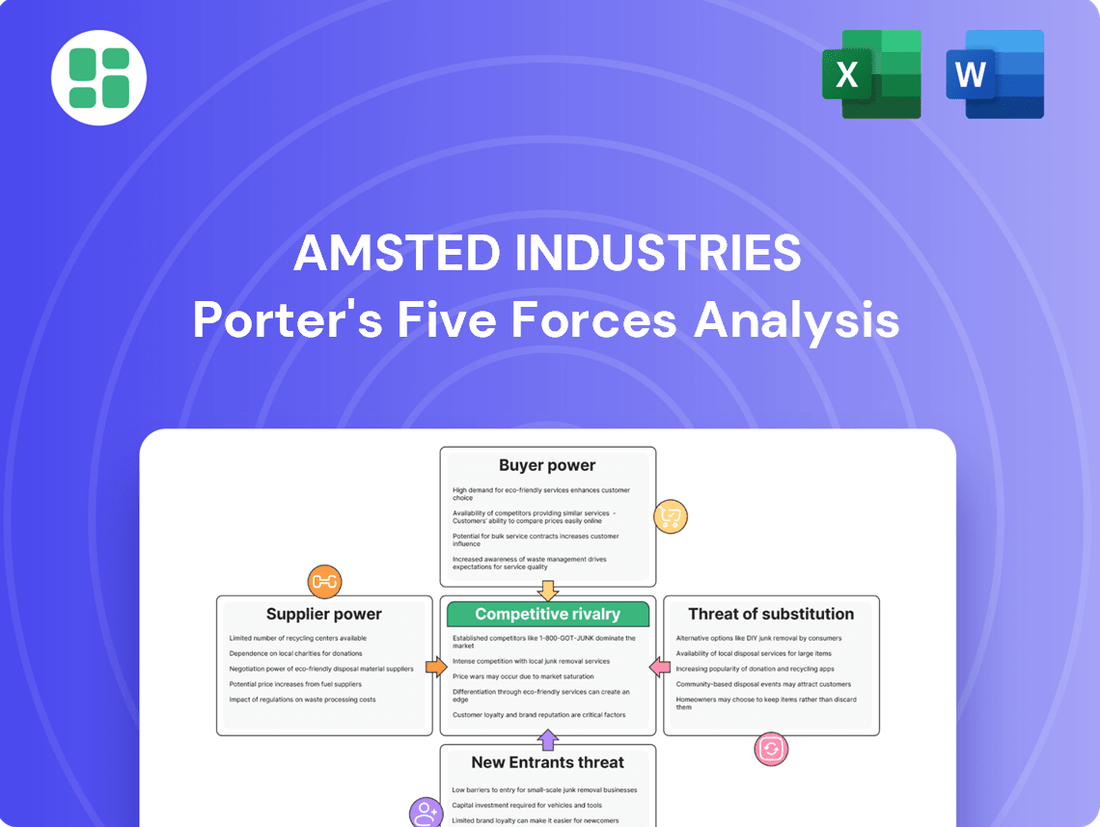

Amsted Industries Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amsted Industries Bundle

Amsted Industries navigates a landscape shaped by moderate bargaining power of buyers and suppliers, with the threat of substitutes being a significant consideration.

The intensity of rivalry within its sectors is notable, while the threat of new entrants presents a dynamic challenge to its market position.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Amsted Industries’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Amsted Industries depends on suppliers for essential raw materials such as steel, specialized components, and sophisticated manufacturing machinery. The leverage these suppliers hold can be significant if their numbers are limited or if they provide highly specialized inputs that are indispensable for Amsted's engineered products.

Considering Amsted's emphasis on heavy-duty and precision parts, it's likely that certain raw materials or proprietary technologies originate from a concentrated group of suppliers. For instance, the global steel market, while large, can exhibit concentrated power among major producers, especially for specific grades required for demanding applications.

Amsted faces considerable switching costs when changing suppliers, particularly for specialized or integrated parts. These costs encompass retooling manufacturing equipment, the lengthy process of qualifying new materials, and the potential for significant production downtime. For instance, if Amsted relies on a supplier for a unique alloy used in its railcar components, the cost and time to find and vet an alternative supplier capable of meeting stringent quality and performance standards could be substantial.

