Andritz PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Andritz Bundle

Navigate the complex global landscape affecting Andritz with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping their strategic direction and market opportunities. Gain a competitive edge by leveraging these critical insights. Download the full report now for actionable intelligence.

Political factors

Global trade policies and protectionism significantly shape Andritz's operational landscape. For instance, the imposition of tariffs, such as those seen in 2018-2019 trade disputes, directly increases the cost of imported components and materials vital for Andritz's manufacturing processes. This can impact project margins and the competitiveness of its offerings in affected markets.

Furthermore, shifts towards protectionist measures can restrict market access for Andritz's large-scale equipment and plant exports. Countries implementing local content requirements or favoring domestic suppliers can create substantial hurdles for international technology groups. Andritz's ability to adapt its supply chains and market strategies in response to these evolving trade dynamics is crucial for maintaining its global market position.

Governments worldwide are heavily investing in green initiatives, with many setting ambitious targets for renewable energy adoption. For instance, the European Union's Green Deal aims for climate neutrality by 2050, backed by significant funding. This policy shift directly boosts Andritz's hydropower segment and its sustainable offerings in pulp & paper and metals, as these sectors align with governmental priorities for decarbonization and eco-friendly industrial practices.

Andritz's global footprint, spanning numerous countries including emerging markets, makes political stability a paramount concern. For instance, in 2024, the company's significant presence in regions experiencing heightened geopolitical tensions, such as parts of Eastern Europe and the Middle East, exposes it to potential project delays and supply chain disruptions.

Sudden policy shifts or civil unrest in these operating areas can directly impact project execution and investment security. The World Bank's 2024 Ease of Doing Business report highlighted that political instability in certain developing economies can significantly increase operational risks, a factor Andritz must continuously monitor and mitigate through thorough risk assessment and contingency planning.

Industrial Policies and Local Content Requirements

Many nations are actively fostering domestic industries by implementing policies that prioritize local content, local manufacturing, or the transfer of technology. For a company like Andritz, a global leader in plant engineering and supplier of equipment for the pulp and paper, hydropower, steel, and other specialized industries, this translates into a need to adapt its operational strategies. Meeting these evolving national demands often requires forging local partnerships, establishing joint ventures, or even setting up manufacturing bases within crucial markets to ensure successful project acquisition and adherence to regulatory frameworks.

These industrial policies can significantly influence Andritz's market access and project pipelines. For instance, in 2024, several emerging economies have strengthened their local content mandates in renewable energy projects, with some requiring up to 60% of project components to be sourced domestically. This trend is expected to continue through 2025, directly impacting Andritz's procurement strategies and the feasibility of certain international bids.

Key implications for Andritz include:

- Strategic Local Investment: Evaluating the necessity of establishing or expanding local manufacturing capabilities to meet stringent local content requirements, potentially impacting capital expenditure plans.

- Partnership Development: Actively seeking and nurturing relationships with local suppliers and technology providers to integrate them into Andritz's supply chain and project execution.

- Supply Chain Adaptation: Reconfiguring global supply chains to incorporate locally sourced materials and components, which may involve increased logistics complexity and cost considerations.

- Technology Transfer Negotiations: Engaging in discussions and agreements for technology transfer to local entities to comply with national industrial development goals and secure market entry.

Sanctions and Export Controls

International sanctions and export controls directly impact Andritz's global operations. For instance, restrictions on trade with countries like Russia, which were intensified in 2022 and remain in place through 2024, limit Andritz's access to certain markets and suppliers. This necessitates careful navigation of evolving geopolitical landscapes to avoid penalties.

Compliance with these complex regulations is critical. Andritz must continuously monitor international relations and adapt its sales and operational strategies. Failure to comply can lead to significant legal repercussions and reputational damage, affecting its ability to supply equipment and services in restricted regions.

- Geopolitical Risks: Increased sanctions on Russia and other nations in 2024 impact supply chains and market access.

- Compliance Burden: Andritz faces ongoing costs and complexities in adhering to diverse international trade regulations.

- Market Adjustments: The company must pivot strategies to mitigate the effects of export controls on its business in affected regions.

- Reputational Impact: Non-compliance can severely damage Andritz's standing with customers and international bodies.

Governmental support for green technologies, such as the EU's €750 billion NextGenerationEU recovery plan, directly benefits Andritz's renewable energy and sustainable process technology segments. These policies encourage investments in sectors where Andritz is a key player, like hydropower and sustainable pulp and paper production, driving demand for its solutions through 2024 and into 2025.

The increasing global focus on energy security and decarbonization, evidenced by national targets for renewable energy deployment, creates significant opportunities for Andritz's core businesses. For example, many countries are accelerating investments in hydropower and biomass energy, aligning with Andritz's strategic focus and bolstering its order intake for these technologies.

