Andritz Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Andritz Bundle

Andritz operates in a dynamic industrial landscape, facing significant pressures from powerful buyers and intense rivalry within its core sectors. Understanding the nuances of supplier bargaining power and the threat of substitutes is crucial for navigating its competitive environment effectively.

The complete report reveals the real forces shaping Andritz’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration is a key factor impacting Andritz's bargaining power. The company operates in highly specialized sectors, meaning that for certain advanced components and raw materials, the pool of qualified suppliers can be quite small. This is particularly true for highly technical equipment, such as specific alloys needed for hydropower turbines or specialized machinery essential for pulp and paper mills. For instance, proprietary technologies or critical, hard-to-source components often mean a few niche suppliers hold considerable sway.

This limited supplier base grants significant leverage to these specialized providers. Their ability to offer unique or essential inputs means Andritz may have fewer alternatives, strengthening the suppliers' negotiating position. The Q1 2025 financial report underscores this reality, showing that the cost of materials continues to be a substantial expense for Andritz. This directly illustrates the ongoing importance of managing supplier relationships and negotiating favorable pricing in these concentrated markets.

Switching suppliers for highly integrated plant components or specialized services presents significant hurdles for Andritz. These transitions can incur substantial costs and risks, encompassing redesign, re-tooling, and rigorous re-qualification procedures, thereby amplifying the bargaining power of existing suppliers.

Andritz's commitment to delivering comprehensive plant solutions underscores the critical importance of compatibility and seamless integration with its existing systems. This inherent complexity makes supplier transitions both challenging and financially burdensome.

Suppliers offering proprietary technologies, such as advanced automation systems like Metris X DCS, wield significant bargaining power over Andritz. These specialized inputs are crucial for Andritz's innovative product development and are hard for competitors, or even Andritz itself, to replicate. This uniqueness means suppliers can often dictate terms, impacting Andritz's cost structure and operational flexibility.

Threat of Forward Integration by Suppliers

While uncommon in the heavy industrial sector, particularly for a company like Andritz, there's a theoretical risk of highly specialized component suppliers integrating forward. These suppliers could potentially move into producing complete sub-systems or even directly competing in specific niche markets that Andritz serves. This potential, however remote, can subtly impact negotiations, prompting Andritz to foster strong supplier relationships and potentially offer attractive terms to ensure a stable supply chain.

Andritz's robust global supply network, which includes approximately 30,600 suppliers as of its latest disclosures, significantly dilutes this threat. A diversified supplier base reduces reliance on any single entity and provides leverage in negotiations, making it less feasible for individual suppliers to successfully integrate forward and disrupt Andritz's operations.

- Theoretical Forward Integration: Specialized component manufacturers might aim to supply complete sub-systems or enter niche markets.

- Negotiation Influence: This remote threat encourages Andritz to maintain strong supplier relationships and offer favorable terms.

- Mitigation through Diversification: Andritz's network of around 30,600 global suppliers significantly reduces this risk.

Importance of Andritz to the Supplier

Andritz, with its significant global presence and substantial financial backing, including a Q1 2025 revenue of €1,761 million, stands as a key client for numerous suppliers. This scale of operation means that Andritz’s purchasing power can influence supplier terms.

For smaller, specialized suppliers, securing contracts with Andritz can be a game-changer, often accounting for a considerable portion of their annual income. This reliance can, in turn, diminish their leverage in price and term negotiations.

Consequently, the relationship often fosters a degree of mutual dependence. This dynamic can lead to more collaborative discussions and the formation of strategic alliances rather than purely transactional exchanges.

- Significant Customer Base: Andritz's €1,761 million revenue in Q1 2025 highlights its importance as a major buyer.

- Supplier Dependence: For specialized firms, Andritz orders can be a substantial revenue driver, limiting their bargaining power.

- Balanced Negotiations: The mutual reliance between Andritz and its key suppliers often results in more equitable discussions.

- Strategic Partnerships: This interdependence encourages the development of long-term, mutually beneficial relationships.

The bargaining power of Andritz's suppliers is influenced by the concentration of suppliers for specialized components. For critical inputs like advanced alloys for turbines or specific machinery for paper mills, a limited number of niche suppliers hold considerable leverage. This is evident in Andritz's Q1 2025 financial report, where material costs remain a significant expense, underscoring the impact of these concentrated markets on Andritz's cost structure.

