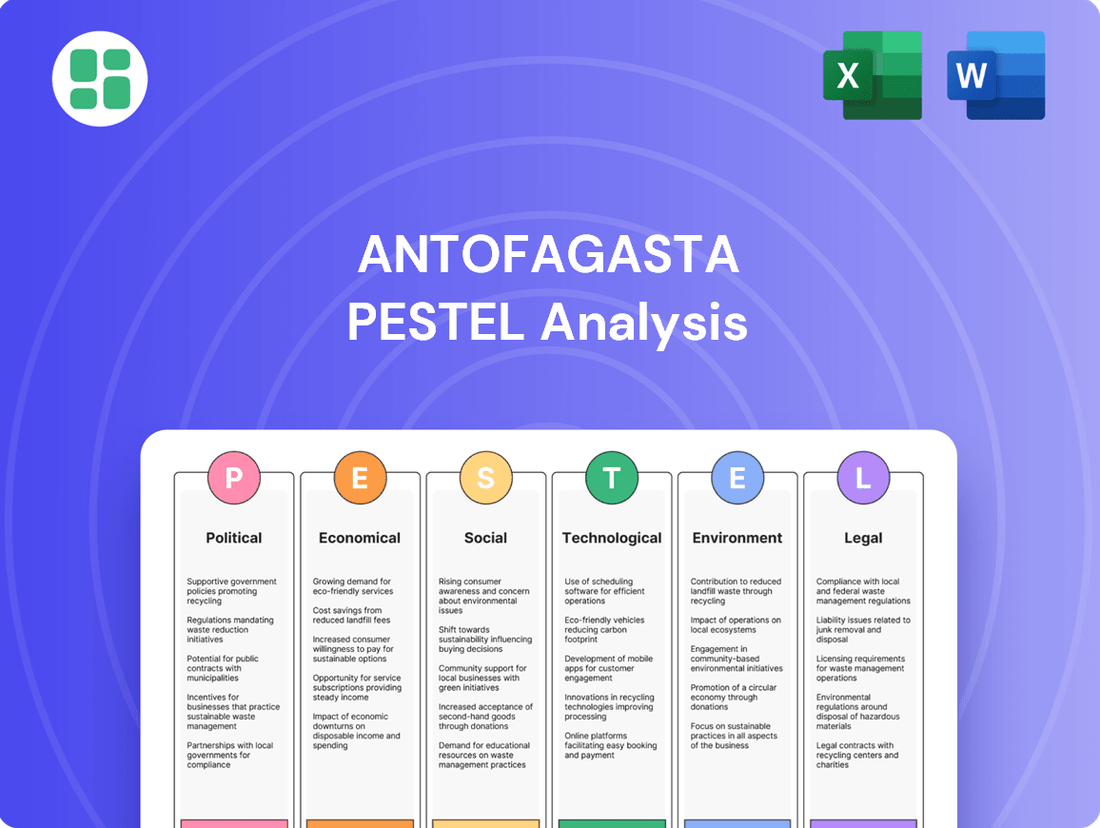

Antofagasta PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Antofagasta Bundle

Uncover the critical political, economic, and technological forces shaping Antofagasta's trajectory. Our PESTLE analysis provides a vital roadmap for understanding market dynamics and identifying strategic opportunities. Equip yourself with actionable intelligence to navigate the evolving landscape – download the full version now!

Political factors

Chile's political climate, particularly with the presidential elections slated for November 2025, presents a key factor for Antofagasta. The upcoming electoral cycle could see shifts in mining policy, with potential debates around state intervention versus private sector involvement in major copper operations like Codelco.

The stability of the Chilean government and the consistency of its mining regulations are paramount for foreign investors. Uncertainty regarding future policies can deter the substantial, long-term capital required for copper extraction and development, impacting Antofagasta's project pipeline.

Chile's Mining Royalty Law, enacted in 2023, introduces a new tax structure for major mining operations. This legislation is set to significantly increase regional funding, with projections indicating a near doubling of allocated funds to approximately $220 billion Chilean pesos by 2025, benefiting local municipalities.

Antofagasta PLC, as a large-scale mining entity, must now factor in the financial impact of this sales-based tax. The company's strategic planning will need to account for these new fiscal obligations while also considering its contribution to Chile's regional development initiatives funded by these royalties.

