics is key to navigating the outdoor recreation industry.

The complete report reveals the real forces shaping American Outdoor Brands’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

American Outdoor Brands' reliance on a global supply chain means the concentration of its suppliers can significantly impact its bargaining power. For instance, if a key component for their M&P firearms comes from only a handful of specialized manufacturers, those suppliers gain considerable leverage.

This is particularly true for unique materials or technologies, such as the advanced polymers used in some of their firearm frames or specialized coatings for outdoor gear. If few companies possess the capability to produce these, their bargaining power increases, potentially driving up costs for American Outdoor Brands.

In 2024, the global supply chain continued to face disruptions, with some sectors experiencing shortages of critical raw materials. This environment generally favors suppliers, especially those who are highly specialized and have few direct competitors.

For American Outdoor Brands, high switching costs with their suppliers would significantly bolster supplier bargaining power. If transitioning to a new supplier demands substantial investments in retooling manufacturing equipment or navigating lengthy re-certification procedures, the company might be hesitant to switch even if facing less favorable pricing. This is especially true for specialized components or established relationships where the integration process is complex and time-consuming.

Suppliers who offer highly unique, patented, or technologically advanced components or materials wield significant bargaining power. For American Outdoor Brands (AOB), if certain suppliers provide innovations that are critical to the performance or distinctiveness of their firearms, shooting accessories, or outdoor gear, these suppliers gain considerable leverage. For instance, a supplier of proprietary, high-performance coatings for firearm barrels or a designer of patented, lightweight materials for camping equipment could command better terms due to the irreplaceable nature of their contribution.

Threat of Forward Integration by Suppliers

The threat of suppliers moving into manufacturing or distribution of outdoor products directly challenges American Outdoor Brands. This scenario would mean suppliers are not just providing components but also selling finished goods, directly competing with the company.

While raw material suppliers are less likely to integrate forward, manufacturers of specialized components with established brands might consider producing their own end products. This could significantly reduce demand for American Outdoor Brands' offerings and bolster the suppliers' leverage.

For instance, in 2024, the outdoor equipment sector saw increased consolidation. Component suppliers with unique technologies, such as advanced fabric manufacturers or specialized electronics providers for smart outdoor gear, are well-positioned to explore forward integration. This could impact American Outdoor Brands' sourcing strategies and cost structures.

- Component Specialization: Suppliers with proprietary technology in areas like advanced waterproofing or lightweight materials pose a higher forward integration risk.

- Brand Strength: Component suppliers who have built strong brand recognition among consumers could more easily transition to selling finished goods.

- Market Dynamics: Shifts in consumer demand towards specialized or technologically advanced outdoor products can incentivize suppliers to capture more value by integrating forward.

- Competitive Landscape: If American Outdoor Brands relies heavily on a few key component suppliers, those suppliers gain more power and a greater incentive to consider direct competition.

Importance of Supplier to the Industry

The bargaining power of suppliers for American Outdoor Brands is significantly shaped by the overall health of the outdoor recreation market. In 2024, this sector continued to show resilience, with many segments experiencing steady demand. This robust demand can empower suppliers, allowing them to negotiate better pricing and terms, especially if they provide specialized components or materials essential for a wide range of manufacturers within the industry.

Conversely, a downturn in the outdoor recreation sector would likely weaken supplier leverage. If demand falters, suppliers would find themselves competing more intensely for fewer orders, making them more amenable to concessions. For instance, if key raw material prices surge due to global supply chain issues, and American Outdoor Brands cannot easily pass these costs on, supplier power increases.

- Supplier Dependence: The degree to which American Outdoor Brands relies on specific suppliers for critical components or materials directly impacts supplier power.

- Industry Demand: A strong outdoor recreation market in 2024 generally translates to higher demand for suppliers' products, bolstering their negotiating position.

- Supplier Concentration: If a few suppliers dominate the market for essential inputs, their collective bargaining power is amplified.

- Switching Costs: High costs associated with changing suppliers for American Outdoor Brands would increase the power of existing suppliers.

