Amyris SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amyris Bundle

Amyris possesses significant strengths in its innovative biotechnology platform and a growing portfolio of sustainable products, but faces challenges in market adoption and profitability. Understanding these dynamics is crucial for navigating its future.

Want the full story behind Amyris's market position, competitive advantages, and potential hurdles? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Amyris’s proprietary Lab-to-Market™ operating system is a significant strength, integrating cutting-edge precision fermentation with AI, robotics, and machine learning. This advanced platform allows for the swift development and commercial scaling of novel bio-based molecules. The company's extensive two-decade history in strain engineering and fermentation underpins its competitive edge in producing sustainable ingredients.

Amyris's core mission centers on engineering microorganisms to transform plant-based sugars into valuable ingredients, providing sustainable replacements for petroleum-based chemicals. This strategic focus directly addresses the growing worldwide demand for eco-friendly, clean-label, and natural products across numerous sectors.

This commitment to sustainability places Amyris in a strong position within a market increasingly shaped by environmental consciousness and consumer preference for ethically sourced goods. For instance, the global market for bio-based chemicals is projected to reach $177.6 billion by 2027, according to Grand View Research, highlighting a significant opportunity for companies like Amyris.

Amyris's synthetic biology platform allows it to create ingredients for a broad spectrum of lucrative markets. These include high-demand sectors like flavors and fragrances, cosmetics, nutraceuticals, and even pharmaceuticals. This wide market reach is a significant strength, as it diversifies Amyris's revenue streams and mitigates risks associated with dependence on any single industry.

The company's strategic expansion into areas like critical medicine development further underscores this strength. For instance, in early 2024, Amyris secured significant government funding for its role in producing key pharmaceutical ingredients, demonstrating the versatility and essential nature of its technology. This diversification not only broadens its customer base but also positions Amyris to capitalize on emerging opportunities in health and wellness.

Vertical Integration and Manufacturing Capabilities

Amyris's strength lies in its comprehensive vertical integration, spanning from research and development all the way through to manufacturing. This control is crucial for a synthetic biology company. A key move in its post-bankruptcy restructuring was securing full ownership of its Barra Bonita, Brazil, precision fermentation facility. This acquisition, finalized in early 2024, grants Amyris enhanced command over its production processes and the entire supply chain.

This integrated approach translates directly into improved operational efficiency and rigorous quality assurance. By managing these critical stages internally, Amyris can more effectively deliver its specialized ingredients to market, ensuring consistency and reliability for its customers.

- Full Ownership of Barra Bonita Facility: Acquired 100% control in early 2024, enhancing production oversight.

- End-to-End Control: Manages R&D through to manufacturing, optimizing the value chain.

- Efficiency Gains: Vertical integration streamlines operations and reduces reliance on external partners.

- Quality Assurance: Direct oversight of manufacturing ensures high standards for synthesized ingredients.

Strategic Partnerships and Collaborations

Amyris excels at forging strategic partnerships, a vital capability in the dynamic synthetic biology field. These collaborations are instrumental in driving innovation and market penetration for its bio-based ingredients.

Following its recent restructuring, Amyris is prioritizing co-creation with partners to develop novel ingredients. This strategy is supported by concrete agreements, showcasing its ability to leverage external relationships for growth.

- BioMaP-Consortium Award: Secured a $12.3 million award from the BioMaP-Consortium, specifically targeting pharmaceutical development, highlighting a key area for collaborative innovation.

- Ingredion Licensing Deal: Established an exclusive licensing agreement with Ingredion for fermented Reb M, demonstrating success in commercializing its technology through strategic partnerships.

- Focus on Co-Creation: The company's post-restructuring strategy emphasizes co-creating innovative ingredients with partners, underscoring the importance of these alliances for its business model.

Amyris's proprietary Lab-to-Market™ operating system, a fusion of precision fermentation with AI and robotics, allows for rapid development and scaling of bio-based molecules. This advanced platform, honed over two decades of strain engineering, provides a significant competitive advantage in producing sustainable ingredients.