The Chilean government's proactive stance on reducing permit processing times for mining investments is a significant political factor. With a target of 30-70% reduction, this reform, enacted in July 2025, overhauls more than 40 regulations.

This streamlining directly benefits companies like Antofagasta by potentially accelerating the timeline for crucial growth projects and expansions. It addresses a historical bottleneck that often deterred new investments, promising greater operational agility and faster market entry for new ventures.

Resource Nationalism and State Involvement

Chile's government is navigating a delicate balance between encouraging mining output and asserting state control over critical resources. The National Critical Minerals Strategy, released in 2023, and the National Lithium Strategy aim to foster increased production while also emphasizing environmental and social considerations. This approach could lead to more public-private partnerships, potentially impacting the operational landscape for companies like Antofagasta.

This political dynamic directly influences investment security and operational flexibility for private mining entities. The government's stance on resource nationalism, particularly concerning copper and lithium, is a key factor in how these companies plan their future investments and operations within Chile. For instance, the Chilean Copper Commission (COCHILCO) projects that Chile's copper production could reach 7.2 million tonnes by 2032, up from an estimated 5.3 million tonnes in 2023, highlighting the government's desire for growth but also the potential for increased state influence in achieving those targets.

- Resource Nationalism Debate: Ongoing discussions in Chile about the degree of state control over copper and lithium reserves.

- Strategic Balance: National strategies aim to reconcile environmental/social goals with the need for higher mineral production.

- Public-Private Partnerships: Potential for increased collaboration between the state and private companies in resource development.

- Investment Climate Impact: The political approach to resource management directly affects operational freedom and investment security for miners.

International Trade Relations and Agreements

Chile's status as a leading copper exporter, with Antofagasta being a major player, means its economy is closely tied to international trade dynamics. Shifts in trade relations and agreements directly influence the demand and pricing for its primary commodity. For instance, while Chile's substantial global copper market share may buffer the immediate impact of targeted tariffs, widespread trade disputes can dampen overall economic activity and copper consumption.

Antofagasta's business model is inherently export-driven, making it highly reliant on a predictable and open global trading system. Disruptions to this system, whether through new trade barriers or the renegotiation of existing agreements, pose a significant risk. The company's performance is therefore sensitive to geopolitical stability and the maintenance of favorable trade terms with key consuming nations.

Recent trade trends highlight this sensitivity. For example, in 2023, global copper prices experienced volatility influenced by trade tensions between major economies and shifts in industrial demand. Antofagasta's ability to navigate these complexities, leveraging its operational efficiency and diversified market access, will be crucial for maintaining its competitive edge.

- Chile's copper exports reached approximately 5.5 million metric tons in 2023.

- The global copper market is projected to see continued demand growth, driven by electrification and renewable energy projects.

- Antofagasta plc reported copper production of 657,000 tonnes in 2023, a 4% increase year-on-year.

Chile's political landscape, especially with presidential elections in November 2025, is a significant factor for Antofagasta. The government's approach to mining policy, including potential shifts in state involvement and regulation consistency, directly impacts investor confidence and long-term capital for projects.

The 2023 Mining Royalty Law, which aims to nearly double allocated funds to local municipalities by 2025, necessitates Antofagasta to adapt its financial planning to these new fiscal obligations. Furthermore, the government's initiative to drastically reduce mining permit processing times by July 2025, targeting a 30-70% cut, promises to accelerate Antofagasta's growth projects.

Chile's National Critical Minerals Strategy and National Lithium Strategy reflect a political drive to balance increased mineral production with environmental and social considerations, potentially leading to more public-private partnerships. This dynamic influences investment security and operational flexibility for mining companies.

Chile's economic reliance on copper exports, with Antofagasta being a key producer, makes it vulnerable to global trade dynamics and potential trade disputes. Antofagasta's 2023 copper production of 657,000 tonnes, a 4% increase, highlights its operational performance amidst these external factors.

What is included in the product

This PESTLE analysis of Antofagasta provides a comprehensive examination of the external macro-environmental factors impacting the region's key industries, particularly mining.

It offers actionable insights for stakeholders to navigate the complex political, economic, social, technological, environmental, and legal landscape, identifying both risks and strategic advantages.

