Antofagasta Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Antofagasta Bundle

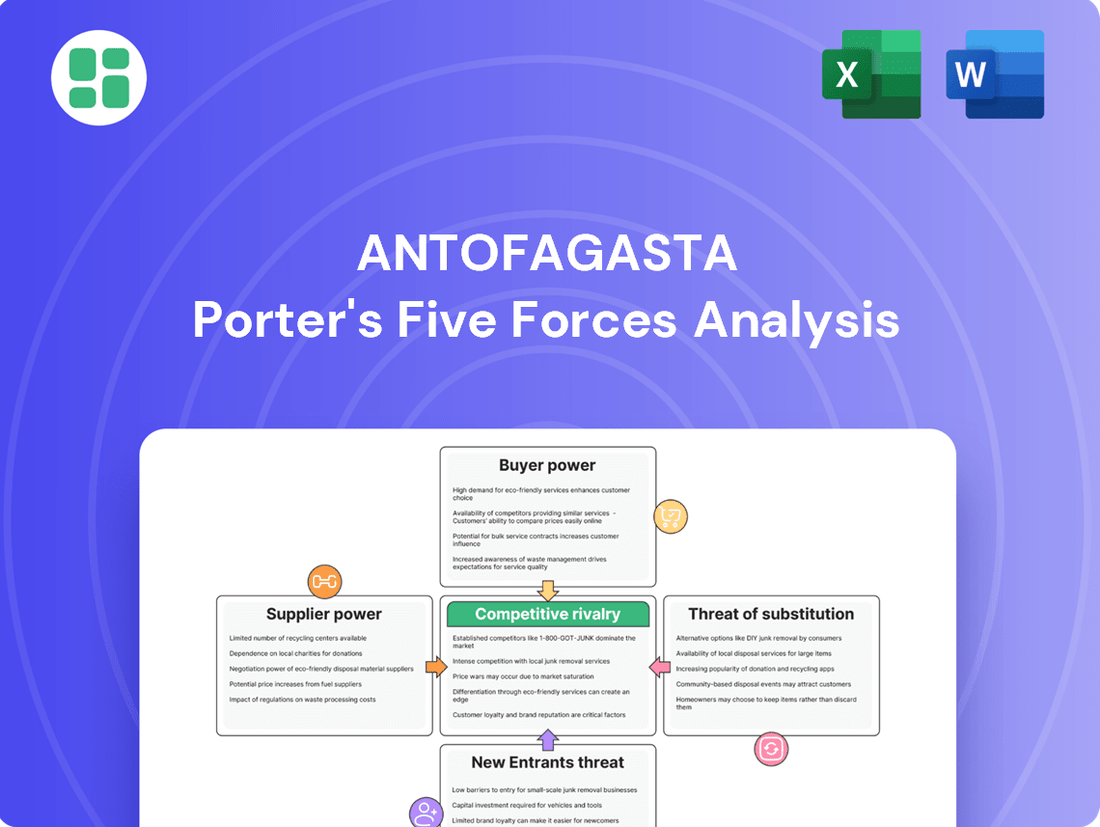

Antofagasta's competitive landscape is shaped by moderate buyer power and intense rivalry among existing players. The threat of substitutes is relatively low, given the specialized nature of its mining operations, but the bargaining power of suppliers, particularly for specialized equipment and raw materials, can be significant.

The full analysis reveals the strength and intensity of each market force affecting Antofagasta, complete with visuals and summaries for fast, clear interpretation.

Suppliers Bargaining Power

Suppliers of highly specialized mining equipment and advanced technologies, like autonomous haul trucks and AI-driven exploration tools, wield considerable power. The immense capital investment required for these systems, coupled with a limited number of providers, means mining companies face high switching costs. For instance, Caterpillar's advanced mining solutions are crucial for efficiency, and integrating them involves significant upfront expense and training, making a change difficult.

Energy, especially electricity and diesel, represents a significant expense for copper mining operations like Antofagasta's. The cost and dependable supply of power from Chilean and global sources directly influence their production expenses.

In 2024, Antofagasta announced its commitment to sourcing 100% renewable electricity, a strategic move that helps stabilize energy costs and reduce environmental impact. However, this transition makes the company reliant on the specific agreements and supply capabilities of renewable energy providers.