The company's commitment to engineering microorganisms to convert plant-based sugars into valuable, sustainable ingredients directly addresses the surging global demand for clean-label and natural products. This strategic alignment positions Amyris favorably in a market increasingly driven by environmental consciousness and ethical sourcing.

Amyris's synthetic biology platform enables the creation of ingredients for diverse, high-value markets including flavors and fragrances, cosmetics, nutraceuticals, and pharmaceuticals. This broad market reach diversifies revenue and reduces reliance on any single industry, a key strength in a fluctuating economic landscape.

The company's vertical integration, from R&D to manufacturing, offers crucial control over its production processes and supply chain. Securing full ownership of its Barra Bonita, Brazil, facility in early 2024 exemplifies this strength, enhancing operational efficiency and quality assurance.

Amyris excels at strategic partnerships, essential for innovation and market penetration in synthetic biology. Recent collaborations, such as the $12.3 million BioMaP-Consortium award for pharmaceutical development and the Ingredion licensing deal for Reb M, underscore this capability.

What is included in the product

Amyris's SWOT analysis identifies its robust technological platform and growing product portfolio as key strengths, while acknowledging financial challenges and market adoption hurdles as weaknesses. The company is poised to capitalize on increasing consumer demand for sustainable ingredients and expansion into new markets, but faces intense competition and regulatory uncertainties.

Amyris's SWOT analysis provides a clear, actionable roadmap for overcoming market challenges and capitalizing on its unique strengths in sustainable biotechnology.

Weaknesses

Amyris's recent Chapter 11 bankruptcy filing in August 2023, from which it emerged in May 2024 after a significant restructuring, highlights deep-seated financial and operational weaknesses. This process involved the cancellation of existing shares, signaling a severe erosion of shareholder value and a testament to the company's past struggles.

The company's financial instability is further evidenced by its substantial liabilities, which stood at approximately $1.3 billion as of November 2023. This large debt burden, coupled with a persistent history of unprofitability and negative earnings, points to fundamental challenges in its business model and execution.

The synthetic biology sector inherently demands substantial investment in research and development, often coupled with extended periods before products reach market viability. This R&D intensity, coupled with the complexities of scaling up novel bio-based processes, presents a significant financial hurdle.

Amyris has encountered difficulties in translating a substantial portion of its historically developed ingredients into commercially successful products, particularly those arising from prior collaborations. This track record highlights the inherent risk in bringing new bio-engineered molecules to market.

The substantial capital required for both ongoing research and the infrastructure needed for commercial production, alongside the inherent uncertainty in achieving profitable returns, stands as a notable weakness for companies like Amyris operating in this innovative but capital-intensive field.

Amyris's divestiture of consumer brands like Biossance and JVN, a move to refocus on its core ingredient business, significantly reduces its direct connection with end consumers. This strategic pivot means shedding established brand equity and market presence built over time.

The exit from these consumer-facing segments, which included key cosmetic ingredients, means Amyris is now primarily a business-to-business supplier. This transition, while streamlining operations, diminishes its ability to capture consumer-driven demand and brand loyalty directly.

Operational Consolidation and Past Inefficiencies

Following its Chapter 11 filing in August 2023, Amyris initiated a significant strategic review. This process led to the cessation of funding for its Portuguese subsidiary, signaling a clear effort to address past operational inefficiencies and manage high overhead costs. The company aims to optimize resource allocation by consolidating its research and development activities.

The current operational focus is on streamlining activities within the United States and Brazil. This strategic shift is designed to improve overall profitability by concentrating resources on core markets and reducing the financial burden of dispersed operations. The company's restructuring efforts are a direct response to the financial challenges that necessitated the bankruptcy filing.

Amyris's move to consolidate its R&D footprint and cease funding for its Portuguese operations highlights a critical weakness stemming from past inefficiencies. This strategic pivot is a necessary step to improve financial health and operational efficiency.