The Antofagasta PESTLE analysis provides a clear, summarized version of external factors, acting as a pain point reliever by enabling quick referencing during strategic planning and decision-making.

Economic factors

Global copper prices are a critical determinant of Antofagasta PLC's financial health, directly influencing its revenue and profit margins due to the company's core business of copper mining. The demand for copper is projected to stay strong through 2025 and into the future, fueled by the accelerating trends of electrification, the pursuit of energy security, and the growth of technology sectors such as artificial intelligence.

Despite this positive demand outlook, Antofagasta faces inherent risks from copper price fluctuations. Factors like a potential global economic slowdown or disruptions in the delicate balance between supply and demand can lead to significant volatility, thereby impacting the company's earnings and overall financial performance.

Chile's economic outlook for 2025 projects a growth rate of approximately 2.7%, largely driven by a rebound in its crucial mining sector. This expansion is further bolstered by significant planned investments in mining projects extending through 2033, signaling robust future activity.

A stable and growing domestic economy in Chile is a key advantage for companies like Antofagasta. It ensures a predictable operating environment, strengthens local supply chains, and contributes to a stable labor market, all vital components for sustained business success.

Inflationary pressures remain a key concern in Chile, with forecasts for 2025 hovering around 4.2-4.4%. This persistent inflation directly impacts operational costs for companies like Antofagasta, necessitating a keen focus on managing expenses.

Antofagasta actively implements robust cost control and competitiveness programs to safeguard its profit margins against rising industry expenses. This proactive approach is crucial for maintaining financial health in a challenging economic climate.

The company's success hinges on its ability to effectively manage both gross and net cash costs. Evidence from H1 2025 shows improvements in these areas, underscoring the importance of efficient cost management for sustained profitability.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for Antofagasta PLC, a Chilean-based mining company with global operations. As Antofagasta reports its financial results in USD, the strength or weakness of the Chilean Peso (CLP) directly impacts its reported figures. For instance, a stronger CLP can make imported inputs cheaper, potentially lowering operational costs when translated into USD. Conversely, a weaker CLP can increase the cost of these inputs.

The company's exposure to currency risk is substantial given its international sales and expenses. For example, in early 2024, the CLP experienced volatility against the US Dollar. If the CLP strengthens significantly against the USD, Antofagasta's revenue generated in USD will translate into fewer CLP when repatriated, potentially affecting local investment and operational expenses. Conversely, a weaker CLP can boost the CLP value of USD-denominated revenues, offering a potential advantage for local cost management.

- CLP/USD Volatility: The Chilean Peso has shown considerable movement against the US Dollar throughout 2024, impacting companies with international financial flows.

- Revenue Translation: Antofagasta's USD-denominated sales are subject to conversion into CLP for local expenses, with exchange rate shifts directly affecting profitability.

- Cost Management: Fluctuations in the CLP can alter the cost of imported materials and services, a key consideration for operational efficiency.

- Hedging Strategies: Managing currency risk through hedging instruments is a continuous financial strategy for Antofagasta to mitigate adverse exchange rate impacts.

Access to Capital and Investment Climate

Antofagasta's significant capital expenditure plans, projected at $3.9 billion for 2025, underscore the critical importance of its access to capital. These investments are earmarked for crucial growth projects, including the Centinela second concentrator and the Los Pelambres expansion, which are vital for future production capacity.

The broader investment climate in Chile plays a pivotal role in shaping the ease and cost of securing funding for such substantial projects. Factors like regulatory stability, the government's approach to mining, and overall economic forecasts directly influence investor confidence and the availability of capital.

- 2025 Capex Projection: Antofagasta anticipates spending $3.9 billion in 2025.

- Key Growth Projects: Investments are directed towards the Centinela second concentrator and the Los Pelambres expansion.

- Investment Climate Influence: Regulatory stability and economic outlook in Chile impact capital access.

- Strategic Importance: A favorable investment environment is essential for Antofagasta's long-term growth strategy.

Global economic stability is paramount for Antofagasta PLC, as a slowdown could dampen copper demand, impacting revenues. Chile's economic growth, projected around 2.7% for 2025, supported by mining investments, offers a positive domestic backdrop.

Persistent inflation in Chile, forecast at 4.2-4.4% for 2025, directly increases Antofagasta's operational costs, necessitating stringent cost management. Currency fluctuations, particularly the CLP against the USD, significantly affect Antofagasta's reported earnings and local expenses.

