American Outdoor Brands PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Outdoor Brands Bundle

Navigate the dynamic landscape of the outdoor recreation industry with our comprehensive PESTLE analysis of American Outdoor Brands. Understand how political shifts, economic fluctuations, and evolving social trends are impacting their operations and future growth. Download the full analysis to gain actionable intelligence and sharpen your strategic advantage.

Political factors

Government regulations on outdoor access and land use significantly shape the market for outdoor recreation products. Policies enacted by federal, state, and local governments concerning public lands, national parks, and wilderness areas directly influence consumer demand for gear like camping, hiking, and hunting equipment.

For instance, the Bureau of Land Management (BLM) manages 245 million acres of public land, a substantial portion of which is open for recreational use, impacting sales for companies like American Outdoor Brands. Changes in land management practices, such as increased conservation efforts or the designation of new recreational zones, can either boost or dampen consumer interest in related products.

In 2023, the National Park Service reported over 320 million recreation visits to national parks, highlighting the sheer scale of public land engagement that drives the outdoor industry. Shifts in accessibility or permitted activities on these lands, whether through new legislation or updated management plans, directly translate to opportunities or challenges for outdoor brands.

American Outdoor Brands' profitability is significantly influenced by trade policies and tariffs. For instance, the company sources a substantial portion of its materials and finished goods internationally. Changes in tariffs, such as those imposed on goods from China in recent years, directly increase the cost of imported components, impacting the cost of goods sold. In 2023, the U.S. continued to navigate complex trade relationships, with ongoing discussions around tariffs and trade agreements potentially affecting supply chain stability and pricing for outdoor lifestyle products.

Political stability in the United States directly impacts consumer confidence, which in turn affects discretionary spending on items like outdoor gear. When the political climate is stable, consumers tend to feel more secure about their financial future, leading to increased spending on recreational activities and associated products. Conversely, periods of political uncertainty or significant policy shifts can dampen this confidence, potentially causing consumers to postpone or reduce purchases of non-essential goods, affecting brands like American Outdoor Brands across their diverse product lines.

Industry-Specific Lobbying and Advocacy

Lobbying by outdoor industry associations significantly shapes legislation impacting consumer access and participation in activities like hunting and fishing. While American Outdoor Brands has divested from some shooting sports segments, these policy areas still influence the broader outdoor recreation market, affecting consumer sentiment and engagement. For instance, in 2024, the Congressional Sportsmen's Foundation reported actively engaging on over 100 legislative proposals impacting sportsmen and women across the nation.

These advocacy efforts can indirectly affect companies like American Outdoor Brands by influencing the overall health and accessibility of outdoor pursuits. Positive legislative outcomes can boost consumer confidence and spending in the outdoor sector. Conversely, restrictive policies might dampen enthusiasm for related activities, potentially impacting sales of outdoor apparel and gear.

- Influence on Access: Lobbying efforts often focus on maintaining or expanding access to public lands for hunting, fishing, and recreational shooting.

- Economic Impact: The outdoor recreation industry is a significant economic driver, with advocacy groups highlighting its contributions to local and national economies.

- Regulatory Environment: Industry associations advocate for regulations that are perceived as fair and science-based, impacting everything from firearm manufacturing to conservation funding.

- Consumer Engagement: Policy decisions can directly affect the cost and ease of participating in outdoor activities, thereby influencing consumer engagement and spending patterns.

Public Safety and Security Policies

Government policies directly impacting public safety and personal security, particularly those concerning self-defense tools and accessories, are a significant political factor for American Outdoor Brands. Shifts in these regulations can directly influence consumer demand for specific product categories within the company's offerings.

For instance, legislative changes at state or federal levels regarding firearm ownership, concealed carry permits, or the sale of certain accessories could either boost or dampen sales for American Outdoor Brands' firearm components and related tactical gear.

- 2024 Data: While specific 2024 policy impacts are still unfolding, the broader trend in 2023 saw continued debate and varying state-level legislation concerning Second Amendment rights, influencing accessory sales.

- Consumer Perception: Evolving public perception of personal security needs, often amplified by media coverage of crime rates, can create a more receptive market for self-defense products, a key segment for American Outdoor Brands.

- Legal Frameworks: Changes in legal frameworks, such as the potential for expanded background check requirements or restrictions on certain types of firearm modifications, directly affect the market accessibility and consumer purchasing behavior for relevant products.

Government policies on public land access, such as those managed by the Bureau of Land Management, directly influence consumer participation in outdoor activities, impacting demand for American Outdoor Brands' gear. The National Park Service reported over 320 million recreation visits in 2023, underscoring the scale of this market. Furthermore, trade policies and tariffs, including ongoing discussions in 2024, affect the cost of imported goods for the company, influencing its cost of goods sold.

