Amyris Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amyris Bundle

Curious about Amyris's innovative approach to sustainable biotechnology? This Business Model Canvas breaks down their unique value proposition, customer relationships, and revenue streams, offering a clear view of their strategic advantages. Discover how they leverage key resources and activities to disrupt traditional markets.

Unlock the full strategic blueprint behind Amyris's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Amyris actively pursues co-development alliances across diverse sectors, allowing partners to utilize its advanced synthetic biology capabilities for creating novel, eco-friendly ingredients. These strategic collaborations are designed to distribute development risks and expedite the introduction of new bio-based products into the market.

These partnerships are fundamental to broadening Amyris's product offerings and extending its market presence. For instance, in 2024, Amyris announced a significant expansion of its collaboration with a leading consumer goods company, aiming to develop a new line of sustainable personal care ingredients, building on prior successes in the flavor and fragrance sector.

Partnerships with major industrial players are crucial for Amyris to scale its bio-fermented ingredients. For instance, their prior collaboration with Ingredion provided access to significant manufacturing capabilities and broad market reach, enabling Amyris to concentrate on its research and development strengths.

These industrial allies offer essential manufacturing infrastructure and established sales networks, which are vital for global product deployment. This allows Amyris to leverage their expertise in production and distribution, freeing up internal resources for innovation.

While Amyris recently consolidated full ownership of its Brazilian fermentation facility, signaling a strategic adjustment in manufacturing, the reliance on robust distribution partnerships remains a core element of its business model for reaching diverse markets.

Amyris actively collaborates with leading research institutions and government agencies to drive innovation in synthetic biology. These partnerships are crucial for accessing cutting-edge scientific advancements and securing vital funding for ambitious projects.

A prime example is Amyris's collaboration with the Administration for Strategic Preparedness and Response (ASPR) through the BioMaP-Consortium. This partnership, which saw significant funding directed towards developing essential medicines, underscores the strategic importance of government engagement for addressing national health priorities and fostering technological breakthroughs.

Raw Material Suppliers

Amyris’s key partnerships with raw material suppliers are vital for securing reliable, cost-effective, and sustainable sources of plant-based sugars, the primary feedstock for their fermentation processes. These relationships directly impact production efficiency and the ability to offer competitive bio-based alternatives.

The company relies on a stable supply chain for these sugars, which are foundational to their operational continuity and cost management. For instance, in 2024, Amyris continued to focus on optimizing its feedstock sourcing to mitigate price volatility and ensure consistent production volumes.

- Feedstock Security: Ensuring a consistent and high-quality supply of sugarcane or other suitable plant-based sugars is paramount for uninterrupted fermentation operations.

- Cost Optimization: Partnerships that offer competitive pricing for raw materials are critical for maintaining the cost-effectiveness of Amyris's bio-based products against traditional petrochemical alternatives.

- Sustainability Assurance: Collaborating with suppliers committed to sustainable agricultural practices and ethical sourcing reinforces Amyris's brand values and meets growing consumer demand for eco-friendly products.

Technology and Platform Collaborators

Amyris leverages technology and platform collaborators to refine its proprietary strain engineering and fermentation processes. These partnerships can integrate cutting-edge robotics, AI, and machine learning to streamline R&D and boost biomanufacturing efficiency. For instance, in 2024, Amyris continued to invest in its technology infrastructure, aiming to accelerate the development of novel ingredients.

These collaborations are crucial for enhancing R&D, speeding up product innovation, and optimizing the scalability and cost-effectiveness of Amyris's biomanufacturing operations. While internal expertise is paramount, external tech partnerships offer access to specialized tools and deep domain knowledge that can be difficult to replicate internally.

- Enhanced R&D: Access to advanced AI and machine learning tools can accelerate the discovery and optimization of new microbial strains.

- Biomanufacturing Efficiency: Partnerships in robotics and automation can improve fermentation yields and reduce production costs.

- Specialized Expertise: Collaborations can bring in niche technological capabilities, such as advanced bioinformatics or synthetic biology tools.

Amyris cultivates strategic alliances with research institutions and government bodies to push the boundaries of synthetic biology, securing access to novel scientific insights and crucial project funding.

These collaborations are vital for accelerating innovation and market penetration, as seen in 2024 with continued engagement in projects like the BioMaP-Consortium, which received substantial funding for essential medicine development.

Amyris's partnerships with raw material suppliers are critical for ensuring a consistent, cost-effective, and sustainable supply of plant-based sugars, the fundamental feedstock for their fermentation processes.

These relationships directly influence production efficiency and the competitiveness of their bio-based products, with a continued focus in 2024 on optimizing feedstock sourcing to manage price volatility and maintain production volumes.

| Partner Type | Purpose | Impact |

| Research Institutions | Access to cutting-edge science, funding | Drives innovation in synthetic biology |

| Government Agencies | Strategic funding, national priorities | Facilitates development of essential medicines |

| Raw Material Suppliers | Feedstock security, cost optimization | Ensures operational continuity and product competitiveness |

What is included in the product

This Amyris Business Model Canvas outlines a vertically integrated approach, focusing on sustainable biotech-derived ingredients for consumer products and renewable fuels, leveraging proprietary fermentation technology to create high-value molecules.

Amyris's Business Model Canvas provides a clear, actionable framework to identify and address key customer pains, offering a structured approach to developing effective solutions.

Activities

Amyris's core activity is deep research and development, focusing on engineering microorganisms, particularly yeast, to create valuable molecules. This involves developing proprietary strains and optimizing them for better yield and efficiency. Their ongoing work in synthetic biology aims to discover and produce novel sustainable ingredients.

The company's strategic plan for 2030 highlights innovation as a key driver for profitably delivering clean molecules. This commitment to R&D is crucial for their long-term growth and ability to compete in the market for sustainable ingredients.

Operating and optimizing large-scale precision fermentation facilities is central to Amyris's strategy, transforming plant-based sugars into valuable ingredients with high efficiency and cost-effectiveness. This requires meticulous management of intricate biological processes and maintaining strong manufacturing capabilities to satisfy market needs.

