American Outdoor Brands Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Outdoor Brands Bundle

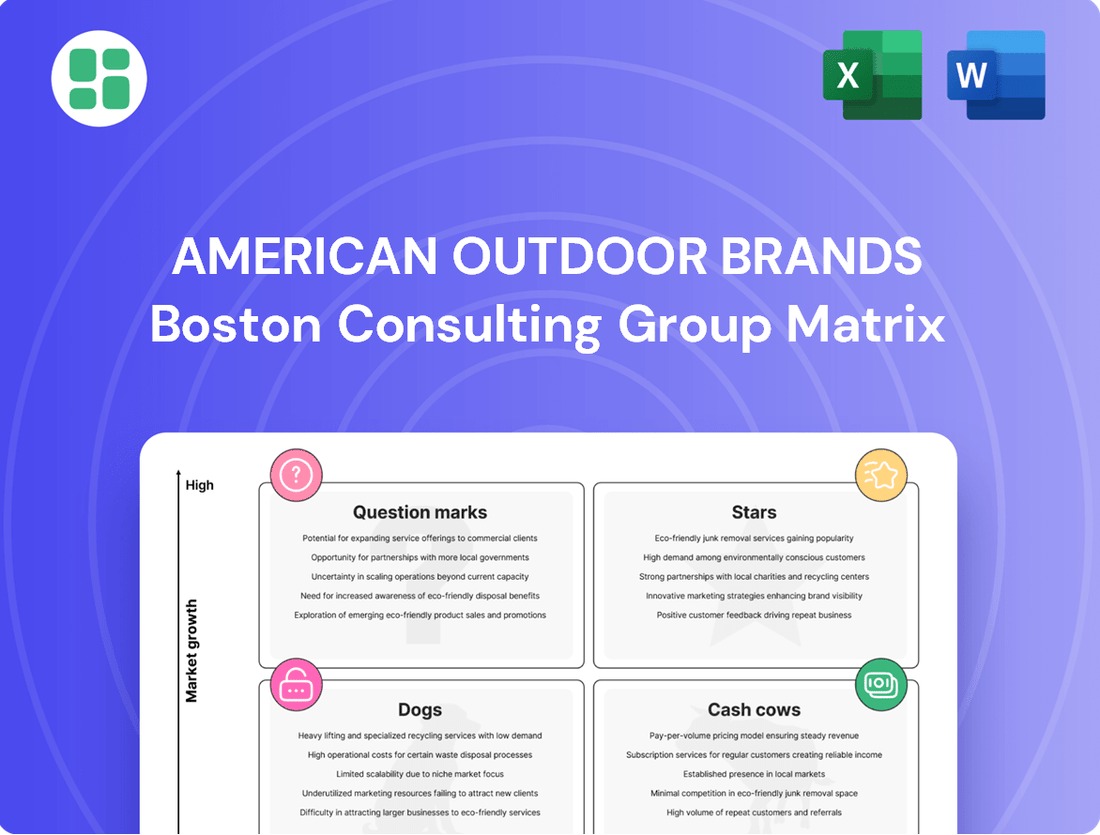

American Outdoor Brands' BCG Matrix offers a strategic snapshot of its diverse product portfolio, highlighting potential growth areas and areas needing careful management. Understanding which brands are Stars, Cash Cows, Dogs, or Question Marks is crucial for informed decision-making.

Don't miss out on the complete analysis that will empower you to optimize resource allocation and capitalize on market opportunities. Purchase the full BCG Matrix for actionable insights and a clear path forward.

Stars

BUBBA Fishing Products is a clear star in American Outdoor Brands' portfolio. Their innovative Smart Fish Scale (SFS) Lite even snagged a 'Best of Category' award at ICAST 2025, highlighting its cutting-edge appeal. This brand is a major contributor to the company's fishing segment, suggesting a dominant presence in the expanding market for technologically advanced fishing equipment.

Grilla Outdoor Cooking Equipment is positioned as a Star within American Outdoor Brands' portfolio. The company is actively expanding its presence in the booming outdoor cooking market, evidenced by recent product introductions such as the Mammoth Vertical Smoker and the Pie-Ro pizza oven. This strategic move into new product lines signals a strong growth trajectory.

With plans for retail entry in fiscal year 2025, Grilla is aiming to capitalize on the high-growth potential of the outdoor cooking sector. This expansion strategy is designed to capture substantial market share, reinforcing its status as a Star performer. The brand's commitment to innovation and market penetration is a key driver of its current success.

