Andritz SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Andritz Bundle

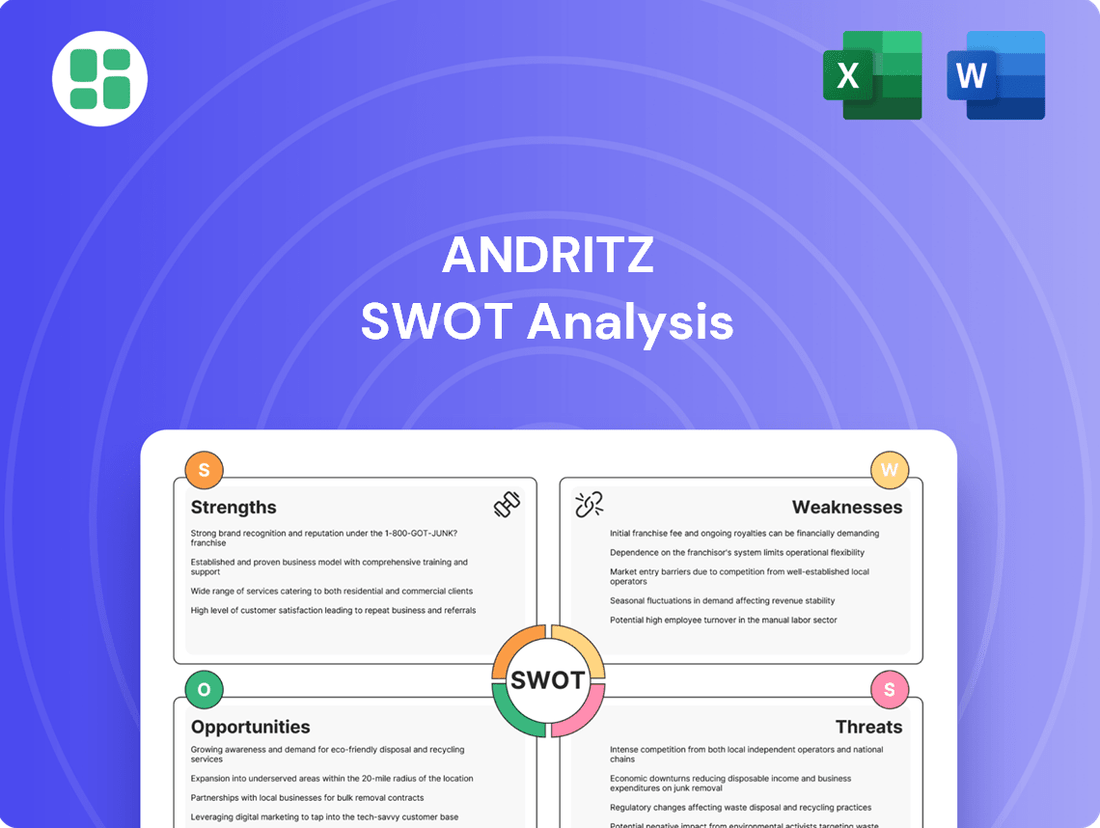

Andritz, a leader in pulp, paper, and energy sectors, boasts strong technological innovation and a global presence, key strengths that fuel its market leadership. However, understanding the nuances of its competitive landscape and potential regulatory shifts is crucial for strategic decision-making.

Want to fully grasp Andritz's competitive edge, potential challenges, and future opportunities? Purchase the complete SWOT analysis to unlock detailed insights, expert commentary, and actionable strategies designed to inform your investment or business planning.

Strengths

ANDRITZ AG stands as a global leader in technology, delivering a wide range of equipment and services to essential sectors like hydropower, pulp and paper, metals, and separation technology. This broad market presence, spanning diverse industries, significantly reduces the company's vulnerability to downturns in any single sector.

The company's diversified business model proved advantageous in 2023, with the Pulp & Paper division, for instance, reporting a substantial order intake, contributing to the group's overall stability and growth trajectory.

Andritz has shown impressive strength in its order intake, with a nearly 20% jump year-over-year in the first quarter of 2025. This growth was particularly strong in the Pulp & Paper and Hydropower sectors, indicating healthy demand for their offerings in these key areas.

The company's substantial order backlog, standing at 10,170 million Euros as of March 31, 2025, is a significant asset. This backlog provides a solid base for future revenue and allows for more predictable operational planning, offering a degree of financial stability.

ANDRITZ is a leader in sustainable technologies, driving the green transition with solutions for decarbonization, clean energy, and the circular economy. This focus taps into a growing global market for eco-friendly industrial solutions.

