Amyris Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amyris Bundle

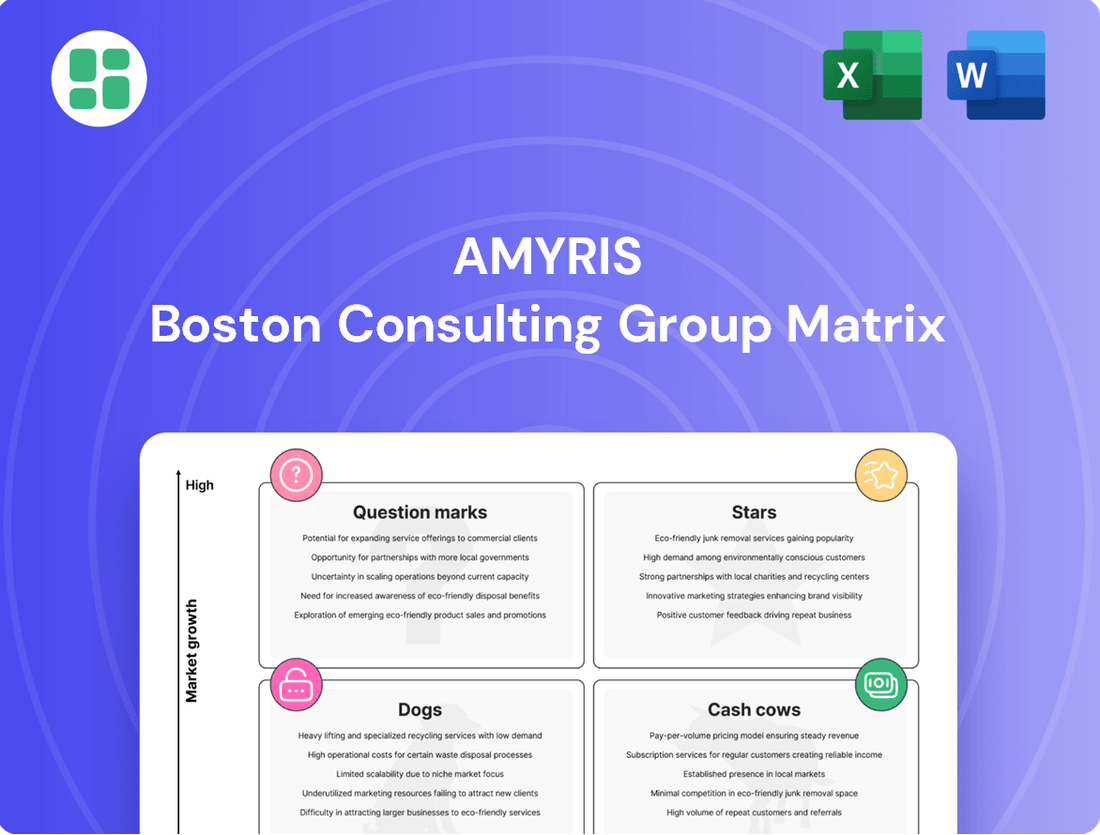

Unlock the strategic potential of Amyris with a comprehensive look at its BCG Matrix. Understand which products are fueling growth (Stars), generating consistent revenue (Cash Cows), lagging behind (Dogs), or requiring careful consideration (Question Marks).

This glimpse into Amyris's product portfolio is just the beginning. Purchase the full BCG Matrix report to gain detailed quadrant analysis, actionable insights, and a clear roadmap for optimizing your investments and product strategy.

Don't miss out on the complete picture of Amyris's market position. The full BCG Matrix provides the strategic clarity you need to make informed decisions and drive future success.

Stars

Amyris's Core Precision Fermentation Platform is central to its strategy, acting as its primary innovation engine. This proprietary Lab-to-Market technology, integrating organism engineering, AI, and advanced fermentation, underpins all its sustainable ingredient development. It's the engine for creating new high-value molecules and securing crucial partnerships.

