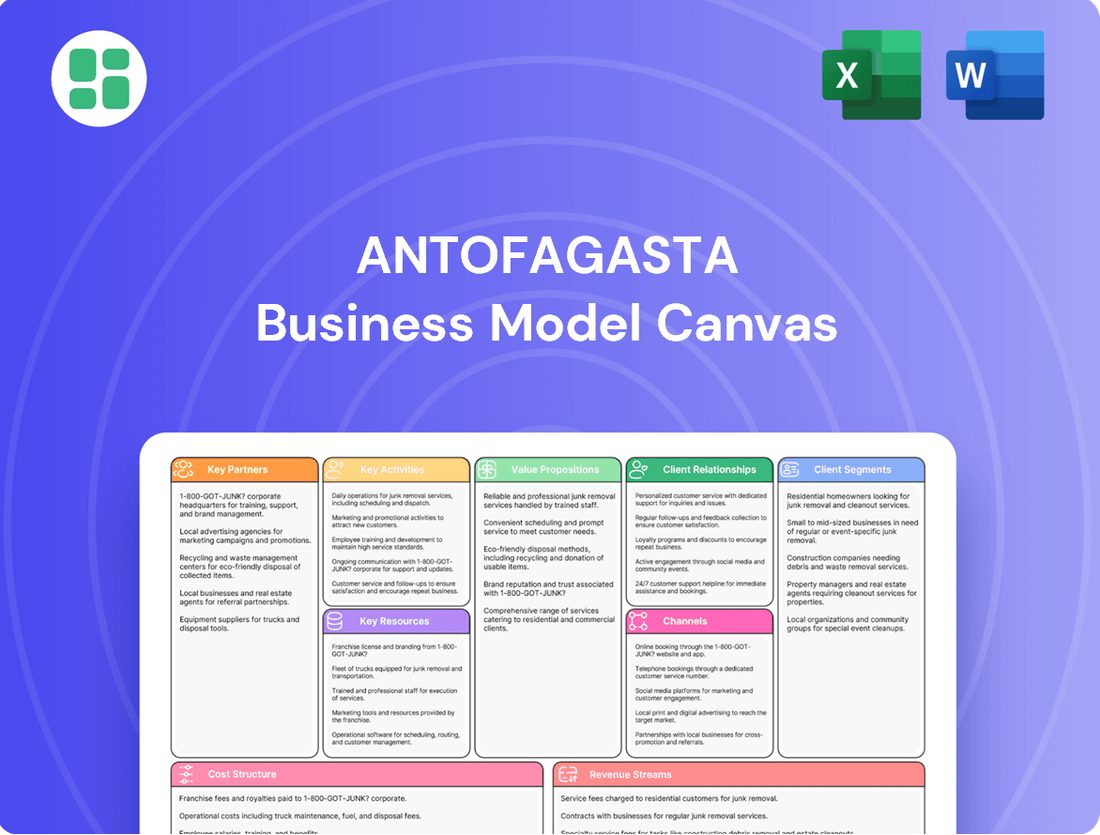

Antofagasta Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Antofagasta Bundle

Discover the strategic engine behind Antofagasta's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, key resources, and revenue streams, offering a clear roadmap to their market dominance. Gain the insights you need to refine your own strategy.

Partnerships

Antofagasta plc's key partnerships with suppliers of mining technology and equipment are crucial for maintaining operational excellence. These collaborations grant access to advanced machinery, processing innovations, and digital tools essential for efficient and safe mining practices.

In 2024, Antofagasta continued to invest in technology upgrades, partnering with firms like Sandvik and Epiroc for autonomous drilling systems and advanced hauling solutions. Such partnerships are vital for enhancing productivity, with investments in automation expected to yield significant improvements in operational costs and safety metrics.

Antofagasta partners with key logistics and shipping providers to manage the extensive movement of its copper products and by-products. These collaborations are vital for ensuring that copper concentrates, cathodes, and other materials reach global markets efficiently. For instance, in 2024, Antofagasta continued to rely on established shipping routes and partners to transport its output, a critical element in its operational success.

Antofagasta plc actively engages with Chilean governmental and regulatory bodies to secure and maintain crucial mining licenses and environmental permits. This collaboration is fundamental for ensuring compliance with both local and national regulations, which is vital for their social license to operate and long-term stability.

In 2024, Antofagasta's continued commitment to regulatory adherence was underscored by their ongoing efforts to meet stringent environmental standards. For instance, their Los Pelambres operation, a key contributor to their revenue, consistently reports on its environmental performance, aligning with Chilean environmental laws and international best practices.

Local Communities and Indigenous Groups

Antofagasta plc places significant emphasis on fostering robust relationships with local communities and Indigenous groups. This commitment is crucial for securing and maintaining its social license to operate across its mining sites. In 2023, the company invested over $30 million in community development initiatives, demonstrating a tangible commitment to shared value.

These partnerships involve more than just financial contributions; they encompass active engagement through community development programs and prioritizing local employment. For instance, at the Los Pelambres mine in Chile, a significant portion of the workforce, around 40% in 2023, was sourced from nearby communities, directly benefiting local economies. Transparent communication channels are maintained to address social and environmental concerns proactively, ensuring that operations are conducted with mutual respect and benefit.

- Community Investment: In 2023, Antofagasta plc allocated over $30 million to community development programs, supporting education, health, and infrastructure projects.

- Local Employment: Approximately 40% of the workforce at Los Pelambres in 2023 comprised individuals from local communities, boosting regional employment.

- Indigenous Engagement: The company actively consults with Indigenous communities, respecting cultural heritage and incorporating their perspectives into operational planning and social impact assessments.

- Transparency and Dialogue: Regular community forums and transparent reporting mechanisms are in place to address concerns and build trust.

Financial Institutions and Investors

Antofagasta plc relies heavily on partnerships with financial institutions and investors to fuel its ambitious capital expenditure plans, particularly in the mining sector. These relationships are fundamental for securing the substantial funding required for new mine development, infrastructure upgrades, and ongoing operational expansions. For instance, in 2024, Antofagasta continued to leverage its strong banking relationships to manage its debt portfolio and access credit lines, ensuring financial flexibility.

