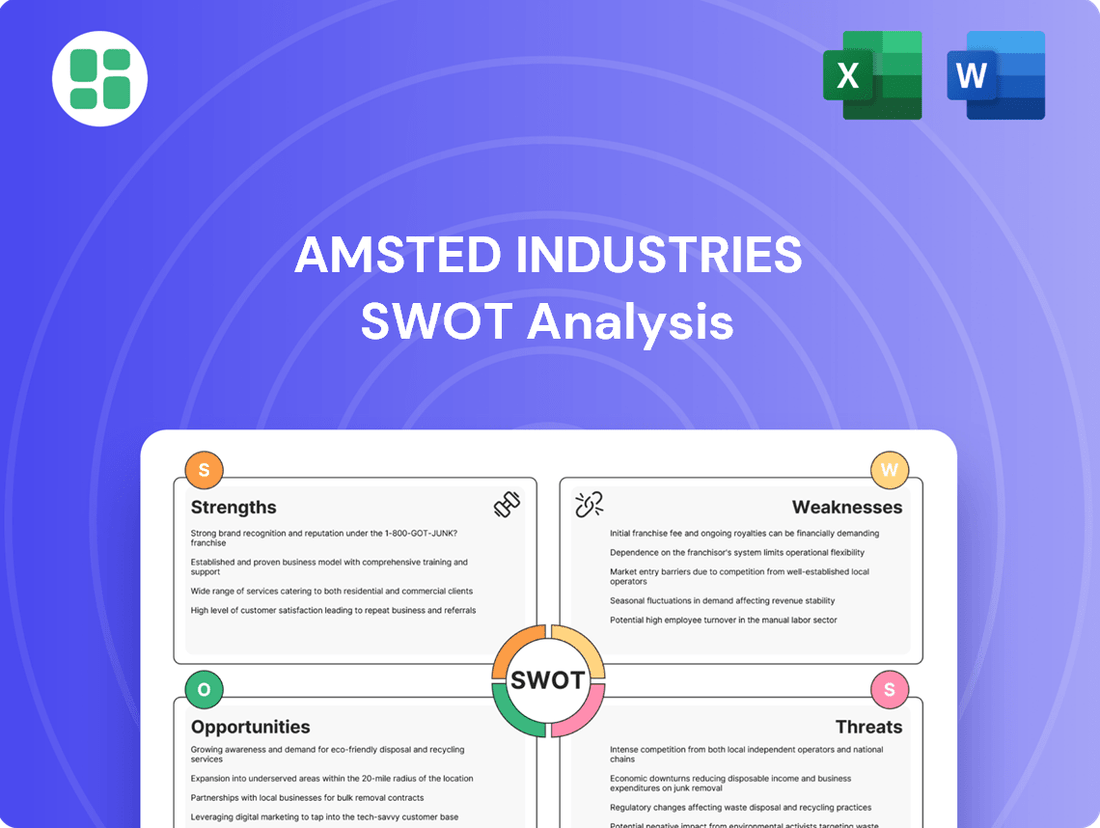

Amsted Industries SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amsted Industries Bundle

Amsted Industries boasts a diversified portfolio and a strong reputation for quality, but faces challenges in adapting to evolving market demands and potential supply chain disruptions. Understanding these internal capabilities and external pressures is crucial for navigating the competitive industrial landscape.

Want the full story behind Amsted Industries' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Amsted Industries boasts a robust global manufacturing network, with operations spanning over 10 countries. This extensive reach, employing more than 17,000 individuals worldwide, allows the company to tap into diverse international markets and manufacturing capabilities.

This broad geographical and operational diversification significantly reduces Amsted's vulnerability to regional economic downturns or sector-specific challenges. For instance, its presence in key markets for railroad, vehicular, construction, and building products ensures a balanced revenue stream.

Amsted Industries commands industry leadership, particularly as the world's largest manufacturer of freight car components. This includes essential parts like wheels, bearings, side frames, and bolsters, underscoring a significant market share.

This dominance is built on a 150-year legacy in freight rail, fostering a robust reputation for dependable performance and unwavering reliability among its clientele.

Amsted's core strength lies in its dedication to delivering engineered solutions, a commitment that fuels its continuous pursuit of technological advancement. This focus is evident in its exploration of cutting-edge areas like additive manufacturing, positioning the company at the forefront of industrial innovation.