Political stability is crucial, as it bolsters consumer confidence and discretionary spending on outdoor products, a trend observed throughout 2023. Lobbying by industry groups, like the Congressional Sportsmen's Foundation's engagement on over 100 legislative proposals in 2024, shapes the regulatory landscape and consumer engagement in activities like hunting and fishing.

Changes in public safety and personal security regulations, particularly those related to firearm ownership and accessories, directly impact key product segments for American Outdoor Brands. The evolving legislative landscape in 2024, following 2023's debates on Second Amendment rights, continues to shape consumer purchasing behavior for self-defense related items.

What is included in the product

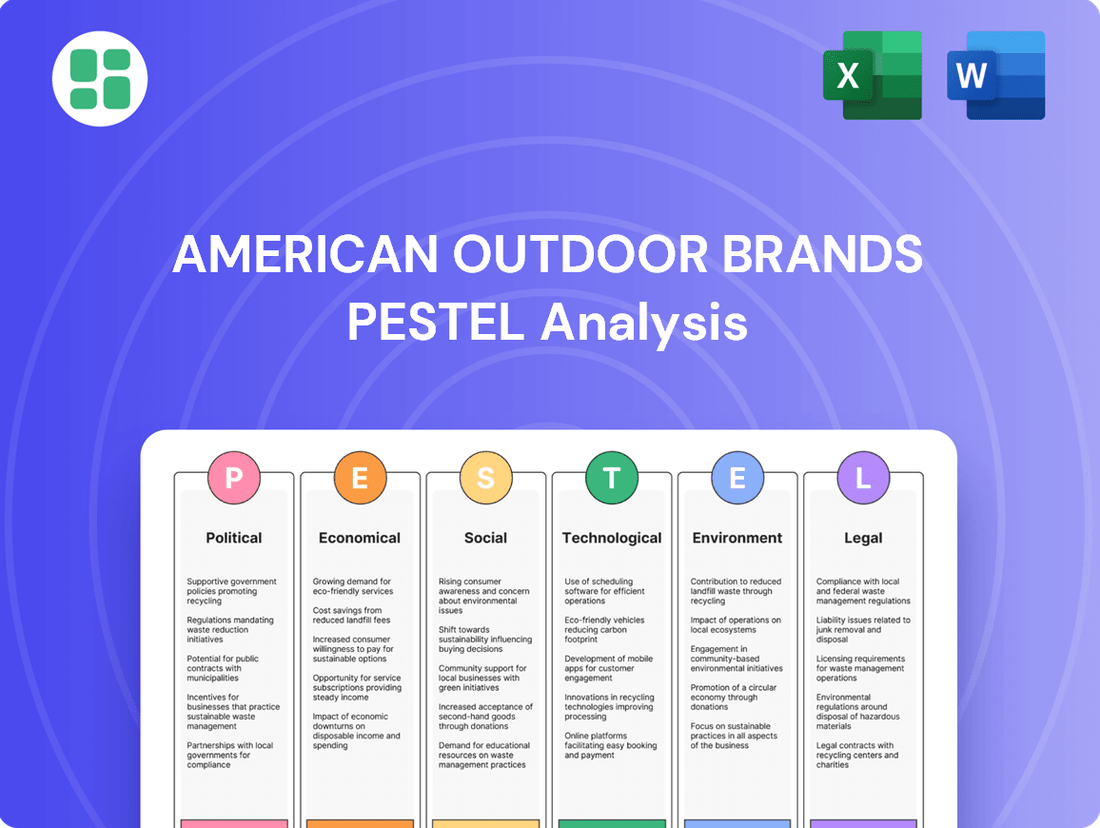

This PESTLE analysis dissects the external macro-environmental forces impacting American Outdoor Brands, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It offers actionable insights for strategic decision-making by identifying key trends and their implications for the company's future growth and competitive positioning.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, distilling complex external factors into actionable insights for American Outdoor Brands.

Economic factors

Consumer discretionary spending is a key driver for American Outdoor Brands, as its products, like firearms and hunting gear, are often considered non-essential. When consumers have more disposable income, they tend to spend more on these recreational items. For instance, in early 2024, reports indicated a slight rebound in consumer confidence, which could translate to increased spending on outdoor pursuits.

However, economic headwinds such as persistent inflation can significantly curb this spending. Higher prices for everyday necessities leave less money for discretionary purchases, directly impacting sales volumes for companies like American Outdoor Brands. Data from late 2023 showed that while consumer spending overall remained resilient, the composition shifted, with more spending on essentials and less on discretionary goods.

Inflation significantly impacts American Outdoor Brands by increasing the cost of raw materials like metals, plastics, and textiles, as well as manufacturing and transportation expenses. For instance, the Producer Price Index for manufactured goods saw an increase, directly affecting the cost of components. This rise in operational costs can squeeze profit margins if the company is unable to pass these higher expenses onto consumers through price adjustments for its outdoor products, influencing its overall financial performance and pricing strategies.

