Andritz Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Andritz Bundle

Unlock the strategic genius behind Andritz's global operations with our comprehensive Business Model Canvas. This detailed breakdown reveals how they masterfully connect customer segments to value propositions, leveraging key resources and activities to drive revenue. Discover their unique approach to partnerships and cost structure, offering invaluable insights for anyone looking to understand industry leaders.

Partnerships

Andritz actively partners with technology providers and research institutions to foster innovation, particularly in areas like sustainable technologies, digitalization, and advanced manufacturing. These collaborations are vital for developing leading-edge solutions and securing technological dominance in rapidly changing sectors.

For instance, Andritz's commitment to R&D, often fueled by these external collaborations, is reflected in its significant investment in innovation. In 2023, Andritz's R&D expenses amounted to €255.3 million, a testament to the strategic importance of these partnerships in accelerating the development of new technologies and maintaining a competitive edge.

Andritz cultivates strategic alliances with suppliers of specialized components and raw materials, crucial for its complex machinery and plant construction. These partnerships are foundational for managing costs effectively, ensuring projects are delivered on schedule, and upholding the stringent quality standards of Andritz's offerings. For instance, in 2024, Andritz continued to leverage long-term agreements with leading steel producers and advanced component manufacturers, securing access to high-grade materials and critical parts necessary for its pulp and paper, hydropower, and industrial plants.

Andritz frequently collaborates with Engineering, Procurement, and Construction (EPC) contractors for extensive plant projects, drawing on their expertise in project management and execution. This allows Andritz to concentrate on its core technological competencies while ensuring smooth, integrated delivery for complex industrial undertakings.

Customers for Co-development and Long-term Service Agreements

Andritz cultivates deep collaborations with its principal customers, focusing on joint development of bespoke solutions and establishing enduring service agreements. This approach allows for a granular understanding of client requirements, driving the creation of precisely engineered innovations and ensuring predictable revenue through ongoing lifecycle support.

These strategic alliances are crucial for Andritz, as they not only refine product offerings but also solidify market position. For instance, long-term service contracts, often spanning decades for major projects like pulp mills or hydropower facilities, provide a stable and substantial income stream, contributing significantly to the company's financial resilience. In 2024, Andritz continued to emphasize these partnerships, with service revenues representing a substantial portion of its overall turnover, underscoring the value of customer loyalty and ongoing engagement.

- Co-development: Andritz works hand-in-hand with key clients to design and implement tailored technological solutions, ensuring optimal performance and integration.

- Long-term Service Agreements: These contracts secure recurring revenue and customer loyalty by providing comprehensive maintenance, upgrades, and operational support throughout the asset lifecycle.

- Customer Understanding: Partnerships foster a deep insight into evolving customer needs, enabling Andritz to anticipate market demands and drive innovation.

- Example Projects: Collaborations on large-scale pulp mill expansions and major hydropower plant modernizations exemplify the depth and strategic importance of these customer relationships.

Industry Consortia and Associations

Andritz actively participates in key industry consortia and associations, enabling them to influence the development of crucial industry standards and share valuable best practices. This engagement is vital for tackling shared challenges, such as the global push for decarbonization and the implementation of circular economy principles across various industrial sectors.

Through these collaborations, Andritz can effectively advocate for supportive regulatory policies and gain critical market insights. This fosters a collaborative ecosystem focused on advancing sustainable industrial development, ensuring they remain at the forefront of innovation and responsible manufacturing.

- Industry Standard Setting: Participation in groups like the International Electrotechnical Commission (IEC) or national engineering societies allows Andritz to contribute to and adopt evolving technical standards, ensuring their equipment meets global benchmarks.

- Collaborative R&D: Engagement in research consortia, potentially funded by entities like the European Union's Horizon program, facilitates joint projects on topics like advanced materials or digital manufacturing, sharing costs and expertise.

- Policy Advocacy: Membership in industry federations, such as national manufacturing associations or sector-specific groups, allows Andritz to collectively voice concerns and advocate for policies that support industrial competitiveness and environmental goals.

Andritz's key partnerships extend to technology providers and research institutions, crucial for driving innovation in areas like sustainability and digitalization. These collaborations are fundamental to developing cutting-edge solutions and maintaining technological leadership. For example, Andritz's investment in R&D, often bolstered by these partnerships, reached €255.3 million in 2023, highlighting their strategic importance.