Andritz's extensive global operations mean that political stability in key markets remains a critical factor. Geopolitical tensions, such as those impacting trade routes or regional stability in 2024, can lead to project delays or increased operational costs. The company's ability to navigate these political risks is essential for maintaining project execution and profitability.

Trade policies and protectionist measures continue to influence Andritz's global business. Tariffs and local content requirements implemented by various nations in 2024 can affect the cost of imported components and market access for its equipment, necessitating adaptive supply chain and market strategies.

What is included in the product

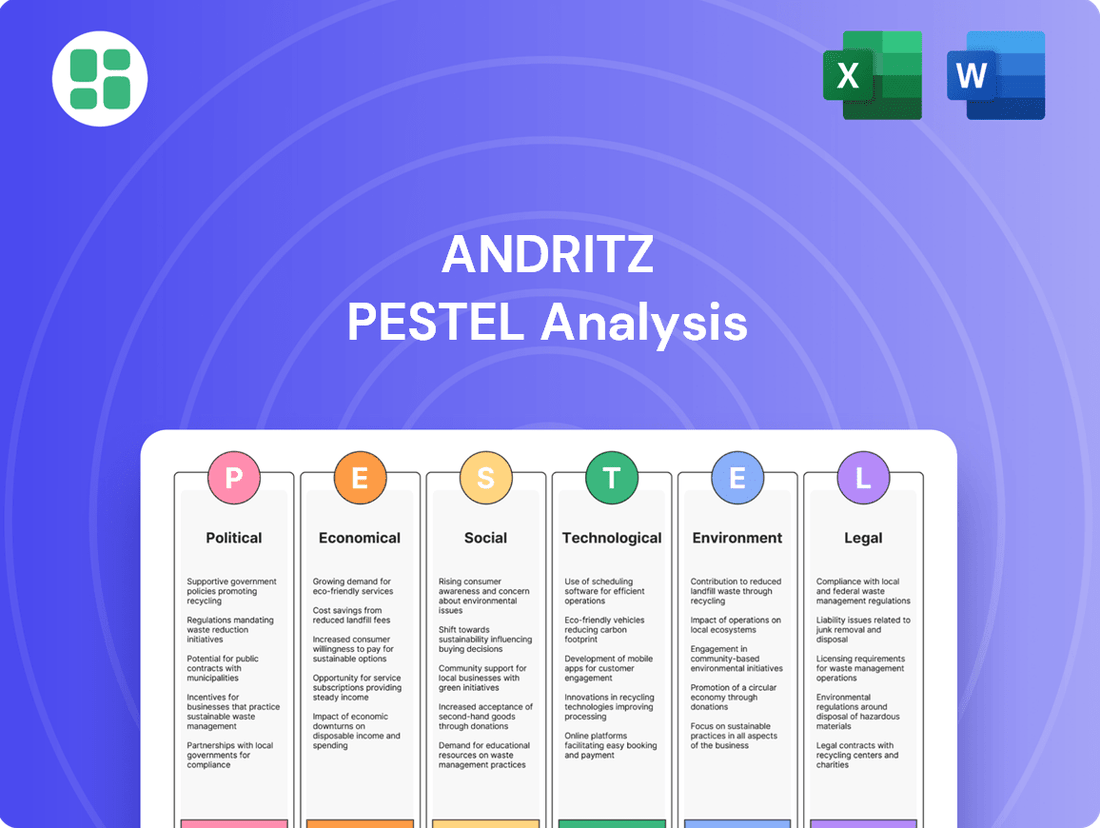

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Andritz, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into market dynamics and regulatory landscapes, enabling strategic decision-making and proactive risk management for Andritz.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for immediate strategic application.

Economic factors

Andritz's performance is intrinsically linked to global economic expansion. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight acceleration from 2023's 3.1%. This growth directly fuels industrial investment in sectors like pulp and paper, metals, and energy, which are Andritz's key markets.

When economies are strong, businesses are more inclined to invest in new facilities, upgrade existing ones, and undertake modernization efforts. This translates into increased demand for Andritz's advanced machinery and comprehensive service offerings. For example, in 2023, Andritz secured significant orders for pulp production lines, reflecting a healthy investment climate in that sector.

Conversely, economic downturns or uncertainties can cause companies to postpone or scale back capital expenditures. This can lead to a contraction in Andritz's order backlog and a slower pace of project execution. A slowdown in global manufacturing output, as seen in some regions during late 2023, directly impacts the demand for industrial equipment.