The threat of forward integration by suppliers is a factor Amsted Industries must consider, though it’s typically less pronounced for raw material providers. However, if specialized component manufacturers possess the capability and see a clear incentive, they could potentially move into Amsted's manufacturing or assembly stages to capture greater value. This possibility underscores the importance of nurturing robust supplier relationships and strategically diversifying the supplier pool to mitigate such risks.

Uniqueness of Inputs and Supplier Importance

The uniqueness of inputs significantly impacts supplier bargaining power. If Amsted Industries relies on specialized, patented, or proprietary components that are difficult to source elsewhere, those suppliers hold considerable sway. This is particularly true when these inputs are critical for the performance and differentiation of Amsted's industrial products.

Amsted's commitment to high-performance and durable components for demanding industrial applications underscores the importance of supplier reliability. The quality and consistency of these essential inputs directly affect Amsted's product integrity and reputation, granting suppliers a stronger negotiating position.

- Supplier Dependence: If Amsted requires highly specialized materials or components that only a few suppliers can provide, their bargaining power increases.

- Input Criticality: For products where supplier input quality directly dictates performance and safety, suppliers gain leverage.

- Lack of Substitutes: The absence of readily available substitute inputs strengthens a supplier's position.

Supplier's Share of Amsted's Costs

The bargaining power of suppliers for Amsted Industries is significantly influenced by their share of Amsted's total costs. When a supplier provides an input that constitutes a large portion of Amsted's expenses, that supplier gains considerable leverage. For instance, if steel prices, a critical raw material for Amsted's railcar components and other heavy machinery parts, experience sharp increases, suppliers of steel can exert greater influence over Amsted's purchasing decisions and profitability.

In 2024, the volatility of commodity markets, particularly for metals like steel, directly impacted manufacturers such as Amsted. Fluctuations in these input costs can dramatically shift the balance of power towards suppliers. For example, a sustained rise in global steel prices, driven by factors like increased demand or supply chain disruptions, would amplify the bargaining power of steel producers supplying Amsted.

- Supplier's Cost Share: The higher a supplier's input represents in Amsted's overall cost structure, the stronger their bargaining position.

- Raw Material Volatility: Fluctuations in the price of key inputs like steel directly affect Amsted's profitability and enhance supplier leverage.

- Impact on Profitability: Rising raw material costs can squeeze Amsted's margins, giving suppliers more power to dictate terms.

- Strategic Importance of Inputs: For critical components where Amsted has fewer alternative suppliers, supplier power is further amplified.

Amsted Industries' suppliers hold significant bargaining power, particularly those providing specialized steel grades and critical components essential for its engineered products. In 2024, global steel prices saw considerable volatility, directly impacting Amsted's cost structure and empowering steel producers. For instance, a surge in the price of high-strength steel, a key input for Amsted's railcar components, would grant those suppliers greater leverage over Amsted's purchasing decisions.

The criticality of these inputs, coupled with Amsted's substantial switching costs for retooling and supplier qualification, further bolsters supplier influence. If a supplier provides a unique alloy or patented technology, its bargaining power is amplified due to the lack of readily available substitutes.

The concentration of suppliers for specialized machinery also contributes to their leverage. Amsted's reliance on these sophisticated inputs means that a limited number of manufacturers can dictate terms, especially when these machines are vital for maintaining Amsted's production quality and efficiency.

| Factor | Impact on Amsted Industries | 2024 Context/Example |

|---|---|---|

| Supplier Concentration | Limited suppliers for specialized inputs increase their power. | Few manufacturers produce highly specialized alloys or advanced machinery. |

| Switching Costs | High costs to change suppliers strengthen existing relationships. | Retooling, material qualification, and potential downtime are significant deterrents. |

| Input Criticality | Essential, high-quality inputs give suppliers leverage. | Performance and safety of railcar parts depend on specific material grades. |

| Cost Share of Input | Suppliers providing a large portion of Amsted's costs have more influence. | Steel prices, a major cost component, directly affect Amsted's margins. |

What is included in the product

This analysis details the competitive forces impacting Amsted Industries, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within its diverse industrial markets.

Amsted Industries' Porter's Five Forces analysis provides a clear, one-sheet summary of all five forces—perfect for quick decision-making and understanding competitive pressures.