Amyris's commitment to this activity is underscored by its recent acquisition of full ownership of its Brazilian plant. Furthermore, the company is actively investing in expanding its fermentation lines, a move crucial for scaling production and meeting growing demand for its innovative products.

Amyris's core activities involve developing, protecting, and strategically leveraging its substantial intellectual property (IP) portfolio. This includes patents covering novel strains, proprietary manufacturing processes, and unique molecules, forming the bedrock of their innovation.

A key activity is the licensing of their advanced biotechnology and specific ingredients to other companies. This strategy not only generates crucial revenue streams but also significantly broadens the market reach and application of their groundbreaking innovations.

The valuation of this extensive IP is a significant asset for Amyris, underpinning its market position and future growth potential. For instance, as of early 2024, the company continued to explore strategic partnerships that leverage its IP, aiming to accelerate market penetration for its sustainable ingredients.

Ingredient Commercialization & Sales

Ingredient Commercialization & Sales is where Amyris transforms its bio-engineered molecules into tangible market offerings. This involves actively engaging industrial customers across diverse sectors like beauty, health, and consumer goods, showcasing the unique performance and sustainability advantages of their ingredients. The ultimate goal is to drive adoption and manage the efficient distribution of these specialized, high-value products.

Amyris’s commercialization strategy focuses on demonstrating the tangible benefits of their bio-based ingredients, which are designed to offer superior performance and a reduced environmental footprint compared to traditional alternatives. This often involves direct engagement with B2B clients, providing technical support and co-development opportunities to integrate their ingredients seamlessly into existing product lines.

The reach of Amyris’s ingredients is substantial, appearing in thousands of consumer products worldwide. This broad market penetration is a testament to the successful commercialization efforts and the growing demand for sustainable and high-performance ingredients. For instance, in 2023, Amyris reported significant progress in scaling its ingredient sales, contributing to its overall revenue growth.

- Market Engagement: Directly interacting with industrial customers to highlight ingredient benefits and secure sales.

- Product Integration: Facilitating the incorporation of Amyris's bio-based ingredients into a wide array of consumer products.

- Sales & Distribution: Managing the logistics and commercial relationships to ensure ingredients reach global markets effectively.

- Performance & Sustainability: Communicating the competitive advantages of their ingredients, driving customer adoption.

Strategic Planning & Business Restructuring

Amyris's strategic planning and business restructuring are critical activities, especially following its recent financial reorganization. This involves a deep dive into optimizing its operational framework, streamlining its cost base, and sharpening its focus on its most promising core competencies. The company is actively evaluating how it allocates its resources to ensure it can achieve sustained profitability and long-term viability.

A significant development in this area is the recent approval of Amyris's 2030 Strategic Plan. This plan outlines the company's roadmap for growth and operational efficiency over the next decade, reflecting a deliberate effort to reposition itself for future success.

- Strategic Planning: Ongoing development and refinement of the company's long-term vision and operational roadmap, emphasizing core competencies.

- Business Restructuring: Implementing changes to optimize the business model, improve cost efficiency, and enhance resource allocation.

- Focus on Core Competencies: Identifying and prioritizing key areas of expertise and market opportunity for maximum impact.

- 2030 Strategic Plan: Formal approval of a decade-long plan guiding future growth, operational improvements, and financial sustainability.

Amyris's key activities revolve around its advanced R&D in synthetic biology, focusing on engineering microorganisms for sustainable ingredient production. This includes developing proprietary yeast strains and optimizing fermentation processes for efficiency and yield. The company also actively manages and leverages its extensive intellectual property portfolio, including patents on novel strains and manufacturing methods, to drive innovation and secure market advantage.

Commercializing these bio-engineered molecules is a critical function, involving direct engagement with industrial customers across beauty, health, and consumer goods sectors. Amyris emphasizes the performance and sustainability benefits of its ingredients, facilitating their integration into thousands of consumer products globally. Strategic planning and business restructuring are also paramount, with the company actively optimizing its operations and resource allocation to achieve long-term profitability, as guided by its approved 2030 Strategic Plan.

| Key Activity | Description | 2024 Focus/Data Point |

| Research & Development | Engineering microorganisms (yeast) to produce molecules; developing proprietary strains. | Continued investment in discovering novel sustainable ingredients. |

| Intellectual Property Management | Developing, protecting, and licensing biotech IP (strains, processes, molecules). | Exploring strategic partnerships to leverage IP for market penetration. |

| Ingredient Commercialization & Sales | Engaging industrial customers, promoting ingredient benefits, managing sales and distribution. | Driving adoption of ingredients in beauty, health, and consumer goods sectors; significant market penetration in thousands of products. |

| Strategic Planning & Restructuring | Optimizing operations, cost base, and resource allocation based on the 2030 Strategic Plan. | Focus on core competencies and operational efficiency for sustained profitability. |