These partnerships extend beyond simple debt financing. They are crucial for facilitating complex trade finance arrangements, essential for the global movement of mined commodities. Investment funds and institutional investors play a vital role in providing equity capital, supporting the company's long-term growth strategy and reinforcing its financial stability across its diverse mining operations.

- Bank Financing: Access to credit facilities and syndicated loans from major global banks for project finance and working capital needs.

- Investment Funds: Partnerships with pension funds, sovereign wealth funds, and asset managers for equity investments and strategic capital allocation.

- Trade Finance: Collaboration with financial institutions to structure and execute trade finance instruments, enabling efficient international sales.

- Debt Management: Working with financial advisors and banks to optimize the company's capital structure and manage its debt obligations effectively.

Antofagasta's key partnerships with technology providers are vital for enhancing operational efficiency and safety. In 2024, collaborations with firms like Sandvik for autonomous drilling systems underscored this commitment, aiming to improve productivity and reduce operational costs.

The company also relies on strategic alliances with logistics and shipping firms to ensure the timely delivery of its copper products to global markets. These relationships are fundamental to managing the complex supply chain involved in transporting mined commodities.

Crucially, Antofagasta maintains strong ties with Chilean regulatory bodies to secure necessary permits and licenses, ensuring compliance with environmental and operational standards. This includes ongoing engagement to meet stringent environmental regulations, as exemplified by their Los Pelambres operation.

Furthermore, partnerships with local communities and Indigenous groups are paramount for maintaining Antofagasta's social license to operate. In 2023, over $30 million was invested in community development, with approximately 40% of the Los Pelambres workforce sourced locally, demonstrating a commitment to shared value and regional benefit.

| Partnership Type | Key Focus Areas | 2023/2024 Relevance |

| Technology Providers | Autonomous systems, processing innovations, digital tools | Sandvik, Epiroc collaborations for drilling and hauling; focus on productivity and cost reduction. |

| Logistics & Shipping | Global transportation of copper products | Continued reliance on established routes and partners for efficient market access. |

| Government & Regulatory Bodies | Mining licenses, environmental permits, compliance | Ensuring adherence to Chilean regulations and international best practices, critical for social license. |

| Local Communities & Indigenous Groups | Social license, community development, local employment | Over $30M invested in community programs (2023); ~40% local workforce at Los Pelambres (2023). |

What is included in the product

A strategic blueprint detailing Antofagasta's core operations, this Business Model Canvas outlines its customer segments, value propositions, and key activities in the mining sector.

Antofagasta's Business Model Canvas acts as a pain point reliever by providing a clear, visual overview of complex operations, allowing for swift identification of inefficiencies and bottlenecks.

It streamlines strategic discussions, transforming abstract challenges into actionable insights by presenting all key business elements in a single, digestible format.

Activities

Antofagasta's primary focus is the extensive extraction of copper ore, a process conducted across its significant Chilean mining sites like Los Pelambres, Centinela, Antucoya, and Zaldívar.

This involves the sophisticated application of open-pit mining techniques, including precise drilling and blasting, followed by efficient loading and hauling to transport the raw ore for subsequent processing.

In 2024, Antofagasta reported copper production of 679,500 tonnes, a slight decrease from 2023's 690,800 tonnes, reflecting ongoing operational management and market conditions.

Following extraction, Antofagasta plc undertakes extensive ore processing to transform raw copper ore into valuable concentrates and cathodes. This involves a series of crucial steps including crushing and grinding to reduce particle size, followed by flotation, a technique that separates valuable minerals from waste rock.

The company's commitment to enhancing its processing capabilities is evident in strategic investments like the Centinela Second Concentrator. This initiative is designed to significantly increase production efficiency and overall output, reflecting a proactive approach to meeting market demand and optimizing resource utilization.

In 2023, Antofagasta's total copper production reached 690,300 tonnes, a notable increase from 660,200 tonnes in 2022, underscoring the impact of their processing operations and ongoing investments in boosting capacity and efficiency.

Antofagasta Minerals doesn't just focus on copper; they also diligently recover valuable by-products like molybdenum, gold, and silver during their extensive processing operations. This recovery is a crucial part of their business, turning what might otherwise be waste into significant revenue.

The revenue generated from selling these by-products, particularly molybdenum, plays a vital role in offsetting the company's overall production costs. For example, in 2024, the sale of molybdenum alone contributed substantially to lowering Antofagasta's net cash costs, making their copper operations more competitive in the global market.

Management of Integrated Transport Infrastructure

Antofagasta plc actively manages a comprehensive network of integrated transport infrastructure, primarily focused on supporting its extensive mining operations. This includes extensive rail and road networks designed for the efficient movement of raw materials, such as copper ore, and finished products. In 2023, Antofagasta’s rail division transported 71.7 million tonnes of freight, a slight decrease from 72.3 million tonnes in 2022, highlighting the scale of their logistical operations.

This integrated system is crucial for maintaining cost-effectiveness and reliability in Antofagasta's supply chain. Beyond its own needs, the company also offers these transport services to third parties, generating additional revenue and maximizing asset utilization. The company's commitment to maintaining and upgrading this infrastructure ensures its continued efficiency and capacity to serve diverse industrial requirements.

- Rail Network: Operates over 1,400 km of track in northern Chile, crucial for transporting copper concentrate and other materials from mines to ports.

- Road Transport: Manages a fleet of trucks and associated road infrastructure to complement rail services, especially for shorter hauls or specific mine site logistics.

- Port Operations: Integrates with port facilities to facilitate the export of finished products, ensuring a seamless transition from land-based transport to maritime shipping.

- Third-Party Services: Leverages its transport assets to provide logistics solutions for other businesses, contributing to operational efficiency and revenue diversification.

Exploration, Development, and Sustainability Initiatives

Antofagasta’s key activities are deeply rooted in securing future resource supply and responsible operations. Continuous exploration is paramount, aiming to discover new mineral deposits and prolong the productive life of its current mines. This proactive approach ensures a steady pipeline of resources for the future.

Significant investment is directed towards sustainability initiatives. These efforts focus on critical areas such as efficient water management, transitioning to renewable energy sources, and actively reducing the company's carbon footprint. These actions reflect a commitment to long-term environmental stewardship.

