Amsted Industries Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amsted Industries Bundle

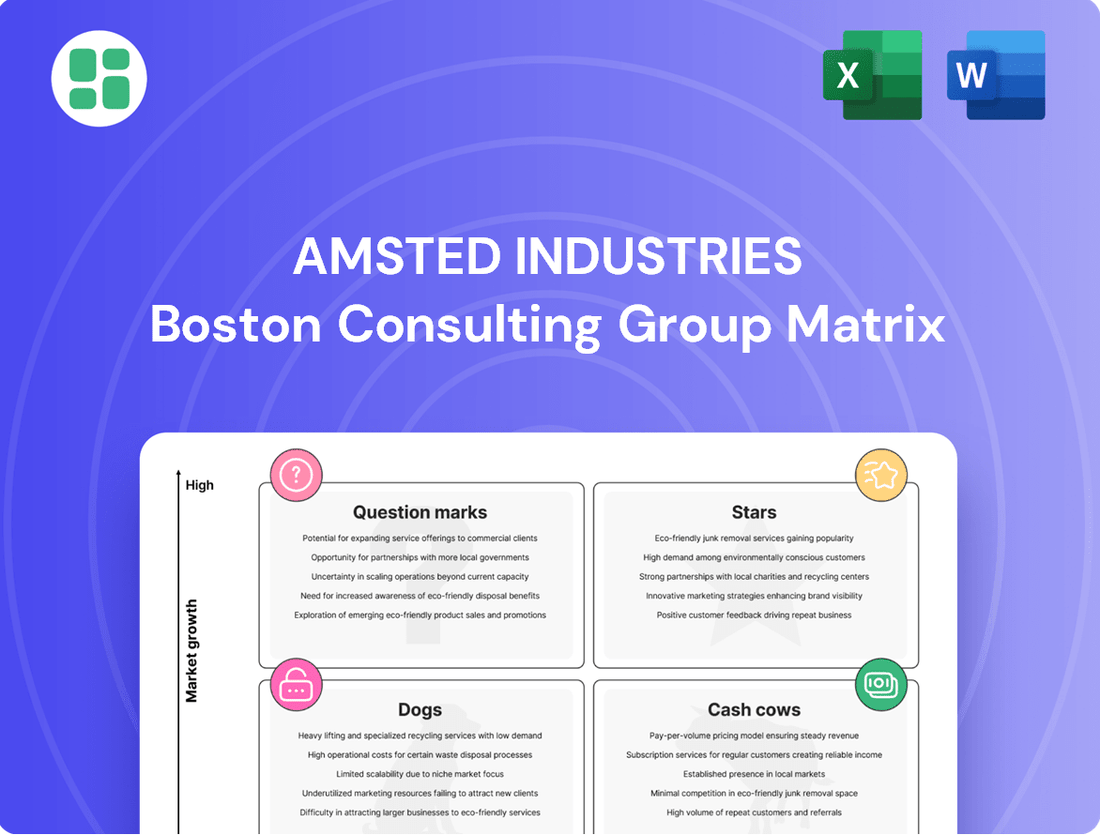

Curious about Amsted Industries' strategic product portfolio? This glimpse into their BCG Matrix reveals how their diverse offerings might be categorized as Stars, Cash Cows, Dogs, or Question Marks. To truly understand their market position and unlock actionable strategies for growth and resource allocation, dive into the full report.

Gain a comprehensive understanding of Amsted Industries' competitive landscape by purchasing the complete BCG Matrix. This detailed analysis will provide you with the essential insights to make informed decisions about where to invest, divest, or nurture their product lines.

Stars

Amsted Automotive is making significant strides in the EV and HEV powertrain components sector. They are actively developing and showcasing technologies like multi-speed shift systems and eAxle disconnects, crucial for enhancing electric vehicle performance. This strategic focus places them at the forefront of a market experiencing explosive growth, fueled by the global transition to sustainable transportation.