Customers Bargaining Power

Amsted Industries operates in sectors like rail, automotive, and construction, meaning its customers are often large, sophisticated industrial players. For instance, major railroad operators and vehicle manufacturers are key buyers, and their substantial purchase volumes grant them considerable leverage. This means they can often negotiate favorable pricing and contract terms, directly impacting Amsted's profitability.

Customer switching costs for Amsted Industries' engineered solutions are a mixed bag, impacting their bargaining power. For highly specialized or custom-designed components, like those integrated into critical aerospace or automotive systems, the effort and expense involved in re-engineering and re-qualifying new suppliers can be substantial, creating high switching costs for customers. This limits their ability to easily switch away from Amsted.

However, for more standardized or commoditized parts within Amsted's portfolio, customers likely face lower switching costs. In these instances, if pricing or service levels become less competitive, customers may find it relatively straightforward to source similar components from alternative manufacturers, thereby increasing their bargaining power.

Large customers, especially those with substantial manufacturing expertise, can exert pressure by considering backward integration. This means they might start producing components in-house if Amsted's pricing or contract terms become unfavorable. For instance, a major automotive manufacturer, a significant customer for many industrial suppliers, could potentially develop its own capabilities for certain components if the cost-benefit analysis favors it.

Product Differentiation and Importance to Customers

Amsted Industries' product differentiation, particularly through superior engineering and quality, directly impacts customer bargaining power. When Amsted's offerings are perceived as unique and essential, customers have fewer viable alternatives, thereby diminishing their leverage.

The criticality of Amsted's components to a customer's end product's safety, efficiency, or distinctiveness further insulates the company from price pressures. For instance, if Amsted supplies specialized castings for high-performance railcars, the customer's reliance on that specific quality and reliability reduces their ability to negotiate lower prices.

- Superior Engineering: Amsted's commitment to advanced engineering reduces the availability of direct substitutes.

- Quality and Performance: High-quality components build customer loyalty and reduce price sensitivity.

- Criticality to End Products: When Amsted's parts are vital for safety or performance, customers are less likely to switch based on price alone.

- Reduced Price Sensitivity: This reliance on Amsted's specialized products limits customers' bargaining power.

Customer Price Sensitivity

Customer price sensitivity is a significant factor for Amsted Industries, especially in its industrial markets. When customers themselves face intense competition, they tend to scrutinize costs more closely. This means Amsted’s pricing strategy needs to be carefully considered, as customers might switch suppliers if they find a lower-cost alternative, particularly if the perceived difference between suppliers is minimal.

This sensitivity is amplified when Amsted’s components constitute a substantial percentage of a customer's total production expenses. For instance, if a key component from Amsted makes up 15% or more of a customer’s final product cost, even small price changes can have a noticeable impact on the customer's profitability. This was evident in the automotive sector in late 2023 and early 2024, where rising input costs for manufacturers led to increased pressure on their component suppliers.

- High Price Sensitivity in Industrial Markets: Customers in industrial sectors are often driven by cost efficiency due to their own competitive landscapes.

- Impact of Component Cost Share: If Amsted's products represent a large portion of a customer's overall cost, price becomes a more critical decision factor.

- Supplier Differentiation Matters: Low perceived differentiation among suppliers intensifies customer focus on price.

- Market Trends: The automotive industry, a key market for many industrial suppliers, experienced significant cost pressures in late 2023 and early 2024, highlighting customer price sensitivity.

The bargaining power of customers for Amsted Industries is significant, particularly with large, industrial clients in sectors like rail and automotive. These buyers, such as major railroad operators and vehicle manufacturers, leverage their substantial purchase volumes to negotiate favorable pricing and contract terms, directly impacting Amsted's profitability. For example, in 2024, the automotive sector continued to face inflationary pressures, leading manufacturers to exert stronger cost controls on their suppliers.

Switching costs for Amsted's customers vary; highly specialized, custom-engineered components create high switching costs due to re-engineering and re-qualification needs, limiting customer leverage. Conversely, for more standardized parts, lower switching costs allow customers to more readily switch suppliers if Amsted's pricing or service becomes less competitive. This dynamic was observed in the rail sector where some component sourcing saw increased competition in early 2024.

