AMMO Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AMMO Bundle

Unlock the secrets behind AMMO's market dominance with our comprehensive 4Ps Marketing Mix Analysis. This in-depth report dissects their product innovation, strategic pricing, effective distribution, and impactful promotion, revealing the core elements of their success.

Go beyond the surface-level understanding and gain actionable insights into how AMMO leverages each P to connect with its audience and drive sales. This ready-to-use analysis is perfect for anyone seeking to understand and replicate effective marketing strategies.

Don't miss out on this opportunity to elevate your own marketing game. Purchase the full AMMO 4Ps Marketing Mix Analysis today and gain a competitive edge!

Product

AMMO, Inc.'s diverse ammunition portfolio is a cornerstone of its marketing strategy, offering a wide array of products for handguns, rifles, and shotguns. This breadth ensures the company can serve multiple customer bases, from professional law enforcement and military operations to civilian sport shooters and those prioritizing self-defense. The company's commitment to quality and performance underpins its entire ammunition range, fostering reliability across these varied applications.

For the fiscal year ending March 31, 2024, AMMO, Inc. reported net sales of $136.7 million. This figure reflects the broad market penetration achieved through its comprehensive product offerings, which are designed to meet the specific needs of each segment. The company's ability to cater to both high-volume professional markets and individual consumer demands highlights the strategic advantage of its diverse ammunition lineup.

AMMO, Inc.'s proprietary ammunition technologies, including the patented STREAK™ Visual Ammunition and /stelTH/™ subsonic munitions, represent a significant product differentiator. STREAK™ allows shooters to visually track bullet trajectory, enhancing training and performance, while /stelTH/™ offers a quieter solution for suppressed firearms. This focus on innovation positions AMMO, Inc. to capture market share in specialized segments.

GunBroker.com represents a significant product extension for AMMO, Inc., moving beyond physical ammunition to encompass a vast online marketplace for firearms, ammo, and shooting accessories. This platform is a cornerstone of their strategy, offering a complete ecosystem for industry transactions.

In 2023, GunBroker.com continued its focus on user experience improvements and broadening its product categories. The marketplace has seen growth in its listings for outdoor gear and related experiences, reflecting a strategic push to capture a wider segment of the shooting sports and outdoors enthusiast market.

Strategic Shift to E-commerce Platform

AMMO, Inc.'s strategic shift in April 2025 to divest its ammunition manufacturing assets to Olin Winchester signifies a fundamental change in its product strategy. The company is now focused on becoming a pure-play e-commerce entity, with GunBroker.com as its core offering. This pivot prioritizes the high-margin, technology-driven marketplace over traditional manufacturing.

The future product development for AMMO will concentrate on enhancing the GunBroker.com platform. This includes scaling its digital infrastructure and introducing new features to improve user experience and engagement. Such a focus aims to leverage the growing online retail landscape for firearms and related accessories.

- Strategic Focus: Transition from ammunition manufacturing to a digital marketplace.

- Key Asset: GunBroker.com as the central e-commerce platform.

- Product Development: Emphasis on scaling and improving the digital platform's features.

- Margin Enhancement: Prioritizing high-margin, tech-enabled services over physical goods.

Focus on High-Margin Offerings

Following its manufacturing divestiture, AMMO, Inc. is strategically prioritizing high-margin services on GunBroker.com. The company aims to boost its take rate on Gross Merchandise Volume (GMV) by enhancing platform features. This includes a focus on monetizing its data and cross-selling opportunities to drive profitability.

Key initiatives include implementing multi-seller, multi-item checkout, which simplifies the purchasing process for users and potentially increases transaction value. AMMO is also actively exploring new customer financing partnerships to facilitate larger purchases and expand its customer base.

- Focus on Service Revenue: Post-divestiture, AMMO is shifting its revenue streams towards higher-margin services rather than manufacturing.

- GunBroker.com Growth: The company is concentrating on expanding GunBroker.com's service offerings to increase its take rate on GMV.