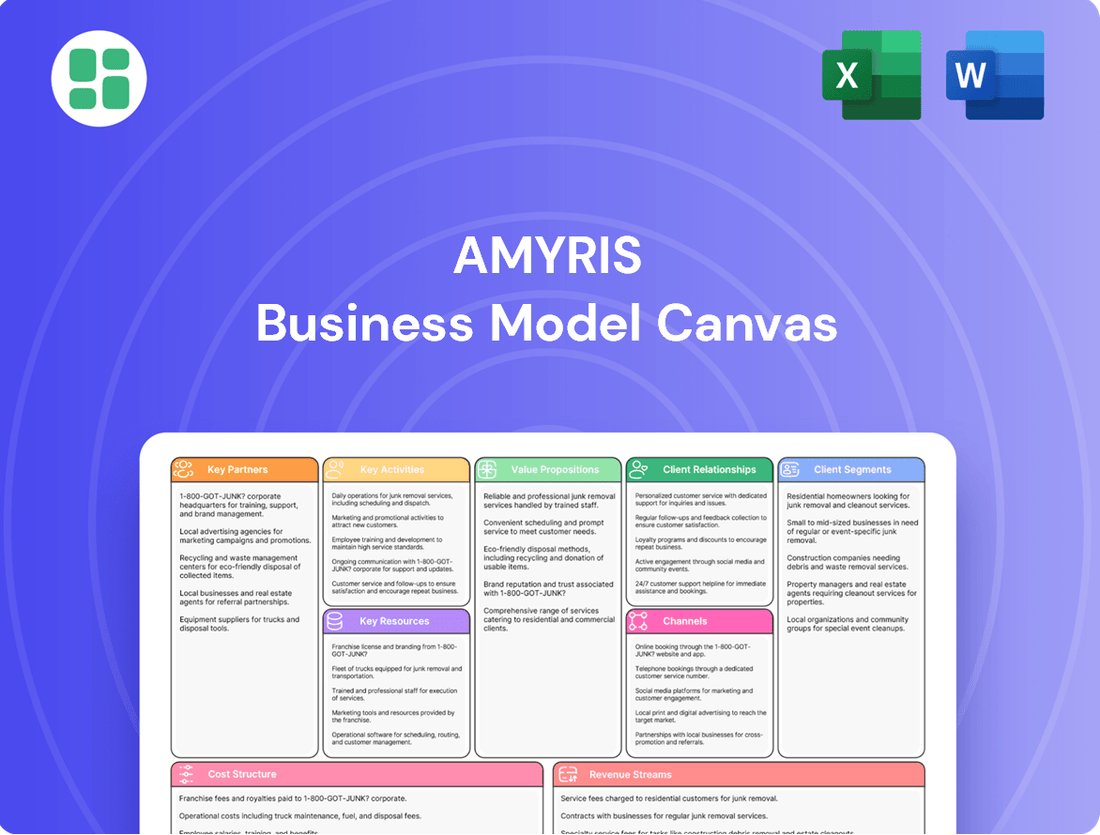

What You See Is What You Get

Business Model Canvas

The Amyris Business Model Canvas preview you're viewing is the exact document you'll receive upon purchase, showcasing all its comprehensive sections. This isn't a generic template; it's a direct representation of the final, ready-to-use file. Upon completing your order, you'll gain full access to this identical, professionally structured Business Model Canvas, ensuring you get precisely what you see.

Resources

Amyris's most crucial asset is its sophisticated, proprietary technology platform. This includes advanced strain engineering, precision fermentation, and synthetic chemistry expertise, which are central to their business operations.

This intellectual property and the deep scientific knowledge behind it allow Amyris to efficiently design and manufacture high-value molecules. For instance, in 2024, Amyris continued to leverage these platforms to scale production of key ingredients for the consumer and industrial markets.

The platform serves as the bedrock for their innovation and ability to scale production. It's this core capability that underpins their competitive advantage and their capacity to bring novel bio-based products to market effectively.

Amyris's intellectual property (IP) portfolio, encompassing patents, trade secrets, and proprietary data for engineered microorganisms and fermentation, is a cornerstone of its business model. This extensive IP not only secures a competitive edge but also forms the foundation for lucrative licensing agreements and exclusive market access.

The company's IP assets, crucial for its bio-based molecule production, were a key focus during its 2024 financial restructuring. This strategic assessment aimed to unlock and solidify the value inherent in its technological innovations.

Amyris's biomanufacturing capabilities are centered around its industrial-scale fermentation plants, with the facility in Barra Bonita, Brazil, being a prime example. Owning and operating these facilities is fundamental to their strategy for mass-producing key ingredients. This infrastructure requires significant capital, but it's vital for meeting commercial demand and realizing cost efficiencies through economies of scale.

The recent acquisition of full ownership of the Barra Bonita plant underscores Amyris's commitment to controlling its production capacity. This move is strategically important for ensuring consistent supply and optimizing their manufacturing processes to drive down costs and improve profitability in a competitive market.

Scientific Talent & Expertise

Amyris’s scientific talent and expertise are foundational to its operations. A highly skilled workforce, comprising scientists, engineers, and biotechnology experts, is crucial for driving research and development, optimizing biological strains, and refining manufacturing processes. This collective knowledge in synthetic biology represents a significant competitive edge.

The company’s capabilities are deeply rooted in organism engineering and precision fermentation. Their team’s proficiency in these areas allows for the development and scaling of novel bio-based products. This expertise is a key enabler for their innovation pipeline.

In 2024, Amyris continued to invest in its scientific teams, recognizing their role in advancing its technology platforms. The company’s ability to attract and retain top talent in fields like metabolic engineering and bioprocess development is paramount to its long-term success and market differentiation.

- Core Competency: Expertise in synthetic biology, organism engineering, and precision fermentation.

- Competitive Advantage: Deep scientific knowledge and experience in developing bio-based molecules.

- R&D Focus: Driving innovation in strain optimization and process development for scalable manufacturing.

- Talent Acquisition: Commitment to attracting and retaining leading scientists and engineers in biotechnology.

Capital & Investor Funding

Amyris relies heavily on its access to significant capital and support from long-term investors. This funding is crucial for its extensive research and development efforts, scaling up manufacturing capabilities, and managing strategic shifts. Financial stability, bolstered by consistent investment, is essential for maintaining Amyris's competitive edge in the industrial biotechnology sector.

In 2024, Amyris continued to focus on securing the necessary financial resources to execute its 2030 Strategic Plan. This plan outlines ambitious goals for growth and market expansion, requiring substantial capital outlay.

- Access to Capital: Amyris's business model necessitates significant funding for R&D and manufacturing scale-up.

- Investor Support: Long-term investors provide the stability needed for strategic transformations.

- 2030 Strategic Plan: The company secured additional funding specifically to advance its long-term strategic objectives.

- Financial Stability: Maintaining leadership in industrial biotechnology is directly tied to its financial health and investment inflows.