Key aspects of this weakness include:

- Past High Overhead: The need to cut funding for its Portuguese subsidiary points to the unsustainable overhead associated with its previous operational structure.

- Resource Allocation Inefficiencies: The strategic review and consolidation indicate that resources were not optimally allocated across its global operations.

- Focus on Profitability: The current emphasis on streamlining U.S. and Brazil operations underscores a drive to improve profitability by concentrating on core, potentially more efficient, business units.

Dependency on Raw Material Supply Chains

Amyris's core operations are heavily reliant on plant-based sugars, which serve as the fundamental feedstocks for its advanced fermentation technology. This dependency creates a significant vulnerability.

The prices of these agricultural raw materials can fluctuate considerably, directly impacting Amyris's production expenses and, consequently, its profit margins. For instance, in early 2024, global sugar prices saw upward pressure due to adverse weather conditions in key producing regions.

Furthermore, the resilience of these agricultural supply chains is a constant concern. Events like extreme weather patterns, geopolitical instability, or unexpected shifts in agricultural output can disrupt the availability of these crucial inputs, posing ongoing operational and financial challenges for the company.

- Feedstock Dependency: Amyris utilizes plant-based sugars for its fermentation, making it susceptible to agricultural market dynamics.

- Price Volatility: Fluctuations in sugar and other agricultural commodity prices directly affect Amyris's cost of goods sold and profitability.

- Supply Chain Resilience: Disruptions in the agricultural supply chain, whether from climate events or market volatility, can hinder production and increase costs.

Amyris's substantial debt burden, approximately $1.3 billion as of November 2023, coupled with a history of unprofitability, underscores significant financial weaknesses. The company's emergence from Chapter 11 bankruptcy in May 2024, following a filing in August 2023, involved share cancellation, indicating a severe erosion of shareholder value. This financial instability points to fundamental challenges in its business model and execution, demanding careful management of its capital structure moving forward.