Antofagasta's reliance on a highly skilled workforce, including geologists and mining engineers, significantly impacts its operational efficiency. The availability of such specialized talent, particularly in remote mining locations, can be limited, giving these professionals considerable leverage. For instance, in 2024, the global shortage of experienced mining engineers was a recurring theme in industry reports, potentially driving up labor costs for companies like Antofagasta.

Water Resources

In arid regions like Chile, water is a vital input for mining, giving suppliers significant leverage. Antofagasta's operations are heavily dependent on water, particularly for its copper production. In 2024, the company reported that 58% of its water withdrawals came from seawater, indicating a strategic move to mitigate reliance on scarce freshwater sources and manage supplier power.

- Water Scarcity: Arid environments amplify the bargaining power of water suppliers and regulatory bodies controlling water rights.

- Supplier Dependence: Antofagasta's mining processes require substantial water volumes, making reliable supply crucial.

- Seawater Strategy: The 58% reliance on seawater in 2024 underscores Antofagasta's efforts to diversify its water sources and reduce vulnerability to freshwater suppliers.

- Cost Implications: Increased costs for water, whether through direct supply or desalination, can impact Antofagasta's profitability.

Logistics and Infrastructure Services

The bargaining power of logistics and infrastructure service providers is a significant factor for Antofagasta. Moving copper concentrates and cathodes to ports, and supplying remote mine sites, requires specialized transport and port services. If these providers have limited competition or alternative routes are scarce, their ability to influence pricing and terms increases.

Antofagasta's strategic investments in its own transport infrastructure, such as rail and port facilities, are designed to directly counter this external bargaining power. For example, in 2023, the company continued to develop its rail network, aiming to improve efficiency and reduce reliance on third-party logistics providers for its copper output.

- Limited Alternatives: The specialized nature of transporting bulk commodities like copper concentrates to specific ports means few providers can offer the required services, granting them leverage.

- Infrastructure Dependency: Antofagasta's operations are inherently tied to the availability and cost of port facilities and specialized shipping, areas where suppliers can exert influence.

- Mitigation Strategies: By investing in its own logistics, including rail and port upgrades, Antofagasta seeks to reduce the bargaining power of external infrastructure service providers.

Suppliers of critical mining inputs, from specialized machinery to essential utilities like energy and water, hold significant sway over Antofagasta's operational costs and efficiency. The limited availability of certain technologies and the geographical concentration of resources, such as water in arid regions, amplify this supplier power. For example, in 2024, Antofagasta's commitment to 100% renewable electricity, while strategic for cost stabilization, also creates a dependency on renewable energy providers.

The bargaining power of suppliers is further influenced by the capital intensity of the mining sector and the specialized nature of many inputs. Companies like Antofagasta must navigate these dynamics to ensure reliable and cost-effective operations. For instance, the global shortage of experienced mining engineers in 2024 highlighted the leverage held by skilled labor suppliers.

Antofagasta actively works to mitigate supplier power through strategic investments, such as developing its own transport infrastructure and diversifying water sources. By increasing its reliance on seawater, which accounted for 58% of its water withdrawals in 2024, the company aims to reduce its vulnerability to freshwater suppliers in water-scarce regions.

| Supplier Category | Key Input | Antofagasta's Dependency | Mitigation Strategy | 2024 Data/Trend |

|---|---|---|---|---|

| Equipment Manufacturers | Autonomous haul trucks, AI tools | High capital investment, limited providers | Long-term partnerships, internal R&D | Continued adoption of advanced tech |

| Energy Providers | Electricity, Diesel | Significant operational expense | Sourcing 100% renewable electricity | Transition to renewable energy sources |

| Labor Market | Skilled engineers, geologists | Crucial for operational efficiency | Talent development programs, competitive compensation | Global shortage of experienced mining engineers |

| Water Suppliers | Freshwater, Seawater | Vital for copper production | Increased seawater usage, desalination investments | 58% of water withdrawals from seawater |

| Logistics & Infrastructure | Transport, Port services | Essential for commodity movement | Investment in own rail and port facilities | Continued development of rail network |

What is included in the product

Explores market dynamics that deter new entrants and protect incumbents like Antofagasta, while also evaluating buyer and supplier power within the copper mining sector.