What is included in the product

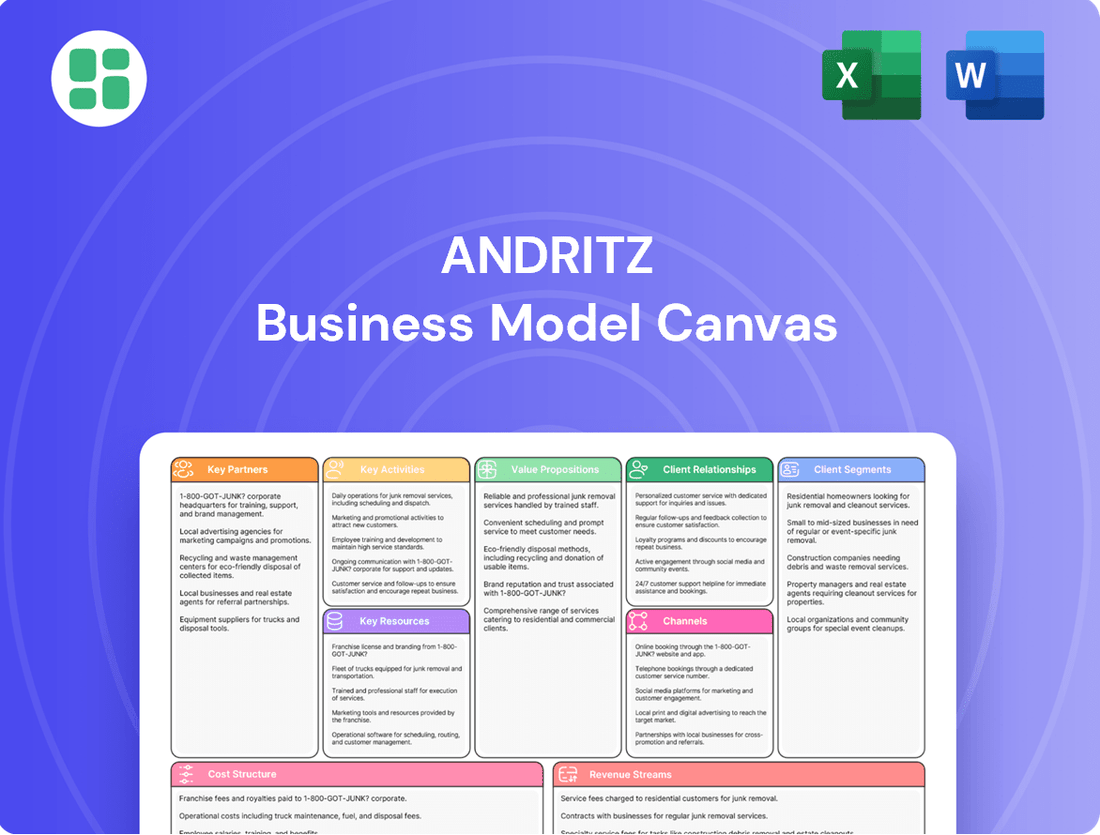

A detailed exploration of Andritz's business model, structured around the nine classic Business Model Canvas blocks, offering insights into their customer segments, value propositions, and operational strategies.

This model provides a clear, narrative-driven overview of Andritz's approach, ideal for understanding their market position and strategic direction.

The Andritz Business Model Canvas acts as a pain point reliever by providing a clear, visual map of their complex operations, enabling rapid identification of inefficiencies and opportunities for streamlining.

It efficiently addresses the pain of information overload by condensing Andritz's diverse business units into a single, digestible framework for strategic analysis and decision-making.

Activities

Andritz's commitment to Research & Development (R&D) and Innovation is central to its strategy, with significant investments fueling the creation of advanced and sustainable technologies across all its business segments. This focus ensures they remain at the forefront of market trends, particularly in digitalization and environmentally friendly solutions.

In 2023, Andritz reported R&D expenses of €239.4 million, representing a substantial portion of its revenue and underscoring its dedication to continuous product enhancement and the development of novel offerings. This investment is crucial for maintaining technological leadership and meeting the growing global demand for more efficient and eco-conscious industrial processes.

Andritz's core activities in engineering, design, and project management are the bedrock of its operations, focusing on the intricate planning and execution of large-scale industrial projects. This involves translating complex client needs into tangible, high-performance equipment and systems. For instance, in 2023, Andritz successfully commissioned a new biomass power plant in Austria, a testament to its comprehensive project management capabilities from initial design through to operational readiness.

This expertise is particularly vital for their key markets, such as the pulp and paper industry and the energy sector. The company's ability to manage these multifaceted projects, often spanning several years and involving numerous stakeholders, is crucial for delivering customized, state-of-the-art solutions. Their project portfolio in 2024 continues to showcase this, with significant contracts for pulp mill upgrades and new hydropower installations across Europe and North America.

Andritz's core activity involves the manufacturing and fabrication of highly specialized machinery, intricate components, and comprehensive plant systems. This hands-on approach is crucial for maintaining stringent quality control throughout the production process.

Utilizing advanced production techniques, Andritz ensures that every piece of equipment meets the exact, often demanding, specifications required for high-performance industrial applications across various sectors.

With a global network of manufacturing facilities, Andritz effectively supports its worldwide project delivery, enabling them to efficiently serve clients and execute complex projects on an international scale.

Installation, Commissioning, and After-Sales Service

Andritz's key activities prominently feature the comprehensive installation and commissioning of its advanced equipment, ensuring seamless integration into client operations. This foundational step is critical for the reliable performance of their solutions.

Beyond initial setup, Andritz provides extensive after-sales services. This includes proactive maintenance, essential upgrades to keep technology current, and a robust supply chain for spare parts, all designed to maximize the lifespan and efficiency of their installed base.

This focus on service is not just about support; it's a strategic imperative. It cultivates strong, lasting customer relationships and is a significant driver of recurring revenue for the company. Andritz has explicitly identified its service business as a key area for strategic growth and investment. For example, in 2023, Andritz reported that its Services segment generated approximately €1.3 billion in revenue, highlighting its substantial contribution to the company's overall financial performance.

- Installation and Commissioning: Ensuring proper setup and operational readiness of all supplied equipment.

- After-Sales Service: Providing ongoing maintenance, repair, and technical support.

- Upgrades and Modernization: Offering solutions to enhance existing equipment performance and capabilities.

- Spare Parts Management: Guaranteeing availability of critical components to minimize downtime.

Digitalization and Automation Solutions Development

Developing and implementing advanced digitalization and automation solutions, like their Metris platform, is central to ANDRITZ's strategy. This involves creating software and hardware that optimize industrial processes for their clients. For example, in 2023, ANDRITZ reported significant growth in its digitalization segment, contributing to improved operational efficiency for customers.