Amyris is strategically positioning itself to be a leading supplier of sustainable ingredients for the flavors and fragrances (F&F) industry. This market is experiencing a significant shift towards bio-based and ethically sourced components, driven by consumer demand for cleaner products. Amyris's advanced fermentation technology allows for the production of high-purity, novel molecules that not only meet these sustainability criteria but also offer enhanced performance characteristics for F&F applications.

The company's focus on the F&F segment is particularly noteworthy given its high growth potential. As global consumer brands increasingly prioritize "clean chemistry" and environmental responsibility in their product formulations, the demand for Amyris's sustainable ingredients is expected to rise. This makes the F&F sector a critical area for Amyris's future growth and profitability, especially following its recent financial restructuring efforts. For instance, the global flavors and fragrances market was valued at approximately $31.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 5.5% through 2030, highlighting the significant opportunity for companies like Amyris.

Amyris, even after selling its consumer brands, remains a vital player in the clean beauty sector by supplying sustainable, bio-based ingredients. Their portfolio includes sought-after emollients like Hemisqualane, a key component for many premium skincare formulations. The global clean beauty market was valued at approximately $15.2 billion in 2023 and is projected to reach $33.4 billion by 2030, showcasing a compound annual growth rate of over 11%, driven by increasing consumer preference for natural and ethical products.

Biopharmaceutical Ingredients for Drug Shortages

Amyris is strategically positioning itself in the biopharmaceutical ingredients sector, particularly focusing on addressing drug shortages. This move represents a significant new market opportunity, with the company having secured $12.3 million in funding to develop small molecule drugs for the FDA's critical shortage list. This initiative highlights Amyris's commitment to leveraging its advanced organism engineering and synthetic chemistry expertise to meet urgent healthcare demands.

This pivot into pharmaceuticals, while in its nascent stages, carries substantial growth potential. By focusing on bio-based active pharmaceutical ingredients (APIs), Amyris aims to become a vital supplier in a market grappling with supply chain vulnerabilities. The company's technological foundation is well-suited to produce complex molecules efficiently, potentially disrupting traditional API manufacturing.

- Market Opportunity: Amyris targets the growing need for reliable API sources, especially for drugs experiencing shortages.

- Funding Secured: A $12.3 million award underscores the market's recognition of this strategic direction.

- Technological Advantage: Advanced organism engineering and synthetic chemistry are key enablers for producing novel biopharmaceutical ingredients.

- Growth Potential: This venture could establish Amyris as a key player in the bio-based pharmaceutical supply chain.

Strategic Co-Creation Partnerships

Amyris leverages strategic co-creation partnerships to accelerate innovation and market penetration for its sustainable ingredients. This approach allows them to tap into diverse industry needs by applying their synthetic biology platform, as seen in their collaboration with Firmenich for fragrance ingredients. This model is designed for high growth, capitalizing on Amyris's technological edge to deliver tailored solutions efficiently.

These collaborations are crucial for expanding Amyris's product portfolio and market reach. By partnering, they can bring novel, bio-based ingredients to market faster and at scale. For instance, their work in developing fermentation-derived ingredients for various applications highlights the power of this strategy.

- Co-Creation for Speed and Scale: Amyris partners with industry leaders to develop and commercialize new sustainable ingredients rapidly.

- Technology Application: Their synthetic biology platform is applied to address specific market demands across sectors like beauty, health, and food.

- Market Expansion: Partnerships enable Amyris to enter new markets and diversify its revenue streams through a broader product offering.

- Leveraging Technological Leadership: Collaborations like the one with Firmenich, a major player in the fragrance industry, allow Amyris to monetize its core technology in high-value applications.

Amyris's Core Precision Fermentation Platform is central to its strategy, acting as its primary innovation engine. This proprietary Lab-to-Market technology, integrating organism engineering, AI, and advanced fermentation, underpins all its sustainable ingredient development. It's the engine for creating new high-value molecules and securing crucial partnerships.