Antofagasta's substantial 2025 capital expenditure of $3.9 billion highlights the critical need for access to capital, influenced by Chile's investment climate and regulatory stability.

| Economic Factor | 2025 Projection/Data | Impact on Antofagasta |

|---|---|---|

| Global Copper Demand | Strong, driven by electrification and technology | Supports revenue and profitability |

| Chile GDP Growth | ~2.7% | Positive for domestic operations and investment climate |

| Chile Inflation Rate | ~4.2-4.4% | Increases operational costs |

| CLP/USD Exchange Rate | Volatile | Affects reported earnings and local costs |

| Antofagasta Capex | $3.9 billion | Requires favorable access to capital |

Full Version Awaits

Antofagasta PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Antofagasta PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the region. Understand the critical external forces shaping business and investment opportunities in Antofagasta.

Sociological factors

Antofagasta plc places significant emphasis on building robust community relations to secure its social license to operate. The company actively engages with local stakeholders, fostering trust through transparent communication and mutual respect, which is crucial for uninterrupted mining activities. For instance, in 2023, Antofagasta reported investing approximately $45 million in social programs across its operational regions, a testament to its commitment to sustainable coexistence.

The company's social investment strategy is multifaceted, targeting key areas such as water management, education, and local economic development. These initiatives are frequently undertaken in collaboration with local governments and indigenous communities, ensuring alignment with their needs and priorities. This collaborative approach is vital for mitigating operational risks and ensuring the long-term viability of its projects, as demonstrated by the successful integration of community feedback into the environmental impact assessments for its new projects.

The mining industry in Chile, including Antofagasta, relies heavily on a skilled labor pool. Labor relations, marked by potential wage negotiations and the possibility of strikes, directly influence operational continuity and production output. For instance, the 2023 mining sector in Chile saw various labor discussions that could affect output.

Antofagasta places a strong emphasis on occupational health and safety, striving for zero fatal accidents and consistently improving its safety metrics. This commitment is crucial in an industry with inherent risks.

Furthermore, Antofagasta is actively pursuing greater gender diversity, with a stated goal of achieving 30% female representation in its workforce by the close of 2025. This initiative aligns with broader societal movements advocating for increased inclusivity and equal opportunities.

Antofagasta plc places significant emphasis on Indigenous rights and land use, aligning with UN Global Compact principles for human rights. This commitment translates into robust human rights due diligence processes and the establishment of social development agreements with local Indigenous communities. For instance, the company has active agreements in regions like the Choapa Valley and with communities in Socaire, Camar, and Talabre, demonstrating a proactive approach to collaboration.

Public Perception of Mining Industry

Public perception of mining in Chile, the backdrop for Antofagasta's operations, is a complex balancing act. While the industry is undeniably a powerhouse of the Chilean economy, contributing significantly to GDP and exports, concerns about its environmental footprint and social impact are equally prominent. For instance, in 2023, mining accounted for approximately 10% of Chile's GDP, a crucial figure, yet public discourse often centers on water scarcity and community relations.

Antofagasta PLC actively works to navigate and positively influence this perception. The company emphasizes its commitment to responsible mining by highlighting sustainable practices and its role in fostering local socio-economic development. This includes initiatives aimed at reducing environmental impact and creating shared value for communities. For example, Antofagasta reported a 13% reduction in its water intensity across its operations in 2023 compared to 2022, a key metric for public acceptance.

Maintaining trust requires a proactive approach to transparency. Addressing public concerns head-on, particularly regarding water usage, pollution control, and the overall well-being of neighboring communities, is paramount. Antofagasta's sustainability reports, which detail progress on these fronts, are crucial tools in this endeavor. The company's 2023 sustainability report detailed investments of over $50 million in community development projects across its operational areas.

- Economic Contribution vs. Environmental/Social Impact: Mining is vital to Chile's economy, contributing roughly 10% to GDP in 2023, but faces scrutiny over its environmental and social consequences.

- Antofagasta's Strategy: The company focuses on showcasing responsible mining, sustainable performance, and positive contributions to local socio-economic development to shape public opinion.

- Key Performance Indicators: Antofagasta achieved a 13% reduction in water intensity in 2023, demonstrating a commitment to addressing environmental concerns.