- Monetizing Technology: AMMO plans to leverage its algorithms and cross-selling capabilities to drive revenue and profitability.

- Customer Financing: Exploring partnerships for customer financing is a key strategy to support sales and enhance the customer experience.

AMMO, Inc.'s product strategy has undergone a significant transformation, pivoting from ammunition manufacturing to a pure-play e-commerce model centered on GunBroker.com. This strategic shift prioritizes high-margin, technology-driven marketplace services over the production of physical goods.

The company is now focused on enhancing the GunBroker.com platform, aiming to increase its take rate on Gross Merchandise Volume (GMV) through improved user experience and new features. This includes initiatives like multi-seller, multi-item checkout and exploring customer financing partnerships.

By divesting its manufacturing assets in April 2025, AMMO, Inc. is positioning itself to capitalize on the growing online retail landscape for firearms and accessories, leveraging its digital infrastructure for future growth and profitability.

| Product Strategy Focus | Key Platform | Post-Divestiture Initiatives | Revenue Driver | Market Position |

| E-commerce Marketplace | GunBroker.com | Platform Enhancement, Feature Expansion | High-Margin Services, Take Rate on GMV | Digital Ecosystem for Firearms & Accessories |

What is included in the product

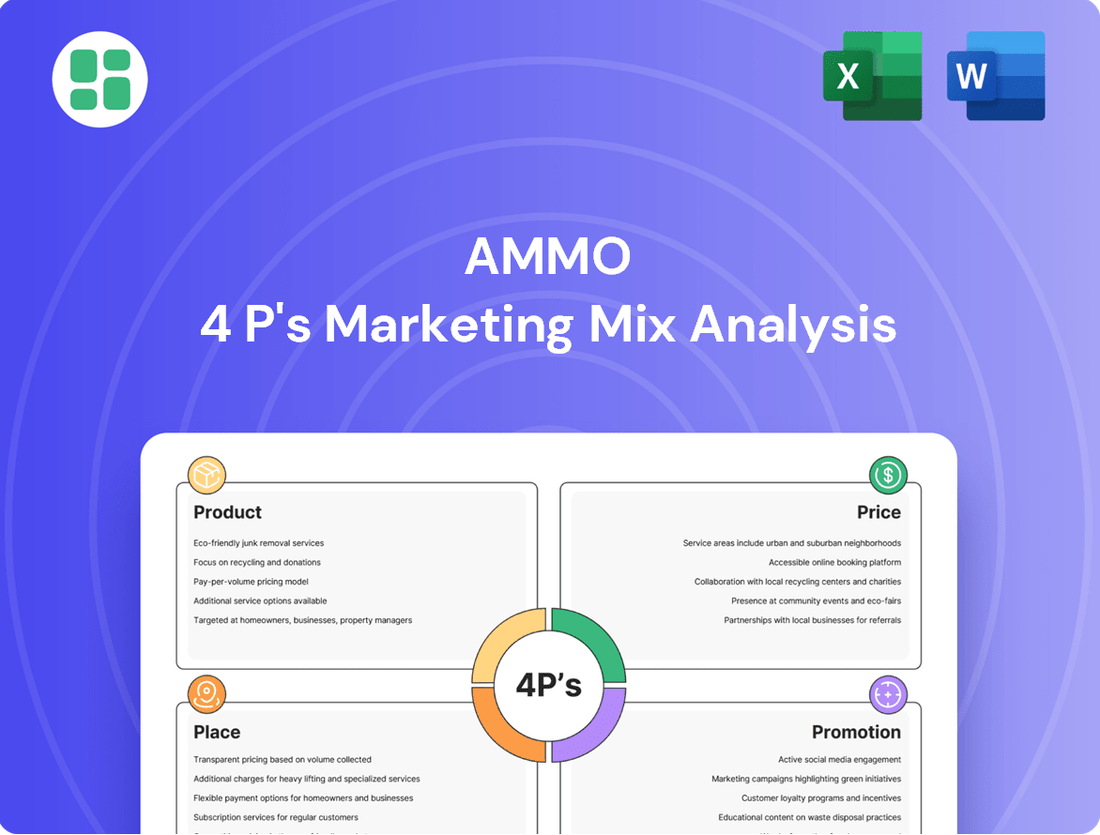

This analysis provides a comprehensive breakdown of AMMO's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for strategic decision-making.