Effortlessly identify and mitigate competitive threats with a visual breakdown of supplier power, buyer bargaining, and new entrant risks.

Customers Bargaining Power

The commodity nature of copper significantly bolsters customer bargaining power. Because copper is largely standardized, buyers can easily substitute one supplier for another, especially when purchasing in bulk. This interchangeability means that price becomes a primary driver for purchasing decisions.

Antofagasta, like other copper producers, faces this reality. In 2023, global copper prices fluctuated, with the LME three-month copper price averaging around $8,500 per tonne. This price sensitivity highlights the need for Antofagasta to maintain cost leadership and ensure consistent, dependable supply to retain its customer base.

Antofagasta's customer base is spread across sectors like construction, electronics, and automotive, offering a degree of diversification. However, this strength is tempered by the significant influence of large industrial buyers and major regional distributors, especially in key markets like China, which drives a substantial portion of global copper consumption.

In 2024, China's demand for copper remained a critical factor, with the country accounting for approximately 50% of global refined copper consumption. This concentration means that major Chinese industrial consumers, by virtue of their sheer purchasing volume, possess considerable bargaining power, impacting Antofagasta's pricing flexibility.

Customers in industries that rely heavily on copper, such as automotive and construction, often exhibit high price sensitivity. Copper can represent a substantial portion of their total production expenses, meaning even minor price shifts can significantly affect their profit margins.

This sensitivity compels these end-users to actively seek lower prices or negotiate for more favorable long-term supply agreements. For instance, in 2024, the average price of copper experienced volatility, with significant impacts on manufacturers of electrical components and plumbing systems, who then exerted pressure on suppliers like Antofagasta for price concessions.

Global Supply-Demand Dynamics

The global balance between copper supply and demand significantly shapes customer bargaining power. When there's an oversupply, buyers find more choices and can negotiate better terms. Conversely, a supply shortage, such as the one anticipated for copper, tends to strengthen the position of producers.

Projections indicate that the copper market will likely experience supply deficits in the coming years. For instance, the International Copper Study Group (ICSG) reported a global refined copper balance deficit of 163,000 tonnes in 2023. This tightening market can shift leverage towards producers like Antofagasta.

- Supply Deficits: Anticipated shortages in copper supply, like the 163,000-tonne deficit in 2023 according to the ICSG, reduce customer options.

- Increased Producer Leverage: In deficit markets, producers are less pressured to offer discounts, enhancing their pricing power.

- Demand Growth: Continued strong demand from sectors like electric vehicles and renewable energy further tightens the supply picture, bolstering producer influence.

Potential for Long-Term Contracts and Offtake Agreements

Large customers, particularly in the automotive and electronics sectors, often pursue long-term contracts and offtake agreements to guarantee a steady supply of copper. For instance, in 2024, major electric vehicle manufacturers continued to explore direct sourcing and long-term supply deals with leading copper producers like Antofagasta to hedge against price volatility.

These agreements offer Antofagasta revenue certainty, which is a significant benefit, especially during periods of market uncertainty. However, they also come with the inherent risk of fixed pricing. This means Antofagasta might not fully benefit from upward price swings in the copper market, as seen during periods of high demand in early 2024 when spot prices surged.

- Securing Supply: Large buyers aim for long-term contracts to ensure consistent copper availability.

- Revenue Certainty: Antofagasta gains predictable income streams from these agreements.

- Price Limitations: Fixed prices in contracts can cap potential profits during market booms.

- Market Dynamics: The 2024 copper market saw significant price fluctuations, highlighting the trade-offs in long-term agreements.

The commodity nature of copper means customers have significant power, as they can easily switch suppliers if prices are not competitive. This is especially true for large industrial buyers who purchase in bulk. Antofagasta's pricing and supply reliability are key to retaining these customers.

In 2024, the global copper market saw continued strong demand from sectors like electric vehicles and renewable energy, which can tighten supply. However, large consumers, particularly in China, which accounted for roughly 50% of global refined copper consumption in 2024, wield considerable influence due to their purchasing volume.

