Andritz Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Andritz Bundle

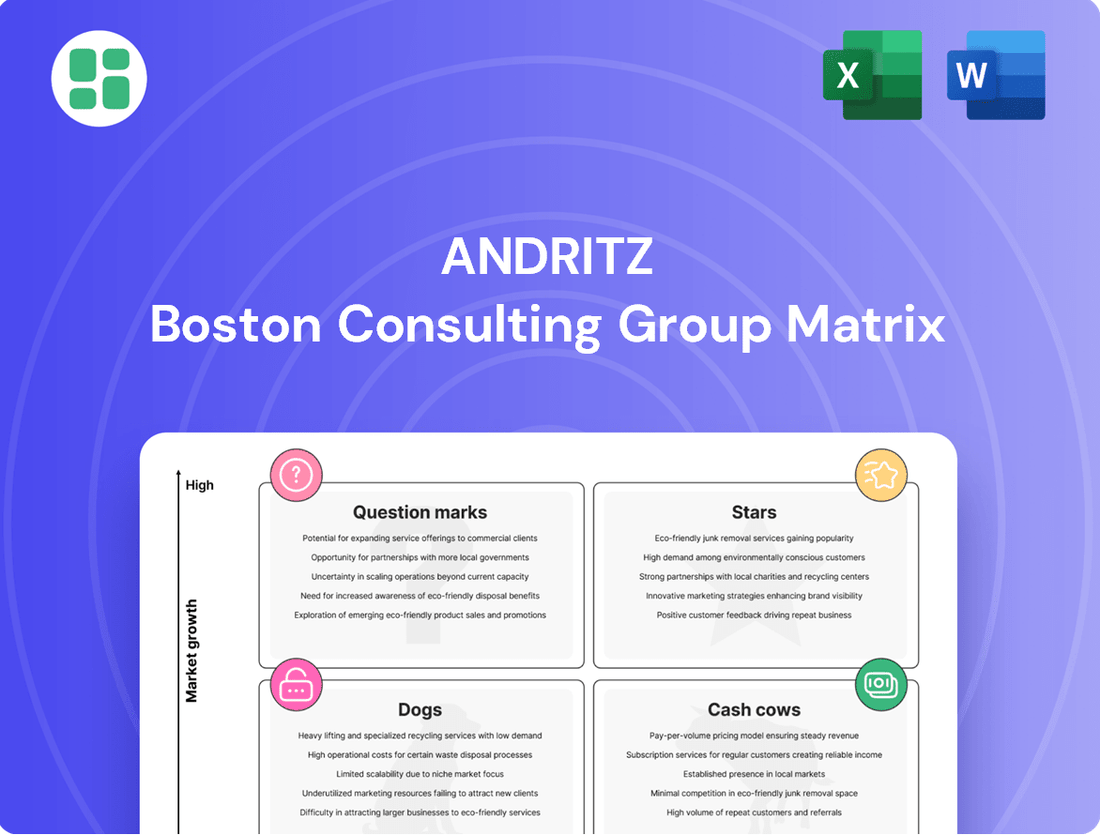

Curious about Andritz's strategic positioning? This glimpse into their BCG Matrix reveals the potential of their product portfolio, highlighting areas of strength and opportunity.

Unlock the full picture and understand exactly where each Andritz product falls – are they market-leading Stars, stable Cash Cows, underperforming Dogs, or promising Question Marks?

Purchase the complete Andritz BCG Matrix for detailed quadrant analysis, actionable insights, and a clear path to optimizing your investment and product strategy.

Stars

Andritz's Hydropower segment is a clear Star in the BCG matrix, fueled by robust order intake growth in 2024 and extending into Q1 2025. This surge is directly linked to the global push for renewable energy and the critical need for modernizing existing power plants to ensure grid stability and efficiency.

The company's leadership in large-scale hydropower projects and rehabilitation contracts solidifies its strong market position within this expanding sector. For instance, Andritz secured a significant contract in 2024 for the modernization of a major hydropower plant in Europe, underscoring its capabilities in complex, high-value projects.