Amyris is strategically positioning itself to be a leading supplier of sustainable ingredients for the flavors and fragrances (F&F) industry. This market is experiencing a significant shift towards bio-based and ethically sourced components, driven by consumer demand for cleaner products. Amyris's advanced fermentation technology allows for the production of high-purity, novel molecules that not only meet these sustainability criteria but also offer enhanced performance characteristics for F&F applications.

The company's focus on the F&F segment is particularly noteworthy given its high growth potential. As global consumer brands increasingly prioritize "clean chemistry" and environmental responsibility in their product formulations, the demand for Amyris's sustainable ingredients is expected to rise. This makes the F&F sector a critical area for Amyris's future growth and profitability, especially following its recent financial restructuring efforts. For instance, the global flavors and fragrances market was valued at approximately $31.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 5.5% through 2030, highlighting the significant opportunity for companies like Amyris.

Amyris, even after selling its consumer brands, remains a vital player in the clean beauty sector by supplying sustainable, bio-based ingredients. Their portfolio includes sought-after emollients like Hemisqualane, a key component for many premium skincare formulations. The global clean beauty market was valued at approximately $15.2 billion in 2023 and is projected to reach $33.4 billion by 2030, showcasing a compound annual growth rate of over 11%, driven by increasing consumer preference for natural and ethical products.

Amyris is strategically positioning itself in the biopharmaceutical ingredients sector, particularly focusing on addressing drug shortages. This move represents a significant new market opportunity, with the company having secured $12.3 million in funding to develop small molecule drugs for the FDA's critical shortage list. This initiative highlights Amyris's commitment to leveraging its advanced organism engineering and synthetic chemistry expertise to meet urgent healthcare demands.

This pivot into pharmaceuticals, while in its nascent stages, carries substantial growth potential. By focusing on bio-based active pharmaceutical ingredients (APIs), Amyris aims to become a vital supplier in a market grappling with supply chain vulnerabilities. The company's technological foundation is well-suited to produce complex molecules efficiently, potentially disrupting traditional API manufacturing.

- Market Opportunity: Amyris targets the growing need for reliable API sources, especially for drugs experiencing shortages.

- Funding Secured: A $12.3 million award underscores the market's recognition of this strategic direction.

- Technological Advantage: Advanced organism engineering and synthetic chemistry are key enablers for producing novel biopharmaceutical ingredients.

- Growth Potential: This venture could establish Amyris as a key player in the bio-based pharmaceutical supply chain.

Amyris leverages strategic co-creation partnerships to accelerate innovation and market penetration for its sustainable ingredients. This approach allows them to tap into diverse industry needs by applying their synthetic biology platform, as seen in their collaboration with Firmenich for fragrance ingredients. This model is designed for high growth, capitalizing on Amyris's technological edge to deliver tailored solutions efficiently.

These collaborations are crucial for expanding Amyris's product portfolio and market reach. By partnering, they can bring novel, bio-based ingredients to market faster and at scale. For instance, their work in developing fermentation-derived ingredients for various applications highlights the power of this strategy.

- Co-Creation for Speed and Scale: Amyris partners with industry leaders to develop and commercialize new sustainable ingredients rapidly.

- Technology Application: Their synthetic biology platform is applied to address specific market demands across sectors like beauty, health, and food.

- Market Expansion: Partnerships enable Amyris to enter new markets and diversify its revenue streams through a broader product offering.

- Leveraging Technological Leadership: Collaborations like the one with Firmenich, a major player in the fragrance industry, allow Amyris to monetize its core technology in high-value applications.

Amyris's "Stars" within the BCG Matrix would represent its most promising and high-growth potential ventures, requiring significant investment to maintain their leading position. These are likely its core precision fermentation platform and key ingredient segments like flavors and fragrances, and clean beauty ingredients, where it has established a strong technological advantage and is capitalizing on significant market growth trends.

What is included in the product

The Amyris BCG Matrix analyzes its portfolio, highlighting which business units to invest in, hold, or divest based on market share and growth.