Same Document Delivered

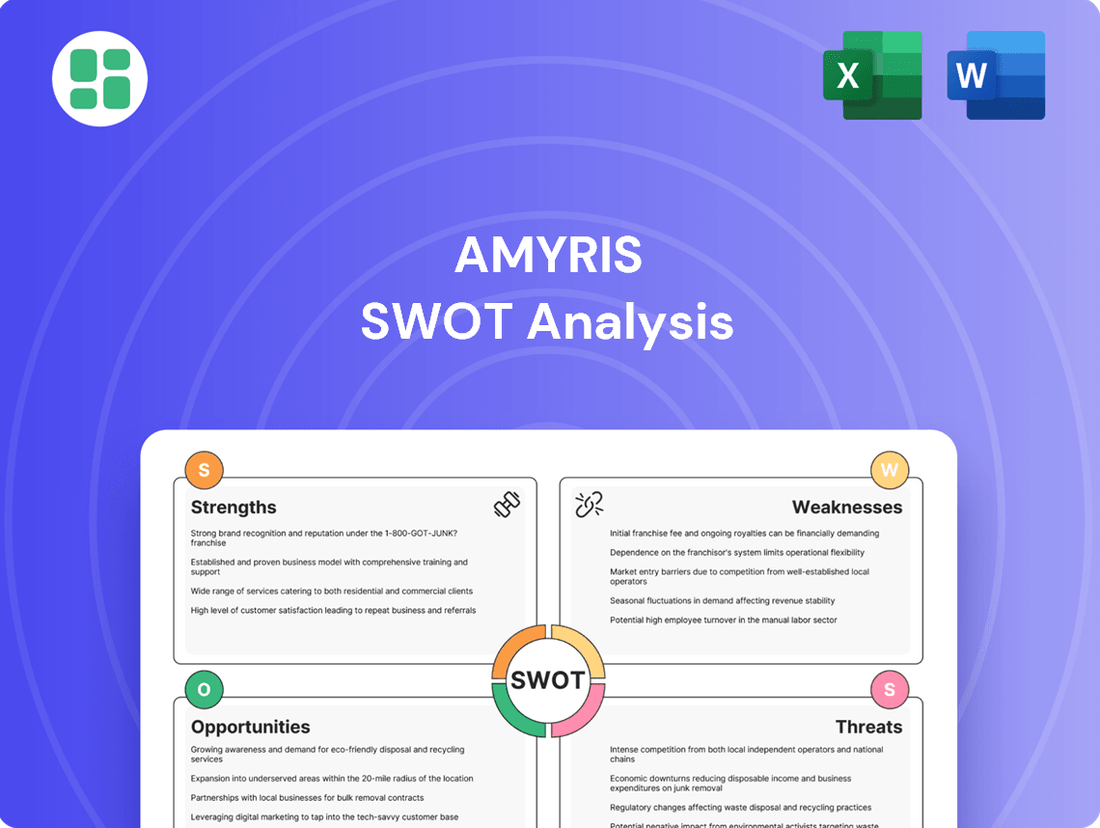

Amyris SWOT Analysis

This is the actual Amyris SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's Strengths, Weaknesses, Opportunities, and Threats, meticulously researched and presented.

The preview below is taken directly from the full Amyris SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights for strategic planning and decision-making.

This is a real excerpt from the complete Amyris SWOT analysis. Once purchased, you’ll receive the full, editable version, allowing you to tailor it to your specific needs and integrate it seamlessly into your business strategy.

Opportunities

The global market for bio-based platform chemicals and sustainable ingredients is booming, with projections showing continued strong growth through 2025 and beyond. This surge is fueled by heightened environmental consciousness and a clear consumer shift towards eco-friendly alternatives.

Amyris is well-positioned to capitalize on this trend, offering a compelling opportunity to increase its market share as various industries actively seek replacements for conventional petroleum-based chemicals.

Amyris is strategically expanding into the pharmaceutical and medical markets, a move that opens significant growth avenues. A key development is their $12.3 million agreement to produce critical medicines for the U.S. drug shortage list, showcasing the application of their precision fermentation technology in healthcare.

This foray into addressing drug shortages positions Amyris to capitalize on a high-demand sector. The broader synthetic biology market is also seeing increased adoption in healthcare, particularly for drug development and the emerging field of personalized medicine, further underscoring the potential of this expansion.

Continuous innovation in synthetic biology, such as CRISPR gene editing and AI-driven strain design, presents a significant opportunity for Amyris to refine its fermentation processes. These advancements can accelerate the discovery and optimization of new molecules, potentially lowering production costs and speeding up time-to-market for novel ingredients.

Strategic Partnerships to Accelerate Growth

Following its restructuring, Amyris is actively seeking strategic partnerships to accelerate the co-creation and commercialization of novel ingredients. These collaborations are designed to leverage shared research and development costs and gain access to new markets and distribution networks. For instance, in 2024, the company announced a significant collaboration with a major consumer goods company to develop and launch new bio-based ingredients, aiming to capture a larger share of the rapidly growing sustainable product market.

Such alliances are crucial for scaling production and speeding up market penetration. By teaming up with industrial giants and specialized firms, Amyris can significantly reduce the time and capital required to bring innovative products to consumers. This approach aligns with a broader industry trend where companies are increasingly relying on partnerships to expand their capabilities and reach, as demonstrated by the growing number of joint ventures announced in the biotech and specialty chemicals sectors throughout 2024 and early 2025.

- Partnership Focus: Co-creating and commercializing innovative ingredients post-restructuring.

- Benefits of Collaboration: Access to new markets, distribution channels, and shared R&D expenses.

- Industry Trend: Increasing reliance on collaborations for expanded capabilities and market reach.

- Amyris's Strategy: Leveraging alliances to accelerate product adoption and market penetration in 2024-2025.