Continued strategic investment in hydropower modernization is crucial for Andritz to sustain its market dominance and capitalize on future growth opportunities. This segment represents a vital engine for the company's renewable energy strategy, demanding ongoing innovation and capacity expansion.

Despite a generally subdued Pulp & Paper market in 2024, Andritz experienced a notable uplift in order intake for sustainable pulp mill technologies in Q1 2025. This growth was particularly driven by large-scale greenfield projects, such as the Suzano mill, which are prioritizing environmentally friendly production methods.

These advanced, sustainable pulp mill technologies are designed for enhanced efficiency and a minimized ecological footprint. For instance, projects like Suzano are incorporating state-of-the-art solutions that reduce water consumption and energy usage, aligning with increasing global demand for eco-conscious manufacturing.

Andritz's strong performance in securing these forward-looking contracts underscores its position as a leader in a high-growth niche. The company's expertise in developing and implementing these cutting-edge, sustainable solutions firmly places these technologies within the Star quadrant of the BCG matrix, indicating significant future potential.

Andritz is making substantial investments in its Metris digital platform, a key component of its digitalization strategy. This platform, along with AI-driven automation, is being actively promoted across all of Andritz's business segments, targeting high-growth markets focused on industrial optimization.

The Metris platform is designed to boost operational efficiency, decrease environmental impact through emission reduction, and facilitate more intelligent decision-making for Andritz's clientele. This strategic emphasis positions Andritz as a leader in the industrial digitalization landscape. For instance, in 2023, Andritz reported a significant increase in orders for digital solutions, reflecting strong market adoption and the growing demand for such advanced technologies.

Environment & Energy Technologies (New Acquisitions)

The Environment & Energy Technologies segment, particularly with its new acquisitions, is positioned as a strong contender in the BCG matrix. In 2024, this business area saw robust growth in both order intake and revenue. This upward trend continued into the first quarter of 2025, underscoring its market vitality.

A key driver of this expansion was the strategic acquisition of LDX Solutions in February 2025. This move significantly enhanced Andritz's capabilities in emission reduction technologies. The market for these technologies is experiencing rapid expansion, fueled by increasingly stringent environmental regulations and a global push towards sustainability.

These newly integrated and improved environmental technologies represent high-growth opportunities for Andritz. The company is actively leveraging these advancements to broaden its market share in a sector that is becoming increasingly critical for industrial operations worldwide.

- 2024 Order Intake Growth: Significant increase reported for the Environment & Energy segment.

- Q1 2025 Revenue Momentum: Continued strong performance in early 2025.

- LDX Solutions Acquisition (Feb 2025): Strengthened emission reduction technology portfolio.

- Market Drivers: Stringent environmental regulations and sustainability goals are boosting demand.

Service Business for Green and Advanced Technologies

Andritz's service business, particularly in green and advanced technologies, is a clear Star in the BCG Matrix. This segment has demonstrated robust growth, reaching 41% of total revenue in 2024 and climbing to 44% in the first quarter of 2025. This expansion is largely driven by the escalating demand for services supporting sustainable and technologically advanced installations.

The increasing reliance on higher-margin service revenue highlights its strategic importance. This is especially true for the operational excellence and lifecycle support of complex, modern industrial plants, where Andritz commands a significant market share in a rapidly expanding sector.

- Service revenue as a percentage of total revenue: 41% (2024) and 44% (Q1 2025).

- Key growth driver: Increased demand for green products and services.

- Strategic positioning: High market share in a growing demand for operational excellence and lifecycle support.

- Segment classification: Star due to high growth and high market share.