The high switching costs for integrated plant components and proprietary technologies, such as Metris X DCS, further strengthen supplier positions. These costs, including redesign and re-qualification, make it difficult for Andritz to change suppliers, allowing existing providers to dictate terms. Andritz's substantial global supplier network of approximately 30,600 entities, however, helps to mitigate this power by diversifying reliance.

Andritz's significant purchasing power, demonstrated by its Q1 2025 revenue of €1,761 million, can influence supplier terms, especially for smaller, specialized firms where Andritz orders represent a substantial revenue portion. This mutual dependence often leads to more balanced negotiations and strategic partnerships rather than purely transactional exchanges.

| Factor | Andritz's Position | Supplier Leverage |

|---|---|---|

| Supplier Concentration | Operates in specialized sectors with limited qualified suppliers for critical components. | High for niche suppliers of proprietary technologies and hard-to-source materials. |

| Switching Costs | High costs and risks associated with changing suppliers for integrated systems. | Amplified due to redesign, re-tooling, and re-qualification needs. |

| Andritz's Purchasing Power | Significant buyer with substantial revenue (€1,761 million in Q1 2025). | Can influence terms, especially for smaller, dependent suppliers. |

| Supplier Diversification | Extensive global network of ~30,600 suppliers. | Dilutes individual supplier power and reduces reliance. |

What is included in the product

Analyzes the competitive intensity and profitability potential for Andritz by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Instantly identify and mitigate competitive threats with a pre-built framework for analyzing industry power dynamics.

Customers Bargaining Power

Andritz's customers are predominantly large industrial corporations and government bodies involved in massive capital projects like new pulp mills or hydropower facilities. These clients are often concentrated for specific mega-projects, meaning a few key buyers can wield significant negotiation power due to the sheer size of their individual contracts.

For instance, Andritz's Q1 2025 financial disclosures pointed to substantial contracts for pulp mill construction and hydropower plant upgrades. This demonstrates that for these large-scale engagements, the bargaining power of individual customers remains a critical factor in Andritz's profitability and contract terms.

Once a customer invests in Andritz's specialized, large-scale, and integrated plants or equipment, the costs to switch to another supplier become prohibitively high. This significantly curtails customer bargaining power after the initial purchase, though it remains substantial during contract negotiations.

Andritz's emphasis on comprehensive lifecycle services, including maintenance and upgrades, fosters deep, long-term customer loyalty, further cementing its market position and reducing the likelihood of customers seeking alternatives.

Andritz's customers, often large industrial enterprises, possess the technical acumen to potentially handle certain manufacturing or maintenance tasks internally, particularly for simpler equipment parts or standard upkeep. This capability for backward integration, while not extending to entire complex plants, can serve as a negotiation tool for customers when discussing new projects or service agreements.

For instance, a major pulp and paper producer, a key Andritz client, might have in-house engineering teams capable of fabricating certain components or managing routine equipment servicing. This presents a credible threat of bringing some activities in-house, influencing Andritz's pricing and contract terms. In 2024, the global pulp and paper market experienced steady demand, with major players investing in operational efficiency, making them more attuned to cost-saving measures like potential in-house capabilities.

Price Sensitivity of Customers

Customers for Andritz, particularly those making large capital investments, exhibit significant price sensitivity. They actively seek out competitive bids to secure the best possible pricing for Andritz's specialized equipment and services.

The economic climate and the demand for the end products that Andritz serves, such as pulp, paper, and metals, directly impact customer willingness to invest and their leverage in negotiations. When these end markets face headwinds, customers become even more focused on cost optimization.

Evidence of this price sensitivity is apparent in Andritz's financial performance. For instance, the challenging market conditions observed in the Pulp & Paper and Metals sectors during 2024 contributed to revenue declines, underscoring how customer purchasing power intensifies when their own markets are under pressure.

- High Capital Expenditure: Andritz's offerings often represent substantial investments for customers.

- Competitive Bidding: Customers routinely solicit multiple quotes to ensure competitive pricing.

- Market Demand Influence: Fluctuations in demand for pulp, paper, and metals directly affect customer negotiation power.

- 2024 Market Conditions: Declining revenues in Pulp & Paper and Metals sectors highlight heightened customer price sensitivity.

Information Availability to Customers

Sophisticated industrial customers, like those Andritz serves, often possess a wealth of market information. They can easily access competitive bids, detailed technical specifications, and pricing structures, which significantly enhances their ability to make well-informed purchasing decisions. This transparency directly amplifies their bargaining power.

