Amyris PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amyris Bundle

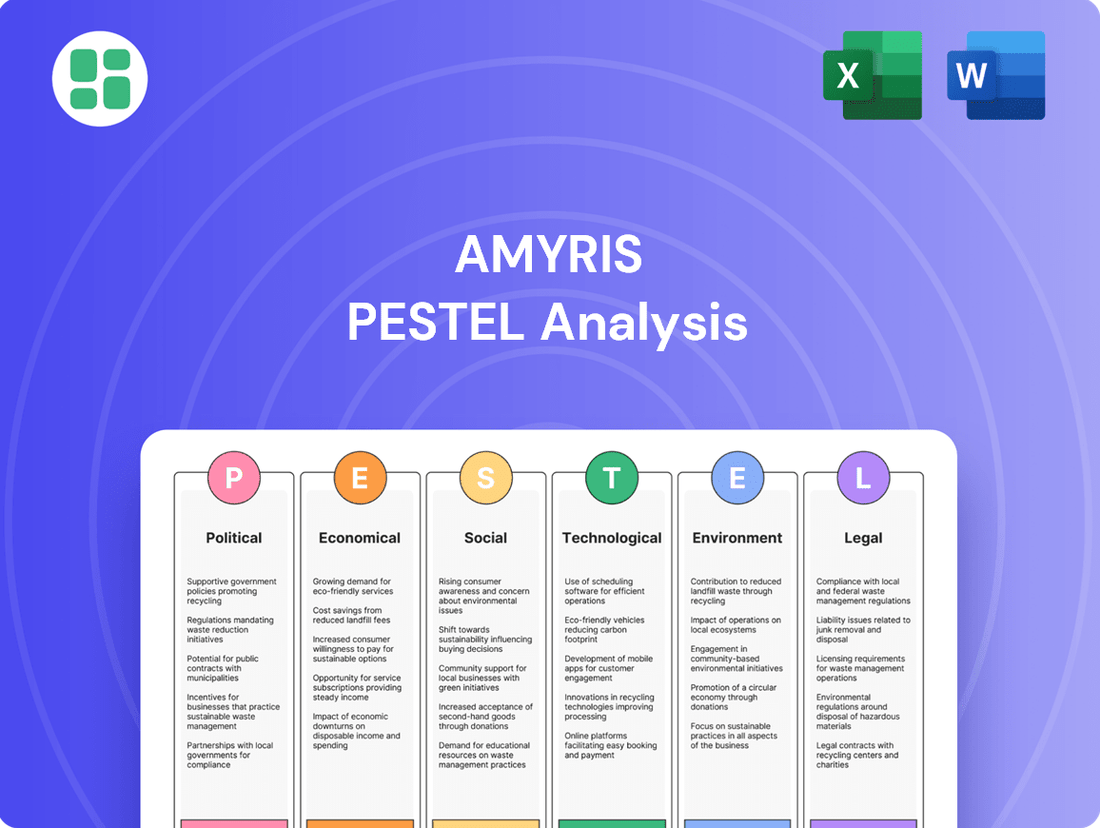

Navigate the complex external forces shaping Amyris's journey. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors impacting this innovative biotech company. Understand the landscape to anticipate challenges and seize opportunities.

Gain a critical advantage with our comprehensive PESTLE analysis of Amyris. We dissect the external environment, from shifting consumer preferences to evolving regulatory frameworks, providing you with actionable intelligence. Equip yourself with the insights needed to make informed strategic decisions.

Unlock the full potential of your understanding of Amyris by exploring our detailed PESTLE analysis. Discover how global trends in technology, sustainability, and policy directly influence Amyris's operations and future growth. Download the complete report for strategic clarity.

Political factors

Government policies and funding are crucial for synthetic biology and bio-based industries, directly influencing Amyris's trajectory. For instance, the U.S. Department of Energy's Bioindustrial Market Accelerator (BMA) program, with its 2024 funding rounds, aims to bolster domestic biomanufacturing, a sector where Amyris operates.

Initiatives focused on transitioning away from petrochemicals towards biochemicals are a significant tailwind for Amyris's core business model. The Inflation Reduction Act of 2022, with its clean energy tax credits, indirectly supports the development and adoption of bio-based alternatives, potentially creating a more favorable market landscape for Amyris’s products.

Furthermore, the emphasis on building resilient domestic supply chains for critical medicines presents a substantial opportunity for Amyris. The Biden administration's executive order on bolstering biomanufacturing and biomanufacturing supply chains, signed in September 2022, underscores this strategic priority, aligning with Amyris's potential to produce essential ingredients.