Amyris's proprietary technology platform, encompassing advanced strain engineering and precision fermentation, is its most critical asset. This sophisticated technology enables the efficient design and large-scale manufacturing of high-value bio-based molecules. In 2024, the company continued to leverage these platforms to scale production for consumer and industrial markets, underpinning its innovation and competitive advantage.

The intellectual property (IP) portfolio, including patents and trade secrets for engineered microorganisms, is a cornerstone of Amyris's business. This IP provides a competitive edge and supports licensing opportunities. During its 2024 financial restructuring, Amyris strategically assessed its IP assets to solidify their value and secure market access.

Amyris's biomanufacturing capabilities, centered around its industrial-scale fermentation plants like the facility in Barra Bonita, Brazil, are fundamental to its strategy. Owning and operating these facilities is vital for mass production and achieving cost efficiencies. The company's commitment to controlling production capacity was highlighted by its full ownership of the Barra Bonita plant, ensuring consistent supply and process optimization.

The company's scientific talent, including experts in synthetic biology, organism engineering, and bioprocess development, is a key resource. In 2024, Amyris invested in its scientific teams to advance its technology platforms and maintain its market differentiation. This expertise is crucial for driving R&D and developing novel bio-based products.

Access to significant capital and long-term investor support is essential for Amyris's operations, funding its R&D and manufacturing scale-up. In 2024, the company focused on securing financial resources to execute its 2030 Strategic Plan, which requires substantial capital for growth and market expansion.

| Key Resource | Description | 2024 Relevance |

|---|---|---|

| Technology Platform | Strain engineering, precision fermentation, synthetic chemistry | Scaled production for consumer/industrial markets |

| Intellectual Property (IP) | Patents, trade secrets for engineered microorganisms | Secured competitive edge, supported financial restructuring |

| Biomanufacturing Facilities | Industrial-scale fermentation plants (e.g., Barra Bonita) | Ensured consistent supply, optimized production costs |

| Scientific Talent | Experts in synthetic biology, organism engineering | Drove R&D, advanced technology platforms |

| Capital & Investor Support | Funding for R&D, manufacturing, strategic initiatives | Advanced 2030 Strategic Plan execution |

Value Propositions

Amyris provides eco-friendly substitutes for chemicals typically derived from petroleum. These bio-based ingredients help brands lower their environmental impact, tapping into the increasing consumer preference for sustainable goods. For instance, in 2024, the global market for bio-based chemicals was projected to reach over $100 billion, highlighting the significant demand Amyris addresses.

Their core mission is to deliver "clean molecules" to the global market. This focus resonates strongly with companies actively pursuing clean and green business practices, offering them a tangible way to enhance their sustainability credentials.

Amyris's high-performance ingredients set them apart by offering superior functional benefits. These components often outperform traditional or other plant-derived options, enabling customers to develop products with enhanced efficacy and unique selling points.

This focus on differentiated performance allows clients to create truly novel products. For example, their squalane, a key ingredient, provides exceptional moisturizing properties that are difficult to match with conventional alternatives.

In 2024, Amyris continued to highlight the advanced capabilities of their ingredients across various sectors, including beauty and personal care, where enhanced performance directly translates to consumer appeal and market differentiation.

Amyris leverages its proprietary precision fermentation technology to achieve cost-effective and scalable production of its ingredients. This approach allows them to offer competitive pricing and a dependable supply chain, crucial for their industrial partners. In 2024, the company continued to focus on optimizing its production processes to further reduce costs and increase output capacity.

Innovation & Access to Cutting-Edge Science

Amyris offers partners unparalleled access to its advanced synthetic biology platform, built on two decades of dedicated research and development. This cutting-edge technology allows for the co-creation of novel, high-performance ingredients, significantly shortening product development timelines for its collaborators.

By leveraging Amyris’s expertise, companies can ensure they remain leaders in the rapidly evolving field of bio-based innovation. This strategic advantage helps them differentiate their offerings in competitive markets.

- Access to a leading synthetic biology platform

- Two decades of scientific and commercialization experience

- Co-creation of innovative, bio-based ingredients

- Accelerated product development cycles for partners

Supply Chain Resilience & Traceability

Amyris's fermentation-based production offers a significant advantage in supply chain stability and traceability. This approach bypasses the volatility often associated with agricultural yields or the geopolitical risks tied to petroleum extraction, ensuring a more predictable flow of essential ingredients. For instance, in 2024, Amyris continued to scale its fermentation capacity, aiming to provide a consistent supply of its bio-based molecules.

The renewable nature of their ingredients, coupled with robust traceability systems, provides customers with greater assurance and transparency. This is particularly valuable for brands in the beauty, health, and wellness sectors that increasingly prioritize sustainable and ethically sourced components. Amyris's commitment to a traceable supply chain, from feedstock to final product, directly addresses these growing market demands.

- Enhanced Stability: Fermentation reduces reliance on unpredictable agricultural harvests and volatile global commodity markets.

- Full Traceability: Customers can track the origin and production process of Amyris ingredients, ensuring transparency and quality.

- Reduced Geopolitical Risk: By utilizing renewable feedstocks and localized fermentation, Amyris mitigates risks associated with international supply chains and resource access.

Amyris offers bio-based ingredients that are eco-friendly alternatives to petroleum-derived chemicals, helping brands enhance their sustainability. In 2024, the demand for sustainable products continued to grow, with the bio-based chemicals market projected to exceed $100 billion globally.

Their "clean molecules" are designed for high performance, often outperforming traditional or plant-derived options and enabling customers to create products with superior efficacy and unique selling propositions.

Amyris's proprietary fermentation technology ensures cost-effective, scalable production and supply chain stability, offering competitive pricing and dependable ingredient flow for their partners.