These solutions are designed to enhance plant operations, boost efficiency, and enable predictive maintenance. They also pave the way for more autonomous factory environments across diverse industries. The company is actively investing in R&D to expand the capabilities of its Metris platform, aiming to provide even greater value through data-driven insights and automated control.

- Metris Platform Development: Continued enhancement of their proprietary digitalization and automation platform.

- Solution Implementation: Tailoring and deploying these solutions to meet specific customer needs in various industrial sectors.

- Efficiency and Optimization Focus: Driving improvements in operational performance, energy consumption, and resource utilization for clients.

- Predictive Maintenance Integration: Building capabilities for proactive equipment upkeep, reducing downtime and maintenance costs.

Andritz's key activities encompass the entire lifecycle of industrial equipment and systems. This includes the critical phases of engineering, design, and meticulous project management to deliver complex, large-scale solutions. Furthermore, the company excels in the manufacturing and fabrication of specialized machinery, ensuring high quality and precision through advanced production techniques. Finally, Andritz provides essential installation, commissioning, and comprehensive after-sales services, including maintenance and upgrades, to guarantee optimal client operations and foster long-term relationships.

| Key Activity | Description | 2023 Data/Focus |

|---|---|---|

| Engineering, Design & Project Management | Planning and executing complex industrial projects from concept to completion. | Successful commissioning of a new biomass power plant in Austria. |

| Manufacturing & Fabrication | Producing specialized machinery and components with advanced techniques. | Global network of facilities supporting worldwide project delivery. |

| Installation, Commissioning & After-Sales Service | Ensuring operational readiness and providing ongoing support, maintenance, and upgrades. | Services segment revenue of approx. €1.3 billion; focus on recurring revenue growth. |

Full Document Unlocks After Purchase

Business Model Canvas

This preview showcases the actual Andritz Business Model Canvas you will receive upon purchase. It's not a generic template or a simplified version; what you see is a direct reflection of the comprehensive document that will be yours. Upon completing your order, you'll gain full access to this exact, professionally structured Business Model Canvas, ready for your strategic planning.

Resources

Andritz boasts a robust intellectual property portfolio, encompassing thousands of patents and proprietary technologies that are fundamental to its competitive edge. This extensive collection of patents, particularly in areas like hydro turbines and advanced pulp production, underscores their commitment to innovation and technological leadership.

Their specialized process know-how, developed over decades, is a critical asset, especially in demanding sectors such as hydropower and metals processing. This deep understanding allows Andritz to offer highly customized and efficient solutions, differentiating them from competitors and driving value for their clients.

In 2023, Andritz continued to invest heavily in research and development, a testament to the importance they place on maintaining and expanding their technological advantage. This focus on intellectual property is a key enabler for delivering high-value, specialized equipment and services across their core business areas.

Andritz leverages a vast global network of manufacturing facilities, workshops, and service centers. This extensive infrastructure is a cornerstone of its business model, enabling efficient production and localized support across diverse markets.

This worldwide presence allows for rapid response to customer needs, crucial for large-scale project execution and comprehensive after-sales service. For instance, in 2023, Andritz reported a significant portion of its revenue generated from its service business, underscoring the importance of its global service footprint.

Andritz's highly skilled workforce, encompassing engineers, technical experts, project managers, and service technicians, is a critical asset. This deep pool of talent is foundational to their success in delivering complex industrial solutions.

Their expertise spans crucial areas like advanced industrial processes, the integration of digitalization, and the development of sustainable technologies. This specialized knowledge directly enables Andritz to design, construct, and maintain sophisticated plants and systems for their global clientele.

In 2024, Andritz continued to invest in its human capital, recognizing that its engineering and technical talent are key differentiators in a competitive market. The company's commitment to continuous training and development ensures its workforce remains at the forefront of innovation in sectors like pulp and paper, metals, and energy.

Strong Financial Capital and Access to Funding

Andritz's robust financial capital and strong access to funding are cornerstones of its business model, enabling significant investments in research and development and the execution of complex, large-scale projects. This financial muscle allows the company to navigate the capital-intensive nature of its industries with confidence, ensuring stability and the capacity for growth. For instance, Andritz's commitment to innovation is evident in its continuous product development, which requires substantial upfront investment.

The company's ability to secure diverse funding sources, from retained earnings to credit facilities, empowers it to manage substantial working capital needs for its long-term projects. This financial flexibility is critical for projects that span several years, ensuring that Andritz can meet its obligations and capitalize on opportunities without interruption. Strategic acquisitions are also a key component, facilitated by strong financial backing, allowing Andritz to expand its market reach and technological capabilities.

- Financial Strength: Andritz maintains a solid financial position, allowing for sustained investment in innovation and operational excellence.

- Access to Capital Markets: The company leverages its reputation and financial health to access diverse funding channels, including debt and equity.

- Project Financing Capability: Andritz possesses the financial acumen to structure and manage financing for its large, complex global projects.

- Strategic Investment Capacity: Robust capital reserves and funding access enable strategic acquisitions and R&D initiatives that drive future growth.

Reputation and Brand Recognition

Andritz's enduring reputation for reliability and technological prowess is a cornerstone of its business model. This strong brand recognition, built over decades, cultivates deep trust among its global clientele, essential for securing long-term contracts in capital-intensive industries.

The company's commitment to sustainability further bolsters its brand, resonating with environmentally conscious customers and investors. This positive perception not only attracts new business but also supports premium pricing and customer loyalty in competitive markets.

In 2024, Andritz continued to leverage this reputation. For instance, their order intake in the first half of 2024 reached €5.1 billion, demonstrating sustained customer confidence. This reflects how their established brand translates directly into tangible business success.