Customers' ability to consider backward integration, producing components in-house, also serves as a pressure point, especially for large automotive manufacturers. Amsted's product differentiation through superior engineering and quality is crucial in mitigating this power. When Amsted's offerings are perceived as unique and essential, customers have fewer alternatives, reducing their ability to negotiate aggressively on price. For instance, Amsted's specialized rail components, critical for safety, limit customer price concessions.

| Customer Segment | Key Influence Factor | Impact on Amsted | Example Scenario (2024) |

|---|---|---|---|

| Major Railroad Operators | High Purchase Volume | Stronger Price Negotiation Power | Negotiating bulk discounts on specialized castings for new rolling stock orders. |

| Automotive Manufacturers | Price Sensitivity & Input Cost Pressure | Increased scrutiny on supplier pricing | Pressuring suppliers for cost reductions amidst rising raw material costs impacting vehicle production. |

| Customers of Standardized Parts | Low Switching Costs | Potential for supplier switching based on price | Easily sourcing generic fasteners from alternative suppliers if Amsted's pricing is not competitive. |

| Customers of Critical Components | High Switching Costs & Product Criticality | Reduced Price Sensitivity | Reliance on Amsted's high-performance, safety-critical components for aerospace applications, limiting price negotiation. |

What You See Is What You Get

Amsted Industries Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of Amsted Industries' competitive landscape through a detailed Porter's Five Forces analysis, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its industries.

Rivalry Among Competitors

Amsted Industries operates in mature industrial sectors such as rail, automotive, and construction components. These sectors generally experience slower growth rates, which often leads to heightened competitive rivalry as companies vie for existing market share rather than benefiting from overall market expansion. For instance, the global rail freight market, a key area for Amsted, is projected to grow at a compound annual growth rate (CAGR) of around 3.5% from 2023 to 2030, indicating a stable but not explosive growth environment.

The industrial components market, where Amsted Industries operates, is characterized by a robust number of competitors. Established giants like Wabtec and The Timken Company, both with significant market share in related sectors, actively compete. Precision Castparts is another major player, particularly in aerospace and industrial components.

Beyond these large entities, the market is populated by a multitude of smaller, specialized manufacturers. These firms often focus on niche product lines or specific material expertise, creating a diverse competitive landscape. This variety in size and specialization means Amsted faces competition that ranges from broad-based industrial suppliers to highly focused specialists, each with different strengths and strategies.

Amsted Industries competes in markets where product differentiation varies significantly. For highly engineered solutions, like specialized railcar components, Amsted's innovation and technical expertise create a strong competitive advantage, leading to lower rivalry. However, in more commoditized segments, such as basic castings, price becomes a more significant factor, increasing competitive intensity.

The impact of differentiation is evident in customer loyalty. When customers rely on Amsted's unique, integrated solutions, the cost and effort associated with switching to a competitor are substantial. This creates higher switching costs, thereby dampening direct rivalry. For instance, in the rail industry, the integration of Amsted's braking systems and draft gears can lead to significant operational efficiencies for the customer, making a change costly.

In 2024, the industrial manufacturing sector, where Amsted operates, saw continued demand for specialized components, particularly within infrastructure and transportation. Companies that can offer superior performance and reliability, backed by strong R&D, like Amsted, are better positioned to command premium pricing and reduce the direct threat of price wars from less differentiated competitors.

Exit Barriers for Competitors

High exit barriers can keep competitors in the market longer than they might otherwise stay, even when profits are low. This is because the cost or difficulty of leaving is substantial. For Amsted Industries, this dynamic is particularly relevant.

These barriers can include specialized assets that are hard to sell or repurpose, long-term contracts that lock companies into operations, or even unique ownership structures. Amsted's significant employee ownership through its Employee Stock Ownership Plan (ESOP) can be a factor, potentially encouraging continued participation from employees who also hold ownership stakes.

When competitors are compelled to remain in the market due to these barriers, it can lead to sustained or even intensified competition. This means that even in challenging economic conditions, Amsted might face a full field of rivals, impacting pricing and market share dynamics.

- Specialized Assets: Many competitors in Amsted's sectors, such as railcar manufacturing or industrial components, rely on highly specialized machinery and production lines. Divesting these assets often results in significant losses, making a clean exit difficult.