Advancements in Digitalization and Automation

Andritz is making significant strides in digitalization and automation, a key strength. They are actively integrating Industry 4.0 concepts, offering Smart Services, and leveraging their Metris brand to optimize plant performance and facilitate autonomous operations. This strategic focus not only boosts their competitive position but also delivers tangible efficiency gains for their clientele.

The company's commitment to digital solutions is evident in its growing portfolio. For instance, in 2023, Andritz reported a substantial increase in its order intake for digital and automation solutions, reflecting strong market demand for these advanced capabilities. This trend is expected to continue into 2024 and 2025 as industries increasingly prioritize smart manufacturing and operational intelligence.

- Industry 4.0 Integration: Andritz is embedding smart technologies across its product lines, enhancing data connectivity and process control.

- Metris Brand Solutions: This dedicated brand offers advanced digital services and analytics to optimize customer plant operations, aiming for peak efficiency and reduced downtime.

- Smart Services: The company provides remote monitoring, predictive maintenance, and performance optimization services, adding significant value beyond equipment delivery.

- Autonomous Operations: Andritz is developing solutions that move towards more autonomous plant management, reducing the need for constant human intervention and improving safety.

Increasing Share of Service Business

ANDRITZ has made significant strides in growing its service business, a key strategic focus. This segment's increasing contribution to overall revenue is a testament to the company's strategy.

The service business reached an impressive 44% of total revenue in the first quarter of 2025. This marks a notable increase from 40% in the same period of 2024, demonstrating consistent growth in this area.

This shift towards services is particularly beneficial as it typically carries higher profit margins than equipment sales. This higher margin contribution directly bolsters ANDRITZ's overall profitability.

Furthermore, the growing service revenue provides a more stable and predictable income stream. This enhanced revenue predictability strengthens the company's financial resilience and reduces reliance on cyclical equipment orders.

- Increased Service Revenue Share: Service business constituted 44% of total revenue in Q1 2025, up from 40% in Q1 2024.

- Higher Profitability: The growing service segment contributes to improved profit margins due to its inherently higher-margin nature.

- Revenue Predictability: The expansion of services enhances revenue stability and predictability, insulating the company from market volatility.

- Business Resilience: A stronger service base bolsters ANDRITZ's overall business resilience and financial health.

Andritz boasts a strong and diversified market presence, operating across crucial sectors like hydropower, pulp and paper, metals, and separation technology. This broad reach significantly mitigates risks associated with any single industry's performance, ensuring greater stability. The company's strategic emphasis on sustainable technologies, including solutions for decarbonization and the circular economy, positions it favorably in a rapidly growing global market for eco-friendly industrial applications.

Digitalization and automation are key strengths for Andritz, with their Metris brand offering advanced services and Industry 4.0 integration enhancing plant performance. This focus on smart solutions is yielding tangible results, as evidenced by a substantial increase in order intake for these capabilities in 2023, a trend projected to continue through 2025.

The company's service business is a growing contributor, reaching 44% of total revenue in Q1 2025, up from 40% in Q1 2024. This expansion into higher-margin services enhances profitability and provides a more predictable revenue stream, bolstering overall business resilience.

| Metric | Q1 2024 | Q1 2025 | Change |

|---|---|---|---|

| Service Revenue Share | 40% | 44% | +4 pp |

| Order Intake Growth (YoY) | N/A | ~20% | Significant |

| Order Backlog (EUR bn) | N/A | 10.17 | Strong Base |

What is included in the product

Maps out Andritz’s market strengths, operational gaps, and risks, providing a comprehensive view of its competitive landscape and strategic positioning.

Offers a clear, actionable framework for identifying and addressing Andritz's strategic challenges and opportunities.

Weaknesses

Despite a robust order intake, Andritz faced a notable revenue decline in early 2025. Specifically, group revenue saw a 6.6% drop year-over-year in the first quarter of 2025.

This downturn was largely driven by significant contractions in two core segments: Pulp & Paper, which experienced a substantial 22.5% decrease, and Metals, which fell by 6.3%. These figures highlight a potential disconnect between securing new business and converting those orders into recognized revenue, suggesting that market headwinds encountered in 2024 are still affecting financial performance in the initial months of 2025.

Andritz's financial performance exhibits volatility, with net income experiencing a 14% decline in the first quarter of 2025 compared to the same period in 2024. This downturn was primarily driven by a reduction in earnings before interest, taxes, and amortization (EBITA) and a less favorable financial outcome.