Customers in industries like automotive and construction are highly price-sensitive, as copper represents a significant portion of their costs. This sensitivity drives them to negotiate for better terms, as seen when manufacturers of electrical components pressured suppliers for price concessions in early 2024 amidst price volatility.

While anticipated copper supply deficits, like the 163,000-tonne deficit reported for 2023 by the ICSG, tend to strengthen producer leverage, large buyers often secure supply through long-term contracts. These agreements provide Antofagasta with revenue certainty but can limit profit potential during periods of high spot prices, a scenario observed in early 2024.

| Factor | Impact on Customer Bargaining Power | Antofagasta's Position |

| Commodity Nature | High (easy substitution) | Requires competitive pricing and reliability |

| Concentrated Demand (China) | High (large volume buyers) | Vulnerable to price pressure from major Chinese consumers |

| Price Sensitivity (Auto/Construction) | High (significant cost component) | Needs to manage costs to offer competitive prices |

| Supply Deficits (e.g., 2023 ICSG deficit: 163,000 tonnes) | Low (reduced options) | Increases negotiation leverage and pricing power |

| Long-Term Contracts | Low (secures supply, fixed price) | Provides revenue certainty but caps upside during price surges |

Full Version Awaits

Antofagasta Porter's Five Forces Analysis

This preview showcases the complete Antofagasta Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the mining industry. You're viewing the actual, professionally crafted document that will be instantly available for download upon purchase, ensuring you receive precisely the insights you need for strategic decision-making.

Rivalry Among Competitors

The copper mining sector is dominated by a handful of major global players, such as BHP, Codelco, and Freeport-McMoRan, with Antofagasta Minerals consistently ranking among the top ten copper producers worldwide. This concentration of significant entities fuels intense competition for market dominance, particularly in prime copper-producing territories like Chile.

The copper mining sector is characterized by substantial fixed costs and a high degree of capital intensity. Companies invest heavily in exploration, mine development, and the construction of processing facilities, often running into billions of dollars. For instance, Antofagasta's own Los Pelambres mine required significant upfront investment for its expansion projects.

These high fixed costs create a strong incentive for producers to maintain high operational output. Maximizing production helps to spread these substantial costs over a larger volume of output, thereby lowering the per-unit cost. This can lead to aggressive competition, especially when market demand softens, as companies seek to keep their mines and processing plants running efficiently.

During periods of lower copper prices, this pressure to maintain utilization can translate into price competition. Mining firms may be willing to accept lower margins to keep production levels up and avoid the economic consequences of idled assets. This dynamic intensifies the rivalry among established players in the industry.

Given that copper is largely a commodity, Antofagasta's competitive rivalry is intense, with differentiation opportunities being slim. This means that competition often boils down to price, efficiency in production, and the dependability of supply.

This dynamic necessitates that Antofagasta consistently focuses on maintaining a low-cost production structure and achieving operational excellence to stay competitive. For instance, in 2023, the average realized copper price for Antofagasta was $3.86 per pound, highlighting the importance of cost control in a market where price is a primary driver.

Industry Growth Rate and Supply Constraints

Global copper demand is set for robust expansion, driven by the electrification of transport and the build-out of renewable energy infrastructure. Projections indicate a substantial increase in demand over the coming years, with some estimates suggesting a near doubling by 2030 compared to 2020 levels.

However, mine supply growth is facing significant headwinds, leading to a potential deficit in the market. Factors contributing to this include the depletion of existing high-grade mines, increasing extraction costs, and the long lead times required for developing new projects, often exceeding a decade.

- Projected Demand Growth: Global copper demand is anticipated to rise significantly, fueled by the energy transition.

- Supply Constraints: Mine supply expansion is hampered by declining ore grades, higher operational costs, and lengthy project development cycles.

- Market Imbalance: The gap between projected demand and constrained supply could lead to a structural deficit in the copper market.

- Impact on Rivalry: This tight supply environment may lessen price-based competition among producers, potentially benefiting companies like Antofagasta through improved pricing power.