- Transparency and Community Engagement: Open reporting on water usage, pollution, and community well-being is essential for building and maintaining a positive public image, supported by over $50 million invested in community projects in 2023.

Health and Safety Standards

Antofagasta plc places paramount importance on the health and safety of its workforce, fostering a robust safety-first culture throughout its mining operations. The company actively tracks safety performance, striving for zero fatalities and a significant reduction in serious incidents.

In 2023, Antofagasta reported a Lost Time Injury Frequency Rate (LTIFR) of 0.45 per million man-hours worked, demonstrating a commitment to continuous improvement in safety metrics. This focus is underpinned by strict adherence to evolving safety regulations and ongoing training programs designed to safeguard employees and contractors.

- Zero Harm Goal: Antofagasta's unwavering commitment to achieving zero fatalities and minimizing high-potential incidents.

- Performance Monitoring: Continuous tracking and improvement of safety indicators across all operational sites.

- Regulatory Compliance: Strict adherence to national and international health and safety legislation.

- Training and Development: Regular safety training for all employees and contractors to enhance awareness and safe practices.

Societal expectations regarding corporate responsibility are a significant influence on Antofagasta's operations. The company actively engages with local communities, investing in social programs and aiming for mutually beneficial relationships. In 2023, Antofagasta reported approximately $45 million in social investments, reflecting a commitment to its social license to operate and community well-being.

Labor relations are a critical factor, with potential wage negotiations and the risk of strikes impacting production. The mining sector in Chile experienced various labor discussions in 2023, highlighting the ongoing importance of managing these relationships effectively.

Antofagasta prioritizes occupational health and safety, with a goal of zero fatal accidents and continuous improvement in safety performance. The company's Lost Time Injury Frequency Rate (LTIFR) was 0.45 per million man-hours worked in 2023, underscoring this focus.

Furthermore, Antofagasta is actively pursuing gender diversity, aiming for 30% female representation by the end of 2025, aligning with broader societal trends towards inclusivity.

Technological factors

Antofagasta is aggressively pursuing automation and digital transformation to sharpen its competitive edge. For instance, their investment in automated shovel maintenance is a clear signal of their commitment to operational efficiency. This focus is further amplified by their exploration of Generative Artificial Intelligence (GenAI) for enhancing operational performance across their diverse mining sites.

Antofagasta is actively investing in technologies to enhance the sustainability of its mining operations. A key focus is the increased utilization of seawater, aiming to significantly reduce its dependence on scarce freshwater resources. This strategic shift is crucial for water-scarce regions where the company operates, aligning with global environmental conservation efforts.

Furthermore, the company is exploring and developing innovative tailings management solutions. This includes investigating alternatives to traditional tailings storage, which often present environmental challenges. These advancements are designed to minimize the environmental footprint of mining activities and improve overall operational efficiency.

Technological advancements are significantly boosting Antofagasta's copper production. Innovations in geological modeling for ore grade management, for instance, are crucial for optimizing extraction and ensuring higher copper yields. This focus on precision helps Antofagasta maximize the value derived from each ton of ore processed.

In processing, the adoption of cutting-edge flotation technology is a game-changer. This advanced equipment minimizes mineral loss during separation, leading to substantially improved recovery rates from the extracted ore. For example, Antofagasta's ongoing investment in technology aims to enhance operational efficiency and resource utilization across its mining portfolio.

Data Analytics and Operational Optimization

Antofagasta Minerals is leveraging advanced data analytics to refine its mining operations. For instance, the Daily Plan Optimiser (SIRO Mezcla) is instrumental in creating the most efficient extraction plans by considering factors like equipment uptime, the volume of material to be moved, and the richness of the ore. This data-driven approach directly supports better resource allocation and yield maximization.

Furthermore, the company is implementing Operational Excellence Management Systems (OEMS) to systematically minimize downtime, particularly for its mobile mining fleet. This focus on reducing idle time for crucial machinery like excavators and haul trucks directly translates to increased productivity and lower operational costs. In 2023, Antofagasta reported a significant improvement in fleet availability, with key equipment experiencing a reduction in unplanned downtime by approximately 8% year-on-year, a direct result of these optimization strategies.

- Data-driven extraction planning using tools like SIRO Mezcla to balance tonnage, ore grade, and equipment availability.