The service business, especially for green and advanced technologies, is a standout Star for Andritz. This segment saw its contribution to total revenue climb from 41% in 2024 to 44% in Q1 2025, showcasing strong growth. The increasing demand for lifecycle support in modern, sustainable industrial plants, where Andritz holds a significant market share, fuels this expansion.

| Segment | BCG Classification | Key Growth Drivers | 2024 Revenue Share | Q1 2025 Revenue Share |

|---|---|---|---|---|

| Services (Green & Advanced Tech) | Star | Demand for lifecycle support, operational excellence in sustainable plants | 41% | 44% |

| Hydropower | Star | Global renewable energy push, plant modernization needs | N/A | N/A |

| Pulp & Paper (Sustainable Tech) | Star | Demand for eco-friendly production, greenfield projects | N/A | N/A |

| Environment & Energy Technologies | Star | Emission reduction tech, acquisitions (LDX Solutions), environmental regulations | N/A | N/A |

What is included in the product

Strategic allocation of resources across Andritz's portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs.

The Andritz BCG Matrix offers a clear, visual assessment of business unit performance, relieving the pain of uncertainty in strategic resource allocation.

Cash Cows

Andritz's Pulp & Paper division is a classic Cash Cow, leveraging its global leadership in a mature market. The company offers a comprehensive suite of technologies and services for pulp, paper, board, and tissue production.

Despite modest market growth, Andritz benefits from a vast installed base of equipment. This foundation generates consistent revenue through spare parts, maintenance contracts, and crucial modernization upgrades.

In 2024, the Pulp & Paper sector, while mature, continued to be a significant contributor to Andritz's overall financial performance. The company's strong market share in this segment ensures a reliable and substantial cash flow, supporting investments in other business areas.

Andritz's established hydropower business, focusing on standard electromechanical equipment for existing plants, functions as a strong Cash Cow. This segment benefits from a vast global installed base, ensuring consistent demand for maintenance, spare parts, and routine rehabilitation. For instance, in 2023, Andritz reported that its Hydro division, which includes these core services, contributed significantly to its overall revenue, demonstrating the stable cash flow generated from these mature assets.

Andritz's Metals Processing and Forming Technologies segment, serving the steel and automotive sectors, operates within a mature market. While investment activity saw some variability in 2024, the company's established position ensures a steady demand for its equipment and services.

This business area, characterized by its stable market share and loyal customer base, generates consistent cash flow. For instance, Andritz reported its Metals business area contributed significantly to group revenue, with specific figures highlighting its ongoing operational strength despite the mature market dynamics.

Traditional Solid/Liquid Separation Technologies

Andritz’s Separation segment, focusing on traditional solid/liquid separation technologies, operates within industries like chemical, food, and mining. These are generally mature sectors with predictable demand patterns, making them reliable sources of consistent revenue.

The company's deep-rooted expertise and significant market presence in these fundamental separation technologies allow it to generate steady cash flow. Even with modest market growth, the inherent stability of these applications positions them as strong cash cows.

- Stable Demand: Mature industries like mining and food processing exhibit consistent needs for solid/liquid separation, underpinning predictable revenue streams.

- Market Leadership: Andritz's established position in these foundational technologies translates to a secure market share and strong cash generation.

- Consistent Cash Flow: Despite potentially lower growth rates, the reliability of these applications ensures a steady and dependable inflow of cash for the company.

Comprehensive Aftermarket Services and Spare Parts

Andritz's comprehensive aftermarket services and spare parts business is a robust Cash Cow. This segment, encompassing general maintenance, repairs, and the supply of essential spare parts across all its divisions, reliably generates a substantial and expanding share of the company's overall revenue. Its success is built on high profit margins and consistent, predictable demand.

The strength of this business lies in Andritz's vast installed base of equipment and its deeply established, long-term relationships with customers. This foundation ensures a steady and dependable stream of cash flow, which is crucial for funding other strategic initiatives and investments within the company.

- 2023 Revenue Contribution: Aftermarket services and spare parts represented approximately 30% of Andritz's total revenue in 2023, demonstrating its significant financial impact.

- Margin Profile: This segment typically operates with EBITDA margins in the range of 15-20%, considerably higher than new equipment sales.

- Installed Base Growth: Andritz's installed base grew by over 5% in 2023, directly translating into increased opportunities for aftermarket revenue.