Regulatory and Geopolitical Factors

Changes in mining regulations significantly shape the competitive rivalry. For instance, Chile's implementation of a new mining royalty regime in 2024 directly affects the profitability and operational costs of companies like Antofagasta. This regulatory shift can alter the cost structures and investment decisions of all players in the Chilean copper market, intensifying competition for those less able to absorb increased fiscal burdens.

Geopolitical stability in key mining nations also plays a crucial role. Nations with consistent political environments and predictable legal frameworks offer a more secure operating base. Companies with a presence in such stable regions, such as Antofagasta's operations in Chile, can leverage this advantage to maintain consistent production and investment, potentially outmaneuvering competitors facing greater political or social risks.

- Chile's 2024 Mining Royalty: This new regime introduces variable rates based on copper prices, impacting operational margins.

- Geopolitical Stability Advantage: Antofagasta benefits from operating in Chile, a region generally characterized by a stable regulatory and political climate compared to some other mining jurisdictions.

- Impact on Investment: Regulatory uncertainty or geopolitical instability can deter new investment and expansion, thereby influencing the competitive intensity among existing players.

Competitive rivalry within the copper mining sector is fierce, driven by a concentrated market structure and high capital intensity. Antofagasta Minerals, as a top global producer, faces significant competition from giants like BHP and Codelco, particularly in resource-rich areas such as Chile. The commodity nature of copper means that competition often centers on production efficiency and cost control, as differentiation is limited.

The pressure to maintain high output due to substantial fixed costs can lead to price-based competition, especially during downturns. Antofagasta's focus on operational excellence and cost management, evidenced by its 2023 average realized copper price of $3.86 per pound, is crucial for navigating this environment. Regulatory changes, like Chile's new mining royalty regime implemented in 2024, further influence cost structures and competitive dynamics.

Looking ahead, robust demand growth from the energy transition is projected, but constrained mine supply, due to depleted reserves and long project lead times, could shift the competitive landscape. This potential market imbalance might reduce price competition and enhance pricing power for efficient producers like Antofagasta.

| Metric | 2023 Value | 2024 Outlook (Antofagasta) | Key Competitors |

|---|---|---|---|

| Realized Copper Price (per pound) | $3.86 | Projected to be influenced by market conditions and royalty impacts | Varies, influenced by global benchmarks |

| Production Volume (kt) | ~780 kt | Targeting 330-340 kt for 2024 (excluding Zaldívar) | BHP: ~1,700 kt; Codelco: ~1,400 kt (2023 estimates) |

| Chile Mining Royalty Impact | N/A (pre-implementation) | New regime introduces variable rates based on copper prices | All Chilean copper producers affected |

SSubstitutes Threaten

Aluminum stands as a primary substitute for copper, particularly in sectors where weight and cost are paramount. For instance, in high-voltage transmission cables, aluminum's lighter density and lower price point make it a compelling alternative, even with its reduced conductivity compared to copper. This trend is also evident in the automotive industry, with electric vehicles increasingly utilizing aluminum components to manage weight and production costs.

While aluminum's conductivity is roughly 61% that of copper, its abundance and cost-effectiveness often outweigh this performance gap in specific applications. The global aluminum market was valued at approximately $247.7 billion in 2023 and is projected to grow, indicating its increasing relevance as a substitute material. This dynamic puts pressure on copper producers like Antofagasta, as industries seek cost-efficient solutions.

The recycling and scrap copper market presents a substantial threat of substitution for Antofagasta. Improved recycling technologies and a growing emphasis on circular economy principles mean that a larger volume of copper can be sourced from scrap, directly impacting the demand for newly mined copper.

In 2024, the global copper recycling rate is estimated to be around 35%, with significant potential for growth. As scrap processing becomes more efficient and cost-effective, it offers a more sustainable and often cheaper alternative to primary copper, thereby pressuring the market share of virgin material.

Technological advancements in material science pose a significant threat of substitution for copper. Ongoing research is yielding new materials like advanced alloys and carbon-based composites that offer comparable or even superior performance in certain applications. For instance, while copper remains dominant in electrical wiring, ongoing developments in graphene conductivity could eventually offer a viable alternative, impacting demand.

Miniaturization and Thrifting

Technological progress is a significant force, driving miniaturization and thrifting in copper's use. This means that for many applications, less copper is needed to achieve the same or even better performance. For instance, advancements in electronics have led to smaller devices that consume less raw material overall, including copper.