MEAT! Your Maker's expansion into the retail channel in 2024 is a smart move, tapping into the growing trend of home food processing and outdoor cooking. This strategic push aims to capture a larger slice of a market that's seeing increased consumer engagement.

This expansion positions MEAT! Your Maker as a Star within the American Outdoor Brands portfolio. By entering retail, they are targeting a segment with substantial growth prospects, fueled by consumer enthusiasm for DIY food preparation and the burgeoning outdoor lifestyle market.

Hooyman Land Management Tools

Hooyman Land Management Tools is showing robust expansion, reflected in its new product launches like seed spreaders and a significant increase in distribution channels. This growth is evident in their entry into DIY and farm and home retail markets, indicating a strategic move to capture a wider customer base.

The brand is effectively increasing its market penetration within the land management sector, a segment benefiting from the ongoing surge in outdoor lifestyle activities. For instance, the U.S. outdoor recreation economy generated $788 billion in economic output in 2022, showcasing the market's potential.

- Product Innovation: Introduction of new items like seed spreaders.

- Distribution Expansion: Entry into DIY and farm and home retail sectors.

- Market Penetration: Growing presence in the land management category.

- Industry Trend Alignment: Capitalizing on the increasing engagement with outdoor lifestyles.

Overall Outdoor Lifestyle Category

American Outdoor Brands' Outdoor Lifestyle category stands out as a strong performer within the company's portfolio. This segment has demonstrated impressive financial traction, with sales climbing 6.9% in fiscal year 2024 and a substantial 16.2% in fiscal year 2025. These figures underscore the category's significant market share and its ability to capitalize on consumer interest in activities like hunting, fishing, and outdoor cooking.

The growth is fueled by strategic initiatives, including the introduction of innovative new products and successful expansion across various sales channels. This dynamic performance positions the Outdoor Lifestyle category as a key contributor to American Outdoor Brands' overall success, reflecting a robust demand for its offerings in a thriving market.

- Robust Sales Growth: 6.9% increase in FY2024 and 16.2% in FY2025.

- Diverse Market Segments: Covers hunting, fishing, outdoor cooking, and rugged outdoor activities.

- Key Growth Drivers: New product introductions and channel expansion.

- Market Position: High market share in growing outdoor activity segments.

BUBBA Fishing Products is a star, evidenced by its award-winning Smart Fish Scale Lite at ICAST 2025, driving growth in the tech-focused fishing gear market.

Grilla Outdoor Cooking Equipment is a star, expanding into new products like the Mammoth Vertical Smoker and Pie-Ro pizza oven, and planning retail entry in FY2025 to capture market share in the booming outdoor cooking sector.

MEAT! Your Maker is a star, successfully entering the retail channel in 2024 to capitalize on the growing home food processing and outdoor cooking trends.

Hooyman Land Management Tools is a star, expanding its product line with seed spreaders and increasing distribution into DIY and farm/home retail, aligning with the robust U.S. outdoor recreation economy which generated $788 billion in 2022.

| Brand | Category | Key Growth Driver | Market Performance Indicator |

|---|---|---|---|

| BUBBA Fishing Products | Fishing Gear | Product Innovation (Smart Fish Scale Lite) | ICAST 2025 Award |

| Grilla Outdoor Cooking | Outdoor Cooking | New Product Launches & Retail Expansion | High Growth Potential |

| MEAT! Your Maker | Food Processing | Retail Channel Entry | Capturing DIY & Outdoor Trends |

| Hooyman Land Management | Land Management Tools | Product & Distribution Expansion | Alignment with $788 Billion Outdoor Economy (2022) |

What is included in the product

This BCG Matrix analysis highlights American Outdoor Brands' product portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs.

American Outdoor Brands' BCG Matrix provides a clear, one-page overview, relieving the pain of scattered business unit performance data.

Cash Cows

Caldwell, a prominent brand within American Outdoor Brands' Shooting Sports segment, consistently demonstrates robust performance in shooting accessories, signifying a substantial market share within this mature industry. The brand's established product lines, such as their popular bipods and shooting rests, continue to be reliable revenue generators.

While American Outdoor Brands is investing in innovation, like the recently expanded Claymore family of lights, Caldwell's core accessory offerings are likely contributing significant, steady cash flow. This is characteristic of a Cash Cow, operating in a market with established demand but limited explosive growth potential.

Schrade Knives and Tools represents a classic cash cow for American Outdoor Brands. As a brand with deep roots and strong recognition in the traditional knives and outdoor tools market, it likely commands a substantial share. This segment, being mature, generates steady and dependable cash flow for the parent company.