- Long-standing Reputation: Andritz is recognized globally for its dependable products and advanced technological solutions.

- Customer Trust: A strong brand fosters confidence, leading to repeat business and strategic partnerships.

- Talent Attraction: The company's positive image makes it an attractive employer, securing skilled personnel.

- Market Advantage: Brand recognition provides a competitive edge, supporting growth and market share.

Andritz's key resources are its intellectual property, global infrastructure, skilled workforce, financial capital, and strong brand reputation. These elements collectively enable the company to deliver complex, high-value solutions to its customers across various demanding industries.

Value Propositions

Andritz provides customers with a complete package, from individual machines to entire production facilities, acting as a single point of contact for complex industrial projects. This integrated offering streamlines the entire process, from initial planning to final operation, ensuring all parts work together harmoniously.

By offering these comprehensive solutions, Andritz simplifies procurement and project management for its clients. This means customers don't have to juggle multiple suppliers, leading to reduced complexity and a more efficient path to getting their operations up and running. For instance, in 2023, Andritz successfully delivered several large-scale integrated plant solutions across its key sectors, contributing significantly to its revenue growth.

Andritz's commitment to technological leadership fuels innovation, particularly in sustainable and digital solutions. This focus directly translates into tangible benefits for clients, such as enhanced operational efficiency and improved environmental performance.

For instance, their advanced technologies in the pulp and paper sector, like the new Prime Shredder, can increase throughput by up to 20% while reducing energy consumption. This kind of innovation empowers customers to not only boost their output but also achieve critical sustainability targets.

Andritz boasts an extensive global network, allowing them to serve customers across continents. This worldwide presence is complemented by localized sales, service, and manufacturing facilities. For instance, in 2023, Andritz maintained over 280 locations globally, demonstrating their commitment to being close to their customer base.

This proximity is crucial for providing rapid support and ensuring the availability of spare parts, significantly reducing downtime for clients. Their decentralized structure fosters cultural understanding and adaptability, making Andritz a trusted partner in diverse international markets.

Lifecycle Service and Optimization

Andritz offers comprehensive lifecycle services designed to keep customer operations running smoothly and efficiently for the long haul. This includes everything from routine maintenance to significant upgrades, ensuring plants remain state-of-the-art.

Their digital optimization tools, like the Metris platform, are key to this. By providing real-time data and analytics, Metris helps customers fine-tune their processes, leading to better performance and reduced waste. In 2023, Andritz reported that its Metris digital solutions contributed significantly to improving operational efficiency for its clients, with some seeing a reduction in unplanned downtime by up to 15%.

This dedication to ongoing support means customers benefit from sustained plant performance and minimized disruptions. It's about maximizing the return on investment by extending the operational life and enhancing the capabilities of their equipment long after the initial purchase.

- Extended Operational Lifespan: Andritz's services ensure equipment remains functional and efficient for longer periods.

- Enhanced Plant Efficiency: Digital tools like Metris optimize processes, leading to improved output and resource utilization.

- Reduced Downtime: Proactive maintenance and upgrades minimize unexpected plant stoppages.

- Continuous Value Creation: Support extends beyond the sale, providing ongoing benefits and performance improvements.

Sustainability and Environmental Performance

Andritz offers technologies that are crucial for the green transition, focusing on reducing CO2 emissions and minimizing resource use. This commitment directly supports clients in navigating increasingly strict environmental regulations.

By adopting Andritz's solutions, customers can enhance their sustainability credentials and realize both ecological and economic advantages. For instance, in 2023, Andritz's focus on sustainable technologies contributed to a significant portion of their order intake, reflecting market demand for eco-friendly solutions.

- Supporting the Green Transition: Andritz provides advanced technologies that enable industries to lower their carbon footprint and transition to more sustainable practices.

- Resource Efficiency: Their solutions are designed to minimize the consumption of raw materials and energy, promoting a circular economy.

- Regulatory Compliance and Enhanced Profile: Customers benefit from meeting stringent environmental standards, which in turn improves their corporate sustainability image and market competitiveness.

- Economic and Ecological Benefits: Andritz's technologies offer a dual advantage, helping clients achieve environmental goals while simultaneously improving operational efficiency and profitability.

Andritz delivers complete solutions, from individual machines to entire plants, simplifying project management for clients. Their global network ensures localized support and fast service, minimizing downtime. By providing advanced digital and sustainable technologies, Andritz helps customers boost efficiency and meet environmental goals.

| Value Proposition | Description | Key Benefit | 2023 Data/Example |

|---|---|---|---|

| Integrated Solutions | Single point of contact for complex industrial projects, from planning to operation. | Streamlined procurement and project management, reduced complexity. | Successful delivery of multiple large-scale integrated plant solutions. |

| Technological Leadership & Sustainability | Focus on innovative, sustainable, and digital solutions. | Enhanced operational efficiency, improved environmental performance, meeting green transition demands. | Prime Shredder can increase throughput by up to 20% while reducing energy consumption. |

| Global Presence & Local Support | Extensive global network with localized sales, service, and manufacturing. | Rapid support, availability of spare parts, reduced downtime, cultural understanding. | Over 280 locations globally in 2023. |

| Lifecycle Services & Digitalization | Comprehensive support from maintenance to upgrades, including digital optimization tools. | Sustained plant performance, minimized disruptions, maximized ROI. | Metris digital solutions reduced unplanned downtime by up to 15% for some clients in 2023. |

Customer Relationships

Andritz employs dedicated key account managers who build strong, lasting connections with their most significant industrial customers. This focused strategy allows them to deeply understand each client's unique requirements and long-term goals, resulting in customized solutions and robust partnerships.