- Customer Retention: The company boasts a customer retention rate of over 90% for its service contracts, highlighting the loyalty and reliance on its aftermarket support.

Andritz's Pulp & Paper and Hydro divisions are prime examples of Cash Cows within its BCG Matrix. These segments benefit from mature markets, a substantial installed base, and consistent demand for services and spare parts.

In 2024, these established businesses continued to be significant profit generators, providing stable cash flow that fuels innovation and growth in other areas of the company.

The aftermarket services and spare parts business, spanning all divisions, acts as a powerful Cash Cow. With high margins and a loyal customer base, it ensures reliable revenue streams.

For instance, in 2023, aftermarket services contributed approximately 30% to Andritz's total revenue, with EBITDA margins often between 15-20%, underscoring its cash-generating prowess.

| Division/Segment | BCG Classification | Key Characteristics | 2023/2024 Relevance |

| Pulp & Paper | Cash Cow | Mature market, extensive installed base, aftermarket services | Significant revenue contributor, stable cash flow |

| Hydro (Standard Equipment) | Cash Cow | Mature market, large installed base, maintenance & rehabilitation | Consistent demand for services and parts |

| Aftermarket Services & Spare Parts | Cash Cow | High margins, customer loyalty, broad applicability | ~30% of 2023 revenue, strong profitability |

What You See Is What You Get

Andritz BCG Matrix

The Andritz BCG Matrix preview you see is the definitive document you will receive upon purchase, meticulously crafted for strategic decision-making. This isn't a sample; it's the complete, unwatermarked analysis ready for immediate application in your business planning. You'll gain access to the full, professionally formatted report, enabling you to effectively categorize Andritz's business units and guide future investments. This comprehensive tool will empower you to identify stars, question marks, cash cows, and dogs within Andritz's portfolio, ensuring a clear path forward.

Dogs

Andritz's Metals Forming sector faced a challenging first half of 2024, with weak demand stemming from reduced investment by steel and automotive manufacturers. This downturn is largely attributed to ongoing structural shifts within these industries.

Within this segment, legacy technologies supporting declining automotive segments, such as those focused on traditional internal combustion engine components or outdated manufacturing processes, are likely classified as Dogs. These specific product lines exhibit low market share and minimal growth potential as the automotive industry pivots towards electrification and new materials.

Within Andritz's Pulp & Paper division, older or less efficient technologies, particularly those not aligned with current sustainability and energy efficiency demands, can be categorized as Dogs. These might include machinery or processes that haven't undergone significant upgrades to reduce environmental impact or operational costs.

These underperforming offerings often face low market share because they struggle to compete with newer, more advanced solutions. If they also target niche or shrinking segments of the market, their growth potential becomes severely limited. Andritz's mention of 'capacity adjustments' in some segments suggests a strategic move to address these less competitive product lines.

Certain niche products within highly fragmented markets at Andritz might be categorized as Dogs. These are typically smaller product lines facing stiff competition in slow-growing, fragmented sectors where Andritz doesn't command a leading position. For instance, if Andritz offers a specialized component for a niche industrial application that has many small competitors and limited overall market expansion, it could fall into this category.

These Dog products often struggle to achieve profitability or require significant investment for minimal gains. In 2024, the industrial equipment sector, which Andritz operates in, continued to see consolidation and intense competition in many specialized areas. Products that don't offer a clear technological advantage or unique selling proposition in such environments are particularly vulnerable to being classified as Dogs.

Standardized Components with Commoditized Pricing

In certain mature sectors, Andritz may supply standardized parts with pricing heavily influenced by market competition from many vendors, a situation known as commoditization. These items, if they lack unique selling propositions and are positioned in slow-expanding markets, risk being categorized as Dogs. Such products typically yield meager profits and necessitate continuous cost reduction efforts to maintain even minimal viability.