The automotive industry's electrification trend is a powerful tailwind for Amsted's EV & HEV powertrain components. Innovations aimed at extending vehicle range and boosting efficiency are key differentiators. For instance, the global electric vehicle market was valued at approximately $380 billion in 2023 and is projected to reach over $1.5 trillion by 2030, highlighting the immense opportunity for companies like Amsted.

Amsted Industries' advanced metallurgy, particularly its award-winning powder metal and metal-stamping, is a cornerstone for the booming eMobility sector. These capabilities are crucial for creating intricate parts like electric motor housings and robust battery trays, essential for the next generation of vehicles.

This technological prowess directly addresses the needs of the high-growth electric vehicle (EV) and hybrid electric vehicle (HEV) markets. Amsted's solutions focus on enhancing vehicle efficiency, optimizing component packaging, and promoting sustainability, key drivers for consumer and regulatory adoption.

With a commitment to innovation, Amsted Industries is also investing heavily in additive manufacturing. This forward-thinking approach ensures they remain at the forefront of developing cutting-edge metallurgical solutions for the evolving eMobility landscape, positioning them for continued success in this dynamic market.

Amsted Digital Solutions, a key player within Amsted Industries, offers advanced telematics like the IQ Series™ gateway. This technology, featuring Bogie IQ®, provides real-time monitoring of railcar health and precise location tracking. The market for these digital rail solutions is expanding rapidly, driven by the industry's push for greater efficiency and connectivity.

The demand for smart, connected rail infrastructure is a significant growth driver for Amsted Digital Solutions. In 2024, the global railway telematics market was valued at approximately $2.5 billion and is projected to grow at a compound annual growth rate (CAGR) of over 8% through 2030. This robust growth indicates a strong market position for Amsted's offerings as a potential star in the BCG matrix.

New Transit Rail Systems & Components

Amsted Rail is leveraging its deep experience in freight rail to enter the transit rail market, focusing on USA-made systems and components. This move into passenger and light rail is fueled by global urbanization trends and the increasing demand for sustainable transportation solutions.

The transit rail sector is a significant growth opportunity, and Amsted is positioning itself to become a leader. The company's expansion is supported by a strong order book and strategic investments in new manufacturing capabilities.

- Market Growth: The global urban rail transit market was valued at approximately $110 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 5% through 2030, driven by infrastructure investments and population shifts.

- Amsted's Focus: Amsted is targeting key components like bogies, couplers, and braking systems for passenger and light rail vehicles, where its engineering prowess can create a competitive advantage.

- USA Manufacturing: The emphasis on domestic production aligns with government initiatives and supply chain resilience, potentially offering Amsted a distinct advantage in securing contracts.

- Strategic Importance: This diversification into transit rail represents a strategic pivot for Amsted, aiming to capture a share of a rapidly expanding market segment.

Specialized Components for Infrastructure Projects

Amsted Industries' specialized components for infrastructure projects are a prime example of its potential stars in a BCG matrix analysis. These heavy-duty parts are crucial for construction and infrastructure development, a sector seeing significant global investment. For instance, the U.S. Infrastructure Investment and Jobs Act, enacted in 2021, allocated $1.2 trillion, with a substantial portion directed towards roads, bridges, and public transit, creating a strong demand for Amsted's offerings.

The demand for Amsted's engineered solutions is further amplified by the rapid growth in critical infrastructure segments. Projects such as new manufacturing plants, the expansion of data centers, and the modernization of transportation networks are all experiencing robust expansion. In 2024, global infrastructure spending is projected to reach trillions, providing a fertile ground for companies like Amsted that supply essential, high-performance components.

Amsted's strength lies in its capacity to deliver highly engineered, specialized components that are vital for the success of these large-scale projects. This deep integration into critical infrastructure development positions the company favorably within these expanding markets.

- Strong demand from infrastructure spending: Global infrastructure investment continues to rise, with significant government initiatives worldwide.

- Growth in key sectors: Amsted's components are essential for expanding data centers, manufacturing facilities, and transportation networks.