Andritz cultivates deep customer relationships through extensive long-term service, maintenance, and modernization contracts. These agreements are crucial, covering the entire lifespan of the equipment they supply, from installation through to upgrades.

These contracts are the bedrock of customer loyalty, offering vital ongoing support, predictive maintenance capabilities, and performance optimization. This ensures consistent customer satisfaction and generates a reliable stream of recurring revenue for Andritz.

For instance, in 2023, Andritz's Services segment, which heavily relies on these long-term agreements, demonstrated robust performance, contributing significantly to the company's overall financial health and underscoring the strategic importance of these customer partnerships.

Andritz actively partners with clients, fostering collaborative development to engineer bespoke solutions for intricate operational needs. This deep technical engagement ensures that innovations are precisely tailored, with feedback driving iterative improvements. For instance, in 2024, Andritz's pulp and paper division reported significant success with co-developed technologies that boosted efficiency by up to 15% for key clients.

Digital Platforms for Enhanced Engagement

Andritz leverages digital platforms, such as its Metris solution, to significantly boost customer engagement. This includes offering smart services, accessible online spare parts catalogs, and advanced remote monitoring capabilities. These digital touchpoints allow for real-time data sharing and streamlined communication, directly improving service delivery and customer satisfaction.

These digital tools empower customers with immediate access to crucial information, simplifying support interactions and enabling a more proactive approach to issue resolution. For instance, in 2023, Andritz reported that its digital services contributed to a noticeable reduction in machine downtime for clients utilizing remote monitoring, highlighting the tangible benefits of this enhanced engagement strategy.

- Metris Digital Platform: Facilitates smart services, remote monitoring, and digital access to spare parts.

- Enhanced Customer Access: Provides real-time information and streamlines support processes.

- Proactive Problem-Solving: Enables early detection and resolution of potential issues.

- Service Efficiency Gains: Contributes to reduced downtime and improved operational performance for clients.

Technical Support and Training Programs

Andritz offers comprehensive technical support and training to ensure customers maximize their equipment's potential. This includes hands-on training sessions and readily available troubleshooting assistance, minimizing downtime and enhancing operational efficiency. In 2024, Andritz reported a significant increase in customer satisfaction scores directly linked to their enhanced support services.

- Expert-led training modules

- 24/7 technical troubleshooting

- On-site and remote support options

- Proactive maintenance guidance

Andritz's customer relationships are built on a foundation of deep technical partnership and long-term service agreements, ensuring ongoing value and support throughout the equipment lifecycle. For example, in 2024, their pulp and paper division saw co-developed technologies improve client efficiency by up to 15%.

Digital platforms like Metris are central to this engagement, offering smart services, remote monitoring, and easy access to spare parts, which in 2023 contributed to noticeable reductions in client machine downtime.

Comprehensive training and 24/7 technical support further enhance customer satisfaction, as evidenced by increased scores in 2024 directly attributed to these enhanced services.

| Customer Relationship Aspect | Key Initiatives | Impact/Data (2023-2024) |

|---|---|---|

| Key Account Management | Dedicated managers for major clients | Deep understanding of unique client needs |

| Long-Term Service & Modernization | Lifespan contracts for equipment | Reliable recurring revenue, customer loyalty |

| Collaborative Development | Bespoke solutions for complex needs | Up to 15% efficiency gains reported in Pulp & Paper (2024) |

| Digital Engagement (Metris) | Smart services, remote monitoring, online catalogs | Noticeable reduction in client downtime (2023) |

| Technical Support & Training | Hands-on training, troubleshooting, proactive guidance | Significant increase in customer satisfaction scores (2024) |

Channels

Andritz leverages a direct sales force, a critical component of its business model, to engage with customers worldwide. This force operates through a vast global network of over 280 locations spread across more than 80 countries, ensuring a localized and accessible presence.

This direct channel is essential for handling complex technical sales processes, offering tailored consultations to clients, and directly negotiating terms for substantial industrial projects. The company's commitment to this direct approach underscores its focus on building strong customer relationships and providing specialized support.

Andritz's extensive network of regional offices and subsidiaries is a cornerstone of its global strategy, allowing for deep market penetration and responsive customer engagement. This decentralized structure ensures that local needs are met with culturally attuned service and efficient project execution.

In 2024, Andritz continued to leverage this global footprint, with operations spanning over 40 countries. This robust presence facilitates not only sales and service but also the localized adaptation of its advanced technologies, crucial for securing and delivering complex projects in diverse economic environments.

Andritz leverages dedicated after-sales service centers and a strong spare parts distribution network as key channels. These are vital for providing ongoing customer support and generating recurring revenue. For instance, Andritz's Hydro division reported a significant increase in its service business, contributing to overall profitability in 2024, highlighting the importance of this channel.

This infrastructure ensures prompt delivery of essential components and expert technical assistance. This focus directly translates into minimized downtime for customers, a critical factor in industries where operational continuity is paramount. The efficiency of this network is a core element of Andritz's value proposition.

Digital Platforms (e.g., Metris, Online Portals)

Andritz leverages digital platforms like its Metris system, alongside online spare part catalogs and dedicated customer portals, to offer seamless access to vital information, support, and services. These digital touchpoints significantly boost customer convenience and simplify the entire ordering lifecycle.

These platforms are designed to streamline operations, offering capabilities such as remote monitoring and advanced diagnostic features. This digital infrastructure not only enhances customer experience but also improves the efficiency of service delivery and product support.

- Metris Platform: Facilitates remote monitoring, predictive maintenance, and operational optimization for Andritz equipment.