The consistent revenue from Schrade doesn't necessitate significant new capital infusions for expansion, allowing American Outdoor Brands to allocate resources elsewhere. In 2024, the outdoor recreation market, which includes tools and knives, continued to show resilience, with many consumers prioritizing durable and reliable gear for their activities.

Old Timer, a cornerstone of American Outdoor Brands' offerings, embodies a rich heritage in traditional cutlery. This brand commands a loyal following, consistently generating stable revenue streams due to its established market presence and predictable demand.

In the context of the BCG Matrix, Old Timer firmly resides in the Cash Cow quadrant. This classification stems from its high market share within a mature, low-growth segment of the cutlery market. For instance, American Outdoor Brands reported net sales of $237.6 million for the fiscal year ended March 31, 2024, with its Outdoor Products segment, which includes cutlery, contributing significantly to this total.

Wheeler Gunsmithing Tools

Wheeler Gunsmithing Tools operates within the firearm maintenance and customization niche, a segment characterized by a dedicated, albeit not rapidly expanding, customer base. This specialization allows Wheeler to command a strong market position. The predictable demand for these tools, essential for firearm enthusiasts, translates into consistent cash flow generation.

In 2024, the outdoor recreation market, which includes firearm accessories and maintenance, continued to show resilience. While specific revenue figures for Wheeler Gunsmithing Tools within American Outdoor Brands are not publicly itemized, the broader accessories and components segment, which Wheeler falls under, has historically been a stable contributor. For instance, in fiscal year 2023, American Outdoor Brands reported total revenue of $204.6 million, with their Outdoor Products & Accessories segment, where Wheeler resides, being a significant part of this. The consistent need for maintenance and upgrades by firearm owners ensures Wheeler's role as a cash cow.

- Niche Market Dominance: Wheeler's focus on firearm gunsmithing tools positions it as a leader in a specialized, recurring-revenue market.

- Stable Cash Flow: The essential nature of firearm maintenance and customization ensures a predictable income stream.

- Market Resilience: The outdoor recreation sector, including firearm accessories, demonstrated continued strength through 2024.

- Brand Loyalty: Enthusiast-driven markets often foster strong brand loyalty, benefiting established players like Wheeler.

Traditional Channel Distribution

American Outdoor Brands' traditional channel distribution is a clear cash cow. This segment experienced an impressive 18.1% growth in fiscal year 2025, showcasing the enduring strength of their brick-and-mortar retail presence.

This established network consistently delivers robust sales and healthy profit margins. It serves as a dependable engine for cash flow, particularly within the stable environment of traditional retail.

- Strong FY2025 Growth: 18.1% increase in revenue from traditional channels.

- High Profitability: Consistent generation of high sales and profit margins.

- Stable Cash Flow: Reliable income source in a predictable retail landscape.

- Market Position: Dominant presence in established brick-and-mortar retail.

Caldwell, Schrade, and Old Timer are prime examples of American Outdoor Brands' cash cows. These brands, operating in mature markets with high brand recognition, consistently generate substantial and stable cash flow. Their established product lines require minimal investment for growth, allowing the company to reallocate capital to other strategic areas.

Wheeler Gunsmithing Tools also fits the cash cow profile, serving a specialized but loyal customer base with essential maintenance products. The company's traditional distribution channels further solidify its cash cow status, demonstrating impressive revenue growth in fiscal year 2025.

| Brand | Category | BCG Quadrant | Key Financial Trait | Market Characteristic |

|---|---|---|---|---|

| Caldwell | Shooting Accessories | Cash Cow | Steady Revenue Generator | Mature, Established Demand |

| Schrade Knives and Tools | Cutlery & Outdoor Tools | Cash Cow | Dependable Cash Flow | Mature, High Brand Recognition |

| Old Timer | Cutlery | Cash Cow | Stable Revenue Streams | Mature, Predictable Demand |

| Wheeler Gunsmithing Tools | Firearm Maintenance | Cash Cow | Consistent Cash Flow | Specialized, Recurring Revenue |

| Traditional Channels | Retail Distribution | Cash Cow | Robust Sales & Profit Margins | Stable, Established Network |

Preview = Final Product

American Outdoor Brands BCG Matrix

The American Outdoor Brands BCG Matrix you are currently previewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive report is designed for strategic clarity, offering a professional and actionable analysis of American Outdoor Brands' product portfolio without any watermarks or demo content.

Dogs

American Outdoor Brands identified a weakness in its personal protection products during the first quarter of fiscal year 2025, a segment within its broader Shooting Sports category. This performance signals a low-growth environment for these products, potentially indicating a declining market position for the company within this niche.