International trade policies and geopolitical shifts significantly impact Amyris's global operations. For instance, the BIOSECURE Act, if enacted, could create complexities for Amyris's supply chain and partnerships, especially those involving foreign entities. Navigating these evolving regulations is critical for maintaining market access and fostering international collaborations.

Regulatory frameworks governing the import and export of bio-based ingredients are paramount for Amyris's worldwide business. These policies can either facilitate market entry or erect substantial barriers, directly affecting the company's ability to source materials and distribute its products globally. Understanding and adapting to these trade dynamics is essential for sustained growth.

The pace at which regulatory bodies approve novel bio-based ingredients is a significant political factor for Amyris. For instance, the U.S. Food and Drug Administration's (FDA) GRAS (Generally Recognized As Safe) notification process, while established, can still involve considerable time and data submission, impacting how quickly Amyris can launch new formulations. A more efficient and predictable regulatory pathway, supported by clear governmental policy, directly translates to faster market entry and reduced development expenses.

Political Stability and Investment Climate

Amyris's operational hubs in the U.S. and Brazil are subject to varying degrees of political stability, directly impacting investor sentiment and strategic forecasting. A predictable political environment fosters foreign direct investment and supports consistent business operations, which is crucial for a company navigating post-restructuring phases.

The U.S. generally offers a stable political climate, though policy shifts, particularly concerning environmental regulations and trade, can introduce some uncertainty. Brazil, while a key manufacturing and R&D location for Amyris, has historically experienced more pronounced political volatility, which can affect economic policy and the ease of doing business.

- U.S. Political Stability: The U.S. maintains a generally stable political system, providing a relatively predictable regulatory landscape for companies like Amyris.

- Brazil's Political Landscape: Brazil's political environment can be more dynamic, with potential impacts on economic policies and investment incentives affecting Amyris's operations.

- Impact on Investment: Political stability directly influences investor confidence, with stable regions attracting more foreign direct investment and supporting long-term business planning for companies in transition.

Post-Bankruptcy Government Oversight

Amyris's emergence from Chapter 11 bankruptcy in April 2024 means it will likely operate under heightened government and court oversight. This includes strict adherence to its confirmed reorganization plan, which often involves detailed reporting on financial performance and operational milestones. For instance, the company must demonstrate progress in its debt reduction and revenue generation targets as outlined in the plan.

This post-bankruptcy environment necessitates a strong focus on transparency and compliance. Failure to meet the terms of the reorganization plan could trigger penalties or further legal interventions. Amyris’s ability to manage its restructured debt, estimated to be significantly reduced post-reorganization, will be a key metric monitored by oversight bodies.

- Reorganization Plan Adherence: Amyris must meticulously follow the terms of its confirmed Chapter 11 plan.

- Financial Reporting: Regular, transparent financial disclosures to courts and relevant government agencies are mandatory.

- Compliance Monitoring: Ongoing adherence to legal and financial commitments made during the bankruptcy proceedings is crucial.

- Operational Milestones: Meeting specific operational targets outlined in the plan will be subject to review.

Government support for biomanufacturing, such as the U.S. Department of Energy's BMA program, directly impacts Amyris's access to funding and market development. The Inflation Reduction Act of 2022 also indirectly bolsters bio-based alternatives through clean energy tax credits.

Regulatory approval timelines for new bio-based ingredients, like the FDA's GRAS process, are critical for Amyris's speed to market. International trade policies and potential legislation like the BIOSECURE Act can significantly influence supply chains and market access.

Amyris's post-Chapter 11 emergence in April 2024 places it under increased government and court oversight, requiring strict adherence to its reorganization plan and transparent financial reporting. Political stability in key operational regions like the U.S. and Brazil affects investor confidence and Amyris's ability to secure foreign direct investment.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Amyris, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats stemming from these global trends.

Amyris's PESTLE analysis offers a clear and actionable roadmap, simplifying complex external factors into digestible insights that directly address strategic planning challenges.

This analysis acts as a pain point reliever by providing a structured framework to understand and navigate the dynamic market landscape, enabling more informed decision-making.

Economic factors

Amyris's ability to secure additional funding post-bankruptcy is paramount to executing its revitalized business model and strategic plan. The company's emergence from Chapter 11 was significantly bolstered by $160 million in exit financing provided by Foris Ventures, a key factor in its operational restart.

Sustained access to capital markets, whether through debt or equity, or continued private investment, will be essential for Amyris to fuel its research and development pipeline and to effectively scale its production capabilities for its innovative bio-based products.