- Online Spare Part Catalogs: Provide customers with easy and quick access to order necessary components, reducing downtime.

- Customer Portals: Offer a centralized hub for managing orders, accessing documentation, and communicating with support teams.

- Digitalization Strategy: Andritz reported a significant increase in digital service offerings in 2023, with a focus on expanding the capabilities of its Metris platform to cover a wider range of customer needs and asset management.

Industry Trade Fairs, Conferences, and Webinars

Andritz leverages industry trade fairs, conferences, and webinars as crucial channels to connect with its diverse customer base and showcase its innovative solutions. These platforms are vital for demonstrating new technologies, fostering direct engagement with potential clients, and establishing thought leadership within key industrial sectors. For instance, participation in events like the European Paper Week or the International Water Association (IWA) World Water Congress allows Andritz to present its latest advancements in pulp and paper, hydropower, and environmental technologies.

These gatherings facilitate invaluable face-to-face interactions, enabling the demonstration of complex machinery and processes, and providing opportunities for strategic networking. In 2024, Andritz continued its active presence at major global exhibitions, such as the ACHEMA trade fair for the chemical engineering and process industry, where it highlighted its expertise in separation technology and sustainable solutions. Such participation directly supports lead generation and brand visibility.

- Trade Fairs: Andritz actively exhibits at premier global events like the SMM (Shipbuilding, Machinery & Marine Technology) exhibition, showcasing its marine technologies.

- Conferences: The company participates in specialized conferences, such as those focused on renewable energy and water treatment, to share technical expertise and market insights.

- Webinars: Andritz hosts targeted webinars to educate customers on new product features, process optimization, and industry trends, reaching a wider audience efficiently.

- Engagement: These channels provide direct feedback loops, allowing Andritz to understand evolving customer needs and market demands in real-time.

Andritz utilizes a multi-faceted approach to reach its customers. This includes a robust direct sales force operating through over 280 global locations, ensuring localized expertise and support for complex industrial projects. Complementing this, dedicated after-sales service centers and an efficient spare parts network are crucial for ongoing customer satisfaction and recurring revenue streams. The company also actively engages through industry trade fairs, conferences, and webinars, demonstrating new technologies and fostering direct client relationships.

Digital channels, such as the Metris platform and customer portals, enhance accessibility for information, support, and ordering, streamlining the customer lifecycle. In 2024, Andritz's global presence, spanning over 40 countries, facilitated the localized adaptation of its technologies, a key factor in securing and executing large-scale projects across diverse markets.

| Channel Type | Key Features | 2024 Relevance/Activity |

|---|---|---|

| Direct Sales Force | Global network, technical consultation, project negotiation | Essential for complex sales and strong customer relationships. |

| After-Sales Service & Spares | Customer support, minimized downtime, recurring revenue | Hydro division saw increased service business contribution in 2024. |

| Digital Platforms (Metris) | Remote monitoring, diagnostics, online ordering | Focus on expanding Metris capabilities for asset management. |

| Industry Events (Trade Fairs, Conferences) | Technology showcase, lead generation, thought leadership | Active participation in global events like ACHEMA in 2024. |

Customer Segments

Large-scale industrial corporations, including significant players in pulp and paper, metals, hydropower, and separation sectors, represent a core customer segment for Andritz. These are companies like major pulp mills, steel manufacturers, and utility providers who rely on extensive, high-capacity, and cutting-edge plant solutions to drive their primary business functions.

For instance, in 2024, Andritz secured a significant order from a leading pulp producer in South America for a new pulp line, highlighting the demand for advanced, large-scale processing capabilities. These clients often require integrated, fully automated systems that optimize efficiency and output, reflecting their substantial operational needs.

Renewable energy developers and operators, particularly those focused on hydropower and the burgeoning green hydrogen sector, represent a core customer segment for Andritz. These entities require robust and efficient equipment for power generation, crucial for both established hydropower facilities and new green hydrogen production plants. For instance, in 2024, the global renewable energy market saw significant investment, with hydropower remaining a stable contributor while green hydrogen projects gained substantial momentum, driving demand for specialized turbines and electrolysis technologies.

Municipal and industrial wastewater treatment plants are key customers, needing sophisticated separation technologies and environmental solutions. They are driven by the need to comply with stringent environmental regulations, which are becoming increasingly strict globally. For instance, in 2024, many regions are implementing stricter discharge limits for pollutants like phosphorus and nitrogen, pushing these facilities to adopt advanced treatment methods.

These clients are particularly interested in solutions that not only treat water and wastewater effectively but also facilitate solid-liquid separation and enable waste-to-value applications. This means they are looking for ways to recover valuable resources from waste streams, such as biogas or nutrient-rich sludge, thereby improving operational efficiency and sustainability. The market for such technologies saw significant investment in 2023 and is projected for continued growth as circular economy principles gain traction.

Manufacturers Seeking Decarbonization and Digitalization Solutions

Manufacturers are increasingly prioritizing sustainability and operational upgrades. This segment is actively seeking solutions to reduce their environmental impact and improve efficiency. For instance, in 2024, the global manufacturing sector continued to invest heavily in green technologies, with renewable energy adoption in factories seeing a significant uptick.

These companies are looking for partners who can provide integrated solutions for decarbonization and digitalization. They aim to leverage smart technologies to achieve their sustainability targets and boost productivity. The demand for Industry 4.0 technologies, including AI and IoT, within manufacturing is projected to grow substantially by 2025, driven by these needs.

- Decarbonization Goals: Manufacturers are setting ambitious targets to reduce greenhouse gas emissions, often driven by regulatory pressures and consumer demand.