The bargaining power of suppliers for American Outdoor Brands is influenced by supplier concentration and the uniqueness of their offerings. In 2024, continued global supply chain volatility meant that specialized component providers, especially those with proprietary technology, held significant leverage. This is compounded by high switching costs for American Outdoor Brands, making it difficult and expensive to change suppliers for critical inputs.

Suppliers who provide unique, patented, or technologically advanced components or materials can command better terms due to their irreplaceable contributions. For example, a supplier of advanced waterproofing membranes for outdoor apparel or specialized polymer compounds for firearm components can exert considerable influence.

The threat of forward integration by suppliers, where they begin manufacturing or distributing finished goods, also strengthens their bargaining position. In 2024, consolidation within the outdoor equipment sector created opportunities for component suppliers with unique technologies to consider direct competition with brands like American Outdoor Brands.

The overall health of the outdoor recreation market in 2024, which remained resilient, generally empowered suppliers. Strong demand for their products allowed them to negotiate more favorable pricing and terms, particularly for those supplying essential, specialized inputs critical to numerous manufacturers in the industry.

What is included in the product

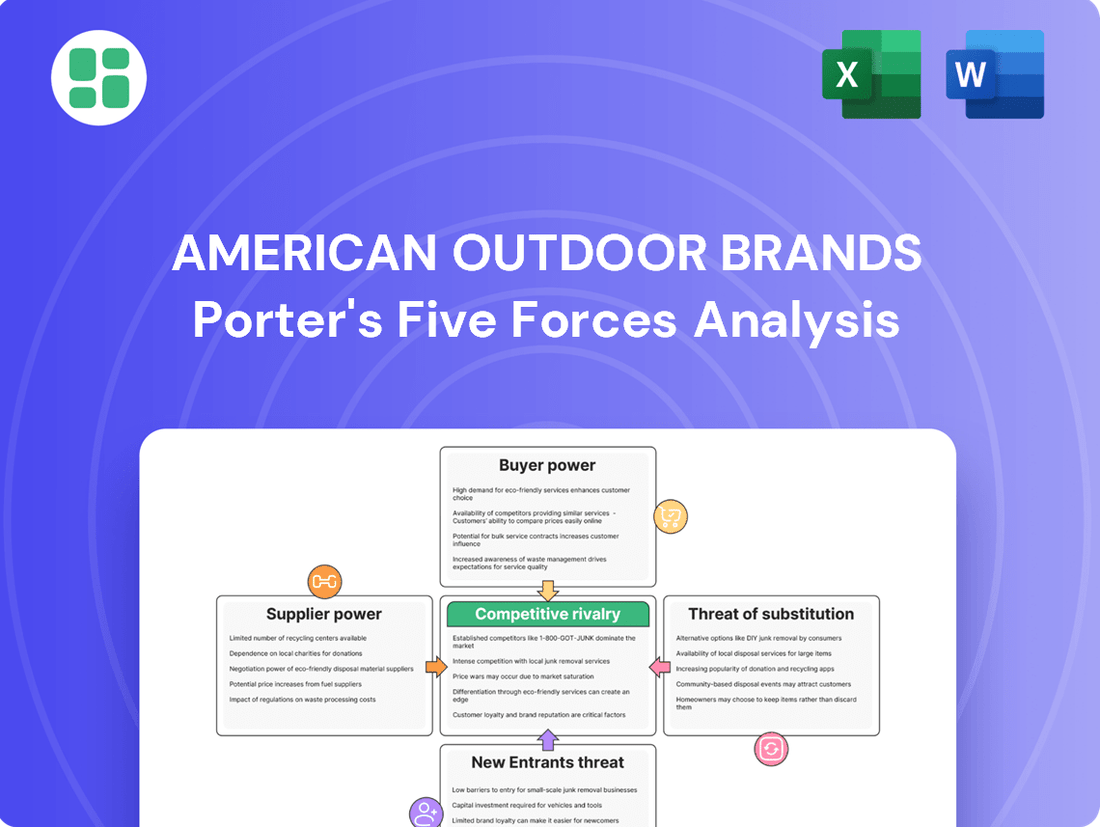

This analysis dissects American Outdoor Brands' competitive environment, evaluating the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products.