- Reduced mobile equipment downtime through the implementation of Operational Excellence Management Systems (OEMS).

- Improved operational performance and informed decision-making stemming from the effective utilization of real-time operational data.

Energy Efficiency and Renewable Energy Adoption

The mining industry in Chile, a major electricity consumer, is experiencing a significant shift towards renewable energy sources. Antofagasta's strategic focus on climate change mitigation directly impacts its operations, driving efforts to lower its carbon footprint.

By investing in energy-efficient technologies and embracing renewable energy, Antofagasta aims to achieve dual benefits: reducing operational expenses and improving its overall environmental standing. For instance, in 2023, renewable sources like solar and wind power accounted for approximately 50% of Chile's electricity generation mix, a figure expected to grow. This trend presents opportunities for mining companies to secure more stable and potentially lower energy costs.

- Renewable Energy Growth: Chile's commitment to renewable energy is accelerating, with solar and wind power becoming increasingly dominant in the national grid.

- Cost Reduction Potential: Transitioning to renewables can lead to substantial savings on electricity bills for energy-intensive operations like mining.

- Environmental Performance: Adopting cleaner energy sources directly supports Antofagasta's climate change commitments and enhances its corporate social responsibility profile.

Antofagasta is heavily investing in automation and digital tools to boost efficiency and reduce costs. For example, their use of the Daily Plan Optimiser (SIRO Mezcla) helps create the most efficient extraction plans by considering equipment uptime and ore grade. This data-driven approach is key to maximizing resource allocation and yield.

The company is also focused on reducing mobile equipment downtime through Operational Excellence Management Systems (OEMS). In 2023, this strategy led to an approximate 8% year-on-year reduction in unplanned downtime for key mining equipment, directly improving productivity.

Furthermore, Antofagasta is exploring advanced flotation technology to improve mineral recovery rates during processing. This, along with innovations in geological modeling for ore grade management, is crucial for increasing copper yields and extracting more value from each ton of ore processed.

Antofagasta is also embracing renewable energy sources to lower operational expenses and its carbon footprint. By 2023, renewables accounted for about 50% of Chile's electricity generation, a trend Antofagasta is leveraging to secure more stable energy costs.

Legal factors

Chile's mining legal framework saw substantial updates in 2024, impacting the Mining Code and associated regulations. These changes are designed to encourage more active resource development.

Key revisions include adjustments to the concession system, notably a hike in exploration patent fees. Furthermore, exploitation concessions that don't show demonstrable progress will face progressively higher fees, a move aimed at optimizing resource utilization.

Antofagasta's operations are directly affected by these new rules, requiring strict adherence to the updated concession terms. Non-compliance could lead to increased financial burdens, underscoring the need for diligent regulatory management.

Projects in Chile, particularly those in the mining sector, face rigorous environmental scrutiny under the Environmental Act No. 19,300. This legislation mandates comprehensive Environmental Impact Assessments (EIAs) to evaluate potential ecological and social consequences before project approval.

Antofagasta's operations are significantly influenced by upcoming reforms to the EIA system, slated for implementation in 2024-2025. These changes are designed to empower administrative bodies and expedite the approval process, aiming for a reduction in processing times while upholding strict environmental standards.

Successfully navigating this evolving EIA framework is crucial for Antofagasta's new ventures. Securing environmental approvals requires meticulous adherence to updated regulations and demonstrating a commitment to sustainable practices, impacting project timelines and financial projections.

Chile's Mining Activity Royalty Act No. 21,591, effective in 2024, introduces a significant new tax on mining sales. This legislation is designed to boost government revenue from the mining sector, which is a cornerstone of the Chilean economy. For companies like Antofagasta, this means a direct impact on their bottom line and a need for meticulous financial planning and tax adherence.

The new royalty structure is expected to substantially increase fiscal revenues. For instance, initial projections indicated that the royalty could generate an additional US$1 billion annually for the Chilean government, depending on commodity prices and production levels. This directly affects Antofagasta's profitability by increasing their tax burden, making accurate forecasting of future earnings and financial commitments essential.

Water Rights and Regulations

Water management is a significant legal and operational hurdle for mining firms in Chile, a nation grappling with water scarcity. Stringent regulations govern water extraction and utilization, with non-compliance risking environmental litigation and substantial fines.

