Antofagasta Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Antofagasta Bundle

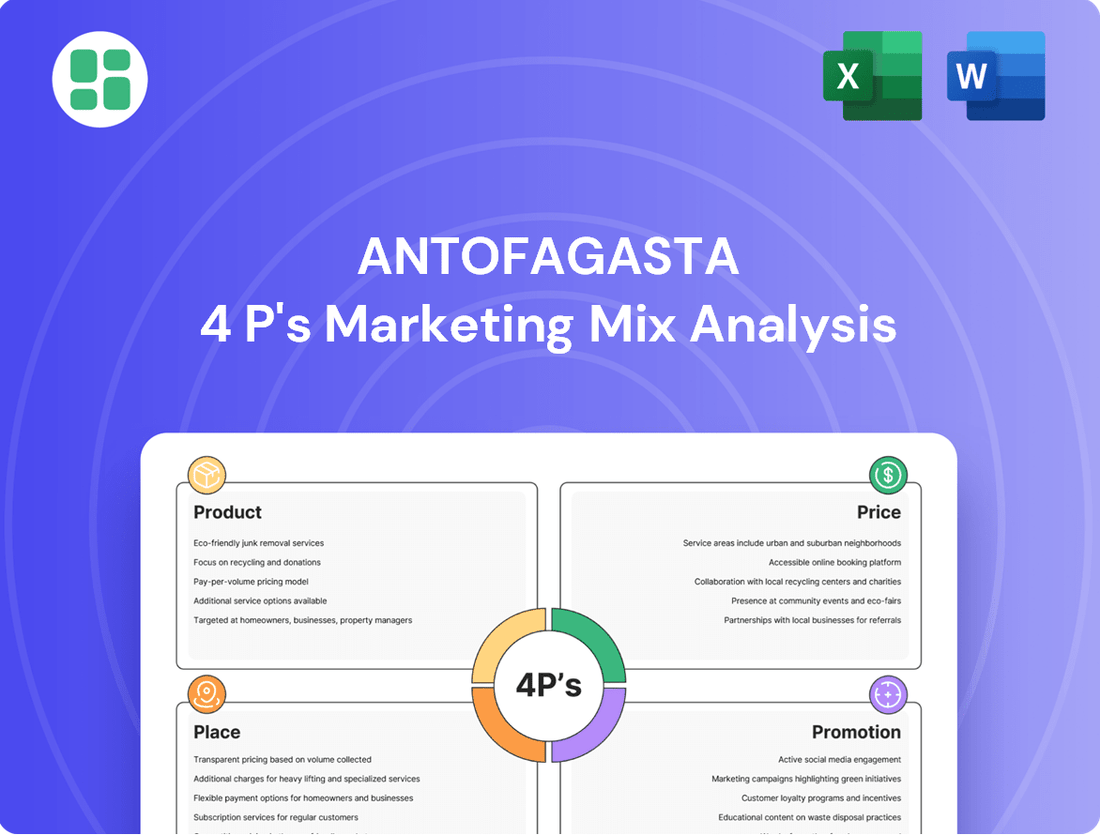

Antofagasta's marketing prowess is built on a foundation of strategic Product, Price, Place, and Promotion. Delve into how their product offerings meet market demands, their pricing reflects value, and their distribution and promotional efforts create a powerful presence.

Unlock the full story behind Antofagasta's marketing success. Our comprehensive 4Ps analysis provides actionable insights into their product, price, place, and promotion strategies, empowering you to learn from their approach.

Ready to understand what makes Antofagasta a market leader? Get instant access to our detailed 4Ps Marketing Mix Analysis, offering a complete breakdown of their product, pricing, distribution, and promotional tactics in an editable format.

Product

Antofagasta's core product is copper, primarily offered as high-grade concentrates and refined cathodes. These are essential building blocks for industries like construction, automotive, and electronics, driving global economic activity.

