Antofagasta SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Antofagasta Bundle

Antofagasta's strategic position is defined by its robust mining operations and strong financial performance, but also faces challenges from fluctuating commodity prices and environmental regulations. Understanding these dynamics is crucial for navigating the competitive landscape.

Want to dive deeper into Antofagasta's competitive edge, potential pitfalls, and future opportunities? Purchase the complete SWOT analysis to unlock a professionally crafted, editable report that provides actionable insights for your investment or strategic planning.

Strengths

Antofagasta PLC showcased impressive financial strength in 2024, with EBITDA climbing 11% to $3.4 billion. This performance translated into a healthy EBITDA margin of 52%, placing them favorably among industry peers.

The company's operational efficiency is further highlighted by an 8% increase in cash flow from operations, reaching $3.3 billion in 2024. This consistent cash generation underpins their ability to invest in future growth initiatives.

Antofagasta's solid balance sheet is a key strength, evidenced by a low net debt to EBITDA ratio of 0.48x at the close of 2024. This financial stability provides ample capacity to fund substantial capital expenditures and strategic development projects.

Antofagasta PLC stands as a premier copper producer, consistently ranking among the top 10 globally. Its strategic focus on extracting and processing high-quality copper ore is underpinned by its exceptional asset base in Chile.

The company's flagship mines, Los Pelambres and Centinela, are cornerstones of its production, boasting impressive ore grades and substantial reserves. These high-quality assets are crucial for Antofagasta's sustained operational success and its position in the global market.

With long mine lives and efficient operational management, Antofagasta's Chilean operations provide a stable foundation for future growth and reliable copper supply. This strength is particularly evident in its 2023 production figures, where it produced 647,300 tonnes of copper, demonstrating the robust output from these key assets.

Antofagasta's Competitiveness Programme demonstrates exceptional cost management, a significant strength. This initiative yielded $248 million in benefits in 2024, surpassing its $200 million target and highlighting effective operational efficiency.

The company's success in controlling costs, even amidst inflationary pressures, directly bolsters its competitive position. This disciplined approach to cost management is crucial for maintaining profitability and resilience in the mining sector.

Diversified By-Product Production

Antofagasta's strength lies in its diversified by-product production, extending beyond its core copper operations. The company efficiently recovers valuable metals like molybdenum, gold, and silver, which are crucial for boosting overall revenue and mitigating production expenses.

This strategic approach significantly enhances Antofagasta's financial resilience. For instance, in the first quarter of 2025, the company reported a notable increase in by-product output, with gold production rising by 29% and molybdenum production up by 15% compared to the same period in 2024. These performance improvements directly contribute to higher by-product credits, offering a buffer against copper price volatility.

- Revenue Enhancement: By-products like gold and silver add substantial revenue streams.

- Cost Mitigation: Recovered metals help offset the operational costs associated with copper extraction.

- Performance Boost (Q1 2025): Gold production increased by 29% and molybdenum by 15% year-on-year.

- Risk Diversification: Reduces reliance on copper prices, creating a more stable financial profile.

Commitment to Safety and Sustainability

Antofagasta's dedication to safety is a significant strength, evidenced by its record safety performance in 2024, which included zero fatalities. This commitment extends to operational efficiency, with an improving Lost Time Injury Frequency Rate (LTIFR) demonstrating a proactive approach to risk management.

The company's proactive stance on sustainability is another key advantage. By achieving 100% renewable energy use in its mining division, Antofagasta not only meets but anticipates the increasing demands from investors and society for environmentally responsible practices.

- Record Safety Performance: Zero fatalities in 2024.

- Improving LTIFR: Demonstrates a downward trend in workplace injuries.

- 100% Renewable Energy: Mining operations powered entirely by renewable sources.

- Stakeholder Alignment: Meets growing expectations for ESG (Environmental, Social, and Governance) performance.

Antofagasta's financial health is a significant strength, with a 2024 EBITDA of $3.4 billion and a healthy 52% EBITDA margin. This robust performance is supported by strong operational cash flow and a low net debt to EBITDA ratio of 0.48x, providing ample financial flexibility.

The company's core strength lies in its exceptional copper asset base in Chile, featuring high-grade mines like Los Pelambres and Centinela, which produced 647,300 tonnes of copper in 2023. This operational excellence is further bolstered by a successful Competitiveness Programme that delivered $248 million in benefits in 2024.