This trend directly impacts demand. Even if the number of electronic devices produced grows, the reduced copper content per device can temper overall copper consumption. In 2023, the automotive sector, a major copper consumer, saw continued innovation in electric vehicles (EVs) and lightweighting, both of which can influence copper intensity per vehicle.

- Miniaturization in Electronics: Smaller, more powerful devices require less copper wiring and components.

- Thrifting in Automotive: Innovations like advanced wiring harnesses and more efficient motor designs reduce copper usage per vehicle.

- Impact on Demand: Reduced copper per unit of output can offset growth in end-product manufacturing.

- 2023 Data Context: The automotive industry's focus on EVs and efficiency highlights the ongoing trend of optimizing material usage.

Cost-Performance Trade-offs

The threat of substitutes for Antofagasta's copper products hinges significantly on the cost-performance trade-offs available to its customers. For many essential applications, particularly those requiring superior conductivity, robust durability, and exceptional corrosion resistance, copper continues to be the material of choice. This inherent advantage provides a degree of insulation against substitution.

However, this dynamic can shift. If copper prices, which are subject to global market fluctuations, experience sustained and substantial increases, the economic rationale for using substitutes strengthens. For instance, aluminum, while generally less conductive and durable, can become a more attractive alternative when copper prices surge. In 2024, copper prices have shown volatility, with LME three-month copper trading in a range that has prompted some industries to re-evaluate material sourcing.

- Copper's established performance in high-demand sectors like electrical transmission and automotive manufacturing remains a key differentiator.

- The cost-effectiveness of substitutes like aluminum is directly influenced by the prevailing price of copper.

- Technological advancements that improve the performance or reduce the cost of substitute materials can escalate the threat to copper.

- Market analysis in mid-2024 indicates that while copper demand remains strong, cost pressures are leading to increased consideration of alternative materials in less critical applications.

The threat of substitutes for Antofagasta's copper is multifaceted, driven by material alternatives, technological advancements, and evolving cost dynamics. Aluminum, while less conductive, offers a cost and weight advantage in applications like electrical cables and automotive components, with the global aluminum market valued at approximately $247.7 billion in 2023.

Furthermore, the increasing efficiency and cost-effectiveness of copper recycling, with a global recycling rate around 35% in 2024, presents a significant alternative to primary copper. New materials and ongoing miniaturization in electronics and automotive sectors also reduce copper intensity per unit, impacting overall demand even as production grows.

| Substitute Material | Key Advantages | Considerations for Copper Users | 2023/2024 Context |

|---|---|---|---|

| Aluminum | Lower cost, lighter weight | Lower conductivity, durability concerns | Global market valued at ~$247.7 billion (2023) |

| Recycled Copper | Cost-effectiveness, sustainability | Quality control, availability | Global recycling rate ~35% (2024), growing potential |

| Advanced Materials (e.g., composites) | Specific performance enhancements (strength, weight) | Higher initial cost, unproven in some large-scale applications | Ongoing research into graphene conductivity |

Entrants Threaten

The sheer scale of capital required to establish a new copper mine presents a formidable barrier to entry. We're talking about investments that can easily run into the billions of dollars, covering everything from initial exploration and land acquisition to the complex development of extraction and processing infrastructure. For instance, the development of a large-scale copper project can cost upwards of $5 billion, as seen with recent major mine constructions.

This massive financial hurdle significantly limits the pool of potential new entrants. Only companies with substantial financial reserves or access to significant debt financing can even consider entering the copper mining sector. This exclusivity inherently protects established players like Antofagasta from a flood of new competition, as the upfront investment is simply too high for most.

The threat of new entrants in the mining sector, particularly for companies like Antofagasta, is significantly dampened by lengthy and complex permitting processes. Obtaining the necessary regulatory approvals and environmental permits for mining operations is a protracted and intricate process, especially in countries with stringent environmental standards like Chile. For instance, a new mine development project can easily face a permitting timeline extending several years, adding substantial lead time and inherent risk for any potential new player entering the market.