- Engineered solutions advantage: The company's specialized, high-performance parts offer a competitive edge in demanding infrastructure applications.

- Market positioning: Amsted is well-placed to capitalize on the ongoing global infrastructure build-out.

Amsted's advanced metallurgy and additive manufacturing capabilities are positioning it as a leader in the rapidly expanding eMobility sector. These technologies are critical for producing high-performance components for electric and hybrid vehicles, such as motor housings and battery trays. The global electric vehicle market's significant growth, projected to exceed $1.5 trillion by 2030, underscores the star potential of Amsted's EV & HEV powertrain components.

Amsted Digital Solutions' telematics offerings, like Bogie IQ®, are well-positioned for growth in the connected rail market. The increasing demand for efficiency and real-time monitoring in rail operations supports this segment's star status. With the global railway telematics market valued at approximately $2.5 billion in 2024 and a projected CAGR of over 8%, Amsted's digital solutions are poised to capture significant market share.

The company's strategic expansion into the transit rail market, focusing on USA-made systems, represents another star opportunity. Driven by global urbanization and sustainable transportation trends, the urban rail transit market is expected to grow by over 5% annually. Amsted's expertise in critical components like bogies and couplers for passenger and light rail vehicles aligns perfectly with this expanding sector.

Amsted's specialized components for infrastructure projects are also strong contenders for star status. The substantial global investment in infrastructure, exemplified by the U.S. Infrastructure Investment and Jobs Act, creates robust demand for Amsted's high-performance parts. The projected trillions in global infrastructure spending in 2024 provide a fertile ground for these essential components.

| Business Segment | BCG Category | Key Growth Drivers | Market Size (2024 Est.) | Amsted's Competitive Advantage |

| EV & HEV Powertrain Components | Star | Global EV market growth, demand for efficiency | ~$380 billion (2023, global EV market) | Advanced metallurgy, additive manufacturing |

| Digital Rail Solutions | Star | Rail efficiency, connectivity, telematics adoption | ~$2.5 billion (2024, global railway telematics) | IQ Series™ gateway, Bogie IQ® |

| Transit Rail Components | Star | Urbanization, sustainable transport, infrastructure investment | ~$110 billion (2023, global urban rail transit) | USA manufacturing, expertise in key components |

| Infrastructure Components | Star | Global infrastructure spending, government initiatives | Trillions (2024, global infrastructure spending) | Highly engineered, specialized parts |

What is included in the product

Amsted Industries' BCG Matrix offers a tailored analysis of its diverse product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

Amsted Industries' BCG Matrix offers a clear, one-page overview, relieving the pain of deciphering complex portfolio strategies.

Cash Cows

Amsted Rail, a cornerstone of Amsted Industries, commands a leading position in the manufacturing of critical freight railcar components like wheels, axles, bearings, and brake systems. This segment thrives in a mature yet remarkably stable global railway market, where the demand for maintenance and replacement parts remains consistently robust.

The company's extensive market share and deeply entrenched industry position translate into substantial and dependable cash flow generation. For instance, in 2024, the railcar parts market saw continued growth driven by increased freight volumes and an aging fleet requiring more replacements.

ConMet, a key Amsted Industries business, dominates the commercial vehicle market with its wheel ends and PreSet® hub assemblies. This segment is a mature, steady market, showing consistent demand for dependable replacement parts.

The heavy-duty automotive aftermarket, where ConMet operates, is a substantial sector. In 2024, the global commercial vehicle aftermarket was valued at over $70 billion, demonstrating its significant size and stability.

ConMet's strong brand recognition and loyal customer relationships solidify its high market share. This leadership position translates into consistent cash flow, making its wheel end and hub assembly business a classic cash cow for Amsted Industries.

Amsted Industries' ductile iron pipe and fittings business is a classic cash cow. This segment serves the vital water infrastructure and utility markets, which, while experiencing some growth, are fundamentally mature. The demand for these foundational components remains stable and predictable.