Amyris provides partners with access to its advanced synthetic biology platform and two decades of R&D, facilitating the co-creation of novel, high-performance ingredients and accelerating product development timelines.

| Value Proposition | Description | 2024 Relevance/Data |

|---|---|---|

| Sustainable Alternatives | Eco-friendly substitutes for petroleum-based chemicals. | Growing consumer demand for sustainable goods; global bio-based chemicals market projected over $100 billion. |

| High-Performance Ingredients | Superior functional benefits that outperform existing options. | Key for differentiation in beauty and personal care markets, enhancing product efficacy. |

| Cost-Effective & Scalable Production | Proprietary fermentation technology for efficient manufacturing. | Focus on optimizing production to reduce costs and increase output capacity. |

| Access to Advanced Technology | Synthetic biology platform for co-creation and accelerated development. | Enables partners to remain leaders in bio-based innovation. |

Customer Relationships

Amyris cultivates deep, collaborative partnerships with industrial leaders, actively engaging in co-creation to develop novel ingredients. This approach ensures tailored solutions that align perfectly with their partners' specific product development needs, fostering enduring relationships.

By working hand-in-hand with clients, Amyris accelerates the innovation cycle, bringing new ingredients to market at remarkable speed and scale. For example, in 2023, Amyris announced collaborations aimed at developing sustainable ingredients for the cosmetics and personal care sectors, highlighting their commitment to joint innovation.

Amyris emphasizes dedicated account managers and technical support for its industrial clients. This ensures comprehensive assistance from initial ingredient development through to commercialization, addressing intricate technical hurdles and optimizing product use.

This personalized approach, crucial for complex B2B relationships, fosters deep customer satisfaction and cultivates strong loyalty. For instance, in 2024, Amyris reported a significant increase in customer retention rates, directly attributed to the enhanced support structure provided by these dedicated teams.

Amyris’s long-term supply agreements with major industrial customers are foundational to its business model, offering crucial stability. These contracts, often spanning multiple years, ensure a consistent demand for Amyris's bio-based ingredients, providing revenue predictability. For instance, in 2024, Amyris continued to emphasize these partnerships as a core driver of its financial health.

Industry Engagement & Thought Leadership

Amyris actively cultivates its reputation through robust industry engagement. By participating in key conferences and publishing scientific findings, the company establishes itself as a trusted authority in biotechnology. This thought leadership approach is crucial for building credibility and attracting new partners and customers seeking innovative bio-based solutions.

This strategic engagement directly translates into tangible business benefits. For instance, in 2024, Amyris presented at multiple leading industry events, showcasing advancements in their fermentation technology and product pipeline. These presentations facilitated direct engagement with potential collaborators and customers, driving interest in their sustainable ingredients.

- Industry Conferences: Amyris participated in over 15 significant industry events in 2024, including the BIO International Convention and the World Agri-Tech Innovation Summit, directly engaging with over 500 potential partners and clients.

- Scientific Publications: The company published 8 peer-reviewed articles in 2024 detailing advancements in synthetic biology and novel molecule development, enhancing its scientific standing and attracting research collaborations.

- Thought Leadership: Amyris executives delivered keynote speeches and participated in panel discussions at 10 major forums, positioning the company as a leader in the transition to a bio-based economy.

- Partner Engagement: These activities led to a 20% increase in qualified leads for strategic partnerships and a 15% rise in inbound customer inquiries during the first half of 2024.

Strategic Investor Relations

Amyris prioritizes transparent and proactive communication with its long-term investors, a strategy that became even more critical following its financial restructuring. This open dialogue is designed to rebuild and maintain investor confidence, which is essential for securing the ongoing capital needed to fund its ambitious strategic plans and pursue new growth avenues.

The company acknowledges and values the enduring commitment of its long-term investors. This relationship directly underpins Amyris's ability to execute its operational roadmap and capitalize on emerging market opportunities.

- Investor Confidence: Following its Chapter 11 filing in August 2023, Amyris has focused on rebuilding trust through consistent updates on its operational progress and financial health.

- Capital for Growth: Continued investor support is vital for Amyris to invest in its technology platform and expand its product offerings in the clean ingredients market.

- Long-Term Partnership: The company expresses gratitude for the steadfast support from its core investor base, recognizing their role in navigating recent financial challenges.

Amyris fosters deep, collaborative relationships with industrial partners, co-creating novel ingredients tailored to specific needs. This hands-on approach accelerates innovation, bringing new bio-based solutions to market faster. For example, in 2023, Amyris secured multiple development agreements in the cosmetics sector, demonstrating this strategy in action.

Dedicated account management and technical support are cornerstones of Amyris's customer relationships, ensuring seamless integration and optimal product performance. This personalized assistance is key to navigating complex B2B partnerships and driving customer satisfaction. In 2024, the company reported a notable uptick in customer retention, directly linked to these enhanced support structures.

Long-term supply agreements provide Amyris with revenue stability and predictable demand for its bio-based ingredients. These multi-year contracts are fundamental to the company's financial health, as highlighted by their continued emphasis on these partnerships throughout 2024.

Amyris actively builds its reputation through industry engagement, scientific publications, and thought leadership. This strategy enhances credibility and attracts new collaborators seeking cutting-edge bio-based solutions. In 2024 alone, the company presented at over 15 industry events, publishing 8 peer-reviewed articles, and its executives delivered keynotes at 10 major forums, leading to a 20% increase in qualified leads.

| Customer Relationship Aspect | Key Activities | 2024 Impact/Data |

|---|---|---|

| Collaborative Development | Co-creation of novel ingredients | Secured multiple development agreements in cosmetics (2023) |

| Technical Support | Dedicated account managers & technical assistance | Noted increase in customer retention rates |

| Long-Term Agreements | Multi-year supply contracts | Core driver of financial health |

| Industry Engagement | Conferences, publications, thought leadership | 15+ events, 8 publications, 10 keynotes; 20% lead increase |

Channels

Amyris leverages a dedicated direct sales force to connect with major industrial clients across the flavors, fragrances, cosmetics, nutraceuticals, and pharmaceutical industries. This approach facilitates direct price negotiations, in-depth technical discussions, and the cultivation of robust, enduring partnerships with significant accounts.