For instance, if a specific type of standard pump component, widely produced by multiple manufacturers, experiences stagnant demand, it would likely be a Dog. In 2024, the industrial pump market, while robust overall, sees intense competition in the segment for basic, mass-produced components. Andritz’s profitability in such areas would depend heavily on operational efficiency and scale, rather than premium pricing power. This segment might represent a smaller portion of Andritz's overall revenue, with margins potentially below the company average.

- Low Market Share: Products in this category often struggle to gain significant market traction due to intense competition and lack of differentiation.

- Low Growth Prospects: They operate in mature or declining markets where demand is not expected to increase substantially.

- Minimal Profitability: These offerings typically generate low returns, often just covering costs, and require constant vigilance on expenses.

- Potential Divestment: Companies may consider divesting or phasing out Dog products if they do not contribute strategically or financially.

Product Lines Impacted by Structural Market Declines

Andritz's 2024 financial reports highlight structural changes in specific markets, prompting capacity adjustments. This indicates that certain product lines are experiencing fundamental market declines, where demand is shrinking despite the company's efforts.

These segments would likely be classified as Dogs in the BCG matrix, characterized by low growth and potentially declining market share. For instance, if a specific segment within their pulp and paper division, like equipment for a mature paper type, faces reduced global demand, it would fit this category.

- Market Decline Example: Reduced demand for certain types of industrial boilers due to shifts towards renewable energy sources in specific regions.

- Capacity Adjustment: Andritz's 2024 reports noted a need for capacity adjustments in divisions serving these mature markets.

- Strategic Consideration: Products in these declining markets might be candidates for divestiture or require significant restructuring to remain viable.

- Financial Impact: Low growth and potential market share erosion in these Dog segments can negatively impact overall profitability and resource allocation.

Products classified as Dogs within Andritz's portfolio are those with low market share in slow-growing or declining industries. These offerings typically struggle to generate significant profits and may require substantial investment to maintain their position. In 2024, Andritz's focus on efficiency and strategic adjustments suggests a proactive approach to managing these less dynamic business segments.

These Dog products, such as older technologies in the Metals Forming sector or less efficient machinery in Pulp & Paper, represent areas where Andritz has a limited competitive advantage. Their low growth prospects and minimal profitability make them candidates for divestment or require a strategic overhaul to improve performance.

For instance, certain legacy components for the automotive industry, particularly those not supporting electric vehicle trends, are likely Dogs. In 2024, the automotive sector's transformation means older technologies face shrinking demand, impacting market share and growth potential for Andritz's offerings in this space.

Andritz's strategy in 2024 involves navigating these challenges by optimizing its product mix. This includes addressing segments with low market share and growth, such as commoditized industrial parts or technologies serving mature, non-expanding markets.

| Andritz Business Segment | Potential Dog Product Examples | 2024 Market Context | BCG Classification Rationale |

|---|---|---|---|

| Metals Forming | Legacy machinery for internal combustion engine components | Weak demand due to automotive industry shifts to EVs; reduced investment by manufacturers. | Low market share, low growth prospects in a declining segment. |

| Pulp & Paper | Older, less energy-efficient papermaking machinery | Increased demand for sustainable and energy-efficient solutions; mature market for certain paper types. | Low market share against newer technologies, low growth in specific niches. |

| Hydro Power | Outdated components for small, non-upgraded hydropower plants | Focus on modernizing existing plants and developing new renewable energy sources; mature market for older tech. | Low market share in a segment with limited growth potential due to technological obsolescence. |

Question Marks

Andritz is actively developing solutions for Power-to-X and green hydrogen production, positioning itself in these rapidly expanding sectors vital for global decarbonization efforts. These technologies are crucial for creating sustainable fuels and chemicals from renewable electricity.

While these markets are still in their early stages and face intense competition, Andritz's current market share in these specific Power-to-X and green hydrogen technologies is likely modest. The company is investing heavily in research and development to capture future growth.

These segments represent potential future Stars within the BCG framework, demanding substantial capital investment to scale up and achieve a leading market position. The global green hydrogen market, for instance, is projected to reach over $50 billion by 2030, indicating significant upside potential.