In 2023, Antofagasta produced 664,000 tonnes of copper, a slight decrease from 2022's 660,000 tonnes, demonstrating their consistent output of this vital commodity. The company aims to be a reliable supplier of these fundamental industrial materials to a diverse international client base.

Antofagasta's mining operations extend beyond copper, yielding significant by-products like molybdenum, gold, and silver. These metals are not mere afterthoughts; they represent a crucial diversification of revenue, bolstering the company's financial resilience and maximizing the economic potential of its mineral assets. For example, in 2023, Antofagasta reported that its by-product revenues, including those from molybdenum, gold, and silver, contributed substantially to its overall financial performance.

Molybdenum, in particular, is a key component in advanced manufacturing, finding critical applications in the automotive industry for high-strength steel and in the chemical sector as a catalyst. The growing demand in these areas underscores the strategic importance of Antofagasta's by-product recovery. The company's ability to efficiently extract and market these valuable metals directly enhances its competitive edge and profitability in the global commodities market.

Antofagasta plc places a strong emphasis on upholding rigorous quality and purity standards for its copper output. This dedication is crucial for meeting the demanding specifications of industrial clients who rely on the company's copper concentrates and cathodes for further processing into essential components like wires, rods, and tubes.

In 2023, Antofagasta reported an average copper recovery rate of 87.4%, underscoring their commitment to efficient production and high-quality output. This focus ensures their products are well-suited for a wide array of downstream applications, from electrical conductivity in wiring to structural integrity in tubing.

Sustainable ion Focus

Antofagasta's commitment to sustainable mining is a core element of its marketing strategy. The company actively integrates environmental, social, and governance (ESG) standards throughout its operations, aiming to minimize its ecological impact and foster positive community relations. This focus is increasingly important as global markets demand responsibly sourced materials, directly influencing consumer and investor perception.

The company's sustainability reports detail concrete actions taken to achieve these goals. For instance, Antofagasta has set targets to reduce its greenhouse gas emissions and improve water efficiency in its mining processes. These initiatives are not just about compliance but are strategically positioned to enhance brand reputation and attract environmentally conscious investors and customers.

Key sustainability achievements and targets include:

- Reduction of Greenhouse Gas Emissions: Antofagasta aims to reduce its Scope 1 and 2 GHG emissions by 30% by 2030 against a 2020 baseline. In 2023, the company reported a 14% reduction in these emissions compared to 2020, reaching 1.4 million tonnes of CO2e.

- Water Management Optimization: The company is focused on increasing the use of desalinated water and reducing its reliance on fresh water sources. By the end of 2023, 77% of the water used in their operations was desalinated, up from 73% in 2022.

- Responsible Resource Management: This encompasses efforts in biodiversity conservation and waste reduction at their mining sites.

- Alignment with Global Standards: Adherence to frameworks like the Task Force on Climate-related Financial Disclosures (TCFD) and the UN Sustainable Development Goals (SDGs) demonstrates their commitment to transparency and global sustainability benchmarks.

Long-term Resource Base and Growth Projects

Antofagasta plc is strategically focused on bolstering its long-term resource base through continuous investment in exploration and development. This proactive approach ensures a robust pipeline of future supply, critical for maintaining its competitive edge in the global copper market.

Key growth initiatives are central to Antofagasta's strategy. The Centinela Second Concentrator project, for instance, is slated to add significant copper production capacity, while the Los Pelambres expansion aims to extend the mine's operational life. These projects are projected to substantially increase output, solidifying Antofagasta's standing as a premier copper producer.

- Centinela Second Concentrator: Expected to increase copper production by approximately 150,000 tonnes per year once fully operational.

- Los Pelambres Expansion: This project is designed to extend the mine life by an estimated 15 years and boost average annual copper production by around 20,000 tonnes.

- Exploration Investment: In 2023, Antofagasta allocated $92 million to exploration, targeting new discoveries and resource extensions across its portfolio.

- Production Outlook: The company anticipates its copper production to reach between 690,000 and 730,000 tonnes in 2024, with a target of 930,000 tonnes by 2030, largely driven by these growth projects.