The company's investment in digital telematics, exemplified by the IQ Series™ gateway and Bogie IQ® Technology, directly translates into tangible benefits for its rail industry clients. This technology provides real-time health monitoring and predictive maintenance capabilities for railcars, a critical factor in boosting operational efficiency and significantly lowering overall costs.

Financial Stability and Private Ownership

Amsted Industries' private ownership, fully vested in its Employee Stock Ownership Plan (ESOP), fosters a strong employee commitment and a direct link to company performance. This structure, with reported revenues reaching $4.7 billion by November 2024, allows for a strategic focus on long-term growth and operational efficiency, free from the short-term demands of public markets.

The company's private status grants it considerable agility in decision-making and capital allocation. This can translate into a more consistent approach to innovation and investment, potentially leading to more sustainable competitive advantages.

- Employee Ownership: 100% ESOP ownership aligns employee interests with company success, fostering dedication and a shared stake in profitability.

- Financial Strength: $4.7 billion in revenues as of November 2024 underscores a robust financial foundation.

- Strategic Flexibility: Private ownership allows for long-term planning without the quarterly pressures faced by publicly traded companies.

- Operational Focus: The ESOP structure can drive a culture of operational excellence and cost management.

Resilience and Adaptability in Supply Chain

Amsted's operational strategies are keenly focused on building supply chain resilience, a vital advantage in today's manufacturing environment. This focus helps the company navigate potential disruptions effectively.

The company's commitment to minimizing operational downtime is evident. For instance, Amsted Automotive reported an impressive 1% downtime in 2024, showcasing strong management and adaptability.

- Operational Excellence: Amsted Automotive's 1% downtime figure in 2024 highlights superior operational management.

- Global Adaptability: The company's ability to maintain low downtime across its worldwide facilities demonstrates its capacity to adjust to unforeseen challenges.

- Supply Chain Strength: These operational efficiencies directly contribute to a more resilient and dependable supply chain, a key competitive advantage.

Amsted Industries holds a commanding position as the world's largest maker of freight car components, a testament to its 150-year legacy in the rail industry. This market dominance is further solidified by its strong focus on engineered solutions and continuous technological advancement, including investments in additive manufacturing and digital telematics like its IQ Series™ gateway.

The company's 100% Employee Stock Ownership Plan (ESOP) fosters exceptional employee commitment and aligns interests directly with company performance, contributing to its reported $4.7 billion in revenues as of November 2024. This private ownership structure also grants Amsted significant strategic flexibility, allowing for long-term planning unburdened by public market pressures.

Amsted's operational excellence is highlighted by its global adaptability and supply chain resilience, exemplified by Amsted Automotive's impressive 1% operational downtime in 2024. This focus on minimizing disruptions ensures a dependable supply chain, a critical competitive advantage in today's market.

What is included in the product

Delivers a strategic overview of Amsted Industries’s internal strengths and weaknesses alongside external market opportunities and threats.

Identifies Amsted Industries' key vulnerabilities and threats, enabling proactive risk mitigation and strategic adjustments.

Weaknesses

Amsted Industries' significant presence in cyclical sectors like railroad, vehicular, and construction exposes it to the inherent volatility of these markets. Economic downturns, often triggered by rising interest rates or inflation, directly curb demand for the heavy-duty components Amsted manufactures.

For instance, the railroad industry, a key segment for Amsted, experienced a notable slowdown in freight volumes in late 2023 and early 2024, reflecting broader economic headwinds. This sensitivity means that periods of economic contraction can lead to reduced orders and lower revenue for the company.

Amsted Industries' core business of manufacturing industrial components, such as steel and heavy-duty parts, inherently exposes it to the unpredictable swings in raw material costs. For instance, steel prices saw considerable volatility in late 2023 and early 2024, influenced by global supply chain disruptions and demand shifts. This means Amsted's input expenses can change rapidly.

When the cost of essential materials like steel or aluminum rises sharply, it directly impacts Amsted's profitability. If the company cannot pass these increased costs onto its customers, perhaps due to intense market competition or long-term contracts, its profit margins will inevitably shrink. This pressure on margins is a significant concern for the company's financial health.