A visual representation of competitive intensity and strategic positioning, allowing American Outdoor Brands to proactively address threats and capitalize on opportunities.

Customers Bargaining Power

American Outdoor Brands relies on a mix of traditional retail and e-commerce for product distribution. Large retail chains, by virtue of their purchasing volume, hold significant sway. This means they can often negotiate for lower prices, more favorable payment schedules, or require promotional assistance, directly impacting American Outdoor Brands' margins.

The company's stated strategy of deepening partnerships with its retail and distribution channels highlights its awareness of this customer concentration. For instance, in fiscal year 2023, a substantial portion of American Outdoor Brands' revenue was generated through wholesale channels, underscoring the importance of these large retail relationships and the bargaining power they possess.

American Outdoor Brands (AOBC) boasts a diverse brand portfolio, including names like Smith & Wesson and M&P, catering to distinct outdoor and shooting sports segments. The company's focus on innovation, evidenced by its introduction of new firearm models and accessories, aims to create unique value propositions. However, the extent to which these innovations translate into truly differentiated products, making them stand out from a crowded market, directly influences how much power customers hold.

For end consumers, the switching costs associated with outdoor gear are typically low. Many products, from backpacks to tents, are quite interchangeable, meaning a customer can easily move from one brand to another without significant financial or functional penalty. This low barrier to switching empowers customers.

Retailers face slightly different considerations. Shifting away from American Outdoor Brands might necessitate changes in inventory management, marketing efforts, and how shelf space is allocated. However, if competing brands offer more appealing profit margins or superior sales support, retailers may find the incentive to switch strong enough to overcome these adjustments.

Price Sensitivity and Availability of Information

Customers in the outdoor market, particularly those who are not deeply committed enthusiasts, often show a strong preference for lower prices and are quick to take advantage of sales and discounts. This price sensitivity is amplified by the readily available information online. Consumers can effortlessly compare prices and product specifications across numerous brands, giving them significant leverage in their purchasing decisions.

The digital landscape has transformed how consumers approach outdoor gear purchases. In 2024, online price comparison tools and review sites are more sophisticated than ever, enabling shoppers to identify the best value propositions. For instance, a survey from early 2024 indicated that over 70% of consumers consider online reviews and price comparisons before buying outdoor equipment, directly impacting brands like American Outdoor Brands.

- Price Sensitivity: Casual outdoor consumers are highly attuned to price, actively seeking promotions and discounts.

- Information Accessibility: The internet provides easy access to price comparisons and product details, empowering informed customer choices.

- Value Proposition: Companies must align pricing with perceived product quality and innovation to meet customer expectations.

Threat of Backward Integration by Customers

While not a frequent occurrence, large retailers possess the potential to initiate or bolster their own private-label outdoor product lines. This form of backward integration would enable them to circumvent existing manufacturers, thereby gaining greater command over their supply chains and diminishing their dependence on suppliers such as American Outdoor Brands. In 2024, the retail sector continued to explore avenues for vertical integration to enhance margins and control product offerings.

Such a strategic shift demands substantial capital outlay for product design, manufacturing capabilities, and rigorous quality assurance protocols. For instance, a major sporting goods retailer might invest tens of millions of dollars to establish or acquire manufacturing facilities to produce their branded apparel or equipment.

The threat of backward integration by customers, particularly large retail chains, can exert downward pressure on pricing and profit margins for manufacturers like American Outdoor Brands. Retailers might leverage the credible threat of developing their own brands to negotiate more favorable terms or secure exclusive product lines.

Consider these potential impacts:

- Reduced Sales Volume: Retailers launching private labels could shift a portion of their sales away from established brands.

- Increased Price Competition: The entry of retailer-owned brands often intensifies price wars in the market.

- Supply Chain Leverage: Retailers gain more control, potentially dictating terms and product specifications.

The bargaining power of customers for American Outdoor Brands is moderate, influenced by price sensitivity and information accessibility. While end consumers can easily switch brands due to low switching costs, large retailers hold more sway through their purchasing volume and potential for private-label development.