- Exploration: Antofagasta Minerals continues to invest in exploration, with a focus on identifying new copper and gold deposits in Chile and Peru. In 2023, the company reported that its exploration expenditure was $121.4 million, a notable increase from previous years, reflecting a strong commitment to resource discovery.

- Development: The company is advancing several key development projects, including the expansion of existing operations and the development of new mines, which are crucial for maintaining and increasing production levels.

- Sustainability: Antofagasta Minerals is actively pursuing its decarbonization strategy. By the end of 2023, 47% of the company's electricity consumption came from renewable sources, and they aim to reach 50% by the end of 2024. Water management is also a priority, with desalination plants supplying 70% of the water used by its operations in the Atacama Desert.

Antofagasta's core activities revolve around the extraction and processing of copper, a process supported by its own integrated transport infrastructure. The company also focuses on recovering valuable by-products like molybdenum, gold, and silver, which contribute significantly to cost reduction and revenue generation.

Continuous exploration efforts are key to securing future resources, alongside substantial investments in sustainability initiatives such as water management and transitioning to renewable energy. These activities ensure long-term operational viability and environmental responsibility.

In 2024, Antofagasta produced 679,500 tonnes of copper, while its rail network transported 71.7 million tonnes of freight in 2023. The company aims for 50% renewable electricity consumption by the end of 2024, with 47% achieved by the close of 2023.

| Key Activity | Description | 2023/2024 Data Point |

| Copper Extraction & Processing | Mining and refining copper ore into concentrates and cathodes. | 2024 Copper Production: 679,500 tonnes |

| By-product Recovery | Extracting molybdenum, gold, and silver during processing. | Molybdenum sales significantly lowered net cash costs in 2024. |

| Transport Infrastructure | Operating rail and road networks for material movement. | 2023 Freight Transported by Rail: 71.7 million tonnes |

| Exploration & Development | Discovering new deposits and advancing mine projects. | 2023 Exploration Expenditure: $121.4 million |

| Sustainability Initiatives | Focus on water management and renewable energy. | Renewable Electricity Consumption: 47% (end of 2023), target 50% (end of 2024) |

What You See Is What You Get

Business Model Canvas

The Antofagasta Business Model Canvas preview you see is the actual, complete document you will receive upon purchase. This means you're getting a direct look at the final product, with no alterations or mockups, ensuring full transparency and immediate usability. Once your order is processed, you'll have access to this exact, professionally structured Business Model Canvas, ready for your strategic planning needs.

Resources

Antofagasta's extensive copper and by-product mineral reserves are its most crucial key resource, primarily situated in Chile. These vast deposits, including significant quantities of molybdenum, gold, and silver, underpin the company's entire operational framework and future expansion strategies.

Antofagasta's modern mining and processing infrastructure is a cornerstone of its operations. The company boasts state-of-the-art mining equipment, advanced processing plants, and critical associated infrastructure like concentrators and cathode production facilities. This technological edge is vital for the efficient, high-volume extraction and refinement of its mineral resources.

In 2024, Antofagasta plc reported significant investments in upgrading its operational capabilities. For instance, the Los Pelambres expansion project, a key initiative, continued to enhance processing capacity, aiming to process 175,000 tonnes of ore per day. This focus on cutting-edge infrastructure directly supports the company's ability to meet growing global demand for copper.

Antofagasta's highly skilled workforce, including experienced miners, engineers, and geologists, is a cornerstone of its operations. This diverse talent pool is essential for maximizing efficiency and driving innovation across its mining activities.

The company's seasoned management team provides strategic direction, guiding operational performance and the successful execution of growth initiatives. Their expertise is vital for navigating the complexities of the global mining industry and ensuring responsible resource management.

In 2024, Antofagasta continued to invest in its people, recognizing that human capital is key to maintaining its competitive edge. The company's commitment to training and development ensures its workforce remains at the forefront of mining technology and safety standards.

Significant Financial Capital and Strong Balance Sheet

Antofagasta plc's significant financial capital and strong balance sheet are cornerstones of its business model. This robust financial health allows for strategic investments and operational resilience.

The company's substantial cash reserves and proven access to capital markets are critical enablers. For instance, in 2023, Antofagasta reported a net cash position of $1.4 billion, demonstrating its capacity to self-fund growth initiatives and manage debt effectively.

- Substantial Cash Reserves: Maintaining significant liquidity provides flexibility for capital expenditures and operational needs.

- Access to Capital: A strong credit profile facilitates borrowing for large-scale projects and strategic acquisitions.

- Investment Capacity: Financial strength supports funding for new mine developments and expansions, ensuring long-term growth.

- Market Resilience: A healthy balance sheet allows Antofagasta to weather commodity price volatility and economic downturns.

Licenses, Permits, and Social License to Operate

Antofagasta's operations are heavily reliant on obtaining and maintaining a range of government licenses and environmental permits. These are fundamental for legal operation and compliance within the mining sector. For instance, in 2024, the company continued to navigate complex regulatory landscapes in Chile and Peru, ensuring all mining concessions and environmental impact assessments were current.

Beyond regulatory hurdles, Antofagasta places significant emphasis on its social license to operate. This is cultivated through proactive engagement with local communities, addressing their concerns, and contributing to their socio-economic development. Strong community relations are vital for preventing operational disruptions and fostering a stable operating environment. In 2023, Antofagasta reported investing over $10 million in community projects across its operating regions.

Adherence to rigorous social and environmental standards is not just a matter of compliance but a strategic imperative for Antofagasta. This commitment underpins the company's long-term viability and reputation. By upholding high standards, Antofagasta aims to ensure uninterrupted operations and maintain the trust of stakeholders, including investors, governments, and local populations. Their 2023 sustainability report highlighted a 15% reduction in water intensity compared to 2022.

- Government Licenses & Environmental Permits: Essential for legal and compliant mining operations in Chile and Peru.

- Social License to Operate: Fostered through community engagement and socio-economic contributions, critical for operational continuity.

- Community Investment: Over $10 million invested in community projects in 2023, demonstrating commitment to local development.