With a strong market share in this essential infrastructure area, Amsted benefits from consistent and reliable cash generation. This stability allows the company to fund other ventures or provide returns to shareholders.

Heavy-Duty Automotive Precision Machined Components

Heavy-Duty Automotive Precision Machined Components, represented by Burgess-Norton within Amsted Industries, are a classic Cash Cow. This segment thrives in the large, mature heavy-duty automotive aftermarket, where the demand for maintenance and upgrades remains robust. In 2024, the global commercial vehicle aftermarket was valued at approximately $100 billion, with North America being a significant contributor, underscoring the stability of this market.

Burgess-Norton's strength lies in its deep-rooted relationships with Original Equipment Manufacturers (OEMs) and established aftermarket distribution channels. This allows them to maintain a dominant market share, ensuring consistent revenue streams and high profitability. Their precision-machined components are critical for the longevity and performance of heavy trucks, a sector that saw a 15% increase in new vehicle registrations in the US during 2024, driving aftermarket demand.

The consistent cash flow generated by this segment supports Amsted Industries' investments in other business units. Key factors contributing to its Cash Cow status include:

- Established Market Position: Significant share in the mature heavy-duty automotive aftermarket.

- Strong OEM Relationships: Long-standing partnerships ensure consistent demand for components.

- High Profitability: Mature market dynamics and efficient operations lead to stable earnings.

- Consistent Demand: Ongoing need for maintenance and upgrades in the large fleet of heavy-duty vehicles.

Established Industrial Bearings & Springs

Established Industrial Bearings & Springs within Amsted Industries likely operates as a Cash Cow. These components are vital for heavy-duty machinery, serving mature industries with predictable replacement cycles. Amsted's extensive history and established customer relationships in this sector suggest a dominant market position and consistent, strong cash flows.

In 2024, the industrial bearings market experienced steady demand, driven by infrastructure projects and manufacturing output. For instance, the global industrial bearings market was projected to grow at a compound annual growth rate (CAGR) of around 4.5% leading up to 2025, indicating a stable, albeit not rapidly expanding, sector. Amsted's deep penetration in this market, likely commanding a significant share, allows it to generate substantial profits with minimal investment.

- Market Maturity: The industrial bearings and springs sector is characterized by established demand and limited disruptive innovation, typical of a mature market.

- Consistent Demand: Critical components for sectors like automotive, aerospace, and heavy manufacturing ensure a steady stream of replacement orders.

- Strong Market Share: Amsted's long-standing presence and reputation likely translate into a high market share, enabling efficient operations and pricing power.

- Cash Generation: These factors combine to create a highly profitable segment that generates significant surplus cash for Amsted Industries.

Amsted Rail, ConMet, the ductile iron pipe and fittings business, Burgess-Norton, and established industrial bearings & springs all represent Amsted Industries' cash cows. These segments operate in mature markets with stable, predictable demand for essential components, allowing them to generate significant and consistent cash flow with minimal reinvestment. Their strong market positions and established customer relationships further solidify their status as reliable profit generators for the company.

| Business Segment | Market Characteristic | 2024 Data Point | Cash Flow Contribution |

| Amsted Rail | Mature, stable global railway market | Continued growth driven by freight volumes and fleet replacements | Substantial and dependable |

| ConMet | Mature, steady commercial vehicle market | Global commercial vehicle aftermarket valued over $70 billion | Consistent cash flow |

| Ductile Iron Pipe & Fittings | Mature water infrastructure market | Stable and predictable demand for essential components | Consistent and reliable cash generation |

| Burgess-Norton | Mature heavy-duty automotive aftermarket | Global commercial vehicle aftermarket valued approx. $100 billion; US new vehicle registrations up 15% | Consistent revenue streams and high profitability |

| Industrial Bearings & Springs | Mature industrial machinery sector | Industrial bearings market projected CAGR of ~4.5% leading up to 2025 | Significant profits with minimal investment |

What You’re Viewing Is Included

Amsted Industries BCG Matrix

The Amsted Industries BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase. This comprehensive analysis, designed for strategic decision-making, contains no watermarks or demo content, ensuring you get a ready-to-use document for your business planning. You can confidently use this preview as a direct representation of the professional, actionable insights contained within the purchased Amsted Industries BCG Matrix report.