Amsted Industries operates in diverse markets like rail, vehicular components, and construction materials, but this broad reach also exposes it to significant competitive pressures across all these sectors. For instance, in the North American freight rail market, where Amsted is a major player, competitors like Wabtec and Progress Rail offer a wide array of similar components, leading to potential pricing challenges.

These mature industries often see established competitors with significant market share, such as those in the automotive supply chain, which can implement aggressive pricing strategies or introduce disruptive technologies. This necessitates ongoing investment in research and development for Amsted to not only defend its current market position but also to foster growth.

Potential for Supply Chain Disruptions

Despite Amsted Industries' focus on supply chain resilience, global networks continue to face significant vulnerabilities. Geopolitical tensions, extreme weather events, and persistent labor shortages, as observed across the manufacturing landscape in 2024, pose ongoing risks. These external pressures can translate into substantial delays in component delivery and increased operational costs for Amsted. For instance, the semiconductor shortage, which continued to affect various industries in early 2024, highlighted the fragility of complex global supply chains.

These disruptions directly impact Amsted's ability to maintain consistent production schedules and meet customer demand promptly. The cost of raw materials and transportation also remains susceptible to fluctuations driven by these same external factors. A report from the World Trade Organization in late 2024 indicated that supply chain disruptions cost the global economy an estimated $1.5 trillion in 2023, underscoring the pervasive nature of this challenge.

- Vulnerability to Geopolitical Events: Global conflicts or trade disputes can interrupt the flow of essential materials.

- Impact of Climate Change: Extreme weather events can damage infrastructure and disrupt logistics networks.

- Labor Shortages: A lack of skilled labor in key sectors can slow production and shipping.

- Rising Input Costs: Disruptions often lead to increased prices for raw materials and transportation.

Limited Public Financial Transparency

As a privately held entity, Amsted Industries operates with a degree of financial opacity not seen in publicly traded companies. This means that detailed financial statements and performance metrics are not readily available for public scrutiny, unlike the quarterly and annual reports mandated for listed corporations. For instance, while public companies like General Electric might release detailed revenue breakdowns by segment and forward-looking guidance, Amsted's disclosures are significantly more restrained.

This lack of extensive public financial data presents a hurdle for external parties seeking to perform deep financial due diligence. Potential investors, lenders, or strategic partners may find it more difficult to thoroughly assess Amsted's financial health, profitability trends, and overall market valuation. This can impact the speed and depth of potential collaborations or investment evaluations.

- Limited Disclosure: Amsted Industries, being privately held, does not file public financial reports like 10-Ks or 10-Qs.

- Valuation Challenges: This lack of transparency can make it harder for external analysts to accurately value the company.

- Investor Access: Potential investors may have less readily available information to assess risk and return compared to public market opportunities.

- Comparative Difficulty: Benchmarking Amsted's financial performance against publicly traded competitors in sectors like industrial manufacturing can be more complex.

Amsted's reliance on cyclical industries makes it susceptible to economic downturns, impacting demand for its heavy-duty components. For example, the railroad sector, a key market, saw reduced freight volumes in late 2023 and early 2024, directly affecting Amsted's order intake.

Fluctuations in raw material costs, such as steel prices which were volatile in late 2023 and early 2024, can significantly squeeze Amsted's profit margins if these increases cannot be passed on to customers due to market competition.

Intense competition across its diverse markets, including the North American freight rail sector where companies like Wabtec compete, necessitates continuous R&D investment to maintain market share and drive growth.

The company's private status limits public financial disclosures, making in-depth due diligence challenging for potential investors or partners and complicating performance benchmarking against publicly traded peers.

Full Version Awaits

Amsted Industries SWOT Analysis

You're viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, providing a comprehensive overview of Amsted Industries' Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

Global governments are pouring money into infrastructure, with a strong focus on rail. This is a big chance for Amsted, especially with upgrades and new lines being built worldwide. Think about North America and Asia-Pacific; these regions are leading the way in modernizing their rail systems.

For instance, the U.S. Department of Transportation has allocated significant funds for rail improvements, and India's Amrit Bharat Station Scheme aims to revamp hundreds of railway stations. These initiatives directly translate into increased demand for Amsted's rail components, creating a fertile ground for growth.