In 2024, online price comparison tools and reviews significantly empower consumers, with over 70% referencing these before purchasing outdoor gear. This accessibility forces brands to align pricing with perceived value, impacting profit margins.

Large retail partners, representing a significant portion of AOBC's revenue, can negotiate favorable terms or demand promotional support due to their volume. The threat of retailers launching private labels further pressures AOBC on pricing and product terms.

| Customer Type | Bargaining Power Influence | Key Factors |

|---|---|---|

| End Consumers | Moderate | Low switching costs, high price sensitivity, easy information access |

| Large Retailers | High | Purchasing volume, potential for private labels, negotiating leverage |

Full Version Awaits

American Outdoor Brands Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces Analysis for American Outdoor Brands is meticulously detailed, covering the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. You'll gain a thorough understanding of the competitive landscape and strategic positioning of American Outdoor Brands within the outdoor recreation industry.

Rivalry Among Competitors

The outdoor lifestyle products market is a crowded space, with a large number of diverse competitors. American Outdoor Brands faces rivals from giants like Vista Outdoor and Columbia Sportswear, alongside numerous smaller, specialized brands focusing on specific niches such as hunting, fishing, or camping gear.

This broad spectrum of competitors, each with its own unique strengths and market focus, intensifies the rivalry across all segments American Outdoor Brands operates in. For instance, in the shooting accessories market, the company contends with highly specialized manufacturers, while in the broader outdoor apparel segment, it battles established sportswear brands.

The outdoor recreation market is showing robust growth, with participation rates on the rise. The market size is projected to expand significantly, which can ease competitive pressures by offering room for all players to grow. For instance, the Outdoor Recreation Roundtable reported that outdoor recreation contributed $862 billion to the U.S. GDP in 2022, supporting 4.5 million jobs.

While overall growth is positive, certain segments within the outdoor industry are showing signs of maturity. This maturity can intensify competition as companies vie for existing market share rather than solely benefiting from new customer acquisition. This dynamic means that while the pie is getting bigger, the slices could become more contested in specific product categories.

American Outdoor Brands places a strong emphasis on product differentiation through continuous innovation. In fiscal year 2023, new products accounted for a substantial portion of their net sales, demonstrating their commitment to bringing fresh offerings to market.

However, this strategic focus is mirrored by many competitors. The outdoor gear market is highly competitive, with numerous brands actively investing in research and development to introduce unique features, enhance product performance, and incorporate sustainable materials. This creates a dynamic environment where staying ahead requires constant adaptation and a keen understanding of evolving consumer preferences.

Exit Barriers in the Industry

High exit barriers, like substantial investments in manufacturing plants and specialized equipment, can really heat up competition within an industry. This means companies might stick around and fight for market share even when profits are thin, often leading to price wars or intense promotional campaigns. For American Outdoor Brands, while they aim for an asset-light approach, some fixed costs are unavoidable, potentially contributing to these pressures.

In 2023, the outdoor recreation industry saw continued consolidation. For instance, Vista Outdoor's acquisition of Foresight Sports for $285 million highlights the ongoing M&A activity, driven partly by companies seeking scale to overcome fixed costs. This trend suggests that even with an asset-light strategy, the underlying capital intensity of certain segments can still create significant exit barriers.

- High Capital Investment: Significant upfront costs for specialized manufacturing or R&D can make exiting difficult.

- Specialized Assets: Machinery or facilities tailored to specific products are hard to repurpose or sell.

- Long-Term Commitments: Contracts with suppliers or distributors can lock companies into operations.

- Brand Reputation: The value tied to a brand name might be lost if operations cease abruptly.

Brand Loyalty and Marketing Intensity

The competitive rivalry within the outdoor recreation sector, impacting American Outdoor Brands, is significantly shaped by consumer brand loyalty. American Outdoor Brands actively cultivates this loyalty through its established brands, aiming to create a dedicated customer base. For instance, in fiscal year 2024, the company continued to emphasize brand building across its portfolio, which includes well-recognized names in the outdoor space.