Fluctuations in commodity prices significantly impact Andritz's business. For instance, the pulp and paper industry, a key market for Andritz, sees its investment decisions heavily tied to pulp prices. When pulp prices are high, as they were in early 2024, it often signals strong demand and can encourage customers to invest in new capacity, boosting Andritz's order book. Conversely, sharp drops in metal prices can dampen mining sector investment, affecting demand for Andritz's equipment in that area.

The cost of raw materials for Andritz's own manufacturing operations is also sensitive to commodity markets. For example, steel prices, a major input for their machinery, directly affect Andritz's cost of goods sold. In 2024, global steel prices experienced volatility due to supply chain adjustments and demand shifts, which Andritz would have had to manage through its procurement strategies to maintain profitability.

Andritz, as a global entity, faces significant exposure to currency exchange rate volatility. Fluctuations in currencies like the Euro, US Dollar, and Chinese Yuan directly affect the value of its international contracts and the cost of imported raw materials. For instance, a stronger Euro could make Andritz's exports more expensive, potentially impacting sales volume.

These currency swings can materially alter Andritz's reported financial results when its foreign earnings are translated back into its reporting currency. In 2023, Andritz reported that currency translation differences had a notable impact on its financial statements, highlighting the need for robust hedging strategies to manage these inherent financial risks.

Inflation and Interest Rate Environment

Rising inflation presents a significant challenge for Andritz by increasing its operational expenses. Costs for essential inputs like labor, energy, and raw materials are on the upswing. For instance, the producer price index for manufacturing in the Eurozone saw a notable increase in early 2024, impacting companies with fixed-price contracts. This surge in costs can directly affect Andritz's profitability, particularly on long-term projects where prices are set in advance.

The current interest rate environment also poses a hurdle. Central banks globally have been raising rates to combat inflation, making borrowing more expensive. For Andritz, this means a higher cost of capital for its own investments and expansion plans. Simultaneously, its customers, often involved in large capital-intensive projects, face increased financing costs. This can lead to delays in investment decisions or a reduction in project scope, potentially dampening demand for Andritz's products and services.

- Increased Operational Costs: Global inflation trends in 2024 have pushed up material and energy prices, directly impacting manufacturing costs.

- Higher Cost of Capital: Central bank interest rate hikes in major economies like the US and Eurozone in 2023-2024 increase borrowing costs for both Andritz and its clients.

- Impact on Project Financing: Elevated interest rates make large-scale industrial projects, a key market for Andritz, more expensive to finance, potentially slowing investment.

- Margin Squeeze on Fixed Contracts: Rising input costs can erode profit margins on existing fixed-price contracts if not adequately hedged or passed on.

Investment Cycles in Key End Markets

Andritz's performance is closely tied to the investment rhythms of its core sectors: hydropower, pulp and paper, and metals. These industries experience distinct investment cycles, often spurred by evolving demand, the adoption of new technologies, and shifts in environmental regulations. For instance, the global pulp and paper industry saw significant investment in new capacity and upgrades in 2023, with projections for continued capital expenditure in 2024 driven by demand for sustainable packaging and tissue products.

Navigating these cyclical tides is fundamental for Andritz's strategic planning. The company must adeptly manage its production levels, research and development funding, and sales approaches to capitalize on periods of robust investment and mitigate risks during slower phases. For example, a surge in renewable energy projects, particularly in hydropower, can lead to increased demand for Andritz's turbines and equipment, as seen in the strong pipeline of hydropower projects in emerging markets throughout 2024.

- Hydropower: Global investments in hydropower are expected to remain strong, with an estimated USD 100 billion to be invested annually through 2030, according to the International Energy Agency (IEA), providing a consistent demand driver for Andritz.

- Pulp & Paper: The sector is experiencing a transformation, with a focus on sustainability and e-commerce driving investments in new paper and packaging lines. Global capital expenditure in pulp and paper was projected to reach over USD 30 billion in 2024.

- Metals: While more volatile, the metals industry sees significant investment driven by demand for electric vehicles and infrastructure projects. Investments in steel and aluminum production capacity are anticipated to grow, particularly in regions with strong manufacturing bases.

- Andritz's Strategy: The company's ability to offer integrated solutions across these sectors allows it to balance the impact of individual industry cycles, leveraging strengths in one market to offset potential weaknesses in another.

Global economic expansion is a primary driver for Andritz, influencing investment in its key sectors. The IMF projected global growth at 3.2% for 2024, a slight increase from 2023, which supports industrial investments in pulp and paper, metals, and energy. This growth encourages capital expenditures on new facilities and upgrades, directly benefiting Andritz's machinery and service demand.

Fluctuations in commodity prices, such as pulp and steel, significantly impact Andritz's profitability and customer investment decisions. For instance, strong pulp prices in early 2024 incentivized capacity investments in that sector, boosting Andritz's order book, while volatile steel prices affect its own manufacturing costs.