Antofagasta's product offering centers on high-quality copper concentrates and cathodes, fundamental to global industries. Beyond copper, the company strategically extracts valuable by-products like molybdenum, gold, and silver, diversifying revenue streams and enhancing profitability. This comprehensive product mix, coupled with a commitment to stringent quality standards, ensures Antofagasta meets the precise needs of its international clientele.

| Product | Key Characteristics | 2023 Production (Tonnes) | By-product Contribution |

|---|---|---|---|

| Copper (Concentrates & Cathodes) | High-grade, essential for construction, automotive, electronics | 664,000 | Core revenue driver |

| Molybdenum | Key for advanced manufacturing, high-strength steel, chemical catalysts | N/A (By-product) | Significant revenue diversification |

| Gold & Silver | Valuable precious metals | N/A (By-products) | Bolsters financial resilience |

What is included in the product

This analysis provides a comprehensive deep dive into Antofagasta's Product, Price, Place, and Promotion strategies, offering a clear understanding of their marketing positioning.

It's designed for professionals seeking a grounded, example-rich breakdown of Antofagasta's marketing mix, perfect for benchmarking or strategic planning.

Simplifies complex Antofagasta marketing strategies into actionable 4Ps insights, easing the burden of detailed analysis for busy teams.

Place

Antofagasta's global direct sales strategy focuses on a business-to-business model, supplying copper and by-products directly to industrial clients like smelters and refiners. This approach allows for substantial volume transactions and the establishment of enduring supply contracts. In 2024, Antofagasta continued to serve major industrial hubs, with Asia, particularly Japan and China, alongside Europe and the United States, representing key demand centers for its output.

Antofagasta plc leverages a sophisticated distribution network to move its bulk commodities, primarily copper and its by-products. This strategy is crucial for ensuring raw materials from its Chilean mines reach global markets efficiently. For instance, in 2023, the company's copper production reached 659,100 tonnes, all of which required robust logistical pathways.

The company's distribution relies heavily on its integrated supply chain, connecting its major operations like Los Pelambres to key international ports. From these ports, the materials are shipped to customers worldwide, highlighting the importance of efficient sea freight and port infrastructure in its market reach.

Antofagasta's Integrated Transport Division, a cornerstone of its operations, manages a vital rail and road network in northern Chile. This infrastructure is indispensable for moving raw materials to processing facilities and finished copper products to key export ports.

In 2023, Antofagasta's rail network transported approximately 6.7 million tonnes of freight, a testament to its operational scale and efficiency in supporting the company's mining output. This internal logistics capability provides significant control over supply chain costs and delivery timelines.

Long-Term Supply Agreements

Antofagasta's sales strategy heavily relies on long-term framework agreements and annual contracts with its core clientele. This approach significantly stabilizes sales volumes and guarantees consistent access to crucial markets. For example, in 2023, the company highlighted that a substantial portion of its copper sales were covered by these arrangements, providing a predictable revenue stream.

These agreements are instrumental in mitigating the impact of short-term market volatility, offering a degree of predictability in an often-cyclical industry. This focus on securing off-take provides a solid foundation for operational planning and capital allocation. The company's commitment to these arrangements underscores its emphasis on building enduring customer relationships.

- Secured Sales Volumes: Long-term agreements ensure a baseline of contracted sales, offering revenue visibility.

- Market Access: These contracts provide guaranteed access to key customer bases, crucial for market penetration.

- Reduced Volatility: By locking in sales, Antofagasta lessens its exposure to day-to-day price fluctuations.

- Customer Relationships: The framework fosters strong, lasting partnerships with major buyers.

Proximity to Key Markets via Ports

Antofagasta's strategic location in Chile grants it direct access to Pacific ports, a critical advantage for its export-oriented copper business. This proximity facilitates the efficient shipment of copper concentrates and cathodes to major demand centers, especially across Asia.

The established shipping routes and the region's geographical positioning are fundamental for ensuring that bulk commodities reach their destinations in a timely and cost-effective manner. This logistical efficiency directly impacts the competitiveness of Antofagasta's copper products in the global market.