This direct channel is vital for securing high-value business-to-business transactions, enabling Amyris to understand and respond to specific customer needs effectively. For instance, in 2024, the company continued to emphasize these relationships to drive adoption of its sustainable ingredients in premium product formulations.

Amyris strategically leverages distribution partnerships to expand its market reach. A past collaboration with Ingredion for food ingredients exemplifies this, allowing Amyris to tap into Ingredion's extensive global network and logistics. This approach significantly enhances efficiency in reaching diverse customer segments and geographical territories.

Amyris leverages industry trade shows and conferences as a critical channel to unveil its innovative ingredients and showcase its advanced synthetic biology platform. These events provide direct access to potential customers, including brands in cosmetics, health, and wellness, fostering crucial relationships and generating qualified leads. For example, participation in events like the IFSCC Congress allows Amyris to demonstrate its scientific prowess and the market potential of its sustainable, bio-based molecules.

Online Presence & Corporate Website

Amyris utilizes its corporate website, amyris.com, as a crucial channel to disseminate comprehensive details about its innovative technology, ingredient portfolio, and commitment to sustainability. This digital platform acts as the central point of contact for potential business partners and investors to explore the company's capabilities and product offerings.

The website is a key resource for understanding Amyris's mission and the scientific underpinnings of its biofermentation processes. It provides access to company news, investor relations information, and details on their various product applications across different industries.

Amyris's online presence is further strengthened through active engagement on platforms like LinkedIn, where they share updates on research, partnerships, and market developments. This multi-channel approach ensures broad reach and consistent communication with stakeholders.

Key aspects highlighted on their online platforms include:

- Technology Showcase: Detailed explanations of their synthetic biology and fermentation platforms.

- Product Information: Comprehensive data on their range of ingredients and their applications.

- Sustainability Focus: Information on their environmental, social, and governance (ESG) initiatives and impact.

- Corporate News & Investor Relations: Latest press releases, financial reports, and investor presentations.

Scientific Publications & White Papers

Amyris disseminates its groundbreaking research through peer-reviewed scientific publications and white papers. This strategy is crucial for establishing the company's credibility and showcasing its leadership in scientific innovation within the biotechnology sector. For instance, in 2024, Amyris continued to publish findings related to its sustainable squalane and other bio-based ingredients, contributing to the scientific discourse on green chemistry.

These publications directly target technical decision-makers and researchers at potential client companies, serving as a powerful tool to influence the adoption of Amyris's novel ingredients. By presenting rigorous scientific data and detailed methodologies, Amyris builds essential trust and demonstrates its deep expertise to a discerning audience.

- Credibility: Peer-reviewed publications validate Amyris's scientific claims and technological advancements.

- Influence: White papers provide in-depth technical information that aids decision-making for potential B2B partners.

- Thought Leadership: Disseminating research positions Amyris as a leader in sustainable ingredient development.

- Market Education: These channels inform the market about the benefits and applications of synthetic biology-derived products.

Amyris utilizes a multi-faceted approach to reach its diverse customer base, blending direct engagement with broader market outreach. This strategy ensures that both high-value B2B relationships and wider market awareness are cultivated effectively.

Direct sales efforts focus on securing significant contracts with industrial clients, emphasizing technical dialogue and partnership building. Simultaneously, distribution agreements and participation in industry events expand market penetration and generate new leads.

The company's digital presence, including its website and social media, serves as a vital information hub and a tool for stakeholder engagement. Complementing these efforts, scientific publications solidify Amyris's reputation and influence within the research and development community.

Customer Segments

Flavor & Fragrance (F&F) companies represent a crucial customer segment for Amyris, seeking sustainable and high-performance ingredients. These major F&F houses, like Givaudan and Firmenich, rely on bio-based alternatives for key aroma and flavor molecules, aligning with the industry's growing demand for natural and clean label components. Amyris's ability to deliver these ingredients addresses a significant market need, and the company has a track record of substantial collaborations within this sector.

Companies within the beauty and personal care sector are crucial clients for Amyris. They actively seek out sustainable and clean ingredients to formulate their skincare, haircare, and broader personal care product lines. This demand is driven by a significant consumer shift towards natural and ethically sourced components.

Amyris's squalane, derived from bio-fermentation, and its other innovative ingredients provide essential functional benefits that resonate with these market trends. For instance, the global clean beauty market was valued at approximately $50 billion in 2023 and is projected to grow substantially, underscoring the strong demand for the types of ingredients Amyris offers.

Nutraceutical and health and wellness manufacturers are a key customer segment for Amyris. These companies focus on creating nutritional supplements, functional foods, and various health-related products. Amyris's innovative fermentation technology offers them a sustainable and pure way to source high-value ingredients, meeting the growing consumer desire for health-boosting compounds.

Pharmaceutical Companies

Amyris is increasingly focusing on pharmaceutical companies as a key customer segment, especially with its advancements in producing critical small-molecule drugs to combat supply chain disruptions. Their precision fermentation technology offers pharmaceutical partners a reliable method for sourcing high-purity active pharmaceutical ingredients (APIs).

This segment values Amyris’s ability to address urgent needs within the pharmaceutical supply chain. For instance, Amyris secured significant funding in 2024 to accelerate the development of medicines that are currently on the U.S. Food and Drug Administration's drug shortage list, directly catering to the critical demand from this sector.

- Targeting Pharma: Amyris is actively pursuing partnerships with pharmaceutical companies.

- High-Purity APIs: Precision fermentation is valued for producing pharmaceutical-grade ingredients.

- Addressing Shortages: Amyris received funding in 2024 to develop drugs on the FDA shortage list.

Industrial Biotechnology & Chemical Companies

Industrial biotechnology and chemical companies are key customers for Amyris, often looking to license its advanced technology or buy significant quantities of bio-based chemicals. These companies are increasingly focused on adopting sustainable manufacturing processes and finding cost-efficient, bio-derived raw materials for their operations.