Currency exchange rate volatility, particularly with the Euro, US Dollar, and Chinese Yuan, affects Andritz's international contracts and raw material costs. In 2023, currency translation differences notably impacted Andritz's financial statements, underscoring the need for effective hedging strategies.

Rising inflation in 2024 increased Andritz's operational costs, including labor, energy, and materials, potentially squeezing margins on fixed-price contracts. Concurrently, higher interest rates globally make capital more expensive, impacting both Andritz's financing and its customers' project investment decisions.

| Economic Factor | 2023/2024 Trend | Impact on Andritz | Supporting Data/Example |

| Global GDP Growth | Slight Acceleration (IMF: 3.2% in 2024) | Increased demand for industrial equipment and services | IMF projected 3.2% global growth for 2024. |

| Commodity Prices (Pulp, Steel) | Volatility, with strong pulp prices early 2024 | Influences customer investment decisions; affects Andritz's input costs | Strong pulp prices encouraged pulp sector investment in 2023/2024. |

| Currency Exchange Rates | Significant Volatility (EUR, USD, CNY) | Impacts value of international contracts and reported financials | Andritz noted notable currency translation impacts in 2023. |

| Inflation | Rising operational costs (labor, energy, materials) | Potential margin erosion on fixed contracts; increased operational expenses | Eurozone producer price index for manufacturing increased in early 2024. |

| Interest Rates | Rising globally | Higher cost of capital for Andritz and its customers; potential project delays | Central banks raised rates to combat inflation in 2023-2024. |

Preview Before You Purchase

Andritz PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Andritz PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing crucial insights for strategic planning.

Sociological factors

Societal awareness regarding environmental impact is a significant driver for Andritz. Consumers and businesses alike are increasingly prioritizing eco-friendly products and services. This translates directly into demand for more sustainable production methods across various sectors.

In 2024, the global market for sustainable packaging, a key area for pulp and paper customers, was projected to reach over $300 billion, highlighting the scale of this shift. This growing preference for sustainability compels Andritz's clients in industries like pulp & paper and metals to upgrade their operations.

Consequently, there's a heightened investment in energy-efficient machinery and advanced resource recovery systems. Andritz's focus on sustainable technologies positions it well to capitalize on this trend, creating substantial new market opportunities for its innovative solutions.

Andritz, like many global technology firms, is navigating the complexities of an aging workforce, particularly in critical areas like specialized engineering and advanced manufacturing. This demographic shift presents a tangible risk of skill shortages across its various operational hubs.

The company's ability to maintain its edge in technological innovation and operational smoothness hinges on its success in attracting and retaining skilled professionals. Investing in robust training initiatives and cultivating an inclusive workplace culture are therefore paramount for Andritz's future.

For instance, in 2024, the global engineering sector reported a significant deficit in digitally skilled workers, with projections indicating this gap will widen. Andritz's strategic focus on digitalization and advanced manufacturing means addressing this talent crunch is a key priority.

Societal expectations for corporate responsibility are significantly shaping how companies like Andritz operate. Stakeholders, from investors to employees and the general public, are increasingly demanding that businesses go beyond profit and actively contribute to social and environmental well-being. This translates into a need for ethical sourcing, fair labor, community involvement, and clear reporting on environmental and social impacts.

For instance, a 2024 survey revealed that 70% of consumers consider a company's CSR efforts when making purchasing decisions, directly impacting brand loyalty and sales. Furthermore, responsible investors are channeling more capital into companies with strong Environmental, Social, and Governance (ESG) profiles, with ESG funds projected to reach $33.9 trillion globally by 2026, according to Bloomberg Intelligence. Companies like Andritz that prioritize these aspects not only bolster their reputation but also attract capital and talent.

Urbanization and Infrastructure Development

Global urbanization continues to accelerate, with projections indicating that by 2050, nearly 70% of the world's population will reside in urban areas. This trend directly fuels the demand for robust infrastructure, including energy generation and essential raw materials. Andritz benefits indirectly from this phenomenon, seeing increased opportunities in hydropower projects that supply these growing urban centers. Furthermore, the demand for pulp and paper products, particularly for packaging and hygiene, rises with urbanization, as does the need for metals vital for construction and manufacturing, all of which align with Andritz's key operational segments and offer sustained growth potential.

The infrastructure development spurred by urbanization translates into tangible market opportunities for Andritz. For instance, the global renewable energy sector, heavily reliant on infrastructure upgrades, is expected to see significant investment. The International Energy Agency (IEA) reported in 2024 that renewable power capacity additions reached a record high in 2023, a trend anticipated to continue. This expansion directly supports Andritz's role in providing equipment and solutions for hydropower, a critical component of urban energy supply. Additionally, the surge in demand for sustainable packaging solutions, driven by e-commerce growth in urban areas, bolsters the pulp and paper sector where Andritz is a major player.