Antofagasta also benefits from diversified by-product production, with Q1 2025 seeing a 29% increase in gold and a 15% rise in molybdenum output, enhancing revenue and mitigating costs. Furthermore, a commitment to safety, including zero fatalities in 2024, and 100% renewable energy use in mining operations underscore its strong ESG credentials.

| Metric | 2023 | 2024 | Q1 2025 (vs Q1 2024) |

|---|---|---|---|

| EBITDA | - | $3.4 billion | - |

| EBITDA Margin | - | 52% | - |

| Cash Flow from Operations | - | $3.3 billion | - |

| Net Debt to EBITDA | - | 0.48x | - |

| Copper Production | 647,300 tonnes | - | - |

| Competitiveness Programme Benefits | - | $248 million | - |

| Gold Production Change | - | - | +29% |

| Molybdenum Production Change | - | - | +15% |

| Fatalities | - | 0 | - |

| Renewable Energy Use (Mining) | - | 100% | - |

What is included in the product

Delivers a strategic overview of Antofagasta’s internal and external business factors, detailing its strengths, weaknesses, opportunities, and threats.

Antofagasta's SWOT analysis offers a clear roadmap to identify and address internal weaknesses and external threats, relieving the pain of strategic uncertainty.

Weaknesses

Antofagasta's profitability is directly tied to the unpredictable swings in global copper, gold, and molybdenum prices. For instance, copper prices averaged around $8,000 per tonne in early 2024, a level that, while higher than some historical periods, remains subject to rapid decline. Even with by-product credits from gold and molybdenum, a sharp drop in copper could significantly erode Antofagasta's earnings.

Antofagasta's significant reliance on Chile for all its current production operations presents a notable weakness. This geographical concentration exposes the company to country-specific risks, such as potential political instability, shifts in mining regulations, and labor disputes that are inherent to operating solely within one jurisdiction.

Furthermore, the company is susceptible to environmental challenges unique to Chile's mining regions. While Chile is a global leader in copper production, this singular focus limits Antofagasta's capacity to diversify its operational and regulatory risks across different geographical landscapes and legal frameworks.

Antofagasta faced operational hurdles in 2024, with copper production falling slightly short of its forecast. This was largely attributed to diminished ore grades and less efficient recoveries at key sites like Centinela concentrates.

These ongoing operational issues can directly impact Antofagasta's cost structure, potentially driving up cash costs. Furthermore, they pose a risk to the company's capacity to consistently achieve its projected production volumes, affecting overall output targets.

Increasing Capital Expenditure

Antofagasta's substantial capital expenditure plans present a notable weakness. The company has projected capital spending of $3.9 billion for 2025, placing it at the higher end of its previous forecasts. This significant investment, while vital for future growth, means a large amount of capital will be deployed, potentially affecting immediate cash flow and the ability to distribute dividends if not managed carefully.

The sheer scale of this expenditure, $3.9 billion in 2025, is a considerable commitment. While essential for advancing projects like the expansion of its Los Pelambres mine and the development of new opportunities, it represents a significant drain on financial resources. This could create pressure on Antofagasta’s short-term financial flexibility.

- High Capital Outlay: A planned $3.9 billion capital expenditure for 2025 is a significant financial commitment.

- Impact on Free Cash Flow: Such large investments can reduce immediate free cash flow available for other purposes, including dividends.

- Execution Risk: Large-scale projects carry inherent risks related to cost overruns and schedule delays, which could further strain finances.

- Dividend Capacity: Increased capital spending might limit the company's capacity to maintain or increase dividend payouts in the near term.

Permitting Risks for Key Operations

The Zaldívar operation is currently navigating a significant permit dispute. If this issue isn't resolved favorably by May 2025, the company may need to enact a temporary closure plan for this key asset. This regulatory uncertainty directly threatens production continuity.

Such ongoing regulatory challenges introduce a tangible risk of unforeseen operational disruptions. These disruptions could translate into substantial, unbudgeted costs for Antofagasta. The potential for a temporary closure highlights the sensitivity of operations to the permitting environment.

- Permit Dispute at Zaldívar: A critical permit issue at the Zaldívar mine poses a significant risk.

- Potential Temporary Closure: Failure to resolve the dispute by May 2025 could necessitate a temporary operational halt.

- Production Continuity Risk: Regulatory uncertainties directly threaten the consistent output from Zaldívar.

- Unforeseen Costs: Operational disruptions stemming from permitting issues could lead to unexpected financial burdens.