The Amyris BCG Matrix offers a clear, visual pain point reliever by instantly categorizing business units, simplifying complex portfolio management.

Cash Cows

Amyris's squalane manufacturing for Givaudan exemplifies a classic cash cow. Even after selling the rights, Amyris maintains a crucial role as the manufacturer under a long-term agreement. This partnership guarantees a predictable and reliable income stream, as squalane is a well-established and highly sought-after ingredient in the beauty and health sectors.

The contract itself acts as a de-risking mechanism for Amyris, shielding it from the volatility of direct market sales. This steady cash flow, generated from a mature product with consistent demand, solidifies its position as a dependable cash generator for the company.

Amyris's established nutraceutical ingredients are firmly positioned as Cash Cows within its BCG Matrix. These high-purity, bio-based compounds, produced through advanced fermentation, cater to mature markets with predictable demand, ensuring steady revenue streams and healthy profit margins. The company's commitment to sustainable sourcing in this sector provides a stable competitive advantage, minimizing the need for substantial reinvestment to maintain market share.

Amyris's Rebaudioside M (Reb M) production in Barra Bonita, Brazil, now fully under its ownership, represents a significant Cash Cow. This high-purity steviol glycoside is a key player in the expanding zero-calorie sweetener market, which saw global sales reach an estimated $17.8 billion in 2023, with projections indicating continued growth.

The dissolution of the RealSweet joint venture with Ingredion has granted Amyris complete operational and strategic control over Reb M manufacturing. This allows for more efficient supply chain management and direct market access, ensuring a consistent revenue stream from this established product. The company's ability to directly serve the growing demand for sugar reduction solutions solidifies Reb M's position as a reliable cash generator.

Licensing of Proprietary Technology

Amyris's core technology platform, built on synthetic biology and precision fermentation, is a significant asset that can be leveraged through licensing. This strategy allows the company to monetize its extensive intellectual property by granting other businesses the right to use its innovations.

Licensing agreements offer a path to generate revenue without the substantial capital expenditure and operational complexities associated with direct manufacturing and marketing across diverse applications. This approach transforms Amyris's technological prowess into a high-margin, albeit potentially lower-growth, revenue stream, capitalizing on its established expertise.

For instance, in 2023, Amyris continued to explore and secure licensing deals, demonstrating the ongoing viability of this cash cow. While specific figures for licensing revenue are often embedded within broader financial reporting, the strategic focus on IP monetization remains a key component of their business model. The company’s commitment to expanding its technology applications through partnerships underscores the enduring value of its synthetic biology platform.

- Core Technology Platform: Amyris possesses advanced capabilities in synthetic biology and precision fermentation.

- Intellectual Property Monetization: Licensing its technology allows Amyris to generate revenue from its innovations.

- High-Margin Revenue: Licensing provides a profitable income stream with reduced operational overhead.

- Strategic Partnerships: Agreements with other companies leverage Amyris's expertise without direct market expansion costs.

Long-Term Supply Agreements for Key Ingredients

Amyris leverages long-term supply agreements for key bio-based ingredients beyond squalane, securing predictable revenue. These partnerships ensure stable demand across sectors like food, beverage, and industrial applications, fostering consistent cash generation. By minimizing market volatility, these contracts guarantee steady utilization of Amyris's manufacturing assets.

- Secured Revenue Streams: Long-term contracts provide a predictable income base, reducing reliance on spot market sales.

- Stable Demand: Agreements with industrial partners ensure consistent offtake for Amyris's bio-based chemicals.

- Operational Efficiency: Predictable demand allows for optimized manufacturing schedules and consistent asset utilization.

- Market Resilience: These agreements buffer Amyris against the fluctuations common in commodity chemical markets.

Amyris's established nutraceutical ingredients, like its high-purity, bio-based compounds produced via fermentation, represent significant Cash Cows. These products serve mature markets with consistent demand, ensuring steady revenue and healthy profit margins. The company's focus on sustainable sourcing in this segment offers a stable competitive edge, reducing the need for extensive reinvestment to maintain market share.