Furthermore, operating cash flow saw a substantial decrease, falling to €73 million in Q1 2025 from €285 million in Q1 2024. This significant drop is largely attributable to increased working capital requirements stemming from the progression of ongoing projects.

Andritz's reliance on its core industries makes it vulnerable to investment cycles. For instance, a slowdown in capital expenditure within the Pulp & Paper and Metals sectors during early 2024 directly impacted its revenue streams into the first quarter of 2025, highlighting this sensitivity.

This inherent cyclicality can cause significant fluctuations in Andritz's financial performance, even when the company maintains a robust overall order backlog. Such volatility underscores the challenge of predicting consistent revenue growth in the short to medium term.

Impact of Capacity Adjustments

Andritz's 2024 provisions for capacity adjustments in specific markets, driven by decreased demand, highlight a vulnerability to market fluctuations. These adjustments, while necessary for operational efficiency, can lead to significant one-time expenses and signal underlying structural issues within certain business segments. For instance, the company's financial statements for 2024 would detail the specific costs associated with these rationalizations, impacting profitability in the short term. This strategic move underscores the challenge of maintaining optimal production levels when faced with uneven global demand across its diverse product lines.

The need for capacity adjustments points to potential weaknesses in Andritz's market forecasting or its ability to quickly pivot production in response to shifting economic landscapes.

- Market Sensitivity: Andritz's reliance on specific markets makes it susceptible to regional downturns, necessitating costly capacity adjustments.

- Cost of Restructuring: Provisions for capacity adjustments in 2024 indicate direct financial outlays that can pressure short-term earnings.

- Operational Inflexibility: The requirement for capacity changes suggests potential challenges in rapidly adapting its operational footprint to evolving demand patterns.

Integration Risks of Acquisitions

ANDRITZ's strategy of acquiring companies, including LDX Solutions in February 2025 and Procemex and PulpEye in 2024, carries significant integration risks. These risks stem from the challenge of harmonizing different corporate cultures, achieving expected operational synergies, and ensuring the acquired businesses meet financial performance targets post-acquisition.

Failure to effectively integrate these new entities can lead to:

- Disruptions in operational continuity: Merging systems and processes can cause temporary setbacks in service delivery or production.

- Underachievement of synergy targets: Expected cost savings or revenue enhancements may not materialize as planned, impacting profitability.

- Cultural clashes and employee retention issues: Differences in work environments can lead to decreased morale and the loss of key talent from acquired companies.

Andritz's financial results for the first quarter of 2025 showed a significant dip, with group revenue down 6.6% year-over-year. This decline was heavily influenced by a substantial 22.5% drop in the Pulp & Paper segment and a 6.3% decrease in Metals. This suggests challenges in translating a strong order book into immediate sales, possibly due to ongoing market pressures that began in 2024.

The company's net income also suffered, falling 14% in Q1 2025 compared to the prior year, driven by lower EBITA and less favorable financial results. Operating cash flow saw a dramatic decrease, plummeting to €73 million from €285 million in Q1 2024, largely due to increased working capital needs from ongoing projects.

These figures highlight Andritz's vulnerability to the cyclical nature of its key industries. A slowdown in capital expenditure within the Pulp & Paper and Metals sectors during 2024 directly impacted its revenue streams into early 2025, demonstrating how investment cycles can cause significant financial performance fluctuations, even with a healthy order backlog.

Furthermore, provisions made in 2024 for capacity adjustments in response to decreased demand in certain markets indicate a sensitivity to market shifts. These adjustments, while strategic, incur one-time expenses that can affect short-term profitability and signal potential issues with market forecasting or operational agility in adapting to changing economic conditions.

Full Version Awaits

Andritz SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive look at Andritz's strategic positioning.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version, allowing for detailed strategic planning based on Andritz's strengths, weaknesses, opportunities, and threats.

Opportunities

The global push for sustainability presents a substantial opportunity for ANDRITZ. As countries and industries prioritize decarbonization, the demand for advanced technologies in renewable energy, such as hydropower and biomass boilers, is surging. ANDRITZ is well-positioned to capitalize on this trend, with its expertise in these areas and its growing focus on Power-to-X (P2X) solutions. This aligns perfectly with the market's increasing appetite for greener industrial processes.

The global push for cleaner energy sources is a significant tailwind for ANDRITZ. This trend fuels demand for modernizing existing power plants and building new ones, especially for hydropower, which is crucial for grid stability. ANDRITZ's expertise in this area positions them to win substantial projects.