Antofagasta's profitability is highly susceptible to commodity price volatility, particularly for copper, which averaged around $8,000 per tonne in early 2024. This reliance on fluctuating global prices, even with by-product credits, poses a significant risk to earnings. The company's operations are concentrated solely in Chile, exposing it to country-specific political, regulatory, and labor risks without geographical diversification. Additionally, operational challenges such as diminished ore grades and lower recovery rates at key sites, as seen in 2024, can increase costs and hinder production targets.

The company's substantial capital expenditure plans, with $3.9 billion projected for 2025, represent a significant drain on financial resources. This large outlay, while necessary for growth projects like the Los Pelambres expansion, could impact short-term cash flow and dividend capacity. Furthermore, the Zaldívar operation faces a critical permit dispute, with a potential temporary closure by May 2025 if unresolved, directly threatening production continuity and potentially leading to unbudgeted costs.

| Weakness | Description | Impact | Relevant Data (2024/2025) |

|---|---|---|---|

| Commodity Price Volatility | Dependence on copper, gold, and molybdenum prices. | Erodes profitability during price downturns. | Copper prices averaged ~$8,000/tonne in early 2024. |

| Geographical Concentration | All current production in Chile. | Exposes company to single-country political, regulatory, and labor risks. | 100% of production from Chile. |

| Operational Issues | Diminished ore grades and lower recovery rates. | Increases cash costs and impacts production targets. | 2024 copper production fell slightly short of forecast due to these issues. |

| High Capital Expenditure | Significant investment planned for growth projects. | Reduces free cash flow and potentially dividend capacity. | $3.9 billion capital expenditure projected for 2025. |

| Regulatory Uncertainty (Zaldívar) | Permit dispute at Zaldívar mine. | Risk of temporary closure by May 2025, threatening production and increasing costs. | Permit dispute deadline: May 2025. |

Preview Before You Purchase

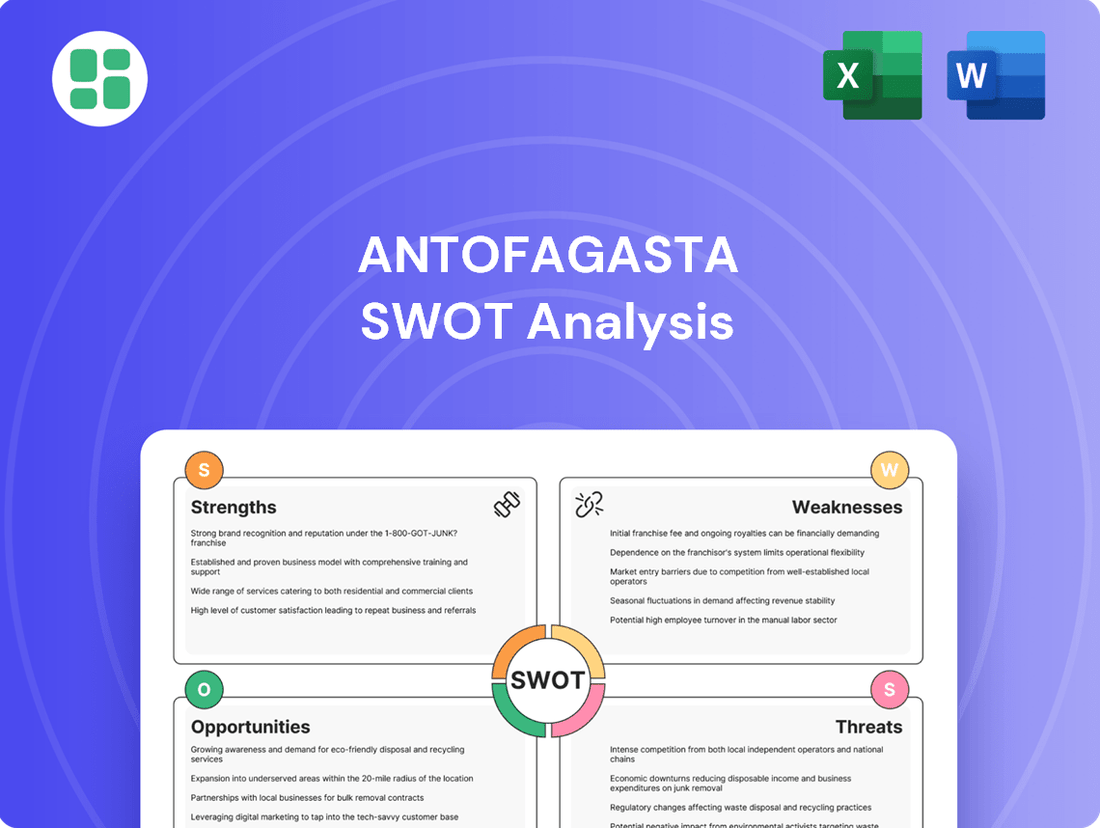

Antofagasta SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Antofagasta SWOT analysis, giving you a clear understanding of its depth and quality. Purchase unlocks the complete, in-depth report for your strategic planning needs.