- Urban Population Growth: By 2050, 68% of the global population is projected to live in urban areas, up from 56% in 2021.

- Hydropower Demand: Urbanization necessitates increased electricity consumption, driving demand for reliable energy sources like hydropower, a core area for Andritz.

- Pulp & Paper Market: Increased urban living and e-commerce growth boost demand for paper-based packaging and hygiene products, benefiting Andritz's pulp and paper segment.

- Infrastructure Investment: Global infrastructure spending is projected to reach trillions of dollars annually in the coming decade, creating opportunities for companies like Andritz involved in construction and manufacturing supply chains.

Health and Safety Standards

Societal expectations and regulatory requirements for occupational health and safety are increasingly rigorous globally, particularly within heavy industries where Andritz is a key player. This heightened focus directly impacts operational procedures and product design.

Maintaining top-tier safety standards for employees, contractors, and in equipment design and operation is not merely a legal obligation. It's fundamental for Andritz's reputation, risk mitigation, and cultivating a motivated workforce. For example, in 2023, workplace safety initiatives across the manufacturing sector aimed to reduce incident rates by 5-10% compared to 2022, reflecting this trend.

- Increased regulatory scrutiny on safety protocols in industries like pulp and paper, and hydropower.

- Growing employee and public demand for safe working environments and reliable equipment.

- Potential for significant financial penalties and reputational damage for non-compliance with health and safety legislation.

Societal demand for greater corporate responsibility is a significant influence on Andritz. Stakeholders increasingly expect companies to contribute positively to social and environmental well-being, not just focus on profits. This translates into a need for ethical practices across the board.

For example, a 2024 survey indicated that 70% of consumers consider a company's corporate social responsibility (CSR) efforts when making purchasing decisions. Furthermore, responsible investors are directing more capital towards companies with strong Environmental, Social, and Governance (ESG) profiles, with ESG funds projected to reach $33.9 trillion globally by 2026.

This emphasis on CSR and ESG performance directly impacts Andritz's reputation, ability to attract investment, and talent acquisition. Companies that prioritize these aspects, like Andritz, are better positioned for long-term success and stakeholder trust.

Technological factors

Andritz is aggressively integrating digitalization and Industry 4.0 principles, evident in their development of smart sensors and advanced data analytics. These technologies are crucial for offering predictive maintenance solutions, directly improving operational efficiency and minimizing downtime for their clients' plants and equipment.

This strategic focus on data-driven solutions solidifies Andritz's position as an innovator. For instance, by Q3 2024, the company reported a significant increase in demand for their digital service packages, contributing to a notable portion of their aftermarket revenue growth, underscoring the competitive advantage gained through these technological investments.

Andritz is heavily influenced by technological advancements in sustainable production. Innovations like advanced recycling for paper and plastics, green hydrogen for steel, and more efficient hydropower turbines are key growth areas. For instance, Andritz's focus on circular economy solutions in the pulp and paper sector directly addresses the growing demand for recycled materials, with global recycled paper consumption projected to reach over 250 million tonnes by 2027.

The manufacturing sector, a core area for Andritz, is seeing a significant surge in automation and robotics. This trend directly impacts efficiency, safety, and product quality, both in Andritz's production lines and for its global customer base. For instance, the global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to grow substantially, demonstrating the widespread adoption of these technologies.

To maintain its competitive edge, Andritz must consistently embed cutting-edge automation into its equipment designs. Furthermore, offering advanced robotic solutions to clients is crucial. This ensures Andritz’s portfolio remains aligned with the industry's drive for enhanced industrial productivity and cost optimization, a necessity in a market where operational efficiency is paramount.

Artificial Intelligence (AI) and Machine Learning (ML) Applications

Artificial Intelligence (AI) and Machine Learning (ML) are fundamentally reshaping industrial operations. These technologies allow for advanced data analysis, predictive capabilities, and increasingly autonomous control systems. Andritz is well-positioned to leverage AI and ML to refine plant efficiency, optimize maintenance, elevate product quality, and pioneer new smart services, thereby delivering substantial customer value and reinforcing its status as an industry innovator.

The adoption of AI and ML presents significant opportunities for Andritz. For instance, in 2024, the global industrial AI market was projected to reach over $10 billion, with continued strong growth expected. Andritz can integrate these capabilities across its product lines:

- Optimized Process Control: Implementing AI algorithms to dynamically adjust parameters in real-time for pulp and paper production lines, potentially leading to a 5-10% increase in throughput and a reduction in energy consumption.

- Predictive Maintenance: Utilizing ML models to analyze sensor data from turbines and other heavy machinery, predicting potential failures weeks in advance and reducing unplanned downtime by up to 20%.