However, this loyalty is constantly challenged by substantial marketing investments from rivals. Competitors are not only spending on traditional advertising but also on community engagement and digital branding to capture and hold consumer interest. This dynamic creates an ongoing struggle for market share, where continuous efforts are needed to stand out and attract spending in a crowded marketplace.

- Brand Loyalty as a Driver: Consumer allegiance to specific outdoor brands directly intensifies the rivalry.

- American Outdoor Brands' Strategy: The company utilizes its portfolio of recognizable brands to build and maintain customer loyalty.

- Competitor Marketing Efforts: Rivals counter by heavily investing in marketing, branding, and community engagement to attract and retain customers.

- Continuous Battle for Attention: This leads to a constant struggle for consumer attention and spending in the outdoor products market.

Competitive rivalry for American Outdoor Brands is intense due to a fragmented market with numerous players, from large corporations like Vista Outdoor to niche specialists. This broad competition is further fueled by significant marketing investments from rivals aiming to capture consumer attention and loyalty, creating a constant battle for market share.

The outdoor recreation market's growth, contributing $862 billion to the U.S. GDP in 2022, offers opportunities, but segment maturity can intensify competition for existing market share. High exit barriers, such as specialized assets and brand reputation, also encourage companies to remain competitive even in challenging conditions, as seen with Vista Outdoor's acquisition activity in 2023.

| Competitor | Market Focus | 2023 Revenue (Approx. USD) |

|---|---|---|

| Vista Outdoor | Shooting Sports, Outdoor Recreation | $3.1 billion |

| Columbia Sportswear | Apparel, Footwear | $3.5 billion |

| YETI Holdings | Coolers, Drinkware, Bags | $1.7 billion |

SSubstitutes Threaten

The threat of substitutes for American Outdoor Brands is significant due to the vast array of alternative recreational activities available to consumers. Many leisure pursuits, such as indoor fitness centers or the booming esports industry, do not require specialized outdoor equipment, diverting potential spending. For instance, the global esports market was projected to reach over $1.8 billion in 2024, illustrating the scale of entertainment alternatives.

The rise of casualization and multi-purpose products presents a considerable threat of substitutes for American Outdoor Brands. Consumers are increasingly drawn to apparel that seamlessly transitions from outdoor adventures to everyday wear, blurring the lines between specialized outdoor gear and athleisure. This means a pair of high-quality hiking pants might be overlooked in favor of stylish, durable cargo pants suitable for both trail and town.

This trend directly impacts purchasing decisions, as versatility becomes a key purchasing driver. For instance, the athleisure market, valued at over $100 billion globally in 2023, demonstrates consumer willingness to adopt comfortable, functional clothing for a wider range of activities. This shift encourages consumers to opt for general-purpose items, potentially reducing demand for American Outdoor Brands' more specialized offerings.

The threat of substitutes for American Outdoor Brands' products, particularly in the general consumer goods category, is significant. If less specialized alternatives can deliver adequate performance at a lower cost, they can lure price-sensitive customers away. For instance, a basic multi-tool from a discount retailer might suffice for a casual camper, bypassing the need for a more specialized, higher-priced item from American Outdoor Brands.

This price-performance trade-off is especially relevant for products that aren't mission-critical for extreme conditions. In 2023, the outdoor recreation market saw continued growth, but also increased competition from mass-market retailers offering more affordable, albeit less specialized, gear. Consumers looking for general utility items, like knives or basic camping equipment, may opt for these lower-cost substitutes, impacting sales of more premium, niche offerings.

Growth of Rental and Secondhand Markets

The expanding rental and secondhand markets present a significant threat by offering consumers viable alternatives to new purchases. This shift is fueled by a growing preference for affordability and environmental sustainability, directly impacting the demand for new outdoor equipment.

For instance, the outdoor gear rental market, valued at approximately $1.5 billion in 2023, is projected to see continued growth. This trend allows consumers to access high-quality equipment for specific trips without the commitment of ownership, thereby reducing the perceived need to buy new from brands like American Outdoor Brands.

- Growing Consumer Preference: An increasing number of consumers are opting for rentals or pre-owned gear due to cost savings and a desire to reduce their environmental footprint.