Antofagasta Minerals is actively addressing these challenges by prioritizing increased seawater usage and implementing advanced water efficiency measures. This strategic approach not only aims to mitigate risks associated with water scarcity but also ensures adherence to evolving environmental legal frameworks. For instance, in 2023, Antofagasta reported that its desalination plants supplied 70% of its water needs, a figure projected to rise further.

- Regulatory Compliance: Adherence to Chile's strict water withdrawal and usage laws is paramount to avoid legal repercussions and operational disruptions.

- Water Scarcity Mitigation: The company's strategy focuses on reducing reliance on freshwater sources in an arid environment.

- Seawater Desalination: Antofagasta is expanding its use of desalinated seawater, which represented 70% of its water supply in 2023, to ensure operational continuity.

- Efficiency Improvements: Continuous investment in water-saving technologies and practices is key to meeting environmental standards and managing costs.

Labor Laws and Social Security

Chilean labor laws and social security regulations are critical for Antofagasta's operations, dictating employment practices in the mining sector. These laws encompass crucial areas like working conditions, minimum wages, employee benefits, and stringent safety standards. For instance, as of early 2024, Chile's minimum wage was CLP 440,000 per month, a figure that companies must adhere to, with potential adjustments anticipated.

Antofagasta's commitment to full compliance with these regulations, particularly those concerning occupational health and safety, is paramount. This ensures a legal and ethical operating framework, crucially mitigating the risk of costly labor disputes. The nation's social security system requires employers to contribute a percentage of an employee's salary towards pensions, healthcare, and unemployment insurance, adding to the overall cost of labor but also fostering a stable workforce.

- Compliance with Chilean Labor Code: Adherence to regulations covering hiring, firing, working hours, and collective bargaining is mandatory.

- Occupational Health and Safety Standards: Strict adherence to safety protocols, including regular inspections and training, is vital to prevent workplace accidents and associated penalties.

- Social Security Contributions: Employers must contribute to Chile's pension (AFP), health insurance (ISAPRE or FONASA), and unemployment insurance funds, impacting payroll costs.

- Minimum Wage Adherence: Ensuring all employees receive at least the legally mandated minimum wage, which is subject to annual review and potential increases by the government.

Chile's legal landscape for mining underwent significant shifts in 2024, with updated regulations impacting concession fees and exploration incentives. Non-compliance with revised concession terms, particularly regarding demonstrable progress, can lead to escalating fees, directly influencing Antofagasta's operational costs and strategic planning.

Environmental regulations, specifically the Environmental Act No. 19,300, mandate rigorous Environmental Impact Assessments (EIAs). Upcoming reforms to the EIA system, expected in 2024-2025, aim to streamline approvals while maintaining stringent environmental standards, requiring Antofagasta to adapt its project development strategies.

The Mining Activity Royalty Act No. 21,591, effective from 2024, imposes a new tax on mining sales, directly affecting profitability. Projections suggested this royalty could add over US$1 billion annually to government revenue, necessitating careful financial forecasting by Antofagasta.

Water management laws are critical due to Chile's scarcity; Antofagasta's strategy to increase seawater usage, which supplied 70% of its needs in 2023, is a key legal and operational adaptation.

Environmental factors

Antofagasta operates in a region facing significant water scarcity, making robust water management a paramount environmental challenge. The company is strategically shifting towards desalinated seawater, which represented a substantial portion of its total water intake in recent years, aiming to lessen dependence on scarce continental freshwater sources.

By increasing its reliance on desalinated seawater, Antofagasta is mitigating operational risks associated with water availability. This approach is crucial for ensuring long-term operational sustainability and maintaining compliance with environmental regulations, particularly as water stress intensifies in the Atacama Desert. For instance, in 2023, the company reported that desalinated water accounted for a significant percentage of its water supply, a figure it aims to further increase.

Antofagasta plc has identified climate change as a significant risk, integrating its mitigation into its core business strategy to reduce its carbon footprint. The company is actively pursuing decarbonization across its operations, including a substantial shift towards renewable energy sources for its mining activities.

By 2024, Antofagasta aims to power 50% of its electricity needs from renewable sources, a key step in its broader goal of achieving carbon neutrality in its own operations (Scope 1 and 2) by 2035. This transition involves significant investments in solar and wind power generation, directly impacting operational costs and long-term sustainability.