Fluctuations in interest rates directly impact American Outdoor Brands' ability to access capital and influence consumer spending on big-ticket items like firearms and outdoor equipment. When interest rates rise, borrowing becomes more expensive for the company, potentially slowing down investment in new product lines or facility upgrades. For instance, if the Federal Reserve raises its benchmark rate, the cost of servicing existing debt for American Outdoor Brands increases, and new loans for expansion become pricier.

Higher interest rates also tend to curb consumer demand. Potential buyers may postpone purchases of recreational vehicles, boats, or even high-end sporting goods if financing costs become prohibitive, as seen in periods of aggressive monetary tightening. This reduced consumer spending can lead to slower sales growth for American Outdoor Brands, impacting revenue and profitability. For example, during the Fed's rate hikes in 2022-2023, many durable goods sectors experienced a slowdown in demand.

Exchange Rates and International Sales

Fluctuating exchange rates significantly impact American Outdoor Brands' international sales. A stronger U.S. dollar, as seen at various points in 2024 and projected into 2025, makes the company's products more expensive for overseas customers, potentially dampening demand. For instance, if the Euro weakens against the dollar, European consumers will need more Euros to purchase the same dollar-priced item, leading to a decrease in sales volume.

Conversely, a strong dollar can benefit American Outdoor Brands by reducing the cost of imported components. This can lower the cost of goods sold, potentially improving profit margins on products manufactured with foreign parts. However, the net effect depends on the balance between sales volume and sourcing cost changes.

The company's international sales performance is therefore directly tied to currency movements. For example, if the Canadian dollar depreciates significantly against the U.S. dollar in late 2024, sales to Canadian customers could see a noticeable decline in dollar terms, even if unit sales remain stable.

- Impact on Export Pricing: A stronger USD in 2024-2025 makes American Outdoor Brands' goods pricier overseas, potentially hurting international sales volume.

- Sourcing Cost Advantage: A strong dollar can lower the cost of imported raw materials and components, improving cost of goods sold.

- Profitability Sensitivity: The net effect on profitability hinges on the interplay between reduced sales revenue from weaker foreign currencies and lower input costs.

- Regional Variations: Currency fluctuations vary by region, meaning the impact on sales and costs will differ across American Outdoor Brands' international markets.

E-commerce Growth and Retail Landscape

The shift towards online shopping continues to reshape the retail sector, directly impacting outdoor brands. In 2024, e-commerce sales in the U.S. were projected to reach over $1.1 trillion, demonstrating a significant portion of consumer spending now happens digitally. This trend necessitates a robust online presence and effective digital marketing strategies for companies like American Outdoor Brands to capture market share.

Adapting to an omnichannel retail environment is paramount for sustained economic performance. Consumers increasingly expect a seamless experience across online and physical stores, demanding integrated inventory management and consistent brand messaging. For American Outdoor Brands, this means optimizing their direct-to-consumer (DTC) channels while also managing relationships with traditional retail partners.

- E-commerce Dominance: U.S. e-commerce sales are expected to surpass $1.1 trillion in 2024, a critical benchmark for retail strategy.

- Omnichannel Imperative: Consumers demand integrated shopping experiences, requiring brands to bridge online and offline channels effectively.

- Digital Marketing Investment: Companies must allocate resources to digital advertising and customer engagement to remain competitive in the online space.

- DTC Growth: Direct-to-consumer sales channels offer higher margins and direct customer relationships, a key area for growth.

Consumer confidence, a key economic indicator, influences discretionary spending on outdoor goods. In early 2024, consumer sentiment showed signs of a modest recovery, suggesting potential for increased spending on recreational items. However, persistent inflation remains a concern, impacting both consumer purchasing power and the company's operational costs.

Inflationary pressures directly affect American Outdoor Brands by increasing the cost of raw materials and manufacturing. For instance, the Producer Price Index for manufactured goods saw increases in late 2023 and early 2024, directly impacting component costs. This can squeeze profit margins if higher expenses cannot be fully passed on to consumers.

Interest rate fluctuations impact borrowing costs for the company and consumer demand for larger purchases. Higher rates make financing more expensive, potentially slowing investment and consumer spending on big-ticket outdoor items. For example, during the Federal Reserve's rate hikes in 2022-2023, demand in many durable goods sectors experienced a slowdown.

Exchange rates play a crucial role in international sales. A stronger U.S. dollar, observed at various points in 2024, makes American Outdoor Brands' products more expensive for international customers, potentially reducing sales volume in those markets. Conversely, a strong dollar can lower the cost of imported components, benefiting gross margins.

| Economic Factor | 2024/2025 Trend/Data | Impact on American Outdoor Brands |

|---|---|---|

| Consumer Confidence | Slight recovery in early 2024 | Potential increase in discretionary spending |

| Inflation | Persistent, impacting costs and purchasing power | Increased raw material costs, potential margin pressure, reduced consumer spending |

| Interest Rates | Variable, with potential for hikes | Higher borrowing costs, reduced consumer financing affordability |

| Exchange Rates (USD Strength) | Strong at various points in 2024 | Makes exports more expensive, lowers import costs |

Same Document Delivered

American Outdoor Brands PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting American Outdoor Brands.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, offering a comprehensive PESTLE analysis for American Outdoor Brands.