- Market Size and Growth: The secondhand apparel market, which includes outdoor gear, is expected to reach $77 billion by 2025, indicating a substantial shift in purchasing habits.

- Impact on New Sales: These alternative channels directly compete with new product sales, potentially limiting market share and revenue for traditional manufacturers.

DIY Solutions and Minimalist Approaches

The threat of substitutes for American Outdoor Brands is amplified by the growing popularity of DIY solutions and minimalist outdoor approaches. Some enthusiasts, driven by a desire for self-sufficiency or a simpler connection with nature, are increasingly crafting their own gear or opting for multi-functional, less specialized equipment. This trend can directly reduce demand for commercially produced, often brand-specific, outdoor products.

For instance, the rise of bushcraft and survival skills communities often features detailed guides and tutorials for creating essential items like fire starters, shelters, and even basic tools. This DIY ethos bypasses the need to purchase items like lighters, tents, or specialized knives, directly impacting sales in those categories. In 2024, the market for outdoor recreation equipment, while robust, faces this nuanced challenge from individuals seeking to reduce reliance on manufactured goods.

- DIY Gear Creation: Some consumers are substituting commercially made items by crafting their own equipment, reducing reliance on brands.

- Minimalist Equipment Choices: A preference for fewer, more versatile items can replace the need for a wider array of specialized products.

- Cost and Skill Motivation: The drive for cost savings and the satisfaction of self-reliance fuel the adoption of DIY and minimalist strategies.

The threat of substitutes for American Outdoor Brands is substantial, as consumers have a wide array of alternative leisure activities and products available. This includes the burgeoning esports market, which garnered over $1.8 billion in 2024, and the growing athleisure sector, valued at over $100 billion globally in 2023, demonstrating a shift towards versatile, multi-purpose apparel.

Furthermore, the accessibility of lower-cost, less specialized alternatives from mass-market retailers and the increasing popularity of rental and secondhand markets significantly dilute demand for new, branded outdoor gear. For instance, the outdoor gear rental market was valued at approximately $1.5 billion in 2023, offering a cost-effective substitute for ownership.

| Substitute Category | Market Size/Projection (USD) | Key Drivers |

|---|---|---|

| Esports Market | > $1.8 billion (2024) | Digital entertainment, accessibility |

| Athleisure Market | > $100 billion (2023) | Comfort, versatility, fashion |

| Outdoor Gear Rental | ~ $1.5 billion (2023) | Cost savings, reduced commitment, environmental consciousness |

| Secondhand Apparel Market | $77 billion (by 2025) | Affordability, sustainability |

Entrants Threaten

Entering the outdoor lifestyle products market, particularly for a company aiming for a diverse portfolio similar to American Outdoor Brands, demands significant capital. This investment covers everything from initial product design and development to manufacturing, stocking inventory, and robust marketing campaigns. For instance, establishing a new, fully integrated manufacturing facility for firearms and related accessories, a segment American Outdoor Brands operates in, can easily run into tens of millions of dollars.

New players encounter substantial fixed costs when setting up operations. These costs are tied to building production facilities, securing reliable supply chains, and creating effective distribution networks. Consider the overhead involved in setting up a national distribution center, which can cost millions in real estate, equipment, and staffing, presenting a formidable hurdle for potential new entrants.

The high initial investment acts as a significant barrier to entry. For example, in 2023, the average capital expenditure for a new mid-sized manufacturing plant in the consumer goods sector often exceeded $50 million. This financial commitment deters many smaller companies or startups from entering a competitive landscape where established players already have economies of scale.

American Outdoor Brands benefits from a portfolio of well-recognized and established brands, fostering consumer trust and loyalty. For instance, in fiscal year 2023, the company reported net sales of $558.1 million, showcasing the strength of its existing market presence.

New entrants would need to invest heavily in brand building and marketing to overcome the inherent advantage of existing players. Capturing market share from consumers already loyal to established outdoor brands like Smith & Wesson or Ruger, which are part of American Outdoor Brands' legacy, requires significant capital and time.