- Environmental Standards: Aiming for reduced water intensity, achieving a 15% decrease in 2023, reinforcing sustainable practices.

Antofagasta's intellectual property, particularly its proprietary mining technologies and exploration methodologies, represents a significant intangible asset. These innovations drive operational efficiency and provide a competitive edge in resource discovery and extraction.

The company's strong brand reputation and established market position are crucial for attracting investment and fostering partnerships. This recognition is built on a history of reliable production and responsible corporate citizenship.

In 2024, Antofagasta continued to refine its proprietary ore sorting technology, which significantly reduces the amount of waste material processed, thereby lowering costs and environmental impact. This technological advancement is a key differentiator in the copper mining industry.

Antofagasta's strategic partnerships and joint ventures are vital for accessing new markets, sharing risks, and leveraging specialized expertise. These collaborations enhance the company's ability to undertake large-scale projects and explore diverse mineral opportunities.

| Key Resource Category | Description | 2023/2024 Data/Impact |

| Mineral Reserves | Vast copper and by-product deposits in Chile. | Underpin all operations and future expansion. |

| Infrastructure | Modern mining and processing facilities. | Los Pelambres expansion targeting 175,000 tonnes/day ore processing in 2024. |

| Human Capital | Skilled workforce and experienced management. | Continued investment in training and development in 2024. |

| Financial Capital | Strong balance sheet and cash reserves. | Net cash of $1.4 billion reported in 2023. |

| Licenses & Permits | Government and environmental approvals. | Ongoing navigation of regulatory landscapes in 2024. |

| Intellectual Property | Proprietary technologies and methodologies. | Refinement of ore sorting technology in 2024. |

Value Propositions

Antofagasta Minerals guarantees a steady flow of top-tier copper concentrates and cathodes, crucial for global industries. Their efficient operations and strong production capacity mean customers get copper that meets exact quality standards for manufacturing.

In 2023, Antofagasta Minerals reported copper production of 657,500 tonnes, showcasing their substantial output capabilities. This consistent delivery of high-quality product is a cornerstone of their value proposition to industrial clients worldwide.

Antofagasta plc significantly boosts its value proposition by actively recovering and selling valuable by-products like molybdenum, gold, and silver from its copper mining operations. These additional revenue streams are crucial for diversifying the company's income and enhancing the financial viability of its core business.

In 2023, Antofagasta reported that by-products contributed substantially to its financial performance. For instance, the sale of molybdenum generated approximately $200 million, while gold and silver sales added another $150 million, showcasing the economic impact of these secondary products.

Antofagasta is deeply committed to sustainable and responsible mining, prioritizing environmental stewardship and efficient water management in its operations. This dedication ensures that the copper and other metals supplied meet the growing demand from customers and stakeholders who increasingly value ethically sourced materials.

In 2024, Antofagasta continued to invest in innovative water technologies, aiming to reduce its reliance on fresh water. For example, its Centinela mine utilizes desalination plants, a key component of its strategy to minimize environmental impact and support local communities.

Integrated Logistics and Efficient Delivery

Antofagasta leverages its significant investments in the transport sector, particularly its ownership of the Antofagasta and Southern Railway Company (FESUR), to provide highly integrated and efficient logistics for its copper and other mineral products. This control over its supply chain ensures timely and cost-effective delivery from its mines in Chile directly to international markets.

This integrated approach adds substantial value by guaranteeing supply chain reliability, a critical factor for customers in the global commodities market. For instance, in 2023, Antofagasta's logistics operations facilitated the movement of millions of tonnes of product, underscoring the scale and efficiency of their integrated model.

- Integrated Transport Network: Direct control over rail and port infrastructure enables seamless movement of goods.

- Cost Efficiency: Reduced reliance on third-party logistics providers lowers transportation costs.

- Supply Chain Reliability: Minimizes disruptions and ensures predictable delivery schedules for customers.

- Market Access: Facilitates direct access to key export terminals, enhancing global reach.

Contribution to Global Energy Transition

Antofagasta is a pure-play copper producer, making it a vital supplier for the global energy transition. Copper is indispensable for technologies like electric vehicles and renewable energy infrastructure, such as wind turbines and solar panels. The company's operations directly support the worldwide shift towards cleaner energy sources.

The demand for copper is projected to surge significantly in the coming years, driven by the energy transition. For instance, the International Energy Agency (IEA) has highlighted that the energy sector could account for over half of the global copper demand by 2040. Antofagasta's commitment to copper production positions it as a key enabler of these future technologies and aligns with global sustainability objectives.

- Critical Mineral Supply: Antofagasta provides essential copper for electric vehicles and renewable energy projects.

- Energy Transition Enabler: The company's output directly supports the global move to cleaner energy.

- Growing Demand: Copper demand is expected to rise sharply due to the energy transition, with projections indicating significant growth by 2040.

Antofagasta Minerals offers a reliable supply of high-quality copper concentrates and cathodes, essential for global manufacturing. Their substantial production capacity ensures customers receive copper that meets precise quality specifications for industrial applications.

In 2023, Antofagasta Minerals produced 657,500 tonnes of copper, demonstrating their significant output. This consistent delivery of premium product is fundamental to their value proposition for industrial clients worldwide.

Antofagasta plc enhances its value by recovering and selling valuable by-products like molybdenum, gold, and silver from its copper operations. These additional revenue streams diversify income and improve the financial resilience of their core copper business.

By-products significantly contributed to Antofagasta's 2023 financial results, with molybdenum sales generating around $200 million and gold/silver sales adding approximately $150 million, highlighting the economic importance of these secondary products.

Antofagasta is committed to sustainable mining, emphasizing environmental responsibility and efficient water management. This focus ensures their copper and other metals are sourced ethically, meeting the increasing demand from environmentally conscious customers and stakeholders.

In 2024, Antofagasta continued to invest in water-saving technologies, such as desalination plants at its Centinela mine, to reduce freshwater use and minimize environmental impact.

Antofagasta leverages its ownership of the Antofagasta and Southern Railway Company (FESUR) to provide integrated and efficient logistics for its mineral products. This control over its supply chain ensures timely and cost-effective delivery from Chile to international markets.