The content and structure shown in the preview is the same document you’ll download after payment, providing an in-depth look at the external forces shaping American Outdoor Brands' strategy.

Sociological factors

American society is increasingly prioritizing health and wellness, fueling a significant surge in outdoor recreation. This trend, amplified by a post-pandemic desire for open-air activities, directly translates to higher demand for products supporting camping, hiking, and other adventurous pursuits. For instance, data from the Outdoor Industry Association indicated that outdoor recreation generated $862 billion in economic output in 2022, a testament to its growing importance.

American Outdoor Brands is well-positioned to leverage this societal shift. By expanding its portfolio of gear designed for rugged adventures, the company can effectively tap into this expanding consumer base. This includes offering a diverse range of equipment that caters to both seasoned enthusiasts and newcomers to outdoor lifestyles.

Demographic shifts are significantly reshaping outdoor recreation. For instance, the U.S. population is aging, with the 65+ age group projected to reach 21.7% by 2030, potentially increasing demand for less strenuous activities. Simultaneously, urbanization continues, with over 80% of Americans now living in urban areas, which could influence the type of outdoor gear and experiences sought, favoring accessible local parks and trails.

The growing diversity within the U.S. population also presents opportunities. As minority groups become a larger share of the consumer base, American Outdoor Brands can tailor marketing and product lines to resonate with a broader range of cultural backgrounds and preferences in outdoor pursuits. For example, understanding the specific needs and interests of Hispanic and Asian American consumers, who are projected to be the largest growth segments in the coming years, is crucial for expanding participation rates.

Consumers are increasingly prioritizing sustainability and ethical production. A 2024 survey indicated that 65% of US adults consider a brand's environmental impact when making purchasing decisions, a significant rise from previous years. This growing consciousness means American Outdoor Brands must ensure its supply chain and manufacturing practices resonate with these values.

The company's commitment to using recycled materials and reducing its carbon footprint is becoming a key differentiator. For instance, in 2024, American Outdoor Brands reported a 15% increase in the use of recycled polyester across its apparel lines. This aligns with consumer demand for products that minimize environmental harm throughout their lifecycle.

Influence of Social Media and Digital Communities

Social media platforms are pivotal in shaping consumer behavior for outdoor brands. In 2024, platforms like Instagram and TikTok saw continued growth in user engagement for outdoor lifestyle content, with an estimated 70% of outdoor enthusiasts reporting that social media influences their purchasing decisions. American Outdoor Brands can leverage these channels for product discovery and trend adoption.

Online communities and forums dedicated to specific outdoor activities, such as hiking, camping, and fishing, foster strong brand loyalty and provide valuable consumer insights. A significant portion of these communities actively share product reviews and recommendations, directly impacting brand perception. For instance, user-generated content on platforms like Reddit's r/camping often drives product interest and sales.

Influencer marketing remains a powerful tool in this space. In 2024, collaborations with outdoor lifestyle influencers generated substantial reach, with top-tier influencers commanding engagement rates of over 5% on sponsored posts. American Outdoor Brands' strategic partnerships with authentic voices in the outdoor community can significantly boost brand visibility and drive sales.

- Social Media Influence: Approximately 70% of outdoor enthusiasts in 2024 stated social media impacts their buying choices.

- Community Engagement: Online forums and groups are key drivers of product recommendations and brand loyalty within niche outdoor markets.

- Influencer Impact: Top outdoor influencers in 2024 achieved engagement rates exceeding 5% on sponsored content, demonstrating significant reach.

- Brand Perception: Positive sentiment and authentic user-generated content shared on digital platforms directly contribute to a brand's reputation and sales performance.

Lifestyle Trends: Van Life, Overlanding, and Preparedness

Emerging lifestyle trends like van life and overlanding are significantly shaping the outdoor gear market. These movements, emphasizing self-sufficiency and adventure, create distinct demands for durable, multi-functional equipment. For instance, the van life community often seeks compact, portable cooking solutions and robust storage systems.

The growing interest in personal preparedness and survivalism also presents a substantial opportunity. Consumers in this segment are actively seeking reliable tools, personal security items, and gear that supports extended outdoor living. American Outdoor Brands, with its broad product range, is well-positioned to capitalize on these evolving consumer preferences.

The market for preparedness gear saw a notable surge. In 2024, sales of emergency preparedness kits and survival tools are projected to increase by 15% compared to 2023, according to industry analysts. This growth underscores the increasing consumer focus on self-reliance.

The overlanding sector, in particular, is experiencing rapid expansion. By 2025, the global overlanding market is estimated to reach $1.8 billion, driven by a desire for remote travel and outdoor experiences. This trend directly benefits companies offering specialized camping equipment, navigation tools, and vehicle accessories.