- Digitalization Imperative: The adoption of digital tools, from advanced analytics to automation, is seen as crucial for optimizing resource usage and enhancing competitiveness.

- Seeking Integrated Solutions: This customer segment prefers partners offering a comprehensive suite of services, rather than piecemeal technologies, to manage complex transitions.

- Focus on Energy Efficiency: A key driver is reducing energy consumption through more efficient processes and the integration of renewable energy sources.

Existing Plant Owners Requiring Modernization and Service

Existing plant owners represent a significant customer segment for Andritz, focusing on modernization and ongoing service needs. This group includes owners of both Andritz-manufactured equipment and plants from other providers who are looking to enhance their operations. Their primary requirements revolve around upgrades, refurbishments, securing spare parts, and accessing comprehensive maintenance services. These offerings are critical for extending the operational lifespan of their assets and boosting overall efficiency.

This segment is particularly vital for Andritz's strategic growth in its service business. By addressing the evolving needs of these existing asset owners, Andritz can foster long-term relationships and generate recurring revenue streams. For instance, in 2024, Andritz reported a strong performance in its Service segment, which is largely driven by these types of customer engagements.

- Upgrade and Refurbishment Projects: Addressing aging infrastructure and performance gaps.

- Spare Parts Availability: Ensuring minimal downtime through efficient supply chains.

- Maintenance and Service Contracts: Providing ongoing support to optimize plant operations.

- Efficiency Improvement Solutions: Implementing new technologies to reduce energy consumption and increase output.

Andritz serves a diverse customer base, ranging from large industrial corporations in sectors like pulp and paper and metals, to renewable energy developers and operators in hydropower and green hydrogen. Municipal and industrial wastewater treatment plants are also key clients, seeking advanced separation and environmental solutions to meet stringent regulations.

Manufacturers are increasingly focused on sustainability and operational upgrades, looking for integrated solutions for decarbonization and digitalization. Existing plant owners are a critical segment, requiring modernization, upgrades, spare parts, and maintenance services to enhance asset lifespan and efficiency, driving Andritz's service business growth.

| Customer Segment | Key Needs | 2024 Relevance/Data Point |

|---|---|---|

| Large Industrial Corporations | High-capacity, advanced plant solutions; integrated, automated systems | Secured major order for a new pulp line in South America (2024) |

| Renewable Energy Developers | Robust equipment for hydropower and green hydrogen production | Global renewable energy investment strong; green hydrogen projects gaining momentum (2024) |

| Wastewater Treatment Plants | Sophisticated separation technologies; compliance with environmental regulations | Increased adoption of advanced treatment methods due to stricter discharge limits (2024) |

| Manufacturers | Sustainability solutions, decarbonization, digitalization, energy efficiency | Continued heavy investment in green technologies and renewable energy adoption (2024) |

| Existing Plant Owners | Modernization, upgrades, spare parts, maintenance services | Strong performance in Andritz's Service segment driven by these engagements (2024) |

Cost Structure

Andritz invests heavily in Research & Development to stay ahead in technological advancements and create new sustainable offerings. These significant costs are essential for maintaining their competitive edge and driving innovation across all their operational segments, from pulp and paper to metals and energy.

In 2023, Andritz's R&D expenses amounted to €202.7 million. This substantial investment underscores their commitment to developing cutting-edge solutions and embracing digitalization, which are critical for their long-term success and market leadership.

Manufacturing and production costs represent a significant portion of Andritz's expenses, driven by the complex fabrication of machinery, equipment, and plant components. These costs encompass the procurement of raw materials, skilled labor for specialized production processes, and the overhead associated with maintaining its global network of manufacturing facilities.

In 2024, Andritz continued to invest heavily in its production capabilities. For instance, the company's capital expenditures in manufacturing and production facilities were a key focus area, reflecting ongoing efforts to enhance efficiency and capacity. These investments are crucial for delivering the high-quality, customized solutions that Andritz is known for across its various business segments.

Andritz dedicates significant resources to its global sales, marketing, and distribution efforts. These costs encompass maintaining an extensive worldwide sales force, engaging in targeted marketing campaigns, and actively participating in key industry trade shows to showcase its advanced technological solutions.

Managing a complex global distribution network for both heavy equipment and essential spare parts is a substantial expenditure. This infrastructure is critical for ensuring timely delivery and support to a diverse customer base across various geographic regions, thereby reinforcing Andritz's market presence and accessibility.

In 2023, Andritz reported selling, general, and administrative expenses of €1,205.6 million, a portion of which directly reflects these sales, marketing, and distribution activities essential for its international operations and customer engagement.

Employee Salaries, Wages, and Benefits

Andritz's cost structure heavily features employee salaries, wages, and benefits, reflecting its reliance on a skilled global workforce. This includes compensation for engineers, project managers, technicians, and administrative personnel essential for its complex operations.

For instance, in 2023, Andritz reported personnel expenses of €2,036.1 million. This significant outlay underscores the value placed on its human capital, which drives innovation and project execution.

- Employee Compensation: The core of this cost is the remuneration for a diverse team of specialists.

- Global Operations: Costs are distributed across its numerous international sites.

- 2023 Personnel Expenses: Totaling €2,036.1 million, this figure highlights the scale of investment in its workforce.

- Skilled Workforce: The specialized nature of Andritz's business necessitates competitive compensation to attract and retain talent.

Service and After-Sales Support Infrastructure Costs

Andritz invests significantly in its service and after-sales support infrastructure to ensure customer satisfaction and drive recurring revenue. These costs encompass maintaining a global network of service centers, employing skilled field technicians, and managing extensive spare parts inventories. In 2024, Andritz continued to bolster its digital support platforms, recognizing their importance in efficient problem-solving and customer engagement.