The company's Rebaudioside M (Reb M) production in Barra Bonita, Brazil, now fully owned by Amyris, is a prime example of a Cash Cow. This high-purity steviol glycoside is a key component in the growing zero-calorie sweetener market, which saw global sales reach approximately $17.8 billion in 2023, with continued expansion projected.

Amyris's core technology platform, rooted in synthetic biology and precision fermentation, acts as a valuable asset that can be monetized through licensing. This strategy allows the company to generate revenue by granting other businesses the rights to utilize its innovations, transforming technological expertise into a profitable, albeit potentially slower-growth, income stream.

Amyris also benefits from long-term supply agreements for critical bio-based ingredients beyond squalane, securing predictable revenue streams. These partnerships guarantee consistent demand across various sectors, including food, beverages, and industrial applications, thereby ensuring stable cash generation and optimized utilization of manufacturing assets.

| Product/Technology | Market Position | Revenue Driver | Amyris's Role | Key Data Point |

|---|---|---|---|---|

| Squalane Manufacturing | Mature, High Demand | Long-term supply agreement with Givaudan | Primary Manufacturer | Guaranteed, predictable income stream |

| Nutraceutical Ingredients | Mature Markets | Consistent demand, healthy profit margins | Producer of high-purity, bio-based compounds | Stable competitive advantage via sustainable sourcing |

| Rebaudioside M (Reb M) | Growing Zero-Calorie Sweetener Market | Direct market access, efficient supply chain | Full ownership and operational control | Global market valued at ~$17.8 billion in 2023 |

| Core Technology Platform | Intellectual Property Monetization | Licensing agreements | Licensor of synthetic biology and fermentation innovations | Generates high-margin revenue with reduced capital expenditure |

Preview = Final Product

Amyris BCG Matrix

The Amyris BCG Matrix preview you see is the identical, fully formatted document you will receive upon purchase. This means you're examining the final, analysis-ready report, complete with all strategic insights and professional design elements, ready for immediate integration into your business planning. No watermarks, no placeholder text—just the comprehensive BCG Matrix you need to make informed decisions about Amyris's product portfolio.

Dogs

Biossance, a prominent clean beauty brand, was sold for $20 million to THG Beauty during Amyris's bankruptcy auction. This sale underscores Biossance's position as a consumer-facing business that was a drain on Amyris's resources, highlighting its status as a Question Mark or Dog in the BCG Matrix due to its lack of profitability.

JVN Hair, a celebrity-backed hair care line, was a part of Amyris's consumer portfolio. In 2023, Amyris announced the sale of JVN Hair to Windsong Global for $1.25 million, a move that underscored Amyris's strategic shift away from direct-to-consumer brands.

This divestiture was part of Amyris's broader asset sales aimed at addressing financial difficulties. The company faced significant operational costs and profitability issues across its consumer ventures, including JVN Hair, leading to its exit from this segment.

Pipette, a clean baby care brand, was a part of Amyris's consumer segment. This segment, unfortunately, proved to be a significant drain on Amyris's resources, ultimately proving unsustainable.

In a move reflecting this challenge, Pipette was acquired by HRB Brands for $1.75 million during bankruptcy auctions. This divestment highlights Amyris's strategy to shed underperforming and non-core assets from its portfolio.

Meno Labs Women's Supplements Brand

Meno Labs, a formerly owned Amyris brand focused on women's health supplements, was divested to Dr. Reddy's Laboratories for $3 million. This strategic sale underscores Amyris's pivot away from direct-to-consumer health and wellness ventures that failed to meet profitability and market share expectations.

The sale of Meno Labs suggests it was positioned as a question mark within Amyris's portfolio.

- Low Market Share: Meno Labs likely held a minimal share in the competitive women's supplement market.

- Profitability Concerns: The brand's financial performance was likely insufficient to justify continued investment.

- Strategic Realignment: Amyris's divestiture signals a focus on core competencies and more promising business segments.