Amsted is well-positioned to capitalize on the growing integration of advanced technologies like AI, IoT, and additive manufacturing within the industrial and rail sectors. This presents a significant opportunity for Amsted to innovate its product offerings and streamline its operations. For instance, the global industrial IoT market was valued at approximately $217.9 billion in 2023 and is projected to reach $511.4 billion by 2028, demonstrating the vast potential for smart component development.

By developing smart components equipped with real-time monitoring capabilities, Amsted can significantly boost its market competitiveness. This move not only enhances customer value through predictive maintenance and performance optimization but also opens doors to new, recurring revenue streams. The railway industry, in particular, is increasingly adopting digital solutions; by 2027, the global railway analytics market is expected to grow to $4.6 billion, up from an estimated $2.5 billion in 2022, highlighting the demand for data-driven insights that Amsted's smart components can provide.

The automotive sector's accelerated move towards electric and hybrid vehicles presents a significant opportunity for Amsted Industries. This transition fuels demand for sophisticated powertrain components and advanced metal-forming capabilities, areas where Amsted Automotive is actively innovating.

Amsted Automotive is already demonstrating its readiness by offering solutions that cater to EV, HEV, and traditional internal combustion engine (ICE) platforms. This strategic positioning allows the company to effectively tap into the growing market share of electrified vehicles, which is projected to see substantial growth in the coming years.

For instance, the global EV market alone was valued at approximately $380 billion in 2023 and is expected to reach over $1.5 trillion by 2030, according to various market analyses. Amsted's focus on these evolving technologies ensures it is well-placed to benefit from this expansion, supplying critical components to major automakers.

Expansion into Emerging Markets and Strategic Partnerships

Amsted Industries has a significant opportunity to capitalize on the rapid urbanization and industrialization occurring in developing economies, especially within the Asia-Pacific region. This growth is directly driving demand for the company's core offerings in transportation and infrastructure solutions. For instance, by 2025, the World Bank projects that developing economies will account for the majority of global infrastructure investment, creating a fertile ground for Amsted's products.

To effectively tap into these burgeoning markets, Amsted can pursue a multi-pronged strategy involving strategic acquisitions, forming joint ventures, or establishing key partnerships. These collaborations would allow Amsted to gain local market knowledge, navigate regulatory landscapes more effectively, and accelerate its global footprint expansion. The company's existing expertise in railcar components and industrial solutions positions it well to meet the evolving needs of these dynamic economies.

Key opportunities include:

- Leveraging Asia-Pacific Infrastructure Boom: The region's infrastructure spending is projected to reach trillions by 2025, offering substantial demand for Amsted's specialized components.

- Strategic Market Entry: Partnerships in countries like India and Vietnam, which are experiencing double-digit growth in manufacturing and logistics, can provide immediate market access.

- Acquisition of Local Players: Acquiring smaller, established companies in emerging markets can offer a faster route to market penetration and access to existing customer bases.

Emphasis on Sustainability and Eco-friendly Solutions

The increasing global emphasis on sustainability and eco-friendly solutions presents a significant opportunity for Amsted Industries. As transportation sectors worldwide pivot towards electrification and greener supply chains, Amsted can capitalize by developing and marketing environmentally conscious components and adopting sustainable manufacturing practices. For instance, the global electric vehicle market is projected to reach over $1.5 trillion by 2030, highlighting a substantial demand for innovative, eco-friendly automotive parts.

Investing in these sustainable solutions not only bolsters Amsted's brand image, appealing to a growing segment of environmentally aware consumers and businesses, but also unlocks access to new market niches. Companies prioritizing sustainability often see improved investor relations and can qualify for green financing initiatives.

- Growing Demand for Sustainable Transport: The global shift towards electric vehicles and reduced emissions creates a market for Amsted's sustainable component innovations.

- Enhanced Brand Reputation: Commitment to eco-friendly practices can attract environmentally conscious customers and investors, improving brand perception.

- Access to New Market Segments: Developing green products opens doors to markets that specifically value and prioritize sustainability in their supply chains.

- Potential for Green Financing: Investments in sustainability can lead to access to favorable financing options and government incentives aimed at promoting eco-friendly industries.

Amsted is well-positioned to benefit from the global infrastructure spending surge, particularly in rail. The company can also leverage the automotive industry's shift to EVs by supplying specialized components. Furthermore, Amsted can tap into growing markets in developing economies and capitalize on the increasing demand for sustainable and eco-friendly products.