Given this trend, personal protection products are likely categorized as a 'Dog' within the BCG Matrix framework. This classification suggests that the company may need to re-evaluate its investment and strategy for this product line, as it contributes little to overall growth and may even be a drain on resources.

While the broader Outdoor Lifestyle sector shows positive momentum, certain rugged outdoor sub-segments experienced a slowdown in Q1 FY25. This indicates potential challenges for American Outdoor Brands in areas where its market share might be limited or facing intense competition within a less vibrant market. For instance, sales in some core rugged gear categories saw a modest year-over-year decline, contrasting with the overall category growth.

Within American Outdoor Brands' (AOB) e-commerce operations, specific niches are showing signs of underperformance. While the overall e-commerce channel saw a slight increase in fiscal year 2025, it experienced a decline in fiscal year 2024. This suggests that certain product categories within their online offerings are not keeping pace, potentially due to intense competition and less effective digital strategies.

The competitive online landscape means that even with a slight overall uptick, individual e-commerce niches can struggle. For AOB, this translates to specific product lines within their e-commerce business likely having a low market share and facing significant hurdles in achieving growth. This situation places these underperforming niches in the Dogs quadrant of the BCG Matrix, requiring careful evaluation.

Older, Undifferentiated Product Lines

American Outdoor Brands' commitment to innovation suggests that older, less differentiated product lines are likely in mature or declining markets. These products, not benefiting from recent advancements, would typically hold a low market share and generate modest returns, potentially acting as cash traps within the company's portfolio.

For example, if we consider a hypothetical scenario where older hunting accessory lines within American Outdoor Brands have not been updated in several years, their market share might be stagnant. In 2024, the outdoor recreation market, while robust, sees significant growth driven by new technologies and consumer trends. Products failing to adapt to these shifts, such as those lacking smart features or sustainable materials, would naturally fall into the "Dogs" category.

- Low Market Share: Products not aligned with current consumer demands or technological advancements struggle to capture significant market share.

- Minimal Returns: Undifferentiated products often face intense price competition, leading to low profit margins.

- Stagnant Market: Older product lines are often found in sub-markets that are not experiencing significant growth or innovation.

- Resource Drain: Continued investment in maintaining these products can divert resources from more promising growth areas.

Products Impacted by Shifting Consumer Trends

Products that cater to outdoor trends that are no longer expanding rapidly or have become saturated, particularly if they do not align with the evolving preferences of 'casual consumers,' may constitute Dogs for American Outdoor Brands (AOB). These items, potentially including certain legacy hunting gear or traditional camping equipment, would likely experience low demand and minimal market share as consumer interest shifts towards more specialized or technologically advanced outdoor pursuits.

For instance, if AOB's portfolio includes products heavily reliant on traditional camping techniques that have seen a slowdown in growth compared to the booming market for portable solar chargers or advanced hydration systems, these could be classified as Dogs. The company's 2023 annual report might indicate declining sales figures for specific product lines that fit this description, signaling a need for strategic reassessment.

The market for some traditional outdoor equipment, like basic tent models or manual fishing reels, has matured significantly. In 2024, these segments might show flat or even negative year-over-year growth, especially when contrasted with the high growth rates seen in areas like electric bikes or specialized trail running apparel. This divergence in market dynamics places older, less innovative products in the Dog quadrant.

- Mature Market Segments: Products in outdoor categories experiencing saturation or declining growth, such as basic camping accessories.

- Shifting Consumer Preferences: Items that don't appeal to the growing segment of 'casual consumers' or new outdoor enthusiasts.

- Low Market Share: Products with a diminished presence in the market due to competition or lack of innovation.

- Potential for Divestment: Such offerings might be candidates for discontinuation or sale to focus resources on more promising business areas.

Products identified as Dogs within American Outdoor Brands' portfolio are those with low market share in slow-growing or declining markets. These are often older product lines that haven't kept pace with innovation or shifting consumer preferences. For instance, certain legacy hunting accessories or basic camping equipment that haven't been updated might fall into this category, potentially experiencing stagnant or declining sales figures, as seen in some segments during fiscal year 2024.

| Product Category Example | Market Growth (2024 Est.) | AOB Market Share (Est.) | BCG Quadrant |

|---|---|---|---|

| Basic Camping Tents | Low | Low | Dog |

| Legacy Hunting Optics | Slow | Low | Dog |

| Traditional Fishing Reels | Flat/Declining | Low | Dog |

Question Marks

The Caldwell ClayCopter™ is positioned within American Outdoor Brands' BCG Matrix as a potential Star. This innovative product targets the high-growth clay target throwing market, a segment where the company is strategically focusing its investments.