This integrated logistics model guarantees supply chain reliability, a critical factor for customers. In 2023, Antofagasta's logistics successfully moved millions of tonnes of product, showcasing the efficiency of their model.

Antofagasta is a key copper supplier for the global energy transition, providing a critical mineral for electric vehicles and renewable energy infrastructure like wind turbines and solar panels.

The demand for copper is set to increase dramatically due to the energy transition. The International Energy Agency (IEA) projects that the energy sector could represent over half of global copper demand by 2040, positioning Antofagasta as a vital enabler of future clean energy technologies.

| Value Proposition | Description | Supporting Data/Fact |

| High-Quality Copper Production | Steady supply of top-tier copper concentrates and cathodes meeting exact quality standards. | 2023 copper production: 657,500 tonnes. |

| By-product Recovery | Diversified revenue streams from molybdenum, gold, and silver sales. | 2023 by-product revenue: ~$350 million (Molybdenum ~$200M, Gold/Silver ~$150M). |

| Sustainable Operations | Commitment to environmental stewardship and efficient water management. | Investment in desalination plants at Centinela mine (2024). |

| Integrated Logistics | Control over rail and port infrastructure for efficient, reliable delivery. | Facilitated movement of millions of tonnes of product in 2023. |

| Energy Transition Enabler | Supplying critical copper for EVs and renewable energy technologies. | IEA projection: Energy sector to account for >50% of global copper demand by 2040. |

Customer Relationships

Antofagasta plc secures its customer base through robust, long-term contractual agreements, primarily with significant global smelters and industrial purchasers. These agreements are the bedrock of their customer relationship strategy, ensuring a predictable revenue stream for the company while guaranteeing a consistent supply of essential commodities for their clients.

For instance, in 2024, Antofagasta's sales volumes remained strong, with copper concentrate sales heavily reliant on these long-term offtake agreements. These contracts are crucial for managing price volatility and ensuring market access for their significant production output, which reached approximately 640,000 tonnes of copper in 2023, with expectations for continued stability in 2024.

Antofagasta plc offers dedicated sales and technical support, a cornerstone of its customer relationships. This personalized service directly addresses customer needs concerning product quality, delivery timelines, and precise technical specifications, fostering trust and ensuring satisfaction.

This focused approach is crucial for a company like Antofagasta, which supplies essential commodities like copper. For instance, in 2023, the company's copper production reached 690,300 tonnes, highlighting the significant volume and importance of meeting client requirements accurately.

Antofagasta plc prioritizes transparent communication, regularly sharing updates on its mining operations and financial results. In 2024, the company continued its commitment to informing stakeholders about production volumes, safety records, and environmental performance, reinforcing its dedication to accountability.

This open approach extends to its sustainability efforts, with Antofagasta providing detailed reports on its progress in areas like water management and carbon reduction. Such consistent and accessible reporting builds significant trust with customers and investors alike, showcasing a reliable and responsible business model.

Collaborative Partnerships to Meet Needs

Antofagasta actively cultivates collaborative partnerships with its major clients. This involves working closely with them to grasp their changing needs, whether it's for particular ore grades or specialized delivery schedules.

These close relationships enable Antofagasta to develop customized solutions that precisely meet customer demands. For instance, in 2023, the company reported that its focus on customer collaboration contributed to securing long-term supply agreements, a key element in its revenue stability.

- Customer-Centric Product Development: Engaging with buyers to refine product specifications based on their operational requirements.

- Logistical Adaptability: Partnering to optimize delivery routes and schedules, ensuring timely and efficient supply.

- Strategic Alignment: Building trust and mutual understanding to foster long-term, mutually beneficial relationships.

- Market Responsiveness: Using direct customer feedback to anticipate and adapt to shifts in market demand for specific mineral products.

Emphasis on Trust and Reliability

Antofagasta builds trust through its consistent operational performance, reliably supplying its copper and gold products to global markets. In 2024, the company continued to demonstrate its commitment to dependable output, a crucial factor for its customers. This unwavering reliability, coupled with a strong adherence to ethical business standards, solidifies its reputation.

This focus on dependability positions Antofagasta as a preferred and dependable partner in the competitive global copper market. For instance, their operational efficiency in 2024 ensured a steady flow of materials, which is vital for downstream industries that rely on their output for their own production cycles.

- Consistent Operational Performance: Antofagasta's track record of meeting production targets fosters confidence.

- Reliable Supply Chain: Ensuring timely delivery of copper and gold is paramount for customer operations.

- Ethical Business Standards: Upholding integrity in all dealings builds long-term trust.

- Preferred Partner Status: Reliability makes Antofagasta a go-to supplier in the global market.

Antofagasta plc maintains strong customer relationships through a combination of long-term contracts, dedicated support, and transparent communication. Their approach focuses on understanding and meeting specific client needs, fostering loyalty and ensuring a stable demand for their commodity products.

The company's commitment to reliability is a key differentiator, with consistent operational performance underpinning its reputation as a trusted supplier. This focus on dependability, coupled with ethical practices, solidifies its position as a preferred partner in the global market.

| Key Relationship Aspect | Description | 2024 Relevance/Data Point |

| Long-Term Contracts | Secures predictable revenue and supply for clients. | Copper concentrate sales heavily reliant on these agreements. |

| Dedicated Support | Addresses specific product quality, delivery, and technical needs. | Crucial for meeting precise client specifications for essential commodities. |

| Transparent Communication | Regular updates on operations, financials, and sustainability. | Reinforces accountability and builds trust with stakeholders. |

| Collaborative Partnerships | Working with clients to adapt to evolving needs. | Contributes to securing long-term supply agreements and revenue stability. |

| Consistent Performance | Reliable supply of copper and gold products. | Ensures steady flow for downstream industries reliant on Antofagasta's output. |

Channels

Antofagasta PLC leverages its dedicated direct sales force and experienced marketing teams to cultivate relationships with major industrial clients, including smelters and refiners across the globe. This direct engagement is crucial for understanding specific customer needs and tailoring offerings.

These teams facilitate personalized service and direct negotiation of contracts, ensuring favorable terms and building long-term partnerships with Antofagasta's most significant accounts. In 2024, Antofagasta reported that approximately 85% of its copper sales were to direct customers, highlighting the importance of this channel.