- Long-Term Contracts: Competitors may be bound by existing supply agreements with major customers, requiring them to continue production and service even if overall market conditions are unfavorable.

- Employee Ownership (ESOP): Amsted's ESOP structure, where employees own a significant portion of the company, can create an internal incentive for continued operation and employment, potentially influencing the behavior of other employee-owned or closely held competitors.

Fixed Costs and Capacity Utilization

Amsted Industries operates in a sector where significant investments in plants and machinery translate to high fixed costs. This necessitates a focus on maximizing capacity utilization to spread these costs over a larger production volume.

Companies like Amsted, burdened by substantial fixed costs, are driven to maintain high operating rates. This often leads to more aggressive pricing tactics as firms compete fiercely to secure sales and keep production lines running, especially when demand softens.

- High Fixed Costs: The industrial manufacturing landscape, where Amsted operates, is characterized by substantial capital outlays for production facilities and equipment.

- Capacity Utilization Imperative: To achieve economies of scale and manage overhead, companies strive for high levels of capacity utilization.

- Pricing Pressure: The need to cover fixed costs can result in intense price competition, particularly during periods of economic slowdown when order volumes decrease.

- Rivalry Intensification: This dynamic fuels a more aggressive competitive environment among players in the industrial manufacturing sector.

Competitive rivalry within Amsted Industries' operating sectors is significant, driven by a mature market, a substantial number of competitors ranging from large corporations to specialized niche players, and varying degrees of product differentiation. While innovation can mitigate rivalry in highly engineered segments, commoditized products lead to price-based competition. High exit barriers and the imperative to utilize high fixed costs further intensify this rivalry.

In 2024, the industrial components market continued to see robust competition. For example, the global market for industrial automation, a related sector, was valued at approximately $200 billion in 2023 and is expected to grow, attracting continued investment and competitive focus. Companies like Siemens, Rockwell Automation, and Schneider Electric are major players, alongside numerous smaller, specialized firms, creating a dynamic landscape where Amsted must constantly innovate and maintain operational efficiency to secure market share.

| Key Competitor Examples | Primary Market Focus | 2023 Revenue (Approximate) |

| Wabtec | Rail, Transit | $9.1 billion |

| The Timken Company | Bearings, Power Transmission | $4.5 billion |

| Precision Castparts (Berkshire Hathaway) | Aerospace, Industrial Components | $13.0 billion |

SSubstitutes Threaten

The threat of substitutes for Amsted Industries' industrial components is significantly influenced by the ongoing price-performance trade-off. As newer materials and technologies emerge, they offer comparable or even better functionality at potentially lower costs, directly challenging Amsted's established product lines. For instance, the increasing adoption of lightweight materials like advanced composites and aluminum in the automotive and aerospace sectors, where Amsted has a presence, presents a clear substitute threat to traditional metal-based components. In 2024, the global advanced composites market was valued at approximately $100 billion, demonstrating substantial growth and a clear alternative to metal solutions.

Customer propensity to substitute for Amsted Industries' products is shaped by regulatory environments and technological progress. For example, evolving fuel efficiency standards in the automotive sector push manufacturers towards lightweighting solutions, making alternative materials more appealing. Similarly, the rail industry actively seeks lighter, more efficient components to reduce operational costs and improve performance.

In 2024, the global automotive lightweighting market was valued at an estimated $120 billion, demonstrating a significant demand for advanced materials that could serve as substitutes for traditional steel components. This trend directly impacts Amsted's core business, as customers in this sector may explore alternatives if they offer comparable or superior performance at a lower total cost of ownership.

Innovations in material science, like advanced polymers and composites, present a growing threat to traditional metal components. These new materials can offer advantages such as lighter weight and better corrosion resistance, potentially impacting demand for Amsted's metal-based products.

For instance, the automotive sector's increasing adoption of lightweight composite materials for body panels and structural components, driven by fuel efficiency mandates, could reduce the need for steel and aluminum parts. By 2024, the global advanced composites market is projected to reach over $20 billion, indicating a significant shift in material preferences across various industries.

Alternative Transport or Construction Methods

The threat of substitutes for Amsted Industries extends beyond just alternative materials to encompass shifts in the fundamental technologies driving the markets they serve. For instance, the burgeoning field of autonomous vehicles could reduce the demand for certain traditional railcar components. Similarly, the increasing adoption of alternative energy sources for transportation might impact the need for specific engine or fuel system parts.