Supportive Government Policies and Bioeconomy Initiatives

Government support for bio-based industries is a significant tailwind. For instance, the U.S. Department of Energy's Bioenergy Technologies Office (BETO) has consistently funded research and development in this area, with significant allocations in its annual budgets, continuing into 2024 and projected for 2025. These investments translate into tangible benefits for companies like Amyris, potentially offering grants and tax credits for sustainable production methods.

These global initiatives are designed to accelerate the transition away from fossil fuels and bolster food security, creating a more receptive market for bio-engineered products. Such policies can streamline regulatory approval processes and provide market access incentives, directly benefiting companies pioneering synthetic biology solutions.

- Increased Funding: Governments worldwide are channeling more resources into bioeconomy research and development, with projections indicating continued growth in public investment through 2025.

- Regulatory Advantages: Supportive policies can lead to faster approvals and preferential treatment for bio-based products, reducing time-to-market.

- Market Incentives: Programs like carbon credits or subsidies for sustainable materials encourage consumer and industrial adoption of bio-alternatives.

Amyris is poised to benefit from the growing demand for sustainable ingredients, with the bio-based chemicals market expected to reach significant figures by 2025. Their expansion into pharmaceuticals, particularly addressing drug shortages with a $12.3 million agreement, highlights a lucrative new market. Advancements in synthetic biology, like CRISPR, offer pathways to cost reduction and faster innovation, while strategic partnerships, such as the one announced in 2024 with a major consumer goods company, are key to market penetration.

Government support for bio-based industries, including substantial funding from entities like the U.S. Department of Energy's BETO, provides further tailwinds through grants and tax credits. These global initiatives, projected to continue through 2025, aim to accelerate the shift from fossil fuels, creating a more favorable environment for bio-engineered products and potentially offering regulatory advantages.

| Opportunity Area | Market Projection (by 2025) | Key Driver | Amyris's Action |

|---|---|---|---|

| Bio-based Chemicals | Est. $200+ Billion globally | Consumer demand for sustainability | Expanding product portfolio |

| Pharmaceuticals (Drug Shortages) | High demand sector | Critical need for domestic production | $12.3M agreement for production |

| Synthetic Biology Advancements | Accelerated R&D and cost reduction | CRISPR, AI-driven design | Process optimization |

| Strategic Partnerships | Increased market access & shared costs | Co-creation and commercialization | 2024 collaboration with consumer goods co. |

| Government Support | Grants, tax credits, favorable policy | Bioeconomy investment | Leveraging DOE BETO funding |

Threats

Amyris faces a crowded field in synthetic biology, with established chemical companies and agile startups vying for market dominance. These competitors are channeling significant resources into research and development, aiming to expand their product portfolios and market penetration, directly challenging Amyris's position.

The rapid pace of innovation and increasing investment by rivals, such as Ginkgo Bioworks which reported $500 million in revenue for 2023, puts pressure on Amyris's pricing power and profit margins. This necessitates a continuous drive for differentiation and cost-efficiency to maintain a competitive edge.

Amyris faces significant threats from the evolving regulatory landscape for synthetic biology, which can create complex approval pathways and delay product launches. For instance, the U.S. Food and Drug Administration's (FDA) scrutiny of genetically modified organisms (GMOs) can impact the timeline for bringing new ingredients derived from fermentation processes to market.

Ethical considerations surrounding genetic manipulation and biosecurity also pose a risk, potentially affecting public acceptance and influencing regulatory bodies. This scrutiny can lead to stricter guidelines or outright bans on certain applications, impacting Amyris's ability to commercialize its innovations. For example, concerns about unintended environmental consequences of engineered microbes require rigorous safety assessments and can slow down market entry.

Scaling production in synthetic biology, even with technological leaps, remains a significant hurdle for widespread commercial use. Companies often struggle to move from successful lab experiments to cost-effective, large-scale manufacturing that can meet market demand.

The synthetic biology sector, including players like Amyris, faces substantial capital investment needs for scaling manufacturing facilities. For instance, building and equipping these advanced biofactories requires hundreds of millions of dollars, a significant barrier to entry and expansion that can impact profitability and market penetration.