Andritz is investing heavily in research and development for advanced textile recycling, evidenced by their delivery of tearing lines to institutions like AITEX for pilot projects. This positions them at the forefront of a burgeoning market fueled by the global push for circular economy principles.

The textile recycling sector is experiencing rapid growth, with projections indicating a significant expansion in the coming years as sustainability mandates become more stringent. However, this market is still in its nascent stages of development and widespread adoption.

Given that Andritz's market share in this relatively new and evolving application area is likely to be modest, their textile recycling solutions can be categorized as a Question Mark within the BCG matrix. Successful scaling and market penetration could lead to substantial future growth and market leadership.

Andritz's Metris platform serves as a foundation for developing new, specialized AI and automation applications targeting industrial verticals with limited current penetration. These innovative solutions are designed to address significant growth needs within these sectors.

For instance, in 2024, Andritz has been actively exploring AI-driven predictive maintenance for the pulp and paper industry's specialized machinery, a segment where their market share for such advanced solutions is still developing. The company's investment in these niche applications highlights a strategic push to unlock new revenue streams by leveraging their technological expertise in underserved areas.

The success of these new digital solutions hinges on substantial market adoption efforts. Andritz aims to convert their innovative potential into significant market share by demonstrating clear ROI and operational efficiencies to potential clients in these new verticals.

Emerging Market Expansion for New Technologies

Emerging market expansion for Andritz's new technologies, especially in areas like green hydrogen production or advanced biomass processing, falls into the Question Marks category of the BCG matrix. These are high-growth potential markets where Andritz is still building its market share and brand recognition.

Significant investment is required to establish a foothold, covering market research, local partnerships, and tailored sales strategies. For instance, Andritz's focus on sustainable solutions aligns with the growing global demand for decarbonization technologies, which is projected to see substantial growth in regions actively pursuing green initiatives.

- High Growth Potential: Emerging markets are increasingly adopting sustainable technologies, creating a fertile ground for Andritz's innovations.

- Low Market Share: Andritz is often entering these markets with new offerings, meaning its current market share is relatively small.

- Investment Intensive: Significant capital is needed for market entry, including establishing local operations and building brand awareness.

- Strategic Importance: These ventures are crucial for Andritz's long-term growth and for solidifying its position as a leader in sustainable technology solutions globally.

Niche Acquisitions in Nascent Environmental Technologies

Niche acquisitions like LDX Solutions, acquired by Andritz in February 2025 for its emission reduction technologies, are classic examples of potential Stars within the BCG Matrix, particularly in nascent environmental markets. This strategic move places Andritz in a segment experiencing rapid growth, driven by increasing global environmental regulations and a push for sustainable solutions.

While the acquisition itself signals a strong belief in the technology's potential, the initial market share and long-term profitability of such specialized ventures remain somewhat uncertain. These technologies often require significant investment in integration and scaling to achieve their full market potential.

- Market Position: LDX Solutions' emission reduction technologies target a high-growth environmental sector.

- Strategic Fit: The acquisition aligns with Andritz's focus on sustainable solutions and expanding its environmental technology portfolio.

- Potential for Growth: Niche acquisitions in nascent markets, if successful, can evolve into market-leading Stars.

- Integration Risk: The ultimate success hinges on effective integration and scaling, which carries inherent uncertainties.

Andritz's ventures into advanced textile recycling and new AI-driven industrial applications represent classic Question Marks. These areas offer substantial growth potential, driven by global sustainability trends and technological advancements, but Andritz currently holds a modest market share.

Significant investment is required to scale these operations and capture market leadership, making them capital-intensive endeavors. The success of these initiatives is contingent on market adoption and the ability to demonstrate clear return on investment for clients.

These segments are strategically important for Andritz's future diversification and leadership in sustainable and digital solutions. The company is actively pursuing these opportunities to build future growth engines.

BCG Matrix Data Sources

Our Andritz BCG Matrix leverages comprehensive data, including financial reports, market share analytics, and industry growth projections, to accurately position business units.