- Enhanced Quality Assurance: Deploying computer vision powered by AI to inspect finished products, identifying defects with greater accuracy and consistency than manual inspection, thereby improving customer satisfaction.

- Development of Smart Services: Offering customers data-driven insights and remote monitoring services powered by AI, creating new revenue streams and strengthening customer relationships.

Cybersecurity Threats to Industrial Control Systems (ICS)

As industrial systems increasingly embrace digitalization and the Internet of Things (IoT), the vulnerability of Industrial Control Systems (ICS) to cyberattacks escalates. This trend poses a significant risk to operational continuity and data integrity for companies like Andritz and its clients. For instance, the global average cost of a data breach in 2024 was estimated at $4.73 million, a figure that can be substantially higher for critical infrastructure disruptions.

Andritz must therefore maintain a proactive stance, investing heavily in its own IT infrastructure security while ensuring its delivered solutions offer robust protection. This includes safeguarding sensitive operational data and preventing costly downtime caused by cyber threats. The company’s commitment to cybersecurity is crucial for maintaining customer trust and operational resilience in an evolving threat landscape.

- Increased attack surface: Digitalization expands the entry points for cyber adversaries targeting ICS.

- Financial impact: Cyberattacks can lead to significant financial losses through downtime, data recovery, and reputational damage, with the average cost of a data breach in 2024 reaching $4.73 million globally.

- Operational disruption: Compromised ICS can halt production, affect safety, and damage critical infrastructure.

- Need for continuous investment: Ongoing investment in advanced cybersecurity measures is essential for both internal systems and customer solutions.

Technological advancements are a cornerstone of Andritz's strategy, particularly in digitalization and Industry 4.0. The company is actively developing smart sensors and advanced data analytics to offer predictive maintenance, which by Q3 2024, showed a significant increase in demand for digital service packages, boosting aftermarket revenue.

Innovations in sustainable production, such as advanced recycling technologies and more efficient hydropower turbines, are also critical growth drivers, aligning with the global recycled paper consumption projected to exceed 250 million tonnes by 2027. Automation and robotics are transforming manufacturing efficiency, with the global industrial robotics market valued at approximately $50 billion in 2023.

AI and Machine Learning are being integrated to optimize process control, predictive maintenance, and quality assurance, tapping into a global industrial AI market projected to surpass $10 billion in 2024. However, this digitalization increases the risk of cyberattacks on Industrial Control Systems, with the global average cost of a data breach in 2024 reaching $4.73 million, necessitating robust cybersecurity investments.

Legal factors

Andritz's operations are significantly shaped by environmental regulations, including those for emissions, waste, and water usage. Stricter global standards, particularly concerning carbon output and industrial wastewater, directly influence the engineering of Andritz's machinery. This regulatory landscape, however, also spurs demand for the company's environmentally conscious technologies, especially within the pulp & paper and metals sectors, as businesses seek to meet compliance requirements.

As a global company, Andritz is deeply affected by international trade laws. For instance, anti-dumping duties can significantly impact the cost of imported components or finished goods, as seen when the European Union imposed anti-dumping measures on certain steel products in early 2024. Navigating these regulations, along with import/export controls and customs, is essential for Andritz's operations, requiring constant legal vigilance.

Andritz's core business thrives on its advanced engineering and unique product designs, making intellectual property protection paramount. Robust IP laws, including patents, trademarks, and trade secrets, are essential for safeguarding these innovations across its global operations. For instance, in 2024, Andritz continued to actively pursue patent applications in key markets like the EU and North America to secure its technological edge in areas such as green technologies and digital solutions.

The effective enforcement of these IP laws is critical for Andritz to maintain its competitive advantage and prevent unauthorized use of its proprietary technologies. The company's commitment to IP protection is demonstrated by its proactive approach to monitoring the market and taking legal action against any infringements, thereby preserving the value of its innovations and ensuring a fair playing field.

Labor Laws and Employment Regulations

Andritz navigates a complex landscape of labor laws across its global operations, impacting everything from hiring practices to employee benefits. For example, in Germany, where Andritz has a significant presence, works councils (Betriebsräte) play a crucial role in co-determination, influencing decisions on working hours and personnel matters. Ensuring adherence to these diverse national regulations, such as the UK's Equality Act 2010 or France's strict employment protection laws, is paramount for maintaining operational continuity and fostering positive employee relations.

The company's commitment to compliance is underscored by the need to manage varying minimum wage requirements, overtime rules, and health and safety standards. In 2024, for instance, many European countries saw adjustments to minimum wages, directly affecting Andritz's payroll costs and operational planning in those regions. Failure to comply can lead to significant fines and reputational damage, making proactive legal counsel and robust internal policies critical for Andritz's workforce management.