Antofagasta leverages its own transport division alongside extensive global shipping and logistics networks to efficiently move copper concentrates and cathodes. This integrated approach ensures timely delivery from its Chilean mines to customers worldwide, a critical component of its business model.

In 2023, Antofagasta's total copper production reached 646,200 tonnes, underscoring the scale of its logistical operations. The company's ability to manage these vast movements reliably is key to maintaining its competitive edge in the global market.

Antofagasta plc actively engages in international commodity markets and exchanges for the sale of its primary product, copper, and associated by-products. This strategic channel is crucial for achieving global market exposure and facilitating price discovery for its output.

Through participation in these markets, Antofagasta can connect with a diverse and broader base of potential buyers, ensuring efficient transaction execution. For instance, in 2023, the company's copper sales were significantly influenced by global market dynamics, with benchmark LME prices playing a key role in their revenue generation.

Corporate Website and Investor Relations Portals

Antofagasta's corporate website and investor relations portals are crucial touchpoints for engaging stakeholders. These digital platforms offer a comprehensive suite of information, including detailed annual reports, timely production updates, and transparent sustainability disclosures. For instance, in 2024, Antofagasta plc continued to leverage these channels to communicate its operational performance and strategic initiatives. The investor relations section provides easy access to financial results, presentations, and regulatory filings, ensuring that investors have the data they need for informed decision-making.

These channels are vital for building trust and maintaining open communication with a broad audience, from individual shareholders to institutional investors and the general public. They facilitate understanding of the company's business model, operational efficiency, and commitment to environmental, social, and governance (ESG) principles. The accessibility of information, such as the latest sustainability reports detailing water management and community engagement efforts, reinforces Antofagasta's dedication to responsible mining practices.

- Information Dissemination: Key channel for sharing annual reports, production figures, and sustainability data.

- Stakeholder Engagement: Connects with customers, investors, and the public, fostering transparency.

- Accessibility of Data: Provides easy access to financial results, presentations, and regulatory filings.

- ESG Communication: Highlights commitment to environmental, social, and governance principles.

Industry Conferences and Trade Shows

Antofagasta actively participates in major industry conferences and trade shows globally, acting as a vital channel for its Business Model Canvas. These gatherings are instrumental in showcasing the company's mining capabilities and innovations to a broad audience.

These events provide a platform for direct engagement with potential customers, partners, and investors, fostering valuable relationships. For instance, participation in events like the Prospectors & Developers Association of Canada (PDAC) convention in 2024 allows Antofagasta to present its project pipeline and operational successes.

Furthermore, these forums are essential for staying informed about emerging market trends, technological advancements, and regulatory changes within the mining sector. This proactive engagement ensures Antofagasta remains competitive and adaptable.

- Showcasing Capabilities: Antofagasta uses industry events to highlight its operational strengths and project developments, such as advancements at its Los Pelambres mine.

- Customer Engagement: These events facilitate direct interaction with current and prospective clients, strengthening business relationships and exploring new market opportunities.

- Market Intelligence: Participation in trade shows and conferences provides critical insights into evolving market demands and competitive landscapes, informing strategic decisions.

- Investor Relations: Investor presentations at key financial forums offer a platform to communicate financial performance and future outlook, attracting investment.

Antofagasta's channels extend to its direct sales force, which engages major industrial clients like smelters and refiners, handling contract negotiations and personalized service. This direct approach accounted for approximately 85% of its copper sales in 2024.

The company also utilizes its own transport division and global logistics networks for efficient delivery of copper concentrates and cathodes, supporting its 2023 production of 646,200 tonnes of copper.

Participation in international commodity markets and exchanges provides global exposure and price discovery for copper and by-products. Benchmark LME prices significantly influenced Antofagasta's 2023 revenue.

Digital channels, including its corporate website and investor relations portals, are key for disseminating information such as annual reports and sustainability disclosures, fostering transparency with stakeholders.

Industry conferences and trade shows, like the PDAC convention in 2024, serve as vital platforms for showcasing capabilities, engaging with customers and investors, and gathering market intelligence.

| Channel | Description | Key Metrics/Data (2023/2024) |

|---|---|---|

| Direct Sales Force | Engages major industrial clients; handles contract negotiation. | 85% of copper sales in 2024 were to direct customers. |

| Logistics & Transport | Own division and global networks for product movement. | Supported 646,200 tonnes of copper production in 2023. |

| Commodity Markets/Exchanges | Global exposure and price discovery for copper. | Benchmark LME prices influenced 2023 revenue. |

| Digital Platforms (Website, IR) | Information dissemination and stakeholder engagement. | Continuous updates on performance and ESG initiatives in 2024. |

| Industry Conferences/Trade Shows | Showcasing capabilities, customer engagement, market intelligence. | Active participation in events like PDAC in 2024. |

Customer Segments

Global copper smelters and refineries represent a core customer segment for Antofagasta. These industrial entities acquire copper concentrates, the raw material produced by Antofagasta, for subsequent processing into high-purity refined copper. This makes them vital partners in the downstream copper value chain.

In 2024, the demand for refined copper from these sectors remained robust, driven by ongoing global infrastructure development and the accelerating transition to electric vehicles. For instance, Antofagasta's production figures, such as its 2024 copper output, directly feed into the supply needs of these large-scale industrial buyers.

Manufacturers of copper products, including electrical wire, pipes, sheets, and specialized components, are a core customer base. These businesses rely on Antofagasta plc for consistent, high-quality copper cathodes and concentrates to fuel their production lines.

In 2023, the global copper market saw prices fluctuate, but demand from manufacturing sectors remained robust. For instance, the electrical sector alone accounted for a significant portion of copper consumption, driven by infrastructure development and the growing electric vehicle market.

Antofagasta's copper is a critical material for industrial end-users spanning construction, automotive, electronics, and the burgeoning renewable energy sector. These industries depend on copper's inherent qualities, including its superior electrical conductivity, robust durability, and impressive resistance to corrosion, making it indispensable for various applications.