Dogs

Amsted Industries' legacy components for obsolete industrial machinery likely reside in the Dogs quadrant of the BCG matrix. These are specialized parts for older equipment, facing a shrinking market as newer technologies emerge. For instance, demand for components for certain legacy printing presses or older manufacturing lines, which were once significant, has seen a marked decline.

These products typically hold a low market share and operate within a shrinking industry, thus generating minimal cash flow. Amsted Industries, like many industrial conglomerates, must carefully manage these offerings, as they can tie up valuable capital and resources that could be better allocated elsewhere. For example, a division producing replacement parts for a specific model of industrial loom that is no longer manufactured might represent a significant portion of its historical business but now contributes negligibly to overall revenue.

Without substantial investment in modernization or a significant shift in market demand, these legacy components are prime candidates for divestiture or strategic phasing out. The focus would be on minimizing ongoing costs and extracting any remaining value, rather than attempting to grow these segments. This strategic approach ensures that Amsted Industries can concentrate its efforts on more promising and profitable areas of its diverse portfolio.

Amsted Industries' low-volume, highly specialized parts in stagnant sub-sectors would likely be classified as Dogs in the BCG Matrix. These are products catering to niche markets with little to no growth potential, often characterized by custom engineering and limited applicability.

For instance, imagine a supplier of highly specific, low-volume components for a particular type of industrial machinery that has seen no significant technological advancement or market expansion for years. While Amsted might hold a decent share of this tiny market, the overall market size is so small and stagnant that further investment would likely yield minimal returns.

In 2024, such segments might represent a small fraction of Amsted's overall revenue, perhaps in the low single digits, where the cost of maintaining production and specialized tooling outweighs the incremental profit from sales. The lack of market growth makes it challenging to achieve economies of scale, further suppressing profitability.

If Amsted Industries produces highly commoditized standard fasteners or basic metal stampings without significant differentiation, these would likely be classified as Dogs in the BCG Matrix. These types of products typically face intense price competition and have limited market growth potential.

Products in this category often struggle with low profit margins due to the lack of proprietary technology or unique selling propositions. Their position as Dogs signifies a low market share within a low-growth industry, requiring careful management to avoid draining resources.

Non-Core, Undifferentiated Small Product Lines

Non-core, undifferentiated small product lines within Amsted Industries, particularly those acquired historically without strategic alignment, often fall into the Dogs category of the BCG Matrix. These segments typically exhibit low market share within their respective industries and operate in markets with limited growth prospects. For instance, a small, niche component manufacturer acquired in the early 2000s that doesn't leverage Amsted's core engineering strengths or benefit from scale could represent such a product line. These offerings might contribute less than 1% of Amsted's total revenue, which was reported to be in the billions of dollars annually in recent years, yet consume a disproportionate amount of management focus and resources.

These "Dogs" are characterized by their inability to generate significant profits or cash flow, often requiring ongoing investment simply to maintain their presence. Their lack of differentiation means they struggle to command premium pricing, and their low market share makes achieving economies of scale difficult. In 2024, companies like Amsted are increasingly scrutinizing their portfolios, looking to divest or restructure such underperforming units to reallocate capital towards higher-growth, more strategic areas.

- Low Market Share: Typically less than 5% in their specific, often niche, markets.

- Low Market Growth: Operating in industries with projected annual growth rates below 3%.

- Minimal Revenue Contribution: Accounting for less than 1% of the company's overall sales.

- Disproportionate Resource Drain: Requiring significant management attention relative to their financial returns.