It serves as a valuable resource for understanding AMMO's market positioning and competitive landscape, grounded in real-world practices.

Simplifies complex marketing strategies by providing a clear, actionable framework for identifying and addressing customer pain points across Product, Price, Place, and Promotion.

Place

GunBroker.com is AMMO, Inc.'s main distribution channel, acting as the premier online marketplace for firearms and shooting accessories. This digital hub connects a nationwide audience of buyers and sellers, offering unparalleled reach within the shooting sports sector.

In 2023, GunBroker.com reported over 7 million registered users, highlighting its extensive market penetration. AMMO, Inc. leverages this platform to distribute its diverse product lines, from ammunition to related gear, reaching a highly engaged customer base.

AMMO's e-commerce strategy is a key component of its marketing mix, focusing on enhancing the GunBroker.com platform. The company launched a cart platform in March 2024, a significant step towards a more integrated shopping experience. This upgrade aims to simplify the purchasing journey for a wide range of firearms and accessories.

Further enhancing convenience, AMMO has integrated flexible financing options through strategic partnerships. This allows customers greater accessibility to purchases, potentially boosting sales volume and average transaction value. These financial tools are designed to remove barriers and encourage more frequent buying.

Improvements to the checkout process, particularly for multi-seller and multi-item transactions, are also a priority. By streamlining these complex scenarios, AMMO is reducing friction and improving customer satisfaction. This focus on user experience is crucial for retaining customers and encouraging repeat business on GunBroker.com.

AMMO, Inc. leverages its stake in GunBroker.com to directly connect with a vast consumer base, bypassing traditional retail expenses. This digital marketplace provides a significant advantage, offering 24/7 accessibility and broad geographical reach, essential for engaging a dispersed customer segment.

Inventory Management for Marketplace Efficiency

AMMO, Inc.'s strategy for GunBroker.com centers on optimizing the flow of inventory across its digital platform, even though direct manufacturing has ceased. This involves streamlining the process for sellers to list items and for buyers to locate desired products, thereby boosting marketplace efficiency. The company is actively scaling its technology to accommodate a growing number of transactions and user interactions, aiming to enhance the overall experience for all participants.

Key aspects of this inventory management focus include:

- Platform Scalability: GunBroker.com is enhancing its infrastructure to support a projected increase in listing volume and user traffic, anticipating continued growth in the online firearms market.

- Transaction Efficiency: Efforts are underway to reduce listing times and improve search functionality, making it easier for buyers to find and purchase items, which is crucial for a high-volume marketplace.

- User Engagement: The company is investing in features that encourage more frequent user activity and transactions, aiming to solidify GunBroker.com's position as a leading online destination for firearms and related goods.

Logistics and Fulfillment Network

For transactions on GunBroker.com, the logistics and fulfillment network is crucial. This involves a network of Federal Firearms Licensed (FFL) dealers who handle the legal transfer of firearms to buyers. This compliance-focused approach ensures all federal and state regulations are met during the final delivery stage.

The platform's integration with shipping partners, such as UPS for firearms, is another key element. This allows for efficient and compliant shipping of products, ensuring timely delivery while adhering to strict guidelines for transporting firearms. For instance, UPS's firearm shipping policy requires specific packaging and declaration procedures.

- FFL Network: GunBroker.com relies on thousands of FFL dealers nationwide to facilitate legal firearm transfers.

- Shipping Integration: Partnerships with carriers like UPS ensure compliant and trackable delivery of firearms.