- Van Life Demand: Increased interest in portable power solutions and space-saving storage for recreational vehicles.

- Overlanding Growth: Projections indicate a 10% year-over-year growth in overlanding vehicle sales through 2025, boosting demand for related gear.

- Preparedness Spending: In 2024, the average household expenditure on emergency supplies rose by 20% as individuals prioritize self-sufficiency.

- Niche Market Expansion: These lifestyle trends create new revenue streams for specialized outdoor equipment manufacturers.

Societal emphasis on health and wellness fuels robust growth in outdoor recreation, with the sector generating $862 billion in economic output in 2022. This trend, coupled with demographic shifts like an aging population and increasing urbanization, reshapes demand towards more accessible and less strenuous outdoor activities. Furthermore, evolving consumer values prioritize sustainability, with 65% of US adults in 2024 considering environmental impact in purchases, making eco-conscious practices a key differentiator for brands like American Outdoor Brands.

| Sociological Factor | 2024/2025 Data Point | Impact on American Outdoor Brands |

|---|---|---|

| Health & Wellness Trend | Outdoor recreation economic output: $862 billion (2022) | Increased demand for all types of outdoor gear. |

| Demographic Shifts | US population 65+ projected to be 21.7% by 2030 | Potential rise in demand for less strenuous outdoor activities. |

| Sustainability Concerns | 65% of US adults consider environmental impact in purchases (2024) | Necessitates focus on sustainable supply chains and materials. |

| Lifestyle Trends | Overlanding market projected to reach $1.8 billion by 2025 | Opportunity for specialized, durable, and multi-functional gear. |

Technological factors

Innovations in materials science are significantly shaping the outdoor gear industry. For American Outdoor Brands, advancements in lighter, stronger, and more sustainable fabrics and alloys directly influence product design, durability, and overall performance. For instance, the development of advanced composites could lead to the creation of knives with superior edge retention and reduced weight, a key selling point for hikers and campers.

Leveraging these material science breakthroughs allows American Outdoor Brands to enhance the competitive edge of its product lines, including its well-known Smith & Wesson knives and accessories. By incorporating cutting-edge materials, the company can boost product features and deliver greater consumer value, potentially increasing market share in a segment that increasingly prioritizes performance and innovation.

The ongoing advancement of e-commerce technologies, such as mobile shopping optimization and sophisticated fulfillment networks, presents a significant technological factor for American Outdoor Brands. In 2024, global e-commerce sales were projected to reach over $6.3 trillion, highlighting the immense reach of digital channels. For American Outdoor Brands, a robust online presence and effective digital sales strategies are paramount to expanding its customer base and improving the overall shopping experience for its wide array of outdoor gear and apparel.

Smart technology integration, like GPS and sensors in outdoor gear, presents a significant opportunity for companies like American Outdoor Brands. While their core products may not currently emphasize these features, specialized tools or accessories could tap into new markets. For instance, the global wearable technology market was projected to reach over $116 billion in 2021 and is expected to continue growing, indicating a strong consumer appetite for connected devices.

Supply Chain Automation and Logistics Innovations

Technological advancements are significantly reshaping supply chain operations for companies like American Outdoor Brands. Automation in warehousing, utilizing robotics and AI-driven systems, is becoming a key driver for efficiency. For instance, the global warehouse automation market was projected to reach $30 billion by 2026, indicating a strong trend towards increased adoption. Predictive analytics for inventory management is also crucial, allowing businesses to forecast demand more accurately and optimize stock levels, thereby reducing carrying costs and minimizing stockouts.

Improved logistics through real-time tracking and route optimization software are enhancing delivery speed and reliability. Companies are investing in technologies that provide end-to-end visibility across their supply chains. In 2024, many logistics firms are focusing on leveraging big data and IoT devices to achieve this. These innovations are critical for American Outdoor Brands to ensure product availability and meet consumer expectations for timely delivery, especially in a competitive market where rapid fulfillment is a significant differentiator.

Key technological impacts include:

- Enhanced Warehouse Efficiency: Adoption of automated guided vehicles (AGVs) and robotic picking systems can boost throughput by up to 30%.

- Optimized Inventory Management: Predictive analytics can reduce inventory holding costs by an estimated 10-20% through better demand forecasting.

- Faster Delivery Times: Advanced route optimization software can cut delivery times by 5-15% by minimizing transit inefficiencies.

- Increased Supply Chain Visibility: Real-time tracking technologies provide a clearer view of goods in transit, improving responsiveness to disruptions.

Data Analytics and Personalized Marketing

The increasing sophistication of data analytics is fundamentally reshaping how companies like American Outdoor Brands connect with their customers. By meticulously analyzing consumer behavior, preferences, and past purchasing patterns, businesses can gain a much deeper understanding of their target audience.