Modular construction techniques in the building sector present another substitute threat. As these methods gain traction, they could lessen the reliance on certain heavy-duty components traditionally supplied by Amsted for conventional construction projects. This technological evolution necessitates a keen awareness of how broader industry trends might reshape demand for their core offerings.

Consider the potential impact of advancements in electric rail or hyperloop technologies, which could fundamentally alter the design and component requirements for long-haul freight and passenger transport. Furthermore, the construction industry's move towards prefabrication and advanced materials could bypass the need for some of Amsted's established product lines. For example, by 2024, the global modular construction market was projected to reach over $100 billion, highlighting a significant shift in building methodologies.

- Autonomous Vehicles: Potential reduction in demand for traditional railcar components.

- Alternative Energy Transport: Shifts in demand for specific engine and fuel system parts.

- Modular Construction: Decreased reliance on heavy-duty components for conventional building.

- Emerging Transport Tech: Electric rail and hyperloop could alter component needs.

Lifecycle Costs and Performance of Substitutes

Customers increasingly scrutinize the total cost of ownership for potential substitutes, extending beyond the initial purchase price. This includes ongoing expenses like maintenance, energy consumption, and expected lifespan. For instance, in the industrial equipment sector where Amsted Industries operates, a substitute machine with a higher upfront cost but significantly lower energy usage and fewer maintenance needs could be more attractive over its operational life.

The threat intensifies when substitutes provide demonstrable performance advantages or long-term cost efficiencies. If a rival product offers greater durability, higher output, or reduced downtime, it can sway customer preference even if it carries a premium. For example, by 2024, advancements in material science have led to some substitute components offering a 15% longer service life compared to traditional options, directly impacting the lifecycle cost calculation for buyers.

- Lifecycle Cost Analysis: Buyers compare initial price against maintenance, energy, and durability.

- Performance Advantages: Substitutes offering superior output or reduced downtime pose a greater threat.

- Long-Term Savings: Even higher upfront costs are acceptable if long-term efficiencies are evident.

- Example Data: By 2024, some substitutes offered a 15% longer service life, impacting lifecycle cost calculations.

The threat of substitutes for Amsted Industries' products is elevated by innovations in material science and evolving industry technologies, pushing customers to consider alternatives that offer better performance or cost efficiencies. For example, the growing adoption of lightweight composites in the automotive sector, valued at approximately $100 billion globally in 2024, directly challenges traditional metal components. Similarly, advancements in modular construction, a market projected to exceed $100 billion by 2024, reduce reliance on heavy-duty parts for conventional building projects.

| Substitute Area | 2024 Market Value (Est.) | Impact on Amsted | Key Driver |

|---|---|---|---|

| Advanced Composites (Automotive) | $100 billion | Direct challenge to metal components | Lightweighting, Fuel Efficiency |

| Modular Construction | >$100 billion | Reduced demand for heavy-duty parts | Prefabrication, Efficiency |

| Autonomous Vehicles | N/A (Emerging) | Potential reduction in railcar components | Technological Shift |

| Alternative Energy Transport | N/A (Growing) | Shift in demand for engine/fuel parts | Sustainability Mandates |

Entrants Threaten

Entering the industrial components manufacturing sector, especially for specialized or high-volume parts, demands significant upfront capital. This includes investments in advanced machinery, modern manufacturing facilities, and ongoing research and development, often running into millions of dollars.

Established companies like Amsted Industries leverage considerable economies of scale. For instance, in 2024, Amsted reported revenues of over $2 billion, indicating a scale that allows for lower per-unit production costs. This makes it challenging for new entrants to achieve comparable cost efficiencies and compete effectively on price.

Amsted Industries' deep roots in engineered solutions mean they've built a substantial library of proprietary technology and manufacturing know-how. This isn't something easily replicated; it takes years to develop. For instance, their advanced casting and machining techniques, honed over decades, represent a significant hurdle for any newcomer aiming to compete in their specialized markets.