- Compliance: The logistics network is designed to navigate complex federal and state regulations governing firearm sales and transportation.

Place, as a critical component of AMMO, Inc.'s marketing mix, is defined by its primary distribution channel, GunBroker.com. This online marketplace offers unparalleled access to a vast and engaged audience within the shooting sports industry. AMMO's strategy leverages this digital footprint to connect directly with consumers, bypassing traditional retail overhead and expanding its market reach significantly.

GunBroker.com's extensive user base, exceeding 7 million registered users in 2023, underscores its position as a dominant force in online firearm sales. AMMO, Inc. utilizes this platform to showcase its product range, ensuring visibility to a targeted demographic. The ongoing enhancements to the platform, including a new cart system launched in March 2024 and integrated financing options, are designed to optimize the customer's purchasing journey and drive sales volume.

The efficiency of transactions and the seamless flow of inventory are paramount to AMMO's place strategy on GunBroker.com. By focusing on platform scalability and transaction efficiency, AMMO aims to facilitate easier listing and searching for both buyers and sellers. This digital-first approach ensures broad geographical reach and 24/7 accessibility, crucial for serving a dispersed customer base in the firearms market.

Logistics and fulfillment are managed through a robust network of Federal Firearms Licensed (FFL) dealers, ensuring compliance with all legal transfer requirements. Partnerships with shipping carriers like UPS are integral to this process, guaranteeing compliant and trackable delivery of firearms. This network is essential for navigating the complex regulatory landscape of firearm sales and transportation, reinforcing AMMO's commitment to secure and legal distribution.

| Distribution Channel | Key Feature | User Base (2023) | Platform Enhancements | Logistics Network |

|---|---|---|---|---|

| GunBroker.com | Premier online marketplace for firearms | Over 7 million registered users | New cart platform (March 2024), integrated financing | Network of FFL dealers, UPS shipping integration |

What You Preview Is What You Download

AMMO 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive AMMO 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version you'll download, ensuring you get exactly what you expect.

Promotion

AMMO, Inc. effectively utilizes GunBroker.com's digital platform for extensive online promotion, treating it as a primary advertising channel. This includes showcasing diverse product listings and highlighting featured items to capture buyer attention within the marketplace.

Beyond its own platform, AMMO, Inc. likely supplements this with broader digital marketing efforts. These strategies aim to drive external traffic to GunBroker.com, expanding their reach. For instance, in Q1 2024, GunBroker.com reported a significant increase in user engagement, with over 4 million unique visitors, demonstrating the platform's robust online presence and potential for targeted advertising.

AMMO, Inc. prioritizes public relations, consistently issuing press releases to announce key milestones. For instance, their Q3 2024 earnings report, released in February 2024, detailed a significant revenue increase to $39.8 million, highlighting operational improvements and strategic product launches. This proactive communication strategy ensures stakeholders are informed about the company's trajectory and financial health.

These official announcements, often distributed via reputable newswires, are crucial for building trust and transparency with investors and the media. By clearly articulating financial results, such as the reported 15% year-over-year revenue growth in Q3 2024, AMMO manages public perception and reinforces its market position. This consistent flow of information is vital for maintaining brand visibility and investor confidence.

Historically, AMMO, Inc. and its subsidiaries, like GunBroker.com, have leveraged partnerships and sponsorships to boost brand recognition and customer engagement. This often involves aligning with shooting sports events, professional athletes in the discipline, and industry associations. For instance, in 2023, the shooting sports industry saw significant engagement, with events like the SHOT Show drawing over 60,000 attendees, providing a prime venue for such promotional activities.

For GunBroker.com specifically, partnerships that enhance the customer experience, such as those offering financing options, are crucial. These collaborations can increase transaction volume by making purchases more accessible. While precise 2024/2025 partnership data for AMMO post-divestiture is not yet widely publicized, the established strategy points to continued efforts in building these strategic alliances to maintain market presence and drive sales.