- Pacific Port Access: Facilitates direct export of copper to Asia and other global markets.

- Cost Efficiency: Reduces transportation costs for bulk commodities.

- Timely Delivery: Ensures reliable supply chains for international buyers.

- Market Reach: Connects Antofagasta's production to key global demand centers.

Antofagasta's place in the market is defined by its strategic location in Chile, granting direct access to Pacific ports essential for its global copper exports. This geographical advantage underpins efficient and cost-effective shipping to major demand centers, particularly in Asia. The company's integrated transport network further solidifies its market presence by ensuring seamless movement of materials from mine to port.

| Logistical Aspect | Key Feature | Impact |

|---|---|---|

| Port Access | Direct Pacific Port Access | Facilitates efficient export to Asia and global markets. |

| Transport Network | Integrated Rail and Road Network | Ensures timely movement of raw materials and finished products. |

| Shipping Routes | Established International Routes | Supports cost-effective and reliable delivery to customers. |

What You Preview Is What You Download

Antofagasta 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Antofagasta 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion in detail. You'll gain immediate access to actionable insights for your marketing strategies.

Promotion

Antofagasta's promotional strategy heavily emphasizes investor relations, ensuring transparent and detailed financial reporting. This includes readily accessible annual accounts, half-year results, and timely press releases, all designed to keep stakeholders informed.

These communications are vital for shareholders, prospective investors, and financial analysts. They provide critical insights into Antofagasta's operational performance, strategic direction, and future market outlook. For example, Antofagasta plc reported a profit after tax of $1,303.2 million for the year ended December 31, 2023, demonstrating strong financial health to its investors.

Antofagasta's promotion strategy heavily emphasizes its dedication to sustainability and ESG principles. The company's annual sustainability reports detail its progress in crucial areas like safety, environmental stewardship, community relations, and fostering diversity.

These reports are vital for attracting investors focused on responsible practices and for securing its social license to operate. For instance, Antofagasta reported a 10% reduction in its Scope 1 and 2 greenhouse gas emissions intensity in 2023 compared to its 2019 baseline, showcasing tangible environmental progress.

The company's commitment extends to community investment, with over $25 million allocated to social programs and local development initiatives in the Andean regions where it operates during the 2023 fiscal year.

Antofagasta plc demonstrates a strong commitment to industry engagement by actively participating in key mining and metals conferences. For instance, their presence at events like the World Copper Conference provides a vital platform to connect with potential clients and partners.

These gatherings are crucial for Antofagasta to showcase its ongoing projects and gain insights into emerging market trends and technological innovations. In 2023, the global mining industry saw significant investment, with copper exploration budgets projected to increase, highlighting the strategic importance of such industry events for companies like Antofagasta.

Corporate Communications and Media Engagement

Antofagasta plc actively manages its corporate communications to shape its public perception and share crucial company updates. This involves consistent engagement with media and the release of informative articles, ensuring a clear and accurate portrayal of its operational performance, financial standing, and strategic objectives to a wide range of stakeholders.

In 2024, Antofagasta plc continued its commitment to transparent communication. For instance, its interim results announcement in August 2024 detailed a robust financial performance, highlighting a significant increase in revenue driven by higher copper prices and production volumes. This proactive approach aims to build trust and provide timely insights into the company's trajectory.

The company's media engagement strategy focuses on several key areas:

- Disseminating operational updates: Providing regular information on production figures, project development, and sustainability initiatives.

- Communicating financial performance: Releasing quarterly and annual reports that offer a clear view of revenue, profitability, and investment plans. For example, the 2023 annual report showed a substantial increase in underlying EBITDA compared to 2022.

- Highlighting strategic direction: Articulating the company's long-term vision, including expansion plans and commitments to environmental, social, and governance (ESG) principles.

- Engaging with investors and analysts: Participating in industry conferences and investor calls to foster dialogue and address queries.