Leveraging big data allows American Outdoor Brands to move beyond broad marketing efforts and instead focus on highly targeted campaigns. This data-driven approach informs everything from refining product development to ensuring marketing messages resonate effectively, ultimately leading to more successful customer acquisition and retention strategies.

For example, in 2024, the global big data analytics market was projected to reach over $300 billion, highlighting the widespread adoption and perceived value of these technologies. This trend is expected to continue growing, with forecasts suggesting it will exceed $650 billion by 2029, indicating a significant investment in data capabilities across industries.

- Enhanced Customer Understanding: Data analytics enables granular insights into individual customer preferences and purchasing habits.

- Personalized Marketing: Campaigns can be tailored to specific customer segments, increasing relevance and effectiveness.

- Optimized Product Development: Insights from data can guide the creation of products that better meet consumer demand.

- Improved Customer Retention: Personalized experiences fostered by data analysis contribute to stronger customer loyalty.

Technological advancements in materials science are a key driver for American Outdoor Brands, influencing product design and performance. Innovations in lightweight, durable, and sustainable materials allow for the creation of higher-performing gear, directly impacting competitiveness. For instance, the global advanced materials market is projected to see significant growth, underscoring the importance of embracing these innovations.

The surge in e-commerce, with global sales expected to surpass $7 trillion by 2025, necessitates a robust digital strategy for American Outdoor Brands. Optimizing mobile shopping experiences and efficient fulfillment networks are crucial for reaching a broader customer base. This digital shift is transforming how consumers discover and purchase outdoor equipment.

Integration of smart technologies and data analytics offers avenues for enhanced customer engagement and product development. As the global big data analytics market continues its rapid expansion, expected to reach over $650 billion by 2029, American Outdoor Brands can leverage these tools for personalized marketing and better understanding consumer needs.

| Technological Factor | Impact on American Outdoor Brands | Supporting Data (2024-2025 Projections/Estimates) |

|---|---|---|

| Materials Science Innovation | Enhanced product durability, performance, and sustainability. | Global advanced materials market growth projected. |

| E-commerce Growth | Expanded customer reach and improved sales channels. | Global e-commerce sales projected to exceed $7 trillion by 2025. |

| Data Analytics & AI | Personalized marketing, improved customer insights, and optimized operations. | Global big data analytics market projected to exceed $650 billion by 2029. |

| Supply Chain Automation | Increased efficiency, reduced costs, and faster delivery times. | Global warehouse automation market projected to reach $30 billion by 2026. |

Legal factors

American Outdoor Brands operates under a rigorous framework of product safety and liability regulations. This means every piece of outdoor gear, knife, and tool must meet stringent federal and state safety standards. Failure to comply can lead to costly product recalls, expensive lawsuits, and significant damage to the company's hard-earned brand reputation.

For instance, the Consumer Product Safety Commission (CPSC) actively enforces safety standards across various product categories. While specific data for American Outdoor Brands' compliance isn't publicly detailed for 2024, the general trend shows increased regulatory scrutiny. In 2023, the CPSC reported over $200 million in recalls across all consumer products, highlighting the financial risks associated with non-compliance.

Consumer protection laws, such as the Federal Trade Commission Act and state-specific warranty regulations, heavily influence American Outdoor Brands' operations. Ensuring advertising accuracy and fair trade practices are paramount to building and maintaining consumer trust. For instance, the Magnuson-Moss Warranty Act sets standards for product warranties, requiring clear disclosure of terms and conditions.

Failure to comply can lead to significant legal repercussions and damage brand reputation. In 2024, the FTC reported a substantial increase in enforcement actions related to deceptive advertising, underscoring the critical need for meticulous adherence to these statutes.

Intellectual property rights are a cornerstone for American Outdoor Brands, safeguarding its innovations and brand identity. This includes patents for unique product designs and manufacturing processes, as well as trademarks for its recognizable brand names like Smith & Wesson and M&P. The company actively monitors and enforces these rights to combat the growing threat of counterfeit goods in the competitive outdoor and shooting sports markets.

In 2023, the U.S. Patent and Trademark Office reported a significant increase in trademark applications, highlighting the importance of brand protection. American Outdoor Brands' strategy involves vigilant legal action against infringements, which can dilute brand value and confuse consumers. Protecting these assets is crucial for maintaining market share and the premium perception of its products.

Environmental Compliance and Manufacturing Regulations

American Outdoor Brands faces significant legal obligations concerning environmental protection within its manufacturing operations. This includes strict adherence to Environmental Protection Agency (EPA) standards governing emissions, water discharge, and waste management. For instance, the EPA's Resource Conservation and Recovery Act (RCRA) dictates how hazardous waste generated during production must be handled and disposed of, with potential fines for non-compliance.

The company must also navigate regulations related to chemical usage in its products and manufacturing processes. Compliance with frameworks like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), particularly if American Outdoor Brands engages in international sales within the European Union, is crucial. Failure to meet these chemical safety standards can lead to market access restrictions and reputational damage.