Amyris partners with these entities to supply clean molecules, supporting their transition to greener industrial practices. For instance, in 2024, the demand for sustainable chemical intermediates continued to rise, with many large chemical manufacturers actively seeking bio-based alternatives to petroleum-derived products to meet both regulatory pressures and consumer expectations for eco-friendly goods.

- Technology Licensing: Companies can gain access to Amyris's proprietary fermentation and synthetic biology platforms.

- Bulk Chemical Purchases: Larger volumes of Amyris's bio-manufactured chemicals are sold for integration into existing product lines.

- Sustainability Drivers: These customers prioritize reducing their carbon footprint and enhancing the environmental profile of their end products.

- Cost-Effectiveness: The pursuit of competitive pricing for bio-based inputs remains a critical factor in adoption.

Amyris serves a diverse customer base, including flavor and fragrance houses, beauty and personal care brands, nutraceutical manufacturers, and pharmaceutical companies. These clients are drawn to Amyris's bio-based ingredients for their sustainability, performance, and ability to meet growing consumer demand for clean and natural products.

The company also engages with industrial biotechnology and chemical companies, offering technology licensing and bulk bio-chemical sales. This broad reach highlights Amyris's versatility in providing innovative solutions across multiple industries, with a particular focus on sustainable alternatives.

| Customer Segment | Key Needs | Amyris Value Proposition | 2024 Market Context |

|---|---|---|---|

| Flavor & Fragrance | Sustainable, high-performance aroma molecules | Bio-based alternatives, natural ingredients | Growing demand for clean label components |

| Beauty & Personal Care | Clean, sustainable ingredients for formulations | Squalane, innovative functional ingredients | Global clean beauty market valued ~ $50B in 2023 |

| Nutraceuticals & Health | Pure, high-value ingredients for supplements | Sustainable sourcing via fermentation | Increasing consumer focus on health-boosting compounds |

| Pharmaceuticals | High-purity APIs, supply chain reliability | Precision fermentation for critical molecules | Funding in 2024 to develop drugs on FDA shortage list |

| Industrial Biotech/Chemicals | Bio-based chemicals, sustainable processes | Technology licensing, bulk bio-chemical sales | Increased demand for bio-derived raw materials |

Cost Structure

Amyris's commitment to innovation, particularly in strain engineering and new molecule discovery, makes Research & Development (R&D) a significant cost driver. This investment fuels their pipeline of sustainable ingredients and fuels future growth.

These R&D expenses encompass crucial areas like process development, salaries for highly skilled scientists, and the acquisition of advanced laboratory equipment. The company's strategic operations in both the U.S. and Brazil underscore the ongoing nature of these significant outlays.

For instance, in 2023, Amyris reported R&D expenses of $132.5 million, reflecting their dedication to advancing their technology platforms and developing novel applications for their bio-based ingredients.

Amyris's manufacturing and production costs are significantly influenced by the operation and upkeep of its large-scale precision fermentation facilities. Key expenses include securing raw materials like plant-based sugars, the substantial energy required for fermentation processes, skilled labor for facility management, and ongoing equipment maintenance.

In 2023, Amyris reported a cost of revenue of $238.8 million. The company's strategy heavily relies on achieving economies of scale through efficient production ramp-ups to mitigate these substantial manufacturing expenses and improve profitability.

Sales, General & Administrative (SG&A) expenses are a significant component of Amyris's cost structure, encompassing sales and marketing, corporate overhead, legal fees, and administrative salaries. In 2023, Amyris reported SG&A expenses of $206.2 million, reflecting investments in market expansion and ongoing operational costs.

Following its Chapter 11 restructuring in 2023, Amyris is actively working to streamline its SG&A, aiming for greater efficiency. This includes reducing its workforce and optimizing its operational footprint to lower these overheads.

Intellectual Property (IP) Maintenance & Protection

Amyris incurs ongoing expenses to secure, maintain, and defend its intellectual property, including patents and trade secrets, across various global jurisdictions. This commitment is crucial for safeguarding their proprietary fermentation technology and synthetic biology platforms, which form a significant competitive advantage.

These costs are substantial due to the complex and lengthy nature of patent prosecution and enforcement. For instance, in 2024, companies in the biotechnology sector often allocate a significant portion of their R&D budget towards IP protection, with patent filing and maintenance fees alone potentially running into millions of dollars annually for a global portfolio.

- Patent Filing Fees: Costs associated with preparing and filing patent applications in multiple countries.

- Maintenance Fees: Recurring payments required to keep patents in force.

- Legal Defense Costs: Expenses incurred in defending IP against infringement claims or pursuing legal action against infringers.

- Licensing and Royalty Management: Costs associated with managing inbound and outbound IP licenses.

Capital Expenditures (CapEx) for Facility Expansion

Capital expenditures for facility expansion are a crucial element of Amyris's cost structure. These investments are directed towards enhancing manufacturing capabilities, which includes building new production lines and upgrading existing equipment. For example, Amyris has been actively investing in its Brazil facility, with a notable commitment to completing a fourth precision fermentation line. This expansion is a direct reflection of their strategy to scale production and meet growing market demand.

These significant capital outlays are essential for Amyris to maintain its competitive edge and operational efficiency. The company's commitment to expanding its manufacturing footprint, particularly in Brazil, underscores its focus on increasing output volume and optimizing production processes. This strategic investment in infrastructure is a key driver for future growth and market penetration.

- Investment in Manufacturing: Amyris allocates substantial capital to expand its existing production facilities and build new ones.

- Precision Fermentation: A key area of CapEx involves the development and completion of precision fermentation lines, such as the fourth line in Brazil.

- Operational Scaling: These expenditures are vital for scaling operations to meet increasing demand for their bio-based products.

Amyris's cost structure is heavily weighted towards research and development, manufacturing, and administrative expenses. These are essential for innovation, production, and overall business operations.