Opportunities

The escalating global appetite for copper, fueled by the widespread adoption of electric vehicles and renewable energy infrastructure, represents a substantial long-term growth avenue for Antofagasta. Copper's indispensable role in these burgeoning sectors, coupled with anticipated supply shortages, points towards robust demand and favorable market conditions for the foreseeable future.

Antofagasta's strategic growth projects, including the Centinela Second Concentrator and the Los Pelambres expansion, are on track and even ahead of schedule. These initiatives are poised to drive significant increases in copper production, solidifying Antofagasta's position as a leader in the industry. For instance, the Los Pelambres expansion, which began construction in 2023, is expected to add approximately 60,000 tonnes of copper per year once fully operational, contributing to an estimated 10% increase in the company's total copper output by 2026.

Antofagasta has a significant opportunity to expand its mineral portfolio beyond copper. Exploration activities in Peru and the United States, notably the Twin Metals project in Minnesota targeting copper, nickel, and platinum group metals (PGMs), highlight this potential. This diversification could lessen the company's dependence on its current Chilean copper assets, a key strategic advantage.

Leveraging Technological Advancements

Antofagasta can significantly boost its operational efficiency and cost competitiveness by embracing cutting-edge technological advancements. The company is already investing in digital transformation initiatives, aiming to streamline processes and improve data-driven decision-making across its mining operations.

By adopting automation, digitalization, and advanced ore processing techniques, Antofagasta can achieve improved productivity and reduced operational costs. For instance, the integration of autonomous hauling systems in its mines has shown promising results in increasing truck utilization and reducing fuel consumption.

- Digitalization of Operations: Continued investment in digital platforms for real-time monitoring and control of mining processes.

- Automation: Expansion of autonomous drilling and hauling technologies to enhance safety and efficiency.

- Advanced Ore Processing: Implementation of new technologies to improve recovery rates and reduce waste in mineral processing.

- Data Analytics: Leveraging big data and AI for predictive maintenance and optimization of resource extraction.

Favorable Chilean Copper Production Outlook

Chile, the undisputed leader in global copper production, is poised for a robust expansion. Projections indicate a healthy 3.0% growth in the nation's copper output for 2025. This favorable national trend, fueled by substantial strategic investments and ongoing operational enhancements across the sector, establishes an exceptionally supportive backdrop for Antofagasta's existing operations and future expansion initiatives within Chile.

This positive national environment translates directly into tangible opportunities for Antofagasta. The projected increase in overall Chilean copper supply suggests potential for streamlined logistics and a more competitive supply chain. Furthermore, the government's commitment to the mining sector, evidenced by these strategic investments, often translates into favorable regulatory environments and potential incentives for major producers like Antofagasta.

- Chile's projected copper output growth: 3.0% in 2025.

- Global standing: Chile is the world's largest copper producer.

- Drivers of growth: Strategic investments and operational improvements.

- Benefit for Antofagasta: Supportive environment for operations and expansion.

Antofagasta's strategic growth projects, such as the Centinela Second Concentrator and Los Pelambres expansion, are progressing well, with the latter expected to add around 60,000 tonnes of copper annually, boosting the company's output by an estimated 10% by 2026. This expansion is crucial for capitalizing on the surging global demand for copper, driven by the EV and renewable energy sectors.

Diversifying its mineral portfolio beyond copper presents a significant opportunity. Exploration in Peru and the US, including the Twin Metals project targeting copper, nickel, and PGMs, could reduce reliance on Chilean copper assets and unlock new revenue streams.

Embracing technological advancements like automation and digitalization can enhance operational efficiency and cost competitiveness. For instance, autonomous hauling systems are already improving truck utilization and reducing fuel consumption.

Chile's projected 3.0% copper output growth in 2025, as the world's leading producer, creates a highly favorable operating environment for Antofagasta, potentially leading to streamlined logistics and supportive regulatory conditions.