Products in Geographically Declining Industrial Regions

Products in Geographically Declining Industrial Regions would likely be classified as Dogs in Amsted Industries' BCG Matrix. These are components that cater to industrial operations in areas facing long-term economic downturns or de-industrialization. Amsted's lack of diversification in customer base or product application for these specific offerings exacerbates their position.

These products typically hold a low market share within a shrinking market. For instance, if Amsted supplies specialized machinery parts to a region heavily reliant on a single, declining manufacturing sector, and that sector contracts by, say, 5% annually, these parts would fall into the Dog category. This contraction limits their viability for continued investment and growth.

- Low Market Share: Products serving industries in regions like the Rust Belt, which has seen manufacturing employment decline significantly over decades, often struggle to maintain market share.

- Contracting Market: A market experiencing de-industrialization, such as certain automotive supply chains in areas that have lost major assembly plants, presents a shrinking demand for related components.

- Limited Investment Viability: Companies must carefully assess if reinvesting in these product lines will yield sufficient returns compared to focusing on growth areas.

- Potential for Divestment: In many cases, a strategic decision might involve divesting or phasing out these products to reallocate resources to more promising segments of the business.

Amsted Industries' legacy components for obsolete industrial machinery, such as specialized parts for older printing presses, likely reside in the Dogs quadrant of the BCG matrix. These products face a shrinking market and typically hold low market share, generating minimal cash flow.

In 2024, these segments might represent a small fraction of Amsted's overall revenue, perhaps in the low single digits, where the cost of maintaining production outweighs incremental profit. Without substantial investment or market shifts, these legacy components are candidates for divestiture.

These "Dogs" are characterized by their inability to generate significant profits or cash flow, often requiring ongoing investment simply to maintain their presence. Their lack of differentiation means they struggle to command premium pricing, and their low market share makes achieving economies of scale difficult.

Products catering to niche markets with little to no growth potential, often characterized by custom engineering and limited applicability, would likely be classified as Dogs. While Amsted might hold a decent share of this tiny market, the overall market size is so small and stagnant that further investment would yield minimal returns.

Question Marks

Amsted Industries' exploration of additive manufacturing for new markets positions its ventures as potential stars within its BCG matrix. For instance, developing highly customized, on-demand aerospace components using advanced metal printing, targeting the burgeoning space exploration sector, represents a significant opportunity. This market, while nascent, showed a projected compound annual growth rate of over 11% leading up to 2025, indicating substantial future demand.

Another promising area is the creation of intricate, bio-compatible implants for personalized medicine, a field experiencing rapid technological advancement. The global orthopedic implants market alone was valued at over $50 billion in 2023, with personalized solutions expected to capture a growing share. These applications require considerable R&D but offer the potential for high margins and market leadership if successful.

Amsted's deep expertise in engineered solutions positions it to create specialized components for burgeoning green technologies outside of electric vehicles. Think about the growing demand for advanced recycling machinery or the critical need for robust components in renewable energy infrastructure like solar farms and wind turbines. These sectors are experiencing significant growth, with the global renewable energy market projected to reach over $1.9 trillion by 2030, according to some analyses.

While these markets offer substantial high-growth potential, Amsted's initial market share would likely be modest. This necessitates strategic investment to build brand recognition, establish supply chains, and scale production effectively to secure a more significant presence. Capturing even a small percentage of these rapidly expanding markets, such as the estimated 15-20% annual growth in certain segments of the recycling equipment industry, could represent a substantial revenue stream.

When Amsted Industries expands its established product lines into new, rapidly developing geographic markets where it currently has a low market presence, these initiatives can be classified as Question Marks in the BCG Matrix. For instance, if Amsted were to introduce its industrial components into a burgeoning Southeast Asian market experiencing 6% annual GDP growth, this would fit the profile.

While the market itself is growing, Amsted needs significant investment to establish its brand and capture market share, much like companies entering the electric vehicle market in emerging economies. This requires substantial capital for marketing, distribution networks, and potentially local manufacturing to compete effectively.

Electro-mechanical Wheel-End Disconnect Systems (ConMet)

ConMet, a subsidiary of Amsted Industries, is actively developing electro-mechanical wheel-end disconnect systems, a significant innovation for heavy-duty commercial vehicles. This technology is poised to be a key enabler for the burgeoning eMobility sector within the commercial transport industry, which is experiencing rapid growth. For instance, the global electric truck market is projected to reach $89.6 billion by 2030, up from $10.1 billion in 2022, indicating substantial expansion potential.

Given that these systems are relatively new to the market, their current market penetration is expected to be low. This positions them as a Question Mark within the Amsted Industries BCG Matrix. The high growth rate of the eMobility market, coupled with the novel nature of the technology, suggests significant future potential, but also necessitates considerable investment to capture market share and overcome early-stage challenges.

- Technological Advancement: ConMet's electro-mechanical wheel-end disconnect systems represent a cutting-edge solution for enhancing the efficiency and performance of electric commercial vehicles.

- Market Potential: The rapidly expanding eMobility market for heavy-duty vehicles presents a high-growth environment for this innovative product.

- Current Market Position: As a new product, the system likely holds a small market share, characteristic of a Question Mark in the BCG Matrix.

- Strategic Importance: Amsted Industries' investment in this technology underscores its strategic focus on the future of commercial transportation and sustainable mobility solutions.

Integrated Digital Solutions for Broader Industrial Applications

Amsted Industries is strategically positioning its integrated digital solutions beyond its established rail telematics. The company is eyeing high-growth industrial sectors such as construction and general manufacturing, where a convergence of software and hardware offers significant potential. This expansion into new markets represents a move towards diversifying its digital offerings and capturing new revenue streams.

These broader industrial applications are characterized by substantial growth prospects, but Amsted faces the challenge of building market share from a potentially nascent position. Significant investment will be required to develop and deploy these integrated solutions, ensuring they meet the specific needs of diverse industrial clients.

- Diversification into Construction and General Industrial: Amsted is exploring opportunities to leverage its digital expertise in sectors beyond rail, aiming to provide integrated hardware and software solutions.

- High-Growth Market Potential: These target sectors are experiencing rapid digital transformation, offering Amsted a chance to tap into significant market expansion.

- Investment Requirements: Achieving a dominant market position in these new areas will necessitate substantial capital investment for research, development, and market penetration.

- Competitive Landscape: Amsted will need to navigate established players and emerging digital solution providers in these diverse industrial markets.

Question Marks in Amsted Industries' BCG Matrix represent business units or products operating in high-growth markets but currently holding a low market share. These ventures require significant investment to increase market share and realize their potential. For instance, Amsted's foray into additive manufacturing for aerospace components targets a sector with projected growth exceeding 11% annually, yet their initial market presence would be modest, necessitating strategic capital infusion.

Similarly, ConMet's innovative electro-mechanical wheel-end disconnect systems for electric commercial vehicles are positioned in the rapidly expanding eMobility market. Despite the sector's projected growth, reaching $89.6 billion by 2030, these novel systems likely have low current penetration, classifying them as Question Marks. Amsted's strategic expansion of integrated digital solutions into construction and general manufacturing also fits this profile, offering substantial growth potential but demanding considerable investment to build market share against established competitors.

| Business Unit/Product | Market Growth | Current Market Share | BCG Classification | Strategic Implication |

| Additive Manufacturing (Aerospace) | High (e.g., >11% CAGR projected) | Low | Question Mark | Requires significant investment for R&D, market penetration, and scaling production. |

| ConMet Wheel-End Disconnect Systems | High (e.g., eMobility sector growth) | Low | Question Mark | Needs substantial capital for market development, brand building, and overcoming early-stage adoption challenges. |

| Integrated Digital Solutions (Construction/Manufacturing) | High (Digital transformation) | Low | Question Mark | Demands investment in product development, sales infrastructure, and competitive positioning. |

BCG Matrix Data Sources

Our Amsted Industries BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.