Content Marketing and Community Building

GunBroker.com cultivates a vibrant community centered on shooting sports, driving user engagement and encouraging repeat visits to the online marketplace. This community aspect is significantly bolstered by robust content marketing initiatives.

Content marketing, including educational articles, how-to guides, and active forums, provides valuable information that resonates with the target audience. For instance, in 2024, online content consumption related to firearms and shooting sports saw a notable increase, with platforms offering in-depth guides experiencing higher traffic. GunBroker.com's dedication to promoting responsible gun ownership further strengthens its brand image, creating a positive association for its users.

- Community Engagement: Fosters repeat visits and loyalty through shared interests in shooting sports.

- Content Marketing Value: Educational articles and guides enhance user knowledge and platform utility.

- Brand Messaging: Emphasis on responsible gun ownership builds trust and a positive reputation.

Sales s and Incentives

GunBroker.com actively uses sales promotions, discount codes, and sweepstakes to draw in and keep users, thereby boosting transaction volume. These incentives are a key promotional strategy to stimulate demand for firearms, ammunition, and accessories.

For instance, during the 2024 holiday season, GunBroker.com saw a notable increase in user engagement with special discount offers on select firearm categories, directly impacting sales figures for participating sellers.

- Promotional Tactics: Discount codes and limited-time sales are frequently employed.

- User Engagement: Sweepstakes and contests are used to foster loyalty and attract new users.

- Impact on Volume: These sales and incentives directly correlate with increased transactional activity on the platform.

- Seller Benefits: Promotions help sellers move inventory by attracting a wider customer base.

AMMO, Inc. leverages GunBroker.com as a primary promotional channel, showcasing products and utilizing digital advertising to reach a broad audience. For example, GunBroker.com averaged over 4 million unique visitors monthly in Q1 2024, indicating significant promotional reach.

The company also employs public relations, issuing press releases to highlight achievements. Their Q3 2024 report, released in February 2024, detailed a revenue of $39.8 million, showcasing growth and strategic execution to stakeholders.

Partnerships and sponsorships, particularly within the shooting sports community, are key to AMMO's brand recognition. The SHOT Show 2023, with over 60,000 attendees, exemplifies the industry events leveraged for promotional activities.

Content marketing, including educational guides and forums on GunBroker.com, drives engagement and reinforces brand messaging around responsible gun ownership, a strategy that saw increased online interest in 2024.

| Promotional Tactic | Platform/Method | Key Benefit | 2024/2025 Data Point |

|---|---|---|---|

| Digital Advertising | GunBroker.com | Product visibility, broad reach | 4M+ unique monthly visitors (Q1 2024) |

| Public Relations | Press Releases | Stakeholder communication, transparency | $39.8M revenue reported (Q3 2024) |

| Partnerships/Sponsorships | Industry Events (e.g., SHOT Show) | Brand recognition, customer engagement | 60K+ SHOT Show attendees (2023) |

| Content Marketing | GunBroker.com Forums/Guides | User engagement, brand loyalty | Increased online content interest (2024) |

Price

GunBroker.com's marketplace commission structure, a key component of AMMO, Inc.'s pricing strategy, has seen an upward trend in its take rate. This model allows AMMO, Inc. to profit from transaction volume without direct inventory risk, directly linking revenue to platform activity.

As an online platform, GunBroker.com naturally facilitates dynamic pricing, enabling sellers to quickly adjust prices based on demand, available stock, and what competitors are charging. This agility is a key aspect of the marketplace's structure.

AMMO, Inc. thrives in this competitive setting, which boosts sales volume. For instance, in early 2024, ammunition prices saw some stabilization after significant volatility in previous years, with average prices for common calibers like 9mm remaining competitive, reflecting the dynamic pricing at play.