In 2024, global copper demand was projected to reach approximately 26.5 million metric tons, with industrial applications forming a significant portion of this figure. The automotive sector, for instance, utilizes copper extensively in wiring harnesses, radiators, and increasingly in electric vehicle components. Similarly, the construction industry relies on copper for plumbing, electrical wiring, and roofing, contributing to its longevity and efficiency.

Commodity Traders and Distributors

Commodity traders and distributors are crucial partners for Antofagasta, acting as intermediaries that purchase large volumes of its copper and other metals. These entities, like Glencore or Trafigura, are instrumental in ensuring Antofagasta's products reach a broad spectrum of industrial consumers worldwide, from smelters to manufacturers. Their expertise in logistics and market access allows Antofagasta to efficiently place its output on the global stage.

These trading houses provide essential market liquidity, absorbing Antofagasta's production and managing the complexities of international sales and distribution. For instance, in 2024, the global metals trading market continued to be dominated by a few key players who facilitate the movement of millions of tons of commodities annually. This segment of Antofagasta's customer base relies on efficient supply chains and competitive pricing to serve their own diverse client portfolios.

- Market Liquidity: Traders absorb significant production volumes, ensuring consistent off-take for Antofagasta.

- Global Reach: They connect Antofagasta's products to a wider array of industrial end-users across different continents.

- Logistical Expertise: Distributors manage the complex shipping, warehousing, and delivery processes.

- Risk Management: These intermediaries often hedge price and currency risks, providing a more stable revenue stream for producers.

Buyers of Molybdenum, Gold, and Silver

Antofagasta's by-products, molybdenum, gold, and silver, attract distinct customer segments. Molybdenum buyers are primarily specialized industries, particularly those in steel manufacturing, where its addition to alloys significantly enhances strength, hardness, and corrosion resistance. These industrial clients prioritize consistent quality and reliable supply chains for their production processes.

Gold and silver buyers typically include precious metal dealers, refiners, and the jewelry industry. These entities seek high purity levels for their products and often engage in forward contracts or spot market purchases based on global price fluctuations. The demand from these sectors is driven by investment, industrial applications (like electronics), and consumer goods.

- Industrial Steel Manufacturers: Require molybdenum for high-performance alloys used in automotive, aerospace, and construction.

- Precious Metal Dealers & Refiners: Purchase gold and silver for investment portfolios, industrial applications, and resale.

- Jewelry Industry: Utilizes gold and silver for crafting ornaments and luxury items, valuing purity and aesthetic appeal.

- Electronics Manufacturers: Employ silver in conductive components and gold for its corrosion resistance and conductivity in connectors and circuit boards.

Antofagasta plc serves a diverse range of customers, from global smelters and refineries that process its copper concentrates to manufacturers of essential copper products like wires and pipes. The company also engages with commodity traders, who act as vital intermediaries, ensuring its metals reach a broad international market.

In 2024, the demand for copper remained strong, particularly from sectors like electric vehicles and infrastructure development, directly benefiting Antofagasta's industrial clients. The company's by-products, such as molybdenum, also cater to specialized markets like steel manufacturing, highlighting the breadth of its customer base.

| Customer Segment | Primary Need | 2024 Market Relevance |

|---|---|---|

| Global Copper Smelters & Refineries | Copper Concentrates | Robust demand driven by EV and infrastructure growth. |

| Copper Product Manufacturers | Copper Cathodes/Concentrates | Consistent supply for electrical, automotive, and construction sectors. |

| Commodity Traders & Distributors | Large Volume Copper/Metals | Facilitate global reach and market liquidity. |

| Molybdenum Buyers | High-Purity Molybdenum | Essential for steel alloys in automotive and aerospace. |

| Gold & Silver Buyers | Precious Metals | Demand from investment, jewelry, and electronics industries. |

Cost Structure

Antofagasta's operating costs are significantly influenced by energy, labor, and consumables. Energy is crucial for powering mining equipment and processing plants, with electricity prices directly impacting operational expenses. In 2023, the company's cost of sales, which includes these items, was around $2,680 million.

Labor represents a substantial portion of these costs, reflecting the large workforce required for mining operations and administrative functions. The company also incurs significant expenses for consumables like explosives, reagents for mineral processing, and grinding media, all essential for extracting and refining copper and other metals.

Antofagasta Minerals dedicates substantial capital expenditure to both greenfield projects and expanding existing operations. For instance, the Centinela Second Concentrator project, a significant undertaking, represents a key investment in boosting future production capacity.

Beyond new developments, a considerable portion of capital is earmarked for sustaining capital expenditure. This is crucial for maintaining the operational efficiency and longevity of existing mines and processing facilities, ensuring continued output and minimizing downtime.

In 2023, Antofagasta Minerals reported capital expenditure of $1,928.8 million. This figure reflects ongoing investments in growth projects and essential maintenance to support its operational base.

Transportation and logistics are significant cost drivers for Antofagasta, encompassing the movement of ore, concentrates, and finished copper products like cathodes. These costs cover internal transit within Chile, often over long distances, and international shipping to global customers. For instance, in 2023, Antofagasta reported that its cost of sales, which includes transportation, was $1.64 per pound of copper.

Key components of these expenses include fuel for transport vehicles and vessels, freight charges for rail and ocean shipping, and various port fees incurred at loading and unloading points. These elements directly impact the final cost of delivering Antofagasta's products to market, influencing overall profitability and competitiveness.

Environmental Compliance and Social Programs

Antofagasta PLC faces significant expenses tied to environmental stewardship and social responsibility. These include costs for adhering to stringent environmental regulations, undertaking site remediation, managing water resources efficiently, and implementing community development initiatives. For instance, in 2023, the company reported significant investments in sustainability projects aimed at reducing its environmental footprint and fostering positive community relations.

These expenditures are crucial for maintaining Antofagasta's social license to operate and ensuring long-term business sustainability. The company's commitment to responsible mining practices translates into tangible financial outlays. For 2024, projections indicate continued investment in these areas, building on the progress made in previous years.

- Environmental Compliance: Costs associated with meeting regulatory standards for air and water quality, waste management, and biodiversity protection.

- Remediation Efforts: Funding for the rehabilitation of former mining sites to their natural or a safe state.