Global economic growth directly impacts Amyris's top line, as consumer spending on premium, sustainable ingredients and derived products is sensitive to economic health. During periods of economic slowdown, consumers may cut back on discretionary purchases, affecting demand for Amyris's cosmetic, fragrance, and nutraceutical ingredients. For instance, if global GDP growth falters, as projected by the IMF to be around 2.8% in 2024, this could translate to reduced consumer spending power for higher-priced bio-based alternatives.

Conversely, robust economic expansion, with projected global GDP growth of 3.2% in 2025 according to the IMF, generally fuels consumer confidence and increases willingness to spend on innovative and sustainable products. This environment would likely accelerate Amyris's market penetration and adoption of its bio-engineered ingredients, as consumers and businesses prioritize value and sustainability when their budgets allow.

Amyris's reliance on plant-based sugars as feedstocks means that the cost and availability of these renewable resources are critical economic drivers. For instance, the price of corn, a common feedstock, can be volatile. In late 2024, corn prices saw fluctuations driven by weather patterns and global demand, directly influencing Amyris's input costs.

Energy expenses for the fermentation processes are another significant economic factor. The cost of electricity and natural gas used in these large-scale operations directly impacts Amyris's operational expenditures and, consequently, its profitability. As of early 2025, energy markets have shown some stability, but geopolitical events can quickly alter these costs.

The ability to optimize supply chains for these raw materials and manage energy procurement is therefore paramount for Amyris. Efficient sourcing and cost management of feedstocks and energy are essential for maintaining competitive pricing and ensuring consistent production output, directly affecting their bottom line.

Competition in Synthetic Biotechnology

The synthetic biotechnology sector is intensely competitive, with Amyris facing pricing pressures from both bio-based rivals and traditional petroleum-derived products. This dynamic directly impacts Amyris's ability to capture market share and maintain healthy profit margins.

The market is crowded with innovative startups and established corporations leveraging precision fermentation, demanding constant technological advancement and cost optimization from Amyris. Differentiation through unique, proprietary technology is therefore crucial for Amyris to stand out.

- Intense Competition: Amyris operates in a highly competitive synthetic biology market.

- Pricing Pressures: Both bio-based and petroleum-derived alternatives exert downward pressure on pricing.

- Innovation Imperative: The presence of numerous startups and large players necessitates continuous innovation.

- Cost Efficiency: Achieving cost efficiencies is vital for maintaining competitiveness.

- Proprietary Technology: Differentiation through unique technology is a key strategic advantage.

Market Demand for Bio-Based Ingredients

The increasing consumer and corporate desire for sustainable, bio-based ingredients is a significant tailwind for Amyris. This trend is reshaping industries such as flavors and fragrances, cosmetics, and pharmaceuticals, pushing them away from traditional petroleum-based chemicals. For instance, the global bio-based ingredients market was valued at approximately USD 100 billion in 2023 and is projected to grow substantially, with some estimates suggesting it could reach over USD 200 billion by 2030, reflecting a compound annual growth rate (CAGR) of around 8-10%.

Amyris's strategic shift to focus on its B2B ingredients business is a direct response to this burgeoning demand. Companies across various sectors are actively seeking renewable and environmentally friendly alternatives to meet their sustainability goals and cater to evolving consumer preferences. This market push is further amplified by regulatory pressures and corporate social responsibility initiatives that encourage the adoption of greener chemistry.

- Consumer Preference: A growing segment of consumers actively seeks products with natural and sustainable ingredients, influencing purchasing decisions across multiple categories.

- Brand Commitments: Major brands are setting ambitious sustainability targets, including reducing their reliance on fossil fuel-derived ingredients, creating a direct market for bio-based alternatives.

- Industry Shifts: Sectors like personal care and food are experiencing a significant transition, prioritizing bio-based materials for their environmental benefits and perceived health advantages.

- Market Growth: Projections indicate robust growth for the bio-based ingredients market, with anticipated expansion driven by innovation and increasing adoption across diverse applications.

Economic stability and access to capital remain critical for Amyris. The company's emergence from Chapter 11 with $160 million in exit financing from Foris Ventures in late 2023 provided a crucial lifeline. However, sustained access to funding through debt, equity, or continued private investment is vital for R&D and scaling production.

Global economic growth directly influences consumer spending on Amyris's premium, bio-based ingredients. The IMF projected global GDP growth of 2.8% in 2024 and 3.2% in 2025, indicating a moderate but positive environment for discretionary spending on sustainable products.