- EPA Enforcement: In fiscal year 2023, the EPA reported over $13 billion in penalties and fines for environmental violations, highlighting the financial risks of non-compliance.

- Chemical Reporting: Companies are increasingly subject to reporting requirements for chemicals used in manufacturing, such as those under the Toxic Substances Control Act (TSCA).

- Waste Management Costs: Proper waste disposal, especially for potentially hazardous materials common in outdoor gear production, can represent a substantial operational cost, impacting profit margins.

Import/Export Laws and Customs Regulations

American Outdoor Brands must navigate a intricate landscape of import and export laws and customs regulations to manage its global supply chain and sales operations. These rules dictate the flow of goods across borders, impacting sourcing of materials and distribution of finished products. For instance, in 2024, the U.S. continued to enforce tariffs on goods from various countries, directly affecting the cost of imported components for outdoor gear.

Non-compliance with these regulations can result in severe consequences, including substantial fines, seizure of goods, and significant operational disruptions. For example, a single customs violation could lead to product delays, impacting inventory levels and customer satisfaction. The company must remain vigilant in understanding and adhering to evolving trade agreements and compliance standards to avoid these costly pitfalls.

- Tariff Rates: Fluctuations in tariff rates, such as those impacting steel or aluminum used in product manufacturing, directly influence American Outdoor Brands' cost of goods sold.

- Trade Agreements: The terms of trade agreements, like the USMCA, affect the preferential treatment and duties applied to products entering or leaving North America.

- Export Controls: Compliance with export control regulations is crucial for certain specialized outdoor equipment, preventing unauthorized distribution to restricted regions.

- Customs Valuation: Accurate declaration of product value to customs authorities is essential to avoid penalties and ensure smooth clearance of shipments.

Product safety and liability remain paramount, with agencies like the CPSC scrutinizing compliance. In 2023, CPSC recalls exceeded $200 million, underscoring the financial risk of non-compliance for companies like American Outdoor Brands. Consumer protection laws, including warranty regulations, demand accuracy in advertising and fair practices, as highlighted by the FTC's increased enforcement actions in 2024.

Intellectual property protection is vital, with a rise in trademark applications reported by the USPTO in 2023. American Outdoor Brands actively defends its patents and trademarks against counterfeits to maintain brand integrity and market share.

Environmental regulations, enforced by the EPA, govern emissions and waste management. The EPA levied over $13 billion in penalties in fiscal year 2023 for violations, emphasizing the cost of non-compliance with statutes like RCRA and TSCA.

Navigating import/export laws and customs is critical for global operations. In 2024, ongoing tariff adjustments directly impact the cost of goods sold for components, making adherence to trade agreements and export controls essential to avoid penalties and disruptions.

| Legal Area | Key Regulations/Focus | 2023/2024 Data/Trend | Impact on American Outdoor Brands |

|---|---|---|---|

| Product Safety & Liability | CPSC Standards, FTC Act, Warranty Laws | CPSC recalls >$200M (2023); Increased FTC enforcement (2024) | Risk of recalls, lawsuits, brand damage; need for advertising accuracy |

| Intellectual Property | Patents, Trademarks, Counterfeit Enforcement | USPTO trademark applications increased (2023) | Protection of designs, brand names; combating counterfeit goods |

| Environmental Compliance | EPA Standards (RCRA, TSCA), Chemical Regulations | EPA fines >$13B (FY2023) | Costs of waste management, potential fines for non-compliance |

| Trade & Customs | Tariffs, Trade Agreements (USMCA), Export Controls | Fluctuating tariff rates (2024); USMCA impact | Affects cost of goods sold, supply chain operations, market access |

Environmental factors

Climate change is significantly altering outdoor seasons, directly impacting the demand for seasonal gear. For instance, warmer winters in many regions of the United States, like the Northeast, could shorten the ski season, affecting sales of winter sports equipment. Conversely, extended warm periods in the spring and fall might boost demand for hiking and camping gear.

Extreme weather events, such as increased frequency of wildfires or severe storms, also pose a risk. These events can disrupt outdoor activities, leading to temporary or even permanent shifts in consumer behavior and the viability of certain outdoor locations as recreational destinations. This necessitates flexibility in American Outdoor Brands' product offerings and marketing strategies.

Data from the National Oceanic and Atmospheric Administration (NOAA) indicates a trend of rising average temperatures across the US. For example, the contiguous U.S. experienced its warmest January on record in 2024, a pattern that continued into early spring, potentially extending the usability of some spring apparel while curtailing demand for winter items earlier than usual.

American Outdoor Brands faces growing pressure regarding resource scarcity, particularly for specialized metals used in knife manufacturing and synthetic polymers for outdoor gear. The increasing consumer and regulatory demand for sustainably sourced components directly impacts supply chain reliability and brand perception. For instance, the global supply of certain rare earth metals, crucial for high-performance knife blades, experienced price volatility in early 2024, with some sources showing increases of up to 15% compared to the previous year due to geopolitical factors and mining capacity constraints.