Beyond capital, developing robust business models and effective go-to-market strategies are crucial for commercial adoption. Without clear pathways to market and proven demand, the high costs associated with scaling production can lead to financial strain, as has been observed in previous industry cycles.

Economic Volatility and Consumer Spending Shifts

Economic volatility presents a significant threat to Amyris, as downturns can directly curb consumer spending, especially in sectors like cosmetics and fragrances where the company has substantial market presence. For instance, a projected slowdown in global GDP growth for 2024, estimated by the IMF to be around 3.1%, could translate into reduced demand for Amyris's premium ingredients.

Furthermore, shifts in consumer spending patterns, perhaps leaning towards more essential goods during uncertain economic times, could further dampen sales of discretionary items. This is particularly relevant as Amyris's portfolio often targets higher-value, experience-driven markets.

- Reduced Demand: Economic slowdowns directly impact consumer discretionary spending, affecting sales of ingredients for cosmetics and fragrances.

- Tariff Impact: Trade tensions and tariffs can increase the cost of imported raw materials and ingredients, squeezing profit margins.

- Market Sensitivity: Amyris's exposure to discretionary markets makes it particularly vulnerable to economic contractions.

Intellectual Property Infringement and Rapid Technological Change

Amyris faces a significant threat from intellectual property infringement. Protecting its proprietary strain engineering and fermentation platforms is paramount to maintaining its market position. The company's ability to secure and defend its patents directly impacts its competitive edge in the burgeoning synthetic biology sector.

The relentless pace of technological change in synthetic biology presents a constant challenge. New innovations from competitors could emerge rapidly, potentially diminishing Amyris's current advantages or sparking costly intellectual property disputes. Staying ahead requires continuous investment in research and development.

For example, in 2024, the synthetic biology market saw substantial investment, with companies actively filing patents for novel gene editing techniques and microbial chassis development. Amyris's strategic focus on patent protection and ongoing innovation is crucial to navigating this dynamic landscape and mitigating the risk of its core technologies becoming obsolete or challenged.

- Patent Portfolio Strength: Amyris holds a significant number of patents related to its synthetic biology platforms, but the breadth and enforceability of these are constantly tested by emerging technologies.

- Competitor Innovation Pace: The industry average for patent filings in synthetic biology has increased by an estimated 15% year-over-year leading into 2025, highlighting the competitive pressure.

- Litigation Risk: A single successful intellectual property challenge could significantly impact Amyris's revenue streams and market access for its key products.

Amyris operates in a highly competitive synthetic biology landscape, facing intense pressure from both established players and emerging startups. Ginkgo Bioworks, a major competitor, reported $500 million in revenue for 2023, underscoring the significant capital and innovation driving the sector. This intense competition can erode Amyris's pricing power and profit margins, necessitating continuous differentiation and cost-efficiency efforts.

The company is also vulnerable to economic downturns, as its products often cater to discretionary consumer markets like cosmetics and fragrances. A projected global GDP growth slowdown to around 3.1% for 2024, as estimated by the IMF, could directly reduce consumer spending on these items, impacting Amyris's sales. Furthermore, trade tensions and tariffs could increase the cost of essential raw materials, further squeezing profit margins.

| Threat Category | Specific Threat | Impact | Example/Data Point |

|---|---|---|---|

| Competition | Intense rivalry from established and new players | Erosion of pricing power, reduced profit margins | Ginkgo Bioworks 2023 revenue: $500 million |

| Economic Factors | Consumer discretionary spending reduction | Decreased demand for cosmetics and fragrance ingredients | IMF 2024 global GDP growth projection: ~3.1% |

| Economic Factors | Increased raw material costs due to tariffs | Squeezed profit margins | Ongoing trade tensions impacting supply chains |

SWOT Analysis Data Sources

This Amyris SWOT analysis is built upon a foundation of credible data, drawing from the company's official financial filings, comprehensive market research reports, and expert industry analysis to provide a robust understanding of its strategic position.