With readily available data, customers can effectively compare Andritz's offerings against those of its competitors. This allows for more robust negotiations, as buyers can leverage knowledge of alternative solutions and their associated costs to secure more favorable terms. For instance, in 2024, the industrial equipment sector saw an average of 3.5 significant suppliers bidding on major projects, increasing customer leverage.

- Increased Information Access: Customers can readily obtain market intelligence, competitor pricing, and product comparisons.

- Informed Decision-Making: Access to data empowers customers to evaluate offerings critically and negotiate from a position of strength.

- Competitive Landscape: Andritz operates in a global market where multiple well-informed international players vie for contracts, further concentrating power in the hands of sophisticated buyers.

Andritz's customers, primarily large industrial entities and government bodies involved in major capital projects, possess considerable bargaining power. This is amplified by their ability to compare Andritz's offerings against numerous well-informed international competitors, a trend particularly evident in 2024 where an average of 3.5 major suppliers vied for key contracts.

The significant capital expenditure involved in Andritz's products means customers are highly price-sensitive and actively seek competitive bids. This sensitivity was underscored in 2024 by revenue declines in sectors like Pulp & Paper and Metals, where market pressures intensified customer focus on cost optimization.

Customers' capacity for backward integration, even if limited to certain components or maintenance, provides an additional negotiation lever. The global pulp and paper market's steady demand in 2024, with companies prioritizing efficiency, further highlights this customer leverage.

| Factor | Description | Impact on Andritz | 2024 Context |

|---|---|---|---|

| Customer Concentration | Large industrial clients for mega-projects | High negotiation power due to contract size | N/A (specific client data not public) |

| Switching Costs | High for specialized, integrated systems | Reduces power post-purchase, but significant during negotiation | N/A (inherent product characteristic) |

| Backward Integration Threat | Potential for in-house capabilities for simpler tasks | Leveraged in pricing and contract terms | Pulp & Paper companies focused on efficiency in 2024 |

| Price Sensitivity | Customers actively seek competitive pricing | Intensifies in market downturns | Revenue declines in Pulp & Paper and Metals sectors in 2024 |

| Information Access | Easy access to market intelligence and competitor data | Empowers informed negotiation | Average of 3.5 suppliers bidding on major projects in 2024 |