B2B Relationship Building and Thought Leadership

Antofagasta's B2B promotion strategy centers on cultivating deep relationships with its industrial clientele and establishing itself as a thought leader in the mining industry. This involves direct engagement with key buyers, ensuring their needs are understood and met, which is crucial for a company serving a specialized market.

The company actively participates in thought leadership initiatives. For example, Antofagasta Minerals' CEO, Iván Arriagada, frequently shares insights on copper demand projections and the broader market outlook. These pronouncements position the company as a knowledgeable and dependable authority within the copper and mining sectors.

- CEO Commentary: Iván Arriagada's public statements in 2024 and early 2025 have highlighted a positive long-term outlook for copper demand, driven by electrification and renewable energy projects.

- Industry Engagement: Antofagasta Minerals participated in key industry forums throughout 2024, presenting on sustainable mining practices and technological advancements, further solidifying its thought leadership.

- Direct Client Relations: The company maintained dedicated account management teams for its major industrial customers, facilitating direct communication and feedback loops to strengthen B2B relationships.

Antofagasta's promotional efforts are multifaceted, focusing on investor relations, sustainability, and industry engagement to build trust and showcase its value. The company's commitment to transparent financial reporting, exemplified by its 2023 profit after tax of $1,303.2 million, reassures stakeholders of its financial stability.

Furthermore, Antofagasta actively promotes its ESG initiatives, such as the 10% reduction in Scope 1 and 2 GHG emissions intensity in 2023, and substantial community investments exceeding $25 million in 2023. These actions underscore a dedication to responsible operations and stakeholder value.

The company also leverages industry conferences and direct client engagement to foster relationships and share its strategic vision, positioning itself as a thought leader in the copper market. CEO Iván Arriagada's commentary in 2024 and early 2025 has consistently pointed to a strong long-term demand for copper, reinforcing Antofagasta's strategic positioning.

| Focus Area | Key Activity | 2023/2024 Data Point |

|---|---|---|

| Investor Relations | Financial Reporting | Profit after tax: $1,303.2 million (FY 2023) |

| Sustainability | Emissions Reduction | 10% reduction in Scope 1 & 2 GHG emissions intensity (vs. 2019 baseline, 2023) |

| Community Investment | Social Programs | Over $25 million allocated to social programs (2023) |

| Industry Engagement | Thought Leadership | CEO commentary on positive long-term copper demand outlook (2024-2025) |

Price

Antofagasta's copper pricing strategy is intrinsically tied to the ebb and flow of global commodity markets, with the London Metal Exchange (LME) serving as a key benchmark. As a significant player in the copper supply chain, the company's financial performance directly mirrors the volatility of international copper prices.

For instance, in early 2024, LME three-month copper prices saw significant upward movement, reaching over $9,000 per tonne, a level not consistently seen in recent years. This surge directly impacts Antofagasta's revenue potential, as its output is sold at prevailing market rates, highlighting the direct correlation between global demand, supply dynamics, and the company's realized prices.

Antofagasta's revenue streams are heavily influenced by long-term contracts with industrial clients, a core element of their pricing strategy. These agreements often feature negotiated pricing, offering a predictable revenue base. For instance, as of early 2024, a substantial majority of their copper sales are secured through such contracts, providing insulation from short-term market volatility.

The pricing structures within these contracts are diverse, encompassing fixed price agreements for a portion of output, ensuring a baseline income. Other contracts utilize floating prices, directly tied to established market benchmarks like the LME copper price, allowing participation in market upswings. This blend of fixed and floating mechanisms offers both stability and flexibility in managing price fluctuations, a key consideration in the volatile commodities market.

Antofagasta's pricing strategy is deeply intertwined with its cost of production, a factor it diligently controls through ongoing competitiveness programs and operational enhancements. The company's focus on maintaining low cash costs is paramount for ensuring profitability and staying competitive, particularly when commodity prices fluctuate significantly.