- Global Service Network: Costs related to operating and staffing numerous service centers worldwide.

- Field Technician Operations: Expenses for training, travel, and deployment of technicians for on-site support.

- Spare Parts Management: Investment in maintaining adequate stock levels and efficient logistics for spare parts.

- Digital Support Platforms: Development and maintenance costs for online portals, remote diagnostics, and customer service applications.

Andritz's cost structure is dominated by personnel expenses, reflecting its substantial global workforce of skilled engineers, technicians, and administrative staff. Manufacturing and production costs are also significant due to the complex fabrication of machinery and plants, involving raw material procurement and specialized labor. Furthermore, substantial investments in research and development are crucial for maintaining technological leadership and developing sustainable solutions.

| Cost Category | 2023 Value (€ million) | Key Components |

|---|---|---|

| Personnel Expenses | 2,036.1 | Salaries, wages, benefits for global workforce |

| R&D Expenses | 202.7 | Technological advancements, sustainable offerings |

| Selling, General & Administrative | 1,205.6 | Sales force, marketing, distribution, administration |

Revenue Streams

Andritz generates its primary revenue from selling complete industrial plants, specialized machinery, and individual components. This diverse offering spans key sectors like hydropower, pulp & paper, metals, and separation technologies.

These sales are predominantly structured as large, project-based contracts, reflecting the significant investment and tailored solutions provided to clients. For instance, in 2024, Andritz secured a substantial order for a new pulp production line, highlighting the scale of these revenue streams.

After-sales service and spare parts represent a significant and increasingly vital revenue source for Andritz. This segment encompasses a broad spectrum of offerings, including maintenance agreements, plant modernization projects, and the crucial sale of replacement and wear parts. These services are designed to ensure the ongoing efficiency and longevity of the equipment Andritz provides.

This stream delivers stable, recurring income, which is highly valuable for business predictability. For example, in 2023, Andritz reported that its Service segment, which heavily includes these offerings, generated approximately €1.8 billion in revenue, showcasing its substantial contribution to the company's overall financial performance.

Andritz generates revenue by selling and licensing its advanced digital solutions and automation systems. These offerings, such as the Metris platform, are designed to significantly enhance plant performance and facilitate predictive maintenance, aligning with the company's strong commitment to Industry 4.0 principles.

For instance, in 2023, Andritz reported a substantial increase in its digitalization segment, with orders in this area growing considerably, indicating strong market adoption of their smart technologies. This revenue stream is crucial for the company’s future growth and its position as a leader in industrial automation.

Rehabilitation and Modernization Projects

Andritz generates substantial revenue from large-scale rehabilitation and modernization projects. These initiatives focus on extending the operational life and boosting the efficiency of existing industrial plants and critical infrastructure, particularly hydropower stations. This segment represents a key area of ongoing and anticipated growth for the company.

These projects are crucial for maintaining and enhancing the performance of aging assets. For instance, Andritz secured a significant contract in 2024 to modernize several hydropower plants, a testament to the demand in this sector. Such undertakings not only improve operational efficiency but also contribute to sustainability goals by reducing the need for entirely new constructions.

- Revenue from rehabilitation and modernization of industrial plants.

- Income derived from upgrading and extending the life of hydropower stations.

- Focus on improving efficiency and operational performance of existing infrastructure.

- This segment is identified as a major growth driver for Andritz.

Consulting and Engineering Services

Andritz generates revenue through consulting and engineering services, offering clients expert advice, feasibility studies, and design solutions. This segment often acts as a vital initial step, paving the way for subsequent equipment sales or standing as a valuable standalone offering.

These services are crucial for project development, ensuring clients receive tailored engineering and project management expertise. For instance, in 2024, Andritz continued to secure significant engineering contracts across its diverse business areas, contributing to its overall revenue stream.

- Expert Consulting: Providing specialized knowledge and strategic advice to clients in project planning and execution.

- Feasibility Studies: Assessing the viability and potential of new projects, offering data-driven insights.

- Engineering Design: Developing detailed technical specifications and blueprints for industrial processes and equipment.

- Project Management: Overseeing project lifecycles from inception to completion, ensuring efficiency and adherence to timelines.

Andritz's revenue streams are diverse, encompassing the sale of complete plants and machinery, after-sales services and spare parts, digital solutions, and expert consulting and engineering. A significant portion of their income also comes from large-scale rehabilitation and modernization projects, particularly for hydropower facilities. These varied revenue channels contribute to a robust and resilient business model.

| Revenue Stream | Description | 2023/2024 Data Insight |

|---|---|---|

| Plant & Machinery Sales | Complete industrial plants, specialized machinery, and components. | Secured significant orders for pulp production lines in 2024. |

| After-Sales Service & Spare Parts | Maintenance, modernization, replacement parts. | Service segment revenue was approximately €1.8 billion in 2023. |

| Digital Solutions | Advanced digital and automation systems (e.g., Metris). | Orders in digitalization grew considerably in 2023. |

| Rehabilitation & Modernization | Extending life and efficiency of existing plants, especially hydropower. | Awarded contracts for hydropower plant modernization in 2024. |

| Consulting & Engineering | Expert advice, feasibility studies, design, project management. | Continued to secure significant engineering contracts across business areas in 2024. |

Business Model Canvas Data Sources

The Andritz Business Model Canvas is built using a blend of internal financial data, comprehensive market research reports, and direct feedback from customer interactions. These diverse sources ensure a robust understanding of our operational landscape and strategic opportunities.