Recent contract wins, such as those in Mozambique for hydropower plant upgrades, underscore ANDRITZ's strong market position. These projects are not just about capacity but also about enhancing efficiency and reliability in a sector vital for the energy transition.

ANDRITZ's commitment to digitalization, evident through its Metris brand and strategic cybersecurity partnerships, offers a significant opportunity to advance autonomous factory solutions. This focus allows for enhanced operational efficiency and cost reductions for clients.

By developing and implementing these autonomous systems, ANDRITZ can tap into new revenue streams by offering advanced digital services and predictive maintenance, further solidifying its market position.

Strategic Acquisitions to Enhance Portfolio

Andritz's strategic acquisition approach is a key opportunity for portfolio enhancement. Recent moves, such as acquiring LDX Solutions to bolster emission reduction technologies and Procemex for advanced paper machine vision systems, highlight a clear focus on environmental solutions and digitalization. These acquisitions are not just about adding new capabilities; they are about integrating technologies that align with global sustainability trends and the increasing demand for smart manufacturing in the industries Andritz serves. This proactive strategy allows Andritz to expand its service and product offerings, solidifying its market leadership.

Continued strategic acquisitions can significantly strengthen Andritz's market position and broaden its solution portfolio. By targeting companies with complementary technologies or market access, Andritz can accelerate its growth and innovation. For instance, in 2023, Andritz completed several acquisitions, contributing to its overall revenue growth and expanding its footprint in key geographical markets and technological segments. This disciplined approach to M&A allows Andritz to adapt to evolving market demands and maintain a competitive edge.

- Acquisition of LDX Solutions: Strengthened Andritz's environmental technology portfolio, particularly in emission reduction solutions for the pulp and paper industry.

- Acquisition of Procemex: Enhanced Andritz's digitalization offerings with advanced vision systems for paper machine monitoring and quality control.

- Strategic Alignment: These acquisitions align with global trends towards sustainability and Industry 4.0, positioning Andritz for future growth.

- Market Expansion: Continued acquisitions offer opportunities to enter new markets or deepen penetration in existing ones.

Increasing Service Business Potential

The increasing potential within Andritz's service business presents a significant opportunity for sustained and profitable growth. This segment has demonstrated consistent expansion, now representing a substantial component of the company's overall revenue, which contributes to financial stability.

Leveraging this strength further by enhancing comprehensive lifecycle support and integrating advanced digital services can amplify revenue streams and improve profit margins. For instance, Andritz's focus on aftermarket services, including maintenance, upgrades, and spare parts, is a key driver of this growth. In 2023, the service segment continued to be a robust contributor to overall performance, reflecting the strategic importance of this area for the company's future financial health.

- Growing Service Revenue: Andritz's service business consistently contributes a significant portion to total revenue, offering a stable revenue base.

- Higher Margin Potential: The service segment typically operates with higher profit margins compared to new equipment sales, enhancing overall profitability.

- Lifecycle Support Expansion: Opportunities exist to deepen customer relationships through comprehensive lifecycle support, from installation to modernization and maintenance.

- Digital Service Integration: Implementing digital solutions for predictive maintenance, remote monitoring, and operational optimization can unlock new revenue streams and improve customer value.

The global drive for sustainability, particularly in energy and environmental technologies, offers significant growth avenues for Andritz. The company's expertise in hydropower, biomass boilers, and emerging Power-to-X solutions aligns with increasing demand for greener industrial processes and renewable energy infrastructure. For example, Andritz secured a significant contract in 2024 for a major hydropower plant upgrade in South America, highlighting their role in the energy transition.

Threats

ANDRITZ faces a persistently challenging market due to economic volatility, including rising interest rates which can dampen capital expenditure for their clients. For instance, the European Central Bank's key interest rates have been elevated throughout 2024, impacting borrowing costs for industrial projects.

Geopolitical instability poses a significant threat, potentially disrupting global supply chains essential for ANDRITZ's manufacturing and project delivery. Trade policy shifts, such as those seen in ongoing tariff disputes between major economic blocs, can also create uncertainty and affect demand in key markets like Asia and North America.

Market cyclicality poses a significant threat, particularly evident in sectors like Pulp & Paper and Metals. In 2024, these industries saw subdued investment, directly translating into a downturn in Andritz's order intake for these segments. This weakness underscores the vulnerability to economic cycles.