Fluctuations in feedstock costs, such as corn prices, and energy expenses for fermentation processes directly impact Amyris's operational expenditures. For instance, volatile energy markets in early 2025, influenced by geopolitical events, can significantly affect production costs and profitability.

Amyris faces intense competition from both bio-based and traditional petroleum-derived alternatives, leading to pricing pressures. The need for continuous innovation and cost optimization is paramount, with proprietary technology serving as a key differentiator in the crowded synthetic biology market.

Preview Before You Purchase

Amyris PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Amyris PESTLE analysis covers all critical Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to detailed insights into Amyris's market landscape and strategic considerations.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a thorough examination of the external forces shaping Amyris's operations and future growth.

Sociological factors

Consumers are increasingly prioritizing sustainability, with a growing demand for products that are environmentally friendly, feature clean labels, and are ethically sourced. This societal shift directly fuels the market for bio-based ingredients like those offered by Amyris. For instance, a 2024 Nielsen study indicated that 73% of global consumers would change their purchasing habits to reduce their environmental impact, highlighting a powerful driver for companies aligning with these values.

The increasing global emphasis on health and wellness, particularly the demand for natural, non-toxic, and nutraceutical ingredients, directly benefits Amyris. This societal shift strongly supports the market for bio-fermented components used in health supplements and personal care products.

Consumers are actively seeking healthier lifestyle choices, and Amyris's product portfolio, which includes ingredients like squalane for skincare and fermentation-derived vitamins, aligns perfectly with these preferences. For instance, the global nutraceutical market was valued at approximately $230 billion in 2023 and is projected to grow significantly, indicating a robust demand for the types of ingredients Amyris produces.

Public acceptance of synthetic biology, particularly the use of genetically engineered microorganisms, significantly shapes consumer and regulatory views on bio-based products. Misinformation can lead to market resistance, whereas clear communication emphasizing sustainability and safety, as Amyris aims to do, can encourage adoption. For instance, a 2023 survey indicated that while consumer awareness of synthetic biology is growing, a substantial portion still harbors concerns about safety and environmental impact, highlighting the need for transparent outreach.

Ethical Considerations of Biotechnology

Societal debates concerning the ethics of genetic engineering and synthetic biology, particularly regarding potential environmental impacts or unforeseen consequences, are increasingly shaping public policy and consumer trust. For companies like Amyris, navigating these complex discussions with transparency is crucial for maintaining a reputation as a responsible innovator in the biotechnology sector. This ethical landscape directly influences market acceptance and regulatory pathways for their products.

Amyris, as a leader in synthetic biology, faces scrutiny over its reliance on genetically modified organisms (GMOs) and the long-term ecological implications of its bio-based manufacturing processes. Public perception, often influenced by these ethical considerations, can significantly affect demand for its renewable ingredients. For instance, consumer surveys in 2024 indicated a growing preference for products with clear sustainability credentials, with over 60% of respondents stating they would pay a premium for ethically sourced and environmentally friendly goods.

- Public Perception: Growing consumer awareness of GMOs and synthetic biology necessitates open dialogue about safety and environmental impact.

- Regulatory Influence: Ethical debates can lead to stricter regulations, impacting R&D and market access for biotech products.

- Brand Reputation: Transparent communication and adherence to ethical guidelines are vital for building and maintaining consumer trust in Amyris's innovations.

- Market Access: Negative societal sentiment or ethical concerns can create barriers to market entry or adoption of Amyris's bio-based solutions.

Workforce Skills and Talent Availability

The availability of a highly skilled workforce in synthetic biology, fermentation science, and advanced manufacturing is absolutely critical for Amyris to thrive. Without these specialized talents, their research and development efforts, as well as their manufacturing capabilities, would be significantly hampered. For instance, the demand for bioengineers and fermentation specialists is projected to grow substantially, with some reports indicating a need for tens of thousands of such professionals globally in the coming years to support the burgeoning bioeconomy.

Societal investment in STEM education and targeted training programs directly influences the talent pool available to companies like Amyris. Greater emphasis on these areas leads to a larger and more qualified group of potential employees. In 2024, global spending on science and technology education is expected to see continued increases, reflecting a recognition of its importance for future economic growth.

Attracting and retaining top-tier talent is a significant competitive advantage in the specialized field of synthetic biology. Companies that can secure the best minds in the industry are better positioned for innovation and market leadership. The competition for these highly sought-after individuals is fierce, often leading to aggressive recruitment and compensation strategies.