Threats

Antofagasta faces significant headwinds from volatile global copper prices, a critical factor impacting its financial performance. Despite a generally positive long-term outlook for copper demand, prices remain highly susceptible to external shocks, including shifts in global economic growth and geopolitical instability. For instance, copper prices experienced considerable volatility throughout 2023 and early 2024, with LME benchmark prices fluctuating between approximately $7,500 to $10,000 per tonne, directly affecting Antofagasta's revenue streams and profitability.

These price swings create substantial challenges for financial forecasting and investment planning, as Antofagasta's earnings are directly tied to the market price of copper. For example, a sustained downturn in prices could significantly reduce the company's margins and ability to fund capital expenditures or distribute dividends, as seen in periods of lower commodity prices in previous years. The company's reliance on copper makes it inherently exposed to these market dynamics, requiring robust risk management strategies to mitigate potential negative impacts on its financial returns.

Chile's mining sector navigates a complex web of evolving environmental and social regulations. These can significantly impact operational timelines and costs.

For instance, delays in securing or renewing crucial permits, as experienced by Antofagasta's Zaldívar operation, pose a direct threat. Such setbacks can disrupt production schedules, inflate expenses, and even necessitate temporary operational suspensions, directly affecting revenue streams.

The mining sector is grappling with escalating operational expenses, particularly in energy, labor, and raw materials. Antofagasta's ongoing competitiveness initiatives aim to mitigate these impacts, but persistent inflation could diminish the effectiveness of these cost-saving measures and negatively affect profitability.

Water Availability and Management Risks

Water scarcity in Chile, especially in the arid northern mining regions where Antofagasta operates, presents a substantial threat. This scarcity impacts both the environment and the company's day-to-day operations.

The need to process lower-grade ores often requires more water, potentially straining existing supplies. Furthermore, the possibility of droughts could lead to significant operational limitations and increased expenses for water sourcing, management, and desalination projects.

- Operational Constraints: Increased water demand for processing lower-grade ores could limit production volumes.

- Cost Increases: Droughts and higher water needs will likely drive up costs associated with water acquisition and management.

- Desalination Investment: Companies may need to invest heavily in desalination plants, adding to capital expenditure.

Intense Competition in the Global Mining Sector

The global mining sector is a battleground, with Antofagasta Minerals contending against formidable giants such as BHP, Rio Tinto, and Anglo American. These established players, alongside a growing number of agile emerging companies, create a highly competitive landscape. This pressure directly impacts market share, pricing power, and the ability to secure promising new development projects.

For instance, in 2024, the global copper market, a key focus for Antofagasta, saw significant price volatility driven by supply disruptions and robust demand from sectors like electric vehicles and renewable energy infrastructure. Companies like Glencore and Vale, with their diversified portfolios, are well-positioned to capitalize on these market shifts, posing a direct competitive threat.

- Market Share Pressure: Antofagasta must continuously innovate and optimize operations to maintain its position against larger, more diversified competitors.

- Pricing Dynamics: Fluctuations in commodity prices, especially copper and gold, directly affect revenue and profitability, with competitors' production levels playing a crucial role.

- Access to Growth: Securing rights to new, high-quality mineral deposits and navigating complex regulatory environments are increasingly challenging due to intense competition for exploration assets.

Antofagasta faces significant threats from volatile copper prices, impacting its revenue and profitability, as seen with LME prices fluctuating between $7,500-$10,000 per tonne in 2023-2024. Increasingly stringent environmental and social regulations in Chile, coupled with escalating operational costs for energy and labor, also pose considerable challenges. Furthermore, water scarcity in its operating regions necessitates investments in desalination and can lead to higher operational expenses and potential production limitations.

| Threat Category | Specific Threat | Impact on Antofagasta | Example/Data Point (2023-2025) |

|---|---|---|---|

| Market Volatility | Copper Price Fluctuations | Reduced revenue, lower profitability, challenges in financial planning. | LME Copper prices ranged from ~$7,500 to $10,000/tonne in 2023-early 2024. |

| Regulatory Environment | Evolving Environmental & Social Regulations | Delayed permits, increased operational costs, potential production disruptions. | Permit delays at Zaldívar operation impacting timelines. |

| Operational Costs | Rising Energy, Labor, and Material Costs | Diminished profit margins, reduced competitiveness. | Persistent inflation trends impacting input costs across the mining sector. |

| Resource Availability | Water Scarcity in Northern Chile | Increased costs for water sourcing/desalination, potential production constraints. | Higher water demand for processing lower-grade ores. |

SWOT Analysis Data Sources

This Antofagasta SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence, and expert industry evaluations, ensuring a robust and data-driven strategic perspective.