The prolonged nature of these investment downturns can have a substantial ripple effect on Andritz's financial performance. Given that many projects are large-scale and span extended periods, a sustained lack of new orders directly impacts revenue streams and, consequently, profitability. For instance, the Pulp & Paper sector's order intake saw a notable decline in the first half of 2024 compared to the previous year, a trend that directly affects the company's backlog and future earnings visibility.

ANDRITZ operates in highly competitive global markets, facing significant rivalry from established international players across its diverse business segments. This intense competition can pressure pricing strategies and profit margins, necessitating a constant focus on innovation and cost management to maintain market share and profitability.

Raw Material Price Volatility and Supply Chain Risks

Fluctuations in the cost of key raw materials, such as steel and specialized alloys, present a significant challenge for ANDRITZ. These price swings directly affect production expenses and can impact project profitability if not managed effectively. For example, the global steel price index saw considerable volatility throughout 2023 and into early 2024, driven by factors like energy costs and geopolitical events.

Disruptions within global supply chains, a persistent concern in recent years, also pose a threat. Delays in the delivery of critical components or unforeseen logistical bottlenecks can extend project timelines, leading to potential penalties and impacting ANDRITZ's ability to meet customer commitments. The ongoing geopolitical landscape and trade tensions continue to create an environment ripe for such supply chain vulnerabilities.

- Raw Material Cost Sensitivity: ANDRITZ's reliance on materials like steel means its cost structure is directly influenced by global commodity markets.

- Supply Chain Vulnerabilities: Geopolitical instability and logistical challenges can disrupt the flow of essential components, impacting project execution.

- Impact on Project Timelines: Supply chain disruptions can lead to delays, potentially affecting revenue recognition and customer satisfaction.

- Cost Management Necessity: Effective hedging strategies and diversified sourcing are crucial to mitigate the impact of price volatility.

Regulatory Changes and Environmental Compliance

Evolving environmental regulations and stricter compliance requirements worldwide present a significant threat to Andritz. For instance, the European Union's Green Deal, aiming for climate neutrality by 2050, is driving increasingly stringent emissions standards and waste management protocols. Failure to adapt proactively to these evolving mandates could lead to penalties and reputational damage.

Adapting to new environmental standards and investing in compliant technologies can incur substantial costs. These investments, while necessary for long-term sustainability, may impact project viability and Andritz's short-term profitability. For example, upgrading existing pulp and paper facilities to meet new water discharge limits in 2024 could require millions in capital expenditure.

- Increased Capital Expenditure: Significant investments are needed to retrofit facilities and develop new technologies to meet stricter environmental standards, potentially impacting profit margins.

- Project Delays and Cancellations: Non-compliance or the high cost of compliance could lead to delays or cancellations of projects, particularly in regions with rapidly changing environmental laws.

- Competitive Disadvantage: Companies that are slower to adapt may face a competitive disadvantage against those who have already invested in cleaner technologies and processes.

ANDRITZ faces significant threats from intense global competition, which can compress profit margins and necessitate continuous innovation. Furthermore, the company is susceptible to fluctuations in raw material costs, such as steel, with the global steel price index showing considerable volatility through early 2024, directly impacting production expenses.

Supply chain disruptions, exacerbated by geopolitical tensions, remain a critical threat, potentially delaying projects and affecting customer commitments. The company must also navigate evolving environmental regulations, like the EU's Green Deal, which require substantial investment in compliant technologies, potentially increasing capital expenditure and impacting short-term profitability.

| Threat Category | Specific Risk | Impact on ANDRITZ | Example/Data Point (2024/2025) |

|---|---|---|---|

| Competition | Intense Rivalry | Pressure on pricing and profit margins | ANDRITZ operates in markets with established international players across all segments. |

| Economic Volatility | Rising Interest Rates | Dampened client capital expenditure | European Central Bank key rates remained elevated throughout 2024. |

| Supply Chain Disruptions | Geopolitical Instability | Delays in component delivery, extended project timelines | Ongoing trade tensions and logistical bottlenecks continue to create vulnerabilities. |

| Raw Material Costs | Price Volatility (e.g., Steel) | Increased production expenses, potential impact on project profitability | Global steel price index experienced significant fluctuations in 2023-2024. |

| Regulatory Environment | Stricter Environmental Standards | Increased capital expenditure for compliance, potential project delays | EU Green Deal driving stricter emissions standards; retrofitting costs can be millions. |

SWOT Analysis Data Sources

This Andritz SWOT analysis is built upon a foundation of credible data, including the company's official financial filings, comprehensive market research reports, and expert industry analyses to ensure a robust and accurate strategic overview.