- Talent Demand: Projections show a significant increase in demand for skilled professionals in synthetic biology and advanced manufacturing to support industry growth.

- Education Investment: Societal commitment to STEM education directly impacts the availability of qualified candidates for specialized roles within Amyris.

- Competitive Advantage: The ability to attract and retain leading scientific and technical talent is crucial for Amyris's innovation and market position.

Consumers are increasingly prioritizing sustainability and health, driving demand for Amyris's bio-based ingredients. A 2024 Nielsen study found 73% of global consumers would alter purchasing habits for environmental impact, aligning with Amyris's mission. The growing nutraceutical market, valued at $230 billion in 2023, further supports the demand for Amyris's fermentation-derived vitamins and squalane.

Public perception of synthetic biology and GMOs significantly impacts market acceptance for Amyris. Transparent communication is key, as a 2023 survey revealed ongoing consumer concerns about safety and environmental impact, despite growing awareness. Ethical debates surrounding genetic engineering can also influence regulatory pathways and consumer trust.

The availability of a skilled workforce in synthetic biology and fermentation science is critical for Amyris's success. Global investment in STEM education is rising, reflecting the importance of developing this talent pool. Competition for top scientific talent is intense, making talent acquisition a key differentiator for innovation.

Technological factors

Amyris's competitive advantage is deeply rooted in its advanced strain engineering platform. This system utilizes machine learning, robotics, and artificial intelligence to precisely modify microorganisms, enabling the efficient production of high-value ingredients. For instance, by mid-2024, Amyris reported significant progress in optimizing its yeast strains for producing squalane, a key ingredient in cosmetics and personal care products, with yield improvements exceeding 30% compared to the previous year.

Ongoing breakthroughs in gene-editing technologies, such as CRISPR-Cas9, are further accelerating Amyris's innovation cycle. These tools allow for faster and more precise genetic modifications, which is crucial for developing novel ingredients and improving existing production processes. This rapid development capability ensures Amyris can quickly respond to market demands and maintain its leadership in the biotech ingredients sector, a critical factor in the rapidly evolving biochemical industry.

The ongoing advancements in precision fermentation, from sophisticated bioreactor designs to more efficient downstream processing, directly influence Amyris's ability to scale production, reduce costs, and boost product yields. These technological leaps are crucial for achieving sustainable and cost-competitive manufacturing of bio-based chemicals.

Amyris's strategic move to fully own its Brazilian production facility underscores its commitment to controlling and optimizing these critical fermentation processes. This vertical integration is key to realizing the full potential of innovations in bioreactor technology and downstream purification for bio-based ingredients.

Amyris is leveraging AI and machine learning to speed up its research and development. By integrating these technologies into its processes, the company can more effectively analyze data and optimize production. This allows for quicker identification and development of new bio-based ingredients, ultimately shortening the time to market.

For instance, in 2024, Amyris reported significant progress in using AI to predict and engineer microbial pathways. This technological advancement is crucial for developing sustainable alternatives to traditional ingredients, with the company aiming to bring several new products to market by late 2025, supported by these advanced analytical capabilities.

Intellectual Property Development and Protection

Amyris's core strategy relies heavily on its ability to secure and defend patents for its innovative microbial strains, proprietary fermentation processes, and unique bio-based ingredients. This intellectual property (IP) is the bedrock of its competitive advantage and market exclusivity in the burgeoning synthetic biology sector.

The evolving landscape of intellectual property law, particularly concerning the patentability of synthetic biology innovations, presents both opportunities and challenges. Clarifications or new precedents in this area can significantly impact Amyris's ability to maintain its market position and fend off competitors. For instance, the ongoing debate around patent eligibility for genetically modified organisms and novel biological processes directly influences the scope and enforceability of Amyris's IP portfolio.

Amyris's robust IP protection is a critical factor in attracting and retaining investment. Investors often view a strong patent portfolio as a key indicator of a company's long-term viability and its potential for sustained profitability. As of early 2024, Amyris has been actively managing its IP, filing new patent applications and defending existing ones, reflecting the dynamic nature of this technological factor.

- Patent Portfolio Strength: Amyris holds a significant number of patents and pending applications covering its core technologies, essential for safeguarding its innovations in areas like cannabinoid production and specialty ingredients.

- Synthetic Biology Patenting Trends: The legal landscape for synthetic biology patents is continually shaped by court decisions and regulatory updates, directly impacting the defensibility of Amyris's innovations.

- Investor Confidence and IP: A strong and well-defended IP portfolio is a key driver for investor confidence, as demonstrated by the valuation metrics often tied to companies with defensible technological moats.