As a relatively new entrant, the ClayCopter™ currently holds a nascent market share. However, its disruptive nature and the company's commitment to development suggest a strong possibility of capturing significant market share, thereby evolving into a Star performer within the portfolio.

American Outdoor Brands' international market expansion is a key area for future growth, as evidenced by its recent performance. In the first quarter of fiscal year 2025, international net sales surged by over 21%. This follows a robust 20% increase in international net sales for the entirety of fiscal year 2025 when compared to the previous fiscal year.

While this growth is impressive, international sales currently represent a modest percentage of the company's total net sales. This low current market share in international territories suggests significant untapped potential and a strong opportunity for continued expansion and increased revenue generation abroad.

The introduction of the Grilla Pie-Ro™ in May 2025 signifies American Outdoor Brands' strategic move into the burgeoning backyard pizza oven market. This represents a new venture into a high-growth segment of outdoor cooking, aiming to capture market share from a nascent position.

This category is experiencing significant expansion, with the outdoor cooking market projected to reach $20.7 billion by 2027, growing at a CAGR of 4.5%. The pizza oven sub-segment is a key driver of this growth, fueled by consumer interest in authentic, high-quality outdoor culinary experiences.

Enhanced Direct-to-Consumer (DTC) Initiatives

American Outdoor Brands (AOB) is actively investigating new avenues for reaching customers, with a particular focus on strengthening its direct-to-consumer (DTC) operations. This strategic pivot acknowledges the burgeoning growth of DTC channels within the outdoor sector, a trend that has seen significant acceleration in recent years.

While AOB is still formulating its comprehensive DTC strategy, this area is currently classified as a 'Question Mark' within the BCG Matrix. This classification signifies a business unit with high growth potential but currently low market share. Substantial investment will be crucial for AOB to establish a strong foothold and capture significant market share in this competitive landscape.

The outdoor industry's DTC segment has demonstrated robust expansion. For instance, in 2024, the global outdoor recreation market was projected to reach hundreds of billions of dollars, with DTC sales forming an increasingly significant portion of that total. AOB's investment in this channel aims to capitalize on this trend.

- DTC Growth: The outdoor industry's DTC channel is experiencing rapid expansion, presenting a key opportunity for AOB.

- Strategic Investment: Enhancing DTC initiatives requires significant capital infusion to build brand presence and customer loyalty.

- Market Share Potential: As a 'Question Mark', AOB's DTC efforts have the potential for high returns if successful in gaining market share.

- Competitive Landscape: AOB faces established players in the DTC space, necessitating a well-defined and differentiated strategy.

Advanced Technology-Infused Outdoor Gear

The outdoor industry is seeing a significant shift towards technology integration, with American Outdoor Brands actively exploring this trend. Their focus on advanced technology-infused outdoor gear positions them to potentially capture future growth.

While current market share for these specific high-tech items might be low, their high growth potential aligns with the characteristics of a 'Star' in the BCG matrix. For instance, the broader smart outdoor equipment market was projected to reach over $10 billion by 2024, indicating substantial room for expansion.

American Outdoor Brands' investment in this area, building on successes like the BUBBA SFS, signals a strategic move towards developing next-generation products. This approach is crucial for maintaining a competitive edge in an evolving market.

- Market Trend: Increasing technological integration in outdoor products.

- Company Strategy: Exploration of nascent, high-tech product ventures.

- BCG Classification: Potential 'Stars' with low current market share but high growth prospects.

- Industry Data: Smart outdoor equipment market projected to exceed $10 billion by 2024.

American Outdoor Brands' direct-to-consumer (DTC) channel is classified as a Question Mark due to its high growth potential and currently low market share. The company is strategically investing in this area to build brand presence and customer loyalty in a rapidly expanding segment of the outdoor industry.

The DTC segment within the outdoor sector is experiencing significant acceleration, with global DTC sales in the outdoor recreation market projected to form an increasingly substantial portion of the overall market's hundreds of billions in value during 2024. AOB's focus here requires substantial capital to compete effectively.

This strategic pivot acknowledges the growing importance of direct customer relationships. Success in this area could lead to significant revenue growth, but it demands careful execution against established competitors.

The company's investment in DTC is a calculated move to capitalize on market trends, aiming to establish a strong foothold and capture market share in this competitive yet promising landscape.

BCG Matrix Data Sources

Our BCG Matrix for American Outdoor Brands is built on verified market intelligence, combining financial data from SEC filings, industry research from market analysis firms, and official company reports to ensure reliable insights.