American Outdoor Brands faces increasing scrutiny regarding its manufacturing waste and product packaging. Consumers and regulators alike expect robust waste reduction and recycling programs. For instance, the outdoor recreation industry is grappling with the environmental footprint of its products, from synthetic materials to packaging, with a growing demand for sustainable end-of-life solutions.

The company must address the disposal of outdoor gear, which often involves durable materials that can be challenging to recycle. By 2024, many outdoor brands are investing in take-back programs and exploring biodegradable packaging options to meet these evolving environmental standards and consumer expectations for corporate responsibility.

Conservation Efforts and Land Preservation

The growing emphasis on conservation and land preservation directly supports the long-term viability of outdoor recreation, a core market for American Outdoor Brands. Initiatives aimed at protecting natural landscapes, such as the expansion of national parks and wilderness areas, ensure the continued availability of environments where consumers use the company's products. For instance, as of early 2024, over 120 million acres are managed by the National Park Service, a figure expected to see continued growth with bipartisan support for conservation funding.

These environmental trends influence consumer values, with a marked increase in demand for sustainable and eco-conscious products. Companies aligning with these principles, like American Outdoor Brands, can leverage conservation efforts to enhance brand loyalty and market appeal. The outdoor recreation industry's economic contribution, estimated at $887 billion annually in the U.S. in 2023, is intrinsically linked to the health of these preserved lands.

- Market Longevity: Conservation ensures the sustained existence of natural spaces essential for outdoor activities.

- Consumer Values: Growing environmental awareness drives demand for sustainable outdoor gear.

- Economic Link: The multi-billion dollar outdoor recreation industry relies on preserved natural resources.

Consumer Demand for Eco-Friendly Products

Consumer demand for eco-friendly products is a significant environmental factor impacting American Outdoor Brands. There's a clear upward trend in consumers prioritizing sustainability, recycled materials, and reduced carbon footprints in their purchases. This shift presents a substantial opportunity for American Outdoor Brands to enhance its market position.

By strategically developing and promoting eco-conscious product lines, the company can directly appeal to the values of environmentally aware outdoor enthusiasts. This alignment can translate into a distinct competitive advantage. For instance, a 2024 report indicated that over 60% of consumers are willing to pay more for sustainable products, a figure that continues to grow.

- Growing Market Share: The sustainable outdoor gear market is projected to see robust growth, with some analysts estimating a compound annual growth rate of 8-10% through 2028.

- Brand Loyalty: Consumers who connect with a brand's environmental commitment often exhibit higher loyalty, leading to repeat purchases and positive word-of-mouth referrals.

- Innovation Driver: The push for eco-friendly materials and manufacturing processes can spur innovation, leading to the development of new, high-performance products.

- Regulatory Preparedness: Proactively adopting sustainable practices can also position American Outdoor Brands favorably for potential future environmental regulations.

Climate change continues to reshape outdoor seasons, directly influencing demand for seasonal gear. For example, the contiguous U.S. experienced its warmest January on record in 2024, impacting the typical demand for winter apparel and extending opportunities for spring and fall outdoor activities.

Resource scarcity, particularly for specialized metals in knife manufacturing and synthetic polymers for gear, is a growing concern. The price of certain rare earth metals, vital for high-performance blades, saw volatility in early 2024, with some increases reaching 15% year-over-year due to supply constraints.

Consumer demand for eco-friendly products is a significant trend, with over 60% of consumers in a 2024 survey indicating a willingness to pay more for sustainable items. This presents a clear opportunity for American Outdoor Brands to enhance its market position by developing and promoting eco-conscious product lines.

| Environmental Factor | Impact on American Outdoor Brands | Supporting Data/Trend (2024/2025) |

|---|---|---|

| Climate Change | Alters seasonal demand for outdoor gear; increases risk of extreme weather events. | Warmest January on record in contiguous U.S. (2024); potential for shortened ski seasons or extended hiking periods. |

| Resource Scarcity | Affects supply chain reliability and costs for materials like metals and polymers. | Price volatility in rare earth metals for knife blades; some increases up to 15% in early 2024. |

| Consumer Demand for Sustainability | Drives preference for eco-friendly products; creates opportunities for brand loyalty and market share growth. | Over 60% of consumers willing to pay more for sustainable products (2024); projected 8-10% CAGR for sustainable outdoor gear market through 2028. |

| Conservation Efforts | Ensures long-term viability of outdoor recreation; supports brand appeal. | Over 120 million acres managed by the National Park Service (early 2024); outdoor recreation industry contributed $887 billion annually in the U.S. (2023). |

PESTLE Analysis Data Sources

Our PESTLE Analysis for American Outdoor Brands is built on a foundation of credible data, drawing from U.S. government agencies, reputable market research firms, and industry-specific publications. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are accurate and relevant to the outdoor recreation sector.