Automation and Biomanufacturing Scale-Up

Amyris's success hinges on advancements in automation and scaling up its synthetic biology processes. This transition from lab-scale to industrial production is vital for efficiently meeting market demand. For example, the company's 2023 financial reports indicated ongoing investments in expanding its manufacturing capabilities to support higher production volumes, a direct response to growing market interest in its sustainable ingredients.

The shift to industrial-scale facilities, coupled with the adoption of continuous biomanufacturing, directly impacts cost reduction and speeds up the introduction of new products. This operational efficiency is a cornerstone of Amyris's profitability strategy. By streamlining production, Amyris aims to achieve better economies of scale, making its bio-based products more competitive.

- Automation: Enhancing process control and reducing manual labor in fermentation and downstream processing.

- Biomanufacturing Scale-Up: Increasing production capacity from pilot to commercial volumes to meet global demand.

- Cost Reduction: Achieving lower per-unit production costs through optimized processes and larger batch sizes.

- Market Entry Acceleration: Shortening the time from product development to commercial availability.

Amyris is at the forefront of technological innovation in the bio-manufacturing sector, leveraging advanced synthetic biology. Their proprietary strain engineering platform, enhanced by AI and machine learning, allows for rapid development and optimization of microbial production of high-value ingredients. By mid-2024, Amyris reported over 30% yield improvements for key ingredients like squalane, showcasing the direct impact of these technological advancements on efficiency.

The company's investment in automation and scaling up its precision fermentation processes is critical for cost-effectiveness and market competitiveness. By late 2025, Amyris aims to launch several new products, a goal supported by their ongoing efforts to integrate AI for predictive pathway engineering and optimize industrial-scale biomanufacturing, as highlighted in their 2024 progress reports.

Amyris's robust intellectual property portfolio, particularly patents on microbial strains and fermentation processes, is a key technological asset. The company actively manages its IP to maintain market exclusivity, recognizing that advancements in synthetic biology patent law directly influence its competitive standing. As of early 2024, Amyris's IP strategy remains central to investor confidence.

| Technology Area | Key Advancement/Impact | Amyris Data/Target |

|---|---|---|

| Strain Engineering | AI/ML-driven optimization | 30%+ yield improvement (mid-2024) |

| Gene Editing | CRISPR-Cas9 acceleration | Faster development cycles |

| Precision Fermentation | Scale-up & cost reduction | New product launches by late 2025 |

| Intellectual Property | Patent protection | Securing market exclusivity |

Legal factors

Amyris's recent emergence from Chapter 11 bankruptcy in early 2024 significantly shapes its legal landscape, with its reorganized operations strictly adhering to the terms of its confirmed reorganization plan. This plan dictates everything from debt restructuring to the management of asset sales, making compliance a critical legal imperative.

The bankruptcy process itself provided a legal framework that enabled Amyris to undertake a strategic transformation, shedding certain liabilities and repositioning itself for future growth. For instance, the company successfully reduced its debt by hundreds of millions of dollars through this process, a key outcome of the legal proceedings.

The synthetic biology sector, including Amyris, operates within a complex legal framework concerning intellectual property. This involves navigating patents, trade secrets, and licensing, areas frequently subject to litigation. Amyris's ability to protect its innovations hinges on robust IP management and defense against potential infringement. For instance, ongoing disputes surrounding foundational gene-editing technologies like CRISPR can significantly impact the entire industry, affecting research and commercialization pathways.

Amyris must navigate a complex web of health, safety, and environmental regulations for its bio-based ingredients across diverse markets like cosmetics, food, and pharmaceuticals. For instance, the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation imposes stringent data requirements for chemical substances, impacting Amyris's ingredient submissions.

Securing and retaining regulatory approvals, such as FDA GRAS (Generally Recognized As Safe) status for food ingredients or EPA approval for industrial applications, is paramount for market entry and building consumer confidence. Amyris's success in obtaining these approvals directly influences its ability to commercialize new products.

The global nature of Amyris's business means grappling with a patchwork of international regulations, each with its own unique standards and approval processes. This variation, for example between the US FDA and European EFSA regulations, introduces significant complexity and requires tailored compliance strategies for each target market.

Corporate Governance and Compliance

Following its Chapter 11 restructuring, Amyris is under intense scrutiny regarding its corporate governance. Adherence to stringent standards is critical, especially given the new ownership structure and board appointments. This focus on governance is designed to rebuild investor trust.