Preview Before You Purchase

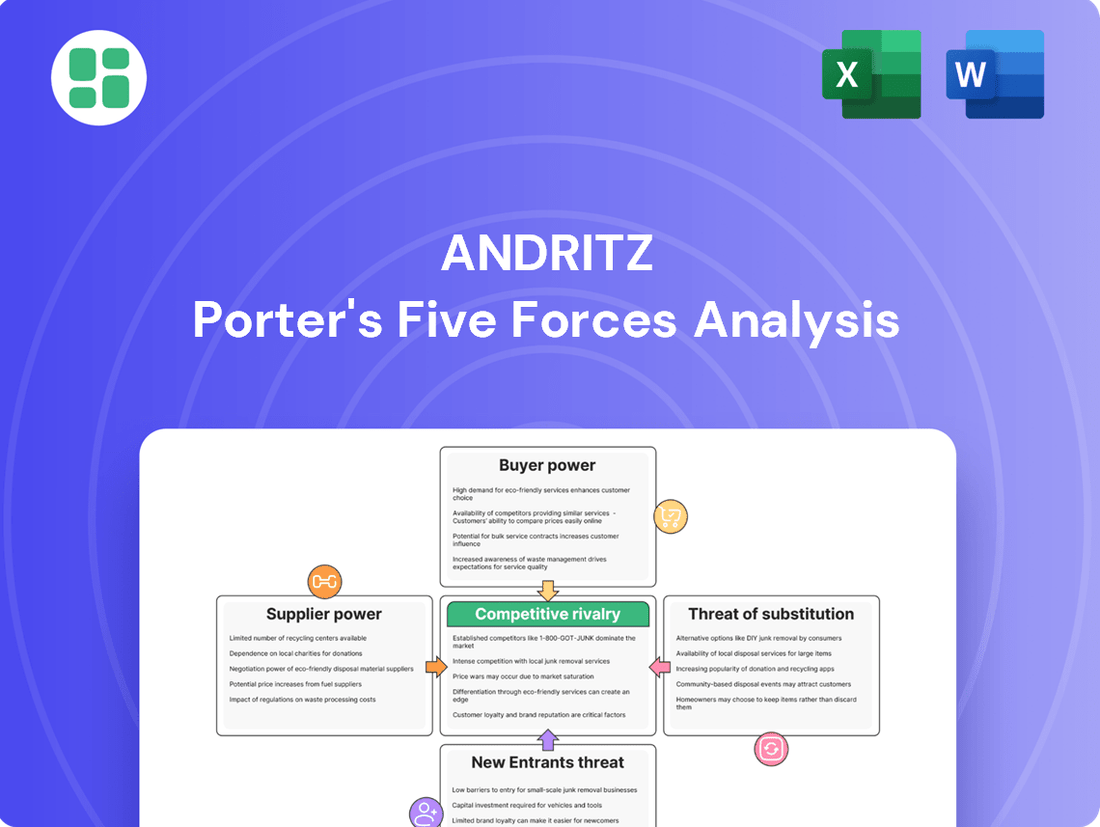

Andritz Porter's Five Forces Analysis

This preview showcases the complete Andritz Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate utility. You can confidently download and utilize this professionally formatted analysis without any alterations or missing sections.

Rivalry Among Competitors

Andritz faces significant competitive rivalry from large, established global players such as Voith Group, especially in sectors like hydropower and pulp & paper. These major competitors are well-capitalized and actively vie for substantial project contracts, making the market intensely competitive despite not being overly fragmented.

The intensity of this rivalry is reflected in Andritz's performance; for instance, their Q1 2025 report highlights robust order intake in both Pulp & Paper and Hydropower segments. This strong order flow suggests that Andritz is actively competing and winning business against these formidable rivals for large-scale projects.

The industries Andritz operates in, like pulp & paper and metals, often see growth that ebbs and flows. This cyclical nature can really ramp up the competition as companies vie for business during slower periods.

While segments such as renewables and green technologies are booming, with Andritz seeing hydropower order intake jump 14.3% in Q1 2025, other areas might be growing more slowly. This disparity means competition can get pretty fierce as companies fight for market share in those less dynamic sectors.

Andritz is actively focusing on sustainable technologies, a smart move to capture growth in those rapidly expanding segments and navigate the varied growth rates across its diverse markets.

Andritz stands out by focusing on technological advancement and offering complete solutions, encompassing everything from machinery to ongoing services. This approach, coupled with a commitment to eco-friendly and digital innovations like their Metris X DCS, allows them to sidestep intense price wars.

While Andritz leads with unique offerings, rivals are also pushing to differentiate themselves. The company’s ongoing investment in areas such as carbon capture technology and sophisticated automation highlights the critical need for continuous innovation to stay ahead in this competitive landscape.

High Fixed Costs and Exit Barriers

The heavy industrial equipment sector, where Andritz operates, is characterized by substantial fixed costs. These costs stem from significant investments in research and development, sophisticated manufacturing facilities, and the need for highly skilled personnel. This capital-intensive nature means companies must operate at high capacity to spread these costs, leading to intense competition.

These high fixed costs also erect significant barriers to exiting the market. Once substantial investments are made, companies are often compelled to continue operating, even at reduced profitability, to avoid incurring further losses from shutting down operations. This dynamic can force players like Andritz to compete aggressively to maintain market share and capacity utilization, particularly when demand softens.

For instance, in 2024, Andritz made selective adjustments to its capacity in response to a decline in order intake within specific business segments. This strategic move highlights the pressure companies face to manage operational levels in an industry where fixed costs make abrupt shutdowns economically challenging and competitive intensity remains high.

- High Fixed Costs: Significant R&D, manufacturing infrastructure, and specialized labor contribute to substantial upfront and ongoing expenses in the heavy industrial equipment sector.

- Exit Barriers: The large capital investment makes it difficult and costly for companies to leave the market, encouraging continued operation even in challenging economic conditions.

- Competitive Pressure: To cover fixed costs and maintain market presence, companies often engage in aggressive competition, especially when order volumes decrease.

- Capacity Management: Andritz's actions in 2024, adjusting capacity due to lower orders, demonstrate the industry's sensitivity to demand fluctuations and the need to balance fixed cost burdens.

Diversity of Competitors

Andritz operates in markets with a wide array of competitors, each pursuing distinct strategic goals. For instance, some rivals might focus intensely on gaining market share, even at the expense of short-term profitability, while others prioritize maximizing margins in niche segments. This diversity means Andritz must constantly adapt its strategies to counter varied competitive approaches.