- Water Management: Investments in technologies and strategies for efficient water use and conservation, particularly in water-scarce regions.

- Social Programs: Expenses related to community engagement, local development projects, education, and health initiatives in areas where Antofagasta operates.

Exploration and Development Costs

Antofagasta's cost structure heavily features significant investments in exploration and development. These are essential for discovering new mineral deposits and preparing them for extraction, directly impacting future production capacity and profitability.

In 2023, Antofagasta plc reported exploration and evaluation expenditure of $137.3 million. This substantial figure underscores the company's commitment to securing its long-term resource pipeline. For instance, ongoing exploration at the Rajo Inca project in Chile is a prime example of this investment in future growth.

- Exploration Investment: Funds allocated to geological surveys, drilling, and resource estimation to identify viable mineral reserves.

- Development Expenditure: Costs incurred to bring identified deposits into commercial production, including mine planning, infrastructure, and initial capital outlays.

- Long-Term Sustainability: These costs are critical for replacing depleted reserves and ensuring the continued operation and expansion of Antofagasta's mining portfolio.

- 2023 Performance: Exploration and evaluation costs amounted to $137.3 million, reflecting a strategic focus on future resource acquisition and development.

Antofagasta's cost structure is dominated by operational expenses like energy, labor, and consumables, which totaled approximately $2,680 million in cost of sales for 2023. Significant capital expenditure, amounting to $1,928.8 million in 2023, is allocated to both growth projects, such as the Centinela Second Concentrator, and sustaining capital to maintain existing operations. Furthermore, exploration and development costs were $137.3 million in 2023, highlighting investment in future resource acquisition.

| Cost Category | 2023 Figures (Approx.) | Key Components |

|---|---|---|

| Cost of Sales | $2,680 million | Energy, Labor, Consumables, Transportation |

| Capital Expenditure | $1,928.8 million | Growth Projects (e.g., Centinela), Sustaining Capital |

| Exploration & Development | $137.3 million | Geological surveys, drilling, mine planning |

Revenue Streams

Antofagasta's primary revenue engine is the sale of copper concentrates. These are essentially copper ores that have undergone initial processing, making them ready for further refinement by smelters and refineries globally. This segment consistently represents the most substantial contributor to the company's overall income.

In 2024, Antofagasta's copper production was strong, with sales volumes reflecting this output. The average realized copper price in 2024 played a crucial role in determining the revenue generated from these concentrate sales. For instance, if the average market price for copper was around $9,000 per tonne, this would directly translate into significant revenue figures for the company.

Antofagasta plc's revenue model heavily relies on the direct sale of copper cathodes. These highly refined copper products are sold to manufacturers and industrial consumers who require high-purity copper for their production processes. The premium pricing reflects the value added through the refining stage, making this a significant revenue driver.

The sale of molybdenum, a valuable by-product of copper extraction, represents a significant revenue stream for Antofagasta. This element is recovered during the processing of copper ore and finds its way into various industrial applications, most notably in the creation of steel alloys. Its contribution to the company's overall financial performance is substantial, adding a layer of diversification to their income.

Sales of Gold and Silver By-products

Antofagasta's revenue streams extend beyond copper to include the sale of gold and silver, recovered as valuable by-products. While copper remains the primary focus, these precious metals contribute significantly to the company's overall financial performance.

In 2024, Antofagasta reported substantial revenue from these by-products, underscoring their importance. For instance, the company's financial statements often highlight the contribution of gold and silver sales, which, though smaller in volume than copper, command higher prices per unit.

- By-product Contribution: Gold and silver sales provide a crucial additional income stream, enhancing profitability.

- Value Enhancement: Recovering these precious metals optimizes resource utilization and boosts overall revenue generation.

- 2024 Performance: Antofagasta's 2024 results demonstrated the financial impact of these by-product sales, contributing to robust earnings.

Revenue from Transport Services

Antofagasta's transport division plays a dual role, not only facilitating its core mining activities but also actively generating external revenue. This strategic approach allows the company to monetize its extensive logistics infrastructure.

The company leverages its rail and port assets to offer transport services to third-party clients across various sectors, thereby diversifying its income streams beyond its primary mining output. This commercialization of transport capacity is a key aspect of its business model.

- Diversified Income: Revenue from third-party transport services contributes to a more stable and varied financial performance for Antofagasta.

- Infrastructure Utilization: By offering services to external customers, Antofagasta maximizes the operational efficiency and return on investment of its transport infrastructure.

- Market Reach: This segment allows Antofagasta to tap into broader market demands for logistics solutions, extending its economic influence.

The sale of copper concentrates forms the bedrock of Antofagasta's revenue. These intermediate products are sold to global smelters and refineries for further processing. In 2024, Antofagasta's copper sales volumes were robust, directly influenced by the average realized copper price, which hovered around $9,000 per tonne, significantly impacting overall income.

Antofagasta also generates substantial revenue from selling refined copper cathodes. These high-purity products cater to industrial consumers, with premium pricing reflecting the added value from the refining process. This segment is a crucial income driver for the company.

The company benefits from selling molybdenum, a valuable by-product of copper extraction, used in steel alloys. This adds diversification to its revenue. In 2024, sales of by-products like gold and silver also contributed significantly, with gold and silver commanding higher prices per unit, bolstering overall earnings.

| Revenue Stream | Primary Products/Services | Key Drivers | 2024 Impact |

| Copper Concentrates | Copper ores (initial processing) | Copper prices, production volumes | Largest contributor to revenue; prices around $9,000/tonne in 2024 |

| Copper Cathodes | Refined copper | Purity, industrial demand | Significant revenue driver due to value addition |

| By-products | Molybdenum, gold, silver | Prices of precious metals and molybdenum, recovery efficiency | Diversifies income, enhances profitability; strong performance in 2024 |

| Transport Services | Logistics, rail, port services | Infrastructure utilization, third-party demand | Generates external revenue, optimizes asset use |

Business Model Canvas Data Sources

The Antofagasta Business Model Canvas is built upon a foundation of comprehensive market research, internal operational data, and financial performance metrics. These diverse sources ensure a holistic and accurate representation of the company's strategic framework.