For new companies entering the outdoor equipment market, securing shelf space in traditional retail stores and building a strong online presence presents a significant challenge. American Outdoor Brands, with its established network of retail partners and a well-developed e-commerce platform, already has a strong foothold.

This existing market access makes it difficult for newcomers to gain the necessary visibility and reach their target customers effectively. In 2024, the outdoor recreation market continued to see growth, with e-commerce sales playing an increasingly vital role, further solidifying the importance of robust digital distribution for any player.

Regulatory and Safety Hurdles

The outdoor products industry, especially sectors like shooting and personal security, faces significant regulatory and safety hurdles. New companies must contend with complex legal frameworks and stringent safety standards, which can be both time-consuming and expensive to comply with. This can act as a substantial barrier, deterring potential entrants from entering specific, highly regulated product categories.

- Regulatory Compliance Costs: Navigating federal and state regulations, such as those from the ATF for firearms or CPSC for general consumer products, adds significant overhead.

- Safety Testing and Certification: Products often require rigorous testing and certification to meet safety benchmarks, increasing development costs and time-to-market.

- Legal Expertise: Companies need access to specialized legal counsel to ensure ongoing compliance, which represents a fixed cost that can be prohibitive for smaller startups.

- Brand Reputation Risk: Non-compliance or safety failures can lead to severe reputational damage and legal repercussions, making the initial investment in regulatory adherence critical.

Economies of Scale and Experience Curve

Existing players like American Outdoor Brands leverage significant economies of scale in production, purchasing, and marketing. This translates to lower per-unit costs, enabling them to offer competitive pricing or maintain healthier profit margins. For instance, in 2024, major outdoor gear manufacturers often operate with production facilities that can handle volumes far exceeding what a startup could initially manage. This cost advantage creates a substantial barrier for newcomers attempting to enter the market.

Furthermore, the experience curve plays a crucial role. Companies with a long operational history have refined their processes, supply chains, and product development cycles, leading to greater efficiency and quality. This accumulated knowledge allows them to innovate faster and more cost-effectively than a new entrant. By 2024, the outdoor industry saw continued consolidation, with larger firms acquiring smaller ones to gain access to new technologies and customer bases, further reinforcing the advantages of scale and experience.

- Economies of Scale: Lower per-unit costs in manufacturing and procurement.

- Experience Curve: Refined processes and product development leading to greater efficiency.

- Competitive Pricing: Established players can offer more attractive prices due to cost advantages.

- Market Entry Barrier: Difficult for new, smaller competitors to match cost structures and operational efficiencies.

The threat of new entrants into the outdoor products market, particularly for a company like American Outdoor Brands, is generally considered moderate to low. Significant capital requirements for manufacturing, distribution, and brand building present substantial initial hurdles. For instance, establishing a new firearms manufacturing facility can easily cost tens of millions of dollars, a figure prohibitive for many startups. This high barrier to entry is further amplified by the need for substantial investment in marketing to compete with established brands and secure market access.

Economies of scale enjoyed by incumbents like American Outdoor Brands, which reported $558.1 million in net sales in fiscal year 2023, create a significant cost advantage. New entrants would struggle to match these efficiencies in production, purchasing, and distribution. Moreover, navigating complex regulatory landscapes, especially in sectors like firearms, adds considerable cost and time, acting as a further deterrent to potential new competitors entering the market in 2024.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High initial investment for manufacturing, inventory, and marketing. | Significant barrier, especially for startups. |

| Economies of Scale | Lower per-unit costs for established players due to high production volumes. | New entrants face higher costs, impacting pricing competitiveness. |

| Brand Loyalty & Market Access | Established brands have consumer trust; securing distribution is challenging. | Requires substantial marketing spend and time to build recognition. |

| Regulatory Hurdles | Complex legal frameworks and safety standards, particularly in firearms. | Increases compliance costs, development time, and legal expertise needs. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for American Outdoor Brands leverages data from the company's SEC filings, investor relations reports, and industry-specific market research from firms like IBISWorld. We also incorporate insights from trade publications and competitor announcements to provide a comprehensive view of the competitive landscape.