Compliance with securities laws and financial reporting regulations is non-negotiable for Amyris. The company must demonstrate robust internal controls to ensure operational integrity and transparency. The recent appointment of new leadership underscores this commitment to enhanced oversight and accountability.

- Regulatory Compliance: Amyris must navigate evolving SEC regulations and state corporate laws, particularly concerning its post-restructuring financial disclosures.

- Board Composition: The new board must demonstrate independence and expertise to effectively oversee management and strategic direction, a key factor for investor confidence.

- Internal Controls: Strengthening internal financial reporting and operational controls is paramount to prevent future compliance failures and ensure data accuracy.

- Investor Relations: Proactive communication regarding governance improvements and compliance efforts is essential to attract and retain investment in the 2024-2025 period.

International Trade and Biosecurity Regulations

Amyris's international trade in biotechnology products is significantly shaped by evolving legal landscapes. For instance, the potential impact of legislation like the BIOSECURE Act, which aims to address biosecurity concerns related to certain foreign biotechnology entities, could influence Amyris's supply chain and market access. Navigating export controls and import restrictions is crucial for global operations, as these regulations are designed to mitigate biological threats and can directly affect the cost and feasibility of international business.

Compliance with these diverse legal frameworks is not merely a procedural requirement but a strategic imperative. These regulations can dictate the terms of strategic partnerships and collaborations, influencing where and how Amyris can operate. For example, differing national regulations on genetically modified organisms (GMOs) or specific biochemicals can create complex compliance challenges for a company like Amyris, which operates on a global scale.

- Global Trade Compliance: Amyris must ensure adherence to international trade laws, including those related to the import and export of biotechnology products, to maintain its global supply chain integrity.

- Biosecurity Legislation: Emerging biosecurity regulations, such as those potentially impacting collaborations with certain foreign entities, require careful monitoring and strategic adaptation to safeguard market access.

- Regulatory Harmonization: The company faces the challenge of navigating varying national regulations concerning biotechnology, necessitating robust compliance strategies to ensure seamless international operations.

- Partnership Frameworks: Legal frameworks governing international trade and biosecurity can directly influence the structure and viability of strategic partnerships, requiring careful legal due diligence.

Amyris's legal standing is significantly defined by its emergence from Chapter 11 bankruptcy in early 2024, necessitating strict adherence to its reorganization plan. This plan dictates debt restructuring and asset management, making compliance a critical operational focus. The company's ability to protect its intellectual property within the synthetic biology sector remains a key legal battleground, with ongoing patent and licensing issues impacting its innovation pipeline.

Navigating global health, safety, and environmental regulations, such as the EU's REACH, is crucial for Amyris's ingredient submissions across diverse markets. Securing regulatory approvals like FDA GRAS status directly influences market entry and consumer trust for its bio-based products. The company must also manage varying international regulations, like those between the US FDA and European EFSA, requiring tailored compliance strategies for each market.

| Legal Factor | Impact on Amyris | 2024/2025 Relevance |

|---|---|---|

| Chapter 11 Reorganization | Dictates operational and financial compliance; reduced debt by hundreds of millions. | Strict adherence to plan terms; focus on rebuilding investor confidence. |

| Intellectual Property | Protection of patents and trade secrets is vital; industry-wide IP litigation risks. | Robust IP management essential for commercializing innovations. |

| Health, Safety & Environmental (HSE) Regulations | Compliance with REACH, FDA, EPA approvals required for market access. | Ongoing need for data submission and approval processes for new ingredients. |

| International Trade & Biosecurity | Navigating export controls and import restrictions; potential impact of legislation like BIOSECURE Act. | Maintaining global supply chain integrity and market access requires adaptive compliance. |

Environmental factors

The global push to reduce dependence on petroleum-based chemicals and combat climate change is a major driver for Amyris's bio-based ingredients. Consumers and industries are increasingly seeking products with a lower carbon footprint, directly benefiting companies like Amyris that offer sustainable alternatives. This trend is underscored by the growing market for bio-based chemicals, which was projected to reach over $100 billion by 2025, reflecting a strong shift towards greener solutions.

Amyris's core business model, converting plant-based sugars into high-value ingredients like squalane and farnesene, inherently embraces circular economy principles by prioritizing renewable feedstocks. This approach significantly reduces reliance on finite petrochemical resources, a key tenet of sustainability.

The company's advanced fermentation technology is designed for resource optimization and waste minimization. For instance, in 2024, Amyris reported achieving over 90% yield efficiency for certain key molecules, showcasing their commitment to maximizing output while reducing byproducts and their associated environmental impact.