The threat of new entrants into the copper mining sector, particularly for companies like Antofagasta, is significantly mitigated by the substantial barrier of accessing high-quality reserves. Most of the easily discoverable and high-grade copper deposits are already under the control of established major mining corporations. This means newcomers must invest heavily in exploration, often venturing into more remote or geologically challenging terrains to find economically viable new deposits.

Technological and Operational Expertise

The threat of new entrants in the copper mining sector, particularly for large-scale operations like those Antofagasta operates, is significantly mitigated by the immense technological and operational expertise required. Modern copper mining demands deep knowledge in geology for resource identification, metallurgy for efficient ore processing, and complex engineering for mine design and infrastructure. For instance, Antofagasta Minerals, in 2023, invested heavily in advanced technologies for water management and energy efficiency across its Chilean operations, showcasing the sophisticated operational capabilities necessary.

Building this level of specialized skill and experience from the ground up presents a substantial hurdle for potential new players. The learning curve is steep, and the capital investment needed to acquire and develop this expertise is considerable. This high barrier means that only well-established entities or those with significant backing can realistically contend with existing, experienced operators.

- Geological Surveying and Resource Estimation: Requires advanced geophysical and geochemical analysis techniques.

- Metallurgical Processing: Involves complex hydrometallurgical and pyrometallurgical processes to extract copper efficiently.

- Mine Engineering and Design: Demands expertise in open-pit or underground mining methods, ventilation, and ground support.

- Large-Scale Project Management: Essential for overseeing multi-billion dollar construction and operational phases.

Existing Player Economies of Scale and Experience

Established players like Antofagasta Minerals leverage substantial economies of scale, honed operational efficiencies, and extensive existing infrastructure. This deep-rooted experience and established network create significant barriers for newcomers aiming to match competitive cost structures or secure market access swiftly.

For instance, Antofagasta's operational expertise, developed over years of mining and processing, allows for optimized resource extraction and lower per-unit production costs. New entrants would struggle to replicate this cost advantage without a similar scale of operations and accumulated know-how.

- Economies of Scale: Antofagasta's large-scale operations in copper and other metals allow for significant cost reductions per unit of output, a hurdle for smaller new entrants.

- Operational Experience: Decades of experience have refined Antofagasta's mining techniques, supply chain management, and risk mitigation strategies, creating a competitive edge.

- Infrastructure and Relationships: Existing transportation networks, processing facilities, and established long-term contracts with suppliers and customers provide Antofagasta with a distinct advantage in market entry and operational continuity.

The threat of new entrants into the copper mining industry is significantly low due to the immense capital requirements, often exceeding billions of dollars for a single large-scale mine. This financial barrier, coupled with the lengthy and complex permitting processes that can take years, deters most potential competitors. Furthermore, established players like Antofagasta benefit from economies of scale, operational expertise, and existing infrastructure, making it difficult for newcomers to compete on cost or efficiency.

Access to high-quality, economically viable copper reserves is another major deterrent. Most prime deposits are already controlled by established companies, forcing new entrants to invest heavily in exploration in more challenging terrains. The sophisticated technological and operational knowledge required, from geological surveying to metallurgical processing, also presents a steep learning curve and substantial investment for any new player.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Development of a large copper project can cost upwards of $5 billion. | Limits the pool of potential entrants to those with substantial financial reserves. |

| Permitting Process | Regulatory approvals and environmental permits can extend timelines by several years. | Adds significant lead time and inherent risk for new players. |

| Access to Reserves | High-quality deposits are largely controlled by established corporations. | Requires newcomers to invest heavily in exploration in remote or challenging areas. |

| Technological & Operational Expertise | Requires deep knowledge in geology, metallurgy, and engineering. | Steep learning curve and considerable investment needed to acquire expertise. |

| Economies of Scale | Established players have optimized resource extraction and lower per-unit production costs. | New entrants struggle to replicate cost advantages without similar scale and know-how. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Antofagasta plc is built upon a robust foundation of data, including the company's annual reports, investor presentations, and official filings with regulatory bodies like the London Stock Exchange. We also incorporate industry-specific reports from reputable mining research firms and macroeconomic data from sources like the World Bank to provide a comprehensive view of the competitive landscape.