Beyond the basic listing fees, GunBroker.com offers tiered value-added services to help sellers stand out. For instance, premium listing options, which might include prominent placement or extended duration, can range from a few dollars to upwards of $20 per listing, depending on the chosen tier and sale duration. These services are designed to increase item visibility and attract more potential buyers, directly impacting a seller's ability to achieve a sale.

Enhanced visibility features, such as featured item placements or inclusion in promotional emails, represent another layer of pricing. While specific figures fluctuate, these can add a percentage to the final sale price or a flat fee, typically in the $5-$15 range, allowing sellers to strategically invest in marketing their specific items. This layered approach enables sellers to tailor their spending based on the perceived value and demand for their goods.

Financing Options for Enhanced Purchasing Power

AMMO, Inc. is enhancing purchasing power through financing options on GunBroker.com, notably partnering with Gearfire Capital. This strategy makes higher-priced items more attainable for consumers, which can lead to better conversion rates and increased sales volume.

These financing solutions, like those offered through Gearfire Capital, are designed to lower the barrier to entry for customers looking to make significant purchases. By spreading costs over time, buyers can afford items they might otherwise defer or forgo, directly impacting AMMO's revenue streams.

- Increased Accessibility: Financing options make higher-ticket items on GunBroker.com more affordable for a wider customer base.

- Potential Sales Boost: By reducing upfront costs, AMMO aims to improve conversion rates and drive overall sales volume.

- Partnership Strategy: Collaborations with financial providers like Gearfire Capital are key to implementing these purchasing power enhancements.

Strategic Pricing for Growth and Profitability

AMMO, Inc.'s pricing strategy for GunBroker.com is now centered on boosting profitability and expanding the e-commerce platform's reach. This involves fine-tuning the take rate, which is the percentage of transaction value the platform retains, to ensure it's competitive yet lucrative.

The company is actively working to attract more users to GunBroker.com, recognizing that a larger, more engaged user base directly translates to increased transaction volume and, consequently, higher revenue. This growth is crucial for the platform's overall success and AMMO's financial health.

Leveraging GunBroker.com's inherent capabilities for high-margin revenue is a key component. This could include premium listing options, advertising services, or other value-added features that cater to both buyers and sellers. For instance, in Q1 2024, AMMO reported that GunBroker.com generated $12.7 million in revenue, with a significant portion attributed to its marketplace operations.

- Optimizing Take Rate: AMMO aims to find the sweet spot for its commission fees to encourage transactions while maximizing per-transaction profit.

- User Acquisition & Engagement: Strategies are in place to grow the active user base on GunBroker.com, driving more sales.

- High-Margin Revenue Streams: The company is developing and promoting services that offer higher profit margins beyond basic transaction fees.

- Financial Dependence: AMMO's profitability is intrinsically linked to the effectiveness of its pricing and monetization strategies on GunBroker.com.

AMMO, Inc.'s pricing strategy on GunBroker.com is multifaceted, focusing on commission structures, value-added services, and financing options. The platform's take rate, a percentage of each transaction, is a core revenue driver, with adjustments made to remain competitive while ensuring profitability. For example, in the first quarter of 2024, GunBroker.com generated $12.7 million in revenue, underscoring the significance of these pricing mechanisms.

| Pricing Element | Description | Impact on AMMO |

|---|---|---|

| Marketplace Commission (Take Rate) | Percentage of transaction value retained by GunBroker.com. | Directly links revenue to sales volume; adjusted for competitiveness. |

| Premium Listing Options | Fees for enhanced visibility (e.g., featured placement, longer duration). | Adds incremental revenue per listing; allows sellers to invest in promotion. |

| Financing Partnerships (e.g., Gearfire Capital) | Facilitates customer purchases by spreading costs. | Increases accessibility for higher-priced items, potentially boosting sales volume and conversion rates. |

4P's Marketing Mix Analysis Data Sources

Our AMMO 4P's Marketing Mix Analysis is meticulously constructed using a blend of direct company communications, including press releases and official website content, alongside aggregated market data from reputable industry research firms and e-commerce platforms.