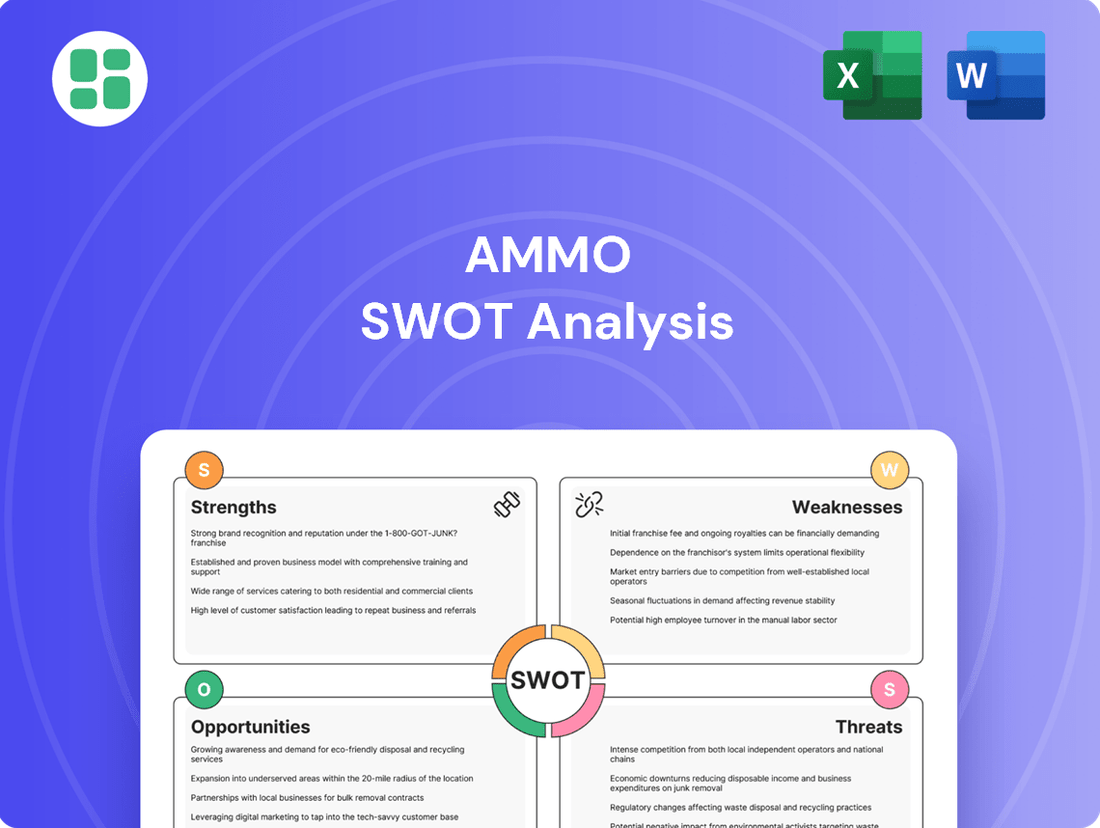

AMMO SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AMMO Bundle

AMMO's market position is shaped by key strengths like its established brand and diverse product range, but also faces challenges in evolving consumer preferences. Our comprehensive SWOT analysis dives deep into these factors, revealing critical opportunities for growth and potential threats to navigate.

Want the full story behind AMMO’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

AMMO, Inc. commands a significant advantage through its ownership of GunBroker.com, the premier online marketplace for firearms and related sporting goods. This platform boasts a substantial user base, exceeding 8.4 million registered users, which fuels robust network effects and a high volume of transactions within the shooting sports industry.

Following the sale of its ammunition manufacturing assets in April 2025, AMMO, Inc. has repositioned itself as a pure-play e-commerce entity centered around GunBroker.com. This strategic pivot enables the company to dedicate its resources to a segment known for its robust profitability.

The e-commerce business, particularly platforms like GunBroker.com, typically boasts impressive gross margins. For AMMO, this segment has historically delivered margins in the high 80s, with FY2025 reporting an exceptional 86.9% gross margin. This focus is a key driver for enhanced overall profitability.

AMMO's financial health is a significant strength, notably reinforced by the $75 million cash infusion from its manufacturing asset sale. This strategic move has demonstrably strengthened its balance sheet.

As of the first quarter of 2025, AMMO reported current assets substantially outpacing its liabilities, underscoring robust liquidity. The company's substantial cash reserves as of March 31, 2025, provide considerable financial flexibility, enabling strategic investments and ensuring operational stability.