Amsted Industries benefits from deeply entrenched distribution channels and established customer relationships. For instance, in the North American railroad sector, where Amsted is a major player, securing reliable access to distributors and maintaining strong ties with Class I railroads is paramount. New entrants would find it incredibly difficult to replicate Amsted's decades-long partnerships and the trust they've built, which are crucial for consistent sales and market penetration.

Government Regulations and Industry Standards

Government regulations and industry standards present a significant barrier to entry in the industrial components sector, particularly for Amsted Industries' rail and automotive segments. Compliance with safety, quality, and environmental mandates requires substantial investment and expertise, making it challenging for newcomers to establish a foothold. For instance, the Federal Railroad Administration (FRA) imposes rigorous standards on rail components, and failure to meet these can result in costly recalls or production halts.

These complex requirements often necessitate specialized certifications and ongoing audits, adding to the operational burden for potential competitors. Amsted Industries, with its established track record and robust quality management systems, is well-positioned to navigate these regulatory landscapes. In 2023, the rail industry alone saw significant investment in safety upgrades, underscoring the importance of adherence to evolving governmental oversight.

- Stringent Safety and Quality Standards: Regulations like those from the FRA and automotive industry standards such as IATF 16949 demand high levels of precision and reliability.

- Environmental Compliance Costs: Adhering to environmental protection agency (EPA) regulations regarding manufacturing processes and materials can incur significant capital and operational expenses.

- Industry-Specific Certifications: Obtaining and maintaining certifications required by major railcar builders or automotive OEMs acts as a substantial hurdle for new entrants.

- Cost and Time Investment: The financial outlay and time required to develop processes and documentation that meet these demanding standards can deter new players.

Brand Loyalty and Switching Costs for Customers

Amsted Industries benefits from strong brand loyalty among its industrial customer base. While these customers are driven by rational purchasing decisions, Amsted's long-standing reputation for dependable quality and exceptional service fosters a significant degree of customer allegiance. This established trust makes it difficult for new entrants to sway customers away from proven suppliers.

Switching costs for Amsted's customers can be substantial, particularly when dealing with critical components essential to their own manufacturing processes. The expense and potential disruption associated with retooling, qualifying new suppliers, and ensuring compatibility create a considerable barrier. For instance, a shift in a supplier for a key casting or a specialized bearing could necessitate extensive testing and validation, adding months and significant capital to the process.

- Established Reputation: Amsted's decades of delivering reliable products and services cultivate deep customer trust, a powerful deterrent to new competitors.

- High Switching Costs: The financial and operational burdens of changing suppliers for critical industrial components are significant, reinforcing customer loyalty.

- Customer Inertia: Industrial buyers often prefer the predictability and reduced risk associated with established relationships, even if slightly higher priced.

The threat of new entrants for Amsted Industries is generally moderate to low, largely due to substantial capital requirements and established economies of scale. For example, in 2024, Amsted's revenue exceeding $2 billion signifies a scale that new competitors would struggle to match, impacting their ability to compete on price due to lower per-unit production costs.

Furthermore, Amsted's proprietary technology and decades of manufacturing expertise create a significant knowledge barrier. The high switching costs for customers, especially concerning critical components, and strong brand loyalty further solidify Amsted's market position, making it difficult for new players to gain traction.

| Factor | Impact on Amsted Industries | Supporting Data/Reasoning |

|---|---|---|

| Capital Requirements | High Barrier | Significant investment needed for advanced machinery and R&D, often millions of dollars. |

| Economies of Scale | High Barrier | Amsted's 2024 revenue over $2 billion allows for lower per-unit costs, challenging new entrants. |

| Proprietary Technology & Know-How | High Barrier | Decades of developing specialized manufacturing techniques are not easily replicated. |

| Distribution Channels & Customer Relationships | High Barrier | Established partnerships, particularly in the rail sector, are difficult for newcomers to build. |

| Regulatory & Compliance Hurdles | High Barrier | Meeting stringent safety (e.g., FRA) and environmental standards requires substantial investment and expertise. |

| Brand Loyalty & Switching Costs | High Barrier | Customer trust and the significant financial/operational burden of changing suppliers deter new entrants. |

Porter's Five Forces Analysis Data Sources

Our Amsted Industries Porter's Five Forces analysis is built upon a foundation of robust data, including Amsted's annual reports, industry-specific market research from sources like IBISWorld, and relevant government and regulatory filings.