By focusing on bio-based production, Amyris directly contributes to lowering the carbon footprint typically associated with traditional chemical manufacturing. This aligns with global efforts to decarbonize industries, as bio-based ingredients can offer a lower lifecycle greenhouse gas emission profile compared to their fossil fuel-derived counterparts.

Amyris's manufacturing, particularly its bio-fermentation processes, directly impacts environmental concerns like waste generation and pollution. The company's core technology is designed to minimize harmful byproducts and emissions, offering a cleaner alternative to conventional chemical synthesis methods. This focus is crucial for meeting stringent environmental regulations and maintaining a positive corporate image.

Biodiversity and Ecosystem Impact

Amyris's reliance on plant-based sugars for its fermentation processes brings biodiversity and ecosystem impact into sharp focus. Large-scale industrial agriculture, often the source of these sugars, can exert significant pressure on natural habitats. This means Amyris needs to be incredibly diligent about where its feedstock comes from.

Ensuring the sustainability of its supply chains is paramount to avoid contributing to deforestation or the loss of vital ecosystems. Responsible sourcing practices are not just good for the planet; they are critical for Amyris's own long-term viability and reputation.

- Feedstock Sourcing: Amyris sources sugars primarily from sugarcane and corn, crops that can have significant land-use footprints.

- Biodiversity Concerns: Expansion of monoculture farming for these crops can lead to habitat fragmentation and reduced biodiversity.

- Sustainable Practices: The company is exploring partnerships and certifications to promote sustainable agricultural methods that protect ecosystems.

Carbon Footprint and Energy Consumption

Amyris is actively working to reduce its environmental impact by focusing on its carbon footprint and energy consumption. Their approach leverages biological manufacturing processes that typically operate under mild conditions, such as room temperature and atmospheric pressure. This contrasts sharply with the energy-intensive nature of traditional petrochemical manufacturing, which often requires high temperatures and pressures.

The company's commitment to sustainability means continuous improvement in energy efficiency is a key objective. For instance, in 2023, Amyris reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions intensity by 15% compared to its 2020 baseline, demonstrating tangible progress in minimizing its operational energy demands.

Amyris's efforts contribute to a broader industry trend towards greener production methods. Their focus on mild reaction conditions not only lowers energy consumption but also reduces the need for harsh chemicals, further enhancing their environmental profile.

Key aspects of Amyris's environmental strategy include:

- Reduced Energy Intensity: Biological processes at ambient conditions significantly lower energy requirements.

- Lower Greenhouse Gas Emissions: A 15% reduction in Scope 1 and 2 emissions intensity was noted in 2023.

- Sustainable Ingredient Development: Minimizing carbon footprint is central to their product innovation.

- Operational Efficiency: Ongoing efforts to enhance energy efficiency across all manufacturing operations.

Amyris's environmental strategy is deeply intertwined with the global shift towards sustainability and a circular economy. By utilizing bio-fermentation to create ingredients from renewable plant sugars, the company offers a lower carbon footprint alternative to petroleum-based chemicals. This aligns with increasing consumer and regulatory demand for greener products, a market projected to exceed $100 billion by 2025.

The company's operational efficiency is a key environmental focus. In 2023, Amyris achieved a 15% reduction in its Scope 1 and 2 greenhouse gas emissions intensity compared to a 2020 baseline, demonstrating a commitment to minimizing its operational energy demands through milder, bio-based manufacturing conditions.

However, Amyris's reliance on crops like sugarcane and corn for feedstock raises concerns about biodiversity and land use. Responsible sourcing practices are crucial to mitigate potential negative impacts on ecosystems and ensure the long-term sustainability of its supply chain.

| Environmental Factor | Amyris's Approach | Data/Impact |

|---|---|---|

| Carbon Footprint | Bio-based production, mild fermentation conditions | 15% reduction in Scope 1 & 2 GHG emissions intensity (2023 vs. 2020) |

| Resource Dependency | Renewable plant sugars (sugarcane, corn) | Reduces reliance on finite petrochemicals |

| Biodiversity & Land Use | Feedstock sourcing | Potential impact from monoculture farming; need for responsible sourcing |

| Waste & Pollution | Optimized fermentation technology | Designed to minimize byproducts and emissions; >90% yield efficiency for key molecules (2024) |

PESTLE Analysis Data Sources

Our Amyris PESTLE Analysis is informed by a comprehensive review of public company filings, industry-specific market research reports, and relevant scientific and technological publications. We also incorporate data from government agencies and regulatory bodies overseeing the biotechnology and renewable fuels sectors.