Diverse Customer Base

AMMO, Inc. benefits from a broad customer base, serving law enforcement, military, sport shooters, and those focused on self-defense. This wide appeal across different market segments provides a significant advantage by reducing dependence on any single customer group.

This diversification helps AMMO, Inc. navigate market volatility more effectively. For instance, while consumer demand for sport shooting products might fluctuate, consistent demand from law enforcement and military contracts can offer a stabilizing revenue stream.

The company's ability to cater to these distinct markets highlights its product versatility and market reach.

- Law Enforcement & Military: Consistent demand for training and operational ammunition.

- Sport Shooting Enthusiasts: A large and growing market driven by recreational and competitive activities.

- Self-Defense Market: Increasing consumer interest in personal safety fuels demand for relevant ammunition.

Strategic Initiatives for Growth

AMMO is strategically investing in GunBroker.com to boost its market position. The launch of a new cart platform in March 2024 is designed to streamline the user experience and drive more transactions.

Further enhancements are planned for Fiscal 2025, including the introduction of financing options and expanded cross-selling of accessories. These moves are expected to increase customer engagement and tap into higher-margin revenue streams.

The company's focus on platform upgrades and new service offerings positions it for sustained growth in the online firearms marketplace.

- Platform Enhancement: New cart platform launched March 2024 for GunBroker.com.

- Future Development: Plans for financing and accessory cross-selling in Fiscal 2025.

- Revenue Growth: Aiming to improve user experience and capture higher-margin accessory sales.

AMMO, Inc. benefits from its ownership of GunBroker.com, a leading online marketplace with over 8.4 million registered users, fostering strong network effects and transaction volume in the shooting sports sector.

The company's strategic divestiture of its ammunition manufacturing assets in April 2025 has transformed it into a pure-play e-commerce business focused on the highly profitable GunBroker.com platform.

This e-commerce segment demonstrates exceptional profitability, with GunBroker.com achieving a gross margin of 86.9% in FY2025, significantly boosting AMMO's overall financial performance.

A substantial $75 million capital infusion from the sale of manufacturing assets has significantly strengthened AMMO's balance sheet and financial flexibility.

As of Q1 2025, AMMO's liquidity is robust, with current assets far exceeding liabilities, supported by substantial cash reserves as of March 31, 2025.

AMMO serves a diverse customer base, including law enforcement, military, sport shooters, and self-defense consumers, mitigating reliance on any single market segment.

Ongoing investments in GunBroker.com, including a new cart platform launched in March 2024 and planned features like financing and accessory cross-selling for FY2025, are designed to enhance user experience and drive revenue growth.

| Strength | Description | Key Metric/Fact |

| Market Leadership | Dominant online marketplace for firearms. | 8.4M+ registered users on GunBroker.com. |

| Strategic Focus | Pure-play e-commerce after asset sale. | Post-asset sale focus on profitable e-commerce segment. |

| High Profitability | Exceptional gross margins in e-commerce. | 86.9% gross margin on GunBroker.com in FY2025. |

| Financial Strength | Strengthened balance sheet and liquidity. | $75M cash infusion from asset sale; robust Q1 2025 liquidity. |

| Diversified Customer Base | Serves multiple market segments. | Law enforcement, military, sport shooters, self-defense. |

| Platform Investment | Enhancements to drive user engagement and revenue. | New cart platform (March 2024); planned financing & cross-selling (FY2025). |

What is included in the product

Analyzes AMMO’s competitive position through key internal and external factors.

Simplifies complex SWOT data into actionable insights, reducing the burden of analysis and enabling faster, more confident strategic decisions.

Weaknesses

AMMO's ammunition segment faced significant headwinds prior to its asset sale, with revenue declining and failing to meet margin targets. This directly impacted the company's overall net revenue, which saw a decrease in Fiscal Year 2024.

A key driver of this underperformance was the company's strategic emphasis on lower-margin pistol ammunition. This product mix, while potentially high in volume, did not generate the profitability needed to offset broader revenue pressures within the segment.

GunBroker.com, a long-standing leader in online firearm sales, has seen a concerning drop in web traffic. This decline is notable even when compared to pre-pandemic figures, suggesting a broader trend of user disengagement or a shift towards alternative platforms. For instance, Guns.com has been actively capturing market share, indicating that GunBroker.com is facing increased competition.