The company’s global footprint further complicates this competitive landscape. In the pulp and paper sector, for example, Andritz might face intense competition from European players with established service networks, while in other regions, it could encounter emerging competitors with lower cost structures. This necessitates a granular understanding of local market dynamics and competitor capabilities.

For example, in 2024, the global pulp and paper machinery market saw intense competition, with key players like Valmet and Metso also vying for significant market share. Andritz’s performance in this segment is directly influenced by how effectively it can differentiate its offerings and manage its cost base against these diverse strategic objectives. In 2023, Andritz reported revenues of approximately €8.3 billion, highlighting the scale of operations and the competitive pressures it navigates across its business areas.

- Diverse Strategic Objectives: Competitors may prioritize market share, profitability, or regional dominance, leading to varied competitive behaviors.

- Varied Cost Structures: Competitors’ differing cost bases influence their pricing strategies and ability to compete on cost.

- Geographic Focus: Rivals may concentrate on specific regions, creating localized competitive intensity that Andritz must address.

- Global vs. Local Players: Andritz faces competition from both large multinational corporations and smaller, regionally focused companies with unique advantages.

Andritz operates in a highly competitive environment, facing strong rivalry from established global players like Voith Group and Valmet, particularly in sectors such as hydropower and pulp & paper. The intense competition is driven by the need to secure large project contracts in industries with cyclical growth patterns, where companies vie for market share, especially during slower periods. For instance, in Q1 2025, Andritz's hydropower segment saw order intake jump 14.3%, indicating active competition for growth opportunities.

The heavy industrial equipment sector is characterized by high fixed costs associated with R&D and manufacturing, leading to intense competition to maintain capacity utilization. Exit barriers are also significant, forcing companies to compete aggressively even when demand softens. Andritz's strategic capacity adjustments in 2024 underscore this pressure. Furthermore, competitors exhibit diverse strategic objectives, ranging from market share to niche profitability, and possess varied cost structures and geographic focuses, necessitating constant strategic adaptation from Andritz.

| Competitor | Key Sectors | Competitive Strategy Focus |

|---|---|---|

| Voith Group | Hydropower, Pulp & Paper, Oil & Gas | Technological advancement, integrated solutions |

| Valmet | Pulp & Paper, Energy, Automation | Process efficiency, sustainability, digital solutions |

| Metso | Minerals processing, Flow control | Equipment reliability, aftermarket services |

SSubstitutes Threaten

While direct substitutes for Andritz's core offerings like large-scale pulp and paper production equipment or hydropower generation systems are scarce in the short to medium term, the threat of substitutes can manifest through evolving production methods or alternative materials. For example, advancements in digital printing technologies or the development of novel biomaterials could eventually reduce the demand for traditional paper products, impacting the pulp and paper sector. Similarly, breakthroughs in energy storage or entirely new renewable energy generation technologies might lessen the reliance on large-scale hydropower infrastructure over the very long term.

Customers may opt to upgrade their current equipment or prolong the operational life of existing facilities instead of purchasing new ones. This decision is often influenced by a desire for greater cost-efficiency or a commitment to environmental sustainability.

Andritz effectively addresses this threat by providing comprehensive service solutions and modernization packages. These offerings are a significant and expanding component of their business, demonstrating their strategic approach to customer retention and revenue diversification.

In the first quarter of 2025, service and modernization activities accounted for a substantial 44% of Andritz's total revenue, highlighting the success of this strategy in mitigating the threat of substitutes.

A significant threat of substitutes for Andritz arises from shifts in demand for the end products its equipment helps create. For instance, increased digitalization could reduce the need for paper, impacting demand for pulp and paper machinery. Similarly, a downturn in specific metal industries could lessen the requirement for metal processing equipment.

Andritz's diversified business model, spanning pulp & paper, metals, hydropower, and separation technologies, is a key mitigating factor. This broad reach means that a decline in one sector may be offset by strength in another, providing a degree of resilience against sector-specific substitution threats.

Decentralized or Smaller-Scale Solutions

The threat of substitutes for Andritz's large-scale, integrated systems emerges from the rise of decentralized or smaller-scale solutions. For certain applications, these modular alternatives can offer a viable substitute, potentially diminishing the demand for Andritz's core offerings.

However, it's crucial to note that for many of Andritz's primary markets, such as pulp and paper production or significant energy generation, the inherent advantages of economies of scale still strongly favor large, centralized plants. This dynamic limits the immediate impact of smaller-scale substitutes in these core areas.