- Global Workforce Diversity: Andritz employs thousands across numerous countries, each with distinct labor legal frameworks.

- Compliance Imperative: Adherence to varied employment contracts, working conditions, wages, and collective bargaining agreements is vital.

- Risk Mitigation: Strict compliance prevents disputes, ensures fair labor practices, and maintains workforce stability.

- Evolving Regulations: Staying abreast of changes in labor laws, like minimum wage adjustments in 2024, is crucial for cost management and operational integrity.

Contract Law and Project Liability

Andritz's global operations involve complex, large-scale projects, making contract law and liability management absolutely essential. These contracts need to meticulously outline project scope, who is responsible for what, deadlines, and potential liabilities, particularly for delays, performance promises, and safety regulations. For instance, in 2023, Andritz reported a significant order backlog, highlighting the sheer volume of contractual commitments they manage across diverse international markets, each with its own legal nuances. Failure to navigate these legal frameworks effectively can lead to substantial financial penalties and damage to their reputation.

Key considerations within Andritz's contract law and project liability framework include:

- Jurisdictional Risk Mitigation: Andritz must actively understand and reduce legal risks stemming from project execution in various countries, ensuring compliance with local laws and regulations to safeguard their financial standing and public image.

- Clear Contractual Definitions: Precisely defining project scope, responsibilities, timelines, performance guarantees, and safety standards within contracts is crucial to prevent disputes and manage liabilities effectively.

- Liability Cap and Insurance: Implementing appropriate liability caps and securing comprehensive insurance coverage are vital strategies to protect Andritz from unforeseen financial consequences arising from project execution.

Andritz operates under a framework of international and national laws, including environmental regulations, trade agreements, and intellectual property rights. These legal factors directly influence the company's engineering practices, supply chain management, and innovation protection. Navigating diverse legal landscapes, such as differing labor laws or customs regulations, requires constant vigilance and adaptation to ensure compliance and mitigate risks.

The company's reliance on intellectual property necessitates robust legal strategies to protect its technological advancements. For example, Andritz actively pursues patent applications globally to secure its innovations in green technologies and digital solutions. Similarly, adherence to labor laws across its numerous operating countries is crucial, with evolving regulations like minimum wage adjustments in 2024 impacting operational costs and workforce management.

Contract law and liability management are paramount given Andritz's large-scale global projects. Ensuring clear contractual definitions and mitigating jurisdictional risks are key to preventing disputes and financial penalties. The company's commitment to compliance across all legal domains is essential for maintaining its operational integrity and reputation.

Environmental factors

Global initiatives to curb climate change are fueling substantial investments in renewable energy and decarbonization, a trend that directly bolsters Andritz's hydropower sector. The company's expertise in energy-efficient and low-carbon technologies for pulp & paper and metals aligns perfectly with customer needs to lower greenhouse gas emissions and achieve national climate objectives.

The market for sustainable technologies is experiencing robust growth, with projections indicating continued expansion. For instance, the global renewable energy market was valued at approximately USD 1.2 trillion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 8% through 2030, creating significant opportunities for companies like Andritz offering decarbonization solutions.

Growing worries about the depletion of vital resources like water, raw materials, and energy are driving industries to adopt more circular economy approaches. This shift is creating significant opportunities for companies that can offer solutions for resource efficiency and waste reduction.

Andritz is particularly well-positioned in this evolving landscape. Their advanced recycling technologies, especially for the pulp and paper sector, alongside solutions designed for efficient resource use in metals and separation processes, directly address this market need. For instance, in 2023, Andritz reported a strong order intake in its various segments, reflecting the increasing demand for sustainable technologies that help clients minimize waste and enhance resource recovery.

Growing concerns over water scarcity and industrial pollution are driving more stringent environmental regulations globally. This trend directly impacts industries that are heavy water users, pushing them towards more sustainable practices.

Andritz is well-positioned to capitalize on this shift, especially with its technologies for the pulp & paper and separation industries. Their solutions focus on efficient water usage, advanced wastewater treatment, and effective sludge management, directly addressing these environmental challenges for their clients. For instance, in 2023, Andritz's order intake in the pulp & paper segment saw significant growth, partly driven by demand for eco-friendly solutions.

Biodiversity Protection and Land Use Considerations

Andritz's large-scale projects, particularly in hydropower, necessitate careful consideration of biodiversity and land use. These developments can significantly alter local ecosystems, impacting flora and fauna. For instance, the construction of a new dam might require extensive land clearing, potentially displacing species and disrupting habitats.