- $3 Million Sale Price: This figure represents the tangible outcome of divesting a non-core, underperforming asset.

Amyris Bio Products Portugal Unipessoal (ABP)

Amyris Bio Products Portugal Unipessoal (ABP) was a subsidiary of Amyris that focused on fermentation byproducts and waste management. However, Amyris ceased funding ABP in November 2024, which resulted in the Portuguese entity filing for insolvency. This strategic decision reflects ABP's status as a low-growth, low-return operation that no longer aligns with Amyris's core business priorities. The company's shift towards a more streamlined business model meant that areas like waste byproducts were divested or deprioritized.

- Subsidiary Focus: ABP concentrated on fermentation byproducts and waste streams.

- Funding Cessation: Amyris stopped funding ABP in November 2024.

- Insolvency Filing: This funding cut led to ABP filing for insolvency.

- Strategic Realignment: ABP was deemed a low-growth, low-return asset outside Amyris's revitalized strategy.

Amyris's consumer brands like Biossance, JVN Hair, Pipette, and Meno Labs are prime examples of "Dogs" in the BCG Matrix. These businesses, despite their market presence, struggled with profitability and were ultimately divested. The sales of Biossance for $20 million, JVN Hair for $1.25 million, Pipette for $1.75 million, and Meno Labs for $3 million highlight their underperformance and drain on Amyris's resources.

Amyris Bio Products Portugal (ABP), focused on fermentation byproducts, also became a Dog when funding ceased in November 2024, leading to insolvency. This reflects a strategic decision to shed low-growth, low-return assets that no longer aligned with Amyris's core business priorities.

These divestitures represent Amyris's necessary move to streamline operations and focus on more promising segments, acknowledging the failure of these ventures to generate sufficient returns or market share.

| Brand | Sale Price | Status |

|---|---|---|

| Biossance | $20 million | Sold |

| JVN Hair | $1.25 million | Sold |

| Pipette | $1.75 million | Sold |

| Meno Labs | $3 million | Sold |

| Amyris Bio Products Portugal (ABP) | N/A (Insolvency) | Ceased Funding |

Question Marks

Amyris is venturing into the development of up to three small molecule drugs, aiming to tackle FDA-identified drug shortages. This strategic move is supported by a $12.3 million agreement, signaling a significant investment in a market characterized by high growth potential and pressing unmet medical needs.

While the pharmaceutical sector offers substantial rewards, Amyris currently holds a minimal market share in this space. The path to success is demanding, requiring considerable investment in research and development, navigating complex regulatory approval processes, and forging new partnerships for Good Manufacturing Practice (GMP) production and market entry.

Amyris's full ownership of the Barra Bonita precision fermentation plant and the planned addition of a fourth fermentation line by early 2026 represent a significant strategic move. This expansion is designed to boost the development and market introduction of novel sustainable products, aiming for key growth sectors in the ingredients market.

This substantial investment in increased capacity positions Barra Bonita as a 'Question Mark' within Amyris's portfolio. While the potential for accelerated product launches and market penetration is high, the ultimate return on this expansion is still uncertain, necessitating ongoing financial commitment and careful performance monitoring.

Amyris is actively exploring new bio-based molecules, moving beyond its established product lines. These emerging candidates target promising sectors such as advanced materials and innovative nutraceuticals, though their market acceptance and commercial success remain uncertain.

The company's commitment to research and development for these future products is substantial. For instance, Amyris reported R&D expenses of $133.7 million in 2023, a significant portion of which is dedicated to pipeline development, aiming for potentially high rewards despite inherent risks.

Bringing these next-generation molecules from initial research to commercial reality demands considerable investment and faces developmental hurdles. Success in these ventures could unlock new revenue streams, but the path to market is fraught with technical and commercialization challenges.

Market Penetration in New Geographic Regions

Amyris's expansion into new geographic regions for its B2B sustainable ingredients is a prime example of a Question Mark in the BCG Matrix. While the company's innovative technology has broad global applicability, success in these new markets hinges on overcoming significant hurdles. These include establishing robust distribution channels, tailoring marketing efforts to local demands, and fostering customer acceptance of novel bio-based ingredients.