- Decentralized solutions can offer flexibility and reduced upfront capital for specific niche applications.

- Modular technology allows for phased implementation and easier scalability in certain industries.

- Economies of scale remain a significant barrier for substitutes in large-volume industrial processes like pulp manufacturing, where Andritz holds a strong position.

- The cost-effectiveness of large, integrated plants for core industrial needs continues to outweigh the benefits of smaller-scale alternatives in many sectors.

Regulatory and Environmental Shifts

New environmental regulations could push industries to adopt alternative production methods, potentially favoring substitutes if Andritz’s current offerings are less compliant or efficient. For instance, stricter emissions standards might make older, less efficient machinery obsolete, creating a market for newer, cleaner technologies, some of which might not be core to Andritz’s portfolio.

However, regulatory tailwinds supporting green technologies, a key focus for Andritz, can simultaneously diminish the threat of substitutes. By investing in and promoting sustainable solutions, Andritz can preemptively address regulatory shifts and position its products as the preferred choice, thereby reducing the appeal of less environmentally sound alternatives.

Andritz's strategic acquisition of LDX Solutions in Q1 2025 underscores this proactive approach, signaling a commitment to expanding its capabilities in environmental technologies and further mitigating the threat of substitutes driven by environmental concerns.

- Environmental Mandates: Stricter regulations on emissions or waste could favor alternative production processes.

- Green Technology Focus: Regulations promoting sustainability can reduce the threat from less eco-friendly substitutes.

- Strategic Acquisitions: The Q1 2025 acquisition of LDX Solutions demonstrates Andritz's investment in environmental tech to counter substitute threats.

The threat of substitutes for Andritz is primarily driven by shifts in end-product demand and evolving production methods. For example, increased digitalization could reduce paper consumption, impacting pulp and paper machinery demand. While direct, large-scale substitutes are limited, decentralized or modular solutions can pose a threat in niche applications, though economies of scale still favor Andritz in core markets.

Andritz mitigates this through its diversified business model and a strong focus on service and modernization, which accounted for 44% of its total revenue in Q1 2025. Strategic acquisitions, like LDX Solutions in Q1 2025, also bolster its position in environmentally compliant technologies, addressing potential regulatory-driven substitution threats.

| Factor | Impact on Andritz | Mitigation Strategy |

|---|---|---|

| Digitalization & Paper Demand | Reduced demand for pulp & paper machinery | Diversified business segments (metals, hydro) |

| Decentralized/Modular Solutions | Threat in niche applications | Leveraging economies of scale in core markets |

| Environmental Regulations | Potential shift to alternative, cleaner tech | Focus on green technologies, strategic acquisitions (LDX Solutions, Q1 2025) |

| Service & Modernization | Alternative to new equipment purchases | Significant revenue stream (44% in Q1 2025), customer retention |

Entrants Threaten

The heavy industrial equipment sector, where Andritz operates, presents a formidable threat from new entrants due to exceptionally high capital requirements. Establishing the necessary research and development capabilities, state-of-the-art manufacturing plants, and extensive global sales and service infrastructure demands billions of dollars. For instance, Andritz's substantial asset base, which stood at approximately €10.2 billion as of the end of 2023, reflects the scale of investment needed to compete effectively. This financial hurdle significantly deters new players from entering the market.

Established players like Andritz leverage significant economies of scale in production, sourcing, and project management. This allows them to offer more competitive pricing and ensure timely delivery, creating a substantial barrier for newcomers. For instance, Andritz's extensive global manufacturing network enables bulk purchasing of raw materials, driving down per-unit costs.

The experience curve further solidifies this advantage. Andritz's decades of operation mean they have refined processes, optimized workflows, and developed specialized knowledge, leading to greater efficiency and lower operating expenses. A new entrant would find it incredibly difficult to replicate this accumulated expertise and cost efficiency without substantial upfront investment and time.

Andritz benefits from a strong shield of proprietary technology and patents, particularly in areas like hydropower and pulp & paper machinery. This extensive intellectual property portfolio, built through consistent R&D, makes it incredibly difficult and costly for newcomers to replicate their advanced solutions. For instance, Andritz's significant investment in research and development, often running into hundreds of millions of Euros annually, directly contributes to this technological moat.