To maintain its social license to operate and ensure sustainable development, Andritz must integrate robust biodiversity protection measures and responsible land-use planning into its project lifecycle. This includes thorough environmental impact assessments (EIAs) and adherence to evolving global conservation standards. Companies are increasingly scrutinized for their environmental footprint, with investors and stakeholders demanding demonstrable commitment to ecological preservation. For example, in 2023, the EU's Nature Restoration Law proposed ambitious targets for restoring degraded ecosystems, signaling a stricter regulatory landscape that will likely influence industrial project approvals.

- Ecosystem Impact: Hydropower projects can alter river flows, sediment transport, and aquatic habitats, affecting fish populations and riparian ecosystems.

- Land Use Planning: Balancing industrial needs with conservation goals requires careful site selection and mitigation strategies to minimize habitat fragmentation.

- Regulatory Compliance: Adherence to national and international environmental regulations, including EIAs and biodiversity action plans, is crucial for project approval and ongoing operations.

- Stakeholder Expectations: Growing public and investor awareness of biodiversity loss pressures companies like Andritz to adopt proactive conservation approaches.

Waste Management and Recycling Regulations

Governments worldwide are tightening waste management and recycling regulations, driven by both environmental concerns and a desire to promote a circular economy. This trend directly impacts industries like pulp and paper, where Andritz's advanced separation technologies play a crucial role. For instance, the European Union's Waste Framework Directive continues to push for higher recycling rates, with specific targets for municipal waste and packaging waste, influencing how paper manufacturers handle their by-products and waste streams.

Andritz's innovative solutions are designed to help clients meet these increasingly stringent requirements. Their technologies facilitate the recovery of valuable fibers and materials from paper recycling processes, thereby reducing the volume of waste sent to landfills. This not only aids compliance but also unlocks economic opportunities by transforming waste into reusable resources, aligning with the growing emphasis on resource efficiency across global supply chains.

- Evolving Regulations: Stricter waste and recycling laws, such as those in the EU aiming for a 65% recycling rate for municipal waste by 2035, necessitate advanced waste management solutions.

- Andritz's Role: The company's separation technologies are key for industries like pulp and paper to process waste streams effectively, enabling resource recovery.

- Circular Economy Focus: By facilitating the recycling of paper and recovering valuable components, Andritz supports the transition towards a more circular economy, reducing reliance on virgin materials and landfill disposal.

- Customer Benefits: Andritz's offerings help customers comply with regulations, lower disposal costs, and extract economic value from waste, enhancing their sustainability profile and operational efficiency.

Global efforts to combat climate change are driving significant investment in renewable energy, directly benefiting Andritz's hydropower sector. The company's focus on energy-efficient and low-carbon technologies for pulp & paper and metals aligns with customer demands for reduced emissions and achievement of national climate goals.

Growing concerns about resource depletion, including water, raw materials, and energy, are accelerating the adoption of circular economy principles. This shift creates substantial opportunities for companies like Andritz that offer solutions for enhanced resource efficiency and waste reduction.

Stricter regulations on waste management and recycling, spurred by environmental concerns and circular economy ambitions, are compelling industries such as pulp and paper to seek advanced solutions. Andritz's separation technologies are crucial for these sectors in recovering valuable materials and minimizing landfill waste.

Andritz's large-scale projects, particularly in hydropower, necessitate careful management of biodiversity and land use impacts to ensure sustainable development. Integrating robust biodiversity protection and responsible land-use planning is essential for regulatory compliance and stakeholder acceptance.

| Environmental Factor | Impact on Andritz | Data/Trend (2023-2025) |

|---|---|---|

| Climate Change & Decarbonization | Increased demand for renewable energy solutions (hydropower) and energy-efficient technologies. | Global renewable energy market valued at ~USD 1.2 trillion in 2023, with an expected CAGR over 8% through 2030. Andritz's order intake in pulp & paper reflects demand for eco-friendly solutions. |

| Resource Scarcity & Circular Economy | Opportunities for waste reduction and resource recovery solutions, especially in pulp & paper and metals sectors. | Strong order intake in 2023 for technologies enabling resource efficiency and waste minimization. |

| Waste Management & Recycling Regulations | Demand for advanced separation and recycling technologies to meet stricter compliance. | EU targets for municipal waste recycling (e.g., 65% by 2035) drive adoption of Andritz's paper recycling solutions. |

| Biodiversity & Land Use | Need for responsible project planning, environmental impact assessments, and conservation measures for large infrastructure projects. | EU's Nature Restoration Law signals a stricter regulatory environment for industrial projects impacting ecosystems. |

PESTLE Analysis Data Sources

Our Andritz PESTLE Analysis is built on a robust foundation of data from leading international financial institutions, national government publications, and reputable industry-specific research firms. This ensures comprehensive coverage of political stability, economic forecasts, environmental regulations, and technological advancements impacting the pulp, paper, and metals industries.