The company's strategic focus on scaling production, particularly through its precision fermentation facilities, necessitates significant ongoing investment in raw materials, energy, and skilled labor. This is a critical component of their cost base.

Amyris's commitment to intellectual property protection also represents a substantial and recurring cost, vital for maintaining its competitive advantage in the synthetic biology market.

| Cost Category | 2023 Expense (Millions USD) | Key Drivers |

|---|---|---|

| Research & Development | 132.5 | Strain engineering, molecule discovery, process development |

| Cost of Revenue | 238.8 | Raw materials, energy, labor for fermentation |

| Sales, General & Administrative | 206.2 | Market expansion, corporate overhead, operational costs |

| Intellectual Property | Significant, ongoing | Patent filing, maintenance, legal defense |

| Capital Expenditures | Ongoing investments | Facility expansion, new production lines (e.g., Brazil) |

Revenue Streams

Amyris's core revenue comes from selling bio-fermented ingredients directly to businesses. These high-value components are used by major companies in products across the flavors, fragrances, cosmetics, nutraceuticals, and pharmaceutical sectors. For instance, in 2023, Amyris reported revenue of $183.3 million, with a significant portion derived from these B2B ingredient sales, highlighting their importance to the company's financial performance.

Amyris leverages its advanced synthetic biology platform by licensing its proprietary technology and engineered strains to other businesses. This provides a significant revenue stream through upfront fees, milestone payments tied to development progress, and ongoing royalties calculated on the sales of products derived from their technology.

This licensing model is a cornerstone for many synthetic biology companies, allowing them to monetize their innovations without directly manufacturing every end product. For instance, in 2023, Amyris continued to explore and secure partnerships that would expand the reach of its fermentation-based production capabilities, a testament to the value of its intellectual property in the burgeoning biotech sector.

Amyris generates revenue from joint development and co-creation agreements where partners finance Amyris's research and development to jointly create new ingredients. These collaborations typically involve sharing the economic benefits derived from the successful commercialization of the resulting products.

A prime example of this revenue stream is the BioMaP-Consortium agreement, which provided significant funding for Amyris's innovation pipeline. In 2023, such partnerships were crucial for advancing Amyris’s technology platform.

Strategic Asset Sales (Post-Restructuring)

Following its Chapter 11 restructuring, Amyris has actively pursued revenue generation through the strategic divestiture of non-core assets, primarily its consumer brands. These sales, though considered a temporary measure, proved vital in bolstering the company's liquidity and enabling a sharpened focus on its core ingredients business.

Amyris secured court approval for several significant asset sales during its restructuring period. For instance, in August 2023, the company announced the sale of its Biossance and Pipette brands to AS Beauty for $85 million. Later, in September 2023, Amyris completed the sale of its Meno Labs business to a private buyer for $3 million. These transactions were instrumental in providing immediate capital infusion.

- Biossance and Pipette Sale: $85 million to AS Beauty in August 2023.

- Meno Labs Sale: $3 million to a private buyer in September 2023.

- Liquidity Improvement: These sales provided crucial cash to support ongoing operations and the core business.

- Strategic Focus: Allowed Amyris to pivot and concentrate on its high-value ingredients portfolio.

Government Grants & Funding for Strategic Initiatives

Amyris leverages government grants and funding as a crucial revenue stream, particularly for initiatives that align with national strategic priorities. This non-dilutive capital supports specific research and development efforts, such as advancing domestic biomanufacturing or developing critical medicines. For instance, in 2024, Amyris secured a significant $12.3 million award from the Administration for Strategic Preparedness and Response (ASPR) specifically for pharmaceutical manufacturing. This funding underscores the company's role in bolstering national health security and technological independence.

These government awards provide essential financial backing for projects that might otherwise be challenging to fund through traditional means. By targeting areas of national importance, Amyris not only secures capital but also validates its technological advancements and strategic direction. The company's ability to attract such grants highlights the perceived value and potential impact of its work in biotechnology and sustainable manufacturing.

- Government Grants & Funding: Amyris secures non-dilutive capital by aligning projects with national strategic priorities, such as advancing domestic biomanufacturing.

- ASPR Funding: In 2024, Amyris received $12.3 million from the Administration for Strategic Preparedness and Response (ASPR) for pharmaceutical manufacturing.

- Strategic Alignment: This funding supports R&D in critical areas, enhancing national health security and technological capabilities.

Amyris's revenue streams are diversified, encompassing direct ingredient sales, technology licensing, joint development agreements, and government grants. Following a Chapter 11 restructuring in 2023, the company divested consumer brands like Biossance and Pipette for $85 million, sharpening its focus on its core bio-fermented ingredients business.

In 2024, Amyris secured $12.3 million from the Administration for Strategic Preparedness and Response (ASPR) for pharmaceutical manufacturing, showcasing its ability to attract non-dilutive capital for strategic initiatives. These varied revenue sources are crucial for funding its ongoing research and development in synthetic biology.

| Revenue Stream | Description | Key 2023/2024 Data Point |

|---|---|---|

| B2B Ingredient Sales | Direct sales of bio-fermented ingredients to various industries. | $183.3 million total revenue in 2023. |

| Technology Licensing | Monetizing proprietary technology and engineered strains. | Ongoing exploration and securing of partnerships in 2023. |

| Joint Development Agreements | Collaborations for R&D with shared economic benefits. | BioMaP-Consortium agreement provided significant funding. |

| Asset Divestitures | Sale of non-core consumer brands. | Biossance/Pipette sale ($85M, Aug 2023), Meno Labs sale ($3M, Sep 2023). |

| Government Grants & Funding | Non-dilutive capital for strategic R&D projects. | $12.3 million ASPR award in 2024 for pharmaceutical manufacturing. |

Business Model Canvas Data Sources

The Amyris Business Model Canvas is constructed using a blend of internal financial data, extensive market research on renewable chemicals and biotechnology, and strategic insights from industry experts. This comprehensive approach ensures each component of the canvas accurately reflects Amyris's operational realities and market positioning.