The company's strategic pivot towards its core B2B ingredients business amplifies the potential for growth through geographic expansion. However, the inherent uncertainty in achieving market penetration in unfamiliar territories places these initiatives squarely in the Question Mark category. This requires substantial upfront investment in market research, regulatory navigation, and building local partnerships, with the eventual market share and profitability remaining speculative in the initial stages.

For instance, in 2024, Amyris continued to focus on scaling its B2B ingredient offerings, such as its squalane and farnesene, in key international markets. While specific figures for new geographic market penetration are often proprietary, industry reports from late 2023 and early 2024 indicated growing demand for sustainable ingredients in Europe and Asia Pacific. Amyris's success in these regions will depend on its ability to adapt its B2B sales and marketing strategies to diverse consumer preferences and regulatory landscapes.

- High Growth Potential: Expanding into new geographic markets offers Amyris a significant avenue for growth in its B2B ingredients business.

- Market Entry Challenges: Achieving substantial market share in new regions necessitates targeted marketing, effective distribution networks, and overcoming customer adoption barriers.

- Investment Uncertainty: These initiatives require considerable investment in market entry strategies, with initial returns being uncertain, characteristic of a Question Mark.

- Strategic Focus: Amyris's commitment to its core B2B ingredients business makes geographic expansion a critical, albeit high-risk, growth driver.

Application of AI and Machine Learning in Strain Engineering

Amyris leverages AI and machine learning extensively within its Lab-to-Market platform to speed up the development of new molecules and enhance the performance of its engineered strains. This technological capability, while not a direct revenue-generating product itself, significantly reduces the time and cost associated with bringing new ingredients to market. For instance, in 2024, Amyris reported a substantial acceleration in its R&D cycle for certain key ingredients due to these AI-driven optimizations.

The impact of AI and machine learning on Amyris's current market share as a standalone offering is minimal. However, its strategic importance is immense, acting as a powerful disruptor that can redefine the economics of ingredient innovation. By continuously investing in these advanced computational tools, Amyris aims to solidify its competitive advantage and unlock significant future growth potential.

- AI/ML accelerates R&D timelines: Reducing the time from discovery to commercialization for new bio-based ingredients.

- Cost optimization: Lowering the expenses associated with strain development and fermentation processes.

- Performance enhancement: Improving the yield and efficiency of engineered microorganisms.

- Disruptive potential: Creating a competitive edge by enabling faster and more cost-effective innovation in the specialty ingredients market.

Amyris's ventures into new drug development, while targeting critical shortages, currently represent a small market share. The significant investment required for R&D, regulatory navigation, and manufacturing partnerships places these initiatives in the Question Mark category. The high growth potential is undeniable, but the path to profitability is uncertain.

The expansion of the Barra Bonita plant and the development of new bio-based molecules for advanced materials and nutraceuticals also fall under Question Marks. These efforts promise substantial future rewards by tapping into high-growth sectors. However, they demand considerable ongoing investment and face inherent risks related to market acceptance and commercialization challenges.

Geographic expansion for Amyris's B2B ingredients is a classic Question Mark. While demand for sustainable ingredients is rising globally, success in new markets depends on overcoming distribution, marketing, and customer adoption hurdles. This requires significant upfront investment with uncertain initial returns.

Amyris's strategic use of AI and machine learning in its Lab-to-Market platform is a key enabler for its Question Mark initiatives. While not a direct product, this technology accelerates R&D and optimizes costs, reducing the risk and time-to-market for new ingredients. This investment in computational tools is crucial for solidifying Amyris's competitive edge in ingredient innovation.

BCG Matrix Data Sources

Our Amyris BCG Matrix is constructed using a blend of proprietary market research, Amyris's public financial disclosures, and industry-specific growth forecasts for comprehensive strategic insights.