For instance, in the first half of 2024, Antofagasta reported a 14% decrease in its copper cash cost to $1.39 per pound, a testament to their efficiency efforts. This focus on cost management directly supports their ability to offer competitive pricing in the market, even amidst price volatility.

Supply and Demand Dynamics

Global copper demand remains robust, driven significantly by the ongoing electrification of transportation and the expansion of renewable energy infrastructure. For instance, electric vehicle production, a major copper consumer, saw substantial growth through 2024, with projections indicating continued expansion into 2025. This sustained demand directly influences the pricing of Antofagasta's copper output.

Supply-side factors are equally critical. Potential disruptions from other major copper-producing regions due to geopolitical events or operational challenges can create price volatility. Antofagasta's ability to maintain consistent production levels, therefore, becomes a key competitive advantage in this dynamic market.

Market analysis for copper in late 2024 and early 2025 highlights several key influences:

- Economic Growth: Forecasts for global GDP growth in 2024 and 2025 suggest a continued need for industrial metals, including copper.

- Energy Transition Demand: The build-out of solar, wind, and battery storage systems is projected to increase copper consumption by an estimated X% annually through 2025.

- Supply Chain Stability: Concerns about supply chain disruptions, particularly in key mining regions, have supported higher copper prices, with spot prices reaching approximately $Y per tonne in recent months.

By-product Credits and Overall Revenue

By-product credits significantly bolster Antofagasta's revenue streams, acting as a crucial offset to copper production costs. In 2023, the company reported substantial contributions from molybdenum, gold, and silver, which effectively lowered their net cash costs for copper. This financial resilience allows for more competitive pricing power in the market.

The impact of these credits is substantial. For instance, a strong performance in by-product sales can directly improve the company's bottom line, making their primary copper product more attractive from a cost perspective. This strategic advantage is vital for navigating the volatile commodity markets.

- 2023 By-product Revenue Impact: Antofagasta's by-product revenues in 2023 played a key role in reducing their overall cash costs, enhancing their competitive position.

- Molybdenum Contribution: Molybdenum sales represent a significant portion of these by-product credits, directly impacting the net cost of copper.

- Gold and Silver Significance: The company also benefits from the market prices of gold and silver, further diversifying its revenue and mitigating copper price fluctuations.

- Pricing Strategy Influence: Higher by-product credits provide Antofagasta with greater flexibility in its pricing strategies for copper, allowing them to remain competitive even during market downturns.

Antofagasta's pricing is fundamentally market-driven, with the London Metal Exchange (LME) copper price acting as the primary reference. The company's revenue is directly correlated to these global benchmarks, making market fluctuations a key determinant of their realized prices.

For example, in early 2024, LME copper prices surged past $9,000 per tonne, a level that significantly boosted Antofagasta's revenue potential for that period. This highlights the direct impact of global supply and demand dynamics on the company's financial outcomes.

Antofagasta strategically utilizes a mix of long-term contracts and market-linked pricing to manage price volatility. As of early 2024, a substantial portion of their copper output is secured through these contracts, providing a degree of revenue predictability.

The company's focus on cost efficiency, demonstrated by a 14% reduction in copper cash costs to $1.39 per pound in H1 2024, underpins its ability to maintain competitive pricing. This cost management is crucial for profitability, especially when commodity prices fluctuate.

| Metric | Value (H1 2024) | Impact on Pricing |

|---|---|---|

| LME Copper Price (Average) | ~$8,500/tonne | Directly influences realized sales prices. |

| Copper Cash Cost | $1.39/lb (-14% vs. prior period) | Enhances competitiveness and margin stability. |

| By-product Credits | Significant contribution (e.g., Molybdenum, Gold) | Reduces net copper costs, allowing for more flexible pricing. |

4P's Marketing Mix Analysis Data Sources

Our Antofagasta 4P's analysis is meticulously crafted using a blend of official company disclosures, including investor reports and press releases, alongside comprehensive industry research and competitive landscape data. This ensures a robust understanding of their product offerings, pricing strategies, distribution channels, and promotional activities.