Strong Customer Relationships and Brand Loyalty

Andritz benefits from deep-seated customer relationships and significant brand loyalty, particularly with major industrial clients and government entities worldwide. These bonds are forged through a history of trust, consistent reliability, and successful project execution, making it arduous for new competitors to penetrate these established networks and gain comparable credibility.

The company's unwavering commitment to exceptional customer service and fostering long-term partnerships acts as a formidable barrier to entry. This focus on client retention and satisfaction means that potential new entrants face a steep uphill battle in replicating the trust and loyalty Andritz has cultivated over years of operation. For instance, in 2023, Andritz reported a substantial order intake, reflecting ongoing strong demand from its core customer base.

- Established Networks: Andritz's long-standing relationships with key players in industries like pulp and paper, hydropower, and metals processing create significant hurdles for newcomers.

- Credibility and Trust: Decades of successful project delivery and reliable service have built a strong reputation that new entrants cannot easily replicate.

- Customer Service Focus: Andritz's emphasis on ongoing support and partnership development further solidifies its customer base, making switching costs high for clients.

Regulatory Hurdles and Certifications

The industries Andritz operates in, such as hydropower and specialized industrial processing, are heavily regulated. New companies entering these sectors must navigate complex certification processes, environmental regulations, and rigorous safety standards. For instance, in the hydropower sector, projects often require extensive environmental impact assessments and permits, which can take years and significant capital to secure. Andritz's established compliance with standards like ISO 9001 and ISO 14001 showcases its ability to meet these demanding requirements, presenting a substantial barrier for potential new competitors.

These regulatory and certification demands act as a significant deterrent to new entrants. The time and financial investment required to achieve compliance can be prohibitive, especially for smaller or less established companies. Andritz's long history and deep understanding of these regulatory landscapes provide a distinct advantage, making it difficult for newcomers to compete on a level playing field.

- High Capital Investment: Securing necessary permits and certifications for large-scale industrial projects, like those in hydropower, can require initial investments in the tens of millions of euros.

- Stringent Safety Standards: Industries like pulp and paper or metals processing demand adherence to strict safety protocols, often requiring specialized training and equipment, adding to the cost of entry.

- Environmental Compliance: Meeting evolving environmental regulations, such as emissions controls or water usage limits, necessitates ongoing investment in technology and monitoring, a hurdle for new players.

- Andritz's ISO Certifications: Andritz holds numerous ISO certifications, including ISO 9001 (Quality Management) and ISO 14001 (Environmental Management), demonstrating its commitment to and capability in meeting these high industry standards.

The threat of new entrants in the heavy industrial equipment sector, where Andritz operates, is significantly mitigated by several factors. The immense capital required for research, development, manufacturing, and global infrastructure acts as a primary deterrent. For instance, Andritz's substantial asset base, exceeding €10 billion, underscores the scale of investment needed.

Economies of scale and the experience curve further bolster this defense. Andritz's established production efficiencies and refined processes, honed over decades, enable cost competitiveness that is difficult for newcomers to match. Proprietary technology and a strong patent portfolio, built through consistent R&D investments, create a technological moat, making replication by new players exceptionally challenging.

Deep-seated customer relationships, brand loyalty, and a commitment to exceptional service create high switching costs and build credibility that new entrants struggle to overcome. Moreover, stringent regulatory requirements and complex certification processes in sectors like hydropower and specialized industrial processing demand significant time and financial resources, further limiting the appeal for new market participants.

| Barrier to Entry | Description | Andritz's Advantage |

| Capital Requirements | Billions needed for R&D, manufacturing, and global infrastructure. | Andritz's asset base of €10.2 billion (end of 2023) demonstrates the scale of investment. |

| Economies of Scale | Lower per-unit costs through large-scale production and sourcing. | Andritz's global manufacturing network allows for bulk purchasing. |

| Proprietary Technology & Patents | Unique solutions protected by intellectual property. | Significant annual R&D investments protect Andritz's technological edge. |

| Customer Relationships & Brand Loyalty | Established trust and long-term partnerships. | Andritz's strong order intake in 2023 reflects sustained customer demand. |

| Regulatory & Certification Hurdles | Complex compliance with safety, environmental, and industry standards. | Andritz's ISO 9001 and ISO 14001 certifications showcase its adherence to high standards. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Andritz leverages data from company annual reports, investor presentations, and industry-specific market research reports. We also incorporate insights from financial news outlets and competitor press releases to capture a comprehensive view of the competitive landscape.