Threats

Global economic instability, marked by persistent inflation and the specter of recessions, directly threatens sectors like industrial manufacturing and construction. For Amsted Industries, this translates into a heightened risk of reduced demand for its essential components.

Uncertainty surrounding interest rates further complicates investment and expansion plans for Amsted's customers, potentially leading to a slowdown in industrial production and a decrease in new construction projects. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.7% in 2024, down from 3.0% in 2023, reflecting these economic headwinds.

The industrial components sector, where Amsted operates, is characterized by fierce rivalry. Established global manufacturers and agile new market entrants are constantly competing for market share, leading to significant pricing pressures that can directly affect Amsted's profit margins.

This intense competition necessitates ongoing investment in innovation and efficiency to stay ahead. For instance, the global industrial components market was valued at approximately $1.3 trillion in 2023 and is projected to grow, but this growth is accompanied by heightened competitive dynamics.

Amsted Industries faces significant threats from ongoing global trade tensions and geopolitical unrest, which can disrupt supply chains and lead to increased raw material costs. For instance, the imposition of new tariffs, as seen in various trade disputes throughout 2024, directly impacts the cost of components and finished goods, potentially squeezing profit margins.

Furthermore, the growing frequency of extreme weather events, such as the widespread flooding and severe storms impacting key manufacturing regions in 2024, poses a direct risk to operational continuity and logistics. Cybersecurity vulnerabilities also remain a critical threat, with the potential for data breaches or operational shutdowns to cripple supply chain stability and Amsted's ability to serve its customers.

Regulatory Changes and Environmental Compliance Costs

Amsted Industries faces growing challenges from evolving environmental regulations. Stricter compliance in manufacturing, particularly concerning emissions and waste management, can significantly increase operational expenses. For instance, the U.S. Environmental Protection Agency (EPA) continues to refine air quality standards, potentially impacting industrial facilities.

Meeting these new environmental standards often necessitates substantial capital outlays for upgraded technology and process modifications. These investments, while necessary for long-term sustainability, represent a direct cost that can affect profitability. The push for greener materials and more sustainable sourcing adds another layer of complexity and potential cost increases.

- Increased operational costs due to evolving environmental regulations.

- Significant capital investment required for new compliance technologies.

- Potential for higher expenses related to waste management and emissions control.

- Need to adapt to stricter material sourcing and sustainability mandates.

Labor Shortages and Workforce Challenges

Amsted Industries, like much of the industrial manufacturing and construction sectors, is grappling with significant labor shortages. This scarcity impacts everything from skilled production roles to logistics and distribution, creating bottlenecks across the supply chain. For instance, a 2024 report indicated that manufacturing job openings in the US remained elevated, with over 800,000 unfilled positions, a trend that directly impacts operational capacity.

These ongoing workforce challenges are compounded by rising wage demands and high employee turnover rates. Such factors directly translate to increased operating costs for Amsted, potentially squeezing profit margins. Furthermore, the inability to secure and retain a stable, skilled workforce can stifle innovation and impede the company's ability to scale production or pursue new growth opportunities, as evidenced by a 15% increase in average manufacturing wages reported in late 2024.

- Persistent Skill Gaps: Difficulty finding workers with specialized manufacturing and technical skills.

- Increased Labor Costs: Rising wages and benefits to attract and retain talent, impacting profitability.

- Operational Inefficiencies: Understaffing leads to production delays and reduced output.

- Hinders Growth: Inability to expand operations due to a lack of available skilled labor.

Amsted Industries faces the persistent threat of global economic instability, with inflation and potential recessions impacting demand for its industrial components. The IMF's projection of slower global growth in 2024 underscores these headwinds.

Intense competition within the industrial components sector, valued at roughly $1.3 trillion in 2023, exerts significant pricing pressure on Amsted. This necessitates continuous investment in efficiency and innovation to maintain market position.

Geopolitical tensions and trade disputes can disrupt supply chains and escalate raw material costs, directly affecting Amsted's profitability. Additionally, the increasing frequency of extreme weather events poses risks to operational continuity and logistics.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, drawing from Amsted Industries' official financial filings, comprehensive market research reports, and expert industry commentary to provide a well-rounded and accurate assessment.