The safe and responsible management of tailings and other mining waste presents a substantial environmental hurdle for copper mining operations like those in Antofagasta. Antofagasta Minerals, for instance, is actively prioritizing robust tailings management practices and investigating novel approaches to move beyond traditional methods.

Adherence to stringent regulations governing the design, construction, operation, and eventual closure of tailings facilities is absolutely critical to avert potential environmental catastrophes. For example, in 2023, Antofagasta Minerals reported investing $204 million in water infrastructure and management, which includes aspects related to waste management and environmental protection.

Biodiversity Protection and Land Rehabilitation

Mining activities, by their nature, can significantly affect local biodiversity and the health of ecosystems. Antofagasta Minerals, recognizing this, places a strong emphasis on its environmental management strategies. These strategies are designed to prevent, control, and lessen any negative environmental impacts, with a particular focus on safeguarding biodiversity.

This commitment translates into practical actions on the ground. The company prioritizes responsible land use practices to minimize the disruption of natural habitats. Furthermore, Antofagasta is dedicated to implementing robust rehabilitation efforts once mining operations in an area conclude, aiming to restore the land to a state that supports ecological recovery.

For instance, in 2023, Antofagasta Minerals reported investing $56 million in environmental management, a significant portion of which is allocated to biodiversity protection and land rehabilitation projects. Their approach often includes:

- Habitat Restoration: Actively working to re-establish native vegetation and ecosystems in areas affected by mining.

- Biodiversity Monitoring: Conducting ongoing studies to track the health and diversity of flora and fauna in and around their operational sites.

- Water Management: Implementing measures to protect water sources, which are crucial for sustaining biodiversity.

- Waste Management: Ensuring responsible disposal and management of mining waste to prevent environmental contamination.

Air Quality and Emissions Control

Mining operations, especially those involving large-scale earth movement, inherently generate dust. Antofagasta, a major player in the mining sector, recognizes this and places significant emphasis on controlling these emissions to maintain air quality around its sites. This is a critical component of their environmental stewardship, aiming to minimize impact on local communities and ecosystems.

The company actively employs a range of strategies to manage and mitigate dust. These often include water spraying on haul roads, covering stockpiles, and using dust suppressants. Such measures are not only for environmental compliance but also to foster positive community relations by addressing potential health and nuisance concerns.

Continuous monitoring of air quality is essential to ensure these control measures are effective and that Antofagasta adheres to stringent regulatory standards. For instance, in 2024, the company reported investing in advanced monitoring equipment across several of its operations to track particulate matter levels in real-time. This data is crucial for adaptive management and demonstrating commitment to environmental performance.

- Dust Management: Antofagasta implements dust suppression techniques like water sprays on roads and covered stockpiles.

- Environmental Monitoring: Continuous air quality monitoring is conducted to ensure compliance with regulations and assess emission impacts.

- Community Relations: Proactive management of air quality addresses community concerns and supports social license to operate.

- Investment in Technology: The company is investing in advanced monitoring systems to improve real-time data collection and emission control strategies.

Antofagasta's environmental strategy heavily focuses on water scarcity, with a significant push towards desalinated seawater to reduce reliance on freshwater sources. The company is committed to decarbonization, targeting 50% renewable energy use by 2024 and carbon neutrality by 2035, investing in solar and wind power. Robust tailings management and biodiversity protection are also key priorities, supported by substantial environmental investments.

| Environmental Factor | Antofagasta's Approach/Data |

|---|---|

| Water Management | Shift to desalinated seawater; invested $204 million in water infrastructure in 2023. |

| Climate Change & Emissions | Aiming for 50% renewable energy by 2024; carbon neutral (Scope 1 & 2) by 2035. |

| Tailings Management | Prioritizing robust practices and exploring novel approaches. |

| Biodiversity | Investing $56 million in environmental management in 2023, focusing on habitat restoration and monitoring. |

| Air Quality | Implementing dust suppression techniques and continuous air quality monitoring. |

PESTLE Analysis Data Sources

Our Antofagasta PESTLE Analysis draws on data from official Chilean government statistics, regional development agencies, and international mining industry reports. This ensures a comprehensive understanding of the political, economic, social, technological, environmental, and legal factors impacting the region.