Adding to these challenges, GunBroker.com's recent attempts to boost revenue through take rate adjustments appear to have had an adverse effect. Reports suggest these initiatives have negatively impacted overall revenues, pointing to difficulties in sustaining platform engagement and transaction volume. This situation highlights a need to re-evaluate strategies for maintaining market presence and profitability.

AMMO, Inc. has encountered substantial hurdles with its financial reporting timeliness, evidenced by deficiency notifications from Nasdaq. These notifications stem from the company's failure to file its Q3 and Q4 2024 Form 10-Qs on schedule.

This delay is directly linked to an ongoing independent accounting investigation and the necessity to restate prior financial statements. Such issues introduce considerable financial uncertainty for investors and raise concerns about potential delisting from the Nasdaq exchange.

Operational Inefficiencies in Manufacturing (Pre-Sale)

Before the divestiture, AMMO's manufacturing operations, especially for rifle ammunition, were not running at their peak potential. This underutilization meant that fixed costs like factory maintenance and staff salaries were spread across fewer units, making each round more expensive to produce and eating into profit margins.

This operational inefficiency directly impacted the company's ability to achieve optimal profitability. For instance, reports from late 2023 indicated that certain rifle ammunition production lines were operating at significantly less than 70% capacity, a key metric for healthy manufacturing output. This situation presented a clear weakness, limiting the financial return on their substantial manufacturing assets.

- Underutilization of Rifle Ammunition Lines: Facilities operated below optimal capacity, impacting cost absorption.

- Overhead Absorption Issues: Fixed manufacturing costs were spread over lower production volumes, increasing per-unit costs.

- Reduced Profitability Potential: Inability to leverage economies of scale due to underutilization hampered profit maximization.

- Asset Underperformance: Manufacturing assets were not generating the revenue and profit they were capable of.

Vulnerability to Macroeconomic Environment

AMMO, Inc. faces significant headwinds from the broader macroeconomic climate, directly impacting its GunBroker.com marketplace. Economic uncertainty often leads consumers to curb spending on non-essential items, and firearms and ammunition fall into this category for many. This consumer caution can translate into reduced transaction volumes and overall sales within the platform.

For instance, during periods of economic contraction or high inflation, discretionary spending on firearms and ammunition typically declines. This was observed in the industry, with decreased activity on GunBroker.com directly linked to these macroeconomic pressures. The company's reliance on this marketplace makes it particularly susceptible to shifts in consumer confidence and disposable income.

- Macroeconomic Sensitivity: AMMO's GunBroker.com marketplace activity is directly tied to consumer spending habits, which are heavily influenced by economic conditions.

- Discretionary Spending Impact: Firearms and ammunition are often considered discretionary purchases, making them vulnerable during economic downturns or periods of high inflation.

- Industry-Wide Downturn: The decrease in marketplace activity reflects a broader trend within the firearms and ammunition industry when the macroeconomic environment becomes challenging.

AMMO's divestiture of its ammunition segment, while addressing prior performance issues, leaves the company heavily reliant on its GunBroker.com marketplace. This concentration creates a significant vulnerability, as the platform has experienced a notable decline in web traffic, even compared to pre-pandemic levels, indicating potential user disengagement or increased competition from rivals like Guns.com.

Furthermore, attempts to bolster GunBroker.com's revenue through adjusted take rates have reportedly backfired, negatively impacting overall transaction volume and revenue. This suggests a delicate balance in platform monetization that AMMO has struggled to maintain, highlighting a weakness in its ability to effectively manage and grow its core online marketplace.

The company's financial reporting has also been a point of concern, with Nasdaq deficiency notifications issued due to delayed filings of its Q3 and Q4 2024 Form 10-Qs. This is directly linked to an ongoing independent accounting investigation and the need to restate prior financial statements, introducing significant uncertainty for investors and raising questions about its listing status.

Preview the Actual Deliverable

AMMO SWOT Analysis

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The online firearms and accessories market is experiencing robust growth, with online sales now representing over 20% of the total market. This digital shift presents a substantial opportunity for platforms like GunBroker.com to significantly broaden their customer base and increase transaction volume.

The global shooting ranges market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of 4.5% from 2024 to 2030, reaching an estimated $2.1 billion. This expansion is fueled by a surge in demand for recreational shooting and organized sport shooting activities. Such increased participation directly translates into a higher need for ammunition and associated accessories, creating a favorable environment for platforms like GunBroker.com that facilitate these transactions.

With the strategic divestment of its lower-margin ammunition manufacturing, AMMO is now positioned to intensely focus on expanding its higher-margin, premium rifle and pistol ammunition sales via its established marketplace. This strategic shift allows for a more concentrated effort on products that deliver better profitability.

Furthermore, AMMO is capitalizing on the burgeoning OEM brass business, a segment experiencing significant growth. This dual focus on premium ammunition and OEM brass is a key opportunity for enhanced revenue and improved margins.

Technological Advancements in Firearms and Accessories

The firearms sector is experiencing a surge in technological innovation, particularly in smart firearms, modular designs, and improved safety mechanisms. These advancements create new product categories and enhance existing ones, appealing to a wider consumer base. For instance, the global smart gun market was projected to reach approximately $1.5 billion by 2025, indicating significant growth potential.

GunBroker.com is well-positioned to leverage these opportunities by showcasing and facilitating the sale of these cutting-edge firearms and accessories. By offering a platform that highlights innovation, the company can attract both manufacturers and consumers interested in the latest developments.

Key opportunities include:

- Facilitating the sale of smart firearms: Platforms can integrate features for verifying smart technology compatibility and user authentication.

- Showcasing modular firearms: Highlighting customizable and adaptable firearm systems appeals to enthusiasts seeking personalized solutions.

- Promoting advanced safety features: Offering a dedicated section for firearms with enhanced safety technologies can attract safety-conscious buyers.

- Partnering with innovative manufacturers: Collaborating with companies at the forefront of firearm technology can drive exclusive listings and platform growth.

Potential for Strategic Partnerships and Cross-Selling

AMMO is actively pursuing strategic partnerships to bolster its market position and revenue. A prime example is the exploration of buyer financing options through collaborations like Gearfire Capital. This initiative aims to make firearm purchases more accessible, potentially driving higher sales volumes.

Furthermore, AMMO is leveraging its GunBroker.com platform for cross-selling opportunities. By offering accessories alongside firearms, the company can increase the average transaction value and deepen customer engagement. This strategy is designed to create diversified revenue streams, reducing reliance solely on core firearm sales.

- Partnership-driven buyer financing can unlock new customer segments.

- Cross-selling accessories on GunBroker.com enhances customer lifetime value.

- Diversification of revenue streams mitigates risks associated with core product sales.

AMMO's strategic focus on higher-margin premium ammunition and OEM brass presents a significant growth avenue, especially as the online firearms market solidifies its 20%+ share. The expanding shooting ranges market, projected to reach $2.1 billion by 2030 with a 4.5% CAGR, directly fuels demand for AMMO's core products.

The company is also well-positioned to capitalize on the firearms industry's innovation, particularly in smart and modular designs, a segment valued at approximately $1.5 billion by 2025. Strategic partnerships for buyer financing, like with Gearfire Capital, and cross-selling accessories on GunBroker.com are key to unlocking new customer segments and increasing transaction values.

| Opportunity Area | Market Trend/Data | AMMO's Strategic Advantage |

| Online Firearms Market Growth | Over 20% of total market sales online | Leveraging GunBroker.com for expanded customer reach |

| Shooting Ranges Market Expansion | Projected $2.1B by 2030 (4.5% CAGR) | Increased demand for ammunition and accessories |

| Focus on Premium Ammunition & OEM Brass | Divestment of lower-margin products | Concentration on higher-profitability segments |

| Firearms Innovation (Smart/Modular) | Global smart gun market ~$1.5B by 2025 | Platform to showcase cutting-edge products |

| Strategic Partnerships & Cross-Selling | Buyer financing (e.g., Gearfire Capital) | Increased accessibility and average transaction value |

Threats

The firearms and ammunition sector, including companies like AMMO, is constantly navigating a complex web of regulations. For instance, proposals for increased federal excise taxes on ammunition, similar to those seen in past legislative discussions, could directly impact consumer pricing and demand throughout 2024 and into 2025.

Furthermore, the potential for new state-level legislation imposing monthly purchase limits on ammunition, a measure debated in various jurisdictions, could restrict sales volume and create operational challenges for manufacturers and retailers alike. These legislative actions represent a significant external threat that could curb market growth and profitability.

GunBroker.com, a dominant force in the online firearms marketplace, navigates a landscape increasingly defined by intense competition. While it holds a leading position, other platforms are actively vying for market share, with some reportedly experiencing growth. This competitive pressure can directly impact revenue streams by forcing adjustments to transaction fees.

The need to stay ahead in this dynamic environment necessitates substantial and continuous investment in platform enhancements and aggressive marketing strategies. For instance, in 2024, e-commerce platforms across various sectors saw marketing spend increase by an average of 15% year-over-year to capture customer attention amidst a crowded digital space. This trend is mirrored in the firearms marketplace, where maintaining a competitive edge requires ongoing innovation and visibility.

The ammunition sector faces significant challenges from supply chain fragmentation and intense competition for essential raw materials such as copper, zinc, and lead. These metals are also in high demand from burgeoning industries like electric vehicles, creating a competitive bidding environment. For instance, copper prices, a key component in many ammunition types, saw volatility in early 2024, influenced by global demand and geopolitical factors, directly impacting production costs for manufacturers.

Economic Downturn and Inflationary Pressures

Economic uncertainty and persistent inflation are significant threats. These factors can directly dampen consumer demand for discretionary items like firearms and ammunition. For instance, rising living costs might lead consumers to cut back on non-essential spending, impacting sales volumes.

Job market fluctuations also play a crucial role. Uncertainty about future employment and income can make consumers more hesitant to make larger purchases. This macroeconomic pressure has already been observed to affect online marketplaces, with reports indicating reduced activity on platforms like GunBroker.com during periods of economic strain.

- Reduced Consumer Spending: Higher inflation erodes purchasing power, making firearms and ammunition less affordable.

- Impact on Sales Volumes: Economic downturns often correlate with decreased demand for non-essential goods.

- Marketplace Activity: Platforms like GunBroker.com have shown sensitivity to macroeconomic shifts, indicating a slowdown in transaction volumes.

Ongoing Accounting Investigation and Delisting Risk

The ongoing accounting investigation and the potential need to restate financial statements present a significant threat to AMMO. Failure to regain compliance with Nasdaq listing requirements could lead to delisting, severely impacting liquidity and investor access. This uncertainty directly erodes investor confidence, as evidenced by the stock's volatility during periods of investigation. For instance, in late 2023, news of the SEC investigation caused a notable dip in AMMO's share price, highlighting the market's sensitivity to these accounting concerns.

The risk of delisting from Nasdaq is a critical concern for AMMO. If the company cannot rectify its financial reporting issues and meet Nasdaq's continued listing standards, its shares could be moved to over-the-counter markets. This would dramatically reduce visibility and trading volume, making it harder for investors to buy or sell shares. Such a move would likely further depress the stock price, making it more challenging for AMMO to raise capital in the future.

- Delisting Risk: AMMO faces potential delisting from Nasdaq if it fails to resolve its accounting issues and regain compliance with listing standards.

- Investor Confidence Erosion: The unresolved investigation and potential restatements significantly damage investor trust, negatively impacting stock performance.

- Market Volatility: Uncertainty surrounding the accounting probe contributes to stock price volatility, making it a risky investment.

- Capital Raising Challenges: Delisting or continued accounting concerns can hinder AMMO's ability to raise necessary capital for operations and growth.

Increased federal excise taxes on ammunition, a recurring legislative proposal, could significantly impact consumer affordability and demand throughout 2024 and into 2025. Furthermore, the potential for new state-level regulations, such as ammunition purchase limits, poses a direct threat by restricting sales volume and creating operational hurdles for companies like AMMO. These regulatory shifts represent a substantial external challenge that could impede market expansion and profitability.

The firearms and ammunition sector is subject to intense competition, particularly for online marketplaces like GunBroker.com. While it maintains a leading position, other platforms are actively seeking to increase their market share, potentially leading to pressure on transaction fees. To counter this, continuous investment in platform upgrades and robust marketing is essential, mirroring the trend of increased marketing spend observed across e-commerce in 2024, which averaged a 15% year-over-year rise.

Supply chain challenges, including fragmentation and competition for raw materials like copper, zinc, and lead, directly affect ammunition production costs. Copper prices, for instance, experienced volatility in early 2024 due to global demand and geopolitical factors, impacting manufacturers' input costs. Economic uncertainty and inflation also pose threats by reducing consumer spending on discretionary items like firearms and ammunition, as evidenced by reduced marketplace activity during economic downturns.

AMMO faces significant threats from its ongoing accounting investigation. Failure to regain compliance with Nasdaq listing requirements could lead to delisting, severely impacting liquidity and investor access, as seen with a notable share price dip in late 2023 following the SEC investigation announcement. This uncertainty erodes investor confidence and makes future capital raising more challenging.

SWOT Analysis Data Sources

This AMMO SWOT analysis is built upon a robust foundation of data, drawing from official company financial filings, comprehensive market intelligence reports, and expert industry evaluations